Energy Recovery Ventilator Core Market Size and Growth 2025 to 2034

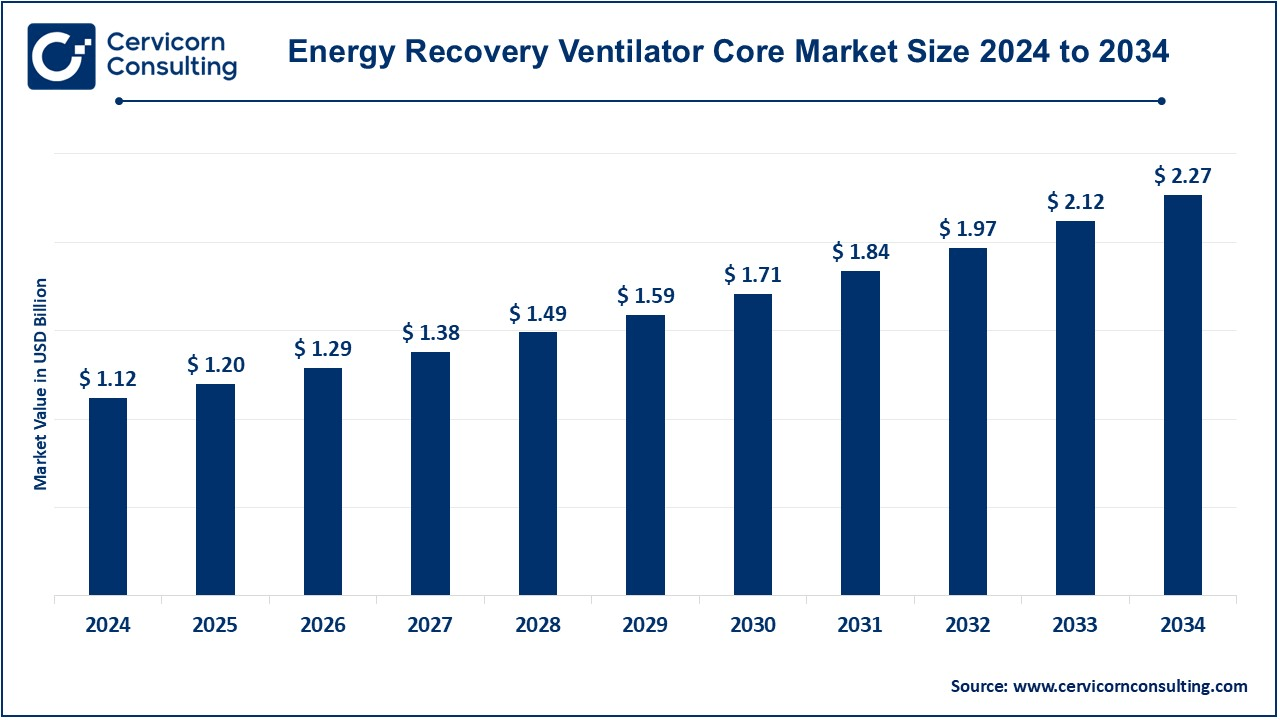

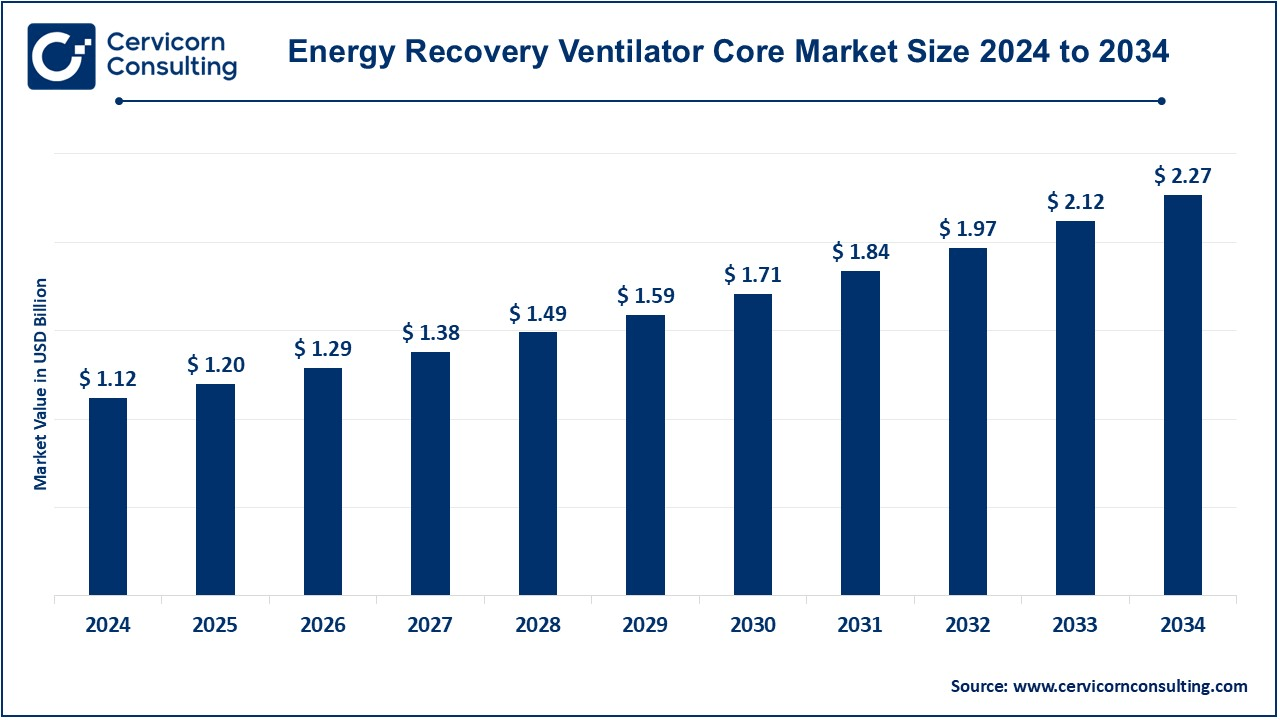

The global energy recovery ventilator core market size was valued at USD 1.12 billion in 2024 and is expected to hit around USD 2.27 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.32% over the forecast period 2025 to 2034. The energy recovery ventilator core market is expected to grow owing to rising focus on the indoor air quality along with its resistance towards various unwanted substances.

The energy recovery ventilator core market is likely to witness considerable growth owing to increased demand for energy-efficient and environmentally friendly HVAC systems within the residential, commercial, and industrial sectors. The ERV core is very important for improving indoor air quality by exchanging heat and moisture between incoming and outgoing air streams, thereby reducing energy consumption while maintaining comfort. There are very strict energy regulations, an increase in environmental awareness, and improvements in ERV core materials and technologies, especially high-performance polymers and enthalpy wheels. Major Players are indulging in innovative designing and strategic partnerships aimed at varied applications, including health care, data centers, and green buildings. The ERV core market will continue to grow owing to the increase in urbanization and construction activities across the world, especially in emerging economies.

Energy Recovery Ventilator Core Market Report Highlights

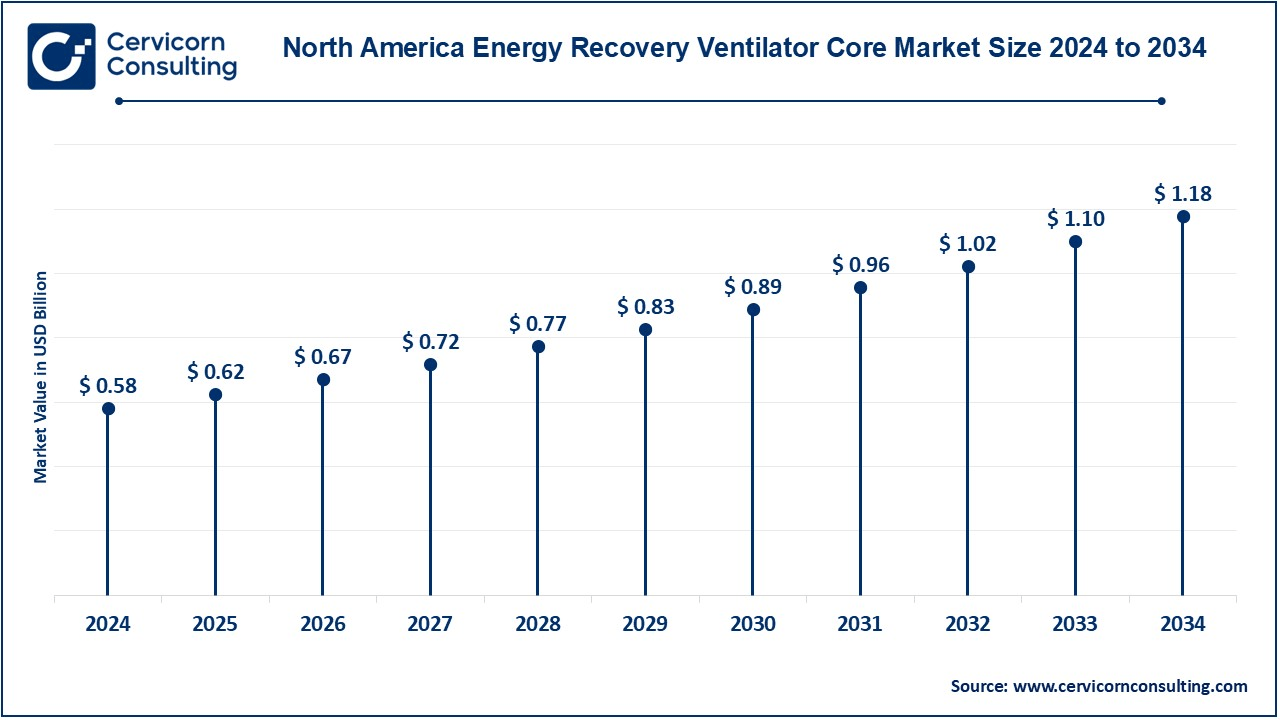

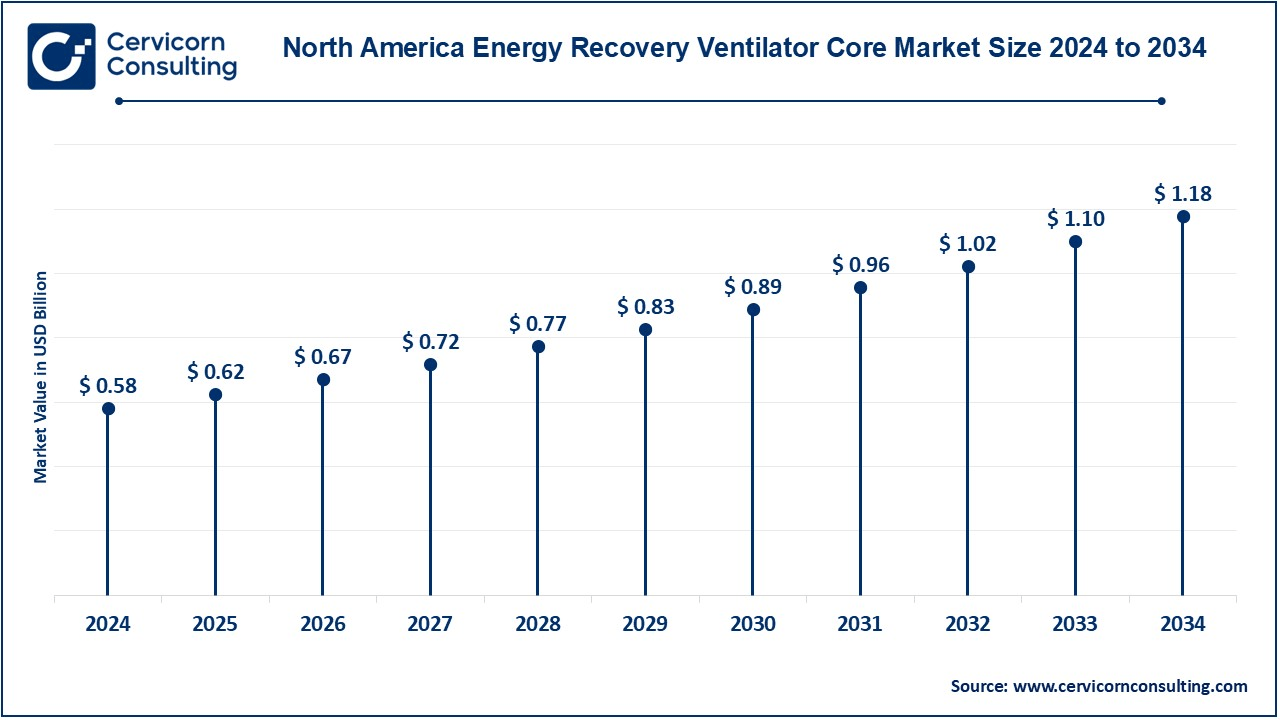

- The U.S. energy recovery ventilator core market size was estimated at USD 0.41 billion in 2024 and is expected to hit around USD 0.83 billion by 2034.

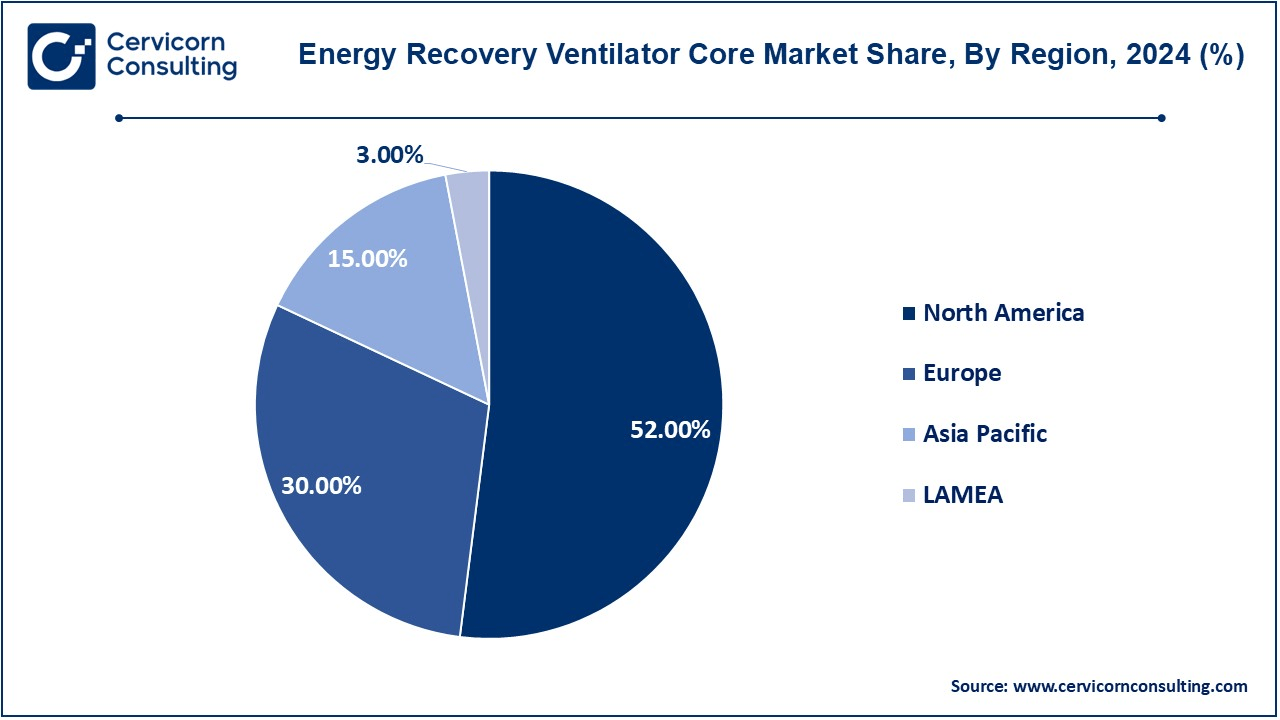

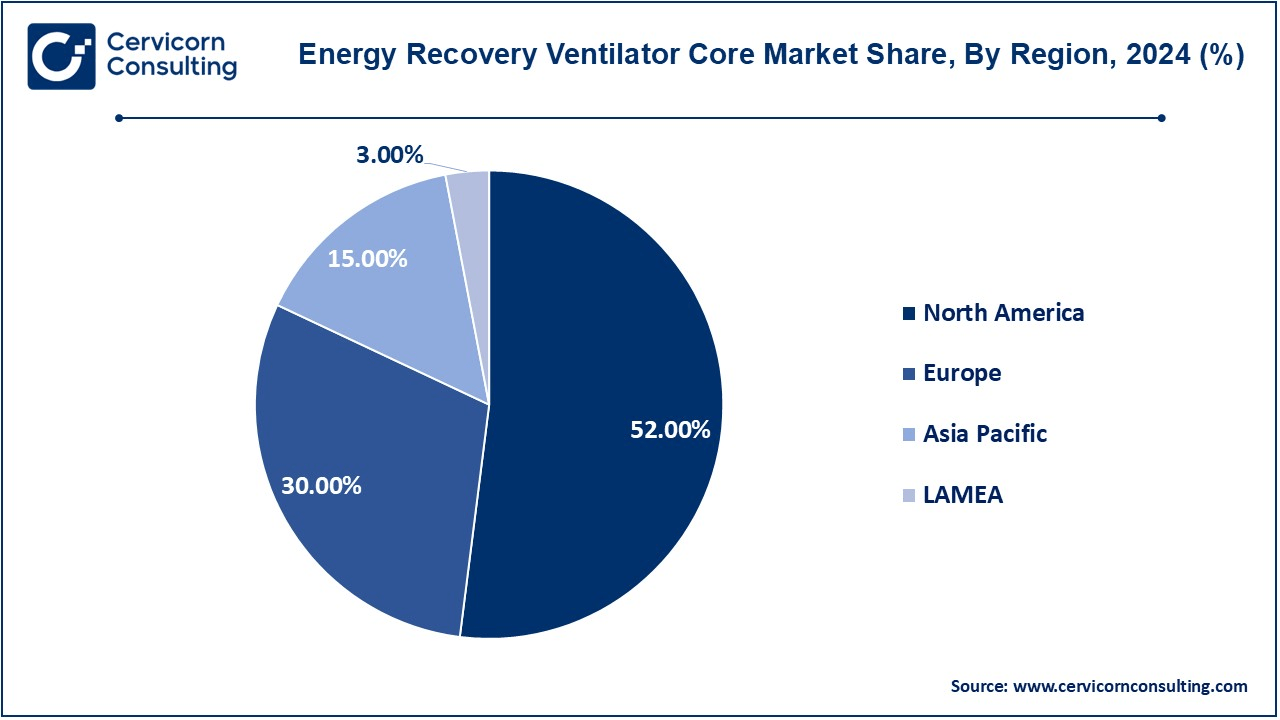

- The North America is leading the ERV core market, accounted revenue share of 52% in 2024.

- Europe has held second position and generated revenue share of 30% in 2024.

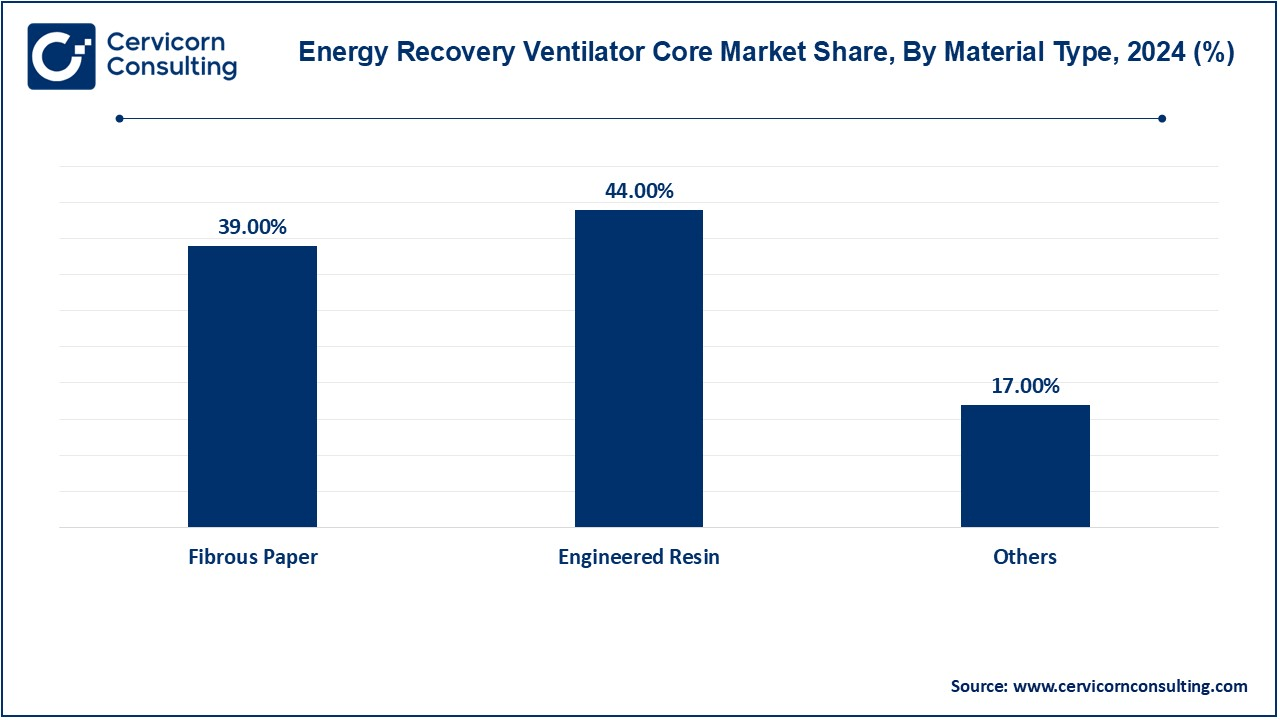

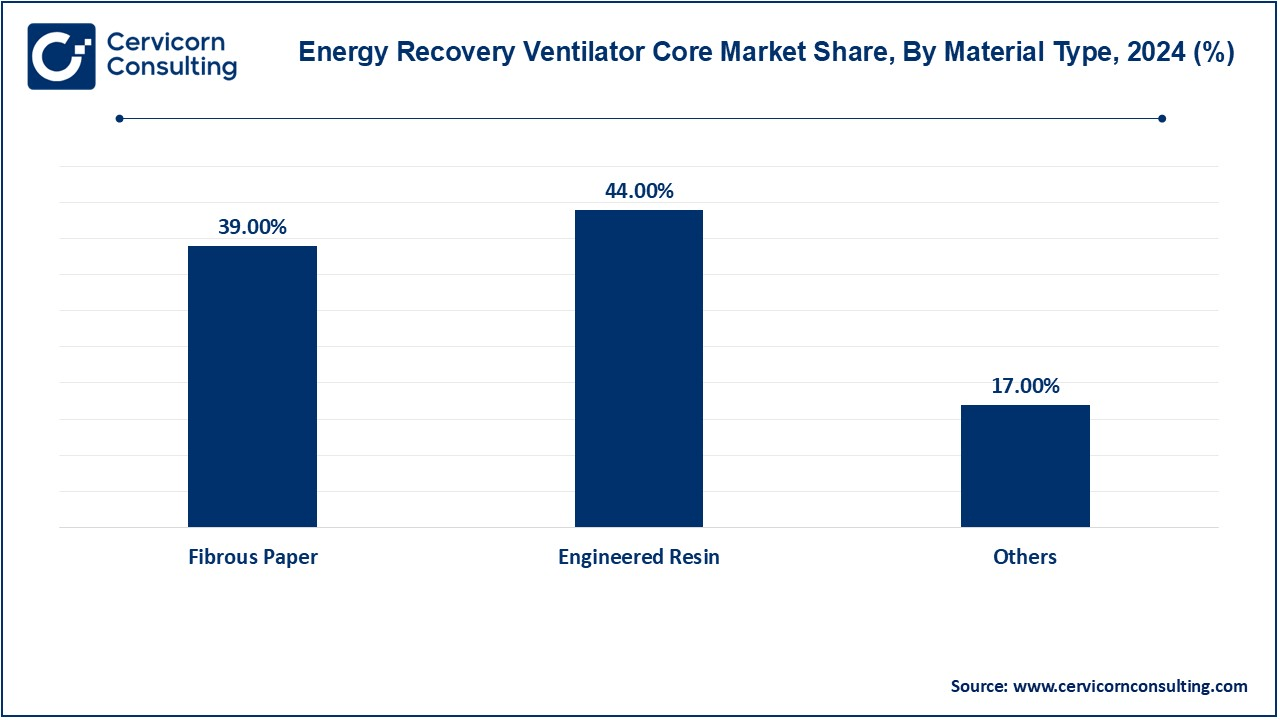

- By material type, the fibrous paper segment has dominated the market with revenue share of 39% in 2024.

- By application, the commercial segment has held revenue share of 51% in 2024.

Energy Recovery Ventilator Core Market Growth Factors

- Energy Efficiency Goals: The fact that energy prices are rising and sustainability is a global problem makes it more pressing to design HVAC systems with high energy efficiencies. In ERV cores, who are those that are now able to deliver, by virtue of their ability, the economies of scale of their use of ventilation energy. Accordingly, the energy of the heating/cooling phase can be considerably reduced by using the generated heat and moisture of the exhaust air and applying it to the supply air. This degree of efficiency is a topic of interest to energy saving initiatives worldwide, in domestic, commercial and industrial sectors, that are looking to reduce their utility bills and their environmental impact.

- Stringent Energy Regulations: To facilitate climate and sustainability, energetic efficiencies (EE) rules are being rolled out across the world to control use. Energy recovery systems intended for ventilation are implicitly, or explicitly, incorporated into, e.g., building codes (e.g., LEED) or the ASHRAE standard provisions. ERV cores contribute to compliance with these codes by enhancing energy performance requirements. Implementation of such processors is a guarantee for continuous conformity that will avoid fines and penalties for the manufacturer and will allow access to benefits and qualifications that open the way for market competitiveness.

- Increasing Awareness of Indoor Air Quality: Growth in health and fitness triggers more consequent discussions towards quality of indoor air (IAQ). Poor indoor air can be a precursor to several ailments, ranging from allergies to respiratory dysfunction and ultimately to sub-optimal performance at work. ERV cores minimize the above evils through proper ventilation and optimization of energy costs while ensuring constant replacement of air without heavily burdening the HVAC. Thus, heat and moisture exchange takes place between the air being expelled and that coming into the space, allowing the possibility of optimized hygrometry and reducing airborne pollutants, hence increasing the quality of indoor air. ERV cores come very handy in environments such as schools, hospitals, residential buildings, etc., wherein air quality becomes exceedingly relevant to one's health and comfort.

- Urbanization and Construction Growth: Due to the fast urbanisation and infrastructure construction, especially in developing economy, novel higher level HVAC technology is required. Modern energy codes and the requirements for sustainability demand efficient climate control systems for newbuild residential, commercial, and industrial buildings. BER cores are a relatively inexpensive means of integrating energy efficiency into new building designs. Furthermore, the engineering of ERV systems in the refurbished old building plays a role not only in enhancing the energy performance of the old building, but also ERV systems are an integral part of the sustainable urban development. As the number of developing urbanized cities and new plans increases, the main market of MRV has the expansion possibility that is related to urban energy demand for ventilation application technology.

- Rising Demand for Green Buildings: Along with the move toward sustainable building on a global level, there has been great need for green structures. The collection of buildings are designed for the energy efficiency, carbon emission reduction and, finally, occupant comfort. ERV cores are part of those components that in the stage of green building design, whose energy efficiency and air quality can be improved. By allowing for an increase in the compactness of the required heating and/or cooling plants to be used by the building itself, ERV cores also enable a building to gain the ability to achieve ratings, such as LEED or BREEAM, which are linked with the good looks, and therefore, the value, of the building. There is a particular relevance in parts of North America and Europe where policies and job sectors support sustainability for buildings.

Energy Recovery Ventilator Core Market Trends

- Technological Advancements: Recent developments have enabled improved efficiency, stability, and versatility of ERV core materials and designs. Innovations based on high-performance enthalpy wheels and complex polymer cores enable more efficient heat and moisture transfer with corrosion and wear resistance. As these advances take us, ERV cores are better suited toward a variety of environments and uses, especially with extreme temperatures or high humidity environments. Furthermore, with current manufacturing methods, the production cost decreases, and complex ERV systems become less expensive to produce. With the convergence of these technologies the deployment of ERV cores has become widespread across various markets, driving market growth by removing performance and cost limitations.

- Economic Incentives: Government policies promoting energy efficiency often include financial incentives like tax credits, rebates, and grants for installing advanced HVAC systems. As the incentives for using these tools are greater than the initial set back of needing to have an ERV system, they have an increasing attraction. Generally, utility companies extend incentivized rebate programs for purchasing and installing EES products for promoting core installations of ERV. Return on Investment (ROI) on the cost incentive of deploying these technologies, and long-term energy efficiency, stimulates the property owner to adopt ERV technologies. Although building energy efficiency policy remains center stage of governmental agenda, among policy tools, incentives used to be best at shaping market demand.

- Climate Change Initiatives: The efforts to fight climate change through international cooperation require energy savings and reduction of emissions’. ERV cores help to advance these goals by promoting the efficiency of HVAC systems, one of the major sources of energy consumption of buildings. Countries aiming for net-zero-energy [and ultimately carbon-neutrality] policies view ERV systems as a key component of sustainable infrastructure. Organizations and persons are, in fact, determined to adopt technology that allows achievement of these objectives and ERV cores offer a practical solution to achieve lower consumption of energy whilst maintaining comfort. This alignment with climate action plans drives market expansion opportunity.

- Residential Market Growth: The residential building sector is increasingly adopting energy-efficient HVAC systems to reduce cost and improve indoor environment. Rising energy expenses and environmentalism have prompted home owners to attempt to implement solutions, like ERV cores, that enhance the efficacy of heating/cooling systems. Present day houses are typically constructed in such a way as to have improved insulation and consequently limit its own ventilation. ERV cores alleviate this problem by ensuring fresh air exchange without superfluous energy transfer. [This pattern] is especially evident in the industrialized world where sustainability is becoming increasingly attractive to the consumer, and in the developing world where energy-saving devices are being increasingly accessible.

- Commercial Sector Expansion: The commercial sector (office, medical, and school buildings) constitutes a big market for ERV cortices. These zones need proper ventilation infrastructure to ensure a liveable air conditions inside the building for the people who dwell inside and meet the extremely stringent indoor air quality regulations. As companies and organizations increase energy efficiency efforts to cut operating expenses and comply with sustainability requirements, ERV systems are becoming highly requested. It can be applied by building facilities in operation at extremely high air quality and humidity levels, with zero high energy consumption and, thus, a recommendation in the current commercial building design. Also, due to the proliferation of construction work in this field, the number of ERV cores required is increasing.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 1.20 Billion |

| Projected Market Size in 2034 |

USD 2.27 Billion |

| Expected CAGR 2025 to 2034 |

7.32% |

| Dominant Region |

North America |

| Growing Region |

Asia-Pacific |

| Key Segments |

Material Type, Shape, Flow Type, Application, Region |

| Key Companies |

Xiamen AIR-ERV Technology Co., Ltd., Ruskin, Oji Industrial Materials Management Co., Ltd., Klingenburg GmbH, Innergy Tech Inc., Hoval, HOLTOP, Greenheck Fan Corporation, Dais Corporation, CORE Energy Recovery Solutions |

Energy Recovery Ventilator Core Market Dynamics

Drivers

Energy Cost Savings

- Possibly the strongest argument for installing ERV cores is potential long-term energy cost savings. Heat and moisture return from the outgoing air to help mitigate the energy used in heating and cooling, and thus lower the utility bills. Not only does this bring energy savings for businesses and homeowners, considering time, but it also means a significant amount of cash saved to help recover that initial investment. In relatively high energy pricing areas, ERV cores are even more beneficial, making them a darling of budget-conscious homeowners who would like to have an energy-efficient upgrade.

Smart Technology Integration

- Smart technology includes IoT enabled HVAC systems. Integration is creating the pace for ERV adoption. Smart systems allow real-time monitoring and optimization of ventilation while improving energy efficiency and indoor air quality. Therefore, controlling and diagnosing ERV cores communicating with the building management system are important at houses and commercial buildings nowadays. Its unique proposition would be the ability to integrate with smart thermostat and sensor devices, so it adds value without compromising on efficiency, but rather designed according to specific user requirements. This type of technological symbiosis will catalyze the growth of the market for the next generation of consumers and enterprises wanting innovation.

Restraints

High Initial Cost

- One of the major hindrances in the large-scale acceptance of energy recovery ventilator (ERV) cores is the cost, which is high as compared with old ventilation systems. The use of advanced materials and technologies in the manufacturing of ERV cores further contributes to the expense, thus making it less viable to budget-conscious consumers and small businesses. For instance, regarding residential applications, the cost differential can even dissuade the homeowner from upgrading to energy-efficient systems but taking advantage of the benefits accruing over the long run. In developing economies where cost sensitivity is raised, such restraint is only better magnified. In addition to subsidies, incentives, or drastic cuts in producer costs, it remains one of the high initial investments as barriers to market growth.

Complex Installations Requirements

- Not-or-very-expensive ERV cores require some specialized or expert skills to allow the correct installation and integration primed in place to specific HVAC lots, which also contributes to higher labor costs and longer installations. These features discourage any potential buyers. In addition, retrofitting older buildings with ERV cores can pose challenges due to spatial constraints, not having a room for major supplementary equipment, and issues integrating these systems with existing fixed systems. Even if the installation is not reticent operation wise, improper installations affect the system in performance terms such as inefficiency and additional maintenance problems, thereby taking away value in general from these systems. These technical and logistical barriers act as huge deterrents in adopting it, especially in countries where such highly skilled professionals are less accessible or in projects with very tight budgets.

Opportunities

Sustainable Construction Trends

- Sustainable building trends are becoming an emerging trend in the growth of the energy recovery ventilator (ERV) core market. Due to the penetration of green building regulations and energy efficiency standards, their use has made it a necessity for building users to have good ventilation systems that will be able to reduce the level of energy consumption while improving the quality of indoor air since these initiatives have become more tight. ERV core is one such technology that helps the building to recover heat and moisture from the exhaust air, and this in turn can reduce the need for HVAC energy. Adoption of ERV systems is growing due to the emphasis on ecofriendly building by governments and the various industries, which have already mapped these systems as a critical part of sustainable building designs and also gave a forward push to the growth in the market.

Expansion into Emerging Market

- New markets will lead to this area's energy recovery ventilator core market. Urbanization has been quite rapid in recent years. Developments in construction have kept pace, and these advancements include an increase in energy-efficient bills. This is what increasingly influences the growth of modern HVAC systems in these regions. There were such incentives for energy-efficient construction at the macro level and, one welcome trend was that governments are now introducing strict energy codes. So, the public and governments are really working towards the realization of the fact that if energy-efficiency is generated in their homes, enhanced productivity will also be through elongated working hours(protocol), lesser times taken in recovering loss energy or development, etc.

Challenges

Potential for Freezing

- The challenge with freezing has something to do with the inevitable rise in the market of integral core inductance (ERV) by energy recovery ventilators-notably in zones with cold over a lot of places. Right under extreme winter conditions, inside the very core of ERV, even the aerosol condenses into snow, reducing the efficiency, causing troubles in operation, or even sometimes destroying the entire system. To develop solutions, these challenges raise the subject of advanced frost prevention mechanisms, such as pre-heaters or bypass systems, increasing installation costs and operational expenditure. First, these issues also work as the most common barrier in achieving sales because having these systems installed under prices is, especially in cost-sensitive markets, a hard task. Hence, it is given that the product will be highly discouraged in regions that are more prone to freezing conditions.

Competition from Other Ventilation Technologies

- A competitive threat from competitive ventilation technologies, such as heat recovery ventilators (HRVs) and the significantly more advanced HVAC technology, forms a cage around the ERV core market. Essentially, while enhanced recovery of latent and sensible heat is offered with ERVs, HRVs are less complex and inexpensive alternatives in low humid regions. In addition to these, modern HVAC technologies offer integrated ventilation options, providing viable substitutes that could potentially diminish the demand for standing ERV cores. As competitors, this implies that ERV manufacturers will always look for ways to add value to their machines, hence increasing research and development costs but, unfortunately, slowing down the expansion of those markets.

Energy Recovery Ventilator Core Market Segmental Analysis

The energy recovery ventilator core market is segmented into material type, shape, flow type, application and region. Based on material type, the market is classified into stainless steel, aluminum, fibrous paper and engineered resin. Based on shape, the market is classified into wheel, hexagon, diamond and square. Based on flow type, the market is classified into crossflow and counter-flow. Based on application, the market is classified into residential, commercial and industrial.

Material Type Analysis

Engineered Resin: Engineered Resin is a popular material constituted for the ERV plant, owing to its least weight property, durability, corrosion-resistance property, and involvements. The material is expected to show an excellent thermal conductivity and moisture transfer efficiency, to increase energy recovery performances. Engineered resin is created to facilitate further complex designs that optimize airflow and heat exchange. Resistance against cleaning and many environmental extremes such as humidity and temperature variance further prolong the service life of the ERV cores.

Fibrous Paper: Fibrous paper is used mostly for the ERV cores because of its high strength to weight ratio, cost, and moisture transfer efficiency. Fibrous paper is made from specially treated cellulose or synthetic fibers, which produces very high exchange rates of humidity enthalpy to control the humidity level of the indoor space. Because of this lightweight structure, it can easily be put up in various HVAC systems. It should be noted that paper-based fibrous cores tend to be more easily worn down and degraded in harsh environments, particularly in areas of high moisture or contamination with corrosive substance.

Aluminum: Aluminum is a very commonly used material in the ERV cores along with being super lightweight and has thermal conductivity high enough to transfer heat efficiently for having optimal efficient energy recovery performance in different climates. Moreover, given that aluminum has very high corrosion resistance, it is suitable for applications in humid or difficult environments. Apart from very durable, it remains valid for long-term operations and also saves maintenance costs. However, aluminum cores are generally costly compared to the alternatives such as engineered resin or fibrous paper. However, despite a huge price tag, excellence and robustness impose aluminum as a widely opted preference for industrial and commercial applications where high-performance ventilation systems are expected to be installed.

Stainless Steel: The tensile strength, durability, and resistance to corrosion are other factors making stainless steel a top choice in ERV cores. This material is well-known for its perfect properties when it comes to installations in the most brutish environments-industrial facilities and coastal areas, places which contaminate every other material with humidity, chemicals, or other contaminants. Stainless steel has developed properties of heat transfer that can further improve energy recovery. However, the cost and weight of such a material in comparison with engineered resin or aluminum hinder its usage wherein cost and light weight are chief concerns. Nevertheless, for all the limitations, stainless steel cores are one of the finest selections for high-service-demand applications requiring long life, reliability, and top performance.

Shape Analysis

Square: The square energy recovery ventilator (ERV) cores are one of the most popular architectures because of their simplicity and ease of integration into the HVAC system. In addition to the fact that the shape enables space-efficient exchange of heat and moisture, it also maximizes existent space. Square cores are mainly applicable to modular systems. It is easy to manufacture and therefore cost-efficient. Its design assures the even patterns of airflow. Thus, square cores are ideal for both residential and commercial applications.

Diamond: Diamond shaped cores ERV have the most special benefit from the point of view of airflow optimization and compactness. The figure with an angle would have the emerging area notably improved for heat and moisture transfer, thereby increasing energy recovery efficiency. These cores apply very efficiently for space-saving requirements like HVAC compact units. It also creates superb aerodynamics due to its shape by reducing the pressure drop and improving overall system efficiency.

Hexagon: The hexagon-shaped ERV cores provide maximum surface area along with the required structural strength and compactness. The shape facilitates efficient energy recovery as it optimizes airflow paths and minimizes lift and consistent exchange of heat and moisture. Mostly used in advanced HVAC systems where performance matters and space is at a premium, hexagonal cores minimize material wastage in manufacturing processes as well as being sustainable.

Wheel: The wheel-shaped ERV cores, or rotary enthalpy wheels, have very high efficiencies in transferring heat and moisture between air streams, due to their continuous rotation, which allows energy extraction to be maximized through recovery in optimum performance in very large-scale HVAC systems. These cores are generally employed in the industrial and commercial segments for their capabilities to handle significant quantities of airflow volume, providing best energy efficiency and durability but requiring detailed maintenance in order to ensure consistent operation.

Flow Type Analysis

Counter Flow: Energy-efficient Counter Flow type ventilators are the types of ventilators which can provide maximum energy recovery or efficiency by contrary flow between two currents of air, one being for outgoing air and the other incoming air. With this, air has a long path for contact, which means better heat and moisture transfer. Such applications provide an energy performance level and lead to higher application areas like hospitals, commercial buildings, and industrial air conditioning areas. In addition, this complex design construction and costlier manufacture may be offset by the increased energy savings and the indoor air quality that would motivate good usage in high-demand air conditioning systems.

Crossflow: An ERV that employs crossflow includes incoming and outgoing streams both going in mutually perpendicular directions from each other so that the two can exchange heat and moisture efficiently. The system is relatively simple and compact-ideal for residential or light commercial applications. Besides being cheaper, crossflow cores are easy to fit into HVAC systems of any kind. They are also adequate when assessed for performance and price. They may not, however, attain the level of efficiency that counterflow yields, but they can handle energy recovery reliability for environments where mild ventilation load requirement is concerned. Construction is also analytical, thereby having low maintenance. Accordingly, they are not as good for cost-effectiveness in terms of space.

Energy Recovery Ventilator Core Market Regional Analysis

The energy recovery ventilator core market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

Why does North America accounts majority share of the energy recovery ventilator core market?

The North America energy recovery ventilator core market size was valued at USD 0.58 billion in 2024 and is expected to reach around USD 1.18 billion by 2034. The North American market is meant to meet intensive energy efficiency preservation mandates, the increasing implementation of green building techniques, and awareness of indoor air quality. Extreme weather conditions from the cold winter extremes to the sultry summers that prevail in the region increase demand for ERV core-equipped HVAC systems for optimizing energy usage. Such incentives from the government and energy-saving programs would propel the adoption of ERVs in homes and commercial establishments. The United States and Canada remain the macro markets, with active construction both on the residential and commercial fronts. Rising adoption of retrofitting projects in older buildings is expected to strengthen market growth across North America.

What factors are contributing the Europe energy recovery ventilator core market?

The Europe energy recovery ventilator core market size was estimated at USD 0.34 billion in 2024 and is projected to hit around USD 0.68 billion by 2034. The European ERV core market benefits from strict environment policies, including those of the EU, like the Energy Performance of Buildings Directive, which mandates energy-efficient implementation in construction. The overall focus across the region on sustainability and carbon neutrality is consistent with installing ERV systems in both residential and commercial applications. Among countries driving demand for ERV cores include Germany, France, and the UK, which are also leaders in green construction. Not only will energy costs attract increasing adoption of energy recovery technologies to cut costs, Europe is also characterized by cold climates and emphasis indoor air quality which make it a suitable market for these technologies especially in healthcare and educational institutions.

Why is Asia-Pacific witnessing strong growth in the energy recovery ventilator core market?

The Asia-Pacific energy recovery ventilator core market size was accounted for USD 0.17 billion in 2024 and is predicted to surpass around USD 0.34 billion by 2034. The Asia-Pacific are characterized by growth on the increased movement of people into cities, urbanization, and the increase in construction activities in various countries, including China, India, and Japan. Such an area, whose climatic situations evolve from humid tropical to cold temperate, indicates a huge need for energy-efficient HVAC systems. Governments stimulate energy conservation and the development of green building certifications as incentives for increasing the penetration of ERV systems in the commercial and residential sectors. Rising disposable incomes with higher sensitive indoor air quality perceptions in individuals also push the growth of the market. The development in infrastructure not only but also defines Asia-Pacific as a growing ERV core market with some advanced HVAC technologies.

LAMEA growing expansion in the energy recovery ventilator core market

The growing expansion of the market in LAMEA, such as those in Latin America, the Middle East, and Africa, is supported by increased infrastructure developments in the regions and a progressive trend toward the application of energy-efficient technologies. Extreme temperature and humidity conditions in the Middle East stimulate the market for HVAC systems, hence creating a demand for ERV cores for energy conservation. Investments in high-rise buildings, mostly in cities within Latin America, could create demand for the market. In this region, the awareness about conserving energy is increasing, hence the investments in modern infrastructures. The initial costs are high for most individuals, and most are not well versed in the use of these systems; hence, these become the challenges. Despite these challenges, the slow adoption of the market has been triggered by various government initiatives and increased energy concerns.

Energy Recovery Ventilator Core Market Top Companies

Recent Developments

- In 2022, With four different models and an array of options and accessories, Greenheck Fan Corporation introduced a new energy recovery ventilator for multi-family residential buildings. Every one of the newly presented models has certified airflow from the Home Ventilating Institute (HVI).

- In 2021, i4 Energy Recovery Wheel, patented sealing technology and released by Innergy Tech, Inc., is an air recovery wheel core suitable for inclusion in new air handling units, as well as retrofitting into existing systems.

Market Segmentation

By Material Type

- Stainless Steel

- Aluminum

- Fibrous Paper

- Engineered Resin

By Shape

- Wheel

- Hexagon

- Diamond

- Square

By Flow Type

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- APAC

- Europe

- LAMEA

...

...