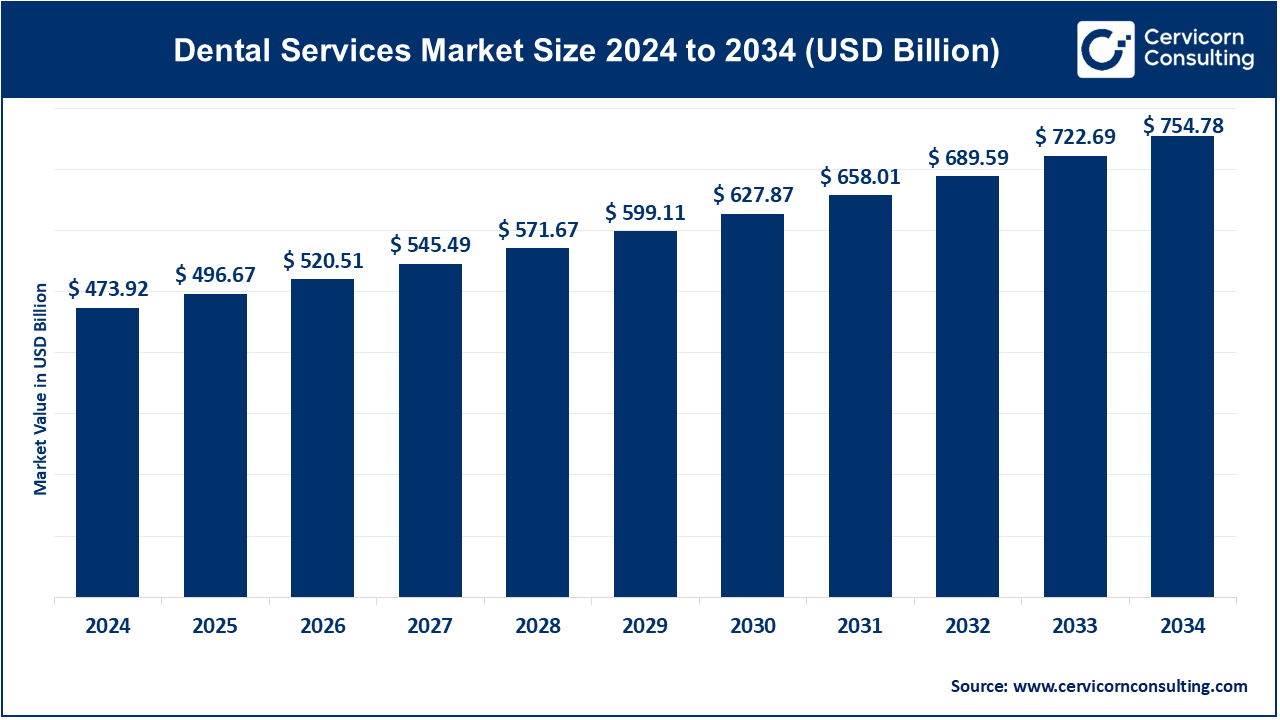

The global dental services market size was calculated at USD 473.92 billion in 2024 and is projected to grow around USD 754.78 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.8% from 2025 to 2034.

The dental services market is experiencing significant growth, driven by an increased focus on oral hygiene and aesthetic dentistry. A growing awareness of the importance of dental health, supported by educational campaigns and improved access to services, has led to higher patient turnout for preventive and corrective treatments. The demand for cosmetic procedures, such as teeth whitening, veneers, and orthodontic aligners, has surged due to a heightened emphasis on appearance and smile aesthetics. Additionally, technological advancements, including digital dentistry, 3D printing, and AI-driven diagnostics, are revolutionizing the industry by improving accuracy and patient experience. Emerging markets are playing a pivotal role in the expansion of dental services. Countries in Asia-Pacific, the Middle East, and Latin America are witnessing a surge in dental tourism, driven by cost-effective treatments and highly skilled professionals. Urbanization and lifestyle changes have also led to an increase in dental issues such as cavities, gum disease, and bruxism, further boosting demand for dental care.

Dental services encompass a wide range of treatments and procedures aimed at maintaining oral health, preventing dental issues, and addressing specific oral conditions. These services include preventive care, such as routine cleanings, fluoride treatments, and sealants; restorative care, like fillings, crowns, and bridges; and cosmetic dentistry, such as teeth whitening, veneers, and smile makeovers. Other common types of dental services include orthodontics, which involves the alignment of teeth using braces or aligners; periodontics, which addresses gum-related issues; endodontics for root canal treatments; prosthodontics for dentures and dental implants; and oral surgery for tooth extractions and corrective jaw surgeries. Pediatric dentistry also focuses on the oral health needs of children. Technological advancements, such as laser dentistry and digital imaging, are enhancing the quality and accessibility of these services.

According to data from the American Dental Association’s Health Policy Institute (HPI), the dental sector experienced a standstill due to COVID-19, with practices restricted to emergency cases in the initial phase of the pandemic. In March 2020, the ADA issued guidance recommending the postponement of elective dental procedures.

The ADA identified elective procedures to include oral examinations, routine cleanings, radiographs, cosmetic treatments, and orthodontic procedures not requiring immediate pain management. Emergency dental services were limited to cases such as oral bleeding, dental or facial trauma, painful cavities, tooth fractures, and abnormal tissue biopsies.

In a November 2022 article by the World Health Organization (WHO), it was reported that approximately 19% of the global adult population suffered from periodontal disease in 2021, equating to more than 1 billion cases worldwide. This substantial patient population is contributing to increased demand for various dental services, thereby driving market growth during the study period.

Report Scope

| Coverage | Details |

| Market Size in 2024 | USD 473.92 Billion |

| Market Growth Rate | CAGR of 4.8% from 2025 to 2034 |

| Market Size by 2034 | USD 754.78 Billion |

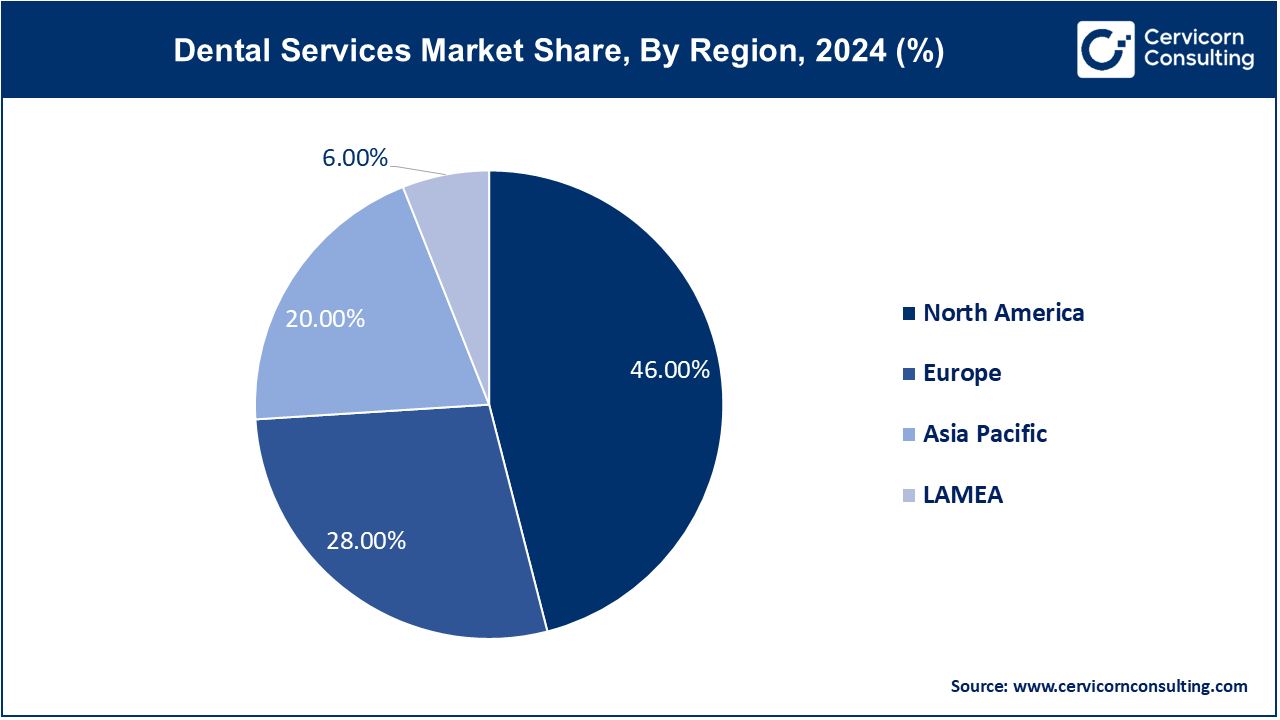

| North America Market Share | 46% in 2023 |

| APAC Market Share | 20% in 2023 |

Increased Insurance Coverage

Rising Incidence of Oral Health Awareness Campaigns

High Cost of Dental Treatments

Shortage of Dental Professionals

Expansion into Emerging Markets

Tele-Dentistry Innovations

Regulatory Compliance

Technological Integration Costs

While advancements in dental technology offer numerous benefits, the initial investment and ongoing maintenance costs for high-tech equipment and software can be prohibitive. Small and mid-sized dental practices may struggle with the financial burden of integrating and updating advanced technologies, potentially limiting their ability to compete and offer state-of-the-art services.

Dental Implants: The dental implants segment has captured market share of 22% in 2023. The demand for dental implants is driven by the aging population and the increasing prevalence of tooth loss. Technological advancements in implant materials and techniques have improved success rates, making implants a preferred solution for tooth replacement. Trends include the adoption of 3D printing and digital planning tools, enhancing precision and patient outcomes.

Orthodontics: Orthodontics is experiencing growth due to the rising demand for aesthetic dental solutions, particularly among adults. Innovations such as clear aligners and 3D imaging technologies are making treatments more discreet and comfortable. Trends include shorter treatment times and increased accessibility through teledentistry, which allows for remote monitoring and consultations.

Periodontics: The periodontics segment is driven by the high prevalence of periodontal diseases, which are linked to systemic health conditions like diabetes and heart disease. Advances in diagnostic tools and minimally invasive surgical techniques are improving treatment outcomes. Public awareness campaigns about oral hygiene's importance also contribute to the growth of periodontic services.

Endodontics: Endodontics, focused on root canal treatments, is growing due to increased dental caries cases and the need to preserve natural teeth. Innovations in rotary instrumentation and digital imaging enhance treatment efficiency and accuracy. The trend towards less invasive procedures and better pain management techniques is also contributing to the segment's growth.

Cosmetic Dentistry: Cosmetic dentistry is booming as patients seek procedures to enhance their smiles, driven by social media and aesthetic trends. Services like teeth whitening, veneers, and bonding are in high demand. Technological advancements, such as digital smile design and minimally invasive techniques, are making cosmetic treatments more effective and appealing.

Laser Dentistry: Laser dentistry is gaining popularity due to its minimally invasive nature and faster recovery times. It is used in various procedures, including gum reshaping, cavity treatment, and teeth whitening. The precision and reduced discomfort associated with laser treatments are key drivers, with ongoing research expanding its applications and effectiveness.

Dentures: The demand for dentures is fueled by the aging population and the need for affordable tooth replacement options. Advances in materials and fabrication techniques have improved the comfort and appearance of dentures. Trends include digital denture fabrication, which enhances fit and reduces production time, and implant-supported dentures offering increased stability.

Oral & Maxillofacial Surgery: This segment is driven by the need for complex dental procedures, including corrective jaw surgery and treatment of oral cancers. Advances in surgical techniques and anesthesia are improving patient outcomes and recovery times. Trends include the integration of digital planning and 3D printing for customized surgical solutions and enhanced precision.

Others: Other dental services include pediatric dentistry, preventive care, and emergency dental services. These segments are driven by increased awareness of oral health's importance and the need for regular dental check-ups. Preventive care trends focus on early detection and intervention, while pediatric dentistry emphasizes child-friendly techniques and education to establish lifelong healthy habits.

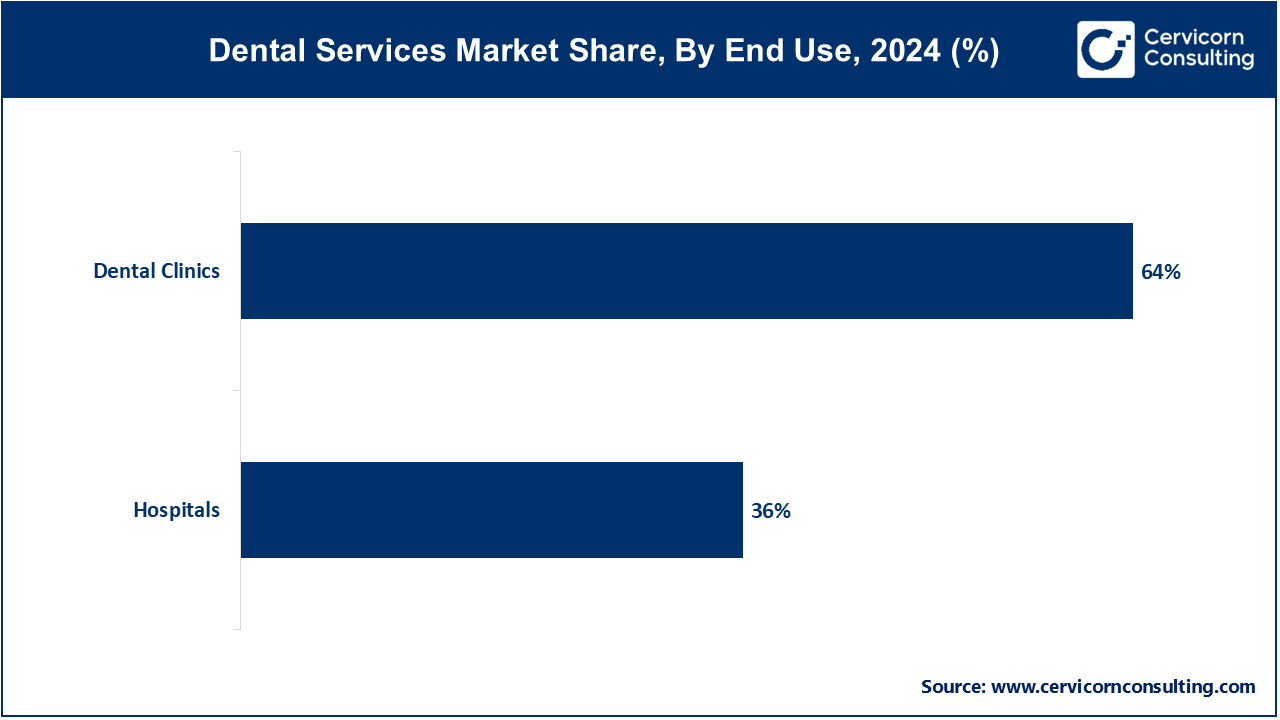

Hospitals: The hospital segment has recorded market share of 36% in 2024. Hospitals play a critical role in providing complex dental procedures and emergency dental care. The trend towards multidisciplinary healthcare and integration of dental services in hospital settings enhances patient access to comprehensive care. Drivers include advancements in medical technology, increasing healthcare infrastructure investments, and the need for coordinated treatment plans for patients with complex medical conditions.

Dental Clinics: The dental clinics segment has registered dominating market share of 64% in 2024. Dental clinics are the primary providers of routine and specialized dental services, including preventive, restorative, and cosmetic procedures. The trend towards personalized care and patient-centric approaches is prominent, with clinics adopting advanced diagnostic tools and digital technologies. Drivers include rising dental awareness, increasing demand for aesthetic treatments, and the convenience of accessing specialized services in a community setting.

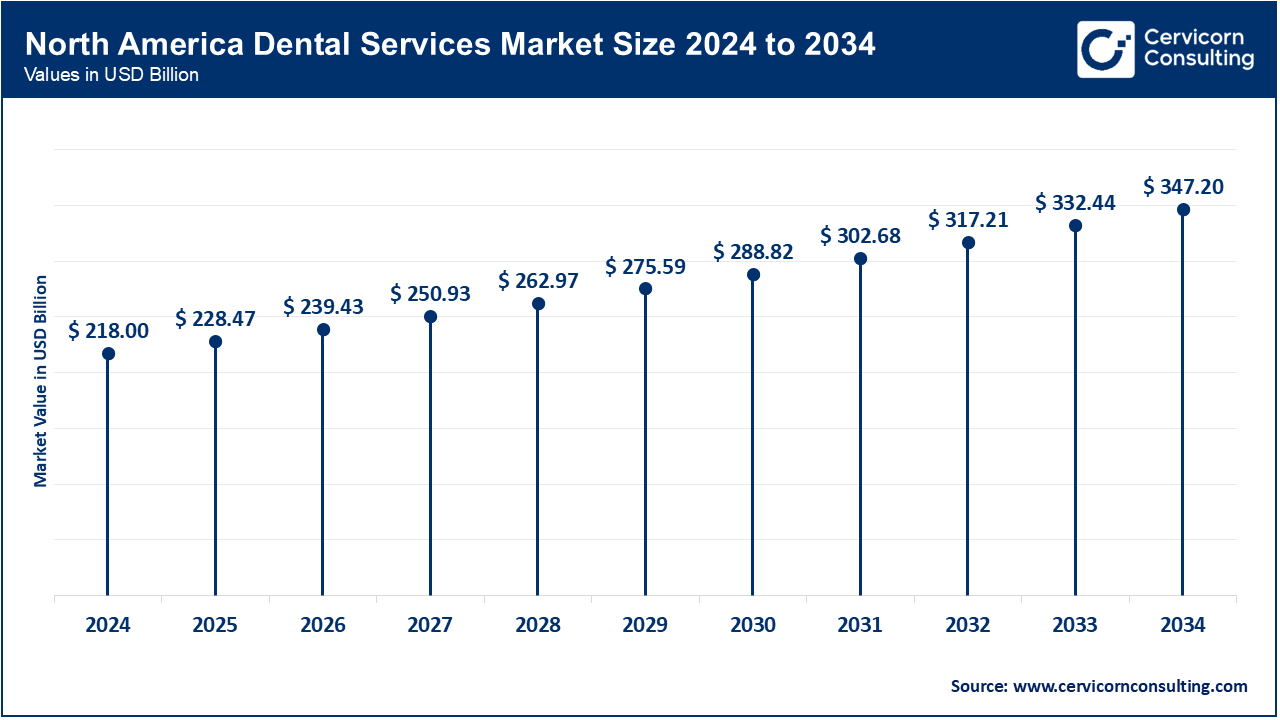

North America dominates the dental services market due to high dental awareness, advanced healthcare infrastructure, and significant disposable income. North America market size is calculated at USD 218.00 billion in 2024 and is projected to grow around USD 347.2 billion by 2034. The region benefits from a strong presence of key market players and the widespread adoption of advanced dental technologies. Increased focus on cosmetic dentistry and orthodontics, coupled with a growing aging population requiring dentures and implants, drives market growth. Government initiatives to improve dental health access and insurance coverage further bolster the market. Dental service providers continuously innovate and expand their offerings to meet the evolving demands of health-conscious consumers.

Europe market size is measured at USD 132.70 billion in 2024 and is forecasted to reach around USD 211.34 billion by 2034. Europe dental services market is driven by advanced healthcare systems, high dental care awareness, and robust demand for cosmetic dentistry. Countries like Germany, the UK, and France lead in adopting innovative dental technologies and procedures. The region's aging population increases the need for dental implants and dentures. Government support for oral health initiatives and insurance schemes enhances the accessibility and affordability of dental services. Dental tourism, particularly in Eastern Europe, is a growing trend, attracting international patients seeking high-quality, cost-effective treatments, and contributing to the market's expansion.

The Asia-Pacific region is experiencing rapid growth in the dental services market due to increasing awareness of oral health, rising disposable incomes, and expanding healthcare infrastructure. Asia-Pacific market size is accounted at USD 94.78 billion in 2024 and is expected to reach around USD 150.96 billion by 2034. Countries like China, India, and Japan lead in market size, driven by a large population base and growing demand for advanced dental procedures. Technological advancements and the adoption of digital dentistry are accelerating market expansion. Government initiatives to improve healthcare access, coupled with a burgeoning middle class seeking aesthetic dental treatments, propel growth. Dental tourism is also on the rise, particularly in countries offering affordable, high-quality care.

The LAMEA dental services market is growing, driven by improving healthcare infrastructure and increasing awareness of oral health. LAMEA market size is calculated at USD 28.44 billion in 2024 and is foreseen to reach around USD 45.49 billion by 2034. In Latin America, countries like Brazil and Mexico see rising demand for orthodontics and cosmetic dentistry, influenced by aesthetic trends. The Middle East benefits from high disposable incomes and a focus on advanced dental treatments. In Africa, market growth is supported by initiatives to enhance dental care access and affordability. Challenges include economic disparities and limited healthcare resources, but increasing investments in healthcare infrastructure and dental tourism opportunities are driving regional market expansion.

Among the new players, Apollo White Dental leverages advanced technology and extensive networks across India to provide comprehensive and affordable dental care. Dentalcorp Holdings stands out with its focus on consolidating high-quality dental practices in Canada, enhancing service standards through shared resources and expertise. Dominating players like Aspen Dental and Heartland Dental drive growth through expansive networks and innovative patient care models. Aspen Dental collaborates with Oral Health America to enhance accessibility, while Heartland Dental invests in cutting-edge technology and continuous education for practitioners. These strategies and innovations reinforce their leadership in the competitive dental services market.

Bob Fontana, CEO of Aspen Dental

"Our mission is to break down barriers to care and bring affordable, quality dental services to communities across the nation. We continue to innovate and expand our reach to ensure everyone has access to the dental care they need."

Stephen Thorne, CEO of Pacific Dental Services

"We believe in the power of modern dentistry to change lives. By integrating advanced technology and fostering a patient-centric approach, we empower dental professionals to provide exceptional care and transform patient experiences."

Rick Workman, CEO of Heartland Dental

"Our focus is on supporting dentists so they can focus on providing the best patient care. We invest in continuous education and state-of-the-art technology to ensure our affiliated practices lead in quality and innovation."

Ken Cooper, CEO of Smile Brands Inc.

"At Smile Brands, we strive to make dental care accessible and enjoyable for everyone. Our mission is to provide Smiles for Everyone®, and we achieve this by creating a culture of compassion and excellence in every office."

Dr. Dan Lieberman, CEO of DentalCare Alliance

"Our approach centers on collaboration and shared expertise. By partnering with top dental practices, we enhance clinical outcomes and operational efficiencies, ensuring patients receive the highest standard of care."

Gerry Cool, CEO of Dentalcorp Holdings

"We are committed to leading the dental industry in quality and innovation. By consolidating the best practices and providing them with the resources and support they need, we elevate the standard of care and patient experience across our network."

These CEO statements underscore a shared commitment to enhancing patient care through advanced technology, continuous education, and strategic partnerships.

Market Segmentation

By Type

By End-use

By Regions