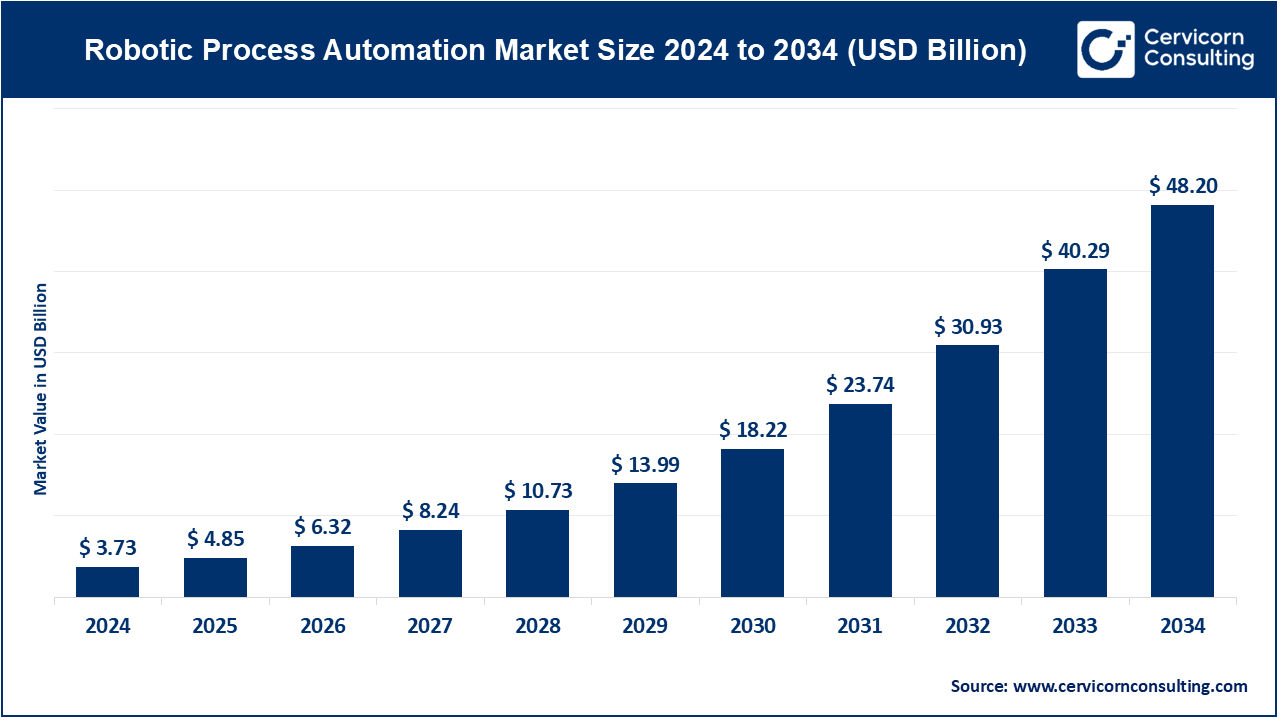

The global robotic process automation market size was accounted for USD 3.73 billion in 2024 and is estimated to reach around USD 48.20 billion by 2034, growing at a compound annual growth rate (CAGR) of 30.28% over the forecast period 2025 to 2034.

The global robotic process automation (RPA) market has witnessed substantial growth in recent years, driven by the increasing demand for automation to reduce operational costs, enhance efficiency, and improve accuracy across various industries. In particular, businesses in finance, healthcare, manufacturing, and customer service are adopting RPA to streamline their operations. The market is expected to continue growing at a rapid pace, with businesses leveraging RPA solutions to handle mundane tasks, allowing employees to focus on higher-value activities. Additionally, advancements in artificial intelligence (AI) and machine learning (ML) are expanding the scope of RPA, enabling bots to handle more complex processes. As of 2024, the RPA market is projected to reach several billion dollars globally, with significant investments from both startups and established tech giants. In 2020, UiPath raised USDD 225 million in Series E funding at a valuation of USD 10.2 billion, marking it as one of the largest players in the RPA industry. Their IPO in 2021 raised over USD 1 billion, further cementing RPA’s position as a high-growth market. This growth is fueled by the rising need for operational efficiency and scalability in a fast-paced business environment.

Robotic process automation (RPA) is a technology that uses software robots or "bots" to automate repetitive and rule-based tasks that were previously performed by humans. These tasks typically involve data entry, processing transactions, handling emails, and other routine office work. RPA works by mimicking the actions of a human user interacting with digital systems through interfaces like graphical user interfaces (GUIs). It reduces the need for manual labor, increases accuracy, and enhances productivity. RPA tools are designed to work with existing systems without requiring significant changes to the infrastructure, making them cost-effective and easy to implement.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 4.85 Billion |

| Market Size by 2034 | USD 48.20 Billion |

| Market Growth Rate | CAGR of 30.28% from 2025 to 2034 |

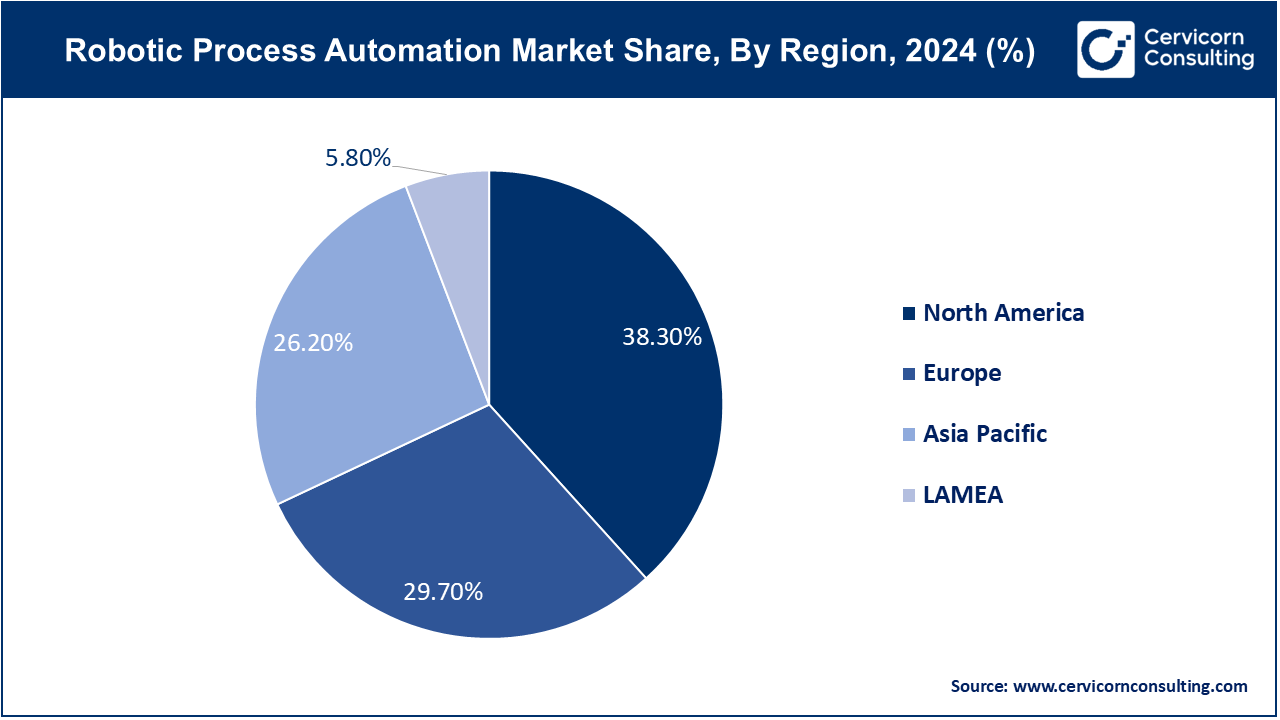

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Deployment, Organization, Operations, Application and Regions |

Workforce Augmentation

Business Continuity and Resilience

High Initial Implementation Costs

Integration Challenges with Legacy Systems

Expansion into Untapped Markets

Enhanced AI and Machine Learning Integration

Skill Gap and Talent Shortage:

Managing Change and Employee Resistance:

The robotic process automation market is segmented into type, deployment, organization, operations, application, and region. Based on type, the market is classified into software, service, consulting, implementation, and training. Based on deployment, the market is classified into cloud, and on-premise. Based on organization, the market is classified into large enterprises, small & medium enterprises. Based on operations, the market is classified into rule-based, and knowledge-based. Based on application, the market is classified into BFSI, pharma and healthcare, retail and consumer goods, Information Technology (IT) & telecom, communication, media, and education, manufacturing, logistics and energy & utilities, and others.

Software: The software segment has recorded market share of 37% in 2024. The software segment in the RPA market is driven by continuous advancements in AI and machine learning, enabling more sophisticated automation capabilities. The trend towards cloud-based RPA solutions enhances scalability and accessibility, encouraging widespread adoption. Innovations in RPA software facilitate seamless integration with existing systems, making it easier for businesses to implement and benefit from automation technologies.

Service: The services segment has generated market share of 63% in 2024. The service segment encompasses various support activities required to implement and maintain RPA solutions. The trend towards outsourcing RPA services allows companies to leverage expertise without significant upfront investment. Drivers include the growing need for managed services to ensure optimal performance and the demand for ongoing maintenance, updates, and support as automation technologies evolve.

Consulting: RPA consulting services are crucial for organizations to identify suitable processes for automation and develop tailored strategies. Trends indicate increasing reliance on consulting firms to navigate the complexities of RPA implementation. The demand is driven by the need for expert guidance to maximize ROI, minimize disruptions, and ensure alignment with business goals and regulatory requirements.

Implementing: The implementation segment involves the actual deployment of RPA solutions within an organization. Trends highlight a growing preference for rapid deployment methodologies to achieve quicker results. Key drivers include the urgency to improve operational efficiency and competitiveness, as well as the need for seamless integration with existing workflows to ensure smooth transitions and minimal downtime.

Training: Training is essential to equip employees with the skills needed to manage and utilize RPA tools effectively. Trends show an increasing investment in comprehensive training programs to address the skill gap. Drivers include the necessity for continuous learning to keep pace with technological advancements and the importance of fostering a culture of innovation and adaptability within the workforce.

Cloud: Cloud segment has accounted market share of 29% in 2024. The cloud deployment segment is rapidly growing due to its scalability, flexibility, and cost-effectiveness. Trends include increased adoption of cloud-based RPA solutions to leverage advanced features and ease of integration. Key drivers are the lower upfront costs, reduced need for IT infrastructure, and the ability to access and manage RPA tools remotely, supporting business continuity and agility.

On-premise: The on-premise segment has calculated dominating market share of 71% in 2024. On-premise deployment remains significant for organizations prioritizing data security and control. Trends indicate a steady demand in sectors with stringent regulatory requirements, such as finance and healthcare. Drivers include enhanced data privacy, customization capabilities, and direct control over the IT environment. This approach allows businesses to tailor RPA solutions to their specific needs while ensuring compliance with internal policies and external regulations.

Large Enterprises: Large enterprises segment has captured highest market share of 64% in 2024. Large enterprises are increasingly adopting RPA to enhance efficiency and streamline complex, high-volume processes. Trends include integrating RPA with AI and other advanced technologies to achieve end-to-end automation. Key drivers are the need to reduce operational costs, improve accuracy and compliance, and gain a competitive edge by leveraging automation for scalability and innovation across global operations.

Small & Medium Enterprises: Small & medium enterprises segment has reported market share of 36% in 2024. Small and Medium Enterprises (SMEs) are embracing RPA to remain competitive and optimize limited resources. Trends show a growing preference for cloud-based RPA solutions due to their affordability and ease of deployment. Drivers include the desire to automate repetitive tasks, enhance productivity, and scale operations without significant capital investment, enabling SMEs to focus on core business activities.

Rule-Based: Rule-based RPA focuses on automating structured, repetitive tasks based on predefined rules and workflows. Trends show widespread adoption in industries like finance and HR for tasks such as data entry and invoice processing. Key drivers include the need to improve efficiency, reduce human errors, and free up employees from mundane tasks, allowing them to focus on higher-value activities.

Knowledge-Based: Knowledge-based RPA leverages AI and machine learning to handle more complex, unstructured tasks requiring decision-making and context understanding. Trends indicate a growing interest in sectors like customer service and healthcare, where sophisticated automation can enhance service delivery. Drivers are the push for advanced analytics, improved customer experiences, and the ability to process and interpret vast amounts of data intelligently.

BFSI: BFSI segment has registered 28% of market share in the year of 2024. The BFSI sector is increasingly adopting RPA to automate processes like loan processing, fraud detection, and compliance reporting. Trends include integrating RPA with AI for enhanced decision-making and risk management. Key drivers are the need for efficiency, error reduction, regulatory compliance, and improved customer service through faster and more accurate transaction handling.

Pharma & Healthcare: Pharma & Healthcare segment has covered 14% of market share in 2024. In the pharma and healthcare industry, RPA is used for automating patient data management, claims processing, and regulatory compliance. Trends indicate growing adoption to enhance operational efficiency and patient care. Drivers include the need to reduce administrative burdens, improve data accuracy, and comply with stringent healthcare regulations, ultimately leading to better patient outcomes.

Retail & Consumer Goods: In 2024, retail & consumer goods segment has measured market share of 8%. Retail and consumer goods companies leverage RPA for inventory management, order processing, and customer service automation. Trends show increasing use of RPA to enhance supply chain efficiency and personalize customer interactions. Drivers include the need to streamline operations, reduce costs, and improve customer satisfaction by providing faster and more accurate services.

Information Technology (IT) & Telecom: 17% of market share has been recorded for IT and telecom segment in the year of 2024. The IT and telecom segment use RPA to manage network operations, customer support, and billing processes. Trends include integrating RPA with AI to handle complex tasks and enhance service delivery. Drivers are the demand for operational efficiency, reduced downtime, improved customer experiences, and the ability to scale operations rapidly in a competitive market.

Communication, Media & Education: This segment has captured a small market share of 4% in 2024. RPA is applied in communication, media, and education for content management, scheduling, and administrative tasks. Trends indicate growing adoption to manage large volumes of data and enhance user engagement. Key drivers are the need for efficient content delivery, improved administrative efficiency, and enhanced user experiences in increasingly digital and remote environments.

Manufacturing: The manufacturing segment has reported 10% of market share in 2024. Manufacturing companies adopt RPA for supply chain management, quality control, and production scheduling. Trends show a rise in automation to increase production efficiency and reduce errors. Drivers include the need to enhance operational efficiency, minimize costs, and improve product quality by automating repetitive and time-consuming tasks.

Logistics and Energy & Utilities: 12% of market share has been calculated for logistics and energy & utilities segment in the year of 2024. In logistics and energy segment, RPA is used for optimizing supply chain operations, billing, and maintenance scheduling. Trends include leveraging RPA for predictive maintenance and real-time data analysis. Drivers are the need to improve operational efficiency, reduce costs, and enhance reliability and service delivery in these critical infrastructure industries.

Others: The others segment has confirmed 7% of market share in the year of 2024. Other segment, includes government, legal, and hospitality, are increasingly adopting RPA to automate administrative and customer-facing processes. Trends show expanding use of RPA to improve service delivery and operational efficiency. Drivers include the need to streamline workflows, reduce operational costs, and enhance service quality and compliance in diverse applications.

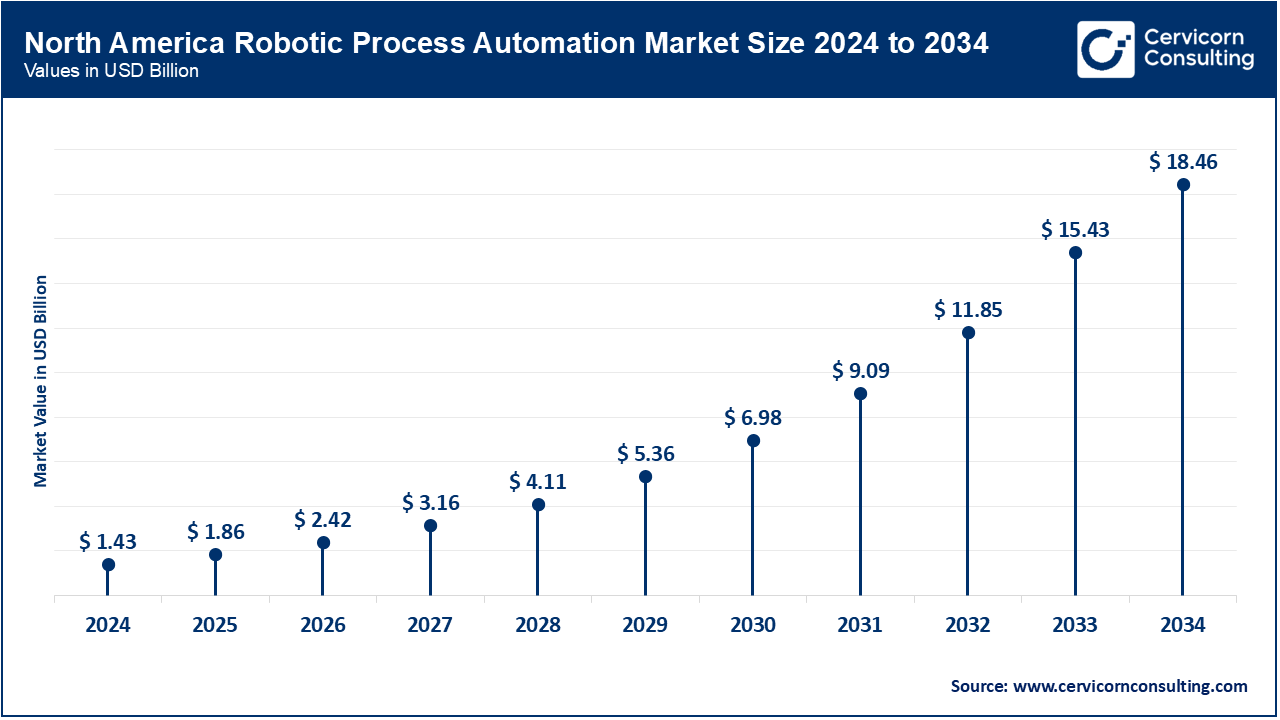

The North America market size is expected to reach around USD 18.46 billion by 2034 increasing from USD 1.43 billion in 2024 with a CAGR of 29.8%. North America dominates the Robotic Process Automation (RPA) market due to its advanced technological infrastructure and high adoption rates among enterprises. The region sees significant investments in AI and machine learning integration with RPA, driven by the need for operational efficiency and cost reduction. Key industries such as BFSI, healthcare, and retail are leveraging RPA for enhanced productivity and compliance. The presence of major RPA vendors and a robust ecosystem of service providers further bolster the market's growth in North America. The U.S market size is estimated to reach around USD 14.77 billion by 2034 increasing from USD 1.14 billion in 2024 with a CAGR of 30%.

The Asia Pacific market size is calculated at USD 0.98 billion in 2024 and is projected to grow around USD 12.63 billion by 20343 with a CAGR of 32.60%. The Asia-Pacific region is experiencing rapid growth in the RPA market, driven by the increasing digitalization of enterprises and government initiatives promoting automation. Countries like India, China, and Japan are at the forefront, with significant investments in AI and RPA technologies. The region's diverse industrial landscape, including manufacturing, IT, and BFSI, is adopting RPA to streamline operations, reduce costs, and improve service delivery. The burgeoning SME sector also contributes to the rising demand for scalable and cost-effective RPA solutions.

The Europe market size is measured at USD 1.11 billion in 2024 and is expected to grow around USD 14.32 billion by 2034 with a CAGR of 28.70%. Europe is a significant player in the RPA market, characterized by high adoption rates across various industries, including manufacturing, finance, and telecommunications. The region’s stringent regulatory environment drives the need for compliance-focused automation solutions. Additionally, initiatives towards digital transformation and Industry 4.0 are key trends propelling RPA adoption. European organizations are increasingly integrating AI and cognitive technologies with RPA to achieve advanced automation capabilities, enhancing operational efficiency and competitiveness in the global market.

The LAMEA market size is forecasted to reach around USD 2.8 billion by 2034 from USD 0.22 billion in 2024. The LAMEA region is gradually embracing RPA, with notable adoption in sectors such as BFSI, telecommunications, and energy. Economic diversification efforts and a growing focus on digital transformation are key drivers. Countries like Brazil, South Africa, and the UAE are investing in RPA to enhance operational efficiency and competitiveness. Challenges such as limited technological infrastructure and skilled workforce are being addressed through increased investments and partnerships with global RPA vendors, fostering market growth in this region.

Among the key players, AntWorks and AutomationEdge are emerging players leveraging advanced AI and machine learning to enhance their RPA capabilities, focusing on intelligent automation and data processing. Dominating players like UiPath, Automation Anywhere, and Blue Prism drive market growth through extensive collaborations and innovations. UiPath's partnerships with tech giants like Microsoft and Google have boosted its cloud and AI integrations, while Automation Anywhere’s collaboration with IBM enhances cognitive automation solutions. Blue Prism's ongoing innovations, such as its AI-powered Digital Workforce, continue to set industry standards and expand automation possibilities, reinforcing their leadership in the RPA market.

Daniel Dines, CEO of UiPath

Mihir Shukla, CEO of Automation Anywhere

Jason Kingdon, CEO of Blue Prism

Alan Trefler, CEO of Pegasystems

Mark Duffell, CEO of Kofax

Rob Enslin, CEO of UiPath

Market Segmentation

By Type

By Deployment

By Organization

By Operations

By Application

By Region