The global sustainable aviation fuel market size was valued at USD 1.77 billion in 2024 and is expected to be worth around USD 40.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 36.88% over the forecast period 2025 to 2034. The sustainable aviation fuel (SAF) market is expanding rapidly as the aviation industry prioritizes reducing carbon emissions to combat climate change. Increasing government support through subsidies, tax incentives, and policy mandates is driving significant investment in SAF production facilities worldwide. Airlines are also committing to using SAF as part of their sustainability goals, with many forming long-term partnerships with SAF producers to secure a steady supply.

Major players in the aviation sector are investing heavily in research and development to improve production processes and scale up capacity, aiming to make SAF more accessible and cost-effective. In addition, international organizations like the International Air Transport Association (IATA) and global initiatives such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) are encouraging widespread adoption of SAF. As public awareness about climate change grows, passenger demand for greener travel options is further accelerating the transition to SAF.

The sustainable aviation fuel (SAF) market is a rapidly growing sector focused on reducing aviation's carbon footprint by utilizing alternative fuels derived from renewable resources. SAF can be produced using various technologies such as Fischer-Tropsch synthesis, HEFA, and alcohol-to-jet pathways. These fuels are used in commercial, military, and business aviation, offering lower emissions compared to conventional jet fuels. The market is driven by increasing regulatory pressures to reduce greenhouse gas emissions, advancements in production technologies, and airline commitments to sustainability.

What is sustainable aviation fuel?

Sustainable Aviation Fuel (SAF) is a renewable and environmentally friendly alternative to conventional jet fuel, designed to reduce greenhouse gas (GHG) emissions and promote cleaner aviation. SAF is primarily derived from sustainable feedstocks such as agricultural residues, municipal solid waste, used cooking oil, algae, or even carbon captured from the atmosphere. It can be categorized into various types based on production processes, including Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene (HEFA-SPK), Alcohol-to-Jet Synthetic Paraffinic Kerosene (ATJ-SPK), and others. These fuels are chemically similar to conventional jet fuel, enabling seamless integration into existing aviation infrastructure and engines without significant modifications. SAF is crucial for decarbonizing the aviation industry, which is responsible for about 2-3% of global GHG emissions.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.46 Billion |

| Market Size by 2034 | USD 40.87 Billion |

| Market Growth Rate | CAGR of 36.88% from 2025 to 2034 |

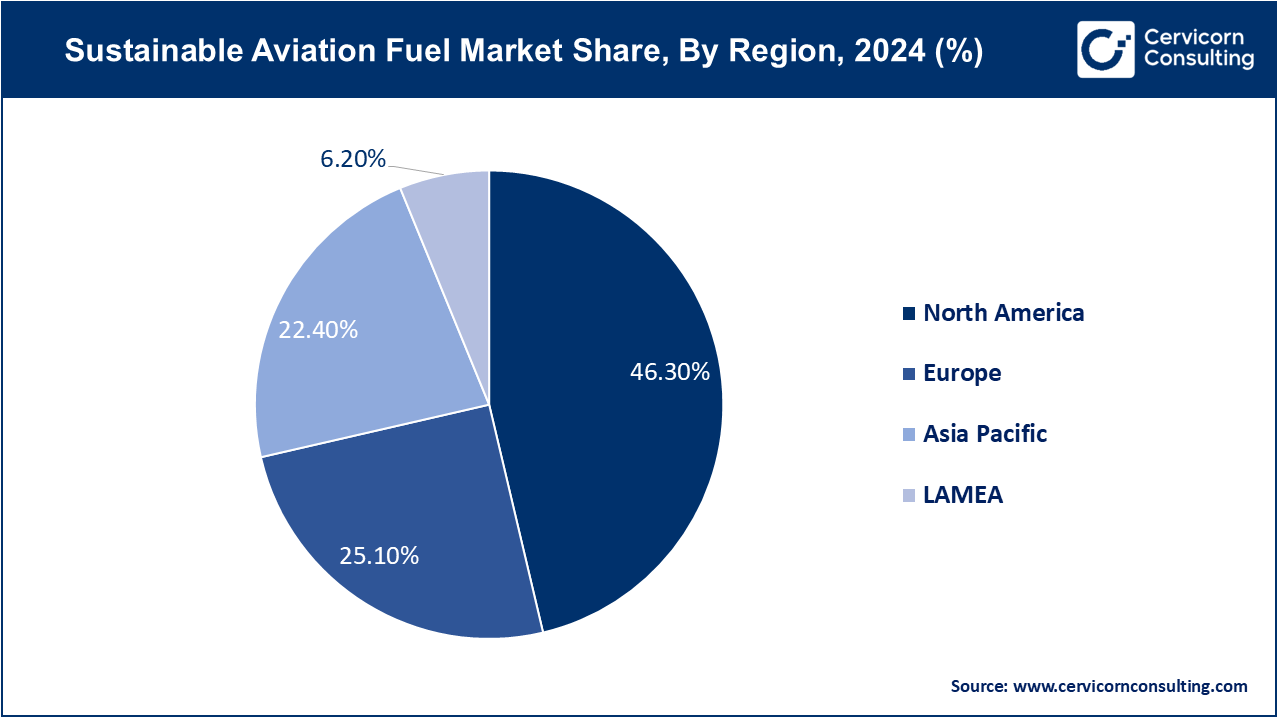

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Segment Coverage | Fuel Type, Manufacturing Technology, Blending Capacity, Platform, Region |

Consumer Demand for Green Travel Options:

Investment in Renewable Energy Infrastructure:

High Production Costs:

Limited Infrastructure for Distribution:

Government Incentives and Tax Benefits:

Technological Innovations in Production:

Feedstock Availability and Competition:

Technological Uncertainty and Maturity:

Biofuel: Biofuel segment has reported market share of 79% in 2024. Biofuels for SAF are derived from biological materials, including plant oils, agricultural residues, and animal fats. They are processed into jet fuel using technologies like Hydro processed Esters and Fatty Acids (HEFA). Biofuels are gaining traction due to their lower carbon emissions and established production methods. They are becoming more cost-effective as technology improves, and are increasingly used by airlines to meet sustainability goals.

Hydrogen Fuel: Hydrogen fuel segment has registered market share of 10% in 2024. Hydrogen fuel for SAF involves using hydrogen as a direct energy source or in combination with other processes to produce jet fuel. It can significantly reduce greenhouse gas emissions when produced from renewable sources. Hydrogen fuel is emerging as a long-term solution for aviation decarbonization. While still in developmental stages, it holds promise for future aviation, with ongoing research into efficient production and storage methods.

Power to Liquid: Power to Liquid segment has accounted market share of 7% in 2024. Power to Liquid (PtL) technology converts renewable electricity into liquid fuels through processes like CO2 capture and hydrogen synthesis. It creates synthetic jet fuel with potentially zero emissions. PtL is advancing with increased investments and pilot projects. Its potential for high emission reductions makes it a strong candidate for future aviation fuel, though scaling up production remains a challenge.

Gas to Liquid: Gas to liquid segment has calculated market share of 4% in 2024. Gas to liquid (GtL) technology converts natural gas into liquid fuels via chemical processes like Fischer-Tropsch synthesis. It produces high-quality jet fuel with lower sulfur content. GtL is valued for producing cleaner fuels with fewer impurities. It is increasingly used in conjunction with SAF to improve fuel quality, although its reliance on natural gas poses sustainability concerns.

FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene): FT-SPK is produced using Fischer-Tropsch synthesis, which converts biomass or waste into synthetic kerosene through gasification and catalytic processing. This technology is gaining traction due to its scalability and versatility in feedstock utilization. Recent trends focus on enhancing production efficiency, reducing costs, and integrating FT-SPK with existing aviation infrastructure to increase its adoption in the SAF market.

HEFA-SPK (Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene): HEFA-SPK is derived from hydroprocessing oils and fats into a jet fuel compatible with current engines. It is widely adopted due to its proven technology and compatibility. Trends in HEFA-SPK include expanding feedstock sources, improving process efficiency, and reducing production costs. Ongoing advancements aim to enhance its economic viability and broaden its market presence.

HFS-SIP (Hydroprocessed Fermented Sugars Synthetic Iso-Paraffinic): HFS-SIP is produced from fermented sugars through hydroprocessing to create iso-paraffinic kerosene. This technology is emerging for its potential in producing high-quality fuels from renewable biomass. Trends focus on optimizing sugar conversion processes, increasing production yields, and lowering costs to make HFS-SIP a competitive option in the SAF market.

ATJ-SPK (Alcohol-to-Jet Synthetic Paraffinic Kerosene): ATJ-SPK is created by converting alcohols, such as ethanol or butanol, into jet fuel via catalytic processes. This technology is valued for its flexibility and use of diverse alcohol feedstocks. Current trends include improving conversion efficiency, scaling up production, and reducing costs to enhance ATJ-SPK's viability and adoption within the aviation industry.

CHJ (Carbon-Hydrogen Jet Fuel): CHJ is produced by converting carbon dioxide and hydrogen into jet fuel through chemical processes. This technology aims to achieve carbon-neutral aviation by utilizing renewable energy. Trends in CHJ focus on improving the efficiency of CO2 conversion, reducing production costs, and scaling up technology to make it commercially viable in the near future.

FT-SPK/A (Fischer-Tropsch Synthetic Paraffinic Kerosene with Aromatics): FT-SPK/A is an advanced form of FT-SPK that includes aromatic compounds to better replicate conventional jet fuel properties. It combines FT-SPK with aromatic components to enhance performance. Trends include optimizing the aromatic content to match conventional fuels' characteristics while maintaining SAF benefits, aiming to improve acceptance and performance in aviation applications.

Others: This category encompasses various emerging SAF technologies and processes not specifically covered by the main segments, such as novel biochemical pathways or hybrid approaches. Trends in this category involve exploring new feedstocks and innovative processes to diversify SAF options. Research is concentrated on finding efficient, scalable methods that complement existing technologies and broaden market opportunities.

Below 30%: SAF blends below 30% involve incorporating small percentages of SAF with conventional jet fuel. This lower blending capacity is often used to meet initial regulatory requirements and gradually introduce SAF into the market. Trends include increasing adoption by airlines aiming to achieve partial sustainability goals while minimizing operational disruptions. Efforts are focused on demonstrating SAF benefits and preparing for higher blending thresholds in the future.

30% to 50%: SAF blends of 30% to 50% represent a moderate incorporation of SAF with conventional jet fuel, enhancing environmental benefits while maintaining performance. This blending range is being increasingly explored as airlines and regulators push for more significant sustainability measures. Trends include advancements in SAF production technologies and growing regulatory support, aiming to facilitate higher SAF integration and improve the economic feasibility of such blends.

Above 50%: SAF blends above 50% involve significant proportions of SAF, often approaching 100% in some cases, with minimal or no conventional jet fuel. This high blending capacity aims to maximize environmental benefits and meet ambitious sustainability targets. Trends include ongoing research to support higher SAF concentrations, technological advancements to ensure compatibility with existing infrastructure, and increasing commitments from airlines for full SAF adoption in the near future.

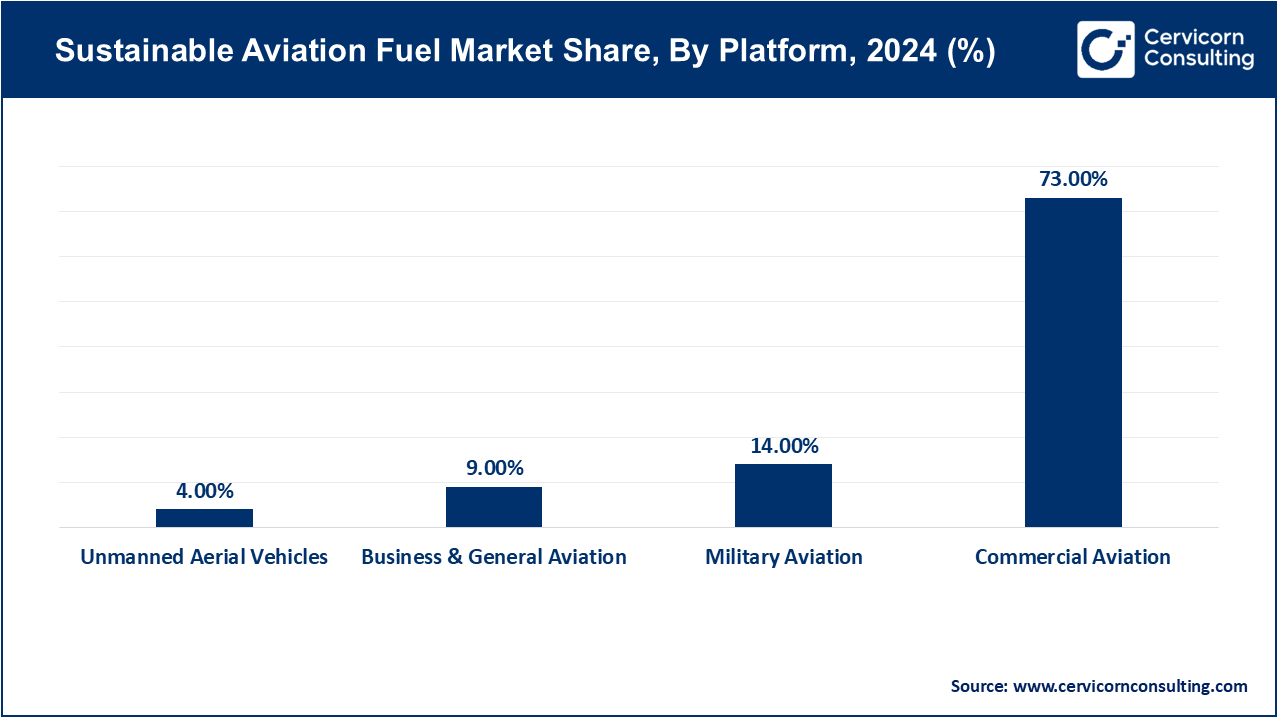

Commercial Aviation: Commercial aviation segment has reported market share of 73% in 2024. Commercial aviation refers to passenger and cargo flights operated by airlines. SAF is increasingly adopted in this sector to reduce carbon emissions and meet sustainability targets. Trends include major airlines committing to SAF usage, significant investments in SAF infrastructure, and government policies encouraging SAF adoption. The focus is on scaling up SAF production to meet the high fuel demands of commercial flights.

Military Aviation: Military aviation segment has generated market share of 14% in 2024. Military aviation involves aircraft used for defense and strategic operations. SAF is being integrated into military fleets to reduce emissions and enhance energy security. Trends include military forces setting sustainability goals, investing in SAF research, and testing SAF blends in various military aircraft. The aim is to achieve operational efficiency while meeting environmental regulations and enhancing fuel resilience.

Business & General Aviation: Business and general aviation segment has captured market share of 9% in 2024. Business and general aviation cover private jets and smaller aircraft used for personal and business travel. SAF is gaining traction in this sector due to increasing environmental awareness among corporate fleets and private owners. Trends include growing adoption of SAF for business jets, partnerships between fuel producers and private aviation companies, and efforts to standardize SAF for general aviation use.

Unmanned Aerial Vehicles: Unmanned aerial vehicles segment has accounted market share of 4% in 2024. Unmanned Aerial Vehicles (UAVs) include drones and other remotely operated aircraft. SAF usage in UAVs is emerging to support longer flight times and reduce environmental impact. Trends involve the development of SAF-compatible fuels for various drone applications, innovations in fuel efficiency for UAVs, and growing interest in sustainable solutions for commercial and industrial drone operations.

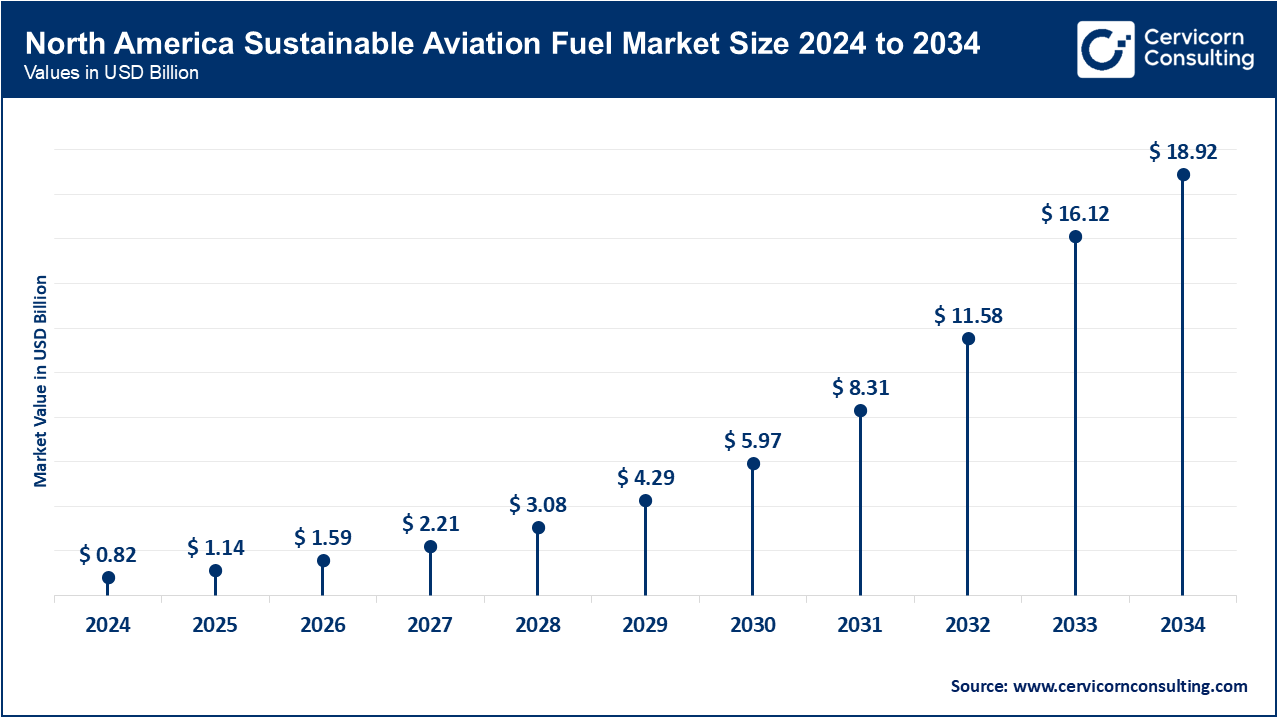

The North America sustainable aviation fuel market size is calculated at USD 0.82 billion in 2024 and is expected to reach around USD 18.92 billion by 2034. North America includes the United States, Canada, and Mexico. The SAF market in this region is driven by strong government support, including federal mandates and incentives for SAF adoption. Trends include major investments from airlines and fuel producers in SAF production facilities, partnerships for research and development, and pilot programs to test SAF blends. North America is also a leader in SAF infrastructure development and commercialization.

The Europe sustainable aviation fuel market size is accounted at USD 0.44 billion in 2024 and is projected to hit around USD 10.26 billion by 2034. Europe encompasses countries like the United Kingdom, Germany, and France. The SAF market in Europe is characterized by stringent environmental regulations and ambitious climate targets. Trends include widespread adoption of SAF by European airlines, extensive government subsidies and mandates for SAF usage, and active participation in international SAF collaborations. European countries are also focusing on integrating SAF into their broader sustainability strategies and achieving net-zero emissions.

The Asia-Pacific sustainable aviation fuel market size is measured at USD 0.40 billion in 2024 and is projected to hit around USD 9.15 billion by 2034. The Asia-Pacific region includes China, Japan, India, and other countries. The SAF market in Asia-Pacific is growing due to increasing aviation traffic and rising environmental concerns. Trends involve regional governments setting up SAF policies and incentives, investments in SAF research, and pilot projects to integrate SAF into existing aviation infrastructure. There is also a focus on developing local SAF production capabilities to meet the region's expanding aviation demands.

LAMEA covers Latin America, the Middle East, and Africa. The SAF market in this region is emerging, with varying levels of adoption and development. Trends include initial SAF projects and collaborations in countries like Brazil and the UAE, growing interest in sustainable aviation as part of broader energy transitions, and efforts to attract investment in SAF infrastructure. The focus is on overcoming logistical challenges and building local SAF production capabilities to support regional aviation needs.

New players entering the SAF market, such as LanzaTech Inc. and Velocys plc, are focusing on innovative technologies like gas fermentation and Fischer-Tropsch synthesis to produce SAF from diverse feedstocks. They are investing in research and scaling up production processes to establish their presence. Dominant players include Neste Corporation and World Energy LLC, which lead the market through extensive SAF production capabilities, established infrastructure, and significant investments in research and development. Their market dominance is bolstered by established partnerships and large-scale production facilities.

Market Segmentation

By Fuel Type

By Manufacturing Technology

By Blending Capacity

By Platform

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Sustainable Aviation Fuel

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Fuel Type Overview

2.2.2 By Manufacturing Technology Overview

2.2.3 By Blending Capacity Overview

2.2.4 By Platform Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Sustainable Aviation Fuel Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Consumer Demand for Green Travel Options

4.1.1.2 Investment in Renewable Energy Infrastructure

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Limited Infrastructure for Distribution

4.1.3 Market Opportunities

4.1.3.1 Government Incentives and Tax Benefits

4.1.3.2 Technological Innovations in Production

4.1.4 Market Challenges

4.1.4.1 Feedstock Availability and Competition

4.1.4.2 Technological Uncertainty and Maturity

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Sustainable Aviation Fuel Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Sustainable Aviation Fuel Market, By Fuel Type

6.1 Global Sustainable Aviation Fuel Market Snapshot, By Fuel Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

6.1.1.1 Biofuel

6.1.1.2 Hydrogen Fuel

6.1.1.3 Power to Liquid

6.1.1.4 Gas to Liquid

Chapter 7 Sustainable Aviation Fuel Market, By Manufacturing Technology

7.1 Global Sustainable Aviation Fuel Market Snapshot, By Manufacturing Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

7.1.1.1 FT-SPK

7.1.1.2 HEFA-SPK

7.1.1.3 HFS-SIP

7.1.1.4 ATJ-SPK

7.1.1.5 CHJ

7.1.1.6 FT-SPK/A

7.1.1.7 Others

Chapter 8 Sustainable Aviation Fuel Market, By Blending Capacity

8.1 Global Sustainable Aviation Fuel Market Snapshot, By Blending Capacity

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

8.1.1.1 Below 30%

8.1.1.2 30% to 50%

8.1.1.3 Above 50%

Chapter 9 Sustainable Aviation Fuel Market, By Platform

9.1 Global Sustainable Aviation Fuel Market Snapshot, By Platform

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2034

9.1.1.1 Commercial Aviation

9.1.1.2 Military Aviation

9.1.1.3 Business & General Aviation

9.1.1.4 Unmanned Aerial Vehicles

Chapter 10 Sustainable Aviation Fuel Market, By Region

10.1 Overview

10.2 Sustainable Aviation Fuel Market Revenue Share, By Region 2023 (%)

10.3 Global Sustainable Aviation Fuel Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Sustainable Aviation Fuel Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Sustainable Aviation Fuel Market, By Country

10.5.4 UK

10.5.4.1 UK Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Sustainable Aviation Fuel Market, By Country

10.6.4 China

10.6.4.1 China Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Sustainable Aviation Fuel Market, By Country

10.7.4 GCC

10.7.4.1 GCC Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Sustainable Aviation Fuel Market Revenue, 2021-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 Neste Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 World Energy LLC

12.3 LanzaTech Inc.

12.4 Gevo Inc.

12.5 SABIC (Saudi Basic Industries Corporation)

12.6 BP plc (British Petroleum)

12.7 TotalEnergies SE

12.8 Shell Global

12.9 Airbus SE

12.10 Boeing Company