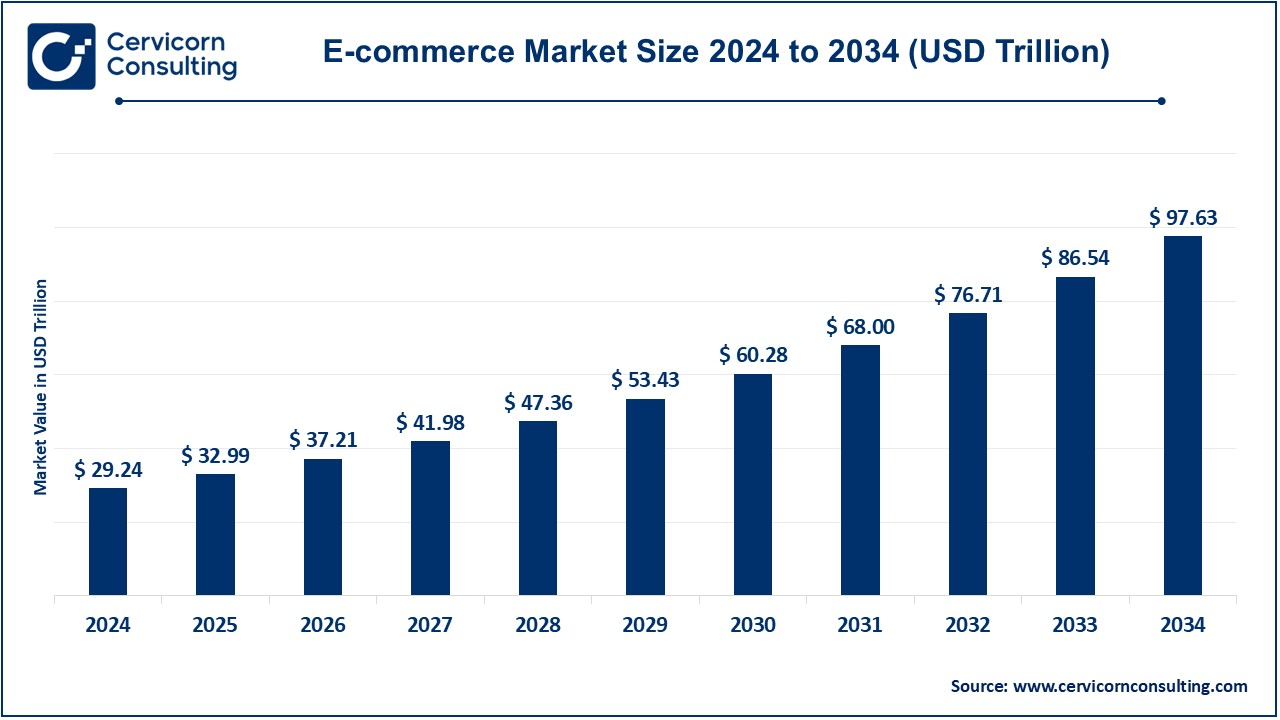

The global e-commerce market size was valued at USD 29.24 trillion in 2024 and is expected to be worth around USD 97.63 trillion by 2034, growing at a compound annual growth rate (CAGR) of 16.37% over the forecast period 2025 to 2034.

The global e-commerce market is expanding at a rapid pace. The rise of mobile commerce (m-commerce), same-day deliveries, and AI-powered recommendations have contributed to this surge. Major players like Amazon, Alibaba, and Walmart dominate the industry, while smaller businesses are leveraging social media platforms for sales. The demand for personalized shopping experiences and flexible payment options is further fueling growth.

The COVID-19 pandemic accelerated e-commerce adoption, with more consumers shifting to online shopping. The fashion, electronics, and grocery sectors have seen the highest growth. Emerging markets like India, Brazil, and Southeast Asia are experiencing a boom due to increasing smartphone penetration and digital payment adoption. The future of e-commerce will be shaped by trends like metaverse shopping, drone deliveries, and AI-driven chatbots, making online shopping more immersive and efficient.

What is E-commerce?

E-commerce (electronic commerce) refers to the buying and selling of goods and services over the internet. It enables businesses and consumers to conduct transactions without needing physical stores. E-commerce platforms like Amazon, eBay, and Shopify allow users to browse products, make purchases, and get doorstep deliveries. Payment is made through digital methods like credit cards, mobile wallets, and online banking.

E-commerce includes different types: B2C (Business-to-Consumer), where companies sell directly to customers (e.g., Amazon), B2B (Business-to-Business), where businesses sell to other businesses (e.g., Alibaba). E-commerce is growing rapidly due to factors like increased internet usage, mobile shopping, and secure digital payments. It offers convenience, wider product choices, and cost savings. Businesses benefit from lower operational costs, global reach, and data-driven marketing. With advanced technologies like AI, AR, and blockchain, e-commerce is becoming more efficient and customer-friendly.

Report Highlights

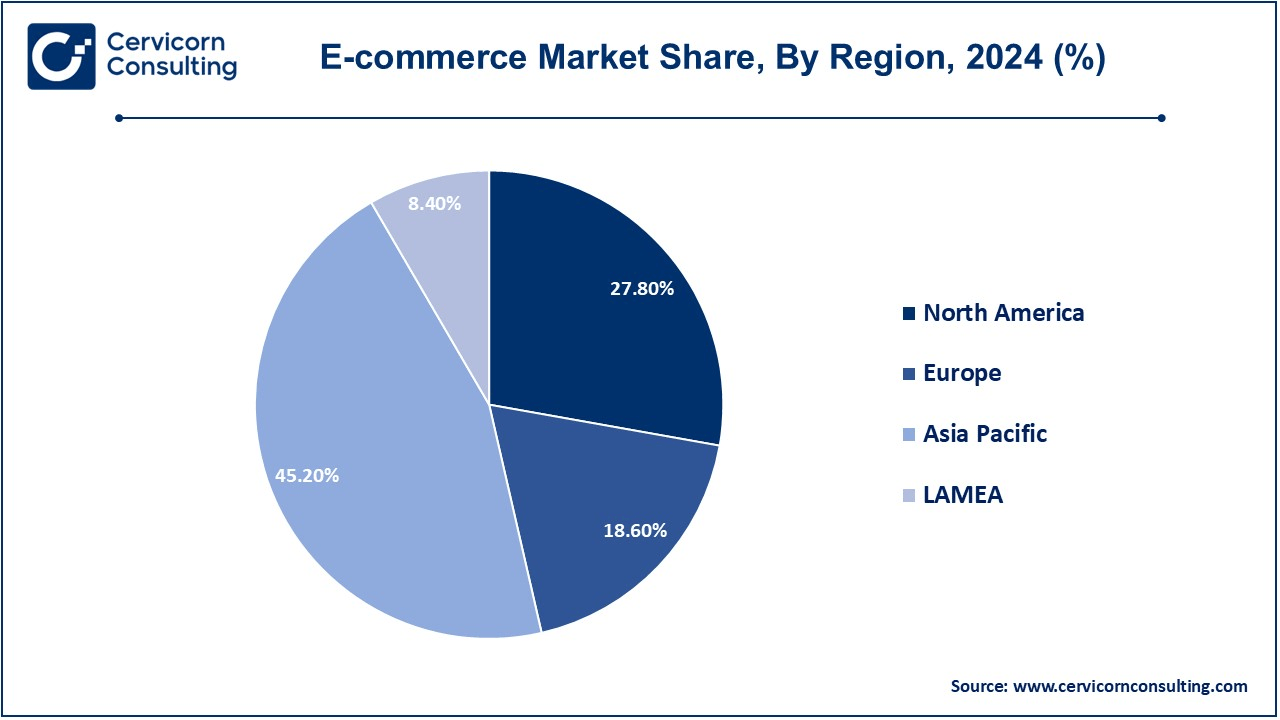

The Asia-Pacific has held a dominant position, accounting for a revenue share of 45.20% in 2024.

The North America has reported a revenue share of 27.80% in 2024.

By model type, the B2C Model segment has captured a revenue share of 63.40% in 2024.

By application, the home appliances segment has garnered a revenue share of 25.60% in 2024.

Mobile Commerce (M-Commerce) Expansion: The rise of mobile commerce is significantly shaping the e-commerce landscape. As of 2023, mobile commerce accounted for 43.4% of total retail e-commerce sales and is projected to reach USD 4.5 trillion by 2025. The increasing affordability of smartphones and faster internet connectivity are key drivers of this growth. Businesses are optimizing their websites for mobile devices and investing in progressive web apps (PWAs) to ensure seamless shopping experiences. Retailers using mobile-optimized platforms see up to 67% higher conversion rates compared to non-mobile-friendly sites. With mobile wallets like Apple Pay, Google Pay, and PayPal, checkout processes are becoming faster, further boosting mobile commerce adoption.

Integration of User-Generated Content (UGC): Consumers increasingly rely on real user experiences before making a purchase. A survey found that 78% of buyers feel more confident purchasing a product after viewing user-generated content (UGC), such as customer reviews, testimonials, and photos. E-commerce platforms incorporating UGC see a 20% increase in conversion rates and a 29% boost in web engagement. Moreover, 49% of e-commerce business owners believe that UGC is more effective than influencer marketing, as it builds authenticity and trust. Retailers like Amazon and fashion brands like ASOS leverage customer reviews, videos, and Instagram posts to enhance their product appeal.

Rise of Social Media Commerce (S-Commerce): Social media is becoming a dominant force in e-commerce. In 2023, global social commerce sales reached USD 1.25 trillion, and this figure is expected to double by 2026. Platforms like Instagram, TikTok, and Facebook have introduced shopping features, allowing users to buy products directly from posts, reels, and live streams. In the U.S., 43% of adults have made a purchase via Facebook, while TikTok Shop is rapidly gaining traction among Gen Z shoppers. Businesses using social commerce report a 32% increase in sales, as it enables direct customer engagement, personalized ads, and impulse purchases. This trend is particularly strong in emerging markets, where social media penetration is high.

Dynamic Pricing Strategies: E-commerce giants like Amazon, Walmart, and Alibaba use dynamic pricing to maximize profits and stay competitive. This strategy involves adjusting product prices based on demand, competition, and market conditions. Studies show that Amazon changes prices up to 2.5 million times a day, with prices fluctuating every 10 minutes for certain products. Businesses using AI-driven dynamic pricing see a 25% increase in revenue and a 20% improvement in profit margins. While dynamic pricing offers flexibility, it also raises concerns about transparency and customer trust, as prices can vary significantly within short periods.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 32.99 Trillion |

| Expected Market Size in 2034 | USD 97.63 Trillion |

| Projected CAGR 2025 to 2034 | 16.37% |

| Dominant Region | Asia-Pacific |

| Rapidly Expanding Region | Asia-Pacific |

| Key Segments | Model Type, Application, Region |

| Key Companies | Amazon, Alibaba Group, JD.com, eBay, Walmart, Shopify, Rakuten, Flipkart, MercadoLibre, Sea Group (Shopee), Zalando, Noon |

Increasing Internet Penetration

Growing Adoption of Digital Payment Solutions

Personalization and AI-Powered Shopping Experiences

Consumer Trust and Security Concerns

Regulatory and Compliance Challenges

Expansion into Emerging Markets

Integration of Advanced Technologies (AI, AR, Blockchain, and IoT)

Emerging technologies are shaping the future of e-commerce.

Companies leveraging these technologies can enhance user experience and gain a competitive edge.

Intense Market Competition

Supply Chain and Logistics Issues

The e-commerce market is segmented into model type, application, and region. Based on model type, the market is classified into B2C and B2B. Based on application, the market is classified into consumer electronics, beauty & personal care, home appliances, clothing & footwear, healthcare, books & stationery and others.

Business-to-Consumer (B2C) Model: The B2C e-commerce model has witnessed rapid growth due to increasing internet penetration, digital payment adoption, and changing consumer preferences. Consumers now prefer shopping online for convenience, better pricing, and a wider variety of products. E-commerce platforms like Amazon, Alibaba, and Flipkart have revolutionized the retail landscape, offering everything from electronics to groceries. Within B2C, retail e-commerce dominates as brands focus on improving customer experience with AI-driven recommendations, same-day delivery, and seamless return policies. Direct-to-consumer (DTC) brands have also emerged strongly, cutting out intermediaries and selling directly to consumers through personalized marketing strategies. Online grocery sales have surged as well, driven by changing consumer habits, on-demand delivery, and subscription-based shopping models. Additionally, subscription-based e-commerce, including services like streaming platforms and curated product boxes, has seen a steady rise due to its convenience and cost-effectiveness.

E-commerce Market Revenue Share, By Model Type, 2024 (%)

| Model Type | Revenue Share, 2024 (%) |

| Business-to-Consumer (B2C) Model | 63.40% |

| Business-to-Business (B2B) Model | 36.60% |

Business-to-Business (B2B) Model: B2B e-commerce has transformed how businesses interact, procure goods, and manage supply chains. With digitalization, companies are increasingly shifting to online platforms for bulk purchasing and automated procurement. Wholesale e-commerce plays a crucial role in enabling businesses to buy large quantities of raw materials, machinery, or office supplies efficiently. Manufacturers and industrial suppliers have also embraced e-commerce, providing digital catalogs, AI-driven pricing models, and automated order fulfillment. Cloud-based solutions and Software-as-a-Service (SaaS) platforms are streamlining business operations, enabling even small enterprises to establish an online presence and conduct transactions globally. The growth of digital marketplaces for B2B transactions has further simplified cross-border trade, fostering stronger supplier-buyer relationships.

Consumer Electronics: The e-commerce sector for consumer electronics has expanded significantly, fueled by the increasing demand for smart gadgets, mobile devices, and home automation products. Online platforms provide a seamless shopping experience with detailed product descriptions, customer reviews, and easy comparisons. Smartphones, laptops, and accessories remain the most sought-after categories, with brands leveraging exclusive online launches and competitive pricing to attract customers. Wearables, including smartwatches and fitness trackers, have gained popularity as consumers prioritize health and fitness. Augmented Reality (AR) and Virtual Reality (VR) tools have further enhanced the online shopping experience, allowing customers to visualize products before purchasing.

Beauty & Personal Care: The beauty and personal care segment has experienced tremendous growth, driven by the increasing preference for online beauty shopping. Skincare, makeup, and wellness products are highly popular, with brands leveraging influencer marketing and social media to engage customers. Personalized skincare and AI-driven beauty consultations have gained traction, offering customers tailored product recommendations. Subscription-based beauty boxes provide a curated experience, allowing consumers to explore new products monthly. Virtual try-on tools using AR technology have improved customer confidence in purchasing cosmetics online. Organic and cruelty-free beauty products have also gained momentum, aligning with the growing consumer preference for sustainable and ethical brands.

Home Appliances: The e-commerce market for home appliances is thriving, as consumers increasingly prefer to purchase large appliances like refrigerators, washing machines, and microwaves online. Smart home products, including connected thermostats, security cameras, and automated lighting, have witnessed strong demand, enhancing convenience and energy efficiency. Online platforms provide extensive product information, customer reviews, and competitive discounts, encouraging more consumers to shop online. The shift towards energy-efficient appliances has also driven growth, with brands focusing on sustainability and innovative features. Kitchen appliances, including coffee makers, blenders, and air fryers, have gained popularity due to the rising trend of home cooking and healthier lifestyles.

E-commerce Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Consumer Electronics | 17.20% |

| Beauty & Personal Care | 10.80% |

| Home Appliances | 25.60% |

| Clothing & Footwear | 14.40% |

| Healthcare | 8.70% |

| Automotive | 6% |

| Books & Stationery | 4% |

| Others | 13.30% |

Clothing & Footwear: Fashion e-commerce has seen remarkable growth, with consumers embracing online shopping for clothing and footwear due to convenience, variety, and personalized recommendations. Fast fashion brands have capitalized on online platforms, offering trendy designs with quick turnaround times. AI-powered sizing recommendations and virtual fitting rooms help reduce return rates, improving customer satisfaction. Luxury fashion brands have also embraced e-commerce, providing exclusive digital storefronts and immersive shopping experiences. Sustainable fashion has emerged as a significant trend, with consumers prioritizing eco-friendly and ethically sourced clothing. Footwear sales have surged, with major brands focusing on DTC models, innovative designs, and limited-edition releases to attract online shoppers.

Healthcare: The healthcare segment has undergone significant digital transformation, with e-commerce playing a crucial role in providing easy access to medicines, health supplements, and medical devices. Online pharmacies have become a preferred choice for consumers, offering doorstep delivery of prescription drugs and wellness products. Telemedicine services have gained traction, allowing patients to consult doctors online and order prescribed medications conveniently. Wearable health devices, including smartwatches and glucose monitors, have seen increased adoption, enabling consumers to monitor their health in real time. The demand for immunity-boosting supplements and organic healthcare products has also risen, reflecting a growing emphasis on preventive healthcare and wellness.

Books & Stationery: The shift towards online book purchasing has accelerated, with e-books and audiobooks gaining popularity among readers. Digital learning platforms have expanded, providing access to educational content, online courses, and research materials. Traditional book sales remain strong, with collectors and academic institutions purchasing hard copies for reference and study purposes. Subscription-based reading services have increased accessibility, allowing users to explore a vast library of books for a fixed monthly fee. Stationery and office supplies have also seen strong online demand, particularly from students and remote workers seeking convenience and bulk purchase options.

Others: This segment encompasses various categories, including online grocery, automotive parts, and home decor. Online grocery shopping has grown significantly, with consumers opting for digital platforms to order fresh produce, packaged foods, and daily essentials. Contactless delivery and AI-driven recommendations have further enhanced the customer experience. The automotive e-commerce industry has also expanded, offering spare parts, accessories, and even vehicle purchases online. Home decor and furniture sales have surged, with consumers relying on virtual design tools and AR applications to visualize products before making a purchase.

The e-commerce market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

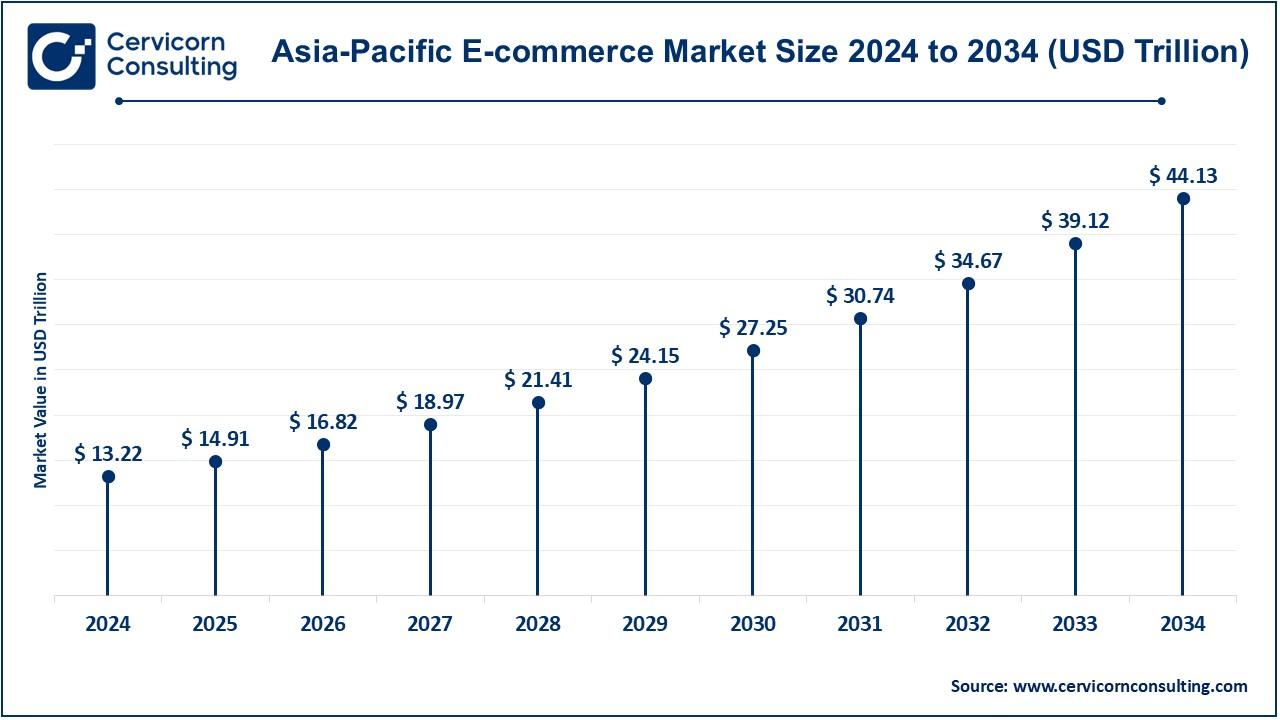

The Asia Pacific e-commerce market size was reached at USD 13.22 trillion in 2024 and is anticipated to surpass around USD 44.13 trillion by 2034. Asia-Pacific (APAC) is the largest and fastest-growing region, accounting for 45.2% of the global market share in 2024. This dominance is fueled by leading economies such as China, India, Japan, and South Korea, where increasing internet penetration, smartphone adoption, and digital payment solutions have accelerated online shopping. China alone contributes over 50% of APAC’s e-commerce revenue, led by giants like Alibaba, JD.com, and Pinduoduo. India’s e-commerce sector is witnessing exponential growth due to rising disposable income, government-backed digitalization initiatives, and expanding logistics networks. Innovations in AI, AR-powered shopping, live-stream commerce, and social commerce are further driving market expansion.

The North America e-commerce market size was estimated at USD 8.13 trillion in 2024 and is forecasted to grow around USD 27.14 trillion by 2034. North America holds 27.8% of the market share in 2024, with the U.S. being the dominant player. The region’s market strength is backed by well-established platforms like Amazon, Walmart, and eBay, along with a rise in direct-to-consumer (DTC) brands. The demand for personalized shopping, fast delivery, AI-driven recommendations, and subscription-based services has accelerated growth. The adoption of Buy Now, Pay Later (BNPL) services, voice commerce, and AI-powered chatbots is further shaping the future of North America’s e-commerce market. Despite being a mature market, technological advancements and increasing consumer spending on online grocery, fashion, and electronics ensure sustained expansion.

The Europe e-commerce market size was accounted for USD 5.44 trillion in 2024 and is projected to hit around USD 18.16 trillion by 2034. Europe represents a significant 18.6% of the global market share in 2024, with leading contributors such as the UK, Germany, France, and Italy. The region benefits from high internet penetration, a strong logistics network, and well-regulated digital commerce policies. European consumers are increasingly favoring sustainable shopping, ethical consumerism, and cross-border e-commerce, contributing to steady growth. The rise of mobile commerce (m-commerce), AI-driven shopping experiences, and AR/VR integration in online retail is further boosting the industry. Stringent data protection regulations like GDPR have enhanced consumer trust in online transactions.

The LAMEA e-commerce market was valued at USD 2.46 trillion in 2024 and is anticipated to reach around USD 8.20 trillion by 2034. LAMEA holds 8.4% of the global market share in 2024, with promising growth opportunities in Latin America, the Middle East, and Africa. While the market share is relatively smaller compared to APAC and North America, countries like Brazil, Mexico, UAE, and Saudi Arabia are experiencing rapid digital transformation. Latin America is seeing increased mobile commerce adoption, with fintech innovations and digital wallets driving e-commerce penetration. The Middle East’s e-commerce sector is expanding due to high smartphone usage, government-led digital initiatives, and the growing demand for cross-border online shopping. In Africa, the rise of local e-commerce platforms such as Jumia and expanding internet access are boosting online retail.

The global e-commerce industry is highly competitive, with key players leveraging advanced technologies, extensive supply chain networks, and customer-centric strategies to maintain their dominance. Companies like Amazon, Alibaba, and JD.com lead the market with vast product offerings, efficient logistics, and AI-driven personalized shopping experiences. Walmart and eBay continue to expand their digital presence through acquisitions and marketplace enhancements, while Shopify empowers small and medium-sized businesses with innovative e-commerce solutions.

Emerging players like Shopee, MercadoLibre, and Flipkart are rapidly expanding in Southeast Asia and Latin America, tapping into rising digital adoption and mobile commerce trends. Companies are increasingly focusing on omnichannel strategies, AI-driven recommendations, and same-day delivery to enhance customer engagement. Additionally, sustainability initiatives, such as eco-friendly packaging and carbon-neutral operations, are becoming crucial in brand positioning. As competition intensifies, strategic partnerships, acquisitions, and technological innovations will play a key role in shaping the future of the e-commerce market.

Market Segmentation

By Model Type

By Application

By Region