The global health and wellness market was valued at USD 5.85 trillion in 2024 and is forecasted to reach around USD 9.69 trillion by 2034, driven by a CAGR of 5.17% throughout the forecast period 2025 to 2034.

With the focus on well-being, the health and wellness market is experiencing a noteworthy change. With advances in technology, an increasing awareness of holistic health, and a burgeoning focus on preventive care, the industry is poised for unprecedented growth and innovation. This blog delves into the vibrant evolution of the health and wellness sector, examining the latest trends, groundbreaking innovations, and the driving forces reshaping how we approach our physical, mental, and emotional well-being.

The health and wellness market is constantly expanding, with the rise of personalized regimens powered by AI, the expansion of wellness tourism, the growing popularity of plant-based diet, and the integration of mental health applications into our daily routines. It's no longer simply about treating symptoms; it's about improving quality of life, attaining balance, and encouraging a proactive approach to health.

Telehealth is assuming a pivotal role in reshaping the delivery and access of healthcare services, as technology continues to advance, and consumer expectations evolve. Telehealth has totally replaced the traditional interaction for healthcare services over the distance interaction with the integration of technology. This shift not only enhances convenience and accessibility but also brings about significant improvements in healthcare outcomes. From wearable devices that monitor vital signs to AI-powered chatbots that provide initial medical advice, technology is continuously evolving to support telehealth services. Telehealth platforms are incorporating advanced features like virtual reality for pain management and rehabilitation, as well as machine learning algorithms that predict patient needs and personalize care plans. This wave of innovation not only enhances the telehealth experience but also paves the way for future advancements in healthcare delivery.

Additionally, telehealth platforms often come equipped with user-friendly interfaces and digital tools that enhance patient engagement, such as remote monitoring, personalized health plans, and direct communication channels with healthcare teams.

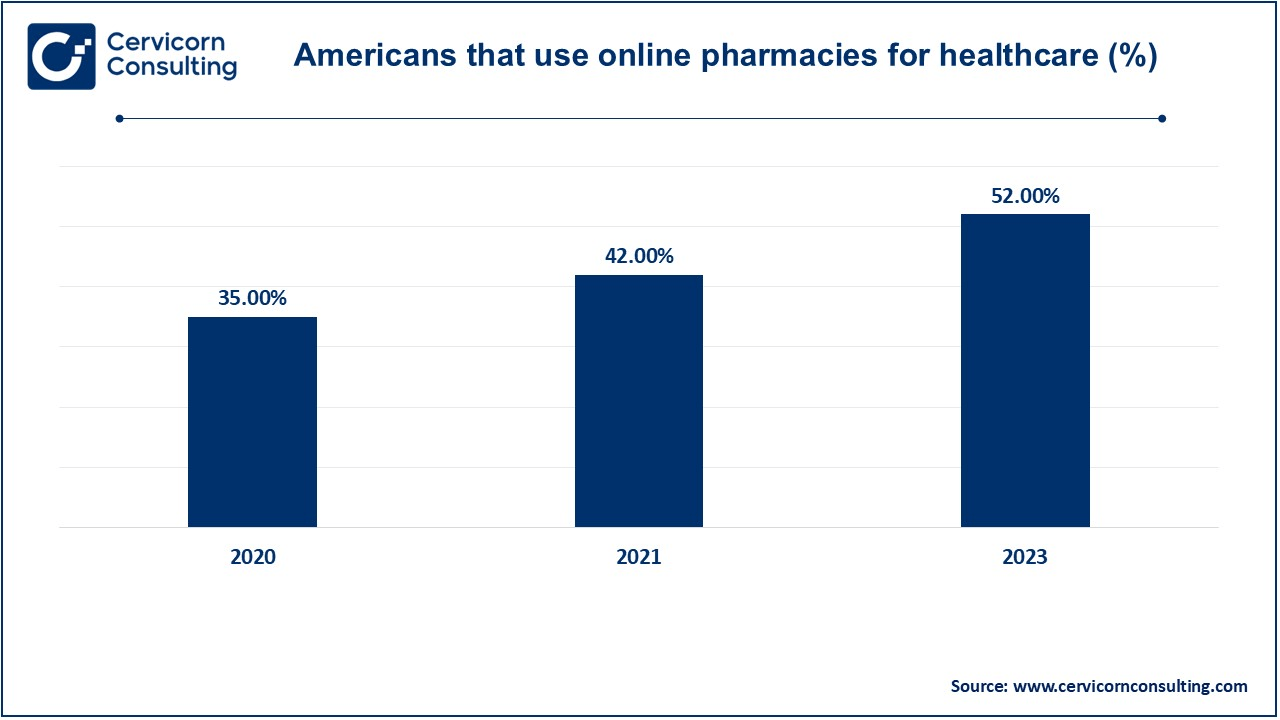

While more businesses began with innovative products associated with health and wellness category since the COVID-19 pandemic occurred. The pandemic created a wide spectrum for all from traditional retailers to online pharmaceutical stores. Multiple surveys following the pandemic revealed that the year 2020 has changed consumer perceptions about online pharmacies.

Boom in Healthcare Apps to Change the Game for the Industry

In year 2023, on a global level, health and fitness apps were downloaded more than 2 billion times. While European countries lead these downloads, Asian countries show a lucrative growth in the adoption of health and fitness apps. One of the significant advantages of health and fitness apps is their ability to deliver personalized plans based on individual goals and preferences. Apps like Nike Training Club and Lose It! use algorithms to create customized workout routines and diet plans, ensuring users receive tailored guidance that aligns with their fitness levels and objectives.

| Country | Total Downloads (2023) |

| Netherlands | 18.1 million |

| Singapore | 6.2 million |

| Belgium | 12.3 million |

| France | 74.6 million |

| Portugal | 8.8 million |

Health and fitness apps have undoubtedly revolutionized the health and wellness market, making it easier for individuals to manage their health proactively. With advancements in AI and machine learning, these apps are set to become even more personalized and effective, further enhancing their impact on global health and well-being.

The broader Asia Pacific wellness market is also witnessing a technological pivot. The integration of AI, IoT, and data analytics into consumer health is redefining engagement. Health-tech startups across Singapore, South Korea, and India are building unified digital wellness ecosystems, connecting fitness wearables, diet apps, and telehealth consultations under a single platform. Furthermore, the region’s hospitality industry is embracing wellness tourism, with Thailand, Indonesia, and Sri Lanka emerging as preferred global destinations for detox programs, Ayurveda resorts, and spa-based retreats.

Ultimately, Asia Pacific’s strength lies in its balance between heritage and innovation. The cultural credibility of ancient practices Ayurveda, Traditional Chinese Medicine, and Zen wellness coexists with the rise of digital platforms and biotech-driven health solutions. As urban professionals and younger generations seek lifestyle-driven wellness, Asia Pacific is not just following the global trend; it is setting the pace for the world’s next era of health-conscious living.

Europe’s health and wellness sector is characterized by strong regulatory frameworks, sustainability goals, and premium consumer spending on organic and ethical brands. The region’s wellness culture is transitioning from fitness-centric to holistic well-being, combining physical, mental, and environmental health.

European Consumer Health Behavior, 2025

| Area of Focus | Share (%) |

| Regular Supplement Users | 47% |

| Preventive Health Approach | 51% |

| Other Consumers | 2% |

The following pie chart illustrates the evolving health behavior of European consumers in 2025. Over half of the population (51%) now embraces a preventive approach to health, while 47% regularly use supplements, signaling a strong shift toward proactive and integrative wellness habits across the region.

The health and wellness market in North America is booming, fueled by technological innovations, rising consumer awareness, and a focus on holistic well-being. Companies that can leverage these trends and meet the evolving needs of health-conscious consumers are well-positioned for success in this dynamic market.

In the past four years, the landscape of United States’ health and wellness market has dramatically evolved. The nation has observed the innovation of multiple therapeutics along with the swift adoption of telehealth and online pharmacies.

The integration of technology in health and wellness is a significant driver of market growth. Wearable devices, health apps, and telehealth services are gaining popularity among consumers who seek to monitor and improve their health proactively. Wellness tourism is another burgeoning segment within the health and wellness sector. Post-pandemic, there has been a significant shift towards health-focused travel, with consumers seeking destinations that offer relaxation, rejuvenation, and holistic wellness experiences.

North America, with its diverse range of wellness resorts and retreats, is becoming a key player in this market. The Global Wellness Institute reports that wellness tourism is expected to grow at an annual rate of 7.5% through 2025, outpacing the growth of general tourism.

The lack of cost transparency and the shift towards value-based payments pose significant challenges. Consumers are increasingly demanding clear pricing for health and wellness products and services. Frequent price hikes and opaque pricing structures can erode consumer trust and loyalty. Companies must focus on cost control and transparency to build and maintain trust with their customers and stakeholders. Navigating the complex regulatory landscape is a major challenge for health and wellness companies. Regulations vary widely across regions, creating barriers to market entry and complicating product development and distribution. Companies must invest heavily in compliance to avoid legal pitfalls, which can be both time-consuming and costly.

The perception of wellness has drastically changed over past few years. The evolving views on emphasizing physical and mental health hold potential to offer lucrative opportunities for the market players to keep going. With times, better mindfulness, nutrition, proper nutrition for adults and better sleep are the few factors that have gained traction across the globe. With the rising consumer interest, multiple key players are setting themselves for product innovation to offer better services. These product launches are observed to supplement the growth of the market.

Wellness Spending by Nutrition, Health and Fitness:

| Countries | Nutrition | Heath | Fitness |

| Brazil | 4.60% | 64.60% | 11.90% |

| China | 11.10% | 43.50% | 17.90% |

| United Kingdom | 8.50% | 47.80% | 16% |

Governments in several countries across the globe have started promoting better health initiative in order to emphasize the physical as well as mental wellness. Such initiatives, with times are observed to supplement the growth of the health and wellness market. Governments worldwide are investing heavily in health technologies, public health programs, and regulatory reforms to improve accessibility, quality, and efficiency in the healthcare sector. Lowering burden from the traditional healthcare system by emerging telehealth services, digital solutions and technology-based monitoring systems, the administrative bodies are observed to promote the industry’s expansion.

Cervicorn Consulting’s analysts note that the adoption of wearable diagnostics and AI-led health tracking is not just a consumer trend, it’s a structural change in the way wellness ecosystems operate. By 2030, the global health and wellness market will be defined by a deeply data-driven, personalized, and technology-integrated ecosystem, where health monitoring, preventive care, and sustainable living become everyday norms.

| Focus Area | Projection | Key Platforms | Major Companies | Description |

| Corporate Mental Wellness | 65% of global corporations to include structured mental wellness programs | AI-driven therapy tools, workplace well-being dashboards | Calm Health | Firms integrating digital wellness tools to boost employee mental health and retention |

| AI-Powered Therapy | Over 500 million AI-assisted therapy interactions annually | NLP-based mental health chatbots, adaptive CBT algorithms | Woebot Health | AI platforms offering real-time emotional support and therapy-based guidance |

| VR Therapy | 200 million global users engaging in VR-based therapy or meditation | Immersive VR therapy environments, biofeedback systems | MindVR | VR used for stress relief, trauma healing, and immersive mindfulness sessions |

As per Cervicorn Consulting’s insights, companies that blend biotechnology, AI, and consumer personalization will emerge as the dominant players by 2030, with an estimated 1.2 billion active wearable devices worldwide, tracking everything from sleep cycles to stress levels. Companies like Apple, Garmin, and Fitbit are expected to expand beyond fitness into full-scale preventive diagnostics, using real-time biosensor data to predict cardiovascular or metabolic disorders before symptoms appear. The number of connected health devices per person is projected to reach 4.6 by 2030, compared to 1.3 in 2023, indicating a major behavioral shift toward continuous wellness monitoring.

Nutritional and lifestyle personalization will also see explosive growth, powered by genetic insights and microbiome analytics. By 2030, it is expected that 1 in 4 adults globally will use DNA-based or AI-driven nutrition plans, as seen in the rise of platforms like Zoe and Nutrigenomix, which use gut and genetic data to deliver precision diet recommendations. Functional beverages and plant-based innovations will continue reshaping consumption patterns, with more than 40% of the global population anticipated to include plant-based meals in their weekly diets. Major brands such as Nestlé and Danone are already redirecting R&D investments toward nutrient-fortified foods and probiotic-rich formulations to meet this demand.

The landscape of the health and wellness market is characterized by a mix of established players and emerging startups, all vying to meet the evolving needs of health-conscious consumers. Key factors influencing competition include product innovation, brand reputation, regulatory compliance, and market reach. The integration of digital health technologies is transforming the health and wellness market. Wearable devices, health monitoring apps, and telemedicine platforms are becoming increasingly popular. Companies like Apple and Fitbit are leading the way with innovative wearables that track various health metrics, providing users with actionable insights into their well-being.

There is growing recognition of the importance of mental health in overall well-being. Startups like Calm and Headspace have developed popular meditation and mindfulness apps that help users manage stress and improve mental health. The success of these platforms underscores the increasing consumer demand for mental wellness solutions.

The rise of digital health solutions, wellness tourism, sustainable products, and personalized health approaches are key trends shaping the market. However, challenges such as regulatory hurdles, cost transparency, and addressing chronic diseases and mental health issues remain. Despite these challenges, recent breakthroughs in telehealth, AI, genetic testing, and functional beverages are propelling the market forward, promising a future where health and wellness are more accessible, personalized, and sustainable.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2351

Ask here for more details@ sales@cervicornconsulting.com