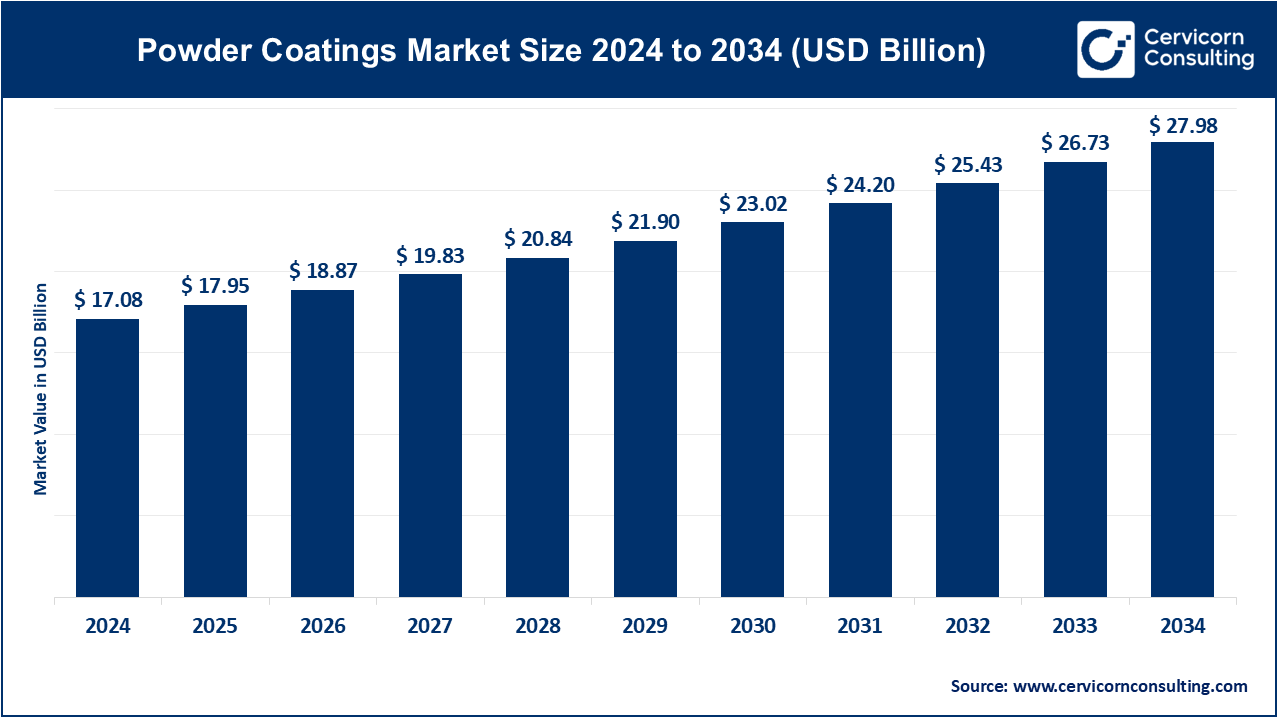

The global powder coatings market size was accounted for USD 17.08 billion in 2024 and is expected to surpass around USD 27.98 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.05% over the forecast period 2025 to 2034.

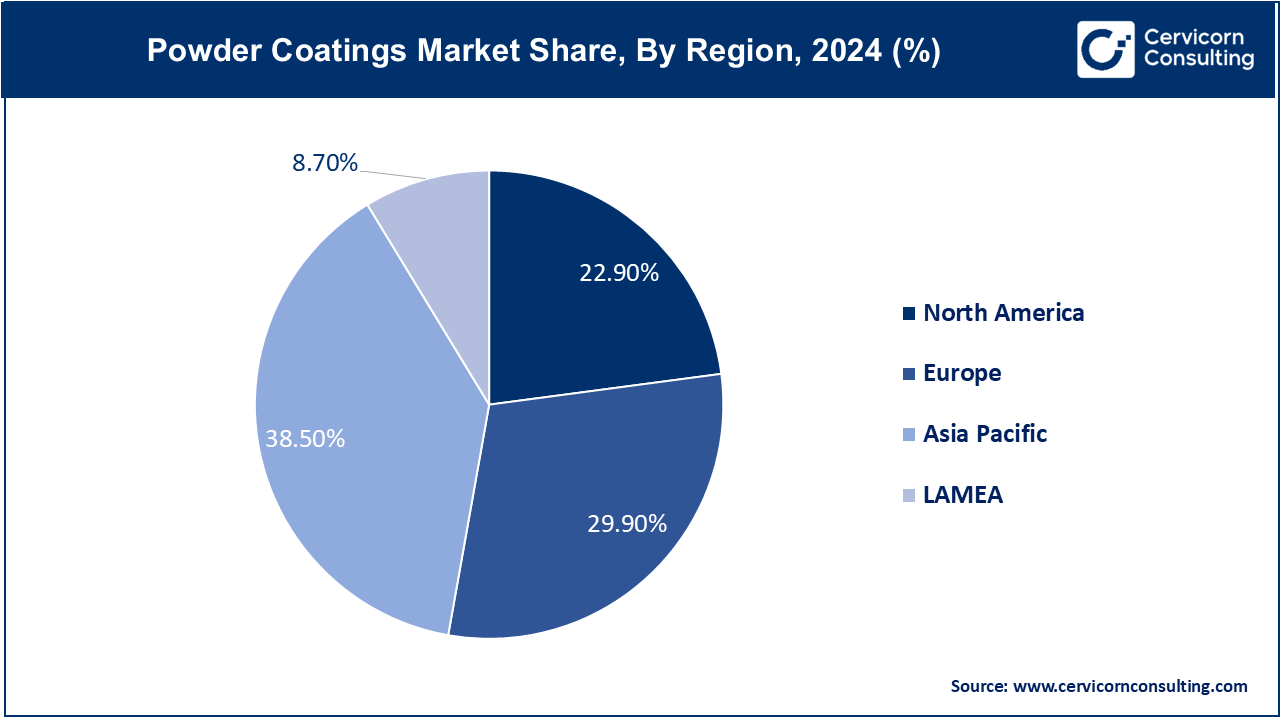

The powder coatings market is witnessing robust growth driven by increasing demand across industries such as automotive, construction, consumer appliances, and furniture. This growth is fueled by the rising preference for sustainable and eco-friendly solutions, as powder coatings contain no volatile organic compounds (VOCs) and minimize environmental impact. The automotive sector, in particular, is a key contributor, with powder coatings being extensively used for wheels, body parts, and under-the-hood components. Similarly, the construction industry relies on powder coatings for durable finishes on metal frameworks, aluminum profiles, and other architectural applications. Geographically, the market is expanding significantly in regions like Asia-Pacific, supported by rapid industrialization, urbanization, and rising infrastructure projects. Europe and North America also exhibit strong demand due to strict environmental regulations and the growing trend toward adopting green technologies.

The powder coatings market revolves around dry finishing processes where finely ground particles of resin and pigment are electrostatically charged and sprayed onto a substrate. Upon curing, they form a durable, protective layer. This method offers advantages like enhanced durability, scratch resistance, and environmental benefits due to negligible volatile organic compounds (VOCs). Key applications span automotive, appliances, furniture, architectural, and industrial sectors, driven by demand for cost-effective, eco-friendly coatings. Innovations in resin formulations and application techniques continue to expand market potential, catering to diverse consumer needs for aesthetics, durability, and sustainability in surface finishing solutions.

What is powder coatings?

Powder coatings are a type of dry coating applied to surfaces as a free-flowing, fine powder, offering a durable and environmentally friendly alternative to traditional liquid paints. Unlike liquid coatings that use solvents, powder coatings rely on electrostatic application, followed by curing under heat to form a hard, smooth finish. These coatings are widely used in industries such as automotive, construction, appliances, and furniture, offering excellent resistance to chipping, corrosion, fading, and scratches. Common types of powder coatings include thermoset and thermoplastic. Thermoset powders, such as epoxy and polyester, form irreversible bonds upon curing, making them ideal for industrial and outdoor applications. Thermoplastic coatings, like nylon and polyvinyl chloride (PVC), can be remelted and are often used for decorative or protective purposes.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 17.95 Billion |

| Market size in 2034 | USD 27.98 Billion |

| Market Growth Rate | CAGR of 5.05% from 2025 to 2034 |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Resin Type, Coating Method, Application, Regions |

Shift towards Sustainable Practices:

Advantages in Application and Handling:

High Initial Investment Costs:

Challenges with Thin Film Applications:

Powder coatings can face challenges when applied in thin film applications, as achieving consistent coverage and uniformity on intricate or detailed surfaces may be difficult. This limitation can impact certain industries that require very thin coatings or complex geometries, reducing the versatility of powder coatings in such applications.

Expansion in Healthcare and Medical Devices:

Growth in Aerospace and Defense:

Complexity in Color Matching and Customization:

Adhesion Issues on Substrates:

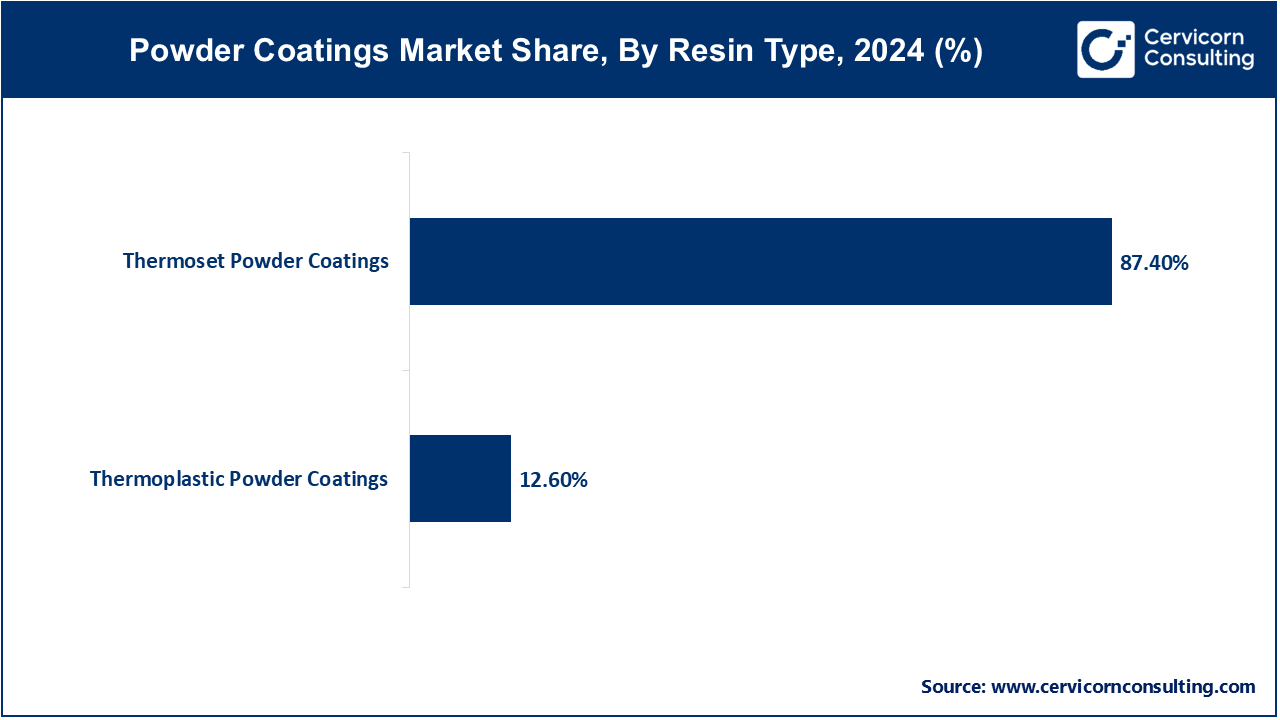

Thermoset Powder Coatings: The thermoset powder coatings Segments has dominated the market with the share of 87.4% in 2024. Thermoset powder coatings utilize resins that crosslink irreversibly upon curing. They offer superior durability, chemical resistance, and weatherability, making them ideal for outdoor applications. Trends include advancements in low-temperature cure formulations and enhanced UV resistance, catering to eco-friendly and high-performance demands in automotive, architectural, and industrial sectors.

Thermoplastic Powder Coatings: The thermoplastic powder coatings segment has captured market share of 12.6% in 2024. Thermoplastic powder coatings soften upon heating but retain their solid state upon cooling, allowing reprocessing. Trends focus on developing sustainable, recyclable coatings with improved impact resistance and flexibility. Applications expand in electronics, consumer goods, and aerospace industries, driven by their ability to provide vibrant colors, ease of rework, and compliance with stringent regulatory standards for environmental sustainability.

Electrostatic Spray: Electrostatic spray involves electrostatically charging powder particles and spraying them onto a grounded substrate, creating a uniform coating when cured. It remains the most widely used method due to its versatility, efficiency, and ability to coat complex shapes. Advances include improvements in application equipment for better control and efficiency.

Fluidized Bed: In fluidized bed coating, preheated substrates are dipped into a bed of fluidized powder particles, which adhere and melt onto the surface upon curing. It's favored for coating small parts with thick, uniform layers. Trends include automation and improved powder recovery systems to enhance efficiency and reduce waste.

Flame Spraying: Flame spraying involves heating powder particles in a flame or plasma jet, which are then sprayed onto the substrate, creating a protective coating upon cooling. It's used for applications requiring corrosion and wear resistance. Trends focus on precision control of spray parameters and advancements in thermal spray technologies.

Electrostatic Fluidized Bed: Combines electrostatic spray and fluidized bed principles, where powder particles are fluidized and electrostatically charged before being attracted to the grounded substrate. It offers benefits of both methods, including enhanced coating uniformity and efficiency. Trends include development of hybrid systems and integration with robotic automation for higher throughput.

Others: Includes niche methods like powder curtain coating and triboelectric charging, which involve unique approaches to applying powder coatings. Niche methods cater to specific industry needs, such as ultra-thin coatings or specialized materials. Trends involve customization and integration with advanced surface preparation and curing technologies.

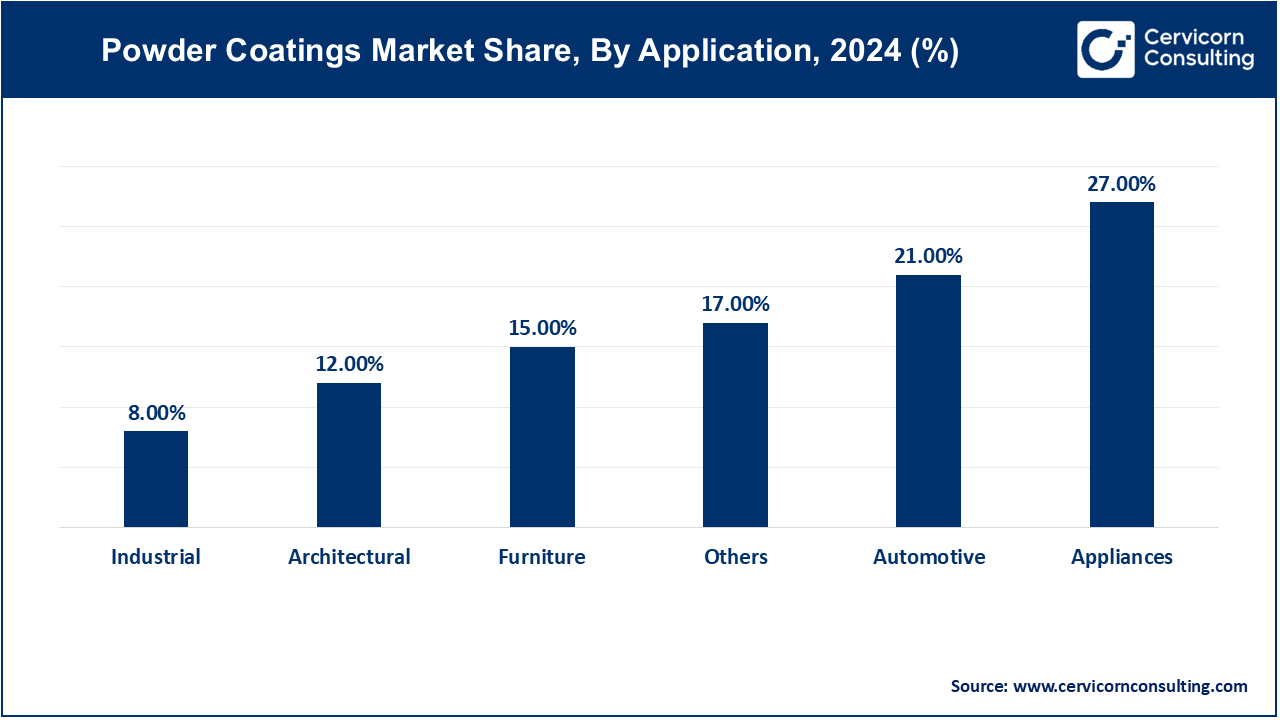

Automotive: The automotive segment has generated market size of 21% in 2024. Powder coatings provide durable, corrosion-resistant finishes for automotive exterior parts, wheels, and underbody components, meeting stringent performance standards while offering a wide range of colors and textures to enhance aesthetic appeal.

Appliances: The appliances segment has garnered market size of 27% in 2024. Used in appliances such as refrigerators and washing machines, powder coatings offer scratch-resistant and attractive finishes, ensuring longevity and customization options that cater to evolving consumer preferences in home appliances.

Furniture: The furniture segment has achieved market size of 15% in 2024. Powder coatings in furniture provide decorative finishes for both indoor and outdoor pieces, delivering robust protection against wear, UV rays, and weather conditions. This segment continues to grow due to increased demand for sustainable and aesthetically pleasing furniture solutions.

Architectural: The Architectural segment has recorded market size of 12% in 2024. Architectural powder coatings are applied to aluminum extrusions, metal facades, fences, and railings, providing long-lasting protection and aesthetic enhancements to buildings. Advances in powder coating technology cater to architectural trends favoring sustainability, durability, and design versatility.

Industrial: The industrial segment has covered market share of 8% in 2024. Widely used in machinery, agricultural equipment, and general industrial components, powder coatings offer superior protection against corrosion, chemicals, and mechanical damage. This segment benefits from ongoing advancements in powder coating formulations that improve performance and reduce maintenance costs in industrial applications.

Others: Other segment has measured market share of 17% in 2024. Powder coatings find applications in diverse sectors such as electronics (for heat dissipation and protection), sports equipment (for durability and customization), and healthcare devices (for hygiene and safety). This versatility underscores powder coatings' ability to meet specialized requirements across a wide range of industries and applications.

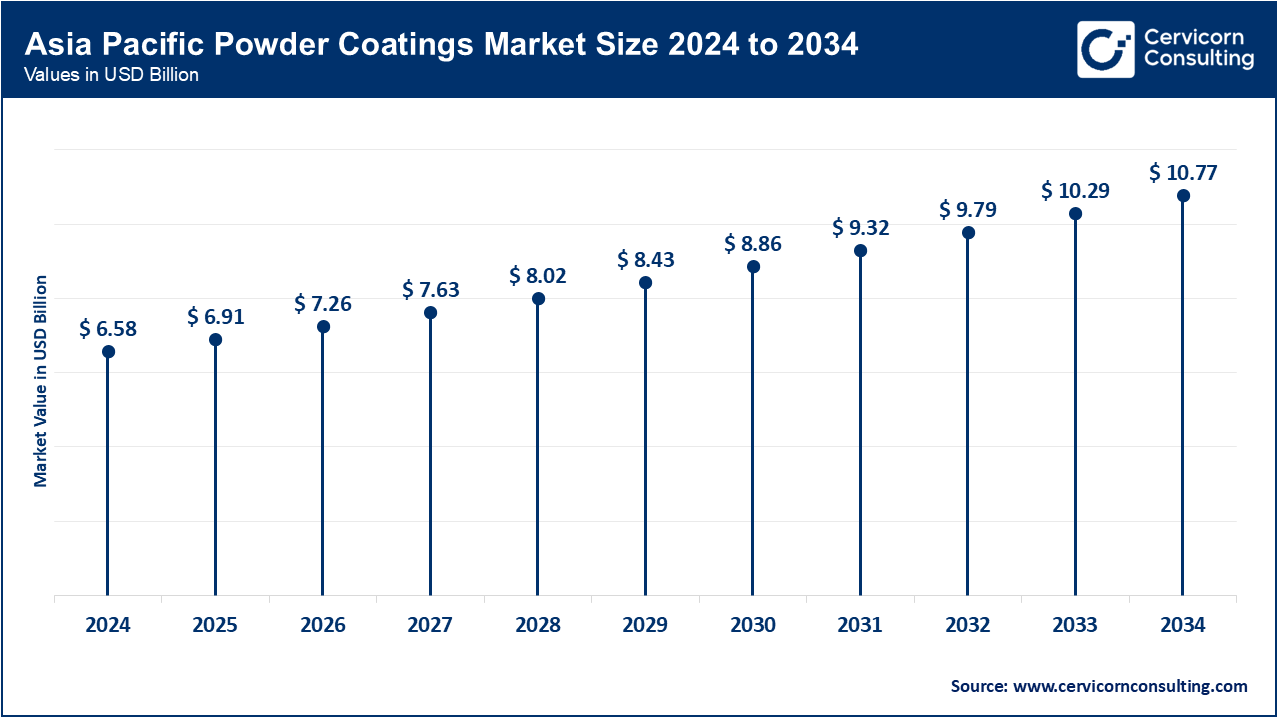

The Asia-Pacific powder coatings market size is accounted USD 6.58 billion in 2024 and is projected to surpass around USD 10.77 billion by 2034. Asia-Pacific region driven bythe demand for powder coatings across diverse applications. In sectors such as automotive, electronics, and consumer goods, powder coatings offer durability, aesthetic versatility, and cost-effectiveness. Technological advancements in powder coating equipment and formulations cater to the region's diverse manufacturing needs, enhancing product performance and application efficiency.

The North America powder coatings market size is measured USD 3.91 billion in 2024 and is forecasted to hit around USD 6.41 billion by 2034. The Powder Coatings Market in North America is characterized by a strong focus on sustainability and innovation. Stringent environmental regulations propel the development of eco-friendly powder coatings, reducing volatile organic compound (VOC) emissions and promoting sustainable manufacturing practices. Advanced application techniques, including automated powder coating systems, are widely adopted to enhance operational efficiency and product quality across industries such as automotive, aerospace, and appliances.

The Europe powder coatings market size is garnered USD 5.11 billion in 2024 and is estimated to reach around USD 8.37 billion by 2034 with a CAGR 0f 5.19%. In Europe, there is a notable emphasis on architectural applications within the Powder Coatings Market. Powder coatings are extensively used for architectural facades, aluminum profiles, and other building materials, driven by strict regulatory standards for energy efficiency and durability. The region leads in integrating powder coatings with thermal insulation and corrosion protection technologies, catering to sustainable building practices. Continuous advancements in powder coating formulations and application methods ensure compliance with stringent quality and environmental standards, supporting the market's growth in both residential and commercial construction sectors.

LAMEA regions are witnessing significant growth in infrastructure development, boosting demand for powder coatings in construction and architectural applications. The market benefits from expanding urbanization and industrialization, particularly in sectors such as transportation and building materials. Emerging markets in Latin America and Africa present opportunities for powder coatings, driven by increasing investments in residential and commercial construction projects.

Innovative newcomers in the powder coatings market include startups like Protech Powder Coatings and TenCate Advanced Composites. These companies focus on developing sustainable and high-performance coatings using advanced materials and application technologies, catering to niche segments such as aerospace and healthcare. Established key players like PPG Industries, Akzo Nobel, and Sherwin-Williams dominate through extensive R&D investments, global distribution networks, and strategic acquisitions. They lead by offering comprehensive product portfolios that meet diverse industry needs while leveraging economies of scale to maintain competitive pricing and ensure widespread market penetration across regions.

Market Segmentation

By Resin Type

By Coating Method

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Powder Coatings

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Resin Type Overview

2.2.2 By Coating Method Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Powder Coatings Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Shift towards Sustainable Practices

4.1.1.2 Advantages in Application and Handling

4.1.2 Market Restraints

4.1.2.1 High Initial Investment Costs

4.1.2.2 Challenges with Thin Film Applications

4.1.3 Market Opportunity

4.1.3.1 Expansion in Healthcare and Medical Devices

4.1.3.2 Growth in Aerospace and Defense

4.1.4 Market Challenges

4.1.4.1 Complexity in Color Matching and Customization

4.1.4.2 Adhesion Issues on Substrates

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Powder Coatings Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Powder Coatings Market, By Resin Type

6.1 Global Powder Coatings Market Snapshot, By Resin Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

6.1.1.1 Thermoset Powder Coatings

6.1.1.2 Thermoplastic Powder Coatings

Chapter 7 Powder Coatings Market, By Coating Method

7.1 Global Powder Coatings Market Snapshot, By Coating Method

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

7.1.1.1 Electrostatic Spray

7.1.1.2 Fluidized Bed

7.1.1.3 Flame Spraying

7.1.1.4 Electrostatic Fluidized Bed

7.1.1.5 Others

Chapter 8 Powder Coatings Market, By Application

8.1 Global Powder Coatings Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

8.1.1.1 Automotive

8.1.1.2 Appliances

8.1.1.3 Furniture

8.1.1.4 Architectural

8.1.1.5 Industrial

8.1.1.6 Others

Chapter 9 Powder Coatings Market, By Region

9.1 Overview

9.2 Powder Coatings Market Revenue Share, By Region 2024 (%)

9.3 Global Powder Coatings Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Powder Coatings Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Powder Coatings Market, By Country

9.5.4 UK

9.5.4.1 UK Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Powder Coatings Market, By Country

9.6.4 China

9.6.4.1 China Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Powder Coatings Market, By Country

9.7.4 GCC

9.7.4.1 GCC Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Powder Coatings Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 PPG Industries, Inc.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Akzo Nobel N.V.

11.3 Sherwin-Williams Company

11.4 Axalta Coating Systems Ltd.

11.5 Valspar Corporation

11.6 Jotun Group

11.7 TIGER Coatings GmbH & Co. KG

11.8 Asian Paints Ltd.

11.9 Kansai Paint Co., Ltd.

11.10 Nippon Paint Holdings Co., Ltd.