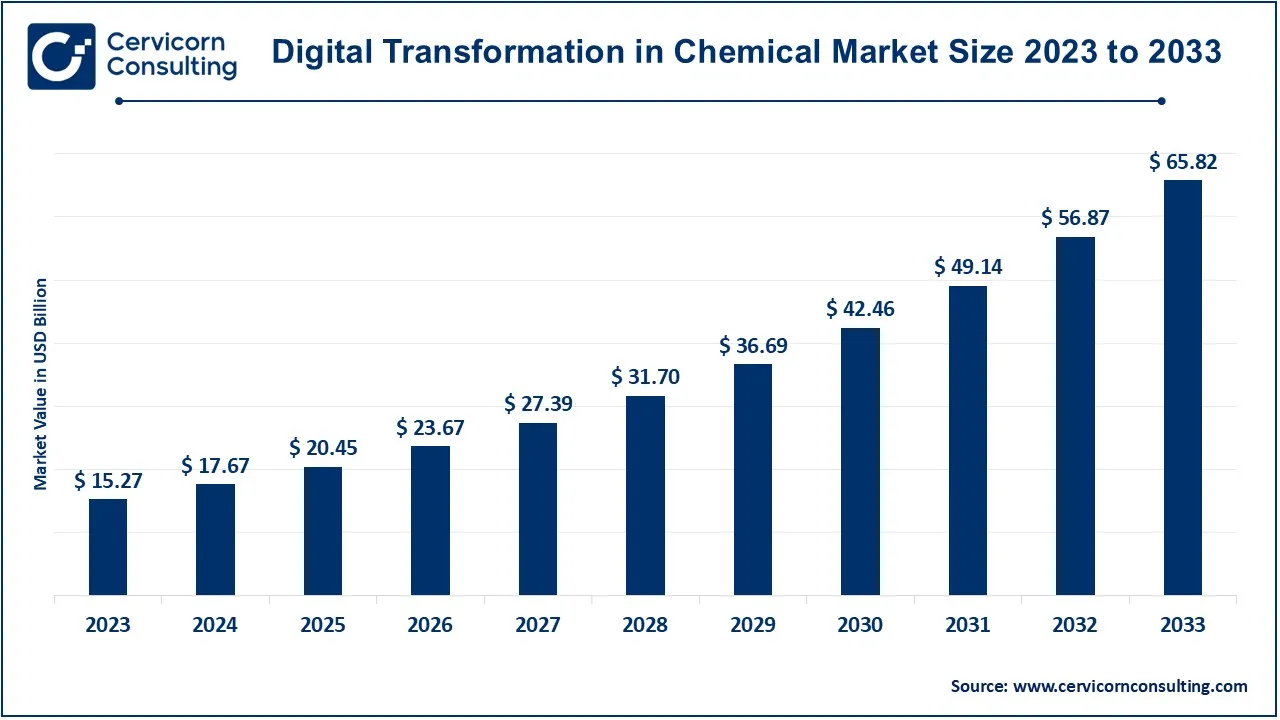

The global digital transformation in chemical market size was valued at USD 17.67 billion in 2024 and is expected to reach around USD 65.82 billion by 2033, growing at a compound annual growth rate (CAGR) of 20.27% from 2024 to 2033.

The digital transformation in chemical market is witnessing substantial expansion as companies increasingly recognize the potential of technology to drive efficiency and competitiveness. A key factor fueling this growth is the need for real-time data analytics and enhanced operational visibility. As chemical manufacturers strive to optimize their production processes and reduce costs, digital tools like predictive maintenance, process automation, and supply chain optimization are gaining widespread adoption. These technologies not only enhance operational efficiency but also enable companies to meet sustainability and regulatory requirements more effectively. Furthermore, the demand for energy-efficient solutions is prompting chemical companies to embrace smart manufacturing practices. By leveraging digital technologies, such as IoT sensors and AI-driven analytics, companies can monitor energy consumption and optimize resource usage, contributing to a reduction in environmental impact. In recent, ADNOC launched XRG, a USD 80 billion investment company focusing on lower-carbon energy and chemicals, aiming to double its asset value within ten years by leveraging energy transformation, AI, and emerging economies.

Digital transformation in the chemical refers to the integration of digital technologies into various aspects of chemical manufacturing, supply chain management, and operations. This transformation leverages technologies like Internet of Things (IoT), artificial intelligence, machine learning, big data analytics, cloud computing, and automation to improve productivity, efficiency, and decision-making processes. Through digitization, chemical companies can monitor equipment in real-time, optimize production processes, reduce waste, and improve safety standards. The adoption of advanced technologies enables better product quality, cost reduction, predictive maintenance, and streamlined supply chains. Digital transformation also helps companies align with sustainability goals, reduce carbon footprints, and enhance regulatory compliance by improving transparency and traceability in operations.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 20.45 Billion |

| Projected Market Size (2033) | USD 65.82 Billion |

| Growth Rate (2024 to 2033) | 20.27% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product, Application, End User, Region |

| Key Companies | BASF SE, Dow Inc., Solvay, SABIC, Covestro AG, Linde plc, Evonik Industries AG, AkzoNobel N.V., DuPont, Clariant, Honeywell International Inc., Siemens AG, Yokogawa Electric Corporation, Emerson Electric Co., Schneider Electric, Rockwell Automation, AVEVA Group plc, Wacker Chemie AG, Aspen Technology, Inc., Hexagon AB |

Rising Demand for Digital Solutions in Manufacturing

Need for Sustainable and Energy-Efficient Processes

High Initial Costs for Digital Transformation

Resistance to Change in Traditional Processes

Expansion into Emerging Markets

Collaborations with Technology Providers

Data Privacy and Cybersecurity Risks

Skill Gap in Digital Technologies

The digital transformation in chemical market is segmented into application, product, end-users and region. Based on application, the market is classified into manufacturing operations, supply chain optimization, customer experience, and research & development. Based on product, the market is classified into cloud-based solutions, IoT platforms, AI & data analytics, cybersecurity solutions. Based on end-users, the market is classified into petrochemicals, specialty chemicals, agrochemicals, and industrial gases.

Manufacturing Operations: Industry 4.0 in manufacturing examines the adoption of effective technologies in manufacturing processes with purposes of efficiency, minimal downtime and quality. Chemical companies are now using automation and machinery with an analytical feature for product quality and means for monitoring and early detection of machinery problems to optimize production and reduce cost and energy consumption.

Supply Chain Optimization: Blockchain, AI and data analytics have become the trending technologies for the chemical industry to increase the transparency of supplies chains and boost their effectiveness. It is important to note that through implementation of these technologies companies can be in a position to track the raw materials in Anthony & Grosso’s supply chain in real time; enhance demand forecasting; and optimize logistics all in a bid to cut on lead time, eliminate high inventories, and manage supply chain disruptions.

Customer Experience: The chemical industry customer experience is being revolutionized through digital innovation with digital channels, online and personalization of services. Big data, CRM, and AI are now being applied to making a clear understanding of the customer need, being able to make better product suggestions, and the simplified and efficient buying methods that this chemical industry is developing.

Research & Development (R&D): Now, in the R & D area, digital transformation accelerates the innovation cycle and helps to use AI, big data and digital replicas of the chemical processes and products. They streamline the new product development process lowering the strive associated with it while enhancing the accuracy of R & D programs.

Cloud-Based Solutions: Chemical companies get to access huge databases and process them in the comfort of the cloud environment. Solutions delivered in the cloud are especially important to enhance the flow of cooperation across teams that are in different geographical locations, improve supply chain operations, and support advances in digital manufacturing.

IoT Platforms: These platforms are part and parcel of the integration process of devices and systems within chemical plants. These platforms allow for real-time monitoring and collection of data of equipment in order to increase efficacy, safety, and reduce infringement with environmental laws. They also help in prediction of failure; thus, less time is spent and costs for repair are low.

AI & Data Analytics: The use of artificial intelligence (AI) and data analysis continues to bring a new level of rigor and detail to decision-making across the chemical sector as the business tries to understand how to maximize operating efficiency, customer satisfaction, and existing market opportunities. Covering everything from supply chain predictions to the enhancement of the chemical production line, AI plays a role in numerous innovations industries.

Cybersecurity Solutions: When they decided to invest in digital transformation, as chemical firms had done, cybersecurity was an increasingly important means by which to safeguard data, information, and technical infrastructure from cyber risks. Promised security solutions protect the integrity of enterprise networks and meet legal requirements on data security as well as preventing cyber threats.

Petrochemicals: The petrochemical sector is using digital capabilities to increase process effectiveness and effectiveness, decrease adverse environmental effects, and increase security. What for, digital technologies have placed smart sensors for monitoring and AI analytics for predicting equipment failure and hence reducing cost by meeting the growing demands.

Specialty Chemicals: Due to the rising interest of consumers in quality products, there is an increased demand for better and innovative digital ways for implementing specialty chemicals into production. Intelligent technologies such as AI, IoT, and advanced analytics are being utilized to make changes in the manufactures to provide highly customizable solutions as per market and consumer requirements in less amount of time.

Agrochemicals: Companies in the agrochemical industry are leveraging the use of technology to design more efficient production methods and supply chain solutions while trying to ensure that the protection products used in crop growing are eco-friendly. Employing digital projects and data analysis, businesses produce less-harmful instruments and solutions in the sphere of agriculture to provide global food security and promote eco-friendly farming.

Industrial Gases: Digital transformation in the industrial gases sector aims at improving and the sectors effectiveness, safety, and sustainability. Application of IoT, AI and advanced automation to the production and distribution of gas allows for continuous delivery and constant efficiency with low energy consumption and low emissions.

The market is headed by North America because of huge spending in futuristic technologies such as AI, IoT, and automation. The application of smart manufacturing and digital solutions has also shown its strength in the chemical industry driven by the changes needed for operational efficiency and sustainability in the U.S. Canada is also leveraging on new technologies to enhance supply chain visibility especially through a green supply chain.

Europe’s chemical industry is currently witnessing tremendous potential for more digitalised change due to tougher environmental standards and sustainability systems. German, French and Britain among others are putting their cash on AI, IoT to optimize resource use charge towards climate targets as defined by the EU. These advancements are also useful for the companies to maintain their position in competitive global market.

The Asia-Pacific region, in particular, is experiencing the fastest rate of digital transformation in the chemical industry due to the rising industrial needs, the fast pace of urbanization, and the growth of technology. China, India and Japan are prime examples of this with its governments seeing digitization means changing manufacturing vastly for the good, thereby making this region a key player in chemical market’s digital revolution.

The LAMEA region remains somewhat conservative about digitalization in the chemical market but trends are slowly shifting in Latin America and Middle Eastern industries which incorporate IoT & AI to streamline processes. Brazil and UAE are employing digital tools to increase efficiency and reduce the environmental impacts, emerging investments in Africa for chemical manufacturing are on the rise with better use of digital solutions.

New entrants in the digital transformation in chemical industry are applying advanced technologies like AI, IoT, data analytics, and others in an attempt to change the landscape of the chemical business for manufacturers. Smart manufacturing solutions are emerging core business strategies for startups, as part of real time monitoring and predictive total maintenance solutions that provide much increased productivity at lower prices. At the same time, incumbents such as BASF and Dow are also building up their digital offerings by integrating digital twins and enhanced automation solutions into their manufacturing to create efficiencies and increase sustainability.

At the same time, large technology firms such as Siemens and Honeywell have already deepened their focus on the chemical sector and offered point solutions – from process optimization software to artificial intelligence-based analytics. Because of their long experience of working in the industrial automation niche, they stand a better chance against the competition. Further, alliances between chemical firms and IT solutions suppliers are pushing measures of change forward and boosting the pace of digitalization. Start-ups and mega corporations are refactoring the chemical market to be much more intelligent and resourceful in terms of production.

CEO Statements

Dr. Martin Brudermüller, CEO of BASF

"At BASF, we are committed to leveraging digital technologies to enhance efficiency, sustainability, and innovation in the chemical industry. By integrating AI and data analytics across our operations, we are making our production processes smarter and more sustainable, ultimately contributing to a more circular economy."

Jim Fitterling, CEO of Dow Inc.

"Digital transformation is a key enabler of growth for Dow. Our investments in digital tools such as predictive maintenance, smart manufacturing, and real-time data analytics are helping us streamline our operations and meet the evolving needs of our customers while significantly reducing our environmental footprint."

Market influencers and key stakeholders in the chemical market digitalization process are increasingly using advanced technologies that seek to enhance operation’s efficiency as well as sustainability, throughout the value chain. These companies are pioneers in daylighting adoption of solutions like Artificial Intelligence, Industrial IoT and machine learning to optimize production, minimize downtime and make real-time decision.

Digital twins and predictive analytics are becoming key enablers, allowing chemical organisations to watch how operations are progressing and even predict when a piece of equipment may fail. In the market there are various new companies to be noticed that. Notable developments in the market include:

Market Segmentation

By Application

By Product

By End-Users

By Region