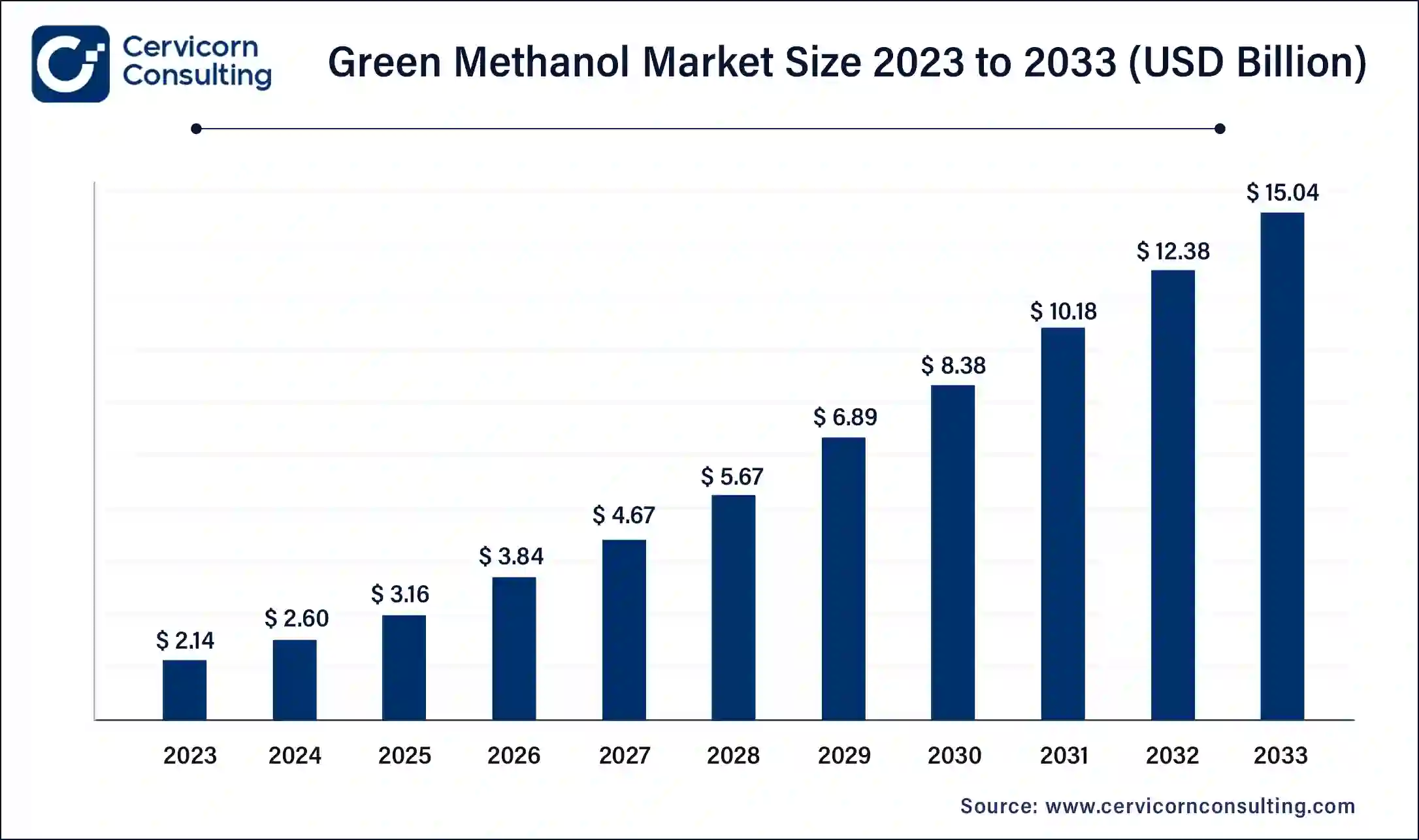

The global green methanol market size was accounted for USD 2.60 billion in 2024 and is projected to grow around USD 17.39 billion by 2034, growing at a remarkable compound annual growth rate (CAGR) of 20.92% from 2025 to 2034.

The green methanol market is growing rapidly, driven by the increasing demand for sustainable fuels and the global push for decarbonization. Green methanol is gaining traction in the maritime industry as a potential clean fuel for shipping, with companies exploring its use as a replacement for heavy fuel oil, which is a significant contributor to maritime greenhouse gas emissions. Additionally, green methanol is being integrated into various industries, including the automotive and chemical sectors, where it can serve as a clean alternative to conventional methanol and other fossil fuel-based products. The expansion of green methanol production facilities, coupled with advancements in carbon capture technologies and renewable energy, is expected to drive the market's growth over the coming years.

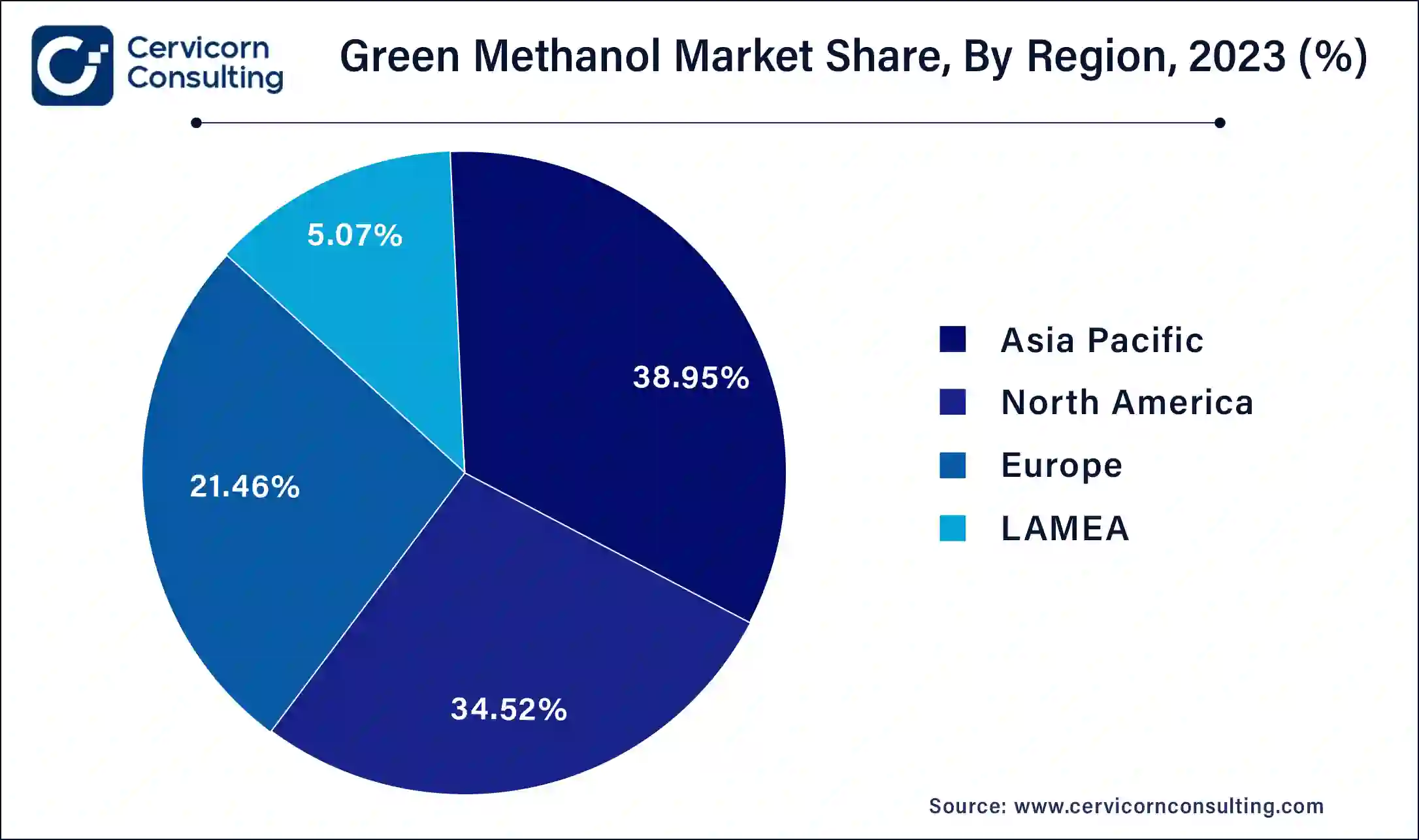

The green methanol market focuses on producing methanol from renewable resources and sustainable processes. This eco-friendly alternative to traditional methanol is derived from feedstocks like biomass, municipal solid waste, and CO2 capture. The market is driven by the push for reduced carbon emissions and the adoption of green fuels in transportation, power generation, and chemical industries. Technological advancements in production methods, such as biomass gasification and CO2 hydrogenation, are enhancing market growth. Regions like North America, Europe, and Asia-Pacific are leading in green methanol adoption due to supportive policies and increasing demand for sustainable energy solutions.

What is the green methanol?

Green methanol is a sustainable and renewable form of methanol produced from renewable sources like biomass, waste, and carbon dioxide (COâ‚‚) captured from industrial processes or the atmosphere. Unlike conventional methanol, which is derived from fossil fuels such as natural gas, green methanol plays a key role in reducing greenhouse gas emissions and combating climate change. The production of green methanol can be achieved through various processes, including biomass gasification, carbon capture utilization and storage (CCUS), and the electrolysis of water to produce hydrogen, which is then combined with captured COâ‚‚ to create methanol. Types of green methanol include biomass-based methanol, COâ‚‚-based methanol, and green methanol from hydrogen produced via renewable energy sources. These methods not only reduce the reliance on fossil fuels but also provide a cleaner alternative for industrial applications like fuel, chemicals, and energy storage.

The Carbon Intensity of the Electricity Grid in Selected Countries and Corresponding Values in Hydrogen Production

| Germany | UK | USA | China | India | |

|

Carbon Intensity of Grid kgCO2e/kWh |

0.401 | 0.2 | 0.417305 | > 0.7 | 0.697 |

| Carbon Intensity for Producing 1 kg H2 (kgCO2e) | 21.05 | 10.50 | 21.91 | > 36.75 | 36.59 |

Report Scope

| Coverage | Details |

| Market Size in 2025 | USD 3.16 Billion |

| Market Growth Rate | CAGR of 20.92% |

| U.S. Market Share | 76% in 2024 |

| APAC Market Share | 21.5% in 2024 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

Advancements in Carbon Capture Technologies:

Increased Awareness of Climate Change Impacts:

High Production Costs:

Limited Infrastructure for Distribution and Storage:

Development of New Applications:

Strategic Partnerships and Collaborations:

Technological Scalability Issues:

Competition from Other Renewable Fuels:

Biomass: Biomass segment has reported revenue share of 27% in 2024. Biomass feedstock for green methanol includes organic materials like agricultural residues, forestry waste, and energy crops. This renewable source is converted into methanol through gasification or fermentation. Trends show increasing investment in biomass-based green methanol due to its sustainability and ability to reduce waste. Technological advancements are enhancing the efficiency and cost-effectiveness of biomass conversion processes.

Municipal Solid Waste: Municipal solid waste segment has measured 40% revenue share in 2024. Municipal solid waste (MSW) as a feedstock involves converting urban waste into green methanol. This process helps address waste management issues while producing renewable fuel. Trends include rising adoption due to the dual benefits of waste reduction and renewable energy production. Advances in waste-to-energy technologies are improving the efficiency and viability of using MSW for methanol production.

Industrial Waste: Industrial waste segment has calculated revenue share of 22% in 2024. Industrial waste feedstock includes by-products and residues from industrial processes, which can be converted into green methanol. This approach helps in managing industrial by-products while producing sustainable fuel. Trends highlight growing interest in utilizing industrial waste due to regulatory pressures and the need for circular economy solutions. Innovations are enhancing the integration of industrial waste into methanol production systems.

CO2 Capture and Utilization: In 2024, CO2 capture and utilization segment has accounted revenue share of 11%. CO2 capture and utilization involves converting captured carbon dioxide into green methanol. This method addresses carbon emissions from industrial sources by recycling CO2 into valuable fuel. Trends include increased focus on this technology due to its potential for reducing greenhouse gas emissions and supporting climate goals. Advances in CO2 capture technologies and catalytic processes are driving market growth.

Biomass Gasification: Biomass gasification involves converting organic materials, such as agricultural residues or wood chips, into syngas, which is then used to produce green methanol. Trends show growing interest in this technology due to its ability to utilize waste materials and reduce carbon footprints. Enhanced efficiency and scaling of biomass gasification processes are driving market adoption.

CO2 Hydrogenation: CO2 hydrogenation converts captured carbon dioxide and hydrogen into methanol using catalytic processes. This method is gaining traction due to its potential to recycle CO2 emissions and produce renewable methanol. Trends include advancements in catalysts and integration with carbon capture technologies, boosting its viability and market growth.

Electrolysis: Electrolysis splits water into hydrogen and oxygen using renewable electricity, with the hydrogen then used to produce green methanol. This method is becoming more prominent as renewable energy sources grow. Trends involve improving electrolyzer efficiency and integrating with renewable power grids to enhance the economic feasibility of electrolysis for methanol production.

Methanol from Renewable Electricity: This process generates methanol using electricity from renewable sources, such as wind or solar power, to electrolyze water and produce hydrogen. The hydrogen is then used to synthesize methanol. Trends indicate increasing investments in renewable energy integration and technological advancements, improving the scalability and cost-effectiveness of this method.

Others: Other production technologies include various innovative methods like photoelectrochemical processes and biological conversion. These emerging technologies focus on improving efficiency and sustainability. Trends in this segment are characterized by experimental approaches and early-stage research, aiming to provide alternative routes for green methanol production with potential long-term benefits.

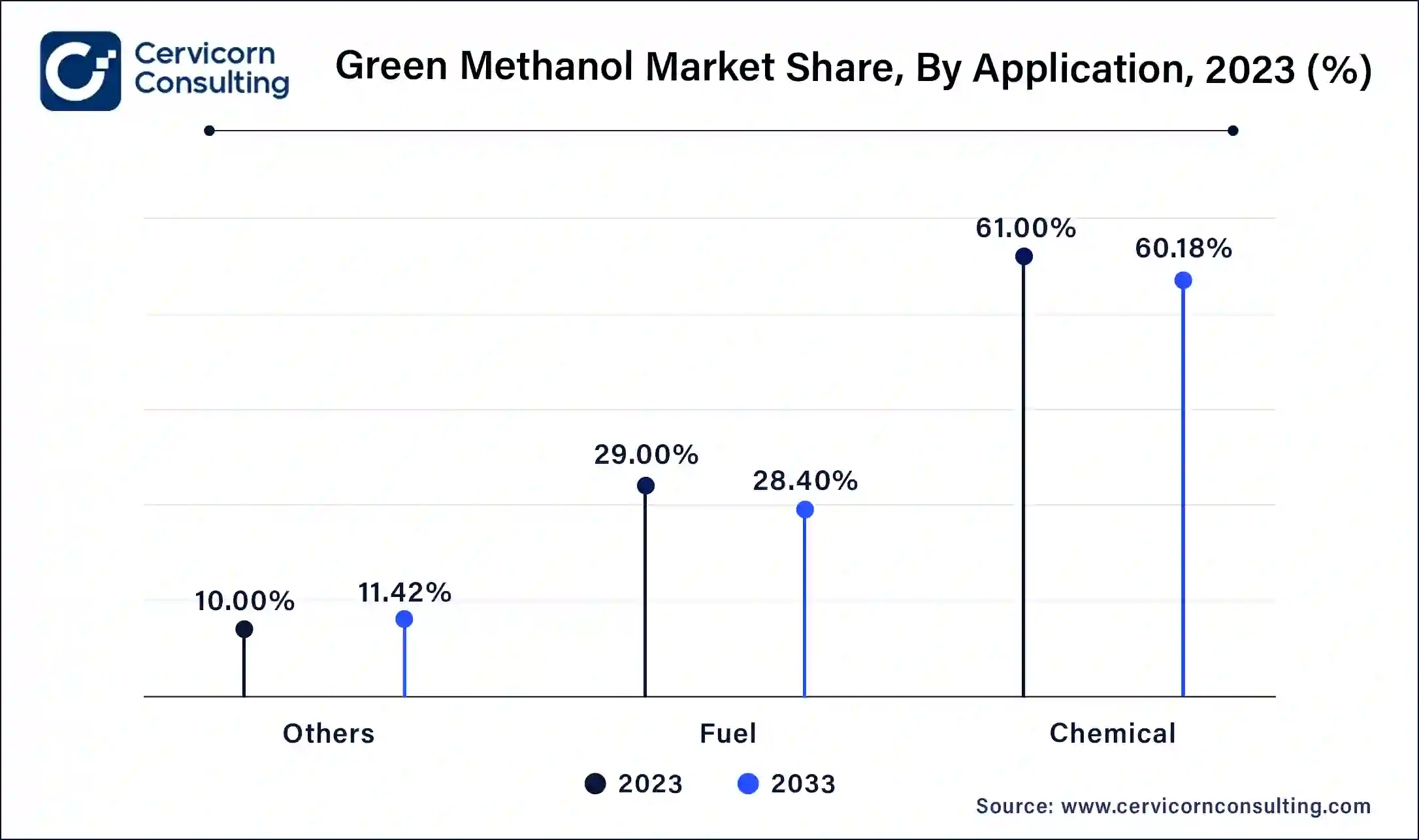

Fuel: The fuel segment has recorded 29% revenue share in 2024. The fuel segment involves using green methanol as a sustainable alternative to traditional fossil fuels for transportation and power generation. Trends include increasing adoption in marine and automotive sectors, driven by stringent emissions regulations and the pursuit of cleaner energy solutions. The segment is growing due to green methanol's potential to reduce carbon footprints and enhance energy efficiency.

Chemical Feedstock: The chemical feedstock segment has generated highest revenue share of 61% in 2024. Green methanol serves as a key feedstock in the chemical industry, used to produce various chemicals, plastics, and solvents. Trends include rising demand for sustainable and renewable chemical inputs driven by environmental regulations and corporate sustainability goals. The market is expanding as industries seek greener alternatives to reduce their overall carbon emissions and align with circular economy principles.

Others: The "Others" segment includes diverse applications of green methanol such as in the production of renewable methanol for energy storage and innovative materials. Trends highlight growing interest in integrating green methanol into emerging technologies and new applications. This segment benefits from advancements in research and the development of novel uses, broadening green methanol’s market potential.

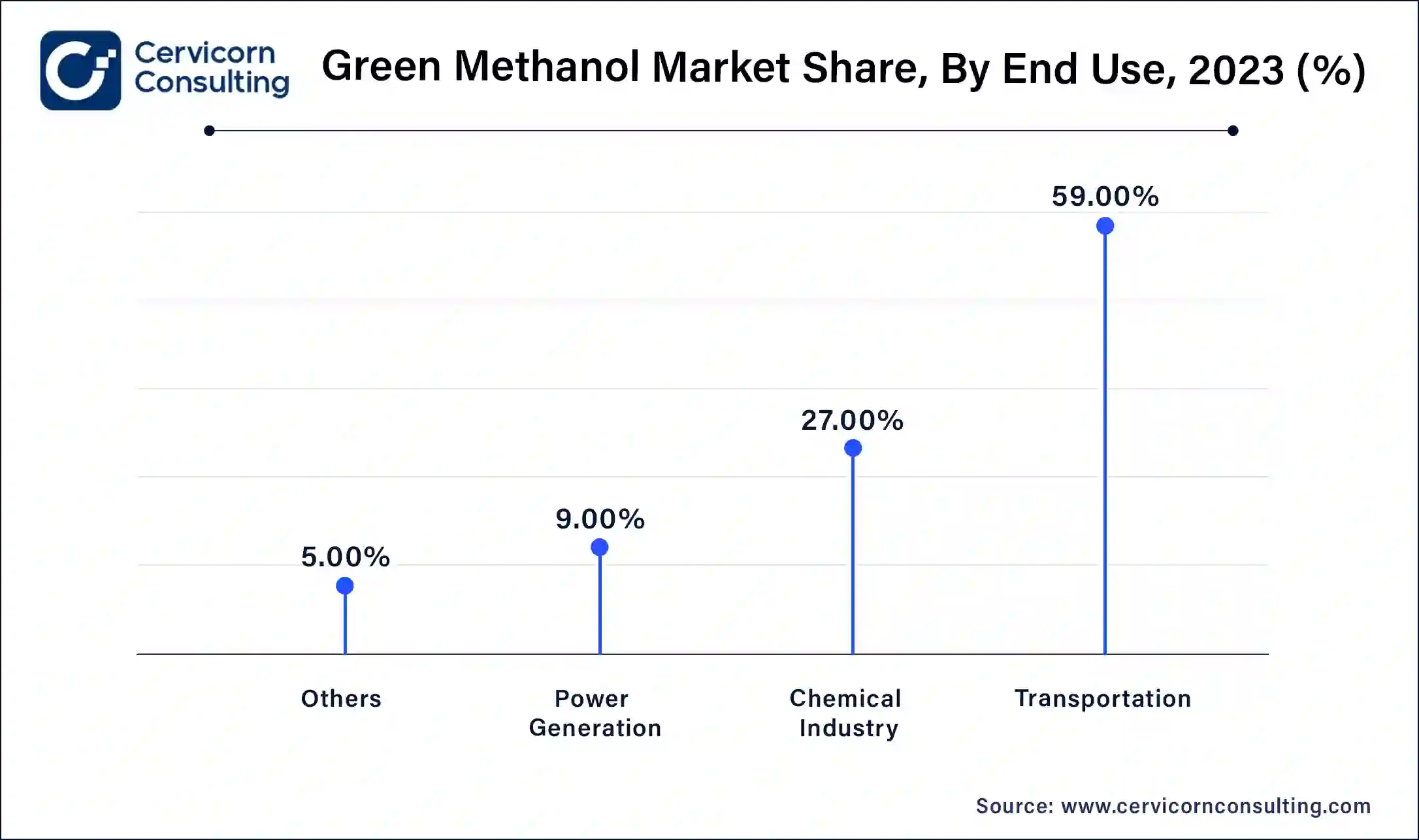

Transportation: The transportation segment has captured 58.88% revenue share in 2024. In transportation is used as a low-carbon fuel alternative for marine, automotive, and aviation applications. Trends include increasing adoption in maritime shipping as a cleaner fuel option and growing interest in its use for automotive fuel. The push for reduced emissions and compliance with international regulations are driving demand in this sector.

Chemical Industry: The chemical industry has generated 27.36% revenue share in 2024. Green methanol is utilized in the chemical industry for producing various chemicals, including formaldehyde, acetic acid, and plastics. Trends show a shift towards using green methanol to replace conventional methanol, driven by the industry's focus on reducing carbon footprints and enhancing sustainability. Its use supports the production of eco-friendly chemicals and materials.

Power Generation: The power generation segment has calculated revenue share of 9.63% in 2024. In power generation, green methanol is used as a fuel for combustion engines and turbines. Trends include growing interest in integrating green methanol into energy systems to reduce reliance on fossil fuels and lower greenhouse gas emissions. It is being explored as a cleaner alternative for power generation in both stationery and backup power applications.

Others: The "Others" segment encompasses various applications of green methanol, including its use in solvents, adhesives, and as a feedstock in research and development. Trends in this segment highlight increasing innovation in new uses for green methanol and its role in developing sustainable solutions across diverse industries.

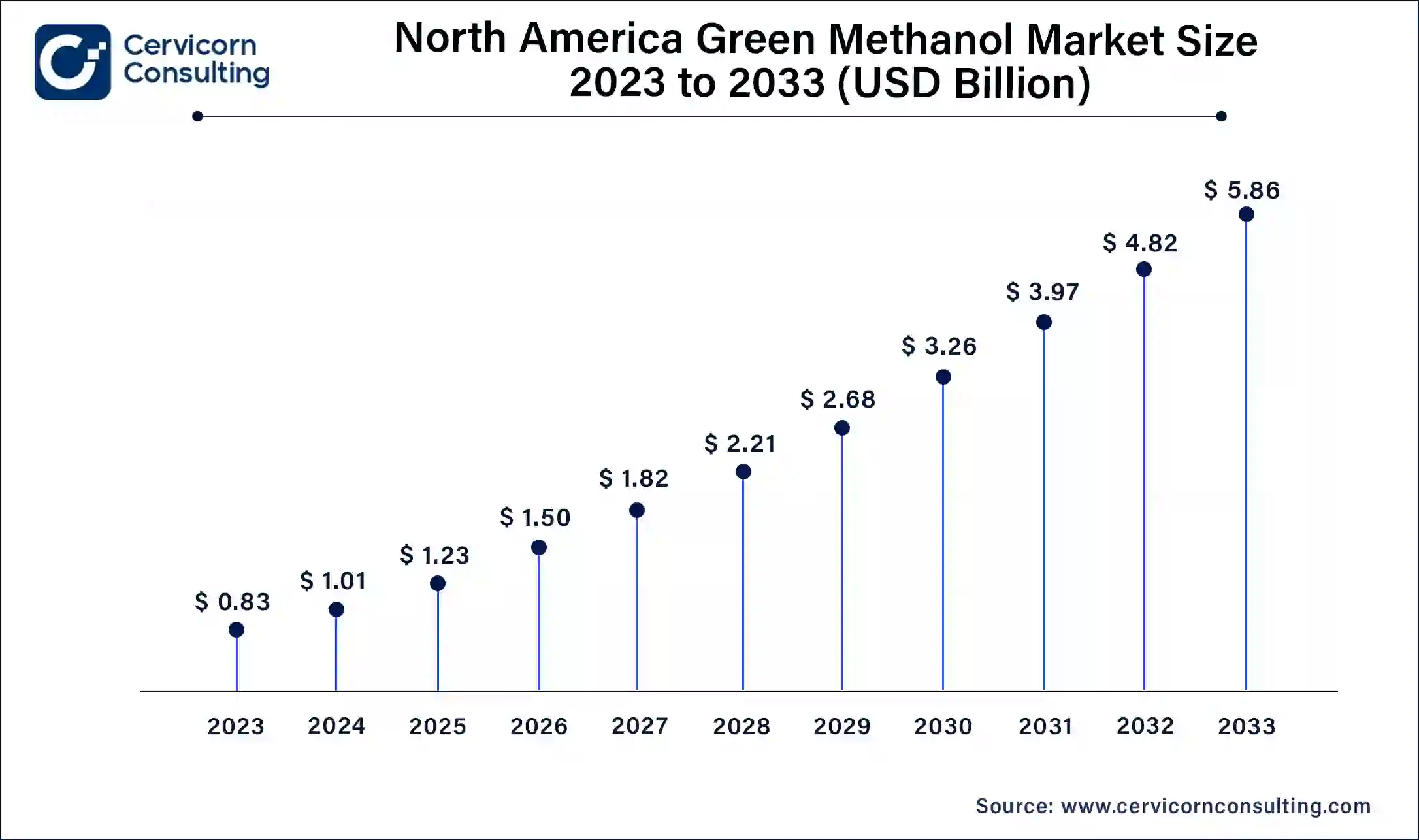

The North America market size is calculated at USD 1.01 billion in 2024 and is projected to grow around USD 6.75 billion by 2034. North America is a leading region in the green methanol market due to its strong focus on sustainability and innovation. Trends include significant investments in research and development, government incentives for renewable energy, and growing adoption of green methanol in transportation and industrial applications. The region is also a hub for technological advancements and pilot projects in green methanol production.

The Asia Pacific market size is expected to reach around USD 3.74 billion by 2034 increasing from USD 0.56 billion in 2024. The Asia-Pacific is experiencing rapid growth in the green methanol market, fueled by rising energy demands and industrialization. Trends include increased investments in green methanol production technologies and expanding applications in power generation and chemical industries. The region is also focusing on scaling up production capabilities and leveraging green methanol to address energy and environmental challenges.

Europe market size is predicted to hit around USD 6.02 billion by 2034 from USD 0.90 billion in 2024. Europe is a major player in the green methanol market, driven by stringent environmental regulations and ambitious climate goals. Trends include high adoption rates in chemical manufacturing and transportation sectors, supported by EU policies and funding for green technologies. European countries are also pioneers in integrating green methanol into existing infrastructure and promoting its use in maritime and aviation sectors.

In LAMEA market is emerging, driven by efforts to diversify energy sources and improve sustainability. Trends include early-stage projects and investments in green methanol infrastructure, with a focus on utilizing local feedstocks and addressing energy access issues. The region is exploring green methanol’s potential in power generation and chemical applications, with increasing interest in sustainable energy solutions.

New players like Global Bioenergies S.A. and Carbon Clean Solutions are entering the green methanol market by leveraging innovative technologies. Global Bioenergies focuses on developing advanced processes for converting renewable resources into green methanol, while Carbon Clean Solutions specializes in cutting-edge carbon capture technologies. Dominant players such as Methanex Corporation and OCI Global lead the market through extensive production capacities and established supply chains. Their dominance is reinforced by their large-scale operations, strategic partnerships, and significant investments in green methanol production and infrastructure.

The geen methanol industry has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their offerings and profitability.

Market Segmentation

By Feedstock

By Production Technology

By Application

By End-Use

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Green Methanol

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Feedstock Overview

2.2.2 By Production Technology Overview

2.2.3 By End-Use Overview

2.2.4 By End-Use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Green Methanol Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advancements in Carbon Capture Technologies

4.1.1.2 Increased Awareness of Climate Change Impacts

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Limited Infrastructure for Distribution and Storage

4.1.3 Market Opportunity

4.1.3.1 Development of New End-Uses

4.1.3.2 Strategic Partnerships and Collaborations

4.1.4 Market Challenges

4.1.4.1 Technological Scalability Issues

4.1.4.2 Competition from Other Renewable Fuels

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Green Methanol Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Green Methanol Market, By Feedstock

6.1 Global Green Methanol Market Snapshot, By Feedstock

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Biomass

6.1.1.2 Municipal Solid Waste

6.1.1.3 Industrial Waste

6.1.1.4 CO2 Capture and Utilization

Chapter 7 Green Methanol Market, By Production Technology

7.1 Global Green Methanol Market Snapshot, By Production Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Biomass Gasification

7.1.1.2 CO2 Hydrogenation

7.1.1.3 Electrolysis

7.1.1.4 Methanol from Renewable Electricity

7.1.1.5 Others

Chapter 8 Green Methanol Market, By End-Use

8.1 Global Green Methanol Market Snapshot, By End-Use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Fuel

8.1.1.2 Chemical Feedstock

8.1.1.3 Others

Chapter 9 Green Methanol Market, By End-Use

9.1 Global Green Methanol Market Snapshot, By End-Use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Transportation

9.1.1.2 Chemical Industry

9.1.1.3 Power Generation

9.1.1.4 Others

Chapter 10 Green Methanol Market, By Region

10.1 Overview

10.2 Green Methanol Market Revenue Share, By Region 2023 (%)

10.3 Global Green Methanol Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Green Methanol Market Revenue, 2021-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Green Methanol Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Green Methanol Market Revenue, 2021-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Green Methanol Market Revenue, 2021-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Green Methanol Market Revenue, 2021-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Green Methanol Market Revenue, 2021-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Green Methanol Market, By Country

10.5.4 UK

10.5.4.1 UK Green Methanol Market Revenue, 2021-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Green Methanol Market Revenue, 2021-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Green Methanol Market Revenue, 2021-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Green Methanol Market Revenue, 2021-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Green Methanol Market Revenue, 2021-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Green Methanol Market, By Country

10.6.4 China

10.6.4.1 China Green Methanol Market Revenue, 2021-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Green Methanol Market Revenue, 2021-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Green Methanol Market Revenue, 2021-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Green Methanol Market Revenue, 2021-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Green Methanol Market Revenue, 2021-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Green Methanol Market Revenue, 2021-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Green Methanol Market, By Country

10.7.4 GCC

10.7.4.1 GCC Green Methanol Market Revenue, 2021-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Green Methanol Market Revenue, 2021-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Green Methanol Market Revenue, 2021-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Green Methanol Market Revenue, 2021-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 Methanex Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 OCI Global

12.3 Haldor Topsoe A/S

12.4 Proman AG

12.5 Carbon Clean Solutions

12.6 Global Bioenergies S.A.

12.7 Nordic Green

12.8 Synlogic Inc.

12.9 Ecospray Technologies S.r.l.

12.10 Zytech Solar Group