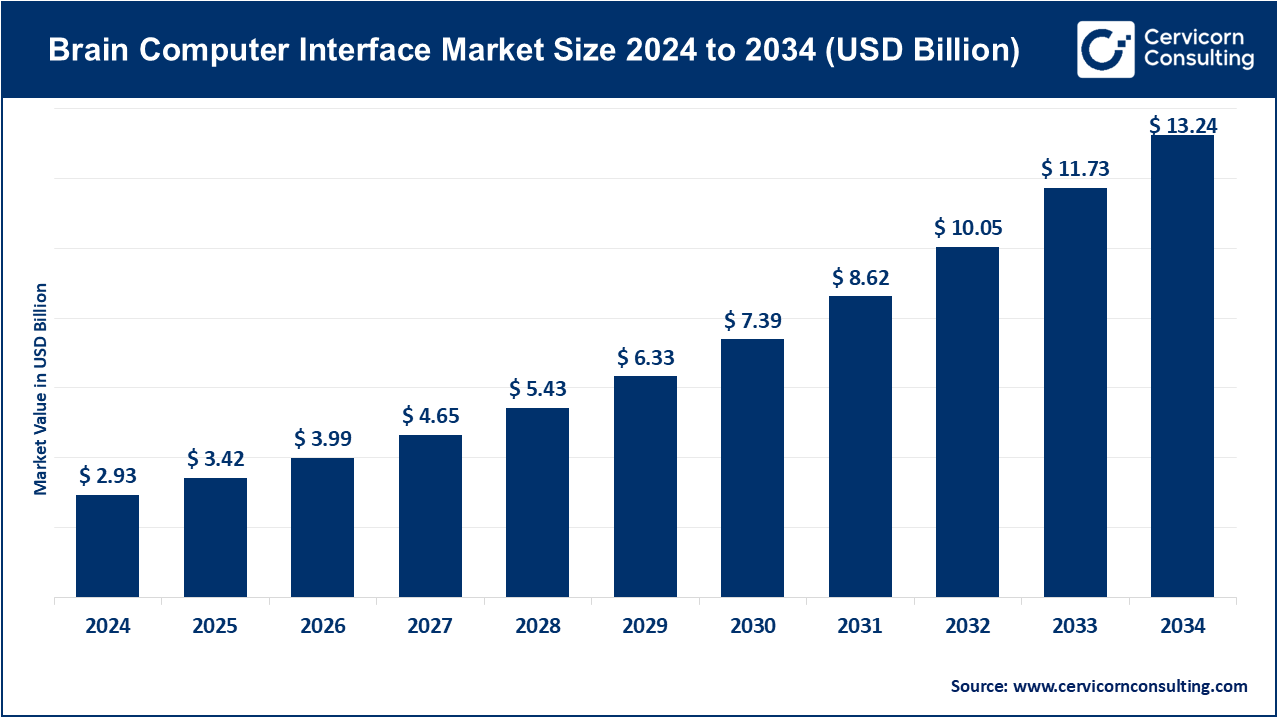

The global brain computer interface market size was valued at USD 2.93 billion in 2024 and is predicted to hit around USD 13.24 billion by 2034, growing at a The compound annual growth rate (CAGR) of 16.28% from 2025 to 2034.

The brain-computer interface (BCI) market has witnessed significant growth over the past decade, driven by advancements in neural engineering, artificial intelligence, and machine learning. As more industries begin to explore the potential applications of BCIs, including healthcare, gaming, and defense, the market has attracted considerable investment. In the healthcare sector, BCIs are revolutionizing the treatment of neurological diseases such as ALS, stroke, and spinal cord injuries, where the technology helps patients regain mobility or communication abilities. The gaming and entertainment sectors are also expected to grow, with BCIs enabling more immersive, hands-free interactions. In December 2024, Precision Neuroscience secured USD 102 million in funding, bringing its total to USD 155 million. This investment aims to advance their AI-powered brain implant designed to enable paralyzed individuals to control computers with their thoughts. The funding round included contributions from General Equity Holdings, B Capital, Stanley F. Druckenmiller’s Duquesne Family Office, and Steadview Capital.

A brain-computer interface (BCI) is a technology that enables direct communication between the human brain and external devices, like computers or robotic limbs, without the need for physical movement. It works by detecting electrical signals generated by the brain, typically using sensors placed on the scalp (non-invasive) or implanted inside the brain (invasive). These signals are then translated into commands that control devices. BCIs have significant applications in healthcare, especially for individuals with disabilities, helping them control prosthetics, communicate, or even interact with their environment more effectively. Research in this field is advancing rapidly, with applications ranging from aiding individuals with paralysis to enhancing virtual reality experiences.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 3.42 Billion |

| Projected Market Size (2034) | USD 13.24 Billion |

| Growth Rate (2025 to 2034) | 16.28% |

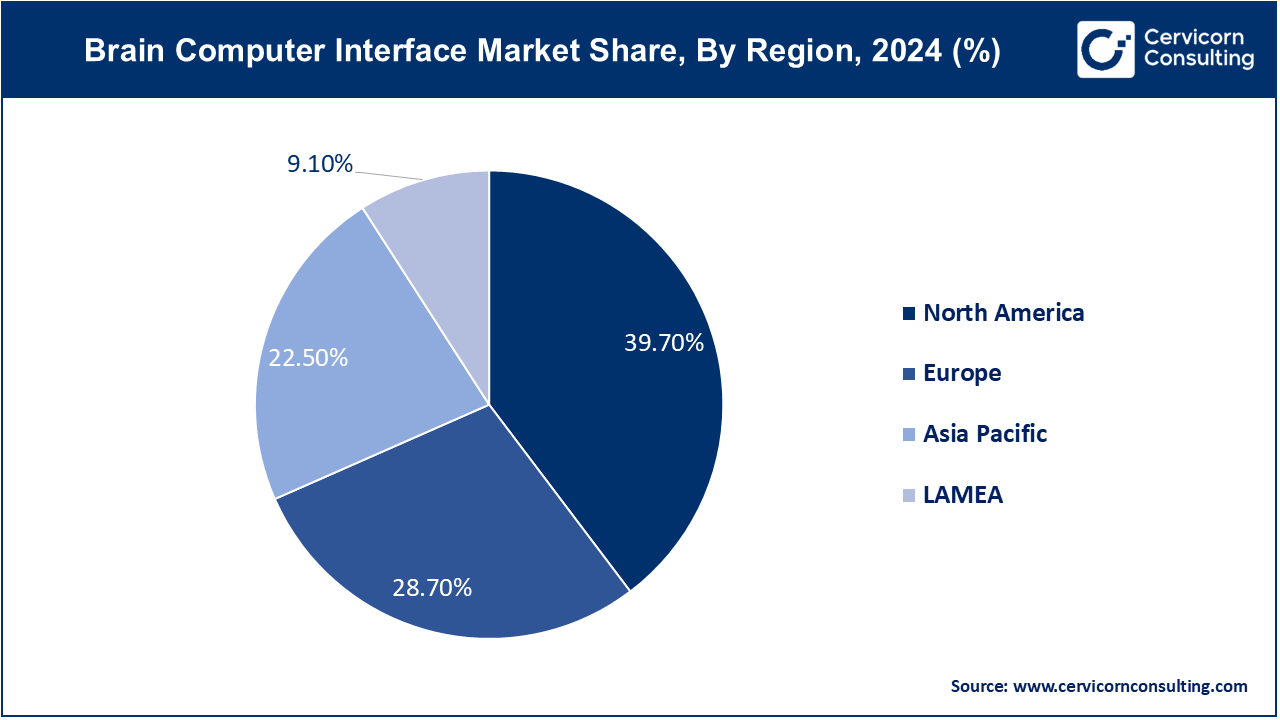

| Dominating Region | North America |

| Growing Region | Asia-Pacific |

| Segmentation Covered | Product, Component, Application, End User, Region |

| Key Players | Compumedics Ltd, G.tec medical engineering GmbH, Natus Medical Inc., Medtronic PLC, Advanced Brain Monitoring Inc., Nihon Kohden Corporation, Integra LifeSciences Corporation, NeuroSky, Cadwell Industries Inc., NIRx Medical Technologies, NextMind, ANT Neuro, MindMaze, Emotive Incorporation, Brain Products GmbH |

High cost of BCI systems: BCI systems are not today a marketable product due to the cost of development and deployment. They have high-cost components and require a huge amount of research in gain control and mechanism principles. This makes them less popular and less reachable to the smaller companies and individuals, particularly in developing regions, effectively limiting their potential data reach.

Integration with existing technology is very complicated: The integration of BCI systems with pre-existing technologies is demanding. This compatibility with the current devices and networks in various industries adds obstacles for the developers and slows down the pace of adopting these systems, especially in those sectors where smooth integration is fundamental.

Such devices possess poor battery lifespan: The majority of the BCI devices that can be worn on the person have very short battery life, and that compromises their usability and comfort. Batteries that need frequent recharging or replacing further limit the scope of such devices in cases of long-term medical or assistive applications and hence pose quite a large hurdle for the developers.

Lack of standardization for protocols applicable to BCI usage and development: That fact that the protocols for BCI development and use necessary in different industrial settings are not standardized compounding efforts to develop similar systems that are interoperable and compatible. This lack makes it difficult for companies to scale such BCI technologies and limits their adoption by those industries that require cross-industry compatibility.

Ensures perfect communication, real-time, between-brain and device: Ensuring the conflation of accuracy and real-time communication between the brain and the BCI device proves burdensome, especially in non-invasive modes. Very accurate interpretation of brain signals while maintaining a real-time response is of essence to the working of BCIs and in the medical and assistive context.

Heavy research and development costs: The development of advanced BCI systems involves huge investments in R&D. The high associated costs of innovations and thoroughly testing and refining the technologies constitute a big barrier to entry for many new ventures and startups and impacts the overall growth of the industry

The brain computer interface market is segmented into component, product, technology, application, end user and region. Based on component, the market is classified into hardware, and software. Based on product, the market is classified into invasive BCI, non invasive BCI, and partially invasive BCI. Based on technology, the market is classified into electroencephalography (EEG), electrocorticography (ECoG), functional magnetic resonance imaging (fMRI), functional near-infrared spectroscopy (fNRIs), and magnetoencephalography (MEG). Based on application, the market is classified into healthcare, communication & control, entertainment & gaming, smart home control, brain function repair, disabilities restoration, and others. Based on end user, the market is classified into medical, military, and others.

Hardware: The hardware segment has accounted highest revenue share in 2024 which is 63.90%. The hardware components of BCI include sensors, amplifiers, and artifact filtration systems. These devices detect brain signals and transmit them to the computable devices. These development broadly focuses on sensitivity enhancement, noise reduction, and embedding capability for the comfort of users. It is also a key section exploring the development of noninvasive and implantable devices with varying applications in health care, gaming, and communication, thus propelling its growth in the BCI market.

Software: The software segment has held revenue share of 36.10% in 2024. BCI software is vitally important for the processing and interpretation of brain signals captured by the hardware. It utilizes algorithms and artificial intelligence to analyze brain activities and convert it into control signals for various applications. It is required for the real-time processing of information, hence improving the accuracy and efficiency of communication and control. Some of the development includes machine learning and neurofeedback systems; hence, they aim at increasing the versatility of the BCI systems in the area of application.

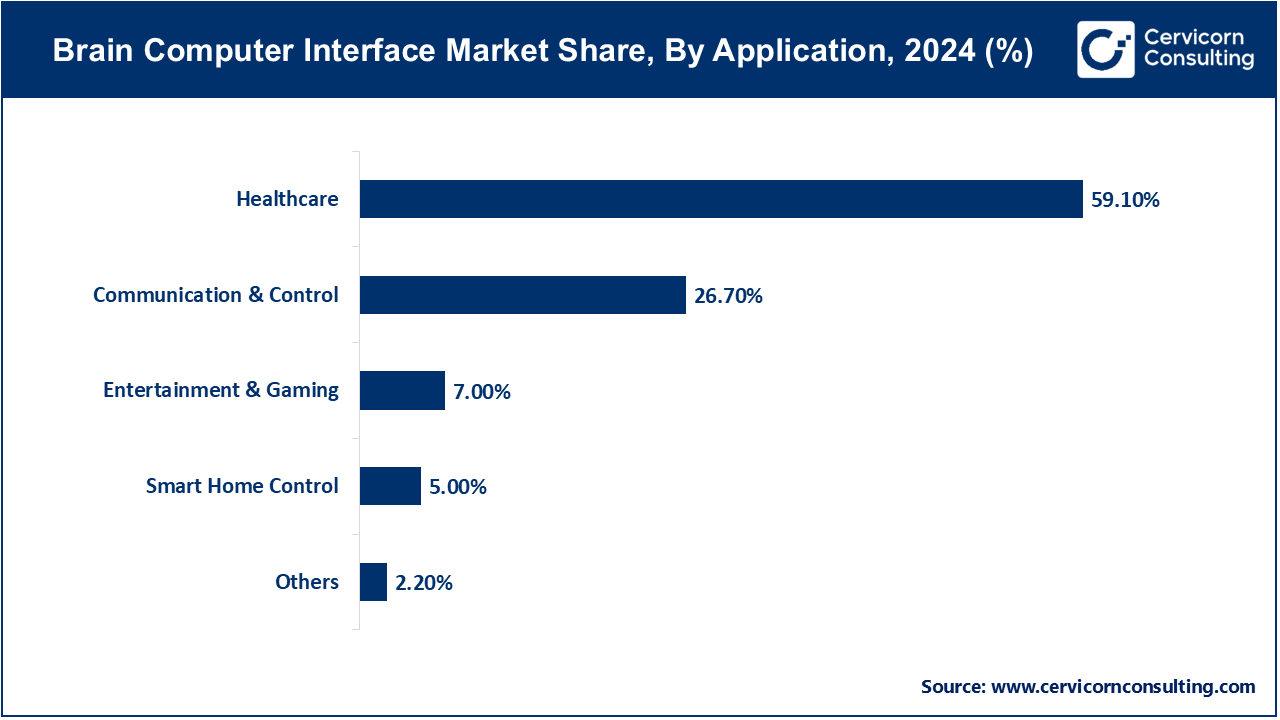

Healthcare: The healthcare segment has generated largest revenue share of 59.10% in 2024. The application of BCIs in healthcare is most significant in rehabilitation and assistive technologies for people with neurological issues or disabilities. BCIs enable the users to control prosthetic limbs, communicate, and carry out other daily activities using brain signals. The emerging technologies in the direction of brain-computer interface technologies intend to elevate the quality of life in patients and this is boosting the demand for BCIs in medical processes. With advancing research, BCIs are being developed for neurorehabilitation, which promotes better rehabilitation outcomes for those afflicted with stroke and spinal cord injuries.

Communication & Control: The communication & control segment has held revenue share of 26.70% in 2024. The communication and control of BCI systems for individuals with severe disability allow the interaction of the persons with their environment and command electric and mechanical devices through brain signals. This application is especially essential for persons who are unable to use traditional inputs such as a keyboard or touch screen. BCIs provide alternative channels of communication, thereby augmenting independence and quality of life. Various ongoing developments may work towards increasing the accuracy and speed of these systems making them more accessible and user-friendly for a broader audience.

Entertainment & Gaming: The entertainment & gaming segment has accounted revenue share of 7% in 2024. In the entertainment and gaming industries, BCIs offer immersive experiences by allowing players to control games and applications using their brain activity. This novel interaction method enhances engagement and accessibility, attracting a diverse audience. Game developers and technology companies are exploring the potential of BCIs to create innovative gaming experiences that adapt to players’ emotional and cognitive states. As technology advances, the market for BCI-based entertainment is expected to expand, fostering collaboration between tech and gaming industries.

Smart Home Control: The smart home control segment has garnered share of 5% in 2024. BCIs are increasingly being integrated into smart home technology, enabling users to control devices such as lights, thermostats, and appliances through brain signals. This application enhances convenience and accessibility, particularly for individuals with mobility impairments. As smart home technologies become more prevalent, the demand for BCI solutions that facilitate seamless interaction with these systems is growing. Future developments aim to improve integration and functionality, allowing users to customize their environments more intuitively.

Invasive Brain Computer Interface: The invasive BCI segment has captured revenue share of 6.90% in 2024. Invasive brain-computer interfaces (BCIs) involve the implantation of electrodes directly into the brain tissue. These systems provide high-resolution brain signal data, allowing for precise control of external devices. Although they offer significant advantages in terms of accuracy and performance, invasive BCIs carry risks, such as infection and surgical complications. Despite these challenges, ongoing research aims to improve safety and effectiveness, making invasive BCIs a promising option for applications in neuroprosthetics and rehabilitation.

Non-invasive Brain Computer Interface: The non-invasive BCI segment has reported share of 83.50% in 2024. Non-invasive BCIs utilize external sensors to detect brain activity without requiring surgical intervention. Common methods include electroencephalography (EEG) and functional near-infrared spectroscopy (fNIRS). These systems are generally safer and more accessible than invasive options, making them ideal for a wider range of applications, including healthcare, gaming, and communication. However, non-invasive BCIs may face limitations in terms of signal quality and resolution, leading to ongoing research focused on enhancing their performance and user experience.

Partially Invasive Brain Computer Interface: The partially invasive BCI segment has held share of 9.60% in 2024. Partially invasive BCIs bridge the gap between invasive and non-invasive systems by placing electrodes inside the skull but outside the brain tissue. This approach minimizes some risks associated with invasive procedures while providing better signal quality than non-invasive methods. Partially invasive BCIs are gaining traction in applications such as neurorehabilitation and cognitive monitoring, where improved accuracy is essential. As technology advances, these systems are expected to become more prevalent, offering a balanced solution for various user needs.

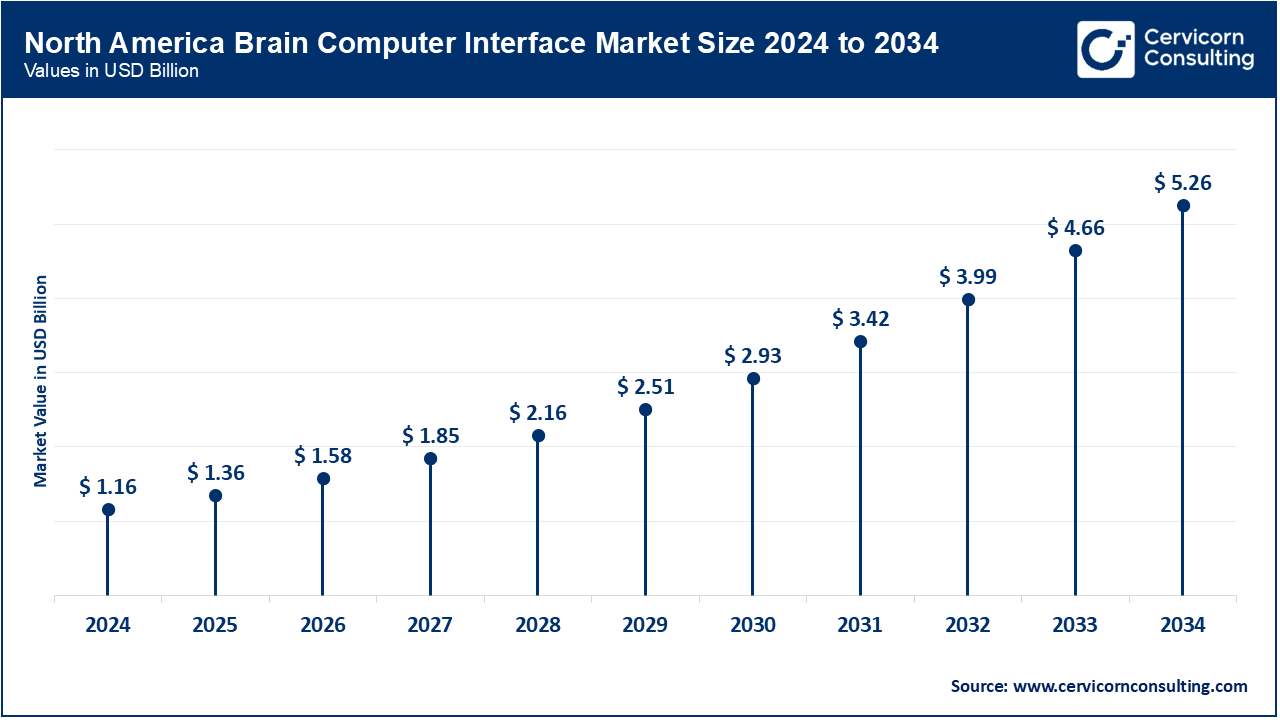

The North America brain computer interface market size was valued at USD 1.16 billion in 2024 and is expected to reach around USD 5.26 billion by 2034. North America region is driven primarily by advancements in technology, extensive R&D investments, and a growing prevalence of neurological disorders. The United States, being the market leader, hosts numerous key players and research institutions focused on developing innovative BCI solutions. Canada also contributes to market growth through government initiatives aimed at enhancing healthcare technologies. The presence of well-established healthcare systems and high disposable incomes further support the adoption of BCIs in this region.

The Europe brain computer interface market size was estimated at USD 0.84 billion in 2024 and is expected to surpass around USD 3.8 billion by 2034. Europe is experiencing substantial growth, supported by increased funding for neuroscience research and healthcare innovations. Countries like Germany, the United Kingdom, and France are at the forefront, with strong academic institutions and a focus on integrating BCIs into healthcare and rehabilitation services. The European Union's initiatives to improve assistive technologies and enhance the quality of life for individuals with disabilities also bolster market expansion. Furthermore, the growing interest in BCIs for entertainment and gaming applications is driving adoption across the region.

The Asia-Pacific brain computer interface market size was valued at USD 0.66 billion in 2024 and is anticipated to surpass around USD 2.98 billion by 2034. The Asia-Pacific region is emerging as a rapidly growing, fueled by advancements in technology and a rising demand for healthcare solutions. Countries such as China, Japan, and India are significant contributors, with investments in R&D and increasing awareness of BCI applications in neurorehabilitation and assistive technologies. Japan's focus on robotics and brain research, combined with China's expanding healthcare sector, enhances the market's growth potential. The rising aging population in these countries also drives demand for BCIs to support patients with neurodegenerative disorders.

The LAMEA brain computer interface market size was valued at USD 0.27 billion in 2024 and is expected to reach around USD 1.21 billion by 2034. The LAMEA region is witnessing gradual growth, influenced by increasing healthcare investments and rising awareness of assistive technologies. In Latin America, countries like Brazil and Argentina are exploring BCI applications to address healthcare challenges. The Middle East is focusing on enhancing healthcare infrastructure, with countries like the United Arab Emirates investing in advanced technologies. In Africa, while the market is still developing, countries like South Africa are beginning to adopt BCIs for healthcare applications, providing opportunities for growth in this diverse region.

The brain computer interface market is dominated by a few central players, including Natus Medical Incorporated, Compumedics Ltd, EMOTIV, g.tec medical engineering GmbH and NeuroSky, among others. These organizations are recognized for their innovative solutions and commitment to advancing Brain computer interface through technologies and innovative solutions. They focus on enhancing user experience, improving accessibility for individuals with disabilities, and advancing healthcare applications. Their commitment to research and development drives continuous innovation, enabling the integration of BCIs into various fields, such as entertainment, communication, and rehabilitation, ultimately shaping the future of human-computer interaction.

CEO Statements

Thomas Reardon – CEO of CTRL-Labs:

"The potential to reshape how humans interact with machines is immense, and we are dedicated to pushing these boundaries."

Elon Musk– CEO of Neuralink:

"We are progressing toward human trials with the goal of enabling people with paralysis to regain independence through direct brain-machine communication”

Marc-Antoine Durand – CEO of NextMind:

"Our technology offers users an unprecedented level of immersion and control. We believe that brain-computer interaction is the future of digital engagement."

The brain computer interface (BCI) market is seeing dynamic advancements and strategic launches as key players focus on improving technological capabilities. Industry leaders are heavily investing in research, collaborations, and manufacturing innovations to enhance their competitive positioning. Some notable examples of key developments in the market include:

Market Segmentation

By Component

By Product

By Technology

By Application

By End User

By Region