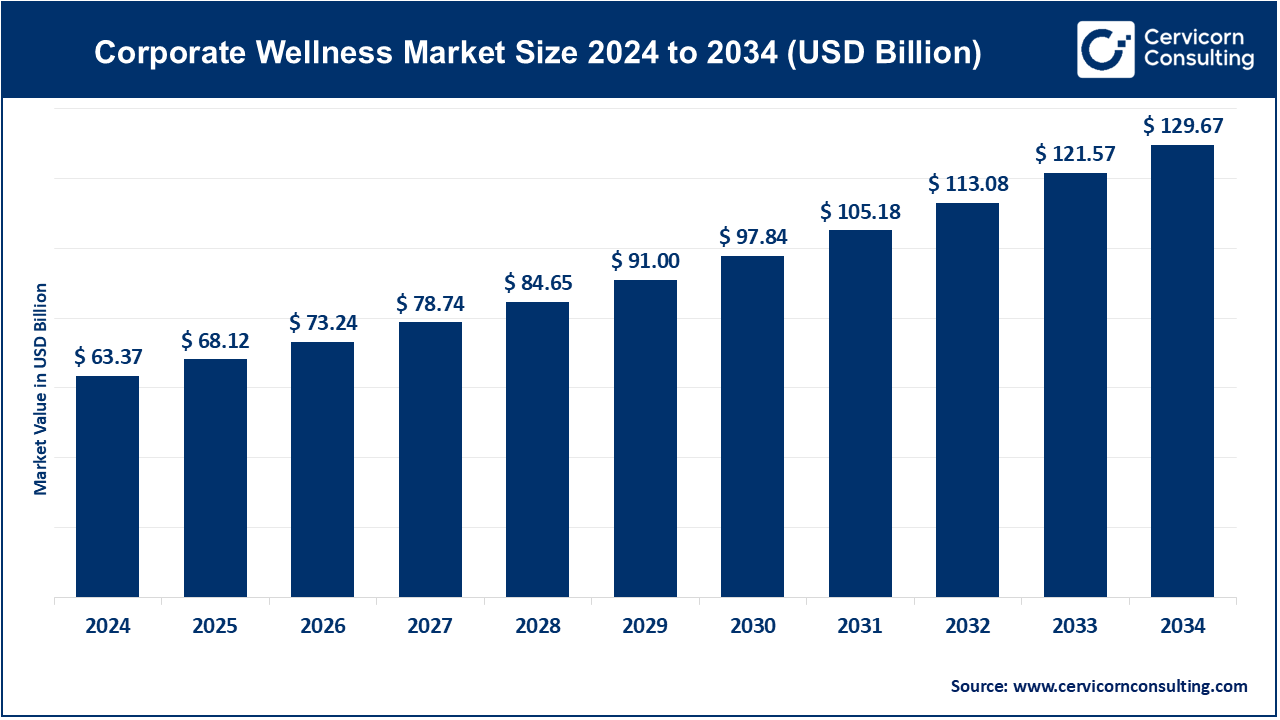

The global corporate wellness market size was valued at USD 63.37 billion in 2024 and is expected to surge around USD 129.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.42% from 2025 to 2034.

The corporate wellness market is expanding rapidly as more companies recognize the value of investing in employee well-being. Many organizations are now viewing wellness programs not as an added expense but as an essential part of their overall strategy for improving productivity and reducing costs. By fostering a healthy, engaged workforce, businesses can experience lower turnover rates, reduced absenteeism, and fewer healthcare claims. Additionally, many businesses are realizing that wellness programs help improve workplace culture, leading to greater employee satisfaction and retention. This has led to increased corporate spending on wellness-related initiatives, ranging from on-site fitness facilities to mental health resources. One of the driving forces behind the growth of corporate wellness is the shift toward more personalized and technology-driven solutions. Additionally, the rise of remote work has accelerated the adoption of virtual wellness programs, while data analytics and wearable technology are being increasingly utilized to tailor and measure the effectiveness of wellness initiatives.

Corporate Wellness refers to a workplace program aimed at promoting the health and well-being of employees. These programs typically include initiatives to improve physical health (e.g., exercise routines, nutrition advice), mental health (e.g., stress management, counseling), and overall workplace satisfaction. A 2023 survey by the American Psychological Association (APA) found that 60% of employees report mental health challenges related to work stress, and 35% felt their employer should do more to support mental health. By focusing on the holistic well-being of employees, corporate wellness initiatives aim to enhance productivity, reduce healthcare costs, and create a positive work environment. Common components of corporate wellness programs include fitness challenges, wellness workshops, on-site gyms, employee assistance programs, and flexible work schedules. The ultimate goal is to create a culture where employees are engaged, healthy, and motivated.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 68.12 Billion |

| Market Size by 2034 | USD 129.67 Billion |

| Market Growth Rate | CAGR of 7.42% from 2025 to 2034 |

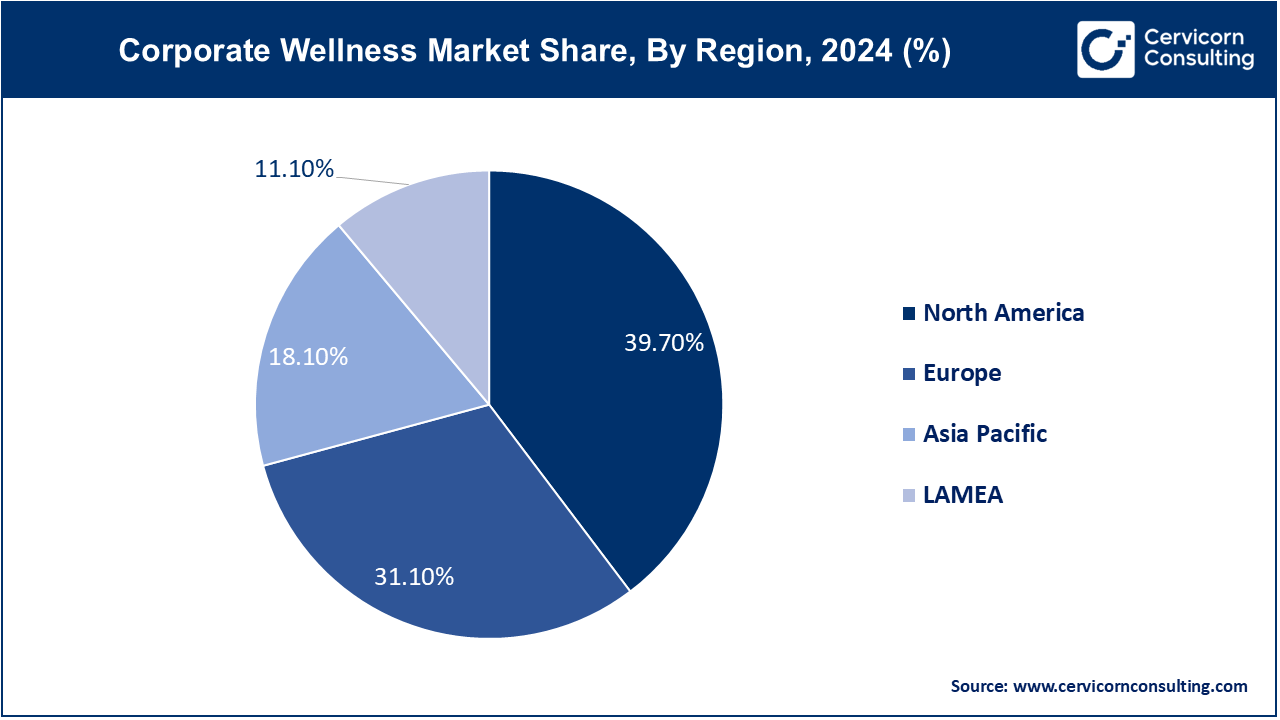

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | Service, End-Use, Category, Delivery Model and Regions |

Workforce Demographics

Corporate Social Responsibility (CSR) Initiatives

High Implementation Costs

Low Employee Engagement

Expansion into Emerging Markets

Development of Specialized Wellness Programs

There is a growing opportunity to create specialized wellness programs that cater to specific industries or employee groups, such as programs focused on occupational health for high-stress professions or wellness solutions tailored for remote workers. By addressing unique needs, companies can differentiate their offerings and attract a broader client base.

Measuring ROI

Data Privacy Concerns

The corporate wellness market is segmented into service, category, end use, delivery model and region. Based on service, the market is classified into health risk assessment, fitness, smoking cessation, and others. Based on end-use, the market is classified into small scale organizations, medium scale organizations and large scale organizations. Based on category, the market is classified into fitness & nutrition consultants, psychological therapists, and organizations/employers. Based on delivery model, the market is classified into onsite and offsite.

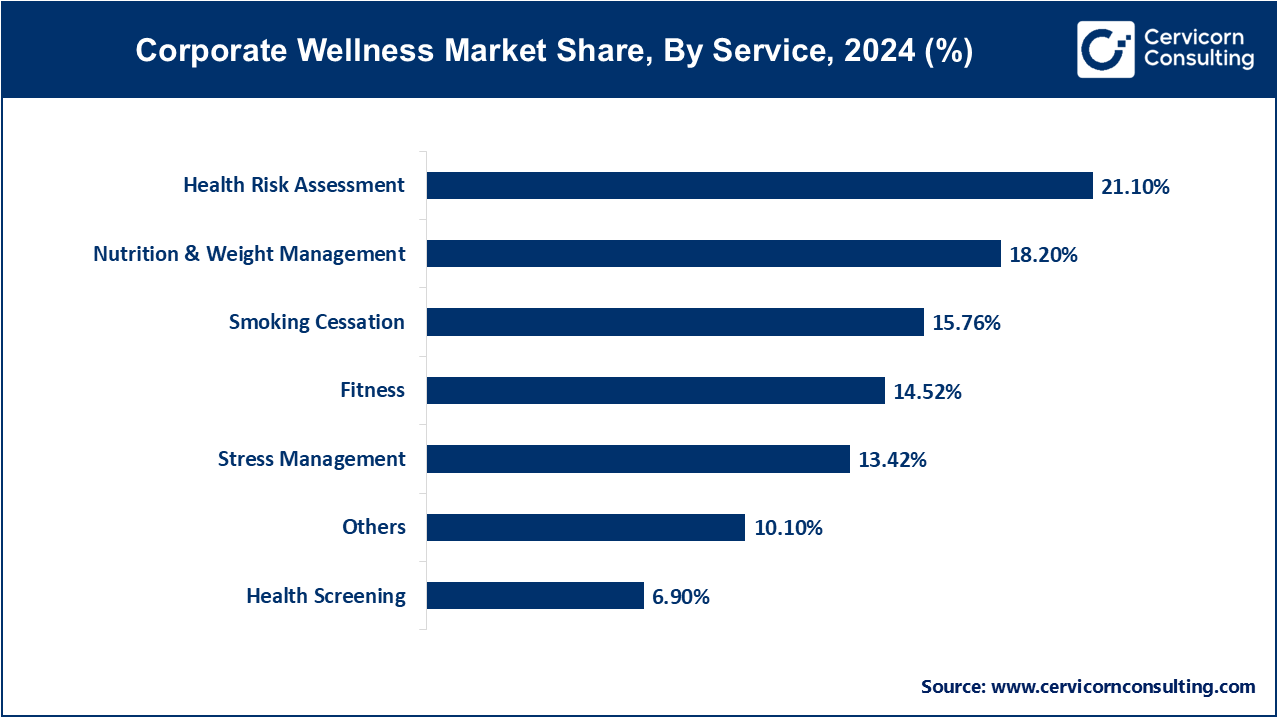

Health Risk Assessment: The health risk assessments segment has accounted 21.1% of market share in 2024. Health risk assessments (HRAs) are foundational in corporate wellness programs, identifying employees' health risks through surveys and screenings. The trend toward data-driven wellness is driving growth in this segment, with companies increasingly integrating HRAs into their wellness strategies to tailor interventions, reduce healthcare costs, and enhance overall employee well-being.

Fitness: The fitness segment has measured market share of 14.52% in the year of 2024. The fitness segment is expanding rapidly as employers prioritize physical health to boost productivity and reduce absenteeism. Trends include the incorporation of digital platforms offering virtual fitness classes and wearable technology to track physical activity. The shift towards hybrid work models has also spurred demand for flexible fitness options that employees can access remotely.

Smoking Cessation: The smoking cessation segment has generated market share of 15.76% in 2024. The smoking cessation segment is gaining traction as companies aim to lower health risks and insurance costs associated with smoking-related illnesses. Trends include the integration of personalized quit plans, counseling, and mobile apps to support employees in quitting smoking. Growing awareness of the health impacts of smoking and regulatory pressures are driving demand for these programs.

Health Screening: The health screening segment has garnered market share of 6.9% in 2024. Health screening services are essential in early detection and prevention of chronic diseases within corporate wellness programs. The trend towards preventive healthcare is fueling this segment, with employers increasingly offering regular screenings for conditions like diabetes, hypertension, and cancer. Advanced diagnostic tools and personalized health insights are enhancing the effectiveness of these screenings.

Nutrition & Weight Management: In 2024 nutrition & weight management segment has held market share of 18.2%. This segment focuses on promoting healthy eating habits and managing weight to prevent obesity-related conditions. Trends include personalized nutrition plans, workshops, and access to dietitians. The growing emphasis on holistic wellness and the rise in lifestyle-related diseases are driving demand for programs that offer sustainable, long-term dietary and weight management solutions.

Stress Management: The stress management has registered market share of 13.42% in 2024. Stress management is becoming a critical component of corporate wellness as workplace stress levels rise. Trends in this segment include mindfulness training, resilience-building workshops, and access to mental health resources like counseling. The shift towards mental health awareness and the need to address burnout in high-stress professions are significant drivers for this segment.

Others: This segment includes a variety of wellness services such as financial wellness, sleep programs, and substance abuse prevention. These services are increasingly being integrated into comprehensive wellness strategies to address diverse aspects of employee well-being. The others segmet has achieved market share of 10.1% in the year of 2024. Trends driving this segment include the growing recognition of the impact of financial stress and sleep disorders on overall health and productivity.

Small Scale Organizations: The small scale organizations segment has confirmed a small market share of 11% in 2024. Small scale organizations are increasingly adopting corporate wellness programs to enhance employee retention and reduce healthcare costs despite limited budgets. Trends include the use of cost-effective, scalable solutions like online wellness platforms and shared services. The focus is on accessible, affordable wellness initiatives that offer maximum impact with minimal investment, driven by the need to compete for talent and improve employee satisfaction.

Medium Scale Organizations: Medium scale organizations segment has calculated market share of 24% in 2024. Medium scale organizations are expanding their wellness offerings to balance cost and impact. Trends include implementing comprehensive wellness programs that integrate fitness, nutrition, and mental health services. The driver for this segment is the need to foster a healthier workforce and improve productivity, while managing moderate budgets and ensuring the scalability of wellness initiatives.

Large Scale Organizations: The large scale organizations segment has recorded dominating market share of 65% in the year of 2024. Large scale organizations are investing heavily in sophisticated wellness programs that offer extensive services and advanced technology. Trends include the integration of personalized wellness plans, data analytics, and on-site health facilities. Driven by the scale of their workforce and the potential for significant cost savings, these organizations focus on robust, data-driven wellness strategies to enhance employee engagement and health outcomes.

Fitness & Nutrition Consultants: The fitness and nutrition consultants segment has recorded market share of 29% in the year of 2024. Fitness and nutrition consultants are in demand as companies seek to offer specialized, personalized wellness solutions. Trends include virtual consultations, tailored fitness programs, and meal planning services. Driven by the growing emphasis on holistic health and personalized care, these consultants help organizations address diverse wellness needs, enhance employee health, and reduce lifestyle-related health issues.

Psychological Therapists: Psychological therapists segment has captured market share of 20% in 2024. Psychological therapists are increasingly integrated into corporate wellness programs to address mental health challenges. Trends include providing access to virtual therapy sessions, stress management workshops, and mental health resources. The driver for this segment is the rising awareness of mental health issues, workplace stress, and the need to support employee well-being, which enhances overall productivity and job satisfaction.

Organizations/Employers: The organizations and employers segment has registered highest market share of 51% in 2024. Organizations and employers are central to implementing corporate wellness programs and shaping their scope. Trends include developing comprehensive wellness strategies that encompass physical health, mental well-being, and preventive care. Driven by the need to improve employee health outcomes, boost productivity, and reduce healthcare costs, employers are investing in integrated wellness solutions that align with their organizational goals.

Onsite: In 2024 the onsite model segment has covered highest market share of 57.2%. Onsite corporate wellness programs are trending due to their convenience and direct engagement with employees. Trends include the establishment of on-site fitness centers, health screenings, and wellness workshops. The driver for this model is the ability to offer immediate, accessible health resources, fostering higher participation rates and creating a healthier workplace environment, which enhances overall employee well-being and productivity.

Offsite: Offsite segment has reported second highest market share of 42.8% in 2024. Offsite wellness programs are gaining traction with the rise of remote and hybrid work models. Trends include virtual fitness classes, online counseling, and mobile health services. Driven by the need to accommodate flexible work arrangements and reach a dispersed workforce, this model offers scalable, accessible wellness solutions that support employee health beyond traditional office settings.

The North America market size is expected to reach around USD 51.48 billion by 2034 increasing from USD 25.16 billion in 2024 with a CAGR of 7.40%. In North America, corporate wellness is well-established with a strong emphasis on comprehensive programs that address physical, mental, and financial health. The region is characterized by high investment in wellness technology, extensive employee benefits, and a focus on preventive health. Companies are increasingly adopting innovative solutions such as digital wellness platforms and personalized health programs, driven by high healthcare costs and a competitive labor market aiming to improve employee productivity and satisfaction.

Asia Pacific market size is calculated at USD 11.47 billion in 2024 and is projected to grow around USD 23.47 billion by 2034 with a CAGR of 8.20%. In the Asia-Pacific region, corporate wellness is rapidly evolving, with growing interest in employee health programs driven by economic expansion and increasing workforce size. Companies are focusing on integrating wellness initiatives that cater to diverse cultural needs and address prevalent health issues such as stress and chronic conditions. The adoption of digital wellness solutions and partnerships with local health providers are key trends, as organizations aim to enhance employee productivity and manage rising healthcare costs.

The Europe market size is measured at USD 19.71 billion in 2024 and is expected to grow around USD 40.33 billion by 2034 with a CAGR of 7.92%. Europe corporate wellness market is diverse, with a strong focus on integrating wellness into employee benefits and organizational culture. The region emphasizes holistic approaches, including mental health support and work-life balance initiatives. Trends include the adoption of wellness programs that comply with varying national regulations and cultural preferences. Increasing awareness of mental health issues and regulatory support for employee well-being drive the growth of comprehensive wellness programs across European countries.

The LAMEA market size is forecasted to reach around USD 14.39 billion by 2034 from USD 7.03 billion in 2024 with a CAGR of 5.10%. In LAMEA, corporate wellness is emerging, with varied adoption rates across the region. The focus is on developing cost-effective wellness programs that address basic health needs and improve workplace conditions. Trends include increasing investment in preventive health measures and employee wellness education. Drivers include growing awareness of the benefits of wellness programs and the need to enhance employee retention and productivity amidst economic and healthcare challenges.

Key players like Zestful leveraging its all-encompassing platform for fitness, nutrition, and mental health, and BurnAlong focusing on virtual fitness and wellness challenges. Whereas, dominating players like Virgin Pulse and Optum drive the market with their comprehensive, integrated solutions. Virgin Pulse excels in behavior change and employee engagement, while Optum integrates advanced analytics and mental health support. Both leaders are advancing through innovations such as digital platforms and wearables, alongside strategic partnerships, to enhance their offerings and sustain their competitive edge.

Virgin Pulse – David Osborne, CEO

"Our mission is to transform the way employees engage with their health and well-being. By integrating personalized wellness solutions and leveraging cutting-edge technology, we empower organizations to drive meaningful behavior change and enhance employee productivity."

Optum – Andrew Witty, CEO

"At Optum, we are committed to redefining healthcare through innovative wellness programs and data-driven insights. Our goal is to create healthier workforces by integrating comprehensive wellness solutions that address both physical and mental health needs."

Ceridian – Leagh Turner, CEO

"Ceridian's approach to corporate wellness is centered on creating a holistic employee experience. By leveraging our Dayforce platform, we deliver integrated wellness solutions that support employee well-being, drive engagement, and improve organizational performance."

LifeDojo – Dr. Mike McGrail, CEO

"LifeDojo is dedicated to making lasting behavior change achievable for employees. Our evidence-based wellness programs are designed to foster personal growth and resilience, ultimately enhancing overall workplace wellness and performance."

Fitbit Health Solutions – James Park, CEO

"Fitbit Health Solutions is at the forefront of wearable technology and corporate wellness. By combining our advanced fitness trackers with tailored health programs, we help organizations encourage healthier lifestyles and reduce healthcare costs."

Market Segmentation

By Service

By End-Use

By Category

By Delivery Model

By Region