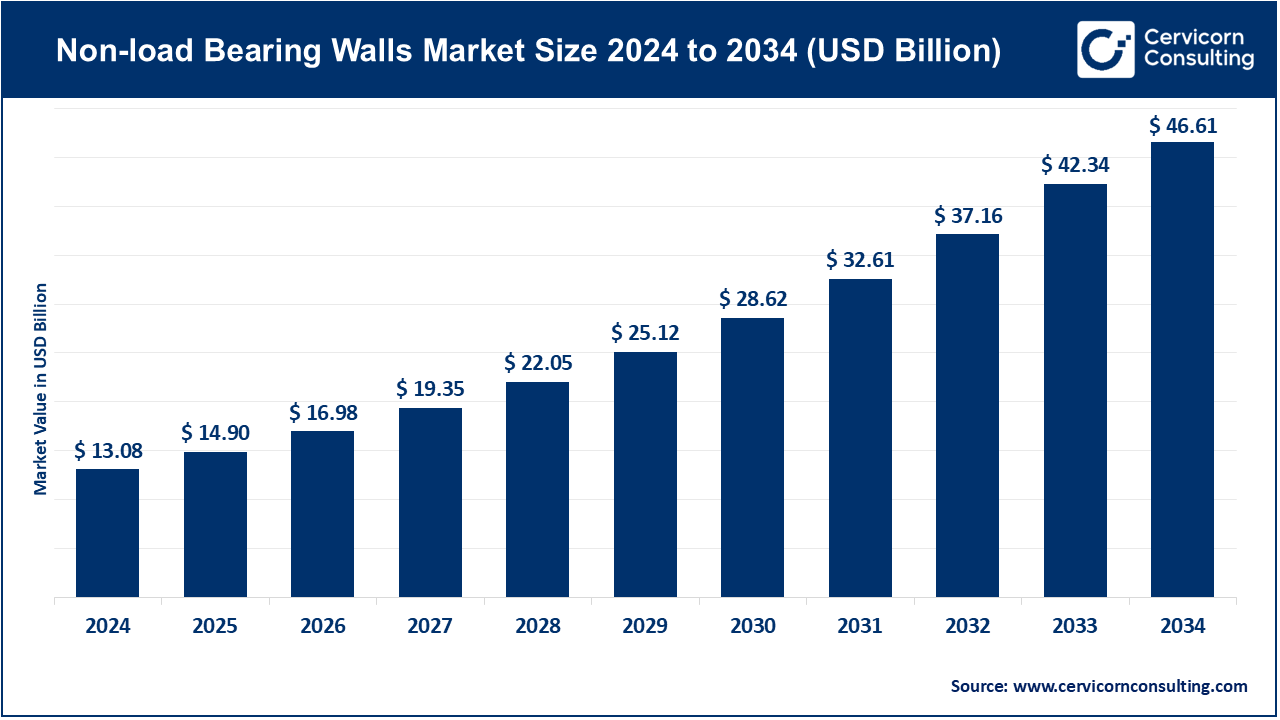

The global non-load bearing walls market size was valued at USD 13.08 billion in 2024 and is projected to grow around USD 46.61 billion by 2034 increasing from USD 14.90 billion in 2025, growing at a compound annual growth rate (CAGR) of 13.55% from 2025 To 2034.

The non-load bearing walls market has experienced significant growth due to the rising demand for modular and flexible construction designs. With the global push toward urbanization, particularly in residential and commercial spaces, there is an increasing preference for lightweight, sustainable, and cost-effective materials. Innovations in prefabricated wall systems and eco-friendly construction have further fueled this trend. The non-load bearing wall market is expected to grow robustly, supported by advancements in construction technology and the rising awareness of green building practices. Regions like Asia-Pacific and North America dominate the market due to rapid urbanization, infrastructural development, and growing real estate projects.

The non-load bearing walls market encompasses partitions and walls that do not support structural loads but are used primarily for spatial separation and aesthetics. These walls are crucial in various building projects, including residential, commercial, and industrial applications. They can be made from materials like gypsum board, metal studs, wood studs, and glass. The market is influenced by factors such as construction activity, building renovations, and advances in wall materials and technologies. It is segmented by material type, construction type, end use, and region, with trends driven by innovations in wall systems and increasing demand for versatile building solutions.

What is non-load bearing walls?

Non-load bearing walls are structural components that do not support the weight of the building or its roof. Instead, they serve as partitions or dividers within a structure, primarily focusing on space management, privacy, and aesthetics. These walls are usually lighter and thinner than load-bearing walls and can be easily altered or removed without compromising the building's structural integrity. Common materials used for non-load bearing walls include brick, glass, gypsum board, wood, and lightweight concrete blocks. Types of non-load bearing walls include partition walls, curtain walls, panel walls, cavity walls, and parapet walls, each catering to specific architectural needs, such as insulation, soundproofing, or decorative purposes.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 13.08 Billion |

| Market Size by 2034 | USD 46.61 Billion |

| Market CAGR | 13.55% from 2025 to 2034 |

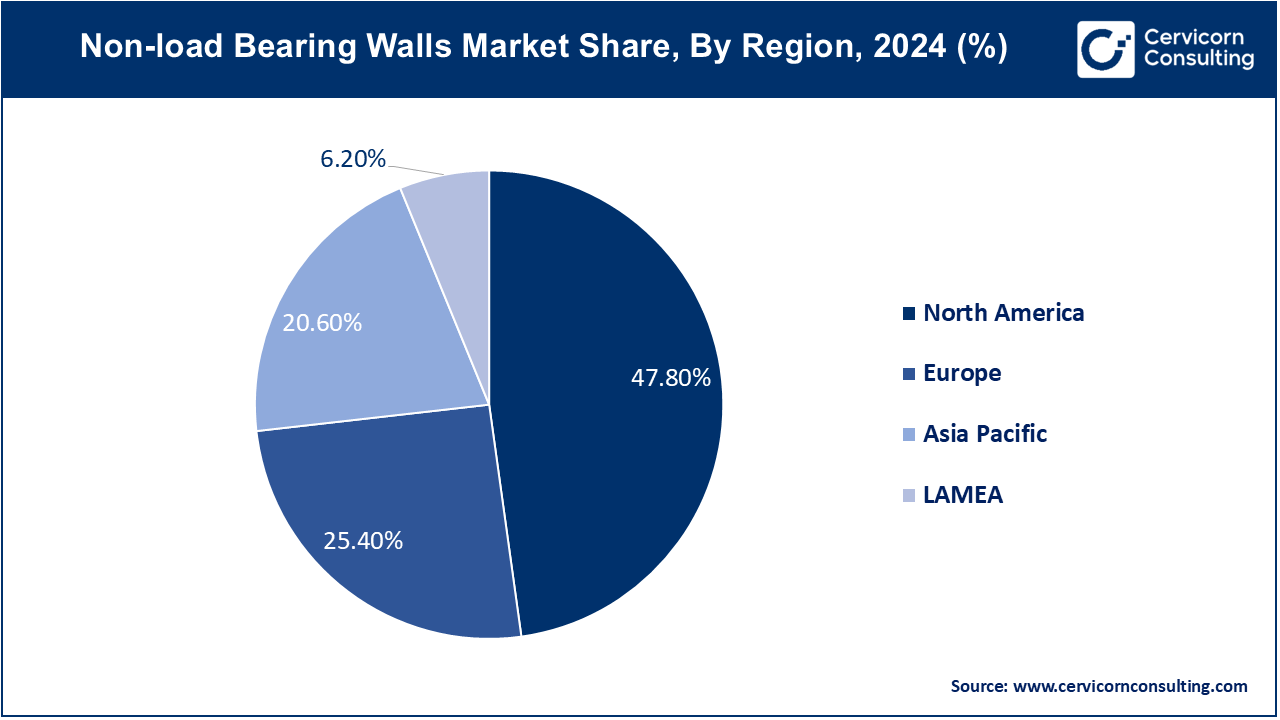

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Market Segmentation | Material Type, System Type, Construction Type, Region |

Increased Focus on Aesthetics and Interior Design:

Advancements in Building Codes and Standards:

Limited Structural Strength:

Higher Initial Costs for High-Quality Materials:

Integration with Smart Building Technologies:

Growing Trend of Modular and Prefabricated Construction:

Durability and Maintenance Concerns:

Acoustic and Thermal Insulation Limitations:

Metal Studs: Metal studs are lightweight, durable framing elements used in non-load bearing walls. They offer resistance to warping and pests, providing a stable and long-lasting framework for wall systems. The use of metal studs is growing due to their fire resistance, recyclability, and ease of installation. Innovations in metal stud designs and manufacturing are enhancing their application in modern construction, especially in commercial and industrial buildings.

Wood Studs: Wood studs are traditional framing elements made from timber, used in constructing non-load bearing walls. They provide a classic, cost-effective solution with good structural integrity for various wall applications. Despite the growing popularity of alternative materials, wood studs remain relevant due to their natural aesthetic and ease of use. Sustainable forestry practices and advances in wood treatment technologies are driving their continued use in residential and small-scale commercial projects.

Gypsum Board: Gypsum board, also known as drywall, is a widely used material for non-load bearing walls. It consists of a gypsum core sandwiched between two layers of paper, offering a smooth surface for finishing and painting. Gypsum board is favored for its versatility, ease of installation, and cost-effectiveness. Innovations include moisture-resistant and fire-rated versions, catering to specific needs in both residential and commercial construction projects.

Glass: Glass panels used in non-load bearing walls provide transparency and aesthetic appeal, often utilized in modern office buildings and high-end residential spaces. They allow for natural light transmission and open visual spaces. The trend towards open-plan designs and natural light integration is boosting the use of glass in non-load bearing walls. Advances in glass technology, such as tempered and insulated glass, are enhancing performance and safety in various architectural applications.

Concrete: Concrete panels or blocks used in non-load bearing walls offer durability and sound insulation. They are commonly used in industrial and commercial settings where robust and low-maintenance walls are required. The use of concrete in non-load bearing walls is increasing due to its durability and low maintenance. Innovations such as lightweight concrete panels and decorative finishes are expanding its application in both residential and commercial projects.

Others: This category includes various alternative materials used for non-load bearing walls, such as fiberboard, PVC panels, and composite materials. These options offer unique properties and applications. The market for alternative materials is growing as manufacturers develop innovative solutions to meet specific needs, such as improved insulation, ease of installation, or unique aesthetic qualities. This trend reflects the increasing demand for customized and versatile wall solutions.

Pre-Fabricated: Pre-fabricated non-load bearing walls are factory-built and assembled off-site before being transported and installed at the construction site. They offer advantages such as faster installation, reduced labor costs, and consistent quality. The trend towards pre-fabrication is driven by the demand for quicker construction timelines and improved efficiency in modern building projects.

Modular: Modular non-load bearing walls are designed as part of larger, pre-assembled modules that can be quickly assembled on-site. This system supports efficient construction and flexible design, allowing for rapid reconfiguration and expansion. The growing trend towards modular construction reflects the industry's focus on speed, scalability, and adaptability in building processes.

Traditional: Traditional non-load bearing walls are constructed on-site using conventional materials and techniques, such as brick, drywall, or plasterboard. Despite being slower to build compared to modern systems, traditional methods remain prevalent due to their familiarity and adaptability to various architectural styles. However, there's a gradual shift towards more efficient, pre-fabricated, and modular solutions in contemporary construction.

Residential: Non-load bearing walls in residential construction are used to partition spaces within homes, such as dividing rooms or creating hallways. They do not support structural loads but are essential for creating functional living spaces. In residential construction, there's an increasing focus on flexible, customizable interiors. Non-load bearing walls offer versatility for interior design and remodeling, catering to changing family needs and preferences. The trend towards open floor plans and smart home integration is also driving demand for innovative wall solutions.

Commercial: In commercial buildings, non-load bearing walls are used to create office partitions, conference rooms, and other functional spaces. They enable layout changes and spatial reconfiguration without affecting the building's structural integrity. The trend towards agile workspaces and flexible office layouts is boosting the demand for non-load bearing walls in commercial properties. Enhanced aesthetic options and high-performance materials that support branding and functional needs are increasingly popular, supporting dynamic and adaptive work environments.

Industrial: Non-load bearing walls in industrial settings are employed to segregate work areas, control environments, and manage workflow within manufacturing facilities. They provide flexibility for layout changes and space optimization without contributing to the building's structural support. Industrial applications are seeing increased use of non-load bearing walls for modular and adaptive manufacturing setups. The focus is on improving operational efficiency and safety through flexible wall systems that can quickly adapt to changing production needs and facilitate better environmental control.

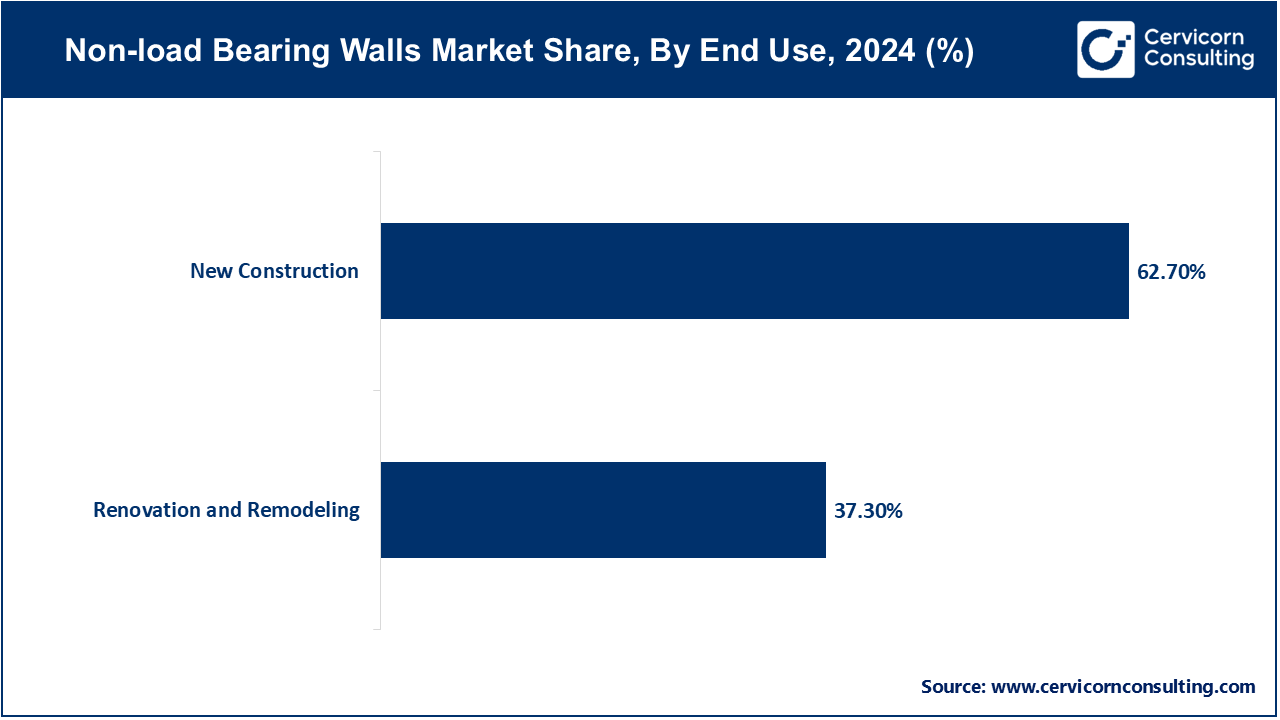

New Construction: The new construction segment has captured highest revenue share of 62.7% in 2024. In new construction, non-load bearing walls are used primarily for interior partitioning, creating functional and flexible spaces within buildings. The trend is towards incorporating lightweight, modular systems that offer easy installation and design versatility. Advances in materials and manufacturing are enabling quicker construction times and improved performance, making non-load bearing walls a popular choice in modern building designs.

Renovation and Remodeling: The renovation and remodeling segment has accounted 37.3% revenue share in 2034. In renovation and remodeling projects, non-load bearing walls are used to reconfigure existing spaces without altering the building’s structural integrity. The trend is toward using these walls to create adaptable, multifunctional spaces that can be easily modified. Innovations in prefabrication and modular wall systems allow for faster and less invasive updates, catering to the growing demand for flexible interior layouts in older buildings.

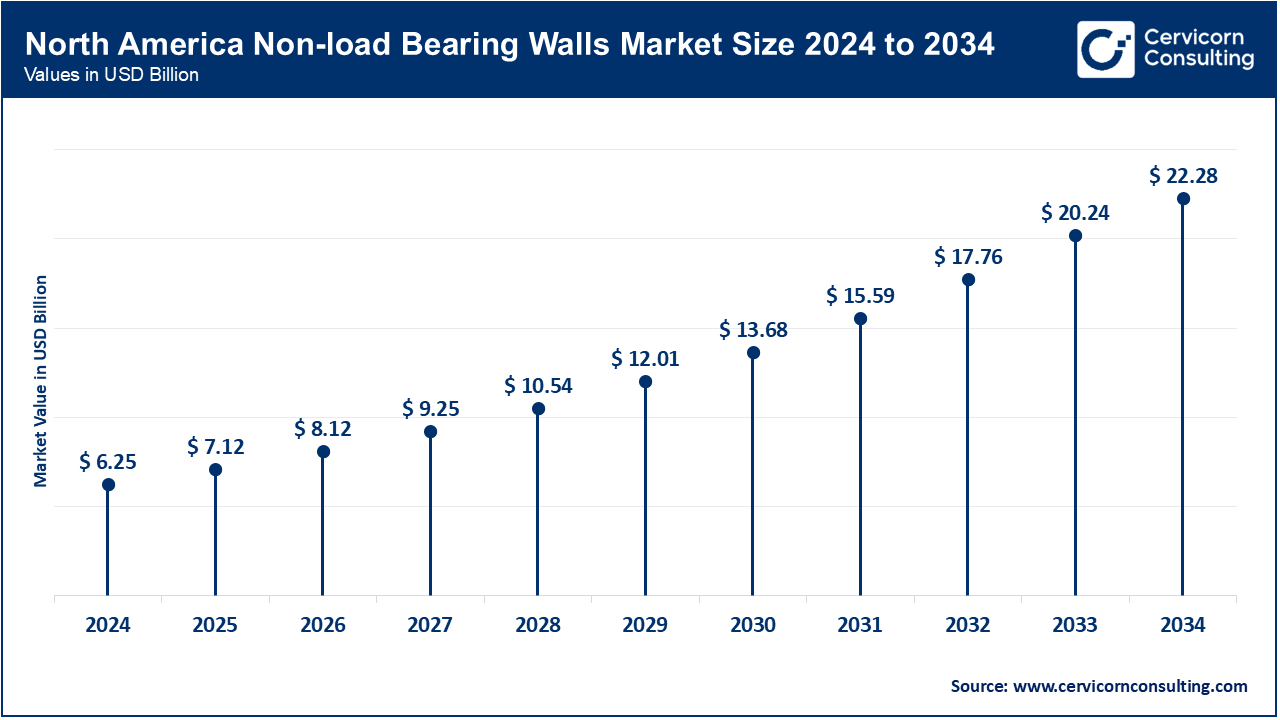

The North America non-load bearing walls market size is calculated at USD 6.25 billion in 2024 and is expected to reach around USD 22.28 billion by 2034. In North America growth is driven by the growing demand for sustainable and energy-efficient building practices. Innovations in materials such as recycled and eco-friendly options are gaining traction. Additionally, the rise of modular and prefabricated construction methods is enhancing the use of non-load bearing walls, facilitating faster and more efficient building processes.

The Europe non-load bearing walls market size is accounted at USD 3.32 billion in 2024 and is projected to hit around USD 11.84 billion by 2034. Europe is experiencing a trend towards incorporating non-load bearing walls in both residential and commercial buildings to meet stringent environmental regulations and energy efficiency standards. There is a strong focus on integrating advanced technologies for thermal and acoustic performance. The use of high-quality, durable materials is also prevalent due to the emphasis on sustainability and long-term performance.

The Asia Pacific non-load bearing walls market size is meajured at USD 2.69 billion in 2024 and is projected to hit around USD 9.6 billion by 2034. The region is seeing significant growth in urbanization, leading to increased demand for flexible and cost-effective construction solutions. Innovations in lightweight materials and modular systems are facilitating quicker construction and accommodating the fast-paced development in this region.

The LAMEA trends is influenced by the growing construction industry and the need for cost-effective building solutions. The focus is on affordable, adaptable systems that can be easily installed and modified. The region is also witnessing increased interest in energy-efficient and sustainable materials as the market evolves to meet both economic and environmental demands.

Emerging companies like Schluter Systems L.P. and Etex Group are entering the non-load bearing walls market with innovative solutions, including modular and prefabricated wall systems that enhance installation efficiency and customization. They are leveraging advanced materials and technologies to offer flexible and cost-effective solutions for modern construction needs. Saint-Gobain S.A. and USG Corporation dominate the market by providing a wide range of high-quality, durable non-load bearing wall products. Their extensive R&D investments and global presence allow them to lead in technological advancements and maintain a strong market share.

The Non-load Bearing Walls Market has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their offerings and profitability. Some notable examples of key development in the Non-load Bearing Walls Market include:

Market Segmentation

By Material Type

By System Type

By Construction Type

By End Use

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Non-load Bearing Walls

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Type Overview

2.2.2 By System Type Overview

2.2.3 By Construction Type Overview

2.2.4 By End Use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Non-load Bearing Walls Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Focus on Aesthetics and Interior Design

4.1.1.2 Advancements in Building Codes and Standards

4.1.2 Market Restraints

4.1.2.1 Limited Structural Strength

4.1.2.2 Higher Initial Costs for High-Quality Materials

4.1.2.3 Integration with Smart Building Technologies

4.1.2.4 Growing Trend of Modular and Prefabricated Construction

4.1.3 Market Challenges

4.1.3.1 Durability and Maintenance Concerns

4.1.3.2 Acoustic and Thermal Insulation Limitations

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Non-load Bearing Walls Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Non-load Bearing Walls Market, By Material Type

6.1 Global Non-load Bearing Walls Market Snapshot, By Material Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Metal Studs

6.1.1.2 Wood Studs

6.1.1.3 Gypsum Board

6.1.1.4 Glass

6.1.1.5 Concrete

6.1.1.6 Others

Chapter 7 Non-load Bearing Walls Market, By System Type

7.1 Global Non-load Bearing Walls Market Snapshot, By System Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 Pre-Fabricated

7.1.1.2 Modular

7.1.1.3 Traditional

Chapter 8 Non-load Bearing Walls Market, By Construction Type

8.1 Global Non-load Bearing Walls Market Snapshot, By Construction Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Residential

8.1.1.2 Commercial

8.1.1.3 Industrial

Chapter 9 Non-load Bearing Walls Market, By End Use

9.1 Global Non-load Bearing Walls Market Snapshot, By End Use

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 New Construction

9.1.1.2 Renovation and Remodeling

Chapter 10 Non-load Bearing Walls Market, By Region

10.1 Overview

10.2 Non-load Bearing Walls Market Revenue Share, By Region 2023 (%)

10.3 Global Non-load Bearing Walls Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Non-load Bearing Walls Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Non-load Bearing Walls Market, By Country

10.5.4 UK

10.5.4.1 UK Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Non-load Bearing Walls Market, By Country

10.6.4 China

10.6.4.1 China Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Non-load Bearing Walls Market, By Country

10.7.4 GCC

10.7.4.1 GCC Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Non-load Bearing Walls Market Revenue, 2021-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 Saint-Gobain S.A.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 USG Corporation

12.3 Knauf Insulation GmbH

12.4 Armstrong World Industries, Inc.

12.5 CertainTeed Corporation

12.6 Rockwool International A/S

12.7 Johns Manville Corporation

12.8 Schluter Systems L.P.

12.9 Cemex S.A.B. de C.V.

12.10 Gypsum Management & Supply, Inc.