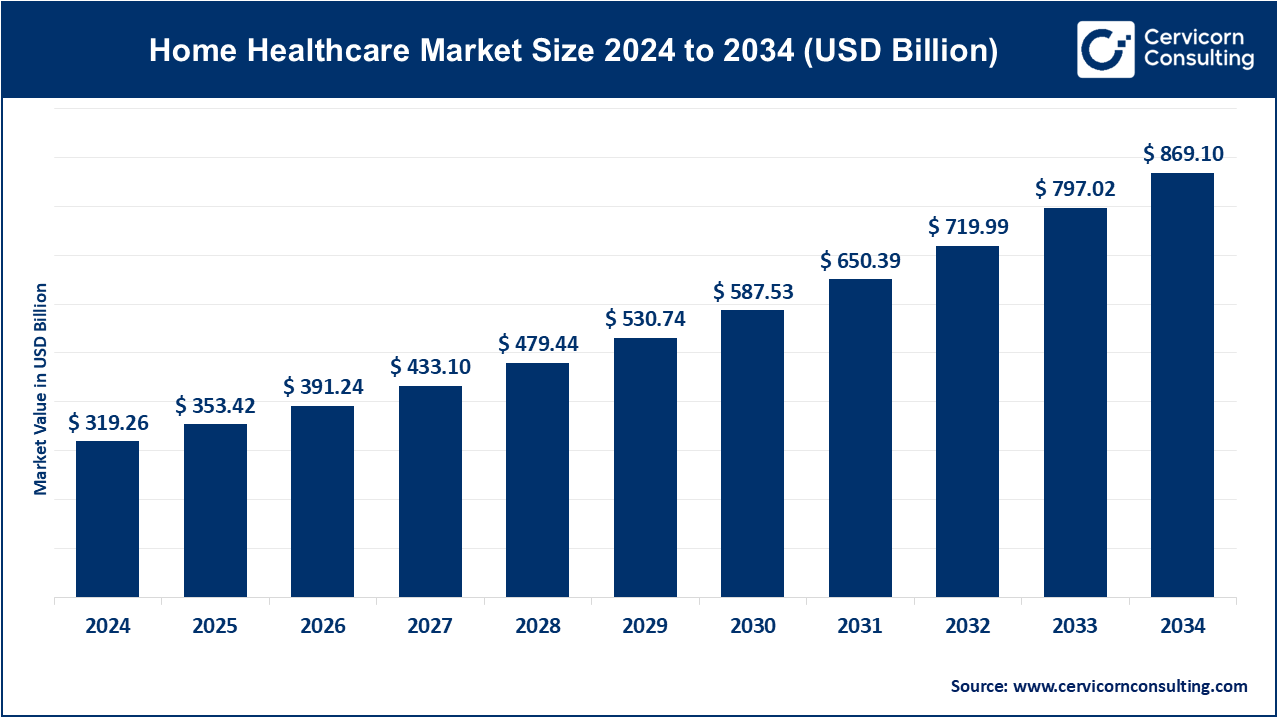

The global home healthcare market size was accounted at USD 319.26 billion in 2024 and is anticipated to reach around USD 869.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.7% from 2025 to 2034.

The home healthcare market has witnessed substantial growth due to several key factors. One of the main drivers is the aging population, with an increasing number of elderly individuals preferring to receive care in the comfort of their homes. This demographic shift is expected to lead to greater demand for home healthcare services, as older adults often require assistance with daily living activities and management of chronic conditions. In addition, advancements in medical technology, such as remote monitoring tools and telehealth services, have made it easier for healthcare providers to offer quality care at home, further expanding the reach of home healthcare services. The market is also influenced by the rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and respiratory disorders, which often require ongoing management and monitoring. Home healthcare services are seen as a cost-effective alternative to hospital stays and nursing homes, reducing hospital readmission rates and promoting better patient outcomes.

Home healthcare refers to a range of medical services provided at a patient’s home, rather than in a hospital or clinic setting. These services can include nursing care, physical therapy, personal care assistance, and the management of chronic conditions. Home healthcare is beneficial for individuals who need ongoing care but prefer to remain in the comfort of their own home. The main types of home healthcare services include skilled nursing care, home health aide services, physical, occupational, and speech therapy, hospice care, and medical social services. These services are typically provided by professional caregivers or medical personnel, such as nurses, therapists, and home health aides, with the aim of improving the patient's health and quality of life.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 353.42 Billion |

| Market Growth Rate | CAGR of 10.7% from 2025 to 2034 |

| Market Size by 2034 | USD 869.10 Billion |

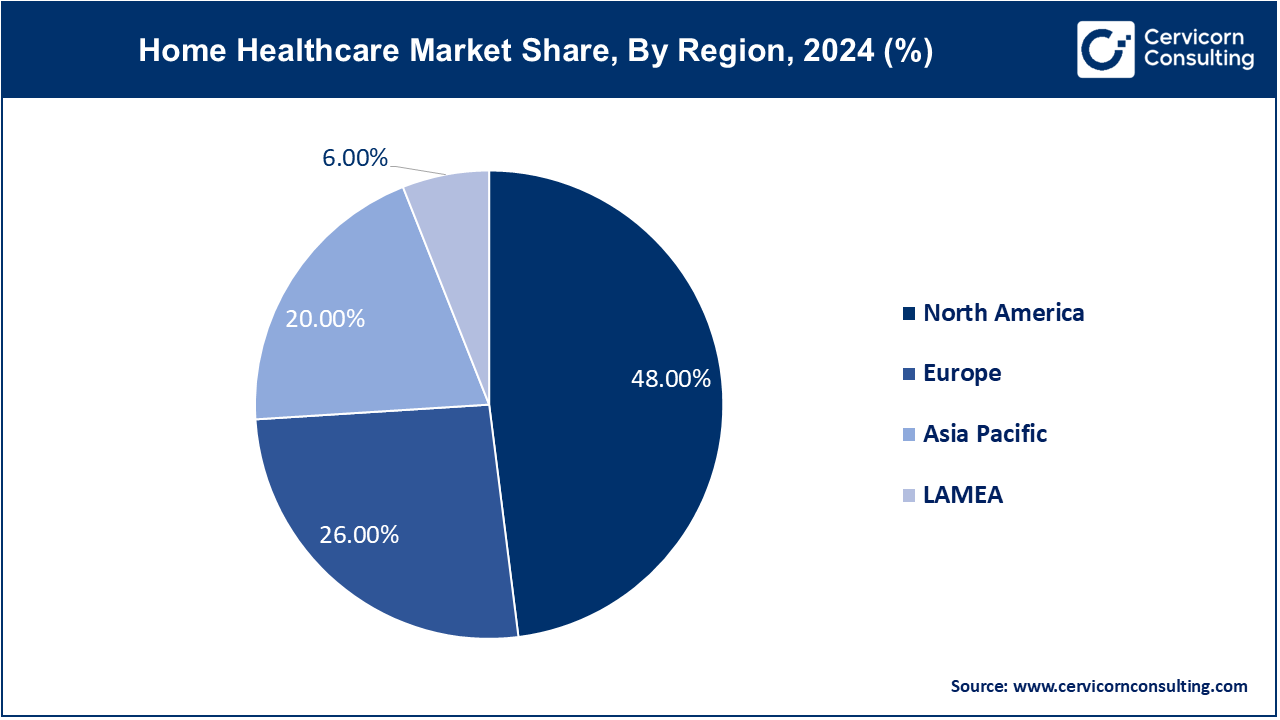

| North America Market Share | 48% in 2024 |

| APAC Market Share | 20% in 2024 |

Consumer Preference for Aging in Place:

Shortage of Healthcare Professionals:

Reimbursement Challenges:

Infrastructure and Technology Barriers:

Remote Monitoring and Telemedicine Expansion:

Collaboration with Non-Healthcare Entities:

Quality Control and Regulatory Compliance:

Caregiver Shortages and Burnout:

Skilled Care: Skilled care in home healthcare involves medical services provided by licensed healthcare professionals such as nurses, physical therapists, and speech-language pathologists. Trends include the integration of advanced medical technologies for monitoring and treatment, personalized care plans tailored to patient needs, and expanded telehealth services to enhance remote patient management.

Unskilled Care: Unskilled care refers to non-medical assistance provided by caregivers or home health aides, including help with activities of daily living (ADLs), companionship, and household tasks. Trends include increasing demand for personalized care services, caregiver training programs to improve service quality, and technological innovations to enhance safety and communication between caregivers, patients, and families.

Diagnostic and Monitoring Equipment: Includes devices like blood pressure monitors, glucose meters, pulse oximeters, and sleep apnea monitors. Trends focus on miniaturization, integration with telehealth platforms for remote monitoring, and advancements in data analytics for personalized patient management.

Therapeutic Equipment: Involves infusion pumps, oxygen therapy equipment, wheelchairs, and mobility aids. Trends emphasize portability, user-friendly designs, and integration with digital health solutions to enhance therapy adherence and patient comfort.

Home Healthcare Software and Solutions: Encompasses electronic health records (EHR), telehealth platforms, and remote monitoring systems. Trends include interoperability enhancements, AI-driven analytics for predictive insights, and user-friendly interfaces to facilitate seamless communication between patients, caregivers, and healthcare providers.

Others: This category includes emerging technologies like robotic assistance devices for daily living activities, smart home sensors for safety monitoring, and virtual reality applications for rehabilitation. Trends focus on enhancing independence, improving care efficiency, and expanding therapeutic options for home healthcare settings.

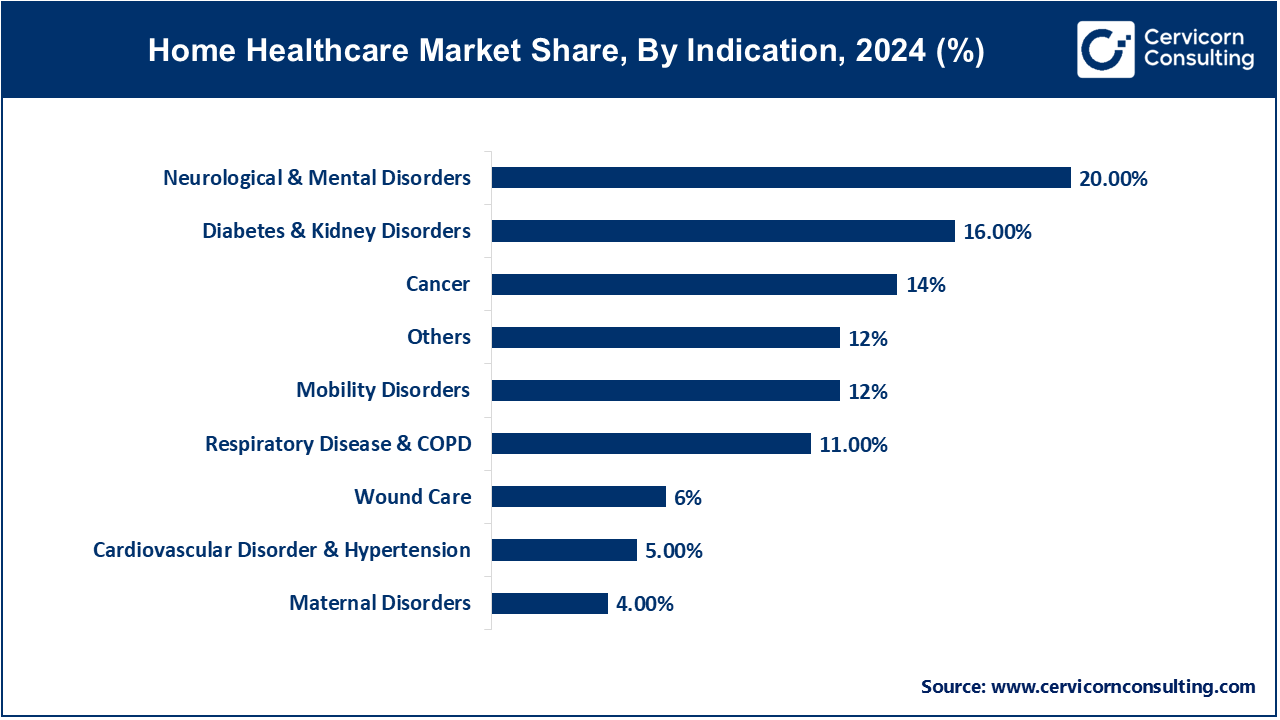

Cardiovascular Disorder & Hypertension: Cardiovascular Disorder & Hypertension segment has registered market share of 5% in 2024. Home healthcare addresses monitoring and management of cardiovascular conditions and hypertension through remote monitoring devices and telemedicine, enhancing patient compliance and outcomes.

Diabetes & Kidney Disorders: Diabetes & Kidney Disorders segment has covered market share of 16% in 2024. Home healthcare provides diabetic management and renal care, focusing on personalized treatment plans, patient education, and telehealth solutions to optimize disease management.

Neurological & Mental Disorders: Neurological & Mental Disorders segment has recorded market share of 20% in 2024. Home healthcare supports patients with neurological and mental health disorders through specialized therapies, medication management, and telepsychiatry, promoting independence and quality of life.

Respiratory Disease & COPD: The respiratory disease & COPD segment has calculated market share of 11%. Home healthcare manages respiratory diseases like COPD with respiratory therapy, oxygen management, and telemonitoring, improving symptom control and reducing hospital admissions.

Maternal Disorders: In 2024, maternal disorders segment has measured market share of 4%. Home healthcare addresses maternal health with prenatal and postpartum care, breastfeeding support, and infant care education, ensuring maternal well-being and newborn health.

Mobility Disorders: In 2024, mobility disorders segment has captured market share of 12%. Home healthcare aids mobility-impaired individuals with physical therapy, assistive devices, and home modifications, enhancing mobility and independence.

Cancer: The cancer segment has generated market share of 14% in 2024. Home healthcare offers cancer patients supportive care, symptom management, chemotherapy administration, and palliative care, focusing on comfort and quality of life.

Wound Care: The wound care segment has garnered market share of 6% in 2024. Home healthcare manages wound care with advanced dressings, wound vacuums, and teleconsultations, promoting healing and preventing infections.

Others: The others segment has achieved market share of 12% in 2024. Includes diverse conditions like autoimmune disorders, genetic diseases, and infectious diseases, expanding home healthcare services through innovative technologies and personalized care approaches.

Geriatric Population: Home healthcare services for the elderly focus on providing personalized medical and non-medical care to support independence and manage age-related health issues, promoting comfort and quality of life.

Patients with Chronic Diseases: Tailored home healthcare solutions address ongoing management and monitoring of chronic conditions like diabetes and cardiovascular diseases, leveraging telehealth and remote monitoring technologies for effective disease management.

Patients Recovering from Surgery or Illness: Post-acute care at home facilitates recovery with skilled nursing, rehabilitation therapies, and medical equipment, promoting faster healing and reducing hospital readmissions.

Disabled Individuals: Home healthcare aids disabled individuals with daily living activities, adaptive equipment, and specialized care plans, enhancing mobility and independence in a familiar environment.

Others: This segment includes pediatric patients needing specialized care, palliative care patients seeking comfort-focused treatments, and those requiring short-term medical support at home, driving diverse service offerings and expanding market accessibility.

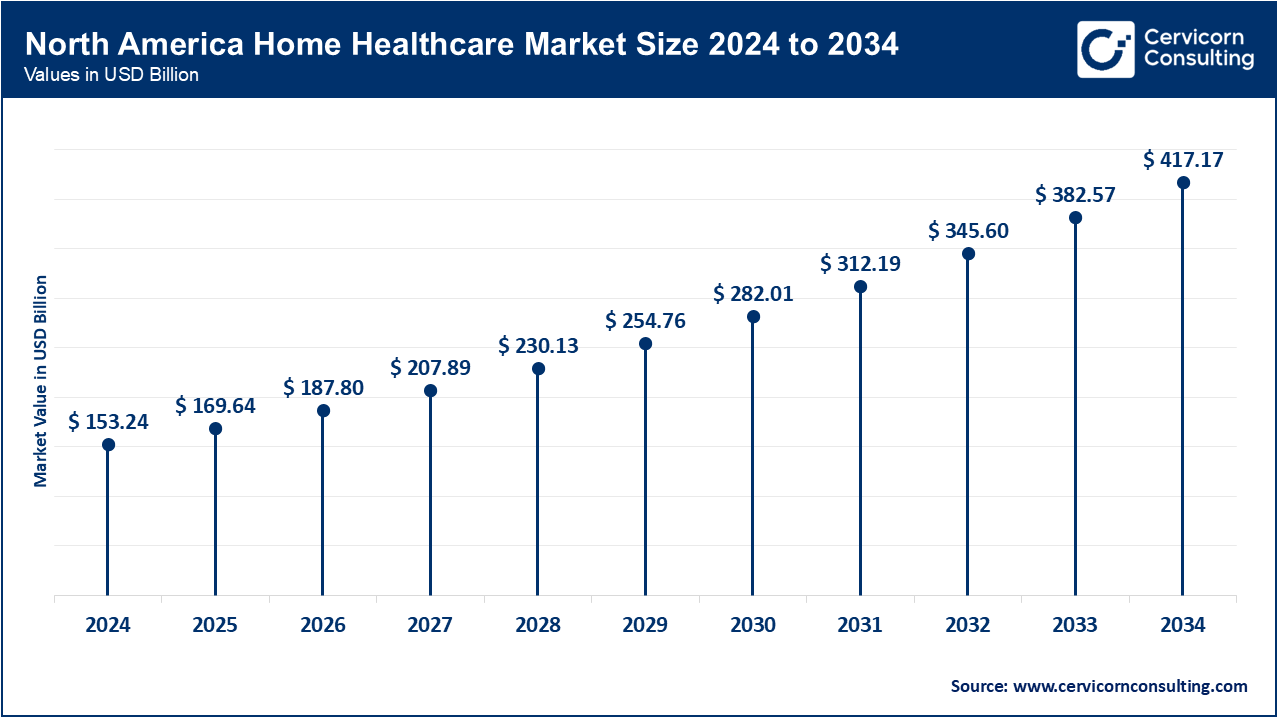

In North America, there is a growing emphasis on telehealth and remote monitoring technologies, driven by a strong healthcare infrastructure and increasing adoption of digital health solutions. North America market size is calculated at USD 153.24 billion in 2024 and is projected to grow around USD 417.17 billion by 2034. The focus is on expanding access to home healthcare services, particularly for aging populations and chronic disease management, supported by favorable reimbursement policies and regulatory frameworks.

The Asia-Pacific region is experiencing rapid urbanization and aging populations, driving demand for home healthcare services. Asia Pacific market size is expected to reach around USD 173.81 billion by 2034 increasing from USD 63.85 billion in 2024. Countries like Japan and South Korea are leading in aging-in-place initiatives and advanced telehealth adoption. Emerging markets such as China and India are focusing on improving healthcare infrastructure and expanding access to home-based care through government initiatives and partnerships with private sectors.

Europe market size is measured at USD 83.01 billion in 2024 and is expected to grow around USD 225.97 billion by 2034. Europe is seeing a rise in integrated care models that combine home healthcare with primary care services. There is a push towards interoperable health systems and standardized care protocols across EU member states, promoting continuity of care and patient-centric approaches. Innovative home healthcare technologies and personalized medicine initiatives are also gaining traction, enhancing care delivery efficiency and patient outcomes.

LAMEA countries are focusing on enhancing healthcare access and affordability, particularly in remote and underserved areas. LAMEA market size is forecasted to reach around USD 52.15 billion by 2034 from USD 19.16 billion in 2024. There is a rising interest in mobile health solutions and community-based care models to address healthcare disparities and improve health outcomes. Governments are investing in healthcare infrastructure development and digital health initiatives to support the growing demand for home healthcare services in the region.

Innovative new players in the home healthcare market, such as DispatchHealth and Ready, have leveraged technology and mobile platforms to offer on-demand medical care at patients' homes, disrupting traditional models. These companies emphasize convenience, rapid response times, and personalized care delivery. Key players dominating the market include Amedisys, Bayada Home Health Care, and LHC Group, known for their extensive service networks, high patient satisfaction, and strong financial performance. They lead through strategic expansions, mergers, and acquisitions, enhancing service capabilities and geographical reach to maintain market leadership in the evolving home healthcare sector.

Market Segmentation

By Service Type

By Equipment/Technologies

By Indication

By End Users

By Regions