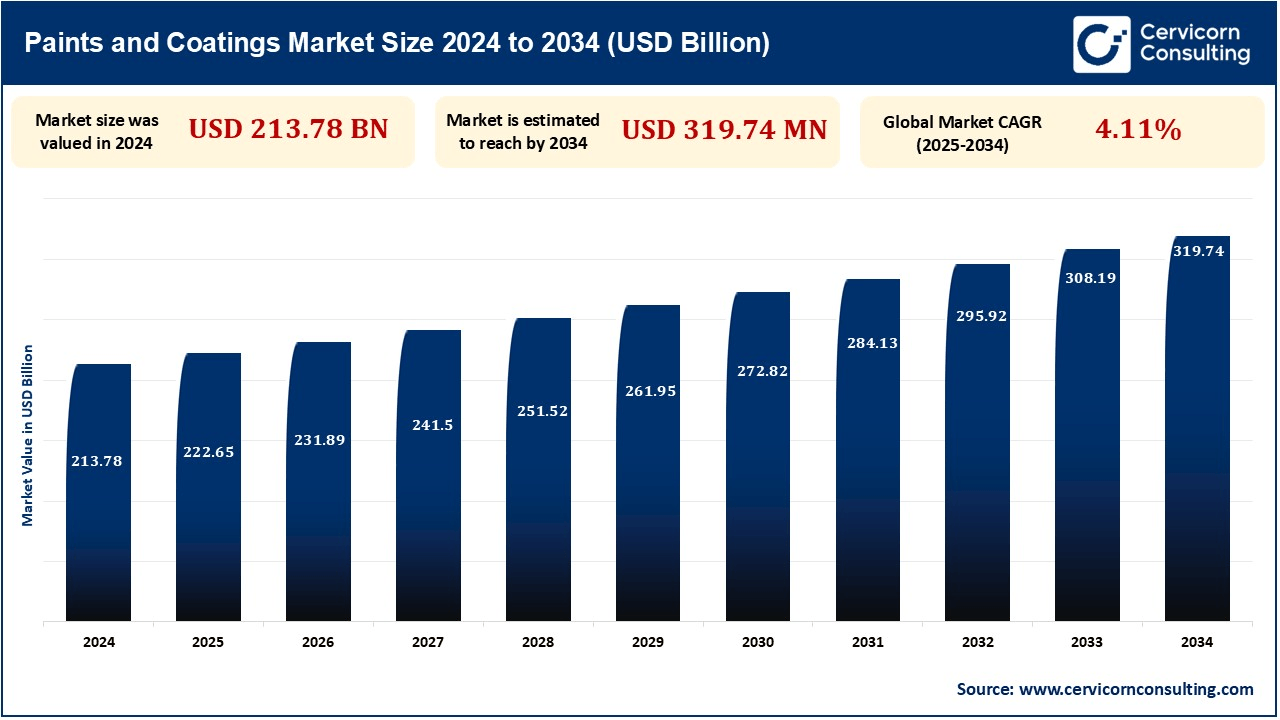

The global paints and coatings market size was accounted for USD 213.78 billion in 2024 and is expected to surge around USD 319.74 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034. The paints and coatings market is growing quickly with rising demand in major segments such as construction, automotive, and manufacturing. The construction industry growth, fuelled by infrastructure development and urbanization, needs coatings for protection and appearance, while automotive growth drives demand for car finishes.

Technological advances in coatings technology, including green, low-VOC, and high-performance coatings, are also picking up speed as sustainability is on top of everybody's list. In addition, the increased industrial demand for protective coatings in aerospace and marine sectors, increased consumer awareness of quality finishes, and government policies supporting energy-efficient and sustainable products are also propelling the market's growth.

The transition to environment-friendly coatings is triggered by increasing environmental awareness and tighter VOC regulations. Consumers and industries alike now look for sustainable alternatives, and hence demand water-based and low-VOC coatings. For example, in September 2024, Cummins Inc. will reduce VOC emissions by 50% by 2030 as part of its PLANET 2050 strategy, having already achieved a 35% reduction by 2023 despite acquisition-related challenges. New properties purchased are implementing VOC reduction strategies, with roadmaps to continue to progress. Regulatory environments within markets like North America and Europe are also compelling the shift to sustainable coatings.

The paints and coatings industry is significantly influenced by the growth of the construction and infrastructure industries. In developed and developing countries alike, there are large-scale infrastructure developments, leading to increased demand for protective and decorative coatings. For instance, in February 2025, India's total spending on infrastructure has witnessed a never-before surge, with the trend towards growth being decided by the public and private sector initiatives. Total spending on India's infrastructure has grown many times over, with spending on the budget crossing USD 133.33 billion during the 2023-24 period. Paint or coating is required for protection of structures and buildings against climatic conditions and for beautifying them. The demand for durable, energy-efficient, and low-maintenance finishes for construction activities once more widens the market.

The expansion in vehicle manufacturing, and especially car finish manufacturing, drives the paints and coatings market predominantly. Worldwide production of automobiles crossed 0.092 billion units in the year 2022 and continues to grow further, particularly across emerging economies. A covering of Automotive coatings has a high involvement in corrosion resistance, scratch resistance, and aesthetic appeal. According to the India Brand Equity Foundation, since January 2025, the automotive industry of India has been emerging very fast owing to the rise of electric vehicles and sustainability initiatives. The Indian government is further giving a boost to the development of this sector by providing various subsidies like the PLI Scheme, which will make India a key player in the global auto industry focusing on innovation, regulations, and consumer demands.

Fluctuation in the raw material price of resins, pigments, and solvents is one major issue of concern for the market of paints and coatings. As an example, the titanium dioxide, being an important pigment, had its price rise with increased demand and interruption in the supply chain, resulting in higher costs for production and therefore the consumer price. Small-scale producers are especially hit by such changes in prices, as they are unable to compete, leading to possibilities of supply-demand imbalance. This uncertainty in raw material prices can make it difficult for market stability and growth.

The automotive market, therefore, is a huge potential for the paints and coatings business, particularly in Japan, the world's fourth-largest car market. The automobile industry is a significant factor in the Japanese economy: it accounts for 2.9% of the GDP and 13.9% of the manufacturing GDP. Automotive coatings are integral not only to the aesthetics of a vehicle but also to its longevity and maintenance. Hence the booming EV market, with its own unique adapted coatings, remains another growth in the sector. As a result, also, coating manufacturers can face opportunities to cater for evolving demands by developing customized solutions for EVs.

North America, including the U.S., Canada, and Mexico, is also a strong market for coatings and paints with its established industrial base and strong automotive and construction sectors. The U.S. dominates demand from these sectors, but expansion is also seen in Canada and Mexico in residential developments and infrastructure. In addition, the region's increasing focus on sustainability and environmental regulation is compelling the adoption of green coatings, including waterborne and low-VOC coatings. All these drivers contribute to consistent market growth.

The most dynamic market for coatings and paint is the Asia-Pacific region covering China, India, Japan, South Korea, and Southeast Asia. China is leading the regional pack with a rapid pace of industrialization, urbanization, and construction drives. India and Southeast Asia follow close behind based on increasing infrastructure and residential real estate construction works. The burgeoning EV and green building activities across these markets also help fuel the demand for sophisticated coatings. The economic development and industrialization of the region drive strong market growth.

Polyester coatings are very resistant to weather, UV degradation, and corrosion, and they are very durable. They have extensive use in the automotive, industrial, and architectural markets due to their very good protection from environmental factors. Polyester coatings have a smooth finish and good performance life, and thus they are most suitable for applications requiring both appearance and harsh protection in a majority of outdoor and industrial applications.

Solvent-borne coatings depend on solvents to dissolve the resins, providing quick drying times and a high-quality, smooth finish. Solvent-borne coatings are used extensively in industrial, automotive, and decorative finishes. Although solvent-borne coatings have their benefits, they are being challenged by environmental issues related to VOC emissions. Though, they are still in demand for their convenience of application and to create long-lasting, good-looking coatings, especially where quick drying is essential, for instance, in the car refinishing industry.

Architectural and decorative paints are generally used on exterior and interior spaces of buildings for enhancing aesthetic appeal as well as functional performance. Architectural and decorative coatings are agents that shield structures and buildings from weathering, UV radiation, moisture, and physical deterioration, making the structures and buildings retain their appearance and integrity. Architectural and decorative coatings come in a variety of different finishes, colors, and textures that can be used depending on preferred designs. Architectural coatings are necessary for residential, commercial, and institutional structures, providing both protective and aesthetic properties, and enhancing energy efficiency and durability.