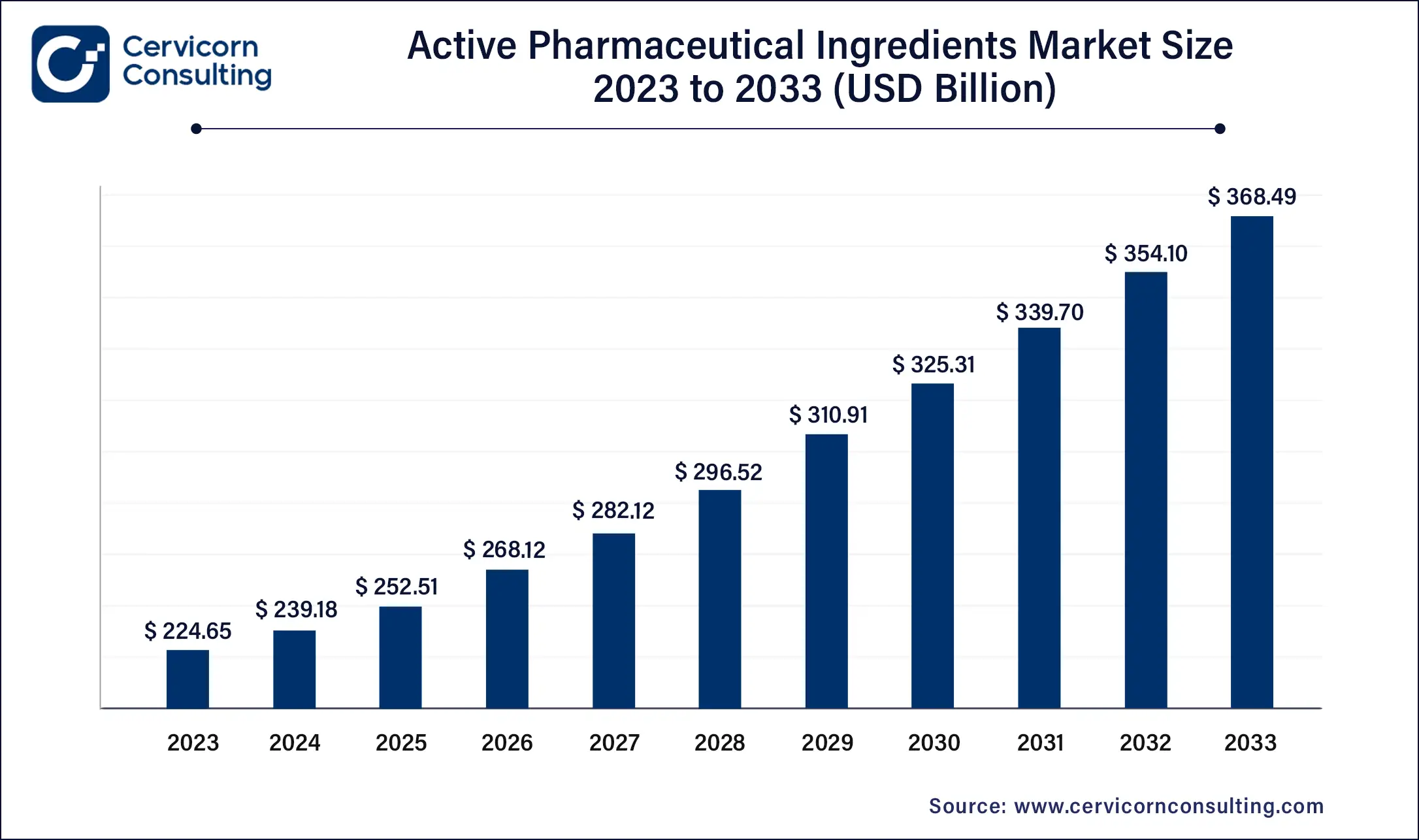

The global active pharmaceutical ingredient (API) market size was valued at USD 239.18 billion in 2024 and is expected to be worth around USD 382.89 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.82% over the forecast period 2025 to 2034.

The active pharmaceutical ingredient (API) market is experiencing significant expansion, driven by factors such as the rising global demand for effective medications, increased prevalence of chronic and infectious diseases, and advancements in pharmaceutical research and development. The growing focus on biologics and biosimilars, which require specialized APIs, has created new opportunities for manufacturers. Additionally, the increasing use of precision medicine, which tailors treatments based on individual genetic profiles, is boosting the demand for innovative and high-quality APIs. The pharmaceutical industry’s efforts to develop drugs for rare diseases, as well as the ongoing need for vaccines and antiviral medications, are further contributing to the market's upward trajectory. Moreover, regulatory emphasis on quality standards and environmentally sustainable production processes, such as green chemistry, is shaping the future of the API market. This growth trajectory reflects the essential role APIs play in the pharmaceutical value chain and their impact on global healthcare.

The active pharmaceutical ingredient (API) market involves the production and distribution of substances that serve as the active components in pharmaceutical products. APIs is synthetic or biologically sourced compounds that provide therapeutic effects while administration. This market is crucial for the pharmaceutical industry, supplying ingredients for a wide range of medications across therapeutic areas such as cardiovascular diseases, oncology, and diabetes management. Key factors driving the API market include increasing global healthcare expenditure, rising prevalence of chronic diseases, and the demand for generic drugs. Regulatory standards and technological advancements in API manufacturing further shape market dynamics and innovation.

What is active pharmaceutical ingredient?

An active pharmaceutical ingredient (API) is the biologically active component of a pharmaceutical drug that produces the intended therapeutic effect. APIs are the key ingredients in medicines, responsible for treating the condition or disease they are designed for. These compounds are either synthesized chemically or derived from natural sources, such as plants or animals. APIs are manufactured through highly regulated processes to ensure purity, potency, and safety. They can be categorized into two main types, generic APIs and innovative APIs. Innovative APIs are developed by pharmaceutical companies with patent protection, while generic APIs are produced once the patent expires. Additionally, APIs are classified based on their origin, such as synthetic APIs (produced through chemical synthesis) and biological APIs (derived from living organisms, including vaccines and monoclonal antibodies).

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 252.51 Billion |

| Expected Market Size in 2034 | USD 382.89 Billion |

| Projected CAGR 2025 to 2034 | 4.82% |

| Leading Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Type of API, Molecule, Type, Type of Manufacturer, Type of Drug, Usage, Potency, Therapeutic Application, Region |

| Key Companies | Lonza Group Ltd., Merck KGaA, Novartis AG, Sanofi, Pfizer Inc., Johnson & Johnson Private Limited, Eisai Co., Ltd., Mylan N.V., AstraZeneca, GSK plc, H. Lundbeck A/S |

The active pharmaceutical ingredient (API) market is segmented into type of API, molecule, type, type of manufacturer, type of drug, usage, potency, therapeutic application and region. Based on type of API, the market is classified into synthetic APIs, and biological APIs. Based on molecule, the market is classified into small molecule, and large molecule. Based on type of manufacturer, the market is classified into captive API manufacturer, and merchant API manufacturer. Based on type of drug, the market is classified into prescription drugs, and over-the-counter. Based on usage, the market is classified into clinical, and research. Based on potency, the market is classified into low-to-moderate potency active pharmaceutical ingredients, and potent-to-highly potent active pharmaceutical ingredient. Based on therapeutic application, the market is classified cardiology, CNS and neurology, oncology, orthopedic, endocrinology, pulmonology, gastroenterology, nephrology ophthalmology, and other.

Synthetic APIs: Synthetic APIs segment has accounted market share of 71.73% in 2024. Synthetic APIs are chemically synthesized compounds used as active ingredients in pharmaceutical formulations. They are typically manufactured through organic chemistry processes. Trends in the synthetic API market include advancements in process efficiency, automation, and the adoption of continuous manufacturing technologies.

Biological APIs: Biological APIs segment has accounted market share of 28.27% in 2024. Biological APIs, also known as biopharmaceutical APIs, are large molecule compounds derived from biological sources such as proteins, peptides, antibodies, and nucleic acids. Trends in the biological API market include the rise of biologics and biosimilars, driven by advancements in biotechnology, genetic engineering, and cell culture technologies. There is a growing emphasis on developing complex biologics for targeted therapies, personalized medicine, and treatments for chronic diseases, supported by robust research and development efforts.

Small Molecule: Small molecules are typically defined as organic compounds with a relatively low molecular weight. They are synthesized through chemical processes and constitute a large proportion of pharmaceutical drugs. Trends in the small molecule API market include advancements in synthetic chemistry, increased generic drug production, and innovations in formulation techniques to improve bioavailability and efficacy, meeting diverse therapeutic needs efficiently and cost-effectively.

Large Molecule: Large molecules, also known as biopharmaceuticals, are complex molecules often derived from living organisms such as proteins, peptides, antibodies, and nucleic acids. They are produced through biotechnological processes and are integral to advanced therapies like monoclonal antibodies and gene therapies. Trends in the large molecule API market include the rise of biosimilars, technological advancements in bioprocessing, and growing applications in oncology, autoimmune diseases, and rare disorders, driving innovation and market expansion in biologic therapies.

Innovative Active Pharmaceutical Ingredients (APIs): Innovative APIs refer to newly developed pharmaceutical substances that offer novel therapeutic benefits or advancements over existing treatments. Trends in this segment include increased investment in research and development, emphasis on biotechnology and complex molecular structures, and partnerships between pharmaceutical companies and biotech firms to accelerate innovation and drug discovery.

Generic Innovative Active Pharmaceutical Ingredients (APIs): Generic innovative APIs are bioequivalent versions of brand-name drugs that have lost patent protection. Trends in this segment include the rise of generic competition, cost-effectiveness compared to branded drugs, and regulatory pathways for generic drug approval. Market growth is driven by the expiration of patents on drugs and the need for affordable healthcare solutions globally.

Captive API Manufacturer: Captive API manufacturers are integrated within pharmaceutical companies, producing APIs exclusively for their own use in drug formulations. Trends in this segment include increased focus on vertical integration to control supply chain reliability, cost efficiency through economies of scale, and leveraging R&D capabilities for innovative API development aligned with proprietary drug pipelines.

Merchant API Manufacturer: Merchant API manufacturers specialize in producing APIs for sale to pharmaceutical companies, contract manufacturers, and biotechnology firms. Trends include globalization of manufacturing operations to optimize cost and regulatory compliance across regions, expansion into niche therapeutic areas and complex generics, and adoption of advanced manufacturing technologies like continuous processing to enhance efficiency and flexibility in API production.

Prescription Drugs: Prescription drugs are medications that require a healthcare provider's authorization for purchase. APIs for prescription drugs are typically complex and regulated, catering to specific therapeutic needs across various medical conditions. Trends in this segment include increasing demand for specialty drugs, personalized medicine approaches utilizing biopharmaceutical APIs, and advancements in drug delivery systems enhancing API efficacy.

Over-the-Counter (OTC) Drugs: OTC drugs are medications that can be purchased directly by consumers without a prescription. APIs for OTC drugs tend to be simpler and cater to common ailments like pain relief, colds, and allergies. Trends in this segment include the rise of natural and herbal-based APIs in OTC products, growing consumer preference for self-medication options, and innovations in formulation technologies for enhanced OTC drug efficacy and safety.

Clinical Usage: APIs used in clinical settings are essential components of pharmaceutical formulations administered to patients for therapeutic purposes. Trends in this segment include increasing demand for APIs supporting personalized medicine, biologics, and specialty drugs.

Research Usage: In research applications, APIs are utilized primarily for experimental purposes, including drug discovery, preclinical studies, and pharmacological research. Trends in the research segment of the API market involve a growing emphasis on high-purity APIs for in vitro and in vivo studies, customization of APIs for specific research needs, and the integration of computational modeling and AI in predicting API properties and interactions.

Low-to-Moderate Potency Active Pharmaceutical Ingredients: These APIs have lower potency and are typically used in medications where precise dosing is critical but the active ingredient concentration is lower. Trends include increasing demand due to their widespread use in common medications like antibiotics and pain relievers. There is a focus on cost-effective production methods and regulatory compliance to maintain quality standards while meeting global healthcare demands.

Potent-to-Highly Potent Active Pharmaceutical Ingredients: These APIs are highly concentrated and potent, often used in medications where small doses are effective, such as oncology drugs and hormone therapies. Trends include advancements in containment technologies and manufacturing processes to ensure safety during production and handling.

Cardiology: APIs for cardiology focus on treating cardiovascular diseases like hypertension and heart failure. Trends include the development of novel anticoagulants, lipid-lowering agents, and heart failure treatments to address global prevalence of cardiovascular disorders.

CNS and Neurology: APIs for CNS and neurology target disorders such as Alzheimer's, Parkinson's, and epilepsy. Trends include the rise of biopharmaceutical APIs for neurological disorders and the development of personalized treatments.

Oncology: APIs in oncology focus on cancer treatment, including chemotherapy and targeted therapies. Trends include the growth of biologic APIs like monoclonal antibodies and biosimilars, and personalized medicine approaches for precision oncology.

Orthopedic: APIs in orthopedics target musculoskeletal disorders like osteoarthritis and osteoporosis. Trends include the development of APIs for bone health, joint inflammation, and regenerative therapies.

Endocrinology: APIs in endocrinology treat hormonal disorders like diabetes and thyroid diseases. Trends include the development of insulin analogs, thyroid hormone therapies, and innovative treatments for metabolic disorders.

Pulmonology: APIs for pulmonology focus on respiratory diseases such as asthma and COPD. Trends include the development of bronchodilators, corticosteroids, and biologics targeting inflammatory pathways in the lungs.

Gastroenterology: APIs in gastroenterology treat digestive disorders like acid reflux, inflammatory bowel disease, and liver diseases. Trends include biopharmaceutical APIs for Crohn's disease, ulcerative colitis, and therapies targeting gut microbiota.

Nephrology: APIs in nephrology treat kidney diseases and disorders like chronic kidney disease and renal failure. Trends include APIs for managing electrolyte balance, blood pressure, and innovative therapies for kidney transplant recipients.

Ophthalmology: APIs for ophthalmology focus on treating eye diseases such as glaucoma and age-related macular degeneration. Trends include APIs for intraocular pressure management, anti-inflammatory agents, and therapies for retinal diseases.

Other: This category includes APIs for dermatology, infectious diseases, and rare disorders. Trends vary widely, from topical dermatological treatments to specialized therapies for orphan diseases.

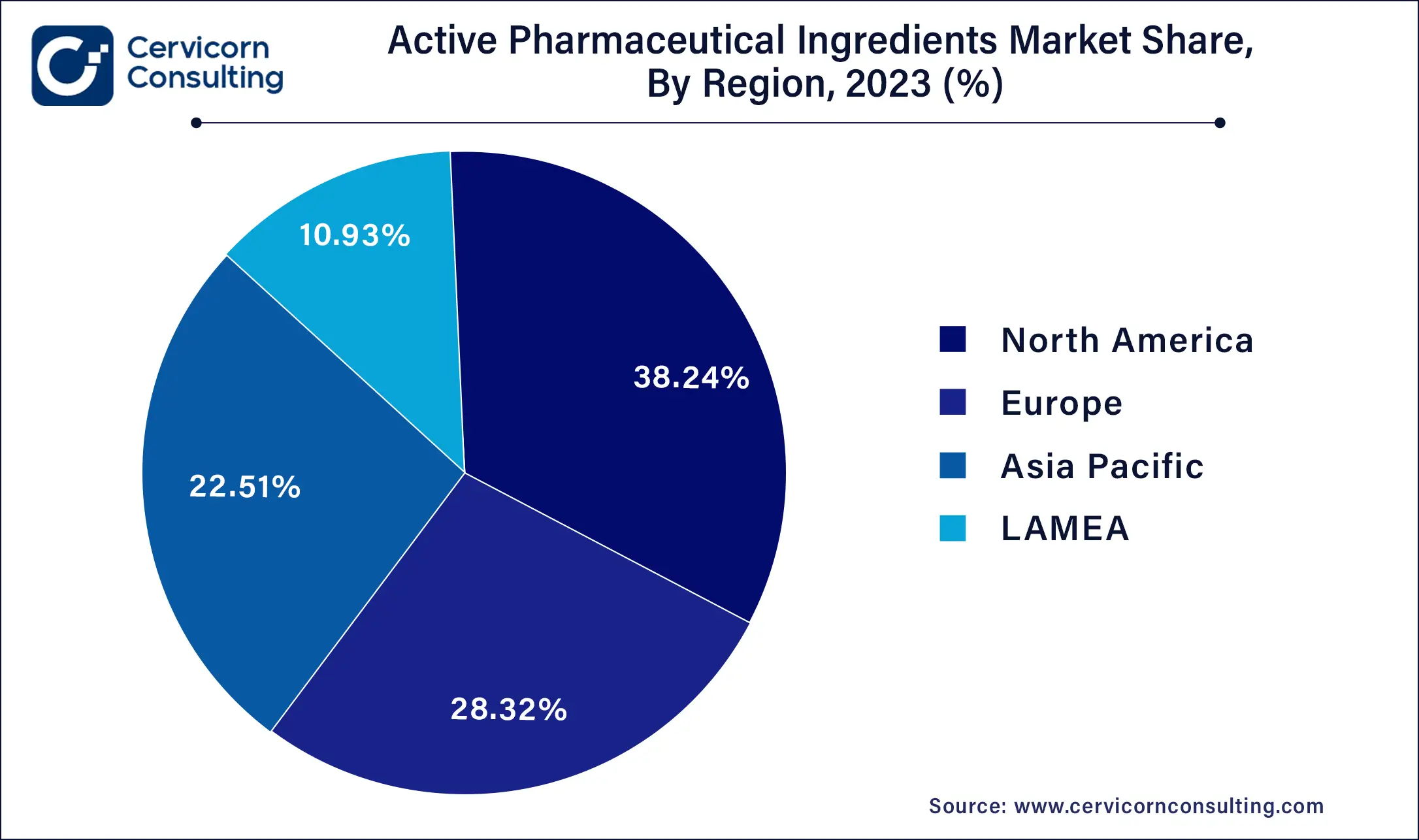

The API market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

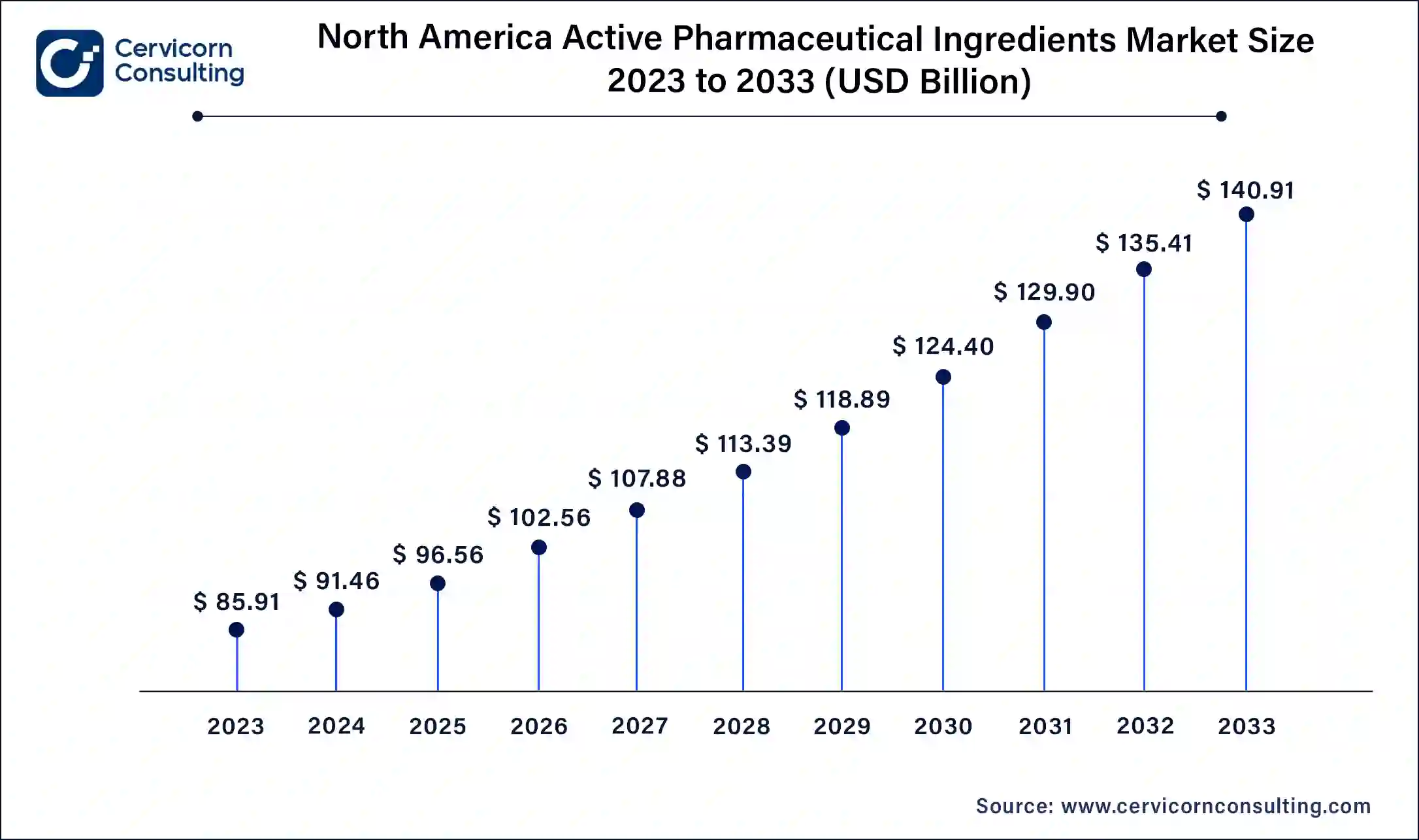

North America API market size was valued at USD 91.20 billion in 2024. North America's API market is characterized by its leadership in advanced biopharmaceutical APIs, particularly monoclonal antibodies and recombinant proteins used in cutting-edge therapies for oncology, immunology, and rare diseases. The region's stringent regulatory environment, enforced by the FDA, ensures high-quality standards and drives continuous advancements in manufacturing technologies and adherence to Good Manufacturing Practices (GMP). This regulatory rigor fosters innovation and confidence in global markets, making North America a hub for biopharmaceutical API development and commercialization. U.S. API market size was accounted for USD 68.4 billion in 2024.

The Europe API market size was valued at USD 67.97 billion in 2024. In Europe, there is a growing demand for generic APIs driven by healthcare cost containment strategies and patent expirations. This trend fuels competition among manufacturers, leading to price transparency and affordability in pharmaceuticals. Additionally, Europe emphasizes sustainable manufacturing practices and environmental stewardship, with regulations promoting the use of green chemistry principles and renewable energy sources in API production. These sustainability efforts align with European Union directives and initiatives, positioning the region as a leader in green APIs and fostering a competitive advantage in global markets.

The Asia-Pacific API market size was surpassed at USD 54.17 billion in 2024. The Asia-Pacific region dominates global API manufacturing, leveraging cost advantages, abundant skilled labor, and supportive government policies. Countries such as India and China lead in the production of generic APIs, driving growth in pharmaceutical exports worldwide. There is also a significant shift towards biopharmaceutical APIs and biosimilars, supported by rapid advancements in healthcare infrastructure and R&D capabilities. This expansion is fueled by increasing investment in biologics and complex therapies, positioning Asia-Pacific as a key player in the global API market.

LAMEA has accounted market share of around 10.8% in 2024. LAMEA presents emerging opportunities in the pharmaceutical and API markets, driven by rising healthcare expenditures, improved access to healthcare, and expanding manufacturing capabilities. The region's pharmaceutical industry benefits from local production initiatives aimed at reducing dependency on imports and enhancing supply chain resilience. Regulatory harmonization efforts further support market competitiveness by streamlining approval processes and fostering a conducive business environment for pharmaceutical and API manufacturers. These developments position LAMEA as a promising growth frontier with untapped potential in the global API landscape.

New players like Moderna and BioNTech are driving innovation in the API market through advancements in mRNA technology and novel delivery systems. Key players dominating the market include Pfizer, Novartis, and Sanofi, leveraging their extensive R&D capabilities, broad product portfolios, and strategic partnerships to maintain a competitive edge. Pfizer’s collaboration with Acuitas for lipid nanoparticles, Sanofi’s partnership with IGM for IgM antibody agonists, and Novartis’ robust pipeline and global reach exemplify how these companies lead through innovation, scale, and strategic initiatives.

The API market has seen several business expansions, and collaboration in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability.

Market Segmentation

By Type of API

By Molecule

By Type

By Type of Manufacturer

By Type of Drug

By Usage

By Potency

By Therapeutic Application

By Region