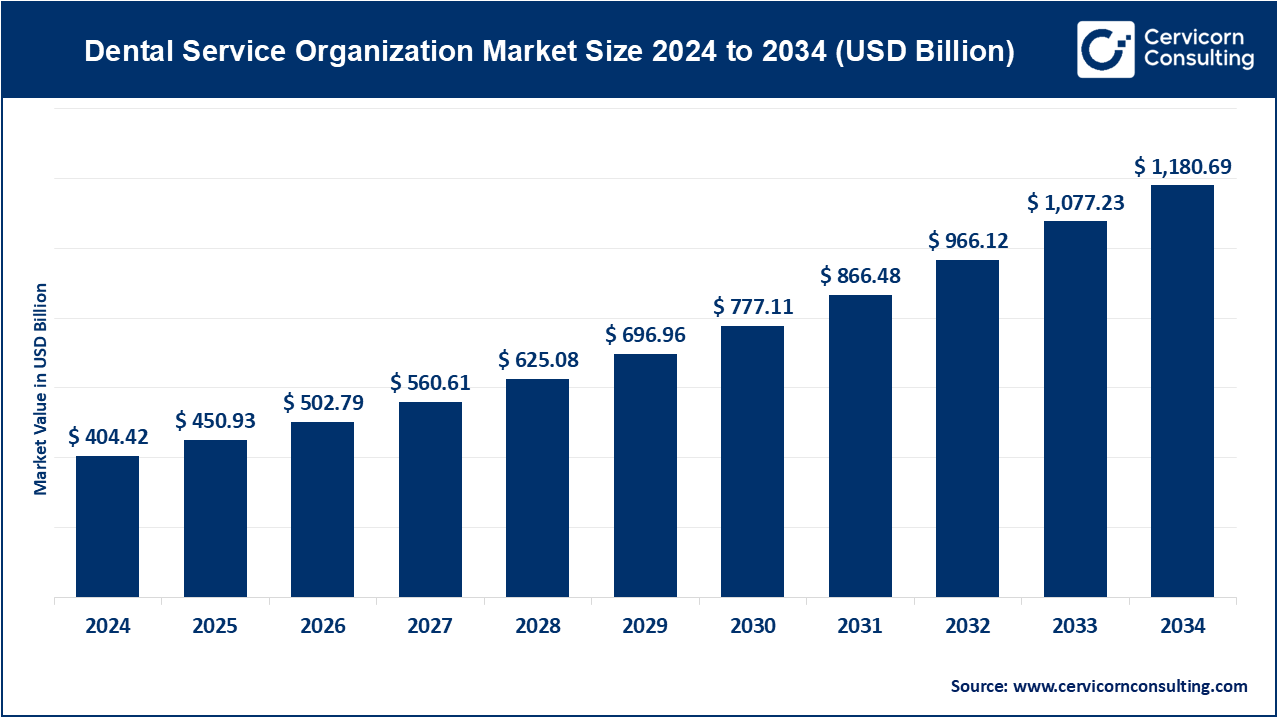

The global dental service organization market size is estimated to reach from USD 404.42 billion in 2024 to USD 1,180.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.5% from 2025 to 2034.

The dental service organization (DSO) market is experiencing significant transformation due to the increasing shift towards consolidation within the dental industry. As private practices face challenges related to rising overhead costs and administrative burdens, more dental professionals are seeking partnerships with DSOs to benefit from economies of scale. This trend is fostering a wave of consolidation, where independent practices join larger networks to improve their operational efficiency and patient service offerings. As a result, DSOs are increasingly seen as a solution that provides access to better technology, larger patient bases, and enhanced negotiating power with insurance providers and suppliers. Another driving factor is the growing demand for dental care, which has been fueled by a larger aging population and greater awareness of oral health's connection to overall health. With these demographic shifts, DSOs are capitalizing on the opportunity to expand their reach into both urban and underserved rural areas.

A Dental Service Organization (DSO) is a business model where dental practices partner with an organization that provides administrative support and resources. These services may include management of operations, billing, human resources, and marketing, allowing dental professionals to focus on patient care. DSOs often help streamline administrative tasks and reduce overhead costs for practices, leading to greater efficiency and profitability. They operate under various models, such as corporate DSOs, private equity-backed DSOs, and physician-owned DSOs, with each offering distinct benefits depending on the structure of the organization and the needs of the dental practice.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 450.93 Billion |

| Market Growth Rate | CAGR of 11.5% from 2025 to 2034 |

| Market Size by 2034 | USD 1,180.69 Billion |

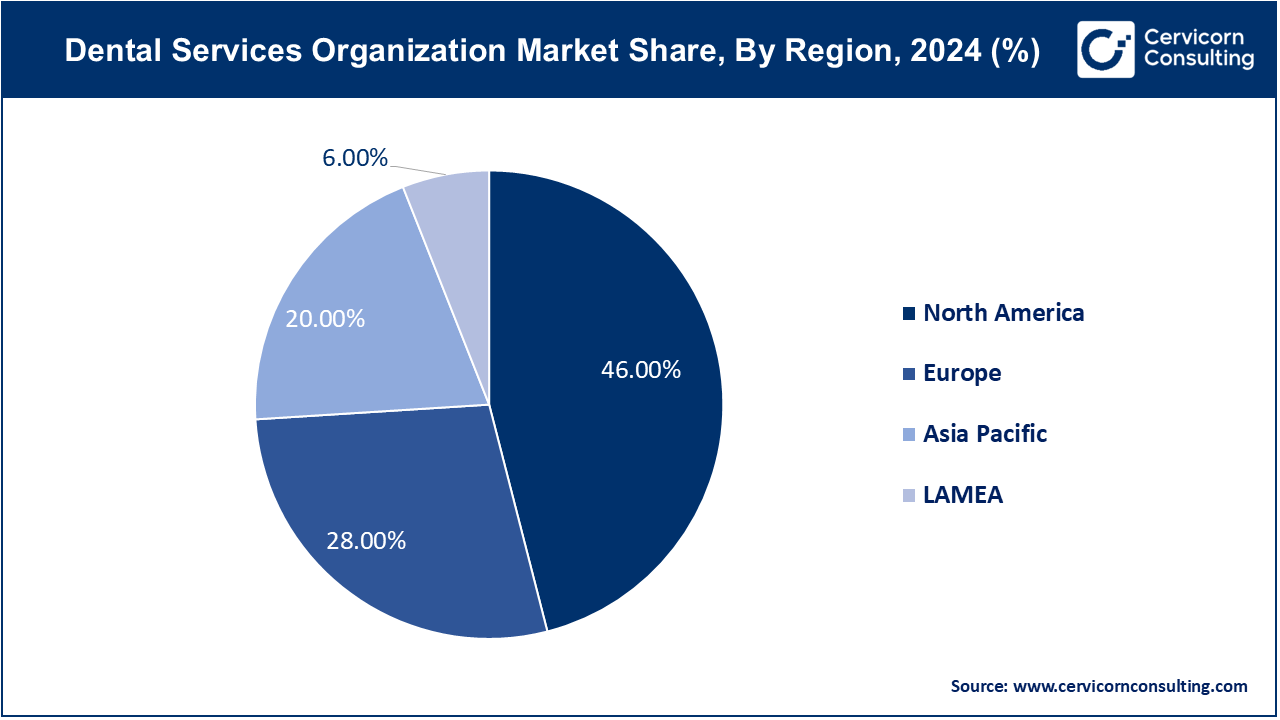

| North America Market Share | 46% in 2024 |

| APAC Market Share | 20% in 2024 |

Regulatory Changes

Aging Population

Regulatory and Compliance Challenges

High Initial Investment Costs

Expansion into Underserved Areas

Integration of Advanced Technologies

Talent Recruitment and Retention

Managing Practice Integration

Human Resources: The Human Resources (HR) segment in Dental Service Organizations (DSOs) is increasingly focusing on talent acquisition, training, and employee retention strategies. With the growing need for skilled dental professionals, DSOs are investing in comprehensive HR systems to streamline recruitment processes, enhance staff training programs, and improve job satisfaction, which in turn supports organizational growth and efficiency.

Marketing & Branding: DSOs are emphasizing robust marketing and branding strategies to differentiate themselves in a competitive market. This includes leveraging digital marketing, social media, and patient engagement tools to build brand awareness, attract new patients, and retain existing ones. Effective marketing and branding help DSOs establish a strong market presence and drive patient acquisition.

Accounting: The Accounting segment in DSOs is critical for managing financial operations, including billing, revenue cycle management, and financial reporting. Advanced accounting systems and software are increasingly used to streamline financial processes, ensure accurate and timely reporting, and improve overall financial management. This supports DSOs in maintaining financial health and operational efficiency.

Medical Supplies Procurement: The procurement of medical supplies is a key operational focus for DSOs, which involves sourcing and managing inventory of dental tools, equipment, and materials. Trends include adopting centralized procurement systems to negotiate better pricing, ensure consistent supply quality, and reduce costs. Efficient supply chain management supports operational continuity and enhances service delivery.

Others: The others segment has captured market share of 33% in 2023. This segment includes various additional services that DSOs provide to support their operations. This can include IT support, facility management, and compliance services. Trends in this segment involve integrating technology solutions to streamline operations, enhance service quality, and ensure adherence to regulatory standards, contributing to overall operational effectiveness.

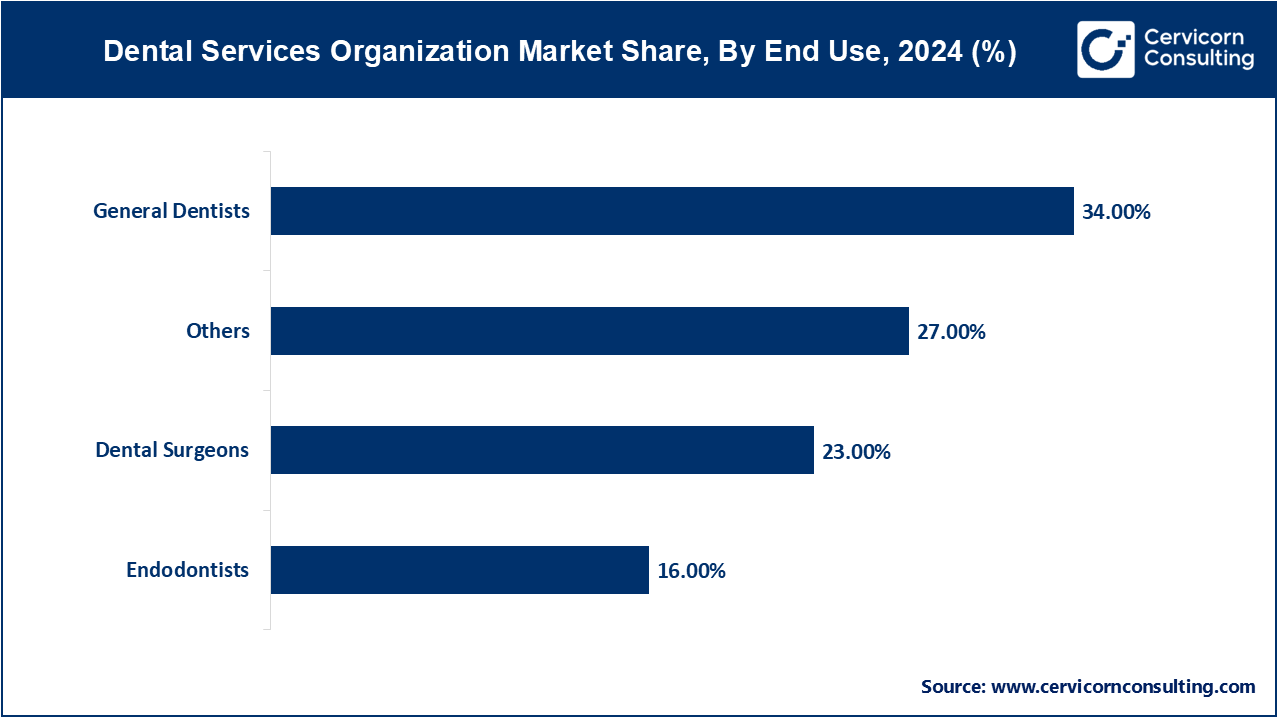

Dental Surgeons: Dental surgeons within DSOs are experiencing increased demand due to advancements in surgical techniques and an aging population requiring complex procedures. Dental surgeons segment has covered market share of 23% in 2024. Trends include the integration of specialized surgical services and technologies to improve outcomes and patient experiences. This focus on surgical excellence drives growth in DSOs that cater to high-complexity procedures and cutting-edge treatments.

Endodontists: The endodontists segment has recorded market share of 16% in 2024. Endodontists, specializing in root canal therapy and other pulp-related treatments, are seeing growing integration within DSOs. The trend towards comprehensive care within DSOs allows for specialized treatment services to be offered under one roof, enhancing patient convenience and continuity of care. Investments in advanced endodontic technology and training support this segment's expansion.

General Dentists: The general dentists has registered market share of 34% in 2024. General dentists are a core component of DSOs, with a focus on providing broad dental care services. Trends include the adoption of integrated practice management systems and enhanced patient care protocols. DSOs are increasingly standardizing general dental practices to offer consistent quality, streamline operations, and improve patient outcomes across their networks.

Others: The other segment has measured market share of 27% in 2024. This segment includes various dental specialties and support roles within DSOs, including orthodontists, periodontists, and dental hygienists. Trends involve expanding the range of services offered to cover diverse patient needs and integrating various specialties within DSOs to provide comprehensive, patient-centered care. This diversification enhances patient attraction and retention.

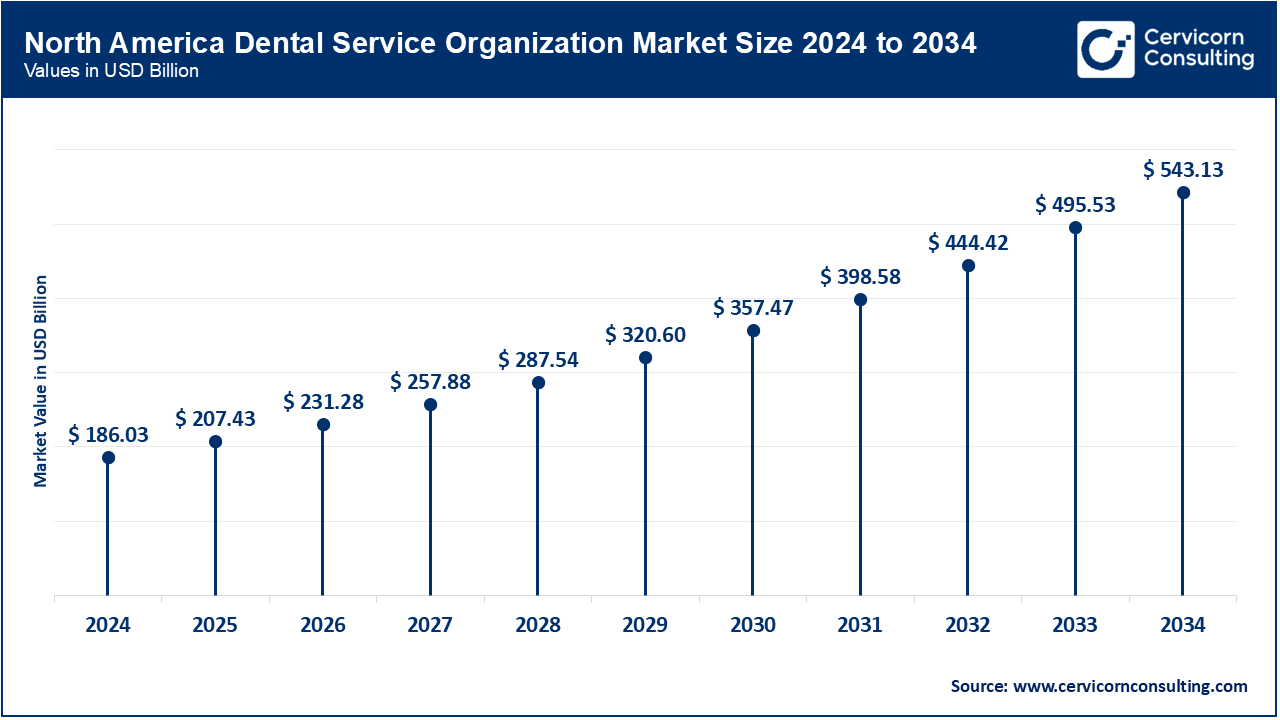

North America market size is calculated at USD 186.03 billion in 2024 and is projected to grow around USD 543.13 billion by 2034. In North America, the Dental Service Organization (DSO) market is robust, driven by high demand for comprehensive dental care and significant investment in dental technology. The United States leads the market due to a large number of established DSOs and a focus on integrating advanced technologies and patient management systems. Canada also shows growth with increasing consolidation of dental practices. Regulatory support and high patient awareness further bolster market expansion in this region.

The Asia-Pacific region is experiencing rapid growth in the DSO market due to rising dental care awareness, urbanization, and increasing disposable incomes. Asia Pacific market size is expected to reach around USD 236.14 billion by 2034 increasing from USD 80.88 billion in 2024. Countries such as China, India, and Japan are driving this expansion with a growing number of dental practices seeking operational efficiencies through consolidation. Government initiatives to improve healthcare infrastructure and the increasing adoption of advanced dental technologies are key factors contributing to market growth.

Europe's DSO market is growing steadily, supported by increasing consolidation and the expansion of dental networks. Europe market size is measured at USD 113.24 billion in 2024 and is expected to grow around USD 330.59 billion by 2034. The region is characterized by diverse regulatory environments and varying market dynamics across countries. Major markets like the UK, Germany, and France are leading the growth, driven by a focus on improving patient care and operational efficiencies. Investment in digital dentistry and cross-border collaborations are also enhancing market development in Europe.

The LAMEA region shows emerging potential in the DSO market, with growth driven by increasing access to dental care and improving healthcare infrastructure. LAMEA market size is forecasted to reach around USD 70.84 billion by 2034 from USD 24.27 billion in 2024. In Latin America, countries like Brazil and Mexico are expanding their dental networks, while the Middle East is investing in advanced dental technologies. The African market is gradually growing, with a focus on increasing dental care access and developing healthcare systems.

Among the emerging players in the Dental Service Organizations (DSO) market, Benevis is gaining traction through its focus on enhancing practice efficiency and patient care across diverse locations. Dental One Partners leverages a robust management infrastructure to support rapid expansion and standardization. Dominating players like Aspen Dental Management, Inc. (ADMI) and Heartland Dental drive their market position through extensive practice networks and technological innovations. Aspen Dental's strategic partnership with Straumann Group enhances its product offerings, while Heartland Dental’s acquisition strategies and investment in advanced digital tools fuel its growth and operational excellence, setting benchmarks in the DSO landscape.

Robert J. Fontana, CEO of Aspen Dental Management, Inc.

“At Aspen Dental, we are committed to transforming the dental care experience by expanding access to high-quality, affordable care. Our recent partnership with Straumann Group is a testament to our dedication to integrating cutting-edge technology and enhancing our service offerings nationwide.”

Patrick Bauer, CEO of Heartland Dental

“Heartland Dental continues to lead the industry by focusing on innovation and operational excellence. Our acquisition strategy and investment in digital dentistry technologies are central to our mission of providing exceptional care while streamlining practice management for our affiliated dentists.”

Steve Bilt, CEO of Smile Brands Inc.

“Smile Brands is dedicated to expanding our network of dental practices to better serve patients across the country. By continuously enhancing our patient engagement tools and investing in the latest dental technologies, we strive to improve both patient outcomes and practice efficiency.”

Rick Workman, CEO of Dental Care Alliance (DCA)

“Dental Care Alliance is at the forefront of dental practice management, leveraging our extensive network to deliver high-quality care and support to our affiliated practices. Our focus on operational support and strategic partnerships allows us to adapt and thrive in a dynamic market.”

Robert Baird, CEO of Pacific Dental Services

“At Pacific Dental Services, our commitment to innovation drives our growth and success. We are continuously expanding our practice network and integrating advanced technologies to enhance patient care, streamline operations, and support the professional development of our affiliated dentists.”

David K. McCarty, CEO of Affordable Dentures & Implants

“Affordable Dentures & Implants is focused on providing accessible and affordable dental care to underserved communities. Our strategic expansion and investment in new facilities enable us to reach more patients and offer comprehensive dental solutions that meet their needs effectively.”

These statements reflect the strategic priorities and innovations that these key players are leveraging to strengthen their positions in the DSO market.

Market Segmentation

By Service

By End-use

By Regions