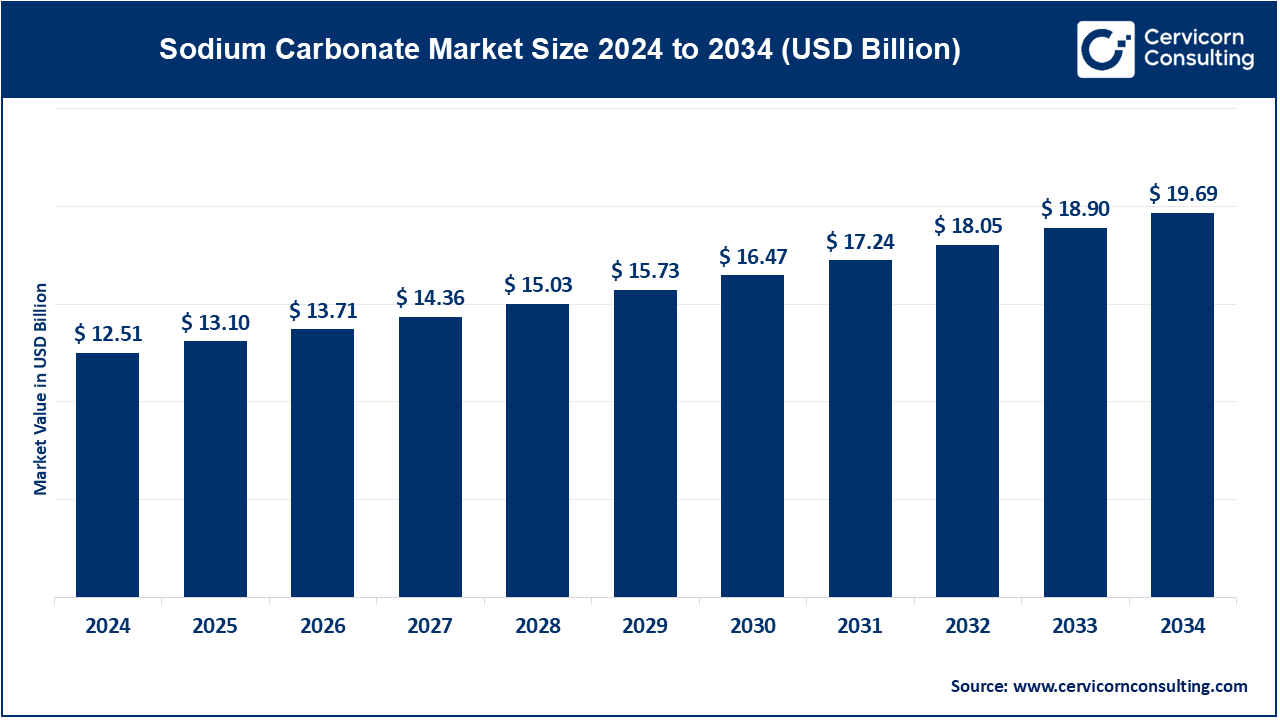

The global sodium carbonate market size was valued at USD 12.51 billion in 2024 and is expected to hit around USD 19.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.64% from 2025 to 2034.

The global market for sodium carbonate has experienced significant growth over the past few years. This growth is driven by the increasing demand in key sectors like glass manufacturing, detergents, chemicals, and water treatment. As urbanization and industrialization rise worldwide, particularly in developing countries, there has been a greater need for sodium carbonate in the production of flat glass for buildings, automobiles, and solar panels. Additionally, its use in laundry detergents and household cleaning products continues to contribute to the market's expansion. With the growing awareness of the benefits of sustainable industrial processes, manufacturers are increasingly focusing on developing eco-friendly production methods for sodium carbonate. Looking forward, the sodium carbonate market is expected to maintain a steady upward trajectory. The increasing adoption of sodium carbonate in emerging economies, coupled with expanding industrial sectors, is anticipated to fuel further growth.

The chemical industry is greatly reliant on sodium carbonate in the manufacture of detergents, soaps, and paper. Such demand is supported by environmental legislation on water treatment and cleaner production processes. The broad industrial applications inherently influence the market, while growth is especially fuelled by the Glass and Chemicals sectors, harnessed on evolving environmental standards and industrial expansion. Carbon dioxide (CO2) emissions from industries are amongst the main contributors to climate change.

Where one approach for dealing with these carbon emissions is the adoption of renewable and clean energy alternatives, on the other hand, a solution to control CO2 emissions includes carbon capture technology. Carbon capture technology can effectively and efficiently be applied with low energy consumption in order to remove CO2 emissions directly from their source into big CO2-emitting industries such as cement, oil refineries, and thermal power plants. Different types of materials have been attempted for the capture of CO2 in industries, which include zeolites, metal−organic frameworks, natural minerals, alkalis, and alkali metal salts. Among them, the alkali metal carbonates-like sodium carbonate (Na2CO3)-are regarded as appropriate and inexpensive materials having stable properties, easy to procure.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 12.51 Billion |

| Projected Market Size (2034) | USD 19.69 Billion |

| Growth Rate (2025 to 2034) | 4.64% |

| Leading Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Type, Form, Application, End User, Region |

| Top Companies | Solvay SA, Tata Chemicals Limited, Ciner Group, FMC Corporation, Nirma Limited, GHCL Limited, OCI Chemical Corporation, Shandong Haihua Group Co., Ltd., Sichuan Hebang Corporation Limited, Genesis Energy, L.P., Tokuyama Corporation, CIECH Group, China National Chemical Corporation (ChemChina), Tronox Holdings plc |

Glass Manufacturing: Sodium carbonate plays a pivotal role in the glass manufacturing industry, where it is a key ingredient used to lower the melting point of silica, the primary component of glass. By reducing the melting temperature, sodium carbonate helps in making the glass production process more energy-efficient and cost-effective. Additionally, it improves the workability of molten glass, allowing for easier shaping and forming of various glass products, such as flat glass for windows, container glass for bottles, and specialty glass for high-tech applications.

Chemicals Manufacturing: In the chemical industry, sodium carbonate is a vital raw material used in the production of several important chemicals. It is integral in the synthesis of sodium silicates, which are used in adhesives, detergents, and as a raw material for silica gel. Sodium carbonate is also essential in the production of sodium bicarbonate, commonly known as baking soda, and sodium percarbonate, a component in oxygen-based bleaches. The versatility of sodium carbonate in chemical manufacturing highlights its importance as a fundamental building block in various industrial processes.

Detergents and Soaps: Sodium carbonate is widely used in the formulation of detergents and soaps, where it acts as a water softener and a cleaning agent. Its ability to remove calcium and magnesium ions from hard water helps in preventing the formation of soap scum and enhances the effectiveness of detergents. In both household and industrial cleaning products, sodium carbonate is valued for its ability to break down stains, grease, and grime, making it a crucial ingredient in laundry detergents, dishwashing agents, and general-purpose cleaners.

Water Treatment: Sodium carbonate is employed in water treatment processes to adjust the pH of water, making it suitable for various industrial and municipal applications. In water treatment plants, it is used to neutralize acidic water, thereby preventing corrosion in pipes and other infrastructure. Sodium carbonate is also used to soften water by precipitating out calcium and magnesium ions, which are responsible for water hardness. This application is particularly important in industrial settings where water quality directly impacts the efficiency of equipment and processes.

Pulp and Paper: In the pulp and paper industry, sodium carbonate is used during the pulping process to help break down wood fibers and separate lignin from cellulose. It is also used in the bleaching process to whiten paper by removing residual lignin that causes discoloration. Sodium carbonate’s role in controlling the pH of the pulp mixture is crucial for optimizing the pulping and bleaching efficiency, ensuring the production of high-quality paper products with the desired characteristics.

Food Processing: Sodium carbonate finds application in the food processing industry, where it is used for pH control, as a leavening agent, and in other specific food applications. In baking, sodium carbonate is used in combination with acids to produce carbon dioxide gas, which helps dough and batter rise. It is also used to regulate the acidity in various food products, ensuring consistent taste and texture. Additionally, sodium carbonate is used in food preservation and as a stabilizer in certain processed foods.

Glass Industry: The glass industry is the largest consumer of sodium carbonate, where it is primarily used in the production of flat glass for windows, container glass for bottles and jars, and other glass products. Sodium carbonate’s role in reducing the melting point of silica and enhancing the workability of molten glass makes it indispensable in glass manufacturing. The growing demand for glass in construction, automotive, and packaging industries drives the consumption of sodium carbonate, making it a critical component in the global glass supply chain.

Chemical Industry: The chemical industry relies on sodium carbonate as a key raw material for the synthesis of various chemical products and intermediates. Its use in producing sodium silicates, bicarbonate, and percarbonate is fundamental to numerous industrial applications, including the manufacture of detergents, adhesives, and bleaching agents. The versatility of sodium carbonate in chemical reactions and its availability make it a preferred choice in the chemical manufacturing sector.

Detergent Industry: In the detergent industry, sodium carbonate is used extensively in the formulation of cleaning agents for both consumer and industrial use. Its ability to soften water and enhance the cleaning power of detergents makes it a staple ingredient in laundry powders, liquid detergents, and dishwasher tablets. Sodium carbonate is also used in industrial cleaning solutions for removing heavy-duty stains and residues, highlighting its importance across various cleaning applications.

Water Treatment: Municipalities and industries use sodium carbonate in water treatment to control water hardness and alkalinity. Its role in adjusting the pH and precipitating calcium and magnesium ions makes it an essential chemical for ensuring water quality in both public water supplies and industrial processes. The demand for clean and safe water in urban areas and industrial applications drives the use of sodium carbonate in water treatment plants and facilities.

Pulp and Paper Industry: The pulp and paper industry integrate sodium carbonate into the paper manufacturing process, where it plays a vital role in pulping and bleaching. Its use in breaking down wood fibres and removing lignin ensures the production of high-quality paper with the desired whiteness and strength. Sodium carbonate’s contribution to the chemical pulping process is crucial for producing a wide range of paper products, from newsprint to high-grade office paper.

Food and Beverage Industry: In the food and beverage industry, sodium carbonate is used in food processing, particularly in baking and as a food additive. Its role as a leavening agent in baked goods helps produce light and fluffy textures, while its pH-regulating properties are important for maintaining the consistency and safety of processed foods. Sodium carbonate is also used in the production of certain beverages and food preservation processes, making it an important ingredient in the food industry.

Dense Soda Ash: Dense soda ash is a high-density form of sodium carbonate used primarily in glass manufacturing and other industrial applications. Its granulated form is ideal for high-temperature processes, where it ensures consistent melting and chemical reactions. Dense soda ash’s properties make it particularly suitable for producing flat and container glass, where precise control over the composition and quality of the glass is required.

Light Soda Ash: Light soda ash is a lower-density form of sodium carbonate used in detergents, chemicals, and various other applications. Its lighter weight makes it easier to handle and mix in manufacturing processes, particularly in the production of cleaning agents, where it helps to soften water and enhance the effectiveness of detergents. Light soda ash is also used in the chemical industry for producing sodium silicates and other compounds.

Soda Crystals: Soda crystals, or crystalline sodium carbonate, are used in domestic cleaning, water treatment, and as a laundry additive. Their crystalline structure makes them effective for removing stains, grease, and odors, making them a popular choice for household cleaning products. Soda crystals are also used in water treatment to adjust pH levels and in various industrial applications where a solid form of sodium carbonate is preferred.

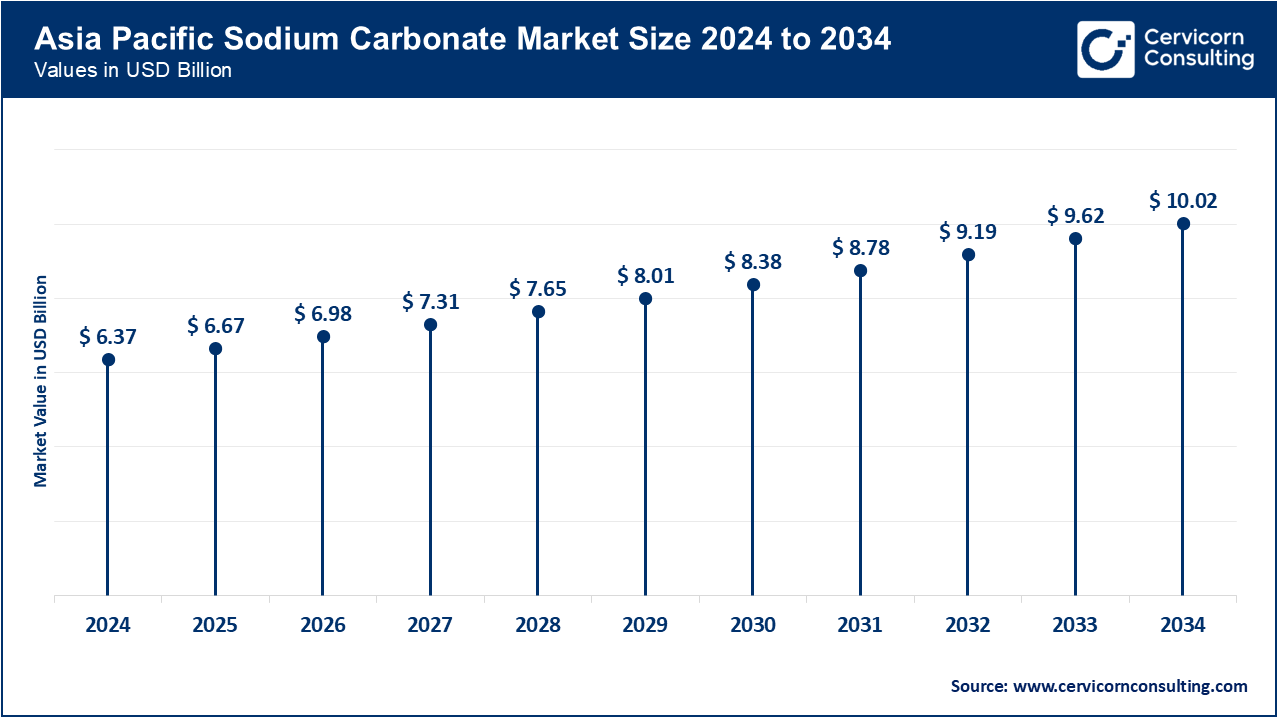

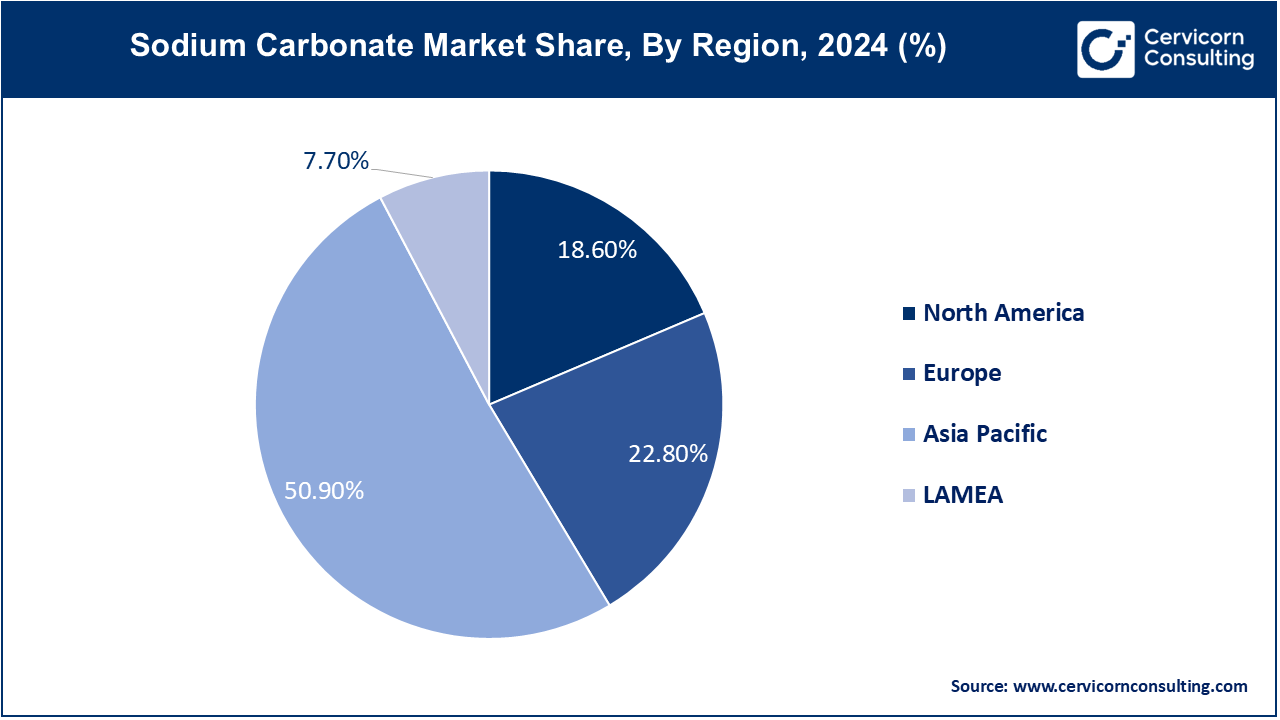

The Asia-Pacific sodium carbonate market size was estimated at USD 6.37 billion in 2024 and is expected to reach around USD 10.02 billion by 2034, expanding at a CAGR of 4.8%. The Asia-Pacific region is leading market, driven by increasing industrialization and urbanization. China and India are the largest contributors, with significant demand coming from the construction, textile, and detergent industries. Japan and South Korea also play important roles, particularly in high-end applications like electronics and pharmaceuticals. The region's growth is supported by large-scale investments in manufacturing infrastructure and a growing emphasis on water treatment, which is crucial for supporting the region’s expanding industrial base and urban population.

The North America sodium carbonate market size was accounted for USD 2.33 billion in 2024 and is projected to surpass around USD 3.66 billion by 2034, growing at a CAGR of 4.6%. The North America is expanding with rapid growth, driven by strong demand from the glass manufacturing and detergent industries. The United States, in particular, is a major producer and consumer, benefiting from abundant natural resources and advanced production technologies. Canada also contributes to market growth, especially in the water treatment and chemicals sectors. The region's market dynamics are shaped by consistent industrial demand, technological advancements, and regulatory standards that support the use of sodium carbonate in various applications.

The Europe sodium carbonate market size was valued at USD 2.85 billion in 2024 and is predicted to reach around USD 4.49 billion by 2034. Europe is a significant player in the market, with demand fueled by the construction and automotive sectors, particularly due to the region's focus on glass production. Countries like Germany and France lead in production and consumption, supported by stringent environmental regulations that favor the use of sodium carbonate in sustainable manufacturing processes. The European market is characterized by a strong emphasis on environmental sustainability and innovation in production techniques, which align with the broader goals of reducing industrial emissions and enhancing resource efficiency.

The LAMEA sodium carbonate market was woth at USD 0.96 billion in 2024 and is expected to garner around USD 1.52 billion by 2034. In the LAMEA region, the market is emerging, with growth primarily driven by industrial expansion and increasing demand for water treatment solutions. Brazil and South Africa are key markets within this region, benefiting from their growing manufacturing sectors and the need for efficient water management practices. The Middle East's construction boom also contributes to the demand for glass production, thereby driving sodium carbonate consumption. However, market growth in this region is moderated by economic and infrastructural challenges, though the region’s vast natural resources present significant opportunities for future development.

The sodium carbonate market is characterized by the presence of several key players that dominate the global landscape. Leading companies like Solvay S.A., Tata Chemicals Ltd., and Ciner Group are among the major producers, with extensive manufacturing facilities and distribution networks. Solvay S.A. is a prominent player known for its integrated production process and strong focus on sustainability. Tata Chemicals Ltd. stands out with its significant production capacity and diversified product offerings. Ciner Group, one of the world's largest natural soda ash producers, benefits from its cost-effective extraction methods.

These players are actively engaged in expanding their market presence through strategic partnerships, mergers, and acquisitions, as well as investments in research and development to enhance product quality and meet the growing demand from various end-use industries such as glass, chemicals, and detergents. The market is also seeing the entry of new players and increased competition, particularly in regions with abundant raw materials and low production costs.

CEO Statements

Marguerite Morrin, executive director, soda ash, at Chemical Market Analytics, said “It’s already a challenge for European producers,” in a September 2022 market update video. Of the 70 or so synthetic soda ash plants operating worldwide, 16 are in Europe and Turkey.

Ilham Kadri, CEO of Solvay SA: As the demand for sodium carbonate, particularly in the glass and detergent sectors, continues to grow globally, we are focused on advancing sustainable production methods. This not only helps us meet regulatory requirements but also strengthens our position as a leader in green chemistry solutions."

R. Mukundan, Managing Director & CEO of Tata Chemicals: Our investment in expanding sodium carbonate production is a strategic move to support the burgeoning industrial needs in Asia. By enhancing our production capabilities, we aim to cater to the rising demand from the glass and detergent industries, particularly in India and China."

Kamil Yilmaz, CEO of Ciner Group: "Ciner Group remains at the forefront of the sodium carbonate industry by continuously integrating new technologies into our operations. These innovations are crucial for enhancing production efficiency and expanding the applications of soda ash, especially in the chemical and water treatment industries."

These developments underscore significant strides in advancing infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the market.

Strategic partnerships and Launches highlight the rapid advancements and collaborative efforts in the sodium carbonate market. Industry players are involved in various aspects of sodium carbonate, including production, storage technologies, and fuel cells, and play a significant role in advancing the market. Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Form

By Application

By End-User

By Region