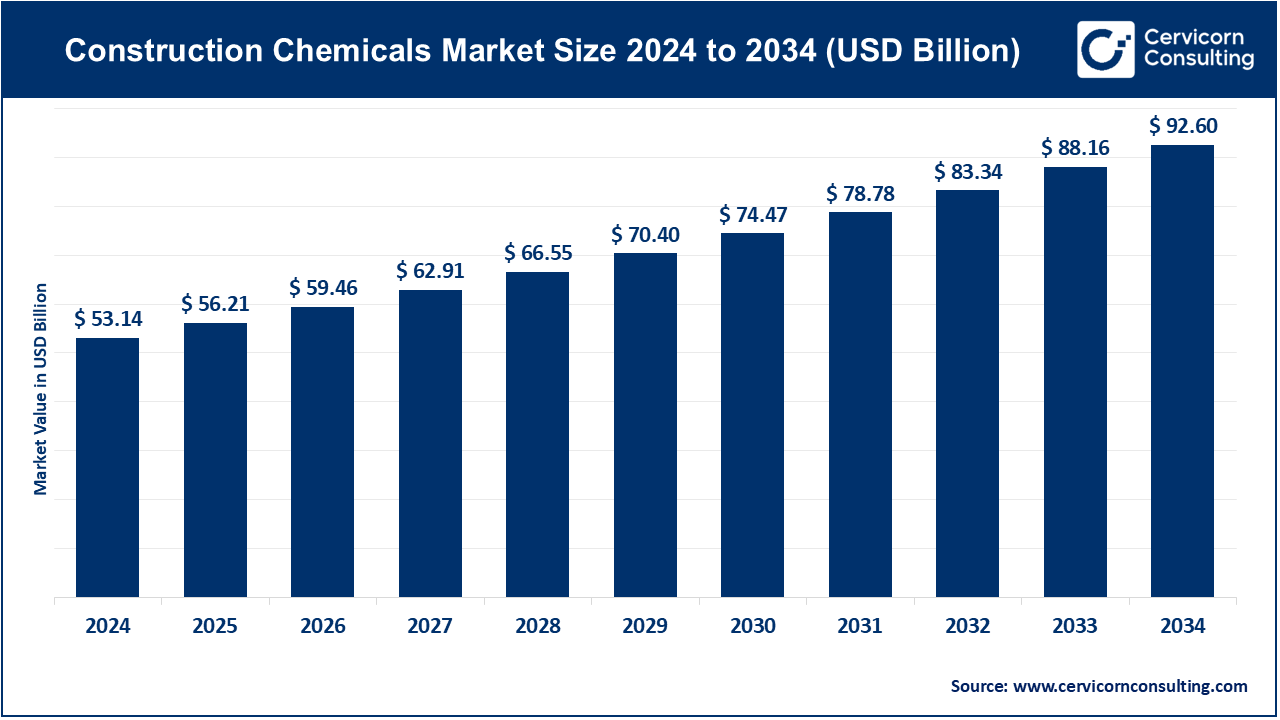

The global construction chemicals market size worth USD 53.14 billion in 2024 and is expected to surpass around USD 92.60 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 5.71% from 2025 to 2034.

The global construction chemicals market is experiencing significant growth due to the increasing demand for infrastructure development, particularly in emerging economies. As urbanization accelerates, there is a rising need for high-performance and durable materials in the construction of buildings, roads, and bridges. Additionally, a growing focus on sustainability and energy efficiency is driving the adoption of eco-friendly construction chemicals. Governments around the world are investing in large-scale infrastructure projects, further boosting the demand for these chemicals. In recent years, the construction chemicals market has seen a surge in innovations, such as the development of smart chemicals that offer enhanced performance in specific applications. The growth of the residential and commercial sectors, along with advancements in construction technologies, is contributing to the rising demand for construction chemicals. In June 2024, Saint-Gobain agreed to acquire Dubai-based construction chemicals company FOSROC for approximately USD 1.03 billion, aiming to expand its international presence in the construction chemicals sector.

Construction chemicals are materials used in the construction industry to enhance the properties of concrete, cement, and other building materials. These chemicals are designed to improve performance, durability, and sustainability. They include a wide range of products such as adhesives, sealants, waterproofing agents, concrete admixtures, and coatings. These chemicals help in controlling setting time, improving strength, preventing corrosion, and enhancing resistance to water, heat, and chemicals. Construction chemicals play a critical role in ensuring that buildings and infrastructure are safe, durable, and long-lasting.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 56.21 Billion |

| Projected Market Size (2034) | USD 92.60 Billion |

| Growth Rate (2025 to 2034) | 5.71% |

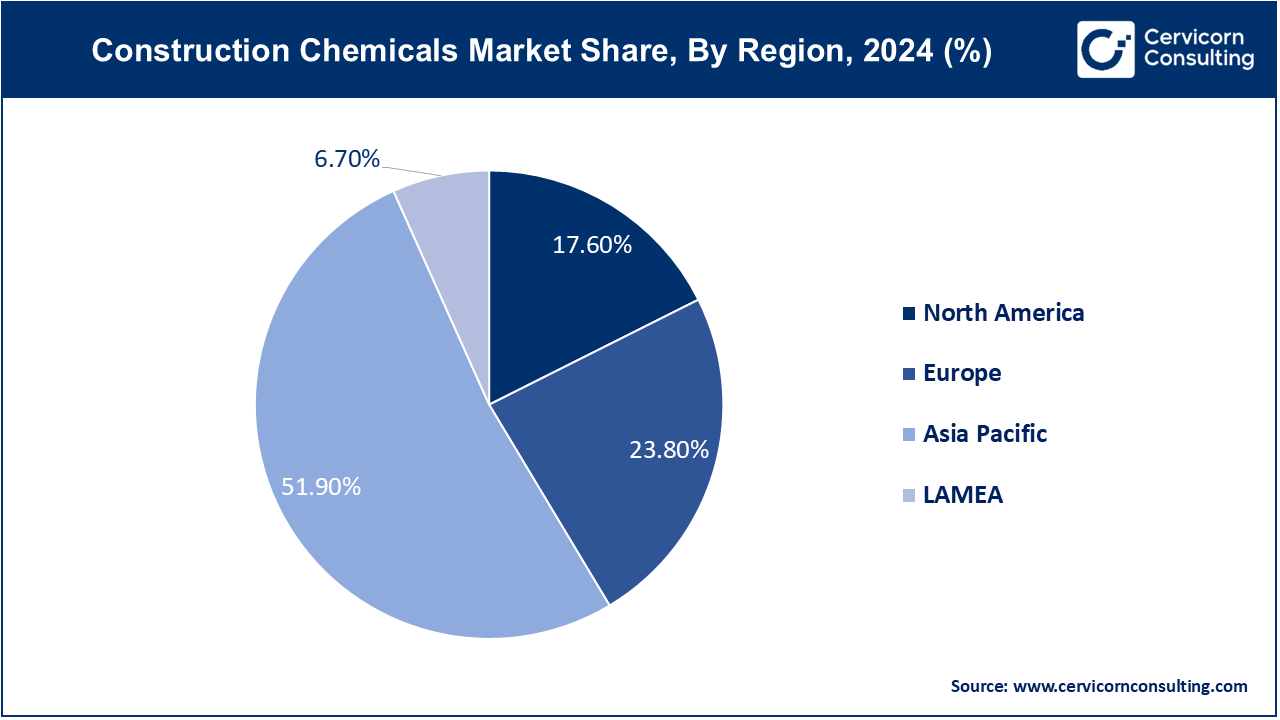

| Largest Revenue Holder Region | Asia Pacific |

| Fastest Growing Region | North America |

| Report Segments | Type, Service, Application, Region |

| Top Manufacturers | BASF SE, Sika AG, RPM International Inc., W. R. Grace & Co., Mapei S.p.A., Dow Chemical Company, Arkema S.A., Pidilite Industries Ltd., Fosroc International Ltd., Saint-Gobain S.A., Ashland Inc., Huntsman Corporation, GCP Applied Technologies Inc., Henkel AG & Co. KGaA, Evonik Industries AG |

Increased Funding and Investment:

Workplace Flexibility and Adaptability:

Economic Volatility

Building Code and Regulatory Challenges

Emerging Technologies:

Growing Awareness and Education

Supply Chain Disruptions

Skilled Labor Shortages

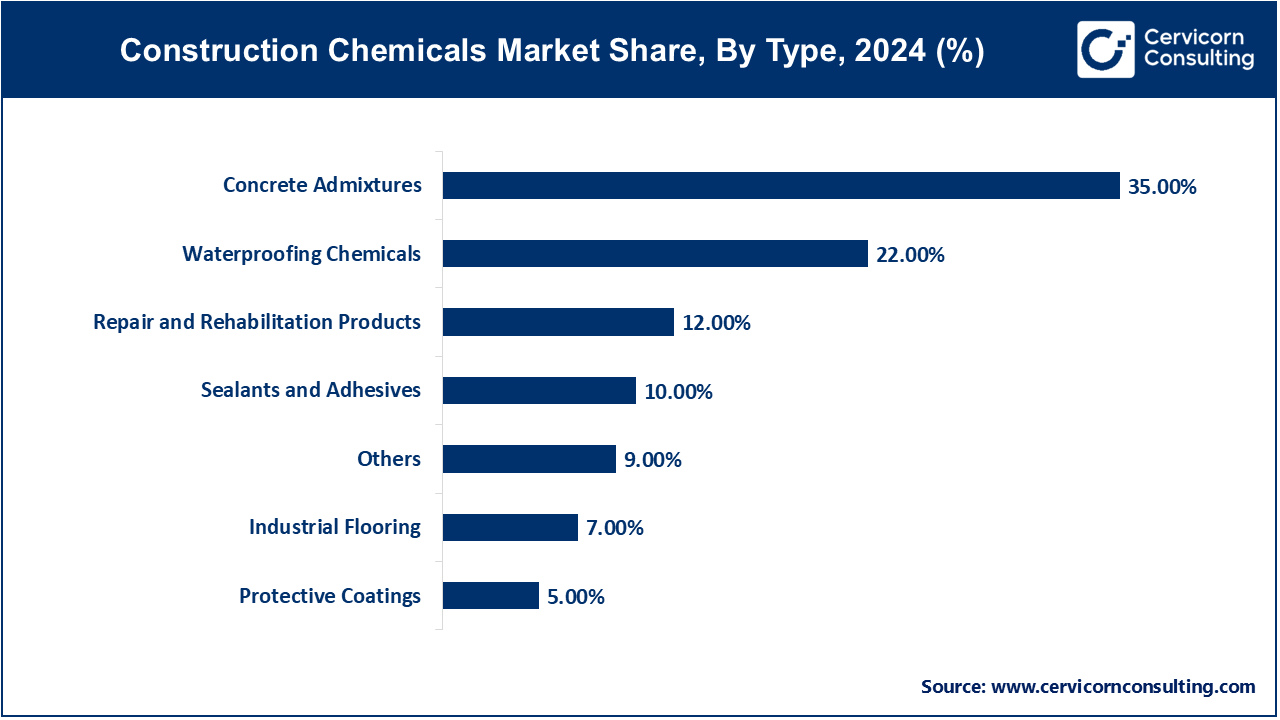

The construction chemicals market is segmented into type, service, application, end user and region. Based on type, the market is classified into concrete admixtures, waterproofing chemicals, sealants and adhesives, protective coatings, repair and rehabilitation products, industrial flooring, and others. Based on service, the market is classified into installation services, consulting services, maintenance and repair services, customization services. Based on application, the market is classified into residential, and non-residential. Based on end user, the market is classified into construction companies, architects and engineers, government and municipal bodies, property developers.

Concrete Admixtures: The concrete admixtures segment has accounted highest revenue share in 2024. Chemicals added to concrete to enhance its properties, such as improving workability, increasing strength, or reducing water content. These are widely used in both residential and commercial construction to meet specific structural requirements.

Waterproofing Chemicals: The waterproofing chemicals segment has accounted revenue share of 22% in 2024. These chemicals are essential for preventing water penetration in various structures, including basements, roofs, and tunnels. They play a crucial role in extending the lifespan of buildings by protecting them from moisture-related damage.

Sealants and Adhesives: In 2024, the sealants and adhesives segment has accounted revenue share of 10%. Used to bind and seal different construction materials, these products are critical for ensuring the integrity of joints and preventing leaks. They are used in a wide range of applications, from glazing to flooring.

Protective Coatings: In 2024, the protective coatings segment has accounted revenue share of 5%. Applied to surfaces to protect them from environmental damage, corrosion, and wear. These coatings are especially important in industrial and marine construction, where structures are exposed to harsh conditions.

Repair and Rehabilitation Products: In 2024, the repair and rehabilitation products segment has generated revenue share of 12%. Chemicals used in the maintenance and repair of existing structures, including crack fillers, bonding agents, and corrosion inhibitors. These products are vital for extending the life of aging infrastructure.

Installation Services: Professional services are provided to apply construction chemicals, ensuring they are used correctly for maximum effectiveness. This includes applying waterproofing solutions, sealants, and protective coatings.

Consulting Services: Expert advice offered by professionals to help construction companies choose the right chemicals for their projects. This service includes material selection, compliance with building codes, and sustainability recommendations.

Maintenance and Repair Services: Ongoing services provided to maintain the performance of construction chemicals and address any issues that arise over time. This includes regular inspections, reapplication of protective coatings, and repair of damaged areas.

Customization Services: Tailored solutions provided to meet specific project needs, such as custom formulations of admixtures or sealants for unique construction challenges.

Residential Construction: In 2024, the residential segment has accounted revenue share of 32%. Use of construction chemicals in building homes, including waterproofing solutions for basements and admixtures for concrete foundations. These products are essential for ensuring the durability and safety of residential buildings.

Commercial Construction: Application of chemicals in the construction of commercial buildings like offices, malls, and hotels. This segment often requires high-performance products such as fire-resistant coatings and advanced adhesives.

Construction Chemicals Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Residential | 32% |

| Non-residential | 68% |

Infrastructure Development: Construction chemicals used in large-scale infrastructure projects, including bridges, highways, and tunnels. These projects demand specialized products like corrosion inhibitors and concrete admixtures for extreme conditions.

Industrial Construction: Chemicals used in the construction of industrial facilities such as factories, power plants, and refineries. This segment requires robust solutions like chemical-resistant coatings and high-strength concrete additives.

Construction Companies: The primary users of construction chemicals, applying them across various projects to enhance building performance, meet regulatory standards, and ensure long-term durability.

Architects and Engineers: Professionals who specify the use of construction chemicals in their designs to achieve specific performance outcomes, such as energy efficiency or structural integrity.

Government and Municipal Bodies: End-users responsible for infrastructure development and public buildings, where construction chemicals are used to ensure safety, longevity, and compliance with environmental regulations.

Property Developers: Companies that oversee residential and commercial property development, using construction chemicals to improve the quality, durability, and marketability of their projects.

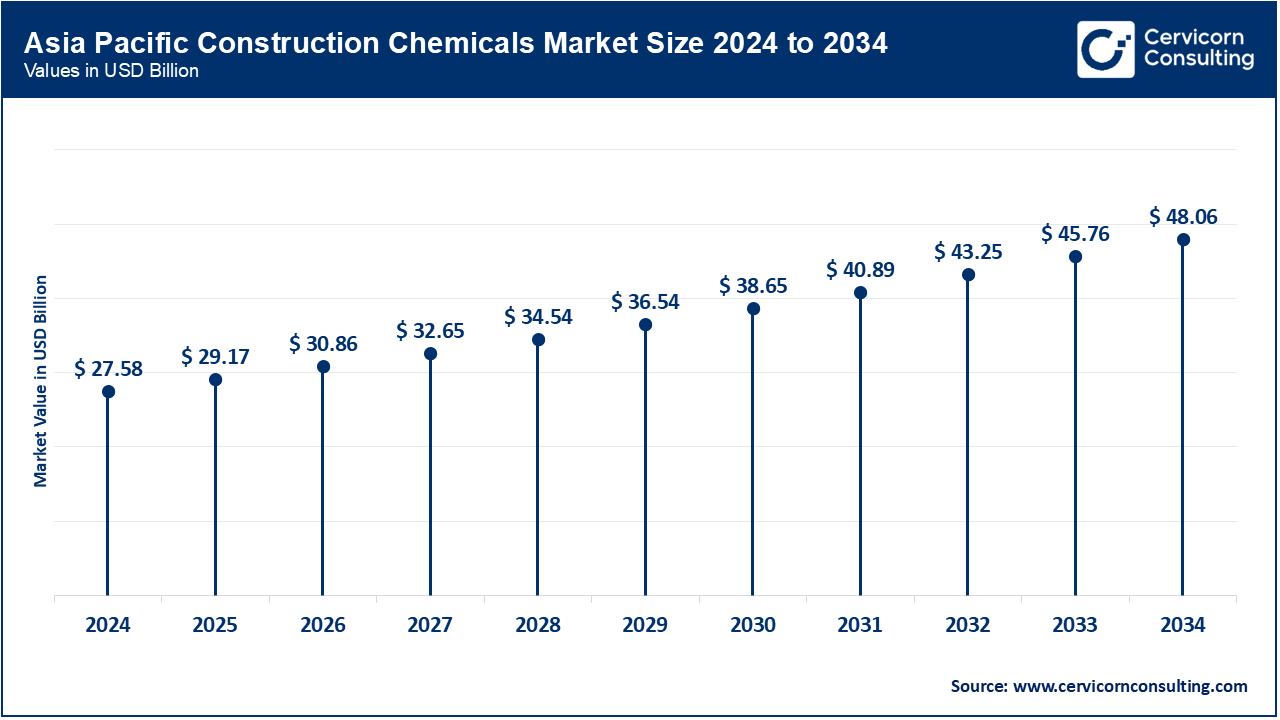

The Asia-Pacific construction chemicals market size is calculated at USD 27.58 billion in 2024 and is projected to hit around USD 48.06 billion by 2034. Asia-Pacific is leading the market, driven by increasing urbanization, rising disposable incomes, and expanding construction activities. Countries like China, Japan, and India are experiencing significant infrastructure development, leading to a surge in demand for construction chemicals. Government initiatives focused on building smart cities and sustainable infrastructure are also boosting the adoption of advanced construction materials and technologies, making the region a key player in the global market.

The North America construction chemicals market size worth USD 9.35 billion in 2024 and is predicted to reach around USD 16.30 billion by 2034. North America expanding rapidly, due to its well-established construction sector and the growing demand for innovative and sustainable building solutions. The U.S. and Canada are prominent in adopting advanced construction technologies, including green building practices and prefabrication techniques. Significant investments in infrastructure projects, coupled with stringent building codes, are driving market growth. Additionally, the region's focus on energy efficiency and environmental sustainability is fostering the demand for eco-friendly construction materials.

The europe construction chemicals market size worth USD 12.65 billion in 2024 and is expected to surpass around USD 22.04 billion by 2034. Europe is expanding remarkably, driven by the region's emphasis on sustainability and energy-efficient construction practices. Government regulations and incentives promoting green building practices are significant factors contributing to market growth. Countries like Germany, the UK, and France are at the forefront of adopting new construction technologies, such as advanced waterproofing and thermal insulation materials, to reduce carbon footprints and enhance building efficiency. The region's commitment to reducing environmental impact continues to propel the market forward.

The LAMEA region is experiencing a steady expansion in the construction chemicals market, supported by growing awareness of modern construction techniques and sustainability. In Latin America, the focus on sustainable building solutions is driving the market, while the Middle East benefits from substantial investments in large-scale infrastructure projects and advanced building technologies. Despite challenges such as limited resources in Africa, international partnerships and funding initiatives are enhancing construction capabilities and access to innovative building materials across the region.

In the evolving construction chemicals market, new and established players are making significant strides through innovation and strategic collaborations. Among the emerging players, James Hardie Industries plc is leveraging advanced fiber cement technology to provide sustainable and durable construction solutions, enhancing both environmental impact and building performance. Siniat Ltd. is focusing on developing eco-friendly construction chemicals that combine sustainability with high performance, catering to the growing demand for green building materials.

Leading companies like BASF SE and Sika AG continue to dominate the market through their extensive product lines and innovations, such as advanced waterproofing solutions and energy-efficient construction materials. Companies like Saint-Gobain S.A. are integrating cutting-edge technologies with a wide range of construction chemicals, offering comprehensive solutions for modern construction needs. These innovations and collaborations underscore the leadership and dynamism within the market, driving the industry toward a more sustainable and efficient future.

CEO Statements

"We have implemented a blueprint of improvements through synergies, capex for efficiency and decarbonisation whilst creating opportunities which will redefine the cement industry landscape."

"After experiencing some pronounced cyclical effects in 2022, SABIC has reached the threshold of an exciting new phase of growth. Our strategic positioning enables us to better address not only macro-economic volatility but also longer-term structural changes related to carbon neutrality and circular value chains."

Key players in the construction chemicals market are at the forefront of delivering a wide array of innovative construction solutions that address modern industry demands, including the integration of sustainable materials, prefabrication techniques, and advanced digital technologies. Some notable examples of key developments in the market include:

These developments highlight a significant expansion in the market through acquisitions and innovative projects, aimed at increasing sustainability, improving construction efficiency, and enhancing product offerings for various building applications.

Market Segmentation

By Type

By Service

By Application

By End User

By Regions