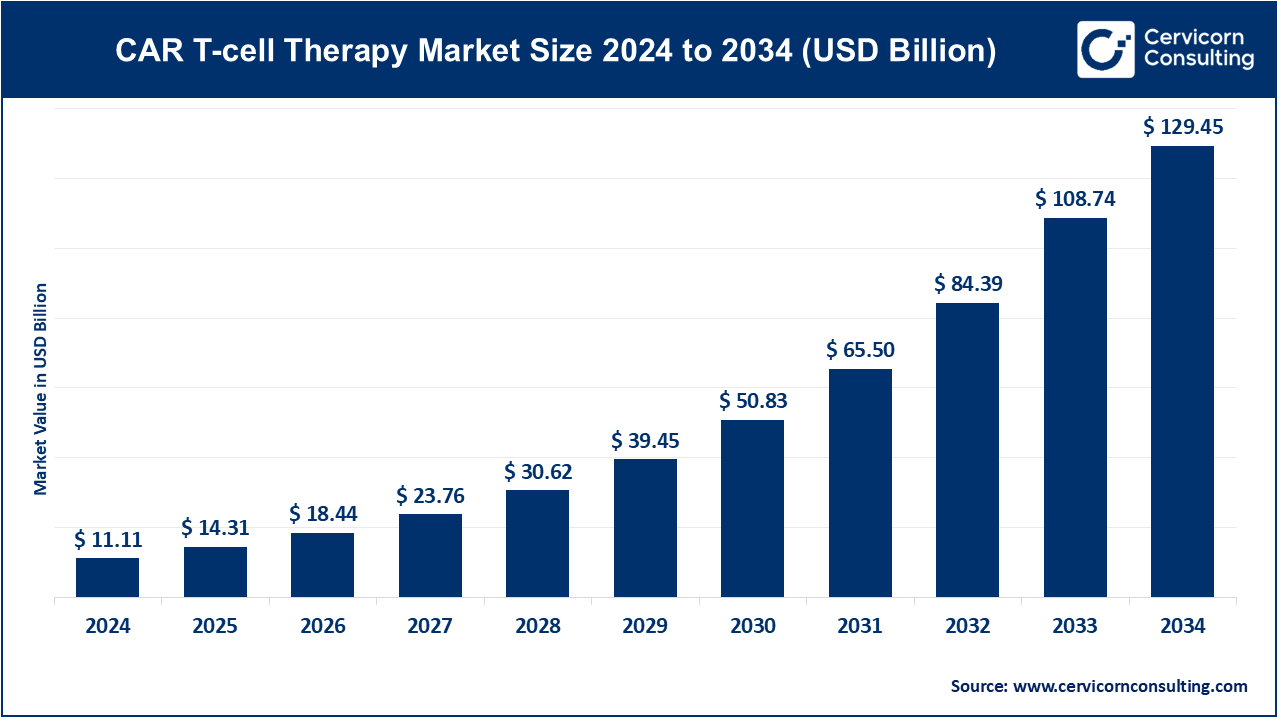

The global CAR T-cell therapy market size was worth USD 11.11 billion in 2024 and is forecasted to reach around USD 129.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 27.83% from 2025 to 2034.

The CAR T-cell therapy market has experienced robust growth due to advancements in cellular therapies and an increasing number of approvals for various indications. The expanding oncology pipeline and ongoing clinical trials have contributed to the market's optimism, particularly in the treatment of blood cancers such as leukemia and lymphoma. Major pharmaceutical companies are heavily investing in the research and development of CAR T-cell therapies, as they hold immense potential to address unmet medical needs in cancer treatment. Partnerships, collaborations, and acquisitions among biotech and pharmaceutical companies are further strengthening the market. Moreover, the market is seeing rising interest from healthcare providers, as CAR T-cell therapies have demonstrated durable responses in patients who previously had limited treatment options.

CAR T-cell therapy, or Chimeric Antigen Receptor T-cell therapy, is an innovative form of immunotherapy that modifies a patient's own T-cells to recognize and attack cancer cells. In this therapy, T-cells are collected from a patient's blood and genetically engineered to produce receptors specific to cancer cell antigens. Once reintroduced into the patient's body, these modified T-cells can seek out and destroy cancerous cells more effectively than the body’s unmodified immune cells. This breakthrough therapy has shown significant success in treating certain blood cancers, including leukemia and lymphoma, and continues to be studied for its application in solid tumors. Despite its effectiveness, CAR T-cell therapy remains complex and expensive, limiting accessibility for some patients.

According to the Leukemia Research Foundation, approximately 6,660 new cases of acute lymphoblastic leukemia were diagnosed in 2022, increasing the demand for CAR T-cell therapy.

The Federation of American Scientists reported in 2023 that around 60 million individuals, or 18.2% of the U.S. population, are covered by Medicare, highlighting a significant patient base for advanced treatments.

In February 2023, the UVM Cancer Center in Vermont introduced new CAR T-cell therapy options for patients with blood cancers.

The Cancer Network noted in 2022 that diffuse large B-cell lymphoma (DLBCL), a major subtype of Non-Hodgkin Lymphoma, affects 30-40% of patients with relapsed or refractory DLBCL within the first two years of diagnosis.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 14.31 Billion |

| Market size in 2034 | USD 129.45 Billion |

| Market Growth Rate | CAGR of 27.83% from 2025 to 2034 |

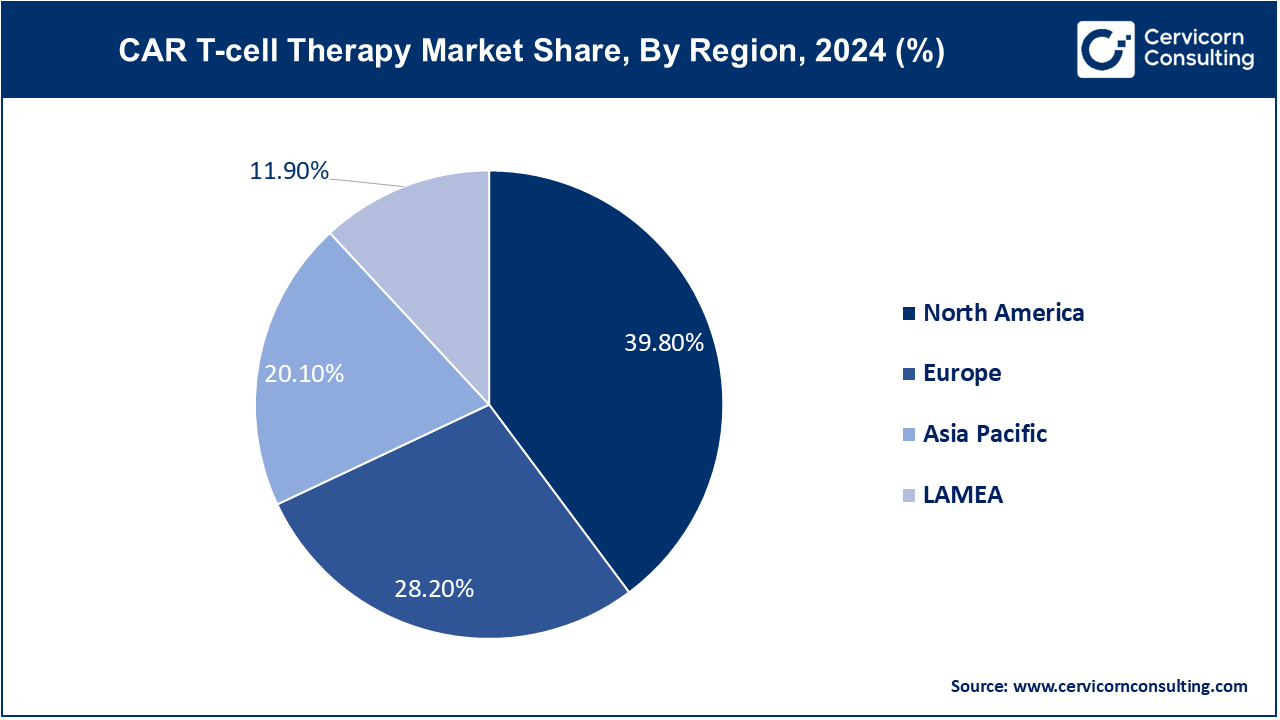

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Product, Disease Indication, End-Use, Regions |

Rising Awareness and Patient Advocacy

Technological Advancements in Manufacturing

High Cost of Treatment

Complex Manufacturing and Logistics

Expansion into Solid Tumors

Global Market Penetration

Limited Long-Term Efficacy Data

Resistance and Relapse

Abecma (idecabtagene vicleucel): Abecma, developed by Bristol-Myers Squibb and bluebird bio, is designed to target BCMA in multiple myeloma. Its approval marks a significant advancement in treating this challenging hematologic cancer, driving demand for innovative treatments.

Breyanzi (lisocabtagene maraleucel): Breyanzi, from Bristol-Myers Squibb, targets CD19 to treat relapsed or refractory large B-cell lymphoma. Its novel manufacturing process enhances T-cell expansion, which contributes to its growing market acceptance and adoption for effective lymphoma management.

Carvykti (ciltacabtagene autoleucel): Carvykti, developed by Bristol-Myers Squibb and bluebird bio, targets BCMA and offers promising results for multiple myeloma patients. Its advanced design aims to improve durability and response rates, thus driving its market uptake.

Kymriah (tisagenlecleucel): Kymriah, from Novartis, was the first CAR T-cell therapy approved for treating large B-cell lymphoma and acute lymphoblastic leukemia. Its pioneering status and effectiveness in these cancers drive its continued adoption and market presence.

Tecartus (brexucabtagene autoleucel): Tecartus, by Kite Pharma, targets CD19 for mantle cell lymphoma. Its specialized approach and efficacy in treating this rare lymphoma contribute to its increasing market share and interest in niche oncology applications.

Yescarta (axicabtagene ciloleucel): The Yescarta segment has captured market share of 44.12% in 2023. Yescarta, developed by Kite Pharma, is designed for relapsed or refractory large B-cell lymphoma. Its robust clinical results and approval for various lymphoma indications enhance its prominence in the CAR T-cell therapy market.

Others: This category includes emerging CAR T-cell products and investigational therapies. Innovations and ongoing research in this segment are expected to introduce new solutions, potentially expanding treatment options and driving growth in the market.

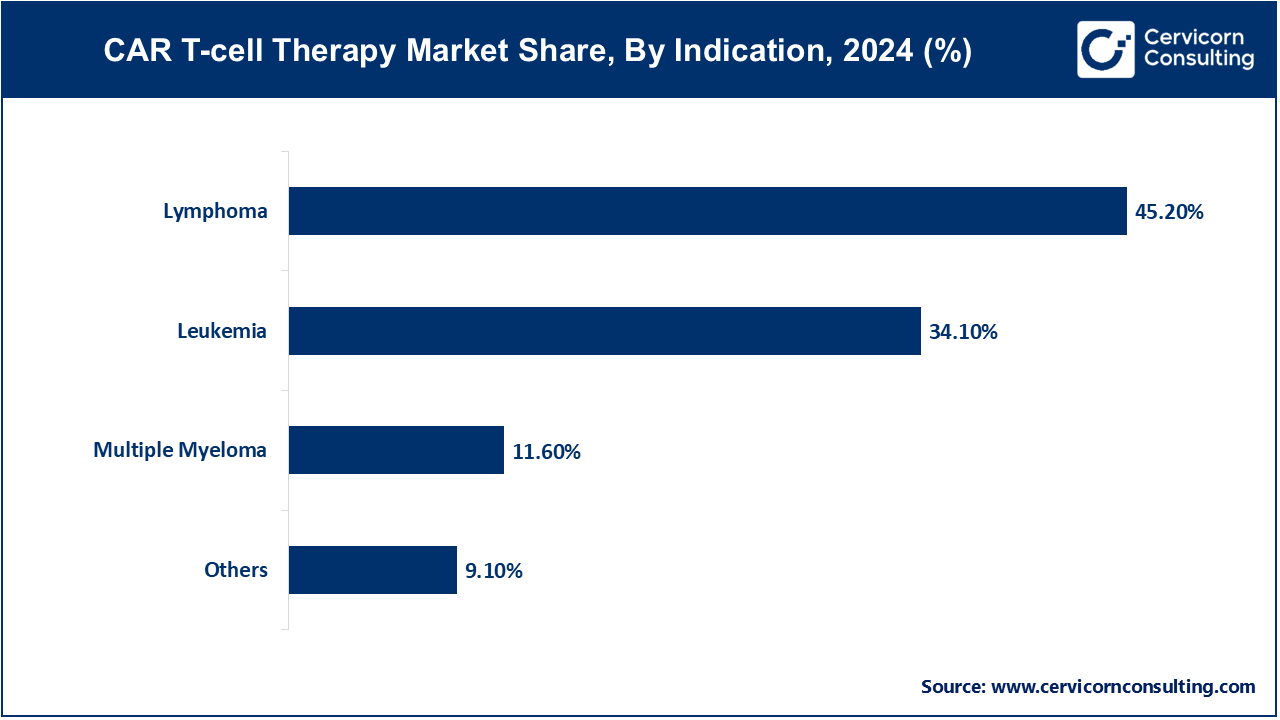

Leukemia: The leukemia segment has recorded market share of 34.1% in 2024. CAR T-cell therapy for leukemia, especially acute lymphoblastic leukemia (ALL), has shown remarkable efficacy in clinical trials. The increasing incidence of leukemia and the therapy's ability to target specific cancer cells are driving its adoption. Continued advancements aim to enhance remission rates and reduce relapse, fueling growth in this segment.

Lymphoma: The lymphoma segment has registered market share of 45.2% in 2024. CAR T-cell therapy targeting lymphomas, including large B-cell lymphoma, has demonstrated significant success, particularly in patients with relapsed or refractory conditions. The effectiveness of therapies like Yescarta and Breyanzi in treating diverse lymphoma types drives market expansion, supported by ongoing research and increasing patient demand for targeted treatments.

Multiple Myeloma: The multiple myeloma segment has accounted market share of 11.6% in 2024. CAR T-cell therapies targeting BCMA, such as Abecma and Carvykti, have shown promising results in treating multiple myeloma. The rise in multiple myeloma cases and the therapy's potential for durable responses are propelling growth. Continued innovation and clinical successes are crucial for expanding this segment's market presence.

Others: The others segment has accounted market share of 9.1% in 2024. This segment includes emerging and experimental CAR T-cell therapies for various cancer types and rare diseases. This segment is driven by ongoing research and the development of novel therapies that address unmet medical needs. Innovations and positive clinical outcomes in these areas contribute to market growth and diversification.

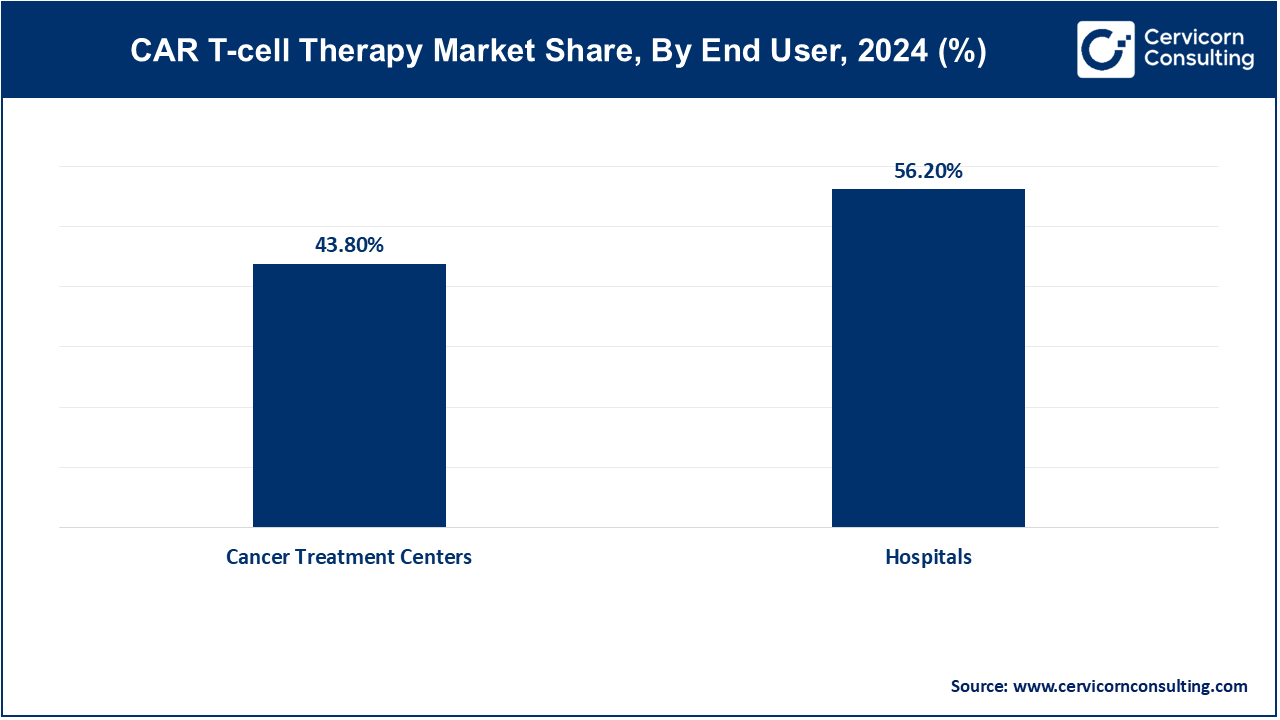

Hospitals: The hospitals segment has achieved market share of 56.2% in 2024. Hospitals are increasingly becoming primary venues for CAR T-cell therapy administration due to their comprehensive infrastructure and multidisciplinary teams. The growing adoption of CAR T-cell therapies is driven by hospitals' capacity to handle complex treatments and manage potential side effects. Advancements in hospital-based treatment protocols and increased investment in oncology facilities are propelling this trend.

Cancer Treatment Centers: Cancer treatment centers segmets has covered market share of 43.8% in 2024. Specialized cancer treatment centers are pivotal in delivering CAR T-cell therapies, offering focused expertise and advanced technologies. These centers are expanding their CAR T-cell service offerings in response to high demand and the complexity of the therapies. Their specialized care, coupled with innovations in treatment protocols, drives growth in this segment.

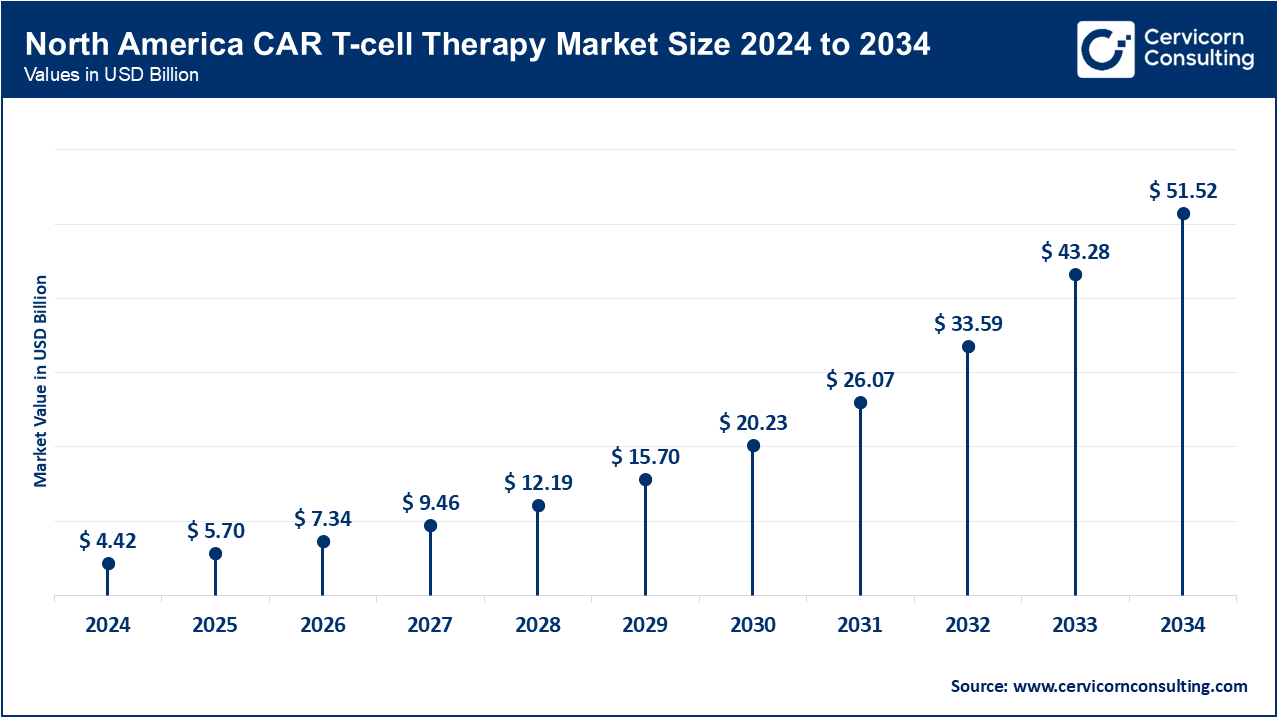

North America leads the CAR T-cell therapy market with the dominating market size of USD 4.42 billion in 2024 and is expected to grow up to USD 51.52 billion by 2034, driven by advanced healthcare infrastructure, high R&D investments, and substantial funding for clinical trials. The U.S. and Canada are at the forefront of adopting CAR T-cell therapies due to high incidences of cancers like lymphoma and leukemia, a strong regulatory framework, and well-established treatment centers. Continuous innovation, significant healthcare expenditure, and supportive reimbursement policies further bolster market growth in this region.

The Europe CAR T-cell therapy market size is calculeted at USD 3.13 billion in 2024 and is expanding around USD 36.5 billion by 2034. Europe is experiencing growing adoption of CAR T-cell therapies, supported by increasing cancer incidences and advancements in treatment options. Countries like Germany, the UK, and France are investing in CAR T-cell research and development, with regulatory approvals and collaborative efforts enhancing market growth. The European market benefits from robust healthcare systems, supportive policies, and rising patient awareness, though differences in reimbursement and access across countries can impact the overall market dynamics.

The Asia-Pacifi CAR T-cell therapy market size is calculated at USD 2.23 billion in 2024 and is projected to hit around USD 26.02 billion by 2034. The Asia-Pacific region is witnessing significant growth in CAR T-cell therapy adoption due to rising cancer rates and improving healthcare infrastructure. Countries such as China, Japan, and South Korea are making strides in CAR T-cell research and clinical applications. Increasing investment in healthcare, growing clinical trial activities, and government initiatives to enhance treatment accessibility are driving market expansion. However, challenges related to regulatory processes and high treatment costs persist.

The LAMEA region is gradually embracing CAR T-cell therapies, spurred by increasing cancer prevalence and improvements in healthcare facilities. Brazil, South Africa, and UAE are key players in this market, with efforts focused on enhancing treatment accessibility and developing local expertise. Market growth is supported by international collaborations and investments, though challenges such as economic constraints and limited healthcare infrastructure continue to affect overall adoption rates.

New players such as TCR2 Therapeutics and Poseida Therapeutics are advancing CAR T-cell therapy with novel approaches, leveraging proprietary technology to enhance efficacy and reduce side effects. TCR2 focuses on TCR-engineered T-cell therapies, while Poseida develops P-CD19 and P-BCMA therapies using its proprietary piggyBac™ gene-editing technology. Dominant players like Gilead Sciences and Novartis drive market growth through established therapies like Yescarta and Kymriah. Gilead's collaboration with other biotech firms and Novartis's continuous R&D investments showcase their innovation efforts, positioning them at the forefront of CAR T-cell advancements.

Here are some recent CEO statements from key players in the CAR T-cell therapy market:

Daniel O'Day, Chairman and CEO, Gilead Sciences

"Our commitment to advancing CAR T-cell therapy is unwavering. Yescarta represents a significant step forward in cancer treatment, and we are excited about the potential to further improve patient outcomes through continued innovation and collaboration."

Vasant Narasimhan, CEO, Novartis

"Kymriah has transformed the treatment landscape for patients with relapsed/refractory B-cell malignancies. We are dedicated to expanding access and driving new advancements in CAR T-cell therapy to address unmet needs across various cancers."

Giovanni Caforio, Chairman and CEO, Bristol-Myers Squibb

"At Bristol-Myers Squibb, we are focused on pushing the boundaries of CAR T-cell therapy. Our collaboration with Juno Therapeutics highlights our commitment to developing novel treatments that offer hope to patients who have exhausted other options."

Nick Leschly, CEO, Bluebird Bio

"Bluebird Bio is at the forefront of CAR T-cell therapy innovation with our cutting-edge technologies. Our goal is to deliver transformative therapies that not only extend life but also improve the quality of life for patients."

James R. Brown, CEO, TCR2 Therapeutics

"Our pioneering TCR-engineered T-cell therapies are designed to overcome the limitations of existing CAR T-cell treatments. TCR2 is dedicated to developing next-generation therapies that address a broader range of cancers with improved precision."

Dr. David Gilham, CEO, Poseida Therapeutics

"Poseida’s unique gene-editing technologies are revolutionizing CAR T-cell therapy. By leveraging our proprietary piggyBac™ platform, we aim to enhance the durability and efficacy of our treatments, bringing us closer to cures for challenging cancers."

These statements reflect the strategic focus and innovations driving growth in the CAR T-cell therapy market.

Market Segmentation

By Product

By Disease Indication

By End-Use

By Regions