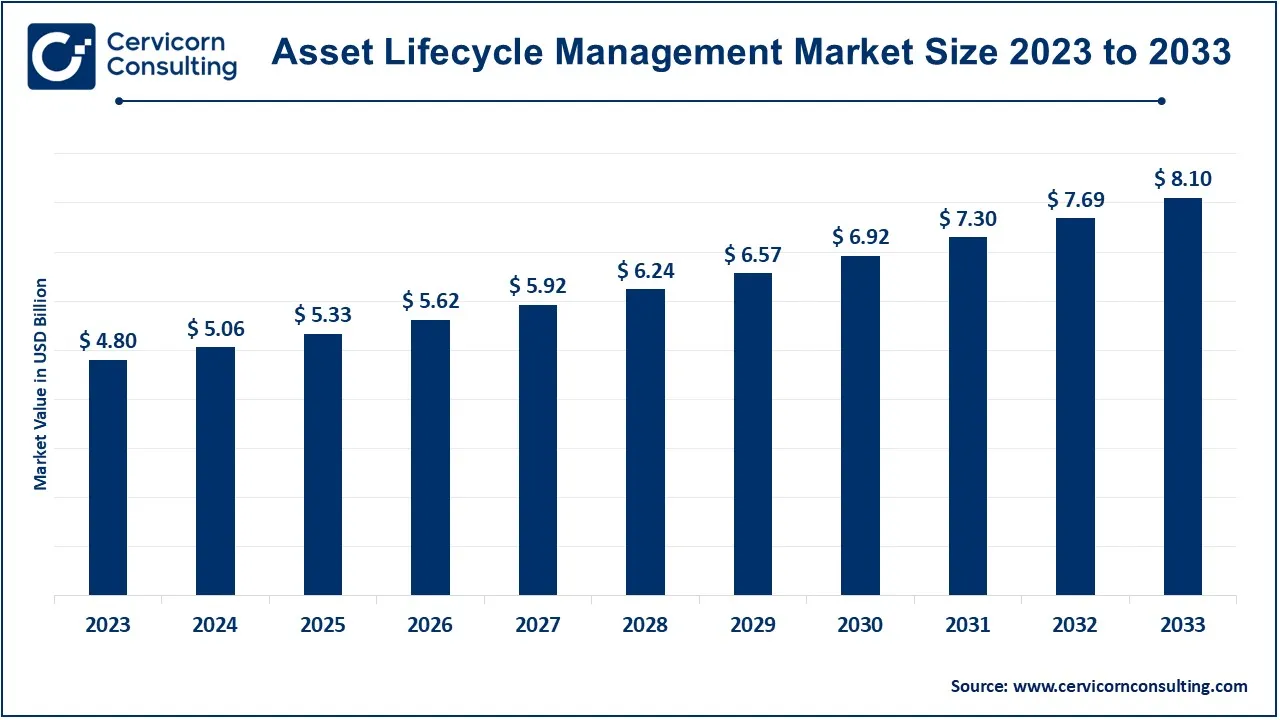

The global asset lifecycle management market size was valued at USD 5.06 billion in 2024 and is expected to reach around USD 8.10 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.6% over the forecast period 2024 to 2033. The asset lifecycle management market is experiencing steady growth due to increasing industrial automation, the rise of IoT-enabled asset tracking, and the need for cost optimization. Organizations are shifting towards cloud-based ALM solutions for better scalability and real-time insights. With a growing emphasis on sustainability, businesses are investing in ALM to ensure optimal resource utilization and regulatory compliance. The rise in digital twin technology and AI-powered analytics is further fueling market expansion. Companies are leveraging predictive analytics to reduce maintenance costs and enhance asset efficiency. The demand for ALM solutions is expected to rise across industries such as manufacturing, healthcare, energy, and transportation.

The asset lifecycle management market enhanced proper management of asset fund. ALM entails integrating ocean-the management of assets with the concern of management represented by corresponding obligations that span over their lifecycle. It seeks indeed through the utilization and optimization of available resources to, throughout the entire lifecycle of the assets, achieve high levels of performance, eliminate the occurrences of downtimes and plug those gaps in the costs incurred. Fortunately, this is no longer a problem, as advanced strategies such as the Internet of Things (IoT), Artificial Intelligence (AI) and predictive analytics have made ALM solutions inherently proactive and performance enhancement strategies with capacity to extend the longevity of the asset.

Asset Lifecycle Management (ALM) is the process of managing an asset from its acquisition to disposal, ensuring maximum efficiency, performance, and cost-effectiveness. It includes several stages: planning, procurement, deployment, utilization, maintenance, and retirement. ALM helps organizations optimize asset utilization, reduce downtime, and improve return on investment (ROI). A well-structured ALM strategy includes predictive maintenance, real-time monitoring, and data analytics to extend asset lifespan. Industries such as manufacturing, energy, healthcare, and IT rely on ALM to enhance productivity and reduce operational risks. Digital transformation, IoT, and AI-driven analytics have further improved ALM, allowing businesses to automate asset tracking, predictive maintenance, and risk assessment.

Key Insights Beneficial to the Asset Lifecycle Management Market:

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 5.33 Billion |

| Projected Market Size (2033) | USD 8.10 Billion |

| Growth Rate (2024 to 2033) | 9.60% |

| Leading Region | Asia-Pacific, Revenue Share 48% in 2023 |

| Growing Region | North America, Revenue Share 25.70% in 2023 |

| Segments Covered | Solution Type, Deployment Type, Organization Size, Industry Vertical, Region |

| Key Players | IBM Corporation, SAP SE, Oracle Corporation, Siemens AG, Infor, Schneider Electric, ABB Ltd., Bentley Systems, IFS AB, Hexagon AB, AVEVA Group, Dassault Systèmes, GE Digital, AspenTech, Siemens Digital Industries Software |

Software: ALM software solutions provide asset tracking, maintenance scheduling, performance monitoring, and life cycle analysis. These solutions may include predictive maintenance, IoT integration, cloud-based services, and AI-driven analytics, Asset Performance Management (APM), Enterprise Asset Management (EAM), Asset Inventory Management, Maintenance, Repair, and Overhaul (MRO).

Services: The services segment covers consulting, implementation, integration, training, and support services ensuring the smooth functionality of ALM software, Consulting Services, Implementation Services, Training and Support Services, Managed Services.

On-premise: To industries dealing with high security and compliance issues, onsite deployment is still of preference. It has more control over the data and could be customized but comes with a higher infrastructure cost.

Cloud-based: Cloud-based ALM solutions are also gaining popularity at a rapid rate in terms of scalability, cost efficiency, and flexibility. The platforms help organizations get access to and manage assets anywhere in the world, which is good for large enterprises spread across geographies.

Small and Medium Enterprises (SMEs): Adoption of ALM among SMEs is increasing with the trend of cloud-based solutions that are cost-effective and do not require significant capital investments. SMEs use ALM in optimized asset utilization, minimization of operational costs, and therefore increase productivity.

Large Enterprises: Large enterprises, which manage large and complex, high-value assets, need ALM for streamlined operations, regulatory compliance, and optimizing performance in global operations.

Manufacturing: ALM helps secure the high-value equipment in manufacturing, ensuring that their service lives are extended and their efficiency is improved. Predictive maintenance and IoT-enabled sensors monitor machinery, minimize downtime, and prolong asset lifecycle.

Energy & Utilities: In energy, especially in power generation and distribution, ALM ensures that critical infrastructure runs efficiently. It supports grid modernization, renewable integration, and enables such equipment to be put into productive use to optimize power delivery.

Transportation & Logistics: In this field of the transportation business, ALM is used in managing fleets, running on reduced costs of operations, and increasing availability of assets. It examines vehicle health, helps in scheduling of maintenance, and improves supply chain effectiveness.

Oil & Gas: This is a capital-intensive industry and ALM solutions extend the life cycle of extraction, refining, and distribution equipment. This reduces unplanned downtime and maximizes companies' compliance with safety and environmental regulations.

Healthcare: ALM will assist in managing medical equipment and healthcare facilities to ensure patient safety and compliance with regulations. Proper maintenance and management of medical devices will therefore result in cost control and operational efficiency.

Construction: ALM will assist construction companies in managing heavy machinery, vehicles, and equipment. It provides critical insight into the utilization of equipment, predictive maintenance, and ensuring timelines in construction without failure from unplanned stops.

Government: Public sector entities use ALM to manage infrastructural projects, public utilities, and other governmental assets. This ranges from the management of city infrastructure to the maintenance of transport networks and public buildings.

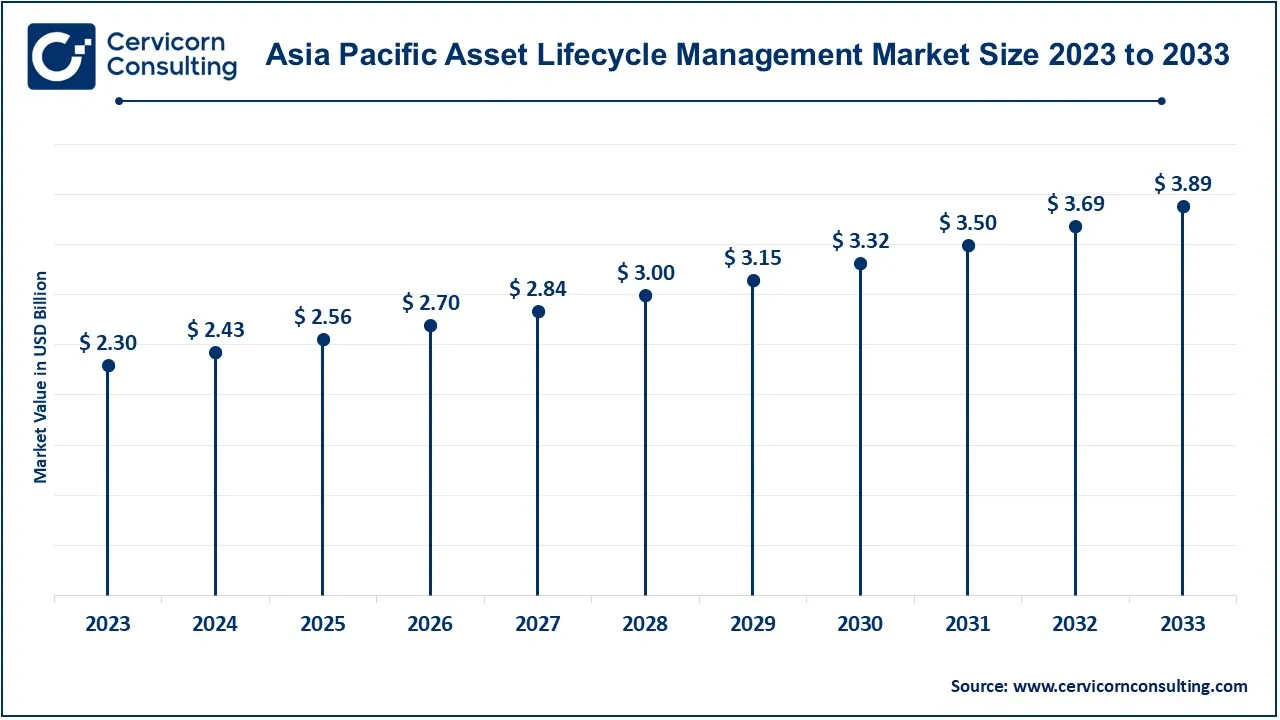

The Asia-Pacific asset lifecycle management market size was estimated at USD 2.30 billion in 2023 and is projected to surpass around USD 3.89 billion by 2033. The Asia-Pacific region is led by industrialization, infrastructure development, and further investments in digital technologies. China, India, and Japan will be the key follower geographies when ALM solutions are implemented to support their growing economies and better asset management practice.

The North America asset lifecycle management market size was valued at USD 1.23 billion in 2023 and is expected to reach around USD 2.08 billion by 2033. The North American ALM market is quite aggressive and has been driven by high industrialization levels, as well as adoption of more advanced technologies. US and Canada have the most prominent positions within the region, with vast investment in the IoT and cloud-based ALM solutions to make their assets more effective and reduce the costs related to the operation and maintenance.

The Europe asset lifecycle management market size was valued at USD 0.82 billion in 2023 and is expected to reach around USD 1.39 billion by 2033. The ALM market in Europe is equally robust and growing very fast, driven by strong regulatory frameworks for sustainability. Germany, UK, and France are focusing on asset optimization to achieve some of the environmental goals while improving the operational efficiency in sectors such as energy, transportation, and manufacturing.

The LAMEA asset lifecycle management market size was estimated at USD 0.44 billion in 2023 and is poised to hit around USD 0.75 billion by 2033. The LAMEA region, comprising Latin America, Middle East, and Africa, is very nascent for the ALM market, particularly with modernization in infrastructures and optimizing assets in the energy, transportation, and manufacturing sectors. Economic challenges notwithstanding, there is increasing interest in adopting ALM solutions to build more efficient organizations and cut costs.

Emerging companies in the asset lifecycle management sector, such as Epic Systems Corporation and GE Healthcare, are making progress with cutting-edge technology, focussing on advanced AI, data analytics and IoT integration to improve healthcare technology efficiency.

Organizations like Tempus and Owlet are also growing and finding their place in the digital transformation in practice, which involves creative solutions in the scope of the data analytics and IoT Technologies for the improvement of patient support and health care management. At the same time, global players such as Epic Systems and Cerner Corporation occupy the relevant market and domain thanks to sufficient international coverage and understanding of the healthcare IT systems. Not only does Epic Systems provide the market with advanced electronic health records and solutions for the data exchange, but integration between various health systems as well, while Cerner Corporation focuses on innovational processes through collaborative activities and active R&D. Emerging and, what is perhaps more important, more established players in the market are key to the further development of the transition of the healthcare system to digital and practical immersion of such innovations into the existing variety of medical and health services.

CEO Statement

Jon Mortensen, Global CTO, Enterprise Asset Management, IFS:

"IDC's positioning of IFS as the #1 in growth among the top 10 vendors and a significant shaper of the ALM market confirms we are doing all the right things for our customers. We have achieved remarkable, sustained growth through differentiating ourselves with Industrial AI-fueled, deep industry expertise while continuing to deliver high levels of customer satisfaction.

Market Segmentation

By Solution Type

By Deployment Type

By Organization Size

By Industry Vertical

By Region