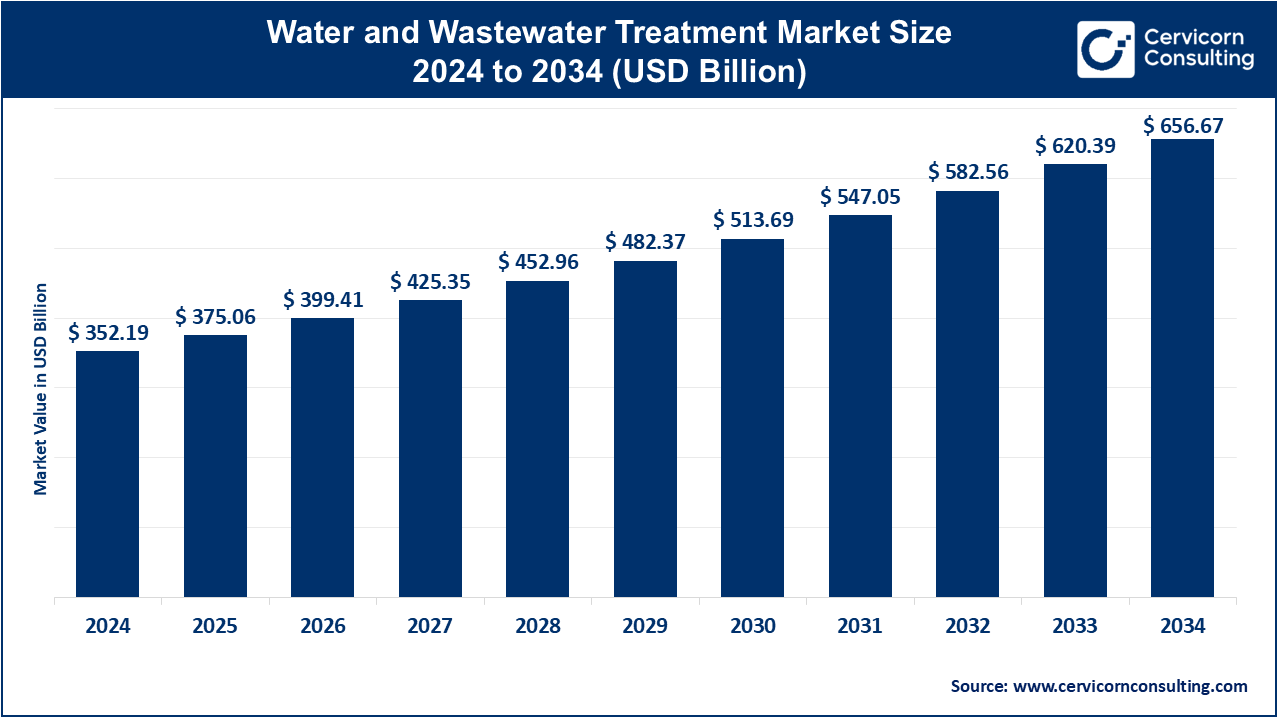

The global water and wastewater treatment market size was accounted for USD 352.19 billion in 2024 and is expected to hit around USD 656.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.42% over the forecast period 2025 to 2034.

The water and wastewater treatment market is rapidly expanding due to growing concerns about water pollution, water scarcity, and the need for sustainable management of water resources. Increasing industrial activities and urbanization are placing immense pressure on water resources, making effective treatment technologies essential. As the global population grows, the demand for clean water and wastewater treatment solutions is intensifying. Industrial sectors such as manufacturing, power generation, and food processing contribute significantly to wastewater generation, driving the need for effective treatment systems. Municipalities are investing in infrastructure to meet the growing demand for potable water and improve wastewater discharge quality, further fueling the market.

What is water and wastewater treatment?

Water and wastewater treatment refers to the processes used to improve the quality of water for specific purposes, including drinking, industrial use, irrigation, or safe environmental discharge. The treatment involves removing impurities such as solids, bacteria, organic matter, and chemicals. Key processes include primary treatment (removal of large debris and sedimentation), secondary treatment (biological processes to remove organic matter), and tertiary treatment (advanced techniques like filtration, disinfection, or desalination). Types of water treatment include physical (filtration, sedimentation), chemical (chlorination, ozonation), and biological (activated sludge, biofilters). Wastewater treatment further involves specialized methods like anaerobic digestion, membrane filtration, and sludge management. These systems are essential for maintaining public health, protecting aquatic ecosystems, and supporting sustainable water use.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 375.06 Billion |

| Market size in 2034 | USD 656.67 Billion |

| Market Growth Rate | CAGR of 6.42% from 2025 to 2034 |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Application, Process by Equipment, Regions |

Public Health Concerns

Urbanization and Infrastructure Development

High Operational Costs

Lack of Awareness and Education

Emerging Markets and Infrastructure Development

Technological Advancements

Complexity of Contaminants

Climate Change Resilience

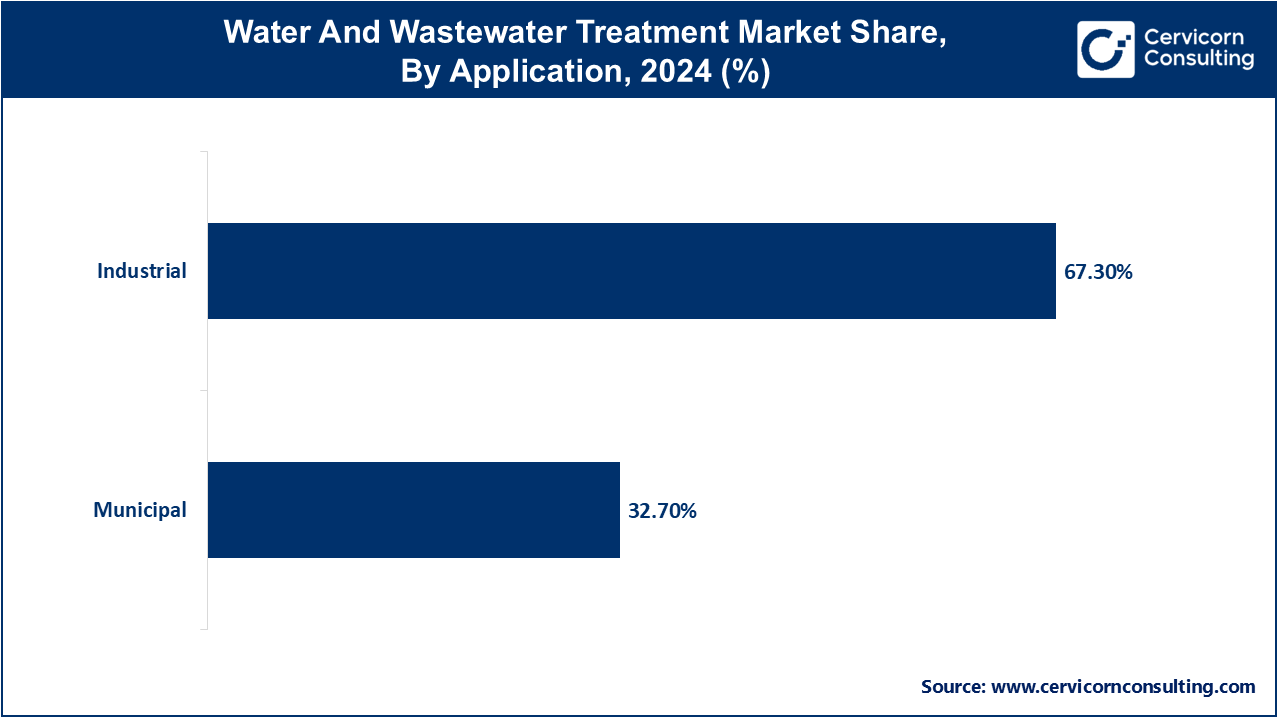

Municipal: The municipal segment has covered market share of 32.7% in 2024. The municipal segment focuses on treating water for public consumption and managing wastewater from residential areas. Market trends include increasing urbanization driving demand for efficient water treatment solutions. Drivers include regulatory requirements for clean drinking water and wastewater discharge standards, prompting investments in advanced technologies like membrane filtration and UV disinfection to meet growing municipal water needs sustainably.

Industrial: The industrial segment has generated market share of 67.3% in 2024. This industrial segment addresses water treatment for various industrial processes and managing wastewater from manufacturing facilities. Market trends involve stricter environmental regulations pushing industries towards sustainable water management practices. Drivers include the need to comply with stringent discharge limits and reduce water consumption through recycling and reuse technologies. Innovations in industrial water treatment focus on tailored solutions for specific contaminants and optimizing resource efficiency amid increasing global industrialization.

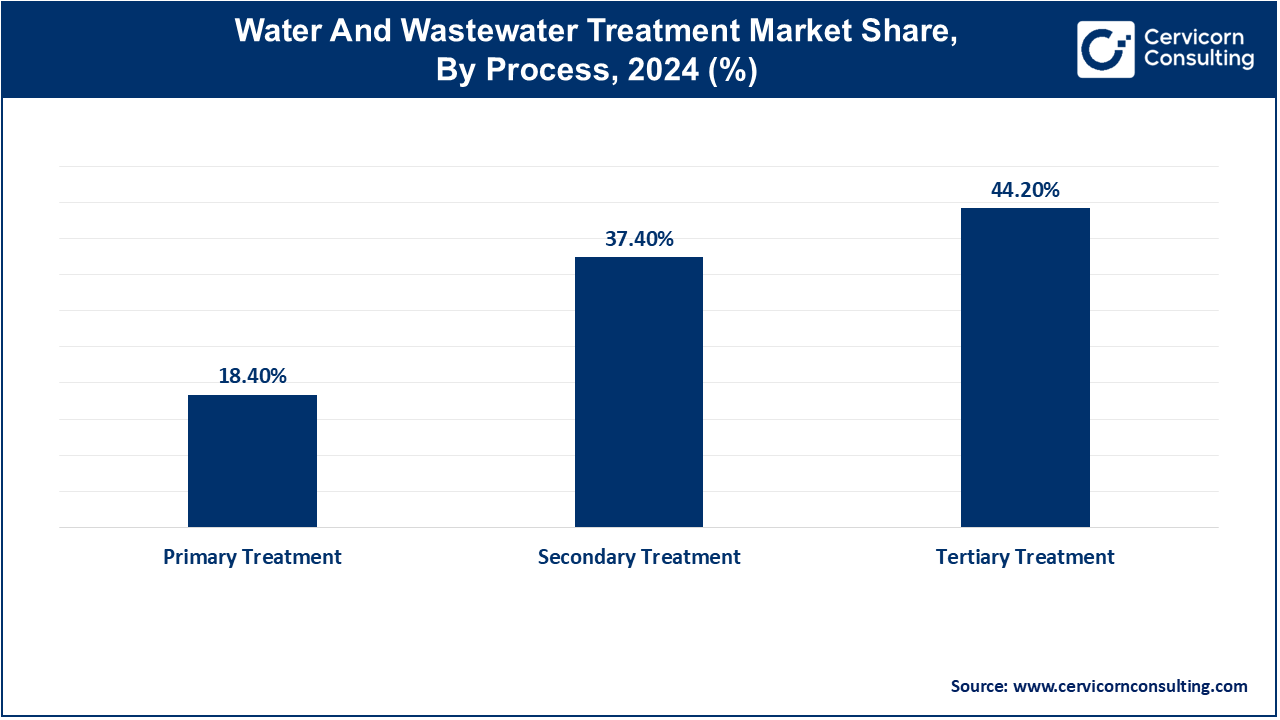

Primary Treatment: This Segement has accounted market share of 18.4% in 2024. Primary treatment in the Water and Wastewater Treatment market involves physical processes like screening and sedimentation to remove large particles and debris from wastewater. Market trends include advancements in screening technologies and automated sedimentation systems to improve efficiency. Drivers include the need for preliminary treatment to reduce organic load and protect downstream processes in wastewater treatment plants, ensuring effective overall treatment.

Secondary Treatment: The secondary treatment segment has calculated market share of 37.4% in 2024. Secondary treatment focuses on biological processes such as activated sludge and biological filtration to further remove dissolved organic matter and nutrients from wastewater. Market trends include the adoption of advanced biological reactors and membrane bioreactors for enhanced treatment efficiency. Drivers include regulatory requirements for nutrient removal and biological oxygen demand reduction, prompting investments in sustainable secondary treatment technologies to meet stringent discharge standards.

Tertiary Treatment: This segment has recorded market share of 44.2% in 2024. Tertiary treatment involves advanced processes like filtration, disinfection, and nutrient removal to achieve high-quality effluent suitable for reuse or environmentally sensitive discharge. Market trends include increasing demand for water reuse applications and advanced disinfection technologies like UV and ozone treatment. Drivers include the rising importance of water scarcity management and regulatory pressures to achieve near-zero discharge, driving innovations in tertiary treatment processes and equipment.

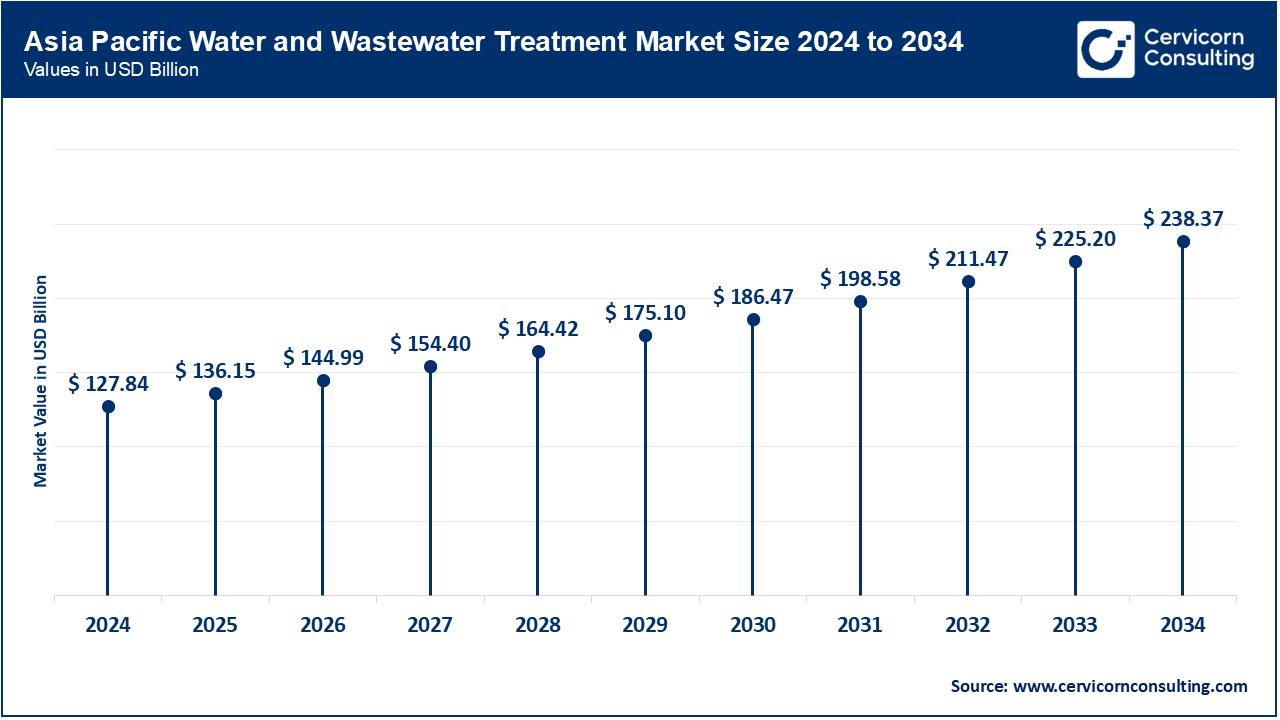

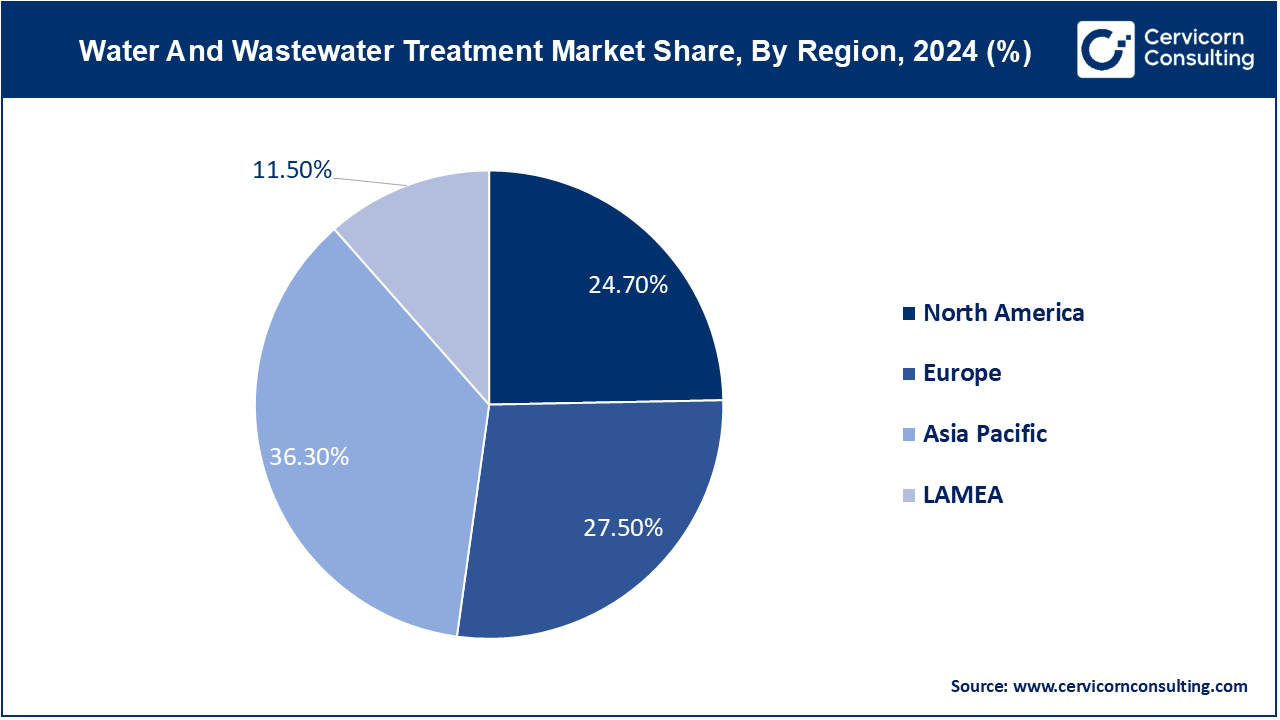

The Asia-Pacific water and wastewater treatment market size is accounted USD 127.84 in 2024 and is forecasted to gain USD 238.37 with a compound annual growth rate (CAGR) of 8.10% from 2025 to 2034. Countries such as China and India invest in expanding treatment capacities to address water pollution issues. The region also sees increasing adoption of smart water management solutions and investments in water infrastructure development.

The North America water and wastewater treatment market size is calculated at USD 86.99 billion in 2024 and is expanding around USD 162.2 billion by 2034. North America market is characterized by stringent environmental regulations and advanced infrastructure. The United States and Canada lead in adopting advanced treatment technologies to meet strict water quality standards. Increasing investments in water reuse and recycling technologies are driven by concerns over water scarcity and sustainability.

The Europe water and wastewater treatment market size is measured at USD 96.85 billion in 2024 and is estimated around USD 180.59 billion by 2034. Europe emphasizes sustainable water management practices with robust regulatory frameworks. Countries like Germany and the UK focus on upgrading aging infrastructure and implementing advanced treatment methods. Innovations in membrane technologies and decentralized treatment systems are prominent trends.

LAMEA's market is expanding due to urban development and industrial growth. Countries like Brazil, South Africa, and the UAE are focusing on improving water quality and managing wastewater effectively. Investments in desalination plants, wastewater treatment upgrades, and sustainable water reuse technologies are key trends in the region, driven by water scarcity concerns and regulatory requirements.

Dominating players in the Water and Wastewater Treatment Market, such as Veolia Environnement S.A. and Suez S.A., are at the leading with a strong emphasis on sustainability and technological advancements. They offer extensive water management solutions and cutting-edge purification technologies on a global scale. Players like Ecolab Inc., Xylem Inc., and Danaher Corporation specialize in industrial water sanitation, intelligent water resource management, and advanced water quality assessment, respectively. Along with that emerging players like AquaVenture Holdings Limited and DuPont Water Solutions focus on decentralized treatment approaches and innovative membrane technologies for desalination and water recycling. Through strategic collaborations with governmental bodies and private sectors, these market leaders drive innovations in smart infrastructure, digital monitoring tools, and decentralized treatment systems, promoting efficiency and sustainability in water treatment practices worldwide.

Market Segmentation

By Application

By Process by Equipment

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Water and Wastewater Treatment

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Application Overview

2.2.2 By Process by Equipment Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Water and Wastewater Treatment Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Public Health Concerns

4.1.1.2 Urbanization and Infrastructure Development

4.1.2 Market Restraints

4.1.2.1 High Operational Costs

4.1.2.2 Lack of Awareness and Education

4.1.3 Market Opportunity

4.1.3.1 Emerging Markets and Infrastructure Development

4.1.3.2 Technological Advancements

4.1.4 Market Challenges

4.1.4.1 Complexity of Contaminants

4.1.4.2 Climate Change Resilience

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Water and Wastewater Treatment Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Water and Wastewater Treatment Market, By Application

6.1 Global Water and Wastewater Treatment Market Snapshot, By Application

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

6.1.1.1 Municipal

6.1.1.2 Industrial

Chapter 7 Water and Wastewater Treatment Market, By Process by Equipment

7.1 Global Water and Wastewater Treatment Market Snapshot, By Process by Equipment

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2033

7.1.1.1 Primary Treatment

7.1.1.2 Secondary Treatment

7.1.1.3 Tertiary Treatment

Chapter 8 Water and Wastewater Treatment Market, By Region

8.1 Overview

8.2 Water and Wastewater Treatment Market Revenue Share, By Region 2024 (%)

8.3 Global Water and Wastewater Treatment Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Water and Wastewater Treatment Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Water and Wastewater Treatment Market, By Country

8.5.4 UK

8.5.4.1 UK Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UK Market Segmental Analysis

8.5.5 France

8.5.5.1 France Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 France Market Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 Germany Market Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of Europe Market Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Water and Wastewater Treatment Market, By Country

8.6.4 China

8.6.4.1 China Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 China Market Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 Japan Market Segmental Analysis

8.6.6 India

8.6.6.1 India Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 India Market Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 Australia Market Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia Pacific Market Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Water and Wastewater Treatment Market, By Country

8.7.4 GCC

8.7.4.1 GCC Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCC Market Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 Africa Market Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 Brazil Market Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Water and Wastewater Treatment Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 9 Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10 Company Profiles Veolia Environnement S.A. Company Snapshot

10.1.1 Company and Business Overview

10.1.2 Financial KPIs

10.1.3 Product/Service Portfolio

10.1.4 Strategic Growth

10.1.5 Global Footprints

10.1.6 Recent Development

10.1.7 SWOT Analysis

10.2 Suez S.A.

10.3 Ecolab Inc.

10.4 Xylem Inc.

10.5 Danaher Corporation

10.6 Pentair plc

10.7 Aquatech International LLC

10.8 Evoqua Water Technologies LLC

10.9 Kurita Water Industries Ltd.

10.10 3M Company