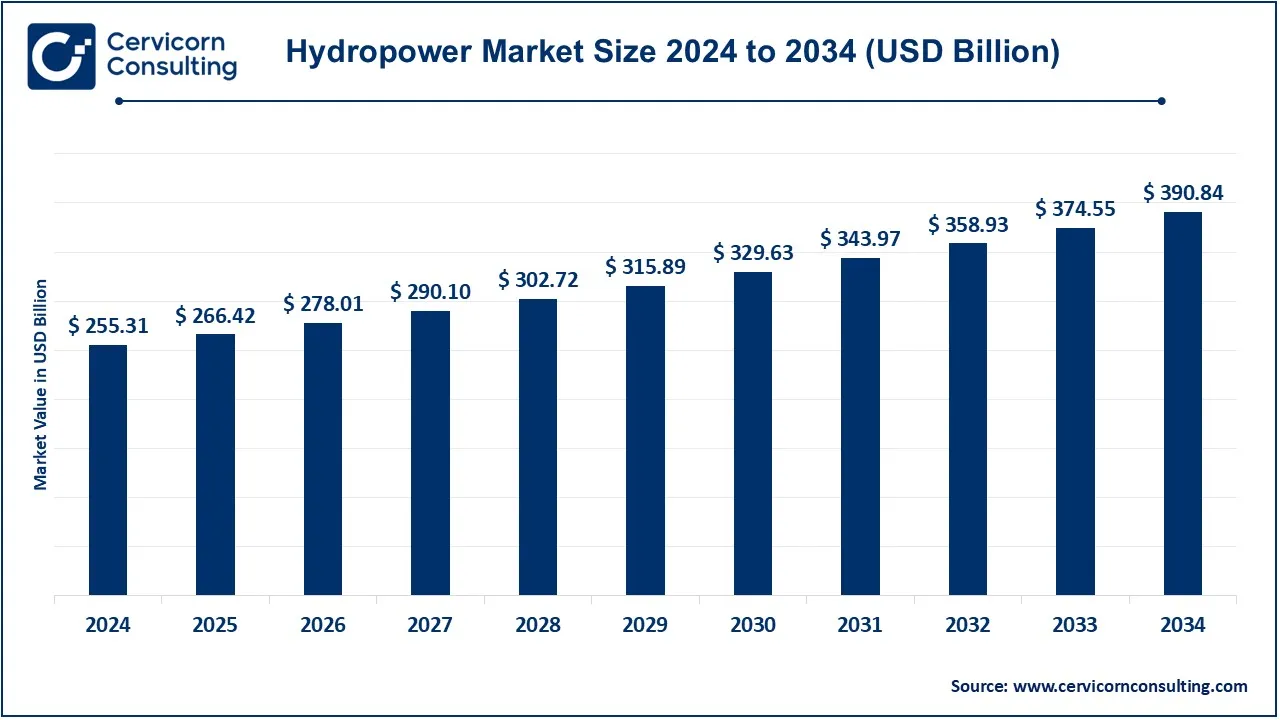

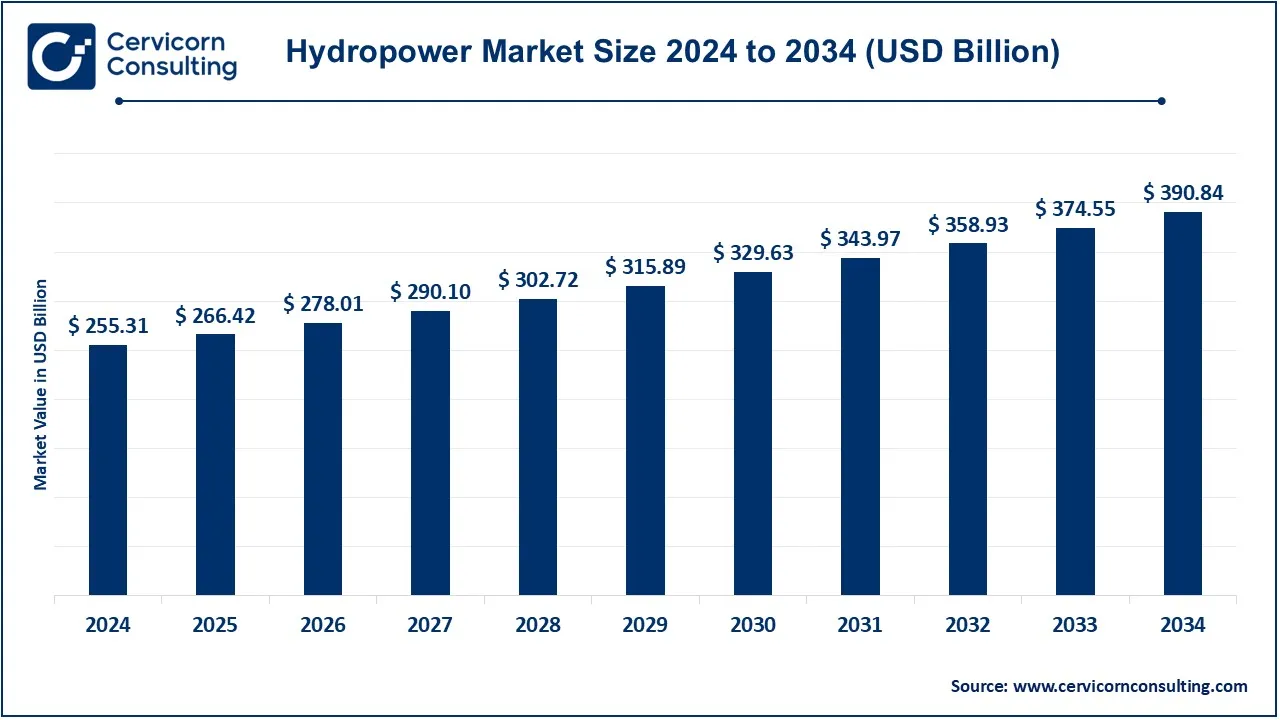

Hydropower Market Size and Growth 2025 to 2034

The global hydropower market size was valued at USD 255.31 billion in 2024 and is expected to be worth around USD 390.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.35% over the forecast period 2025 to 2034.

The global hydropower market has been growing steadily due to increasing demand for clean energy, government initiatives, and technological advancements. Many countries are investing in hydroelectric projects to meet renewable energy targets and reduce carbon footprints. Developing economies, especially in Asia and Africa, are expanding their hydropower capacity to support growing energy needs. Additionally, modernization of old hydro plants in Europe and North America is enhancing efficiency and sustainability. Floating hydropower systems and hybrid models combining solar and hydro energy are also driving market innovation.

Hydropower is the process of generating electricity using moving water. It works by capturing the energy of flowing or falling water, typically from a river or dam, and converting it into electricity through turbines and generators. Hydropower is one of the oldest and most widely used renewable energy sources, offering a clean and sustainable way to produce electricity without burning fossil fuels. One of the key benefits of hydropower is its reliability, as water flow can be controlled through reservoirs to generate power when needed. It also supports grid stability, provides flood control, and creates opportunities for irrigation. Unlike solar and wind energy, which depend on weather conditions, hydropower offers a steady and consistent energy supply. Additionally, it contributes to reducing carbon emissions and dependence on non-renewable energy sources.

Key Insights related to the Hydropower:

- Global hydropower capacity reached over 1,360 GW in 2023, accounting for over 16% of total global electricity generation.

- Hydropower generation increased by 2.5% in 2022, driven by new projects in Asia and South America.

- Investment in hydropower modernization grew by 25% in the last five years, improving efficiency and sustainability.

- Hydropower reduces global COâ‚‚ emissions by approximately 4 billion tons per year.

- Pumped storage hydropower (PSH) capacity is expected to increase by 60% by 2030, improving energy storage solutions.

- China, Brazil, and the U.S. are the top three hydropower-producing countries, with China leading in new installations.

Hydropower Market Report Highlights

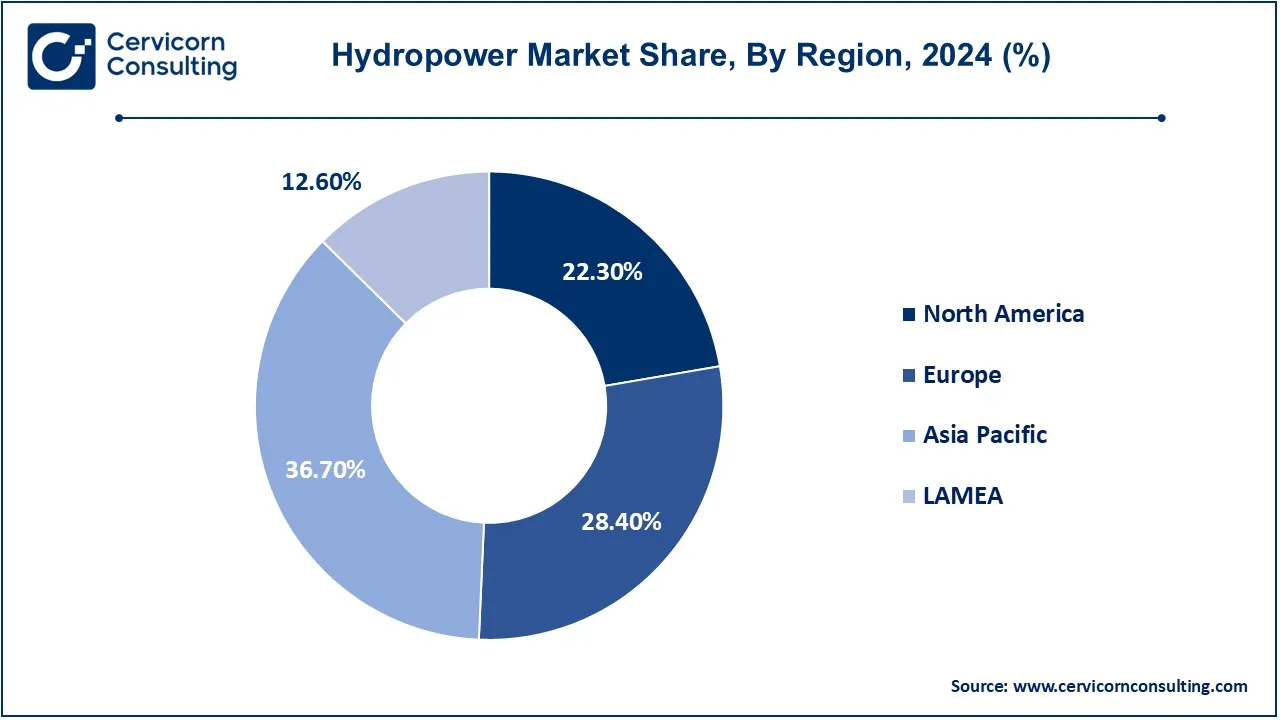

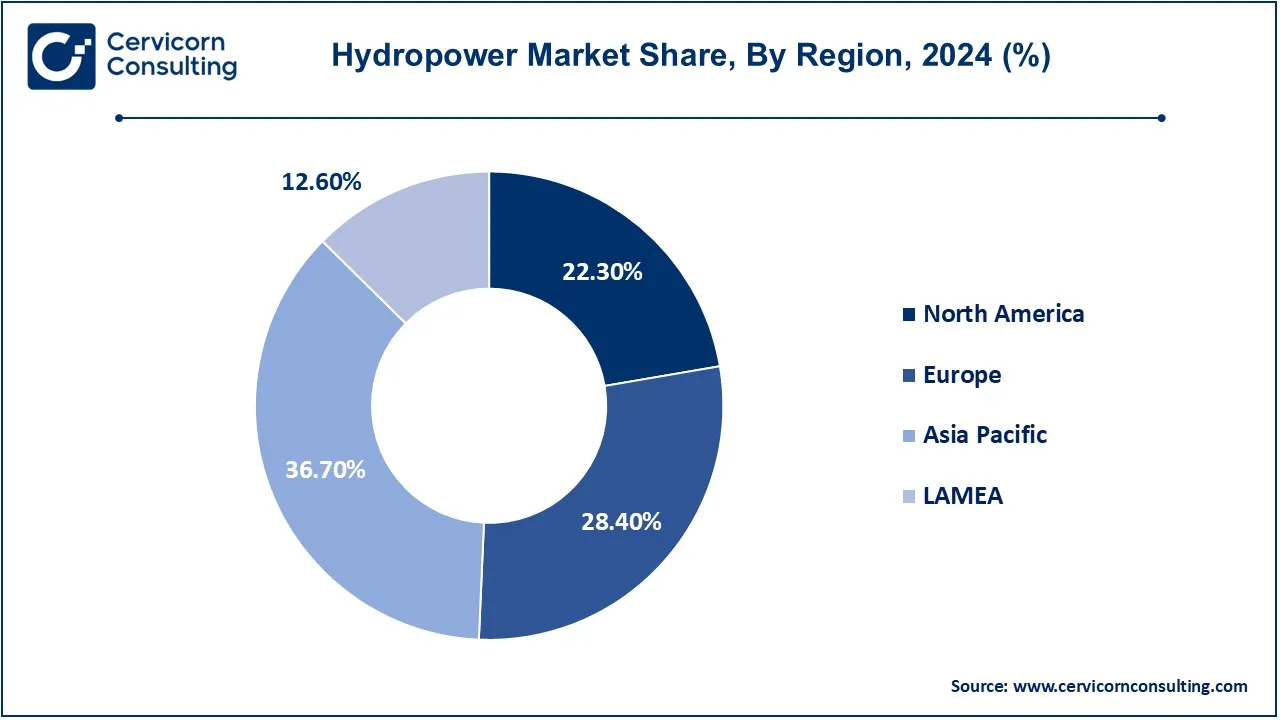

- Asia-Pacific region has leading the market and accounted revenue share of 36.70% in 2024.

- Europe has generated revenue share of 28.40% in 2024.

- By component, the civil construction segment has accounted revenue share of 32% in 2024.

- By application, the industrial segment has captured revenue share of 47% in 2024.

Hydropower Market Growth Factors

- Demand for Renewable Energy: This is related to the general intention of the world to adopt renewable energy due to the growing threats from climate change as well as environmental sustainability. Hydropower has been ranked as one of the safest renewable sources of electricity because of the massive adoption of clean energy technology in an attempt to combat greenhouse gas emissions.

- Technological Advancements: Technological advancements in design concerning turbines, materials, and the generation process have improved the efficiency of hydropower plants. The possibility of using new technologies by turbines operating at variable speeds and further developed control systems enables greater use of energy from water resources already in place. The improvement adds even more performance but reduces operational costs, which makes hydropower even more attractive for investors and producers of energy.

- Investment in Infrastructure: Governments, as well as private financiers, are always pumping in their investments into hydropower infrastructure projects. It is an essential investment not only to upgrade aging facilities to produce more but also to construct new plants. It adds to the value of a country's energy production capacity and also assists in boosting local economies by stimulating employment opportunities and increasing energy security, making it a part of the national energy strategy.

Hydropower Market Trends

- Small Hydropower: The interest in small and micro-hydropower projects is rising with the trend toward localization and sustainability of energy at the community level. Much reduced landscape and water-sensitive environmental footprint form the advantages of smaller systems. They also have relatively easier permitting and financing procedures. It also acts as a greater source of energy access in many remote areas and contributes to local energy resilience.

- Hybrid Systems: Hydropower is now increasingly being hybridized with other renewable sources in the name of hybrid systems of solar power and wind energy. Hybrid systems have now, therefore provided means to capitalise on the benefits of each. For instance, the very same source can provide the baseload power while value addition to build a much stabler and sustainable electricity grid is derived during peak sun or wind conditions.

- Digitalization: Hydropower operations themselves are going through a fundamental change with the integration of IoT and AI-based digital technologies. These technologies will enable this to be realized by recognizing real-time potential threats in advance, identifying when maintenance is needed, and performing complex energy management; this, in turn, leads to better efficiency in operational performance at reduced cost. Digitalization is key in optimizing present assets and enables further development toward smart, resilient energy systems.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 266.42 Billion |

| Expected Market Size in 2034 |

USD 390.84 Billion |

| CAGR (2025 to 2034) |

4.35% |

| Leading Region |

Asia-Pacific |

| Key Segments |

Capacity, Component, Application, Region |

| Key Companies |

GE Energy, Andritz AG, China Three Gorges Corporation, IHI Corporation, The Tata Power Company, Alstom Hydro, Sinohydro Corporation, ABB Ltd, Alfa Laval, Voith GmbH |

Hydropower Market Dynamics

Drivers

- Government Incentives: Most governments, with a vested interest in hydropower, are quick to establish rules, incentives, and support networks that promote the harnessing of renewable sources of energy. This is usually done by way of grants, subsidies, tax breaks, and expedited procedures of the permitting process to encourage increased public and private investment in hydropower ventures. Such support systems would be required for hydropower industries to recover and expand.

- Public Awareness: The public is becoming more conscious of environmental concerns as well as the need for clean energy sources. As this trend is a force that will continue creating demand for clean energy, thus hydropower sources, increased recognition of the benefits of hydropower-including pollution-free power and energy independence will increase demand and support new projects.

- Hydro Power Storage Solutions: Finally, there is pumped storage hydropower that is only now coming under attention as one reliable method for squaring supply and demand in systems. At these facilities, energy storage occurs by pumping water uphill during low-demand times and releasing it during peak demand. Such an attribute increases the stability of the grid; thus, hydropower is a much more versatile contributor to the overall mix of energy, all the more so as sources such as wind or solar become more prominent.

Restraints

- High Upfront Expenditure Costs: The high upfront expenditure needed to develop the project and infrastructure is a major obstacle to hydropower development. Therefore, although in comparison with other renewable energy sources, which have relatively lower upfront expenditures, such costs would deter investment in the development of hydropower, large hydropower project financing involves complicated agreements and often happens to become a bottleneck for the prospective developer.

- Geographical Constraint: Hydropower resource is tied geographically by rivers and elevation differences. Not all regions possess water sources or topography for large-scale hydropower projects. This will limit growth in some hydropower in certain regions, hence there is a need to identify and establish suitable sites.

- Public Opposition: Large hydropower projects cause ecological disruption as well as social impacts, against which the local communities and environmental groups show significant opposition. Such opposition can bring project approvals either on a delay or cancellation basis, which complicates the development process. Community concern needs to be addressed along with ensuring stakeholder engagement as a challenge.

Opportunities

- Turbine and Generator Engineering: Hydropower firms can exploit multiple opportunities in turbine and generator design. For example, efficient, inexpensive designs, for example, in low-flow or high-head turbines, can contribute to better performances of the plant. Equipment also can be developed to last much longer with more reduced environmental impact, which minimizes maintenance and extends the time of operation. In this context, there is bound to be great scope for innovation and tremendous growth in the market for services in turbine manufacturing.

- Climate change resilience and infrastructure: Hydropower projects have to change with the climatic patterns because they have impacts on the flow and availability of water. The opportunities to design infrastructure for resilience against floods and droughts include developing systems that can adapt to store water in times of plenty and then release it in dry spells. Such resilient hydropower projects ensure consistent energy generation, which may be crucial for long-term viability.

- Hydropower Integration to Smart Grid: Smart grids allow the real-time monitoring and management of energy distribution. With this, the connection of hydropower plants in such grids means optimizing power flow, reducing losses during transmission, and stabilizing the supply, especially with the variability of renewable sources. It can rapidly respond to changes, which is a positive aspect for coupling it with the intermittency of solar and wind. Hydropower thus provides for an efficient, more resilient system in response to variable demand and sources of renewables.

- Carbon Credit Trading for Hydropower: Hydropower projects also produce carbon credits by replacing energy that is based on fossil fuels, which contributes to the aim of eliminating greenhouse gas emissions. The hydropower developers can sell these credits in the carbon markets, which are new revenue streams. As governments continue to tighten their emissions regulations and demand for carbon offsets increases, the role of hydropower in earning credits becomes more rewarding. This creates financial incentives for new and existing hydropower projects worldwide to expand.

Challenges

- Financing: This is one of the significant challenges that face the funding of hydropower projects; in addition, with short-term returns for investments, investors are more averse to such ventures and the lead time taken for hydropower is not so appealing to funders. Furthermore, unstable markets of energy and economic uncertainty may reduce investor confidence; thus, the financial models designed should be sound and appealing to the stakeholders involved.

- Balancing Energy Needs with Ecology: One of the biggest challenges for the hydropower sector has been to balance its energy production needs with the protection of the environment. Projects need to be taken properly with the consideration of impacts on the surrounding habitats and communities by proper planning and mitigation measures. A strike of balance would also determine which way public support and, more importantly, long-term sustainable operations would be affected.

- Capacity Planning: Though capacity planning would be sound for the hydropower systems only if the system could assure that it was going to get time to contemplate future energy needs, such overestimation is tough because of changes in regulations, consumption patterns, and advancement in technologies. Hydropower developers will find this compatible with their market requirements and can develop flexible as well as adjustable planning techniques, which can be adapted to changing conditions.

Hydropower Market Segmental Analysis

The global hydropower market is segmented into capacity, component and application. Based on capacity, the market is classified into mini, micro & pico-hydro plants, small hydropower and large hydropower. Based on component, the market is classified into electromechanical equipment, electric & power infrastructure, civil construction and others. Based on application, the market is classified into residential, commercial and industrial.

Capacity Analysis

Small Hydropower: Small hydropower is regarded as constructions with a usual power output of up to 10 MW. Although their capital expenses are low and they support the environment, they generally vary from larger installations. Since small hydropower stations can easily be integrated into water infrastructure in remote or even rural regions, access to big power grids does not have to be the only possibility to receive electricity there. They also contribute to regional economies by availing communities of a source of power while at the same time reducing reliance on fossil fuels.

Large Hydropower: Large hydropower projects have been defined as plants or facilities that generate over 10 MW of electricity. They often require hefty investments and other strategic infrastructure such as dams and reservoirs to tap large quantities of water flows for a very massive electricity production scale. Large hydropower also plays an essential role in the source of renewable energy globally that helps stabilize the grid and industrial energy requirements. This is however not free of such issues as environmental problems and forced eviction from the community.

Others: Under the heading "Others" falls a mixed bag of hydropower technologies and configurations that don't fit neatly into small or large. There's pumped storage hydropower, where the major applications are energy storage and grid balancing. And run-of-river systems, which generate electricity without much in the way of water storage. Such alternative technologies hold the key to diversifying the hydropower mix and meeting particular energy needs while minimizing ecological footprints.

Application Analysis

Residential: The small hydropower installation can be used to power residential homes and communities. This represents off-grid schemes that utilize small hydropower installations to directly feed electricity into homes. In this regard, more access to energy has been realized, mostly in isolated areas; therefore, the people have a reliable sustainable source of power supply for lighting, heating, and appliances.

Commercial: Hydropower in commercial applications is used to power companies and commercial institutions. This part is a small installation similar to those required in hotels or resorts and big systems feeding urban centers. Hydropower for the commercial sector is essential in cutting costs and carbon footprint. It allows companies to produce power from renewable resources and facilitates the achievement of a greener and cleaner environment.

Hydropower Market Revenue Share, By Application, 2024 (%)

| Application |

Revenue Share, 2024 (%) |

| Residential |

30% |

| Commercial |

23% |

| Industrial |

47% |

Industrial: Actually, the industrial sector is still the greatest consumer of hydropower, utilizing large plants that are still at the heart of high energy-intensive manufacturing and processing activities. Electricity generated from hydropower is much more reliable and less costly, thus being aligned with the interests of mining companies, metal manufacturers as well as chemical producers. The installation of renewable sources by industrial players can further aid them in improving their sustainability profiles and greenhouse gas emissions rates as well as providing them with stable long-term energy prices.

Hydropower Market Regional Analysis

The global market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The Asia-Pacific dominated the market in 2024.

What factors contribute to Asia-Pacific dominance in the hydropower market?

The Asia-Pacific hydropower market size was accounted for USD 93.70 billion in 2024 and is predicted to surpass around USD 143.44 billion by 2034. Asia-Pacific is one of the key regions of hydropower development, and China boasts of having the largest hydropower capacity in the world. Of course, the epitome of this hydropower development in China could be seen in the Three Gorges Dam, which is the world's largest hydroelectric project. Other countries with vast potential for hydro electrical development are the Indian nation, with its mountainous areas, and Japan, whose government is keen on the promotion of small- and medium-sized hydropower plants in the wake of the Fukushima disaster. Countries like Nepal and Bhutan have also resorted to hydropower more as means of spurring economic growth and energy security.

North America Hydropower Market Growth

The North America hydropower market size was valued at USD 56.93 billion in 2024 and is expected to reach around USD 87.16 billion by 2034. The North America market is dominated more by the United States and Canada. Among the world's biggest hydroelectric plants, the U.S. has several such as the Grand Coulee Dam and the Hoover Dam. These facilities are highly contributing to the renewable energy mix of the country. Canada contributes similarly in the hosting of enormous volumes of water resources and major projects like Sir Adam Beck Hydroelectric Generating Station. Simultaneously, both states target efficiency and minimum adverse effects on the environment through maintenance and upgrading of existing infrastructure.

Why is the Europe hydropower market experiencing sustainable growth?

The Europe hydropower market size was estimated at USD 72.51 billion in 2024 and is projected to hit around USD 111 billion by 2034. Hydropower in Europe is quite diversified; some of the leading contributors are Norway, Sweden, and France. Hydropower has been the backbone of Norway and accounted for up to 95% of the total electricity produced in the country. Hydropower in Sweden also boasts high capacity results because of a significant number of plants along its rivers. Hydropower is an important proportion in the energy supply system in France, mainly from the Rhône and Loire river systems. The European Union is ever more embracing renewable energy programs, leading to investments in hydropower infrastructure across the continent.

LAMEA Hydropower Market Growth

The LAMEA hydropower market was valued at USD 32.17 billion in 2024 and is anticipated to reach around USD 49.25 billion by 2034. The LAMEA region comprises Brazil and Colombia in the hydropower generation series. Brazil is highly dependent on hydropower; in fact, it gets around 60% of its electricity from this source, the greater portion of which comes from the Belo Monte and Itaipu dams. Colombia has also started to concentrate more on hydropower and is on the drawing boards with projects like the Guatapé Dam. This includes among others the hydropower projects in Africa, such as the giant Grand Ethiopian Renaissance Dam in Ethiopia and Zambia. The goals encompass better energy access, further regional integration, and simplification of cooperation within the region. Hydropower in the region has thus far been explored on a smaller scale mainly under the umbrella of the management of water resources as well as renewable energy diversification.

Hydropower Market Top Companies

- GE Energy

- Andritz AG

- China Three Gorges Corporation

- IHI Corporation

- The Tata Power Company

- Alstom Hydro

- Sinohydro Corporation

- ABB Ltd

- Alfa Laval

- Voith GmbH

CEO Statements

Lawrence Culp, Jr., CEO of GE Energy

- "Our commitment to advancing renewable energy solutions, including hydropower, is essential for a sustainable future."

Joachim Schönbeck, CEO ofANDRITZ

- “ANDRITZ’s continued success as a company as well as our ability to navigate increased uncertainty are attributable above all to the dedication of our employees around the world. I am grateful to all of them and count myself privileged to be leading an exceptional company like ANDRITZ at a time like this. Our teams navigated successfully through 2023, with dedication and commitment to our core values and strategic initiatives”.

Praveer Sinha, CEO of Tata Power Company

- "We are focused on transforming Tata Power into a leading renewable energy company, ensuring a sustainable future for generations to come."

Recent Developments

Proper investments and acquisitions within the hydropower industry reflect a shift towards innovation and strategic cooperation by key market participants. Among these innovators are GE Energy, Andritz AG, China Three Gorges Corporation, IHI Corporation, and Tata Power Company. They develop these through cooperation and new technologies into new operations that improve operating efficiencies, enhance the performance of turbines, and digitize solutions for better management of available resources. That is not to say this collaborative approach breeds innovation; it also positions the industry to meet the increasing demands of global energy while emphasizing sustainability and environmental stewardship. Thus, as they continually innovate, these leaders help shape the future of hydropower and underscore its importance in the renewable energy landscape. Some notable examples of key developments in the hydropower industry include:

- In July 2022, Tata Power invested more than Rs 75,000 crore in renewable energy over the next five years. By then, power generation was likely to rise to 30 GW, and there is a solid commitment towards renewable sources: more than 50% of the generation. As of then, 34% of Tata Electricity's 13.5 GW of electricity generation comes from renewable sources.

- In October 2023, the Baihetan hydropower facility secured the 2023 FIDIC Outstanding Project Award. That marked the fifth successive won by CTG in a FIDIC Award. Baihetan a part of the world's largest clean energy corridor, running along the Yangtze River and including six huge hydropower projects with a total installed capacity of 16 GW. CTG designed the plants, and the commissioning of Baihetan marks the completion of the corridor.

- In November 2022, ÄURO ÄAKOVIĆ TERMOENERGETSKA POSTROJENJA d.o.o. (DD-TEP), founded in Croatia and boasting 100 years of boiler plant manufacturing for various kinds of fuel, with special emphasis on biomass and waste processing using grate technology, is acquired by the global technology group ANDRITZ. With high-capacity workshops and comprehensive engineering and manufacturing services, DD-TEP one of Europe's leading boiler accessory and customized pressure part manufacturers. That acquisitionfurther increased ANDRITZ's ability to produce auxiliary equipment and pressure parts, further strengthen its market in the renewable energy source, and strategically position itself as a leader in boiler and power industry inspection, maintenance, and repair.

Market Segmentation

By Capacity

- Mini

- Micro & Pico-hydro Plants

- Small Hydropower

- Large Hydropower

By Component

- Electromechanical Equipment

- Electric & Power Infrastructure

- Civil Construction

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- APAC

- Europe

- LAMEA

...

...