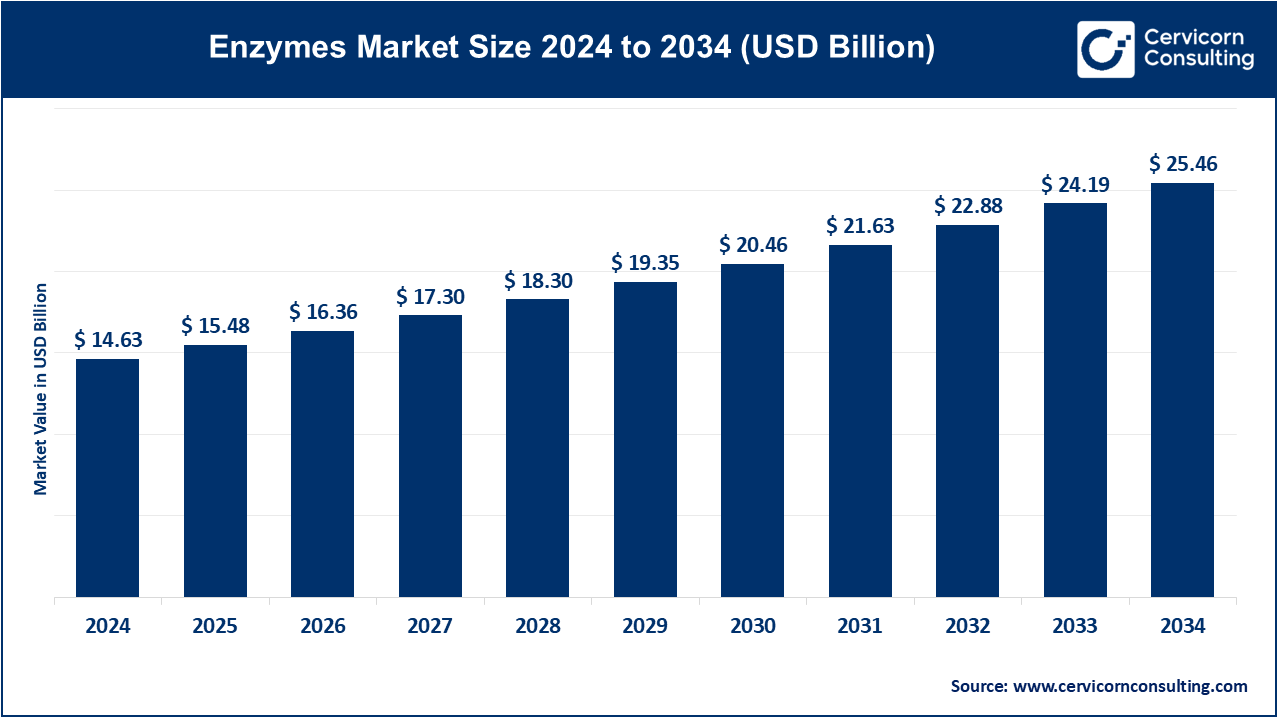

The global enzymes market size was accounted at USD 14.63 billion in 2024 and is expected to reach around USD 25.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.69% from 2025 to 2034.

The global enzymes market is expanding rapidly due to its increasing use in diverse industries like food and beverages, pharmaceuticals, biofuels, and detergents. With a shift towards sustainable and eco-friendly solutions, enzymes are replacing harsh chemicals in various applications. In the food industry, enzymes are widely used to improve texture, flavor, and shelf life, while in the detergent sector, they enhance cleaning efficiency at lower temperatures. The pharmaceutical industry benefits from enzymes in drug manufacturing and personalized treatments, highlighting their versatility. Regionally, North America and Europe dominate the enzymes market due to well-established industries and advancements in biotechnology. However, Asia-Pacific is emerging as a key player, driven by industrial growth and rising demand for processed foods and bio-based products. In 2023, China, Denmark, and Germany collectively accounted for 74% of global industrial enzyme exports, with China leading at 45%.

Enzymes are natural proteins that act as catalysts in living organisms, speeding up chemical reactions necessary for life. Found in every cell, enzymes help in processes like digestion, energy production, and cell repair. Each enzyme is specific to a particular reaction, meaning it works only on a specific molecule, called a substrate. For example, digestive enzymes like amylase break down starch into sugar, while proteases help digest proteins. Enzymes operate under specific conditions like optimal temperature and pH to function effectively. They are biodegradable, efficient, and eco-friendly, making them crucial not just for biological processes but also in various industries.

Personalized Nutrition: The rise of personalized nutrition is influencing the enzymes market as consumers seek customized dietary supplements and functional foods tailored to individual health needs, leading to increased demand for specific enzyme formulations.

Technological Advancements in Enzyme Production: Continuous advancements in enzyme production technologies, such as synthetic biology and advanced fermentation processes, are enhancing enzyme efficiency and lowering production costs, supporting market growth.

Expansion in Emerging Markets: Growing industrialization and economic development in emerging markets, such as Asia-Pacific and Latin America, present significant opportunities for the enzymes market as these regions increasingly adopt enzyme-based solutions across various sectors.

Development of Novel Enzyme Applications: Exploring novel applications of enzymes in emerging fields like bioengineering, environmental remediation, and new product development offers growth opportunities for market players looking to innovate and diversify their product offerings.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 15.48 Billion |

| Market Size by 2034 | USD 25.46 Billion |

| Market Growth Rate | CAGR of 5.69% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Source, Reaction Type, Product, Application and Regions |

Regulatory Support for Biocatalysts:

Increased Demand for Biofuels:

High Production Costs:

Limited Enzyme Stability:

Growing Demand for Enzyme-based Green Chemistry:

Advancements in Enzyme Engineering:

Complexity in Enzyme Formulation:

Competition from Synthetic Alternatives:

Microorganisms: The microorganisms segment has reported highest market share of 84.8% in 2024. Enzymes derived from microorganisms such as bacteria, yeast, and fungi. These enzymes are widely used due to their high efficiency and adaptability in various industrial processes. Microbial enzymes dominate the market due to their cost-effectiveness and stability. They are increasingly used in sectors like biofuels and detergents. Ongoing research aims to enhance enzyme stability and functionality to meet diverse industrial needs.

Plants: Plants segment has registered market share of 5.4% in 2024. Enzymes sourced from plant tissues, such as papain from papaya and bromelain from pineapple. These enzymes are known for their natural origins and specific applications. Plant-based enzymes are gaining popularity for their natural and eco-friendly attributes. They are increasingly used in food processing, pharmaceuticals, and cosmetics. Innovations focus on improving enzyme extraction and efficacy, catering to growing consumer demand for sustainable products.

Animals: The animals segment has calculated market share of 9.8% in 2024. Enzymes extracted from animal sources, such as pancreatic enzymes from bovine or porcine sources. They are used in applications like digestive aids and certain pharmaceuticals. Animal-derived enzymes are essential in specialized applications but face competition from microbial and plant-based alternatives.

Hydrolase: The hydrolases segment has recorded highest market share of 62% in 2024. Hydrolases are enzymes that catalyze the hydrolysis of chemical bonds, breaking down molecules by adding water. They play a crucial role in various biological processes, including digestion and metabolism. The demand for hydrolases is growing due to their applications in the food and beverage industry for improving product quality and shelf life.

Oxidoreductase: The oxidoreductase segment has recorded market share of 17% in 2024. Oxidoreductases facilitate oxidation-reduction reactions, transferring electrons between molecules. They are essential in cellular respiration and various biochemical pathways. The use of oxidoreductases is expanding in pharmaceuticals for drug synthesis and in environmental applications for bioremediation.

Transferase: The transferase segment has recorded market share of 11% in 2024. Transferases transfer functional groups from one molecule to another. They are crucial in biochemical reactions, including those involved in metabolism and biosynthesis. Transferases are increasingly utilized in the agricultural sector for developing enhanced crop protection products and in the pharmaceutical industry for drug development.

Lyase: Lyase segment has recorded market share of 7% in 2024. Lyases break chemical bonds by means other than hydrolysis or oxidation, often forming new double bonds or rings. They are involved in various metabolic pathways. The demand for lyases is rising in the food industry for processing and flavor enhancement. Their applications in biotechnology and environmental sciences, such as waste treatment and synthesis of bioactive compounds, are driving market expansion.

Others: The others segment has recorded a small market share of 3% in 2024. This category includes various enzymes that do not fit into the above classifications, such as isomerases and ligases, which play specific roles in biochemical transformations. Enzymes in the "Others" category are increasingly being explored for niche applications in industrial processes, diagnostics, and research.

Lipase: The lipases segment has reported market share of 5% in 2024. Lipases are enzymes that catalyze the breakdown of fats and lipids into fatty acids and glycerol. They play a crucial role in digestion, industrial processes, and biofuel production. The increasing demand for biofuels and high-fat food products drives growth in this segment.

Polymerase and Nuclease: The polymerases and nucleases segment has reported market share of 9% in 2024. Polymerases and nucleases are enzymes involved in DNA replication, transcription, and degradation. Polymerases facilitate DNA synthesis, while nucleases cleave nucleic acids. Their applications in genetic engineering, diagnostics, and research fuel market growth.

Protease: Protease segment has reported market share of 25% in 2024. Proteases break down proteins into peptides and amino acids, essential for digestion and various industrial processes like leather treatment and detergent production. The growing demand for protein-rich foods and advancements in industrial applications drive market expansion.

Carbohydrase: The carbohydrase segment has reported highest market share of 46% in 2024. Carbohydrases are enzymes that break down carbohydrates into simpler sugars. They are vital in baking, brewing, and biofuel production. The demand for low-sugar and gluten-free products, along with advancements in enzyme technology, is driving growth.

Others: The other segment has reported market share of 15% in 2024. The "Others" category includes various enzymes like cellulases and pectinases used in diverse applications such as textile processing, waste management, and agriculture. The expanding range of applications and technological advancements contribute to growth in this segment. As industries seek more efficient and eco-friendly solutions, innovations in enzyme formulations and applications are enhancing their market potential.

Food and Beverages: Enzymes in this segment are used to enhance the processing and quality of food and beverages, such as baking, brewing, and dairy. They help in breaking down ingredients, improving texture, flavor, and shelf life. Increasing demand for clean-label products, personalized nutrition, and advancements in enzyme technologies drive growth.

Household Care: Enzymes in household care products aid in stain removal and cleaning by breaking down organic stains, fats, and proteins. They are commonly used in laundry detergents, dishwashing liquids, and surface cleaners. Growing consumer awareness of eco-friendly and biodegradable cleaning products is boosting enzyme usage.

Bioenergy: Enzymes used in bioenergy applications facilitate the production of biofuels like bioethanol and biodiesel by breaking down biomass and converting it into usable energy forms. Increasing focus on renewable energy sources and sustainable fuel alternatives is fueling demand.

Pharmaceutical and Biotechnology: Enzymes in pharmaceuticals and biotechnology are employed in drug manufacturing, diagnostics, and therapeutic applications. They play roles in synthesis, analysis, and biotransformation’s. Growing investments in biotechnology research, advancements in personalized medicine, and the increasing prevalence of chronic diseases are boosting enzyme demand.

Feed: Enzymes used in animal feed improve nutrient digestibility and feed efficiency, enhancing livestock growth and health. They help break down complex feed ingredients, making nutrients more accessible. Rising demand for high-quality animal products, coupled with concerns about feed efficiency and sustainability, is driving the use of enzymes in animal feed.

Others: This segment includes applications in textiles, leather, paper, and other industries where enzymes assist in processing and product enhancement. Enzymes are used for functions like bio-polishing, leather tanning, and paper deinking. Technological advancements and the drive for sustainable and environmentally friendly processes are leading to increased enzyme use in diverse industrial applications.

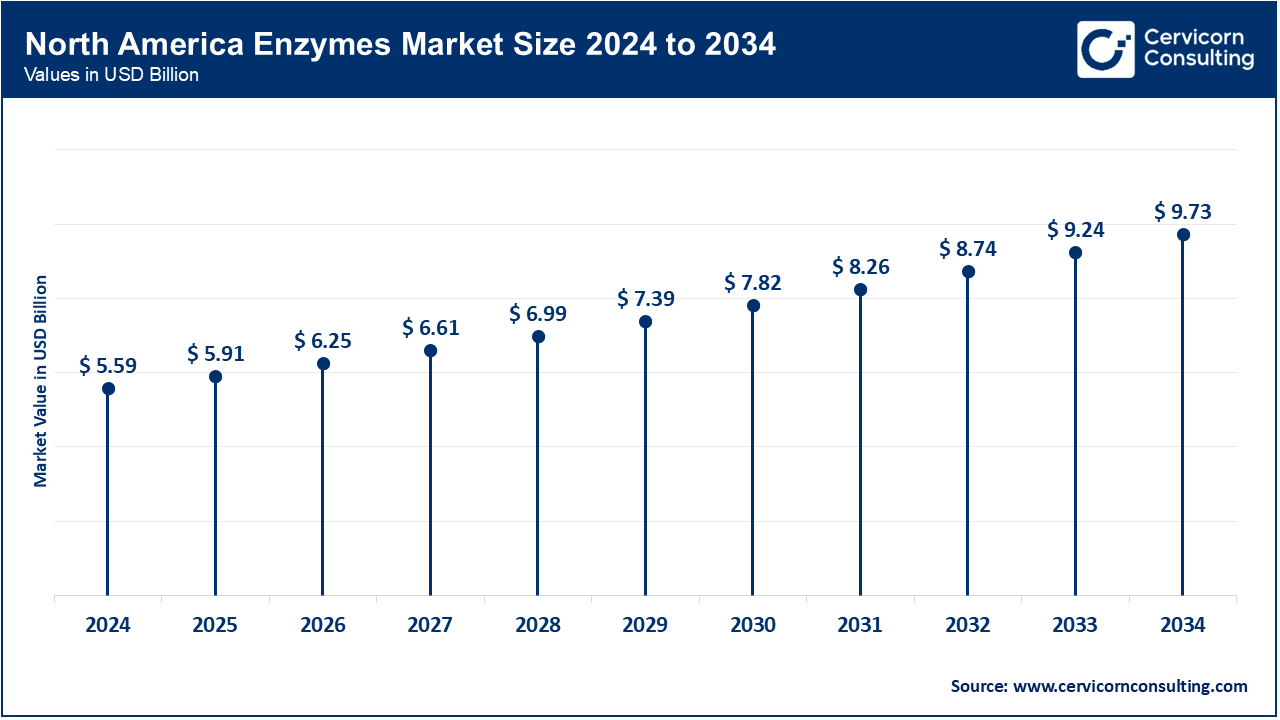

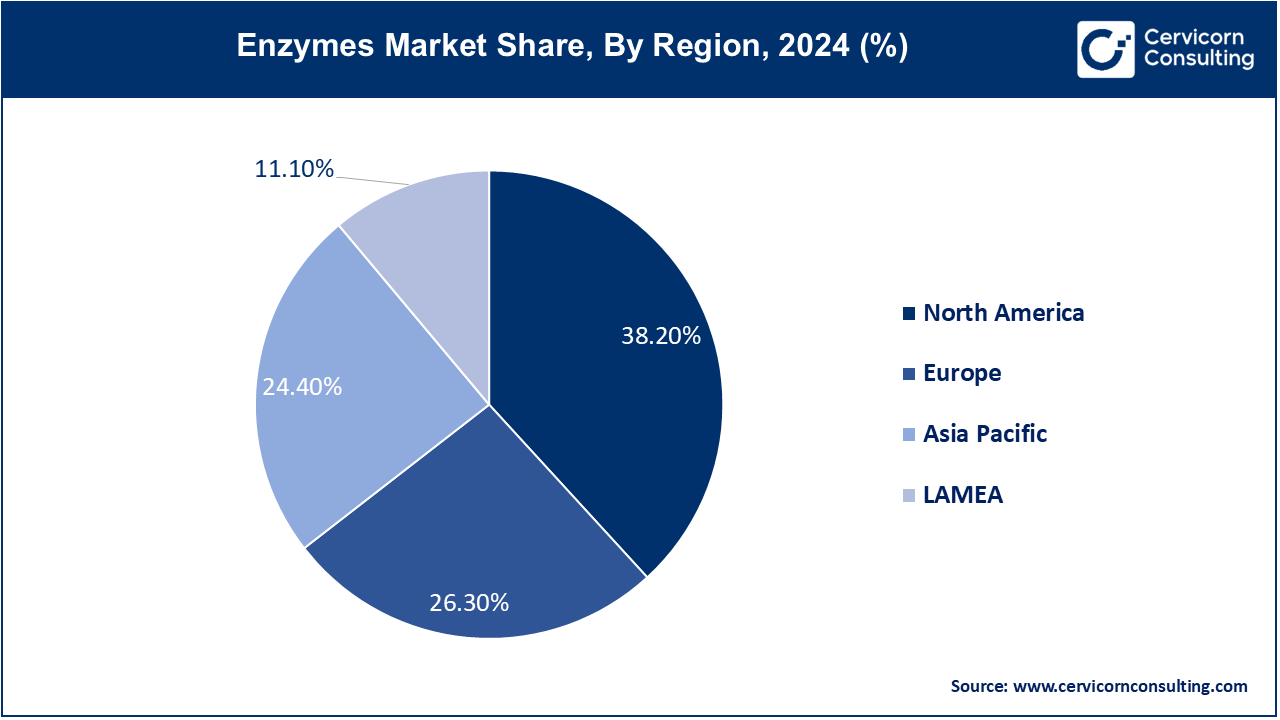

North America leads in enzyme market growth due to advanced technology and high demand across various industries like food and beverages, pharmaceuticals, and bioenergy. North America market size is expected to reach around USD 9.73 billion by 2034 increasing from USD 5.59 billion in 2024 with a CAGR of 5.7%. The focus on sustainable solutions, clean-label products, and advancements in biotechnology is driving innovation and market expansion. Additionally, regulatory support for renewable energy and eco-friendly products boosts enzyme applications. U.S market size is estimated to reach around USD 7.78 billion by 2034 increasing from USD 4.47 billion in 2024 with a CAGR of 25.4%.

Asia-Pacific is experiencing rapid growth in the enzyme market due to increasing industrialization, a burgeoning population, and rising consumer demand for processed foods. Asia Pacific market size is calculated at USD 3.57 billion in 2024 and is projected to grow around USD 6.21 billion by 2034 with a CAGR of 7.2%. The region is also seeing significant advancements in biotechnology and agricultural practices, boosting enzyme applications in food processing, feed, and bioenergy. Expanding economic development and improving infrastructure further drive enzyme demand.

Europe market size is measured at USD 3.85 billion in 2024 and is expected to grow around USD 6.7 billion by 2034 with a CAGR of 6.30%. Europe's enzyme market is influenced by stringent regulations on environmental impact and sustainability. The region emphasizes bio-based and green technologies, with significant investments in research and development. The growing demand for organic and natural products, coupled with a strong focus on reducing carbon footprints, propels market growth. Additionally, Europe's aging population drives the demand for enzyme-based pharmaceuticals.

LAMEA market size is forecasted to reach around USD 2.83 billion by 2034 from USD 1.62 billion in 2024 with a CAGR of 7.2%. In LAMEA (Latin America, Middle East, and Africa), the enzyme market growth is driven by increasing agricultural activities, demand for improved crop yields, and a rising focus on sustainable agricultural practices. The region is also seeing growth in food and beverage sectors due to changing consumer preferences and economic development. Additionally, investments in renewable energy projects and advancements in biotechnology are contributing to market expansion.

New players like Enzyme Development Corporation and Bio-Cat, Inc. are driving innovation with specialized enzyme solutions for niche applications, such as custom enzyme blends and novel bio-catalysts. Novozymes A/S and DuPont de Nemours, Inc. dominate the market through extensive R&D investments, broad enzyme portfolios, and strategic partnerships. Novozymes leads in bioenergy and agriculture enzymes, while DuPont excels in food and beverages and pharmaceutical applications. Their advanced technologies and strong market presence solidify their leadership in the competitive enzymes sector.

Market Segmentation

By Type

By Source

By Reaction Type

By Product

By Application

By Regions