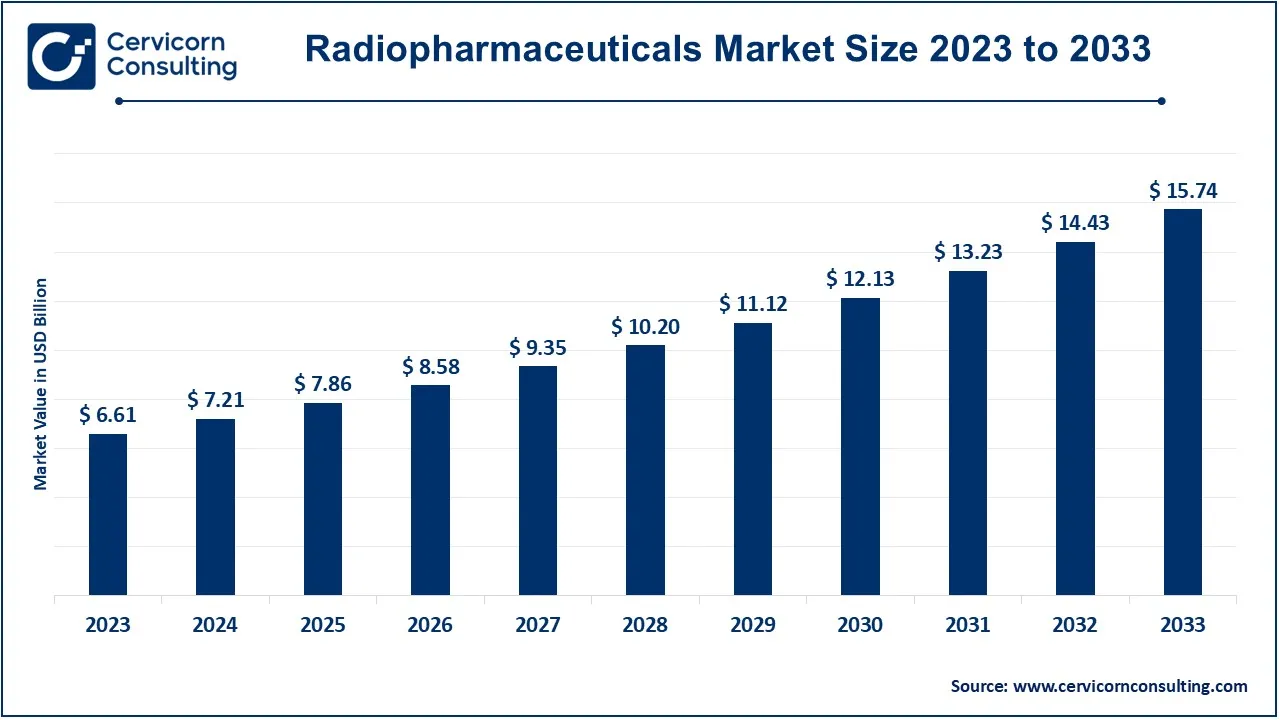

The global radiopharmaceuticals market size was valued at USD 7.21 billion in 2024 and is expected to be worth around USD 15.74 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.06% from 2024 to 2033.

The global radiopharmaceuticals market has been experiencing significant growth due to the rising demand for diagnostic imaging and targeted therapies. The increasing prevalence of chronic diseases like cancer, cardiovascular diseases, and neurological disorders has led to a surge in the adoption of radiopharmaceuticals. Advances in nuclear medicine, along with the development of more precise and efficient radioactive compounds, have further accelerated market growth. Additionally, the growing awareness of early disease detection and personalized treatment options is driving investments in radiopharmaceutical research and development. These factors have collectively fueled the expansion of the market and contributed to its steady growth in recent years. Moreover, the market is expected to continue growing at a robust pace due to ongoing technological advancements and the increasing number of diagnostic and therapeutic applications of radiopharmaceuticals. In recent, Eli Lilly invested USD 10 million in Ionetix, a company focused on producing actinium-225, a critical isotope for radiopharmaceuticals used in cancer treatment. This investment highlights the growing interest in developing advanced radiopharmaceuticals for cancer therapies.

Radiopharmaceuticals are radioactive compounds used in medical imaging and therapy. These compounds are made by attaching a radioactive isotope to a biologically active molecule, such as a protein or antibody. Radiopharmaceuticals are classified into two main categories: diagnostic and therapeutic. Diagnostic radiopharmaceuticals are primarily used for imaging, helping to identify diseases by tracking how a substance behaves in the body. Therapeutic radiopharmaceuticals deliver targeted radiation to specific areas, treating tumors or diseases. Their ability to treat while minimizing damage to surrounding tissues makes them particularly valuable in cancer treatment. These radiopharmaceuticals provide an important tool in personalized medicine, improving both diagnosis and treatment accuracy.

Rising Burden of Chronic Diseases

Growing Adoption of Nuclear Medicine

Focal Developments in R&D Investment

Increasing Demand for Targeted Therapies

Rise in PET Imaging Applications

Extending Offerings of Radiopharmacy Services

Integration of Radiopharmaceuticals with Digital Health Technologies

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 7.86 Billion |

| Projected Market Size (2033) | USD 15.74 Billion |

| Growth Rate (2024 to 2033) | 9.06% |

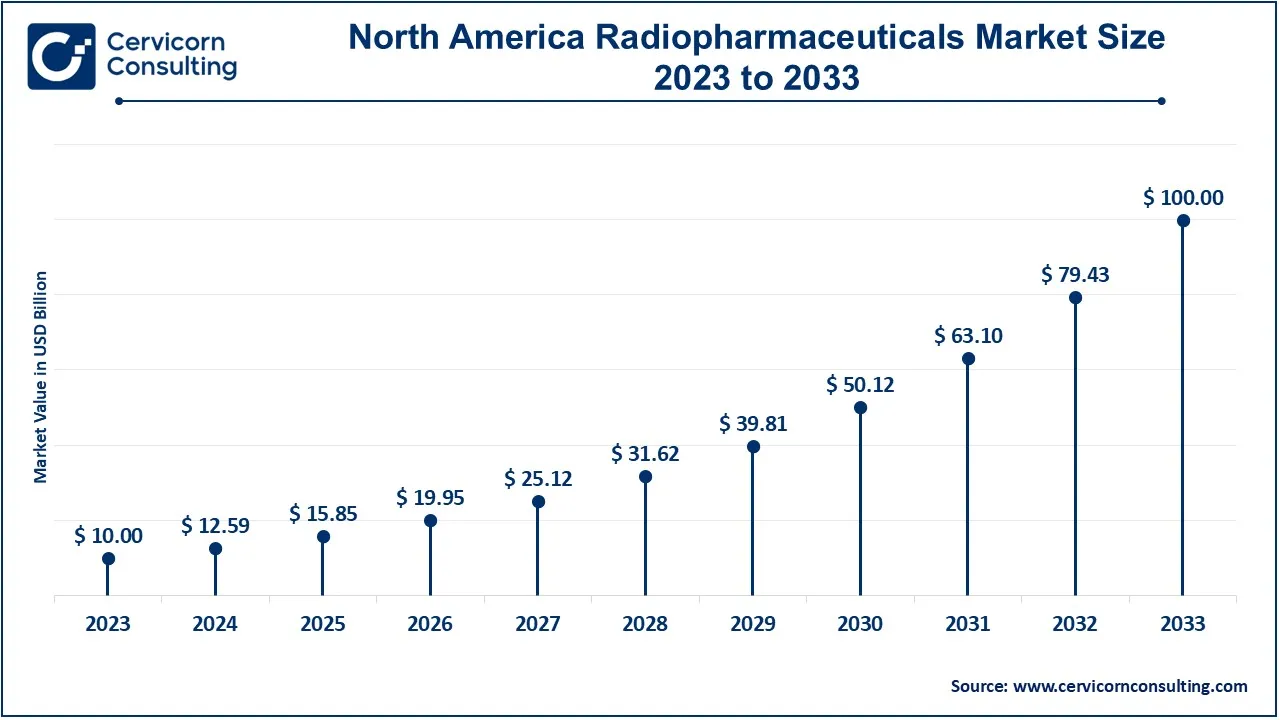

| Dominant Region | North America |

| Rapidly Growing Region | Asia-Pacific |

| Key Segments | Type, Radioisotope Type, Source, Application, End User, Region |

| Ket Companies | Cardinal Health, Advanced Accelerator Applications, A Novartis Company, Lantheus, Curium, GE HealthCare, Jubilant Radiopharma, A Jubilant Pharma Company, China lsotope& Radiation Corporation., Siemens Healthcare GmbH, Eckert & Ziegler, SHINE Technologies, LLC, Eczacıbaşı-Monrol, IBA Worldwide |

Rising Incidence of Cancer

Increased Awareness and Acceptance

Emergence of Personalized Medicine

Rising Healthcare Expenditures

High Cost of Radiopharmaceuticals

The high cost of radiopharmaceuticals poses a significant barrier to market growth. These products often require complex manufacturing processes and specialized handling, resulting in elevated prices. This can limit accessibility for patients and healthcare providers, especially in regions with budget constraints. As healthcare systems seek cost-effective solutions, the high expenses associated with radiopharmaceuticals can hinder their widespread adoption and utilization.

Competition from Other Diagnostic Modalities

Radiopharmaceuticals face competition from other diagnostic modalities, such as MRI, CT scans, and ultrasound imaging. These alternatives may offer similar or superior diagnostic capabilities without the use of radioactive materials, appealing to both healthcare providers and patients. As a result, radiopharmaceuticals must continuously demonstrate their unique advantages to maintain market share and drive growth. Ethical and Safety Concerns:Concerns about the ethical implications and safety of using radioactive materials in medicine can hinder the acceptance of radiopharmaceuticals. Issues related to radiation exposure, environmental safety, and patient consent must be addressed to build trust among healthcare providers and patients. Ensuring the safe handling, administration, and disposal of radiopharmaceuticals is critical for overcoming these concerns and promoting market growth.

Integration with Healthcare Systems

Handling Safety Regulations

Adapting to Rapid Technological Changes

The radiopharmaceuticals market is segmented into type, radioisotope type, application, source, end user and region. Based on type, the market is classified into diagnostic, and therapeutic. Based on radioisotope type, the market is classified into Technetium-99, Iodine-131, Fluorine-18, Lutetium-177, Yttrium-90, Gallium-67, Rubidium-82, Iodine-123, Gallium-68, Iodine-125, Indium-111, and Others. Based on application, the market is classified into oncology, gastroenterology, cardiology, neuroendocrinology, neurology, nephrology, and Others. Based on source, the market is classified into nuclear reactors, cyclotrons, and Others. Based on end user, the market is classified into hospitals, diagnostic centers, cancer research institutes, ambulatory surgical centers, and Others.

Based on type, the global market is segmented into diagnostic radiopharmaceuticals and therapeutics radiopharmaceuticals. The diagnostic segment was dominant in 2023.

Diagnostic Radiopharmaceuticals

The diagnostic segment has accounted revenue share of 60.16% in 2023. Diagnostic are primarily used in medical imaging to diagnose diseases and monitor treatment efficacy. They contain radioactive isotopes that emit radiation detectable by imaging devices like PET and SPECT scans. These agents play a crucial role in identifying conditions such as cancer, cardiovascular diseases, and neurological disorders. The increasing prevalence of chronic diseases and advancements in imaging technologies are driving the demand for these products, enhancing their significance in modern healthcare.

Therapeutic Radiopharmaceuticals

The therapeutic segment has generated revenue share of 39.84% in 2023. Therapeutic are utilized for treatment rather than diagnosis, delivering targeted radiation to cancerous tissues. These products aim to minimize damage to surrounding healthy cells, enhancing patient outcomes. Applications include radioimmunotherapy and targeted radiotherapy for cancers such as lymphoma and prostate cancer. The growing interest in personalized medicine and advancements in radiopharmaceutical development are propelling this segment's growth, making it essential for effective cancer treatment protocols.

Based on end user, the global radiopharmaceuticals market is segmented into hospitals & clinics, diagnostic centers, cancer research institutes, ambulatory surgical centers, others. The hospitals & clinics segment was dominant in 2023.

Hospitals & Clinics: Hospitals & clinics are the primary end users of radiopharmaceuticals, utilizing these products for both diagnostic imaging and therapeutic treatments. They are equipped with advanced imaging technologies and specialized facilities to handle radiopharmaceuticals safely. As the prevalence of chronic diseases and cancer rises, hospitals are increasingly incorporating nuclear medicine into their treatment plans, driving the demand for both diagnostic and therapeutic radiopharmaceuticals. This segment is crucial for the expansion of nuclear medicine practices and enhancing patient care.

Diagnostic Centers: Diagnostic centers play a vital role in the radiopharmaceuticals market, offering specialized services for medical imaging and diagnostics. These facilities focus on providing advanced imaging techniques like PET and SPECT scans, often utilizing a range of radiopharmaceuticals to enhance diagnostic accuracy. The growth of diagnostic centers is fueled by the increasing demand for early disease detection and monitoring. As patients seek accessible diagnostic services, these centers contribute significantly to the overall demand for radiopharmaceuticals.

Cancer Research Institutes: Cancer research institutes are critical end users of radiopharmaceuticals, focusing on the development of new diagnostic and therapeutic solutions for cancer treatment. These organizations conduct extensive research to enhance the efficacy and safety of radiopharmaceuticals, contributing to innovative therapies and imaging techniques. Collaboration between these institutes and pharmaceutical companies fosters the advancement of radiopharmaceutical applications, driving growth in both the research and commercial sectors. The continuous pursuit of improved cancer treatments positions these institutes as key players in the radiopharmaceuticals market.

Ambulatory Surgical Centers: Ambulatory surgical centers (ASCs) are increasingly incorporating radiopharmaceuticals for outpatient procedures, particularly in oncology. These facilities offer convenient access to diagnostic imaging and targeted therapies, allowing patients to receive care without the need for hospital admission. The growth of ASCs is driven by the rising demand for minimally invasive procedures and the need for efficient healthcare delivery. Their focus on patient-centered care supports the adoption of radiopharmaceuticals, contributing to market expansion and enhancing treatment accessibility.

Others: This category encompasses various other end users, including research laboratories, academic institutions, and specialty clinics that utilize radiopharmaceuticals for a range of applications. These facilities contribute to the advancement of nuclear medicine by conducting research, training healthcare professionals, and exploring innovative uses of radiopharmaceuticals. As awareness of the benefits of nuclear medicine grows, the involvement of diverse end users will likely enhance the market's evolution, leading to new applications and broader acceptance of radiopharmaceuticals in clinical practice.

The North America radiopharmaceuticals market size was valued at USD 2.83 billion in 2023 and is expected to reach around USD 6.73 billion by 2033. The North America region is a leader, driven by the high prevalence of cancer, technological advancements, and substantial investments in healthcare infrastructure. The United States dominates this region, with robust research initiatives and extensive nuclear medicine applications in hospitals and outpatient centers. Canada also contributes significantly, emphasizing personalized medicine and advanced imaging technologies. Major companies, including GE Healthcare and Cardinal Health, are pivotal in this market, focusing on innovations and expanding their product offerings to cater to the growing demand for radiopharmaceuticals for both diagnostic and therapeutic purposes.

The Europe radiopharmaceuticals market size was estimated at USD 1.77 billion in 2023 and is projected to hit around USD 4.22 billion by 2033. Europe's radiopharmaceuticals market benefits from a well-established healthcare system, significant research funding, and increasing collaborations between academic institutions and the pharmaceutical industry. Germany and the United Kingdom are key players, leading in the development and distribution of radiopharmaceuticals. Countries like France and Switzerland also play crucial roles due to their advanced healthcare technologies and research initiatives. Regulatory support for nuclear medicine enhances market growth, with a growing emphasis on targeted therapies and personalized treatment options driving demand for innovative radiopharmaceutical solutions.

The Asia-Pacific radiopharmaceuticals market size was accounted for USD 1.56 billion in 2023 and is predicted to surpass around USD 3.72 billion by 2033. The Asia-Pacific region is witnessing rapid growth in the market, primarily due to the rising incidence of cancer and advancements in nuclear medicine. Countries such as Japan, China, and India are at the forefront, with Japan leading in technological innovation and extensive research. China is expanding its nuclear medicine capabilities, increasing the availability of diagnostic and therapeutic radiopharmaceuticals. India is also emerging as a significant market, with growing healthcare investments and a rising demand for advanced imaging solutions. Government initiatives to enhance healthcare access are further propelling the market in this region.

The LAMEA radiopharmaceuticals market was valued at USD 0.45 billion in 2023 and is anticipated to reach around USD 1.08 billion by 2033. The LAMEA region shows a burgeoning interest, driven by the increasing burden of chronic diseases and the need for advanced diagnostic tools. Brazil and Mexico are notable players in Latin America, with growing healthcare expenditures and efforts to improve cancer diagnosis and treatment. In the Middle East, countries like Saudi Arabia and the UAE are investing in healthcare infrastructure, promoting the adoption of nuclear medicine. Africa is gradually emerging, with initiatives aimed at improving healthcare access and enhancing medical imaging capabilities. Collaborative efforts between governments and private sectors are crucial for market growth in this region.

Radiopharmaceuticals industry is dominated by a few central players, including Cardinal Health, GE Healthcare, Lantheus Medical Imaging, Bayer AG, Bracco Imaging, Nordion, Advanced Accelerator Applicationsamong others. These organizations are recognized for their strong commitment to innovation and the advancement of radiopharmaceutical technologies. They are involved in developing a range of diagnostic and therapeutic solutions, focusing on enhancing patient care through improved imaging and targeted therapies. The competitive landscape is characterized by ongoing research and collaborations aimed at expanding product offerings and meeting the growing demand for nuclear medicine applications.

CEO Statements

David Ricks– CEO of Lilly:

"We believe the future of radiopharmaceuticals is promising, and this acquisition will enhance our capabilities in this critical area"

Giovanni Caforio– CEO of Bristol Myers Squibb:

“As we advance our research in radioligand therapies, we are dedicated to delivering new options for patients battling difficult-to-treat cancers”

The radiopharmaceuticals industry is seeing dynamic advancements and strategic launches as key players focus on improving technological capabilities. Industry leaders are heavily investing in research, collaborations, and manufacturing innovations to enhance their competitive positioning. Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Radioisotope Type

By Application

By Source

By End User

By Region