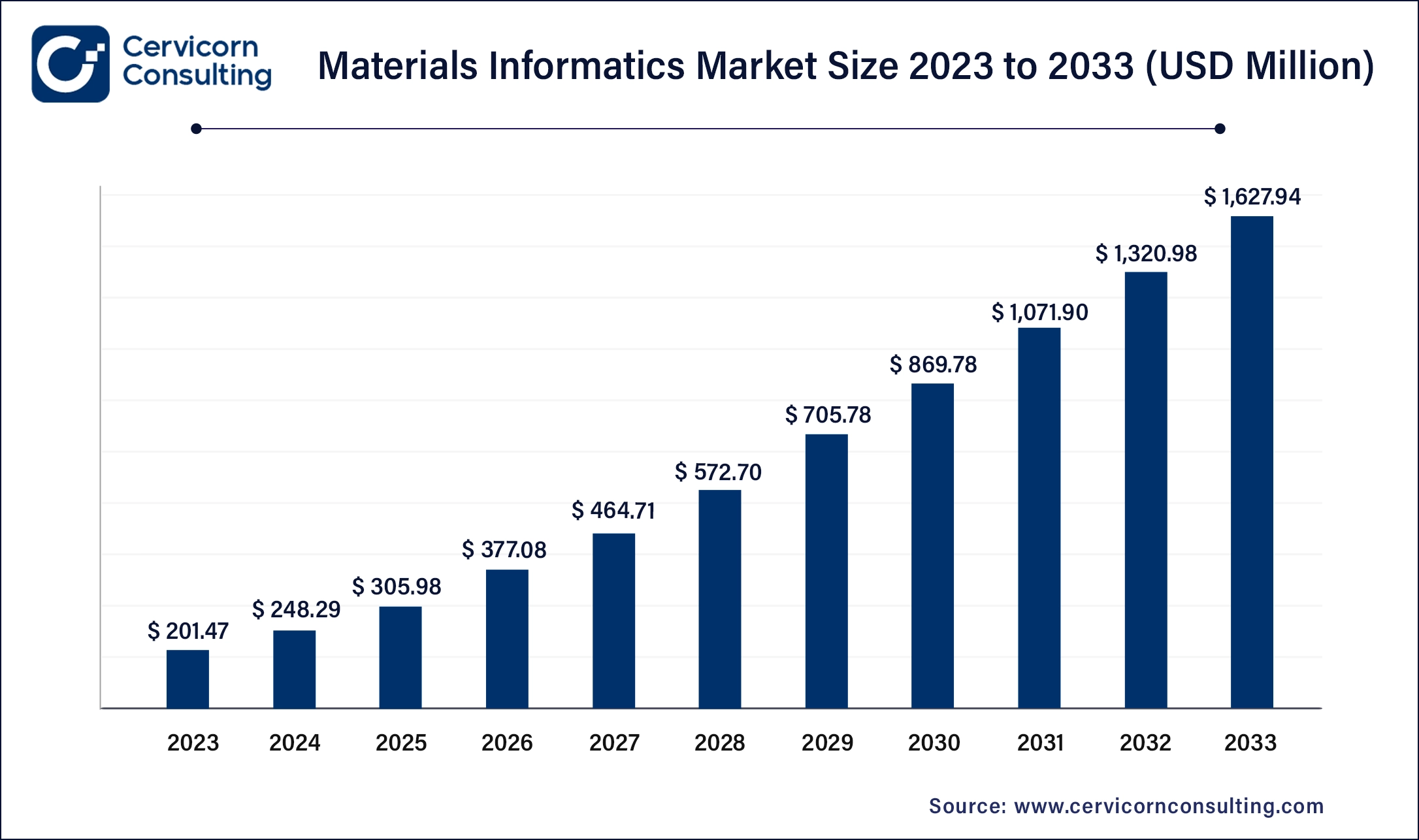

The global materials informatics market size was valued at USD 248.29 million in 2024 and is estimated to reach around USD 1,896.31 million by 2034, exhibiting a compound annual growth rate (CAGR) of 22.54% during the forecast period 2025 to 2034.

The materials informatics market has been growing steadily, driven by increasing demand for innovative materials in industries like aerospace, automotive, electronics, and renewable energy. As industries move towards more sustainable and high-performance materials, the application of machine learning and AI to optimize material properties has become crucial. The global market for materials informatics is expected to continue expanding as new technologies emerge and the need for advanced materials in diverse fields grows. With key advancements in artificial intelligence, computational materials science, and automated laboratories, materials informatics is poised to play a critical role in shaping the future of materials development, contributing to the rapid advancement of technology and sustainability efforts worldwide.

The materials informatics market focuses on leveraging data science, machine learning, and artificial intelligence to accelerate materials research and development. It integrates computational methods with experimental data to discover and optimize materials properties, accelerating the design and deployment of new materials across industries like electronics, healthcare, and manufacturing. Key players in the market offer software platforms and services that enable scientists and engineers to analyze large datasets, predict material behaviors, and optimize formulations. This approach enhances efficiency, reduces time-to-market, and fosters innovation in materials science, addressing global challenges such as sustainability and technological advancement.

Materials informatics is an interdisciplinary field that combines materials science, data science, and computational tools to accelerate the discovery, design, and optimization of materials. By leveraging vast amounts of data from experimental results, simulations, and other sources, materials informatics aims to uncover patterns, predict material properties, and facilitate the design of novel materials with specific characteristics. This approach integrates machine learning algorithms, artificial intelligence, and data mining techniques to create predictive models that guide material development, significantly reducing the time and cost of traditional trial-and-error methods. Materials informatics plays a critical role in advancing industries like electronics, energy, aerospace, and healthcare, where the demand for new and improved materials is constantly increasing.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 305.98 Million |

| Projected Market Size in 2034 | USD 1,896.31 Million |

| CAGR (2025 to 2034) | 22.54% |

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Material, Technique, Application, Region |

| Key Companies | Citrine Informatics, Materials Zone Ltd., BASF, Kebotix, AI Materia, Granta Design, Altair Engineering, Molecular Vista, Cambridge Crystallographic Data Centre (CCDC), Materials Design, Inc., and Exabyte.io. |

Integration of IoT and Sensor Technologies:

Global Shift Towards Industry 4.0 and Smart Manufacturing:

Complexity and Integration Challenges:

Data Privacy and Security Concerns:

Supply Chain Optimization and Resilience:

Circular Economy and Waste Reduction:

Data Quality and Integration Complexity:

Ethical and Legal Considerations:

Organic Materials: Organic materials segment was second largest market share holder in 2024 which was 34.65%. Organic materials, including polymers and carbon-based compounds, are optimized through materials informatics for applications in electronics, healthcare, and coatings. Trends include AI-driven molecular modelling for enhanced property prediction and design of biocompatible materials for medical devices.

Inorganic Materials: Inorganic materials segment has recorded market share of 52.51% in 2024. Inorganic materials like metals, ceramics, and semiconductors are analyzed using materials informatics to improve strength, conductivity, and durability. Trends include digital twin simulations for structural analysis and AI algorithms for optimizing material composition in aerospace and automotive industries.

Hybrid Materials: Hybrid materials segment has reported market share of around 12.84% in 2024. Hybrid materials combine organic and inorganic components, benefiting from materials informatics to design multifunctional properties for applications in renewable energy and biomedicine. Trends include AI-enhanced composite design and simulation for tailored performance in advanced manufacturing and energy storage solutions.

Digital Annealer: Digital annealer segment has spoted market share of 38.92% in 2024. Digital annealers simulate physical annealing processes using quantum-inspired algorithms to solve combinatorial optimization problems in materials informatics. Trends include its application in optimizing material properties and configurations for various industrial applications, such as semiconductor design and energy storage.

Deep Tensor: Deep tensor segment has registered market share of 26.74% in 2024. Deep tensor methods apply deep learning techniques to multi-dimensional data structures (tensors) in materials informatics. This approach enables complex analysis and prediction of materials properties, facilitating advancements in materials discovery, molecular dynamics simulations, and material design optimization.

Statistical Analysis: Statistical analysis segment has noted share of 17.50% in 2024. Statistical analysis methods in materials informatics involve analyzing large datasets to identify correlations, patterns, and trends in materials properties. Trends include the integration of statistical modeling with experimental data to validate predictions and optimize material performance across diverse applications.

Genetic Algorithm: Genetic algorithm segment has listed market share of 12.22% in 2024. Genetic algorithms simulate evolutionary processes to optimize materials design and selection. Trends include their application in exploring vast material composition spaces, predicting material properties, and enhancing materials performance in sectors like aerospace, automotive, and renewable energy.

Others: Other techniques in materials informatics encompass a range of computational and experimental methods, such as machine learning models, high-throughput experimentation, and quantum simulations. Emerging trends focus on integrating these techniques to achieve holistic materials design, accelerate innovation, and address sustainability challenges in various industries.

Chemical Industries: Chemical industries segment has reported share of 35.82% in 2024. Chemical industries focuses on optimizing catalysts, polymers, and process efficiency. Trends include AI-driven molecular simulations for faster material discovery and sustainability initiatives for eco-friendly products.

Dyes: Dyes segment has reported market share of around 14.10% in 2024. In dyes, materials informatics enhances color stability, biodegradability, and application efficiency. Trends include predictive modeling for new dye formulations and sustainable dye synthesis methods.

Research and Development Agencies: R&D agencies segment has captured share of 20.74% in 2024. These agencies utilize materials informatics for diverse applications like materials characterization, performance prediction, and innovation acceleration. Trends include collaborative platforms for data sharing and AI-driven insights for rapid prototyping.

Others: Others segment has captured share of 29.34% in 2024. Additional applications span from electronics to healthcare, utilizing materials informatics for tailored material design and optimization, leveraging AI for advanced material properties prediction and performance enhancement.

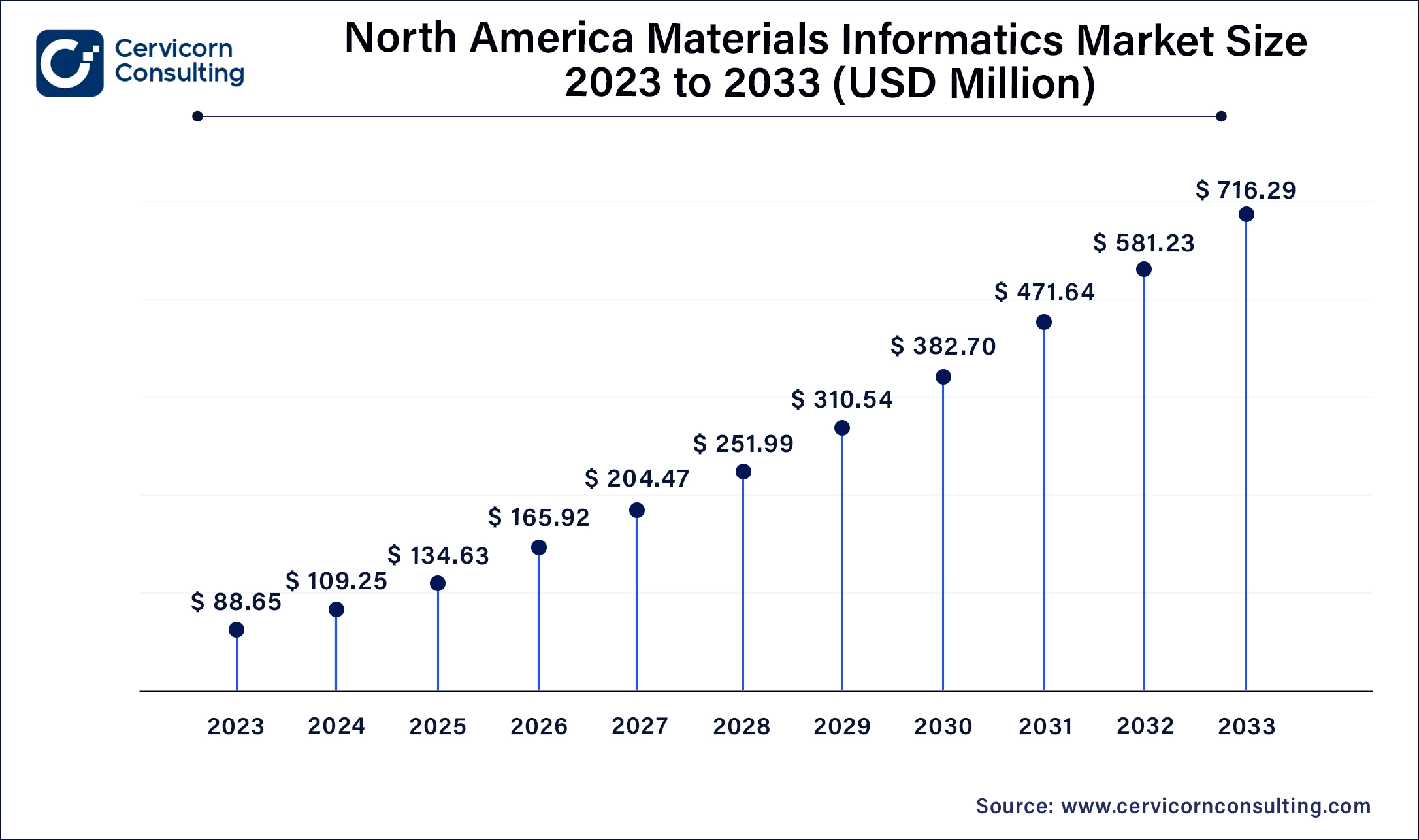

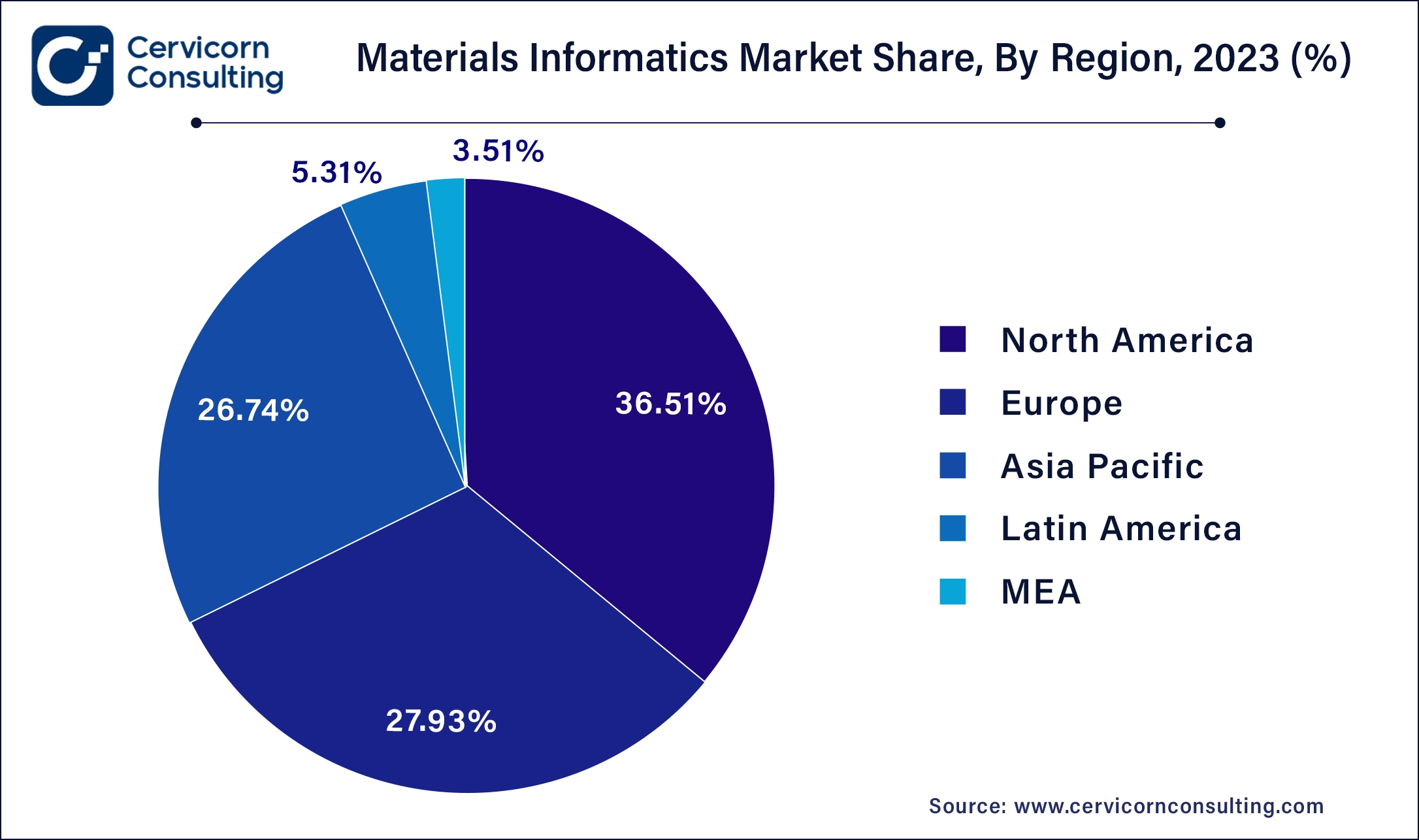

North America has reported highest share in 2024 which is 36.34%. In North America, the adoption of materials informatics is prominently driven by advanced manufacturing practices and the pursuit of cutting-edge technologies. The region leads in leveraging Materials Informatics for the development of smart materials and additive manufacturing processes. Companies and research institutions are increasingly integrating Internet of Things (IoT) technologies with materials informatics to enable real-time monitoring and optimization of material performance in industrial settings.

Europe materials informatics market was valued approximately at USD 60.35 million in 2024 and is projected to grow at USD 529.64 million by 2034 from USD 85.46 million in 2025. Europe places a significant emphasis on sustainability and regulatory compliance in materials informatics applications. The region leads in developing eco-friendly materials and promoting circular economy initiatives through advanced materials design and recycling technologies. Stringent environmental and safety regulations drive the adoption of materials informatics to ensure compliance and optimize resource efficiency.

Asia Pacific materials informatics market size was valued at USD 66.57 million in 2024 and is projected to reach around USD 508.40 million by 2034 from USD 82.03 million in 2025. Asia-Pacific is characterized by rapid industrialization and technological advancement. The region's dynamic manufacturing sectors, including electronics, automotive, and infrastructure, are driving demand for innovative materials solutions. Investments in AI, big data analytics, and materials simulation tools are accelerating materials research and development efforts.

In LAMEA, materials informatics plays a crucial role in optimizing natural resource utilization and supporting infrastructure development projects. The region's rich natural resources drive the adoption of materials informatics in mining, energy, and construction sectors to enhance efficiency and sustainability. Governments and industries are increasingly investing in renewable energy technologies, driving demand for materials solutions in solar, wind, and battery technologies.

The market has seen several partnerships in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability.

Market Segmentation

By Material

By Technique

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Materials Informatics

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Overview

2.2.2 By Technique Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Materials Informatics Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Integration of IoT and Sensor Technologies

4.1.1.2 Global Shift Towards Industry 4.0 and Smart Manufacturing

4.1.1.3 Government Initiatives to support materials & RD

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Security Concerns

4.1.2.2 Complexity and Integration Challenges

4.1.3 Market Opportunity

4.1.3.1 Circular Economy and Waste Reduction

4.1.3.2 Supply Chain Optimization and Resilience

4.1.4 Market Challenges

4.1.4.1 Data Quality and Integration Complexity

4.1.4.2 Ethical and Legal Considerations

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Materials Informatics Market Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.7 Key Stakeholder and Buying Criteria

5.8 Pricing Analysis

5.9 Regulatory Landscape

5.10 Market Investment Feasibility Index

5.11 Major Companies sales by Value & Volume

5.12 Technology Analysis

Chapter 6 Materials Informatics Market Estimates, Trends, Forecast, By Material

6.1 Market Snapshot, By Material

6.2 Market Revenue ($Million) and Growth Rate (%), 2021-2034 (USD Million)

6.2.1 Organic Materials

6.2.1.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.2.2 Inorganic Materials

6.2.2.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.2.3 Hybrid Materials

6.2.3.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7 Materials Informatics Market Estimates, Trends, Forecast, By Technique

7.1 Market Snapshot, By Technique

7.2 Market Revenue ($Million) and Growth Rate (%), 2021-2034

7.2.1 Digital Annealer

7.2.1.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.2 Deep Tensor

7.2.2.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.3 Statistical Analysis

7.2.3.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.4 Genetic Algorithm

7.2.3.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.2.5 Others

7.2.3.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8 Materials Informatics Market Estimates, Trends, Forecast, By Application

8.1 Market Snapshot, By Application

8.2 Market Revenue ($Million) and Growth Rate (%), 2021-2034

8.2.1 Chemical Industries

8.2.1.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.2 Dyes

8.2.2.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.3 Research and Development Agencies

8.2.3.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

8.2.4 Others

8.2.3.1 Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 9 Materials Informatics Market Estimates, Trends, Forecast, By Region

9.1 Overview/Key Trends

9.2 Market Revenue ($Million) and Growth Rate (%), By Region 2023 (%)

9.3 North America

9.3.1 US

9.3.2 Canada

9.4 Europe

9.4.1 UK

9.4.2 Germany

9.4.3 France

9.4.4 Italy

9.4.5 Spain

9.4.6 Rest of Europe

9.5 Asia-Pacific

9.5.1 India

9.5.2 China

9.5.3 Japan

9.5.4 South Korea

9.5.5 Australia

9.5.6 Philippines

9.5.7 Singapore

9.5.8 Thailand

9.5.9 Malaysia

9.5.10 Vietnam

9.5.11 Indonesia

9.5.12 Rest of APAC

9.6 MEA

9.6.1 GCC

9.6.2 North Africa

9.6.3 South Africa

9.6.4 Rest of MEA

9.7 Latin America

9.7.1 Brazil

9.7.2 Argentina

9.7.3 Rest of Latin America

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.1.4 Company Valuation and Financial Metrics

10.1.5 Product/Brand Comparison

10.2 Recent Developments by the Market Contributors (2023)

10.3 Competitive Scenario and Trends

10.3.1 Product Unveiling

10.3.2 Deals

10.3.3 Others

Chapter 11 Company Profiles

11.1 Citrine Informatics

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Materials Zone Ltd.

11.3 BASF

11.4 Kebotix

11.5 AI Materia

11.6 Granta Design

11.7 Altair Engineering

11.8 Molecular Vista

11.9 Cambridge Crystallographic Data Centre (CCDC)

11.10 Materials Design, Inc.

11.11 Alpine Electronics Inc.

11.12 Phaseshift Technologies

11.13 Nutonian Inc.

11.14 Schrodinger

Chapter 12 Appendix

14.1 About Us

14.2 Discussion Guide

14.3 Details of Author

14.4 Relevant Reports