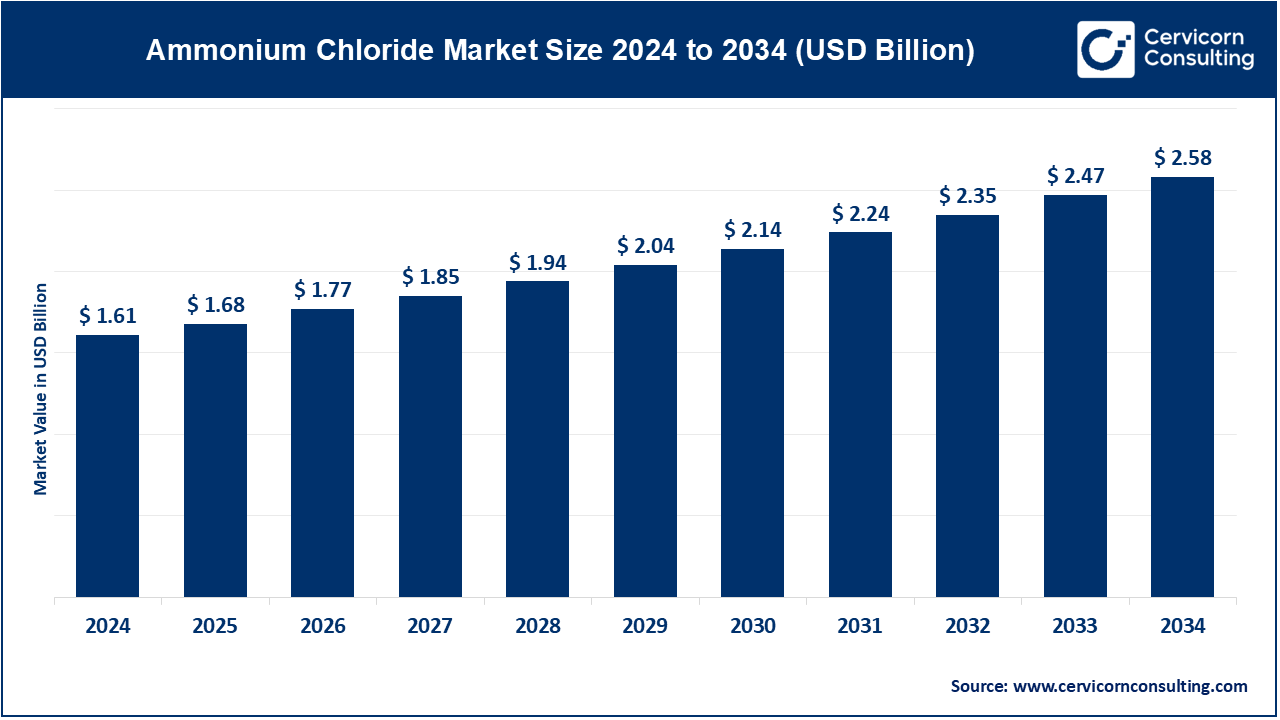

The global ammonium chloride market size was estimated at USD 1.61 billion in 2024 and is expected to be worth around USD 2.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.83% over the forecast period 2025 to 2034.

The ammonium chloride market has been experiencing steady growth due to its wide range of applications. The increasing demand for fertilizers in the agricultural industry, driven by the need to improve crop yields and food production, is one of the key factors boosting the market. Additionally, the rising use of ammonium chloride in the chemical and pharmaceutical industries further drives market expansion. Growth in emerging economies, where agricultural and industrial activities are increasing, is contributing significantly to the market’s overall expansion. As industries such as agriculture, chemicals, and food processing continue to evolve, the demand for ammonium chloride is expected to rise. The increasing adoption of ammonium chloride in wastewater treatment and its growing use in the production of medicines are further fueling market growth.

The ammonium chloride market is an active and complex segment influenced by the application of the chemical compound in various industries. Ammonium chloride (NHâ‚„Cl) which is in the form of white crystalline salt has several applications, especially in agriculture, metal working industry and in pharmaceutical industry among others. This market is mainly driven by its use in water-soluble nitrogen fertilizers as used in crops such as rice and wheat that are food security crops globally. Requirements for improvement of productivity per unit area and promotion of sustainable farming in this sector increase demand in this segment by government programs.

Aside from the uses in agriculture, ammonium chloride is also used in the metalwork industry as a material for surface treatment and surface preparation and for pharmacy as an expectorant and as an agent to acidify urine. Regulations particularly those related to food contact materials make sure that practices in the production of the products are safe and quality. In a nutshell, the demand for ammonium chloride is driven by its utility across various industries and are well-backed by government policies especially in the agriculture sector.

Immunoadjuvant therapeutic has been prepared through the simple glycosylation of different alcohols by monosaccharide without any protection and activation of the monosaccharide molecules using solvent free condition with the help of a catalyst that is ammonium chloride. The sugar acids were glucoquinovose and glucuronic acid, both of which could be glycosylated without esterification, and after regioselective acetylation produced the new 3,6-anhydro compound. All the synthesized sugar glycosides were tested for immunomodulatory activities and they were further grouped as immunostimulator, immunosuppressor, or immunoadjuvant against the weak antigen oval albumin (OVA).

Ammonium chloride is also used in medicine for making cough medicine and mainly as an expectorant according to geeks for geeks. It is useful to alleviate the side effects of nausea and vomiting. The test is also useful in the diagnosis of distal renal tubular acidosis as well, according to a study done by experts.

Mayo Foundation for Medical Education and Research notes that as an adult one is likely to suffer from two to three colds per year. You will note that for instance infants and young children may have colds more often.

According to National library of medicine, Cough is one of the most common medical complaints accountings for as many as 30 million clinical visits per year. Up to 40% of these complaints result in a referral to a pulmonologist. A cough is an innate primitive reflex and acts as part of the body’s immune system to protect against foreign materials.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.68 Billion |

| Projected Market Size (2034) | USD 2.58 Billion |

| Growth Rate (2025 to 2034) | 4.83% |

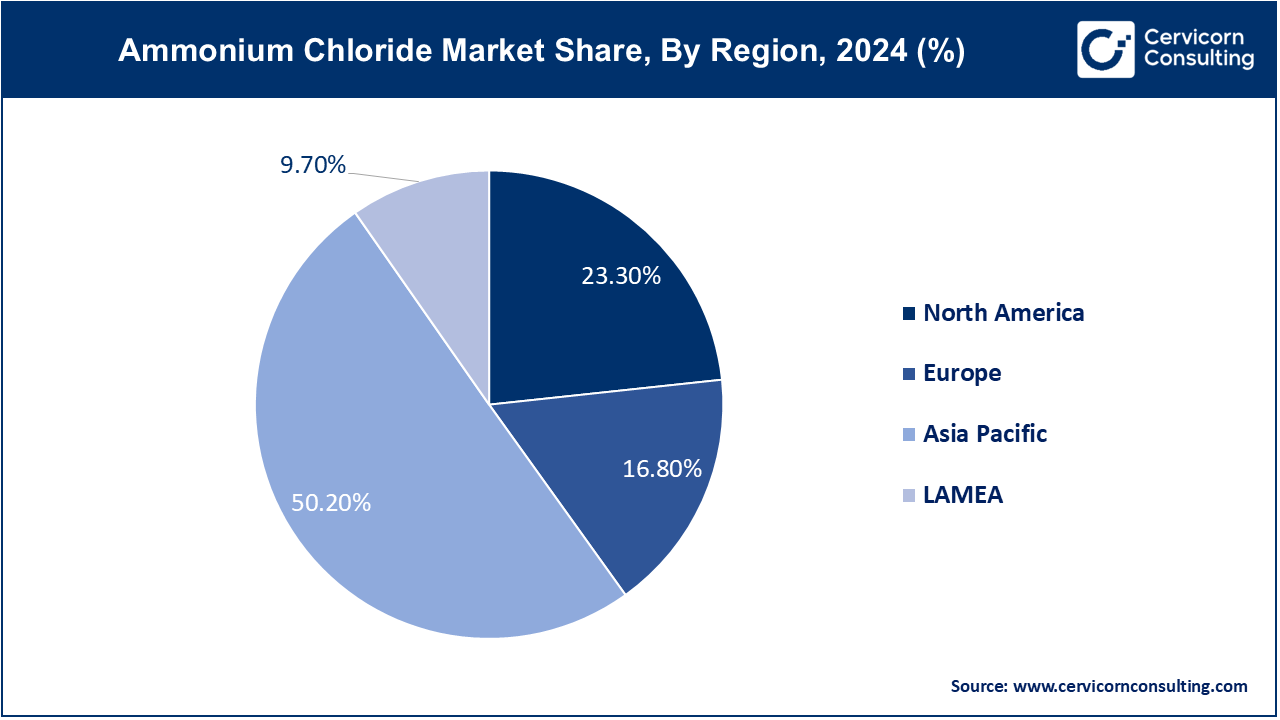

| Largest Revenue Holder | Asia Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Applications, Grade, Form, End Users, Region |

| Top Companies | Tata Chemicals Limited - India, China National Chemical Corporation (ChemChina) - China, Nouryon (formerly AkzoNobel Specialty Chemicals) - Netherlands, Honeywell International Inc. - USA, Nihon Gosei Co., Ltd. - Japan, Nutrien Ltd. - Canada, Ube Industries, Ltd. - Japan, K+S AG - Germany, Yara International ASA - Norway and The Mosaic Company - USA |

Fertilizers: Ammonium chloride is a vital nitrogen source in fertilizers, primarily used in agriculture for crops like rice and wheat. Its high nitrogen content helps improve crop yield and soil fertility, making it particularly beneficial in regions with alkaline soils. Ammonium chloride provides essential nutrients that support healthy plant growth, ensuring that the crops receive the right balance of nitrogen, which is crucial for photosynthesis and overall plant development. Its application in fertilizers is widespread in Asian countries, where it contributes significantly to sustaining food production and enhancing agricultural productivity.

Metalwork: In the metalworking industry, ammonium chloride plays a crucial role in surface treatment processes. It is used extensively in galvanizing, tinning, and soldering to clean metal surfaces and remove impurities such as oxides. The compound acts as a flux, promoting the adhesion of metals during soldering by cleaning the surfaces and preventing oxidation. This application is particularly important in industries where metal parts require precise and clean joints, such as in the manufacturing of electronic components and automotive parts. Ammonium chloride ensures that metal surfaces are adequately prepared for subsequent processes, enhancing the quality and durability of the finished products.

Pharmaceuticals: Ammonium chloride is utilized in the pharmaceutical industry primarily as an expectorant in cough medicines. It helps in loosening phlegm and making coughs more productive, providing relief to patients with respiratory conditions. Additionally, it serves as an acidifying agent in the treatment of certain medical conditions where acidification of the urine is necessary. This compound's role in pharmaceuticals is critical, as it supports the development of over-the-counter and prescription medications that address common health issues such as coughs and colds, contributing to the broader healthcare industry.

Food Additives: In the food industry, ammonium chloride is used as a food additive, particularly as a yeast nutrient in bread-making and a flavoring agent in certain confectionery products, such as licorice. It helps to enhance the texture and flavor of baked goods by promoting the growth of yeast, which is essential for dough fermentation. Additionally, its use in licorice provides a distinct salty taste that is popular in certain cultures. The application of ammonium chloride in food processing underscores its versatility as a compound that can be safely used in small quantities to improve the quality and appeal of various food products.

Electrolytes and Batteries: Ammonium chloride is an essential component in the production of dry cell batteries, where it serves as an electrolyte to enhance the conductivity of the battery. This application is particularly significant in the manufacturing of zinc-carbon batteries, which are commonly used in everyday household items like flashlights and remote controls. The compound's role as an electrolyte ensures that the batteries operate efficiently, providing a reliable source of power for consumer electronics. As the demand for portable power sources continues to grow, the use of ammonium chloride in battery production remains a key application.

Textile and Leather: In the textile and leather industries, ammonium chloride is employed in various processes such as textile printing, dyeing, and leather tanning. It acts as a mordant in dyeing, helping to fix dyes onto fabrics, resulting in vibrant and long-lasting colours. In leather processing, ammonium chloride is used during the tanning process to enhance the quality and durability of the final product. These applications highlight the importance of ammonium chloride in producing high-quality textiles and leather goods, which are essential in the fashion and apparel industries.

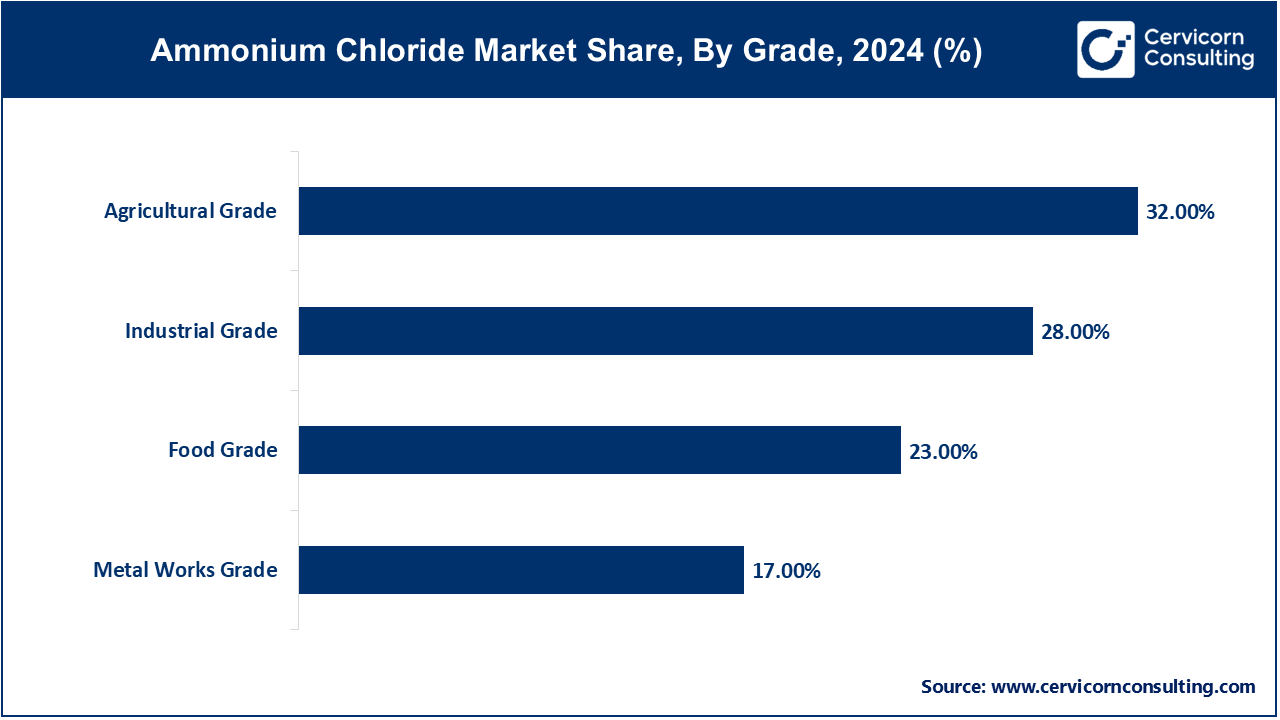

Agricultural Grade: Agricultural grade ammonium chloride is primarily used in the production of fertilizers. This grade is optimized to provide essential nitrogen to crops, improving soil fertility and promoting healthy plant growth. The agricultural grade is carefully processed to ensure that it meets the specific needs of farmers, providing a cost-effective and efficient solution for enhancing crop yield. Its widespread use in agriculture, particularly in rice and wheat cultivation, makes it a critical component in the global food production system.

Industrial Grade: Industrial grade ammonium chloride is used in various industrial applications, including metalworking, textiles, and chemical production. This grade offers high purity levels required for specific processes, such as galvanizing and soldering, where the quality of the final product is directly impacted by the purity of the ammonium chloride used. Industrial grade ammonium chloride is also employed in the production of other chemicals, making it a versatile compound that supports multiple industries. Its role in industrial applications underscores its importance in manufacturing processes that demand high standards of quality and consistency.

Food Grade: Food grade ammonium chloride is of the highest purity and is used in food processing and pharmaceutical applications. This grade is safe for consumption and meets stringent safety and quality standards required in the food and pharmaceutical industries. It is commonly used as a food additive in baking and confectionery, where it enhances flavor and texture. In pharmaceuticals, food grade ammonium chloride is used in the formulation of expectorants and other medications, ensuring that the products are safe for human consumption. The production and use of food grade ammonium chloride are strictly regulated to maintain the highest levels of safety and quality.

Agriculture: The agricultural sector is the largest end-use industry for ammonium chloride, focusing on its role as a key nitrogen source in fertilizers. Ammonium chloride enhances soil fertility and boosts crop yields by providing a readily available form of nitrogen that plants can easily absorb. This application is crucial for maintaining soil health and optimizing agricultural productivity, making it a primary driver of demand in the ammonium chloride market.

Chemical Industry: In the chemical industry, ammonium chloride serves as both a raw material and a catalyst. It is used in the production of other chemicals and compounds, including those required for industrial and consumer applications. Its role in chemical synthesis highlights its importance in manufacturing a wide array of products and processes, contributing significantly to the chemical sector.

Pharmaceuticals: The pharmaceutical industry relies on ammonium chloride for its role in medicinal formulations. As an expectorant, it is integral to cough syrups and other respiratory treatments. This application underscores ammonium chloride’s contribution to healthcare and its role in improving patient outcomes through effective medicinal products.

Textiles: In the textile industry, ammonium chloride is used for dyeing and printing fabrics. It helps fix dyes to textiles, ensuring vibrant and long-lasting colours. Its application in textiles is essential to produce high-quality, colourful fabrics, highlighting its role in enhancing textile manufacturing processes.

Electronics and Batteries: The electronics and battery sectors utilize ammonium chloride for its properties as an electrolyte. It is used in dry cell batteries to facilitate electrical conductivity and in various electronic applications. This segment reflects ammonium chloride’s contribution to the functionality and efficiency of electronic devices and energy storage solutions.

Food and Beverage: Ammonium chloride is used in the food and beverage industry as a food additive, particularly in baking. It helps improve the texture and quality of baked goods, contributing to the overall quality of food products. Its application in food processing demonstrates its role in enhancing food production and consistency.

The ammonium chloride market is segmented into key regions: North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

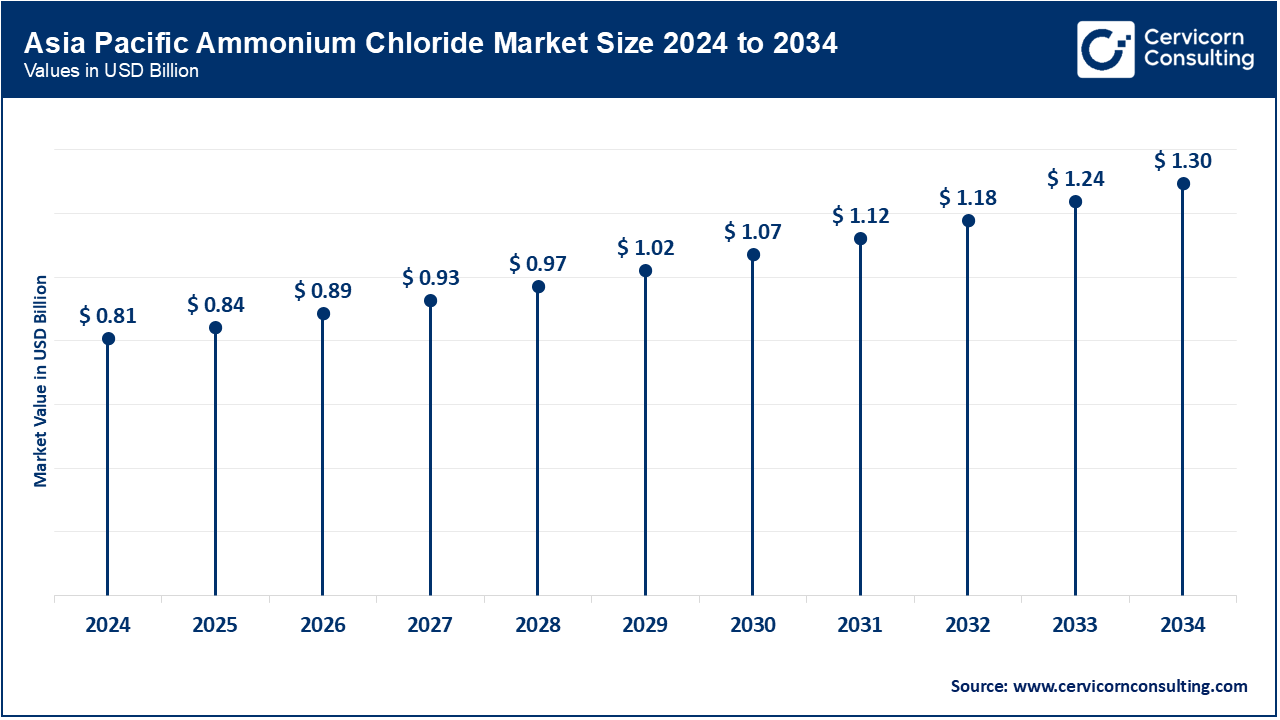

The Asia Pacific ammonium chloride market size was valued at USD 0.81 billion in 2024 and is expected to raroun hcaed USD 1.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.30% from 2025 to 2034. Countries such as China, India, and Japan are key players, utilizing ammonium chloride in fertilizers to boost crop yields and in various industrial applications. Trends include significant investments in production capacity and infrastructure to meet the rising demand. The region is also exploring advancements in production technologies and seeking ways to improve sustainability in manufacturing processes. Economic growth and increasing agricultural activities are key factors fueling market expansion in this region.

In North America, the ammonium chloride market is well-established, driven by strong demand from agriculture and industrial sectors. The North America ammonium chloride market size was accounted for USD 0.38 billion in 2024 and is projected to hit around USD 0.6 billion by 2034, expanding at a CAGR of 5% from 2025 to 2034. The United States and Canada are major consumers, leveraging ammonium chloride in fertilizers, metal treatment, and various industrial processes. Key trends include increased focus on sustainable agricultural practices and advancements in manufacturing technologies. Both countries are investing in improving production efficiencies and expanding applications for ammonium chloride. The market is supported by a robust infrastructure for distribution and a strong network of industrial users.

The Europe ammonium chloride market size was valued at USD 0.27 billion in 2024 and is predicted to surpass around USD 0.43 billion by 2034 with a CAGR of 4.70% from 2025 to 2034. The European Union has stringent regulations and standards that influence the market, particularly in terms of environmental and safety practices. Trends in Europe include the adoption of more sustainable production methods and the development of advanced applications in industries such as textiles and pharmaceuticals. Countries like Germany, France, and the Netherlands are leading efforts to enhance production processes and ensure compliance with regulatory requirements, supported by both public and private sector investments.

The LAMEA ammonium chloride market size was valued at USD 0.16 billion in 2024 and is anticipated to reach around USD 0.25 billion by 2034. In the LAMEA (Latin America, Middle East, and Africa) region, the ammonium chloride market is emerging, with a growing emphasis on agricultural development and industrial diversification. Countries in this region are beginning to invest in ammonium chloride solutions to address agricultural needs and support industrial growth. Trends include initial investments in production facilities and infrastructure, with a focus on leveraging local resources for ammonium chloride production. While the market potential is significant due to vast agricultural areas and industrial growth prospects, challenges such as economic constraints and infrastructure development are impacting the pace of growth.

The ammonium chloride market features several key players who dominate the industry through their extensive product offerings, strong distribution networks, and focus on innovation. Major companies like BASF SE, Akzo Nobel N.V., and Jiangsu Huachang Chemical Co., Ltd., lead the market by catering to diverse industries such as agriculture, pharmaceuticals, and metallurgy. These companies emphasize high-quality production standards, particularly for specialized grades of ammonium chloride, ensuring they meet the varying demands of end-user industries. Strategic partnerships, mergers, and technological advancements also play crucial roles in maintaining their competitive edge in this market.

CEO Statements

Tata Chemicals Limited, CEO

"At Tata Chemicals, our commitment to sustainable agriculture drives our innovation in ammonium chloride production. We are focused on enhancing our production processes to meet the growing demand for high-quality fertilizers while minimizing our environmental footprint. Our strategic investments in advanced technologies and sustainable practices are aimed at delivering superior products to our global customers and supporting agricultural productivity."

China National Chemical Corporation (ChemChina), CEO

"ChemChina is dedicated to advancing our ammonium chloride production capabilities as part of our broader chemical portfolio. We are committed to leveraging our extensive R&D resources to drive innovation in fertilizer applications and industrial processes. Our focus on operational excellence and sustainability ensures that we continue to lead in the global market while addressing the evolving needs of our customers."

Honeywell International Inc, CEO

"Honeywell is committed to expanding our footprint in the ammonium chloride market through technological innovation and strategic partnerships. Our emphasis on safety, efficiency, and sustainability underpins our approach to meeting global demand. By leveraging our expertise in chemical manufacturing, we aim to deliver exceptional value and support the industries that rely on our products."

These statements reflect the commitment of key industry players to advancing Ammonium Chloride technologies and supporting the global transition to sustainable energy solutions.

These developments underscore significant strides in advancing hydrogen infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global hydrogen economy.

Market Segmentation

By Application

By Grade

By Form

By End-User Industry

By Region