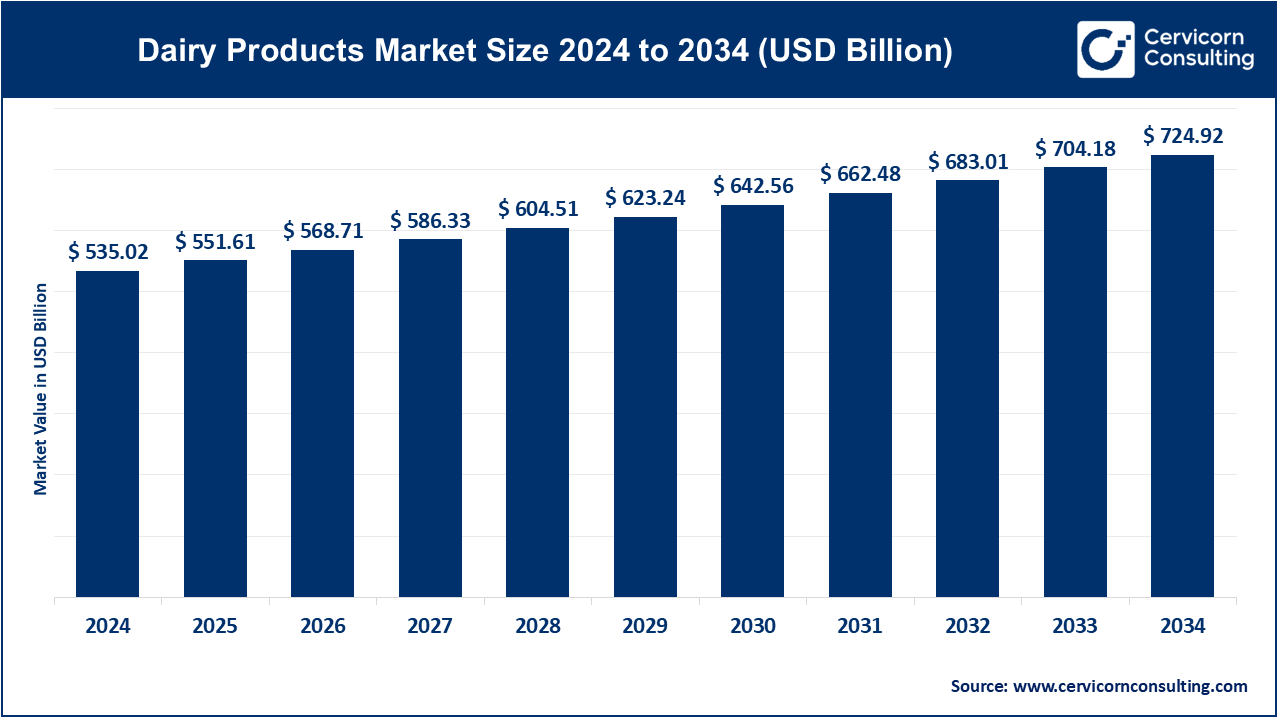

The global dairy products market size was captured at USD 535.02 billion in 2024 and is expected to reach around USD 724.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.09% from 2025 to 2034.

The global dairy product market has experienced significant growth over the past few years and is expected to continue expanding. This growth can be attributed to the rising demand for dairy products in emerging economies, particularly in Asia-Pacific regions. As people’s disposable income increases, there is a greater demand for processed dairy items such as cheese, yogurt, and milk-based beverages. Additionally, the awareness about the health benefits of dairy, such as improved bone health and weight management, has contributed to the market's growth. Companies are innovating by introducing low-fat, lactose-free, and plant-based dairy alternatives to cater to the diverse needs of consumers. In the coming years, the dairy products market is projected to witness continued growth due to the increasing popularity of healthy and functional foods. The rise of the vegan and plant-based diet trend has also led to the development of dairy alternatives like almond, soy, and oat milk. The export value of dairy products from India was over 22 billion Indian rupees in 2023, a decrease from the previous year's export value of over 29 billion rupees.

Dairy products are food items made from milk. The most common dairy products include milk, cheese, yogurt, butter, and cream. These products are rich in essential nutrients like calcium, protein, vitamins A and D, and potassium, making them an important part of a balanced diet. Dairy products are produced from the milk of cows, goats, sheep, and other animals. Milk undergoes processing to produce various products, including pasteurization to kill harmful bacteria and fermentation to create yogurt and cheese. Many people consume dairy for its nutritional benefits, such as supporting strong bones, muscle growth, and overall health. However, some individuals may be lactose intolerant and avoid dairy due to digestive issues.

Increasing Demand for Convenience Foods: The growing preference for ready-to-eat and convenient meal solutions boosts the demand for dairy products such as cheese slices, yogurt cups, and flavored milk, which offer quick and easy consumption options.

Expansion of Dairy Alternatives: The rising popularity of dairy alternatives, such as plant-based milk and cheese, is driven by lactose intolerance and veganism. This trend encourages innovation and product diversification in the dairy sector.

Emerging Markets: Expanding dairy consumption in emerging markets like India and Southeast Asia presents opportunities for growth, as rising incomes and urbanization increase demand for diverse dairy products.

Sustainability and Organic Products: Growing consumer interest in sustainable and organic dairy products creates opportunities for brands to develop and market environmentally friendly and organic dairy options, catering to eco-conscious consumers.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 551.61 Billion |

| Market Size by 2034 | USD 724.92 Billion |

| Market Growth Rate | CAGR of 3.09% from 2025 to 2034 |

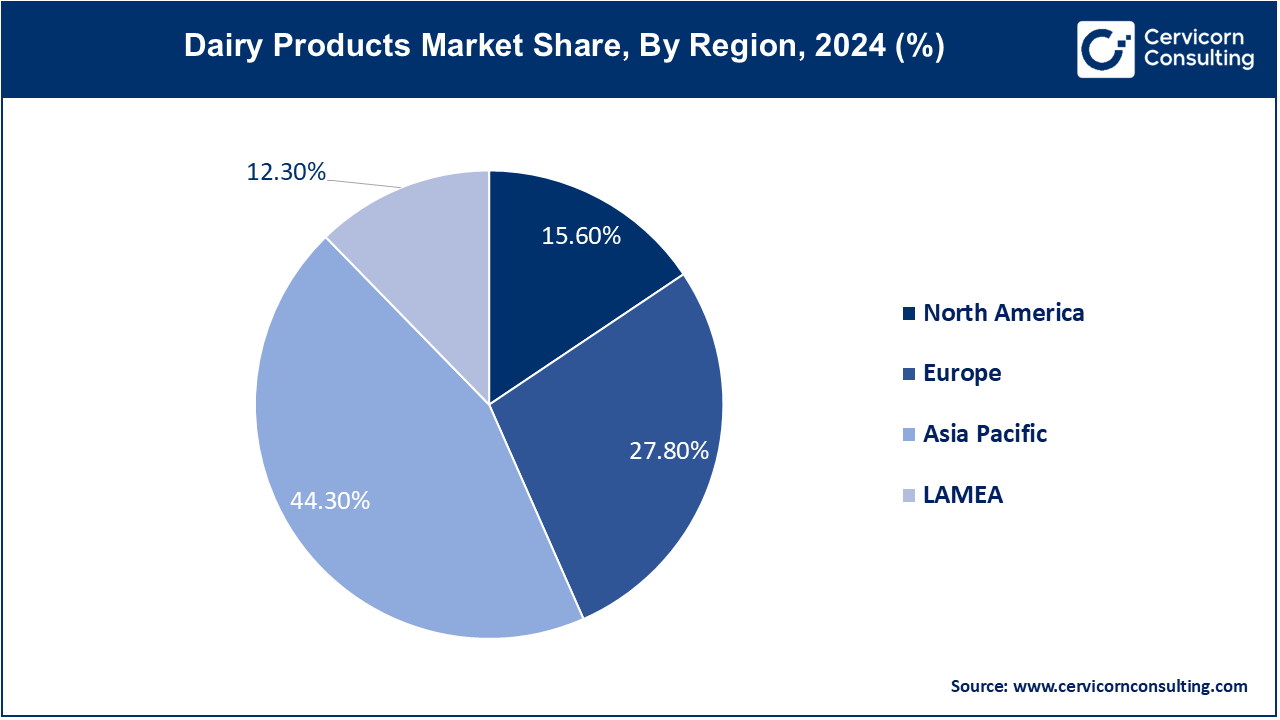

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Product Type, Distribution Channel and Regions |

Increasing Urbanization:

Enhanced Dairy Processing Technologies:

Fluctuating Raw Material Prices:

Regulatory and Health Concerns:

Growth in Functional Dairy Products:

Expansion of Premium and Artisanal Dairy Products:

Environmental Impact:

Supply Chain Disruptions:

Milk: The milk product type has confirmed highest market share of 58.71% in the year of 2024. Milk is a liquid dairy product consumed fresh or processed into various forms, including whole, skim, and flavored varieties. The market is shifting towards organic and plant-based alternatives, such as almond and oat milk, driven by health-conscious consumers and those with lactose intolerance. Additionally, fortified and functional milks with added nutrients are gaining popularity.

Cheese: Cheese segment has recorded second highest market share of 19.16% in 2024. Cheese is a dairy product produced by coagulating milk proteins, available in various types such as cheddar, mozzarella, and gouda. The cheese market is expanding with the growing popularity of gourmet and artisanal cheeses. There is increasing demand for low-fat and reduced-sodium options, and innovative cheese flavors and textures are being introduced to cater to diverse consumer preferences.

Yogurt: The yogurt segment has captured market share of 9.15% in 2024. Yogurt is a fermented dairy product made from milk and beneficial bacteria cultures, available in various forms such as Greek, regular, and probiotic yogurt. The yogurt market is experiencing growth in Greek and high-protein varieties, along with plant-based and dairy-free options. Consumers are increasingly seeking probiotic-rich yogurts for digestive health and functional benefits.

Dessert: Dessert segment has registered market share of 6.3% in 2024. Dairy-based desserts include products like puddings, custards, and ice creams made from milk and cream. There is rising consumer interest in premium and low-sugar dairy desserts, including those with natural and organic ingredients. Innovation in flavors and health-conscious formulations, such as reduced-fat and lactose-free options, is driving market growth.

Butter: In 2024, the butter segment has reported 4.26% of market share. Butter is a dairy product made from churning cream, available in salted, unsalted, and flavored varieties. The butter market is seeing increased demand for artisanal and organic butters. There is also growing interest in plant-based butter substitutes and spreads, driven by dietary preferences and health considerations.

Milk Powder: Milk powder is a dried form of milk used for various applications, including reconstitution into liquid milk and as an ingredient in processed foods. The milk powder market is expanding due to its convenience and long shelf life. Increased demand for infant formula and dairy ingredients in food manufacturing is driving growth, along with innovations in fortification and specialized formulations.

Cream: Cream is a dairy product derived from the high-fat layer of milk, used in cooking and as a topping or ingredient in desserts. The cream market is experiencing growth with the rise of premium and organic creams. There is also increasing interest in reduced-fat and plant-based cream alternatives, catering to health-conscious consumers and dietary preferences.

Others: In 2024, the others segment has measured market share of 2.42%. The "Others" category includes various dairy products not specifically mentioned, such as kefir, buttermilk, and dairy-based sauces. This segment is growing as consumers explore diverse dairy products and traditional items. Innovations in flavors, packaging, and functional benefits are driving interest in these niche products, reflecting broader trends in personalization and health-focused consumption.

Hypermarket / Supermarket: The hypermarkets and supermarkets segment has dominated the market with market share of 54.2% in 2024. Hypermarkets and supermarkets are large retail outlets offering a wide range of dairy products, including milk, cheese, yogurt, and butter. This segment is seeing increased demand for private-label products and organic options. Stores are expanding their dairy sections and integrating advanced inventory management to ensure product freshness and variety. The rise of in-store promotions and loyalty programs is also driving growth.

Convenience Store: Convenience stores segment has achieved market share of 32.71% in 2024. Convenience stores are smaller retail outlets offering essential dairy products like milk, cheese, and yogurt for quick purchases. Convenience stores are focusing on offering ready-to-eat and single-serve dairy products to cater to on-the-go consumers. There is a growing trend toward stocking premium and organic options to meet evolving consumer preferences, along with enhanced refrigeration technologies to maintain product quality.

Speciality Store: The speciality store segment has calculated market share of 9.84% in 2024. Specialty stores focus on niche or premium dairy products, such as artisanal cheeses and gourmet yogurts. This segment is growing due to increasing consumer interest in high-quality, unique dairy items. Specialty stores emphasize product authenticity and sourcing, often highlighting local or organic ingredients. Trends include the rise of curated selections and personalized customer experiences.

Online Stores: Online stores sell dairy products through e-commerce platforms, offering home delivery options for convenience. The online segment is expanding rapidly due to the growing preference for online shopping and home delivery. Innovations such as subscription services, personalized recommendations, and improved logistics are enhancing consumer convenience. There is also a rise in direct-to-consumer sales from dairy brands.

Others: In 2023, the others segment has generated 3.25% of market share in 2024. This category includes alternative distribution channels such as direct-to-salon sales, foodservice, and institutional buyers. Opportunities in this segment include partnerships with foodservice providers and institutions that use dairy products in bulk. There is an increasing focus on customized dairy solutions and supply chain innovations to meet the specific needs of these non-traditional distribution channels.

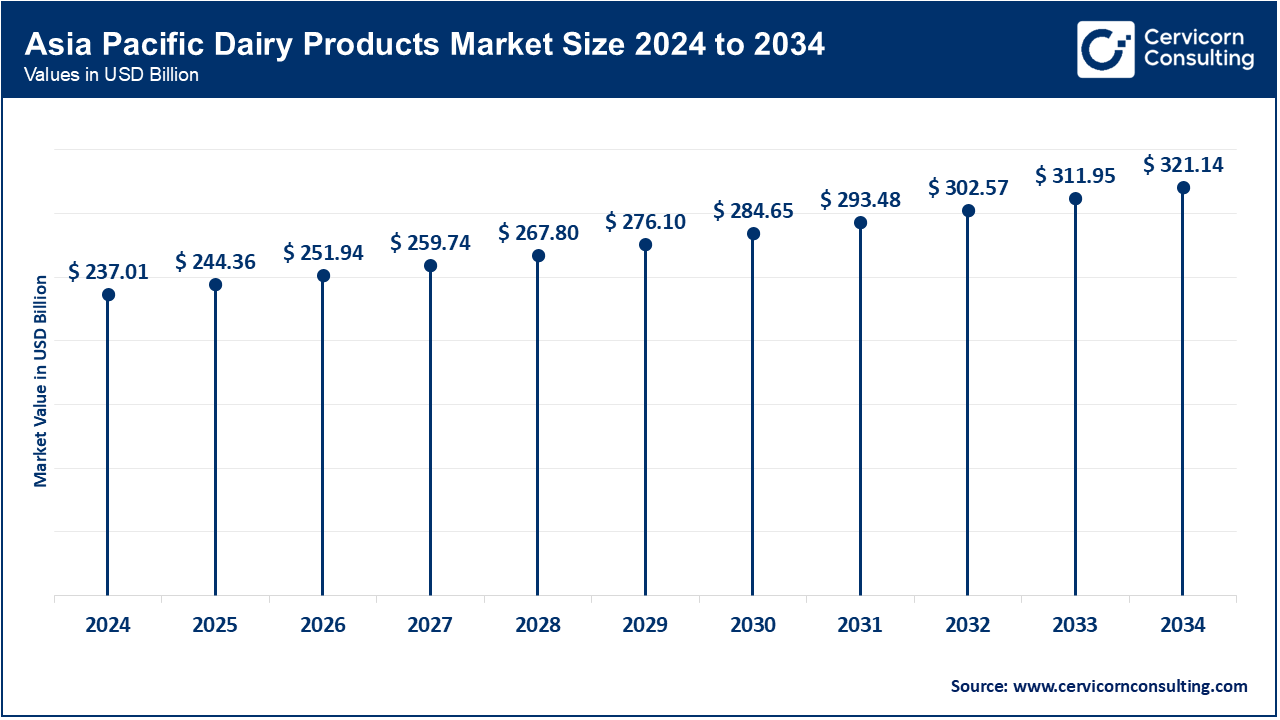

The Asia-Pacific region is experiencing rapid growth in dairy consumption due to increasing urbanization, rising incomes, and changing dietary habits. Asia Pacific market size is calculated at USD 237.01 billion in 2024 and is projected to grow around USD 321.14 billion by 2034 with a CAGR of 3.06%. There is a growing interest in dairy products like yogurt and cheese, coupled with a rising trend for functional dairy products. Market expansion is also driven by innovations in product flavors and formats.

In North America, there is a growing demand for organic and specialty dairy products driven by health-conscious consumers. North America market size is expected to reach around USD 113.09 billion by 2034 increasing from USD 83.46 billion in 2024 with a CAGR of 3.87%. The market is also experiencing increased adoption of dairy alternatives, such as plant-based milks. Technological advancements in dairy processing and supply chain efficiency are enhancing product availability and quality. U.S market size is estimated to reach around USD 84.82 billion by 2034 increasing from USD 62.60 billion in 2024.

Europe is seeing a trend toward sustainable and ethical dairy production, with consumers prioritizing eco-friendly packaging and organic options. Europe market size is measured at USD 148.74 billion in 2024 and is expected to grow around USD 201.53 billion by 2034 with a CAGR of 3.21%. The region is also witnessing growth in premium and artisanal dairy products, driven by a strong emphasis on quality and traditional methods. Regulatory standards and health trends influence product offerings.

In LAMEA(Latin America, Middle East, and Africa), there is growing demand for affordable and accessible dairy products due to rising disposable incomes and urbanization. LAMEA market size is forecasted to reach around USD 89.17 billion by 2034 from USD 65.81 billion in 2024. The market is expanding with increased investment in dairy infrastructure and distribution networks. Additionally, there is a rising interest in dairy alternatives and premium products in select markets.

Companies like Oatly and Elmhurst are entering the market with innovative dairy alternatives, focusing on plant-based products and sustainable practices. They leverage advancements in formulation and production to cater to the growing demand for lactose-free and environmentally friendly options. Nestlé S.A. and Danone S.A. dominate the market through extensive product portfolios, global distribution networks, and substantial R&D investments. They drive innovation with new product launches and strategic acquisitions, maintaining market leadership by adapting to evolving consumer preferences and investing in sustainable practices.

Market Segmentation

By Product Type

By Distribution Channel

By Regions