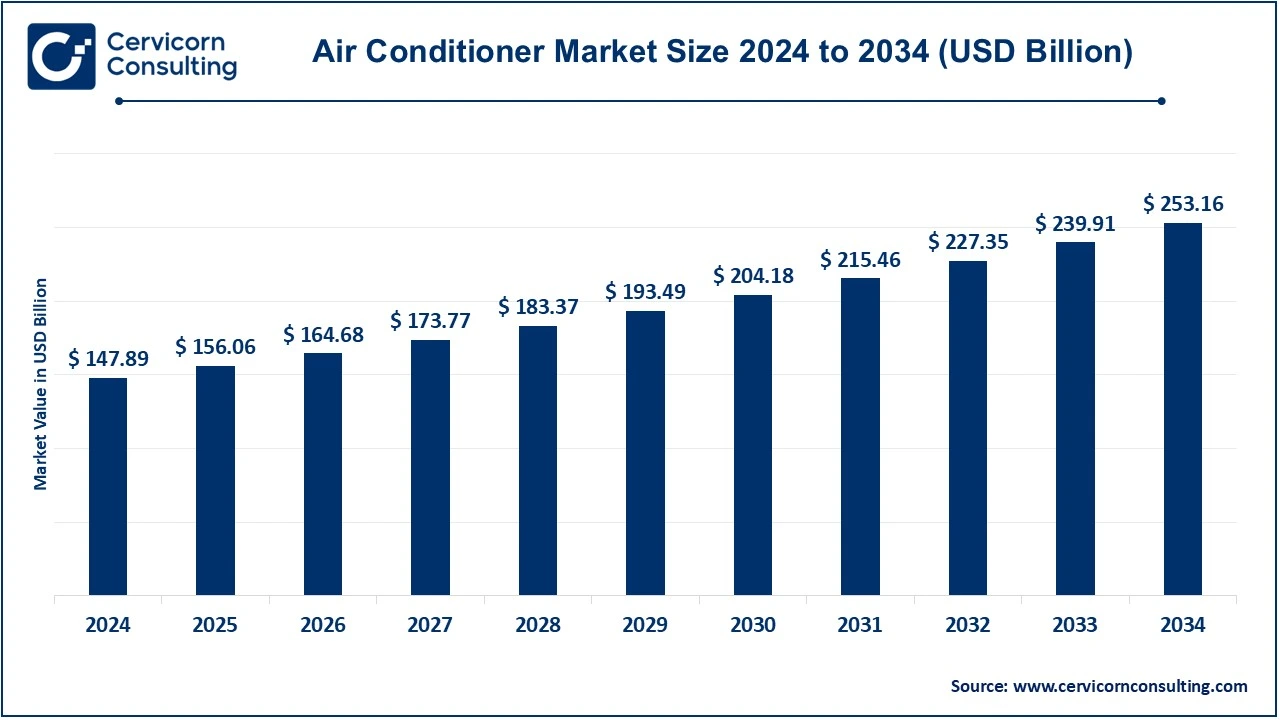

The global air conditioner market size was valued at USD 147.89 billion in 2024 and is expected to be worth around USD 253.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.52% over the forecast period 2024 to 2033.

Air conditioners are becoming an essential home appliance in modern homes, workplaces, commercial buildings and industrial facilities. To ensure a comfortable indoor environment, air conditioners ventilate, cool and humidify. With advancements in technology, air conditioners have evolved to offer smart, eco-friendly and energy-efficient solutions that meet the diverse needs of customers across the globe.

The approach to cooling our environment has evolved due to advances in air conditioning technology. Innovative solutions that offer sustainability and efficiency are rapidly replacing traditional ways. This brief examines the recent advances in air conditioning technology, which represent an intriguing shift in the HVAC industry. From eco-friendly refrigerators to smart thermostats, these advancements are transforming the industry. Driven by demands for energy efficiency, environmental sustainability and increased user convenience, the future of HVAC is not just about comfort, but also about intelligence, efficiency and environmental friendliness. Manufacturers are investing in research and development to develop innovative technologies such as variable refrigerant flow (VRF), inverter compressors, and environmentally friendly refrigerants that aim to reduce energy consumption and CO2 emissions.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 156.06 Billion |

| Projected Market Size in 2034 | USD 253.16 Billion |

| Expected CAGR 2025 to 2034 | 5.52% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, AC Type, Technology, Application, Distribution Channel |

| Key Companies | Daikin Industries Ltd, Electrolux, Blue Star Limited, Trane Technologies Plc., Emerson Electric Company, Gree Electrical Appliances Inc., Samsung Electronics Co. Ltd., Haier Group Corporation, Sharp Corporation, Hitachi-Johnson Controls Air Conditioning Inc., LG Electronics Inc., Carrier Corporation, Midea Group Co. Ltd |

Increasing Demand Worldwide for Air Conditioners

Global Warming

Issues with Maintenance

High Initial Cost of Smart Air Conditioning

Advancements in Technology

Growing Demand for Customized Cooling

Concerns regarding Data Security and Privacy

Effects of Air Conditioning on the Environment

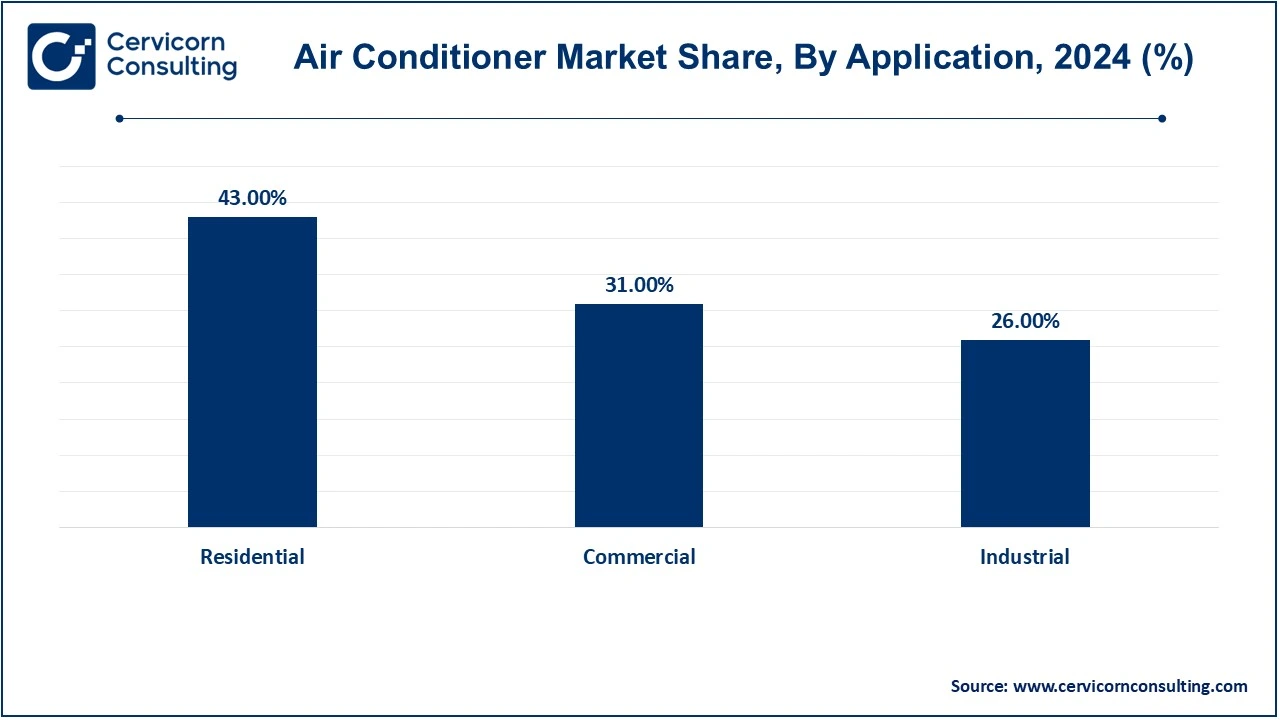

The air conditioner market is segmented into product type, AC type, technology, application, distribution channel and region. Based on product type, the market is classified into split and multi split AC, window AC, variable refrigerant flow (VRF), packaged air conditioner (PAC), central AC, and others. Based on AC type, the market is classified into unitary, rooftop, and PTAC. Based on technology, the market is classified into inverter system, non-inverter system. Based on application, the market is classified into residential and commercial. Based on distribution channel, the market is classified into direct sales, retail store, and online.

Split and Multi Split: The split and multi split AC segment has dominated the market in 2024. Rising temperatures and humidity levels across the globe and extension of work-from-home policies are other major factors driving the sales of split and multi split air conditioners. The ability to convert split and multi split air conditioners into smart air conditioners using smart AC controls is also expected to drive sales growth in this segment. Several important advantages of utilizing multi split air conditioners include convenience and cost benefits, space-efficient installation, adaptable installation, and individual control.

Window: Window air conditioners are widely used in residential and small commercial spaces due to their easy installation and efficient cooling of individual rooms. They are compact, affordable and cost effective, making them attractive to budget conscious consumers. Moreover, window air conditioners have lower energy consumption than central systems, which reduces electricity bills. Continuous technological advancements have further increased the attractiveness of the segment. Manufacturers have introduced advancements such as smart features, remote control capabilities, programmable timers, and energy-efficient modes. These factors, in addition to comfort, affordability, and technical development, have helped window air conditioners become widely used and maintain their market-leading position.

Variable Refrigerant Flow (VRF): VRF technology divides a building into zones tailored for comfort and energy efficiency. VRF technology adjusts refrigerant levels in response to a building's needs, saving energy by turning off when rooms are empty. This adaptability helps lower energy expenses. VRF systems are available as either heat pump systems or heat recovery systems for applications where simultaneous heating and cooling are required. These features make the VRF system ideally suited for any application that has partial load requirements based on usage or building orientation, as well as applications that require zoning.

Packaged Air Conditioner (PAC): Packaged air conditioners integrate the evaporator and condenser into a single unit. These solutions are specifically designed for medium to large spaces. Compressor, coils and air handler are all housed in a single enclosure. The air conditioner can also generate a limited amount of heat by using an electric strip heater. Electric heating strips heat air that is subsequently circulated through ducts to enhance warmth in residences, commonly located in areas with milder climates. Air conditioners with packaged systems are simple to install and maintain.

Others: Others include central air conditioners and portable air conditioners. Central air conditioners use ducts to distribute cooled air throughout buildings or homes. Central air conditioners provide uniform cooling, temperature control and energy efficiency, making them suitable for large residential homes, commercial buildings and industrial facilities. Portable air conditioners are compact, mobile units that can be moved from room to room as needed. Portable air conditioners are versatile, easy to install and suitable for cooling individual rooms or areas with limited space.

Unitary: Unitary air conditioners are in high demand due to the growing residential sector. Combining a unitary air conditioner with warm air heaters in the same ducts in residential and commercial buildings is possible. Households are the major users of centralized air conditioners, so the increasing demand from the growing residential sector is likely to sustain the demand for unitary air conditioners. In both commercial and residential buildings, a unitary air conditioner can be easily combined with warm air heaters in the same ducts, which is expected to drive the development of the sector.

Rooftop: Rooftop systems are commonly used in commercial buildings and provide efficient cooling solutions on rooftops, saving space within the premises. The function of a rooftop air conditioner is to move the hot and noisy air conditioner compressors away from the working areas. Secondly, by centralizing their location and installation, energy consumption is reduced as well as the maintenance process. The installation cost of rooftop air conditioners is extremely high due to their rather complex functioning.

PTAC: The growing popularity of packet terminal conditioners is due to their increasing adoption in the residential and hospitality sectors. PTACs are becoming increasingly popular due to technological advances such as energy efficient systems and wireless communications. PTACs benefit from technological advances such as inverter technology, energy efficient systems and wireless connectivity.

Inverter System: More sophisticated systems that modify the compressor's speed to better regulate the heating or cooling process are called inverter technologies. This technology is well-known for its capacity to modify speed in response to cooling demand, leading to quieter and more energy-efficient operation.

Air Conditioner Market Revenue Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Inverter System | 58% |

| Non-Inverter System | 42% |

Non-Inverter System: Non-inverter systems run at a constant speed; when necessary, their compressor activates and deactivates at intervals to control the temperature. Although these systems are efficient at delivering the needed cooling or heating, they typically consume more energy than their inverter equivalents. Constant speed operation may also lead to a somewhat louder experience.

Residential: In recent years, many countries have experienced a rise in temperatures due to climate change. Due to rising temperatures, air conditioning is now a necessity rather than a luxury. As a result, consumers around the world are installing air conditioning units in their homes, and this trend is expected to continue as global temperatures continue to rise. Due to changing climatic conditions, sales of residential air conditioners are expected to grow significantly during the forecast period.

Commercial: Due to increasing urbanization and growing need for commercial space, the commercial sector is projected to witness significant growth during the forecast period. Commercial air conditioners require a large amount of space and are typically installed on the rooftops of buildings such as shopping malls, hotels, large restaurants, theatres, and commercial offices where energy consumption is the highest. Therefore, increasing use of air conditioners across the commercial market is expected to lead to retrofitting and replacement of these units to reduce energy consumption.

Direct Sales: Channels for direct selling consist of manufacturers offering air conditioners straight to consumers via company-owned stores, websites, catalogs, or sales representatives. Direct selling provides convenience, product knowledge, and customer support, thus resulting in customer contentment and brand allegiance.

Retail Stores: Retail avenues comprise physical storefronts, department shops, home improvement retailers, specialty shops, and appliance outlets that carry and sell air conditioners to customers. Retail offers product visibility, hands-on experience, and competitive pricing, thereby attracting a wide range of customers.

Online: The online medium encompasses e-commerce sites, online market platforms, and manufacturer websites that enable consumers to look for, contrast, and acquire air conditioners from the ease of their own residence. Selling online provides convenience, a range of products, and home delivery, while aiming at technology-oriented consumers and occupied professionals.

The air conditioner market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Asia Pacific air conditioner market size was estimated at USD 79.86 billion in 2024 and is projected to reach around USD 253.16 billion by 2034. Temperature increases and the expansion of the middle class in nations like China and India are driving a boom in the Asia Pacific AC market. This is due to the rise of e-commerce and online discounts, which are boosting sales of low-cost equipment and room air conditioners. This has led to an increase in demand for air conditioners in the region. China in particular, is posing significant competition to globally known brands due to its low component and system prices. In India, the presence of a middle class and the expansion of various industries such as commercial, retail and hospitality are driving market sales. Growing infrastructure, especially in the commercial and residential sectors, is expected to fuel growth in the region, as well as attractive offers from key competitors such as EMI and seasonal discounts.

The North America air conditioner market size was valued at USD 38.45 billion in 2024 and is projected to hit around USD 65.82 billion by 2034. The expansion of the North America is propelled by the implementation of energy efficiency regulations and a shifting view of air conditioners as essential rather than optional due to climate change. The area has been enduring unprecedented heat waves, which have greatly heightened the need for different kinds of air conditioners, including ceiling units. The growing trend of smart homes and appliances is further expected to boost the demand for smart air conditioners in the region. The market is expected to continue to witness growth, mainly driven by spare parts sales. In addition, increasing promotional activities by the government to promote the adoption of energy-efficient air conditioners to reduce energy consumption are also expected to boost the growth of the regional market.

Air Conditioner Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 26% |

| Asia-Pacific | 54% |

| Europe | 14% |

| LAMEA | 6% |

The Europe air conditioner market size was accounted for USD 20.70 billion in 2024 and is expected to reach around USD 35.44 billion by 2034. As summer temperatures in Europe rise, air conditioning systems are becoming more common in new and renovated buildings. The Europe is growing steadily due to higher temperatures, changing climate conditions, and increased awareness of indoor comfort and energy efficiency. Strict environmental regulations, green building initiatives and consumer preference for sustainable cooling options are driving market demand. Energy-efficient cooling systems and eco-friendly refrigerants are particularly popular in Germany due to its environmental regulations, making Germany a major player in the European market.

The LAMEA air conditioner market size was valued at USD 8.87 billion in 2024 and is expanding around USD 15.19 billion by 2034. The LAMEA region is growing steadily, driven by factors such as rising temperatures, urbanization, and higher disposable income. Brazil plays a key role in Latin America due to its warm climate and growing middle class. Demand for air conditioning is increasing in Brazil, especially in regions such as the Northeast, as more people try to cope with high temperatures. Economic growth and the desire for a better quality of life continue to drive this trend. In the UAE, air conditioning is essential for both residential and commercial buildings, as well as the public sector, especially during the hot summer months. The UAE’s construction boom and focus on energy-efficient solutions are driving market growth, with smart air conditioning playing a significant role in shaping the market in the region.

The global market for air conditioners is fiercely competitive. International businesses, regional organizations, and start-ups are all vying for market share. To get a competitive edge and strengthen their market position, the major players in the market are focusing on technical advancements, product innovation, strategic partnerships, and regional expansion. The global air conditioning market consists of a diverse network of suppliers, distributors, contractors, and service providers across the value chain. In response to changing consumer preferences, regulatory requirements, and market demands, market participants are focusing on customer-centric strategies, sustainability efforts, and digital transformation, which is impacting the competitive environment of the industry.

CEO statements

Michael Peter, CEO of Siemens Mobility

Tracy Robinson became president and CEO of the Canadian National Railway Company (CN Rail)

Advancements in sustainability, construction efficiency, and product offerings through strategic acquisitions and innovative efforts are expanding the market and meeting diverse building requirements.

Market Segmentation

By Product Type

By AC Type

By Technology

By Application

By Distribution Channel

By Region