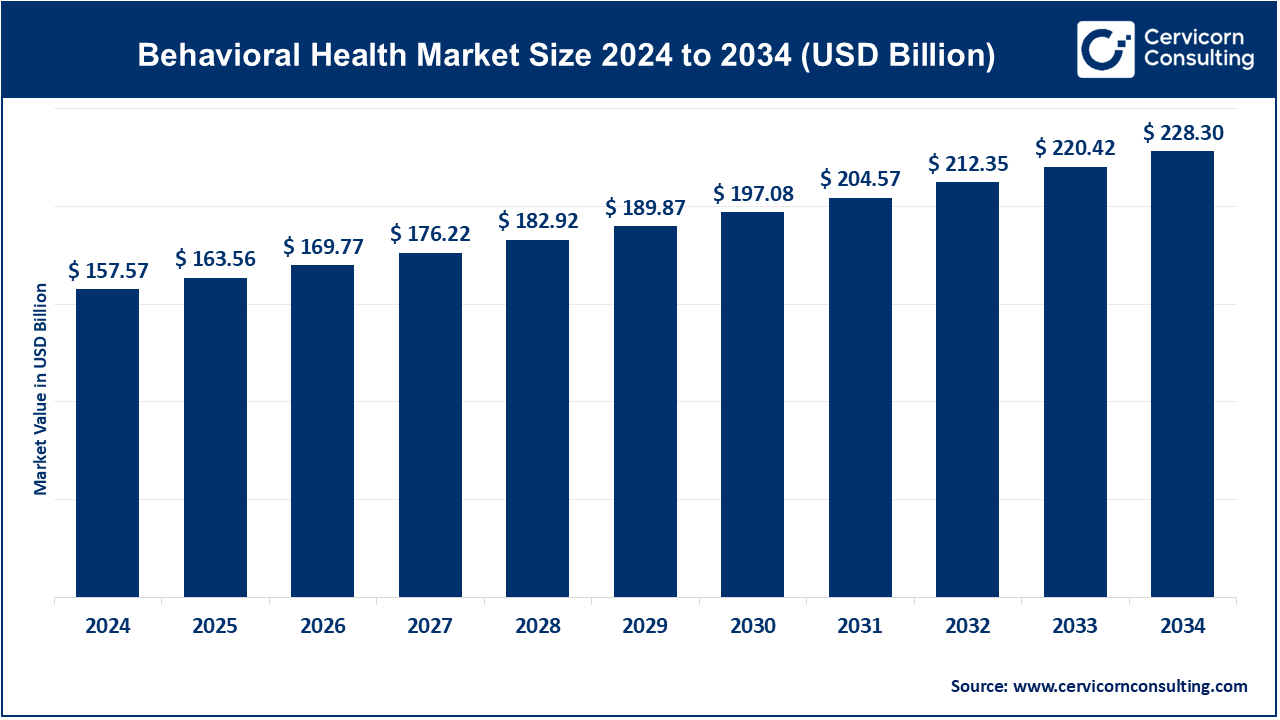

The global behavioral health market size was accounted for USD 157.57 billion in 2024 and is projected to expand around USD 228.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.8% over the forecast period 2025 to 2034.

The global behavioral health market is experiencing significant growth due to an increasing awareness of mental health issues, rising demand for mental health services, and growing support for integrated care models. The market is also driven by technological advancements, including telehealth platforms and digital therapeutic solutions, which offer convenient access to care. Furthermore, the increasing prevalence of behavioral health conditions, particularly among younger populations, is expected to contribute to continued growth. In addition to traditional healthcare settings, behavioral health services are now expanding into schools, workplaces, and community centers, which further accelerates market expansion. As mental health becomes a critical part of overall well-being, the behavioral health industry is poised for ongoing development in the coming years.

The behavioral health market consists of services and products aimed at addressing mental health and substance abuse disorders. This includes therapy, counseling, psychiatric services, medication management, and support for addiction recovery. Key trends driving the market include increasing awareness and destigmatization of mental health issues, the integration of telehealth services, and the adoption of digital health tools like mobile apps and online therapy platforms. Additionally, there is a growing emphasis on personalized treatment plans and holistic approaches that consider both mental and physical health. Government initiatives and insurance coverage expansions are also significant factors promoting market growth.

What is behavioral health?

Behavioral health refers to the connection between a person's behaviors, emotions, and overall well-being. It encompasses a wide range of mental health conditions, including anxiety, depression, substance use disorders, and stress-related disorders. The goal of behavioral health is to address the psychological, emotional, and social factors that contribute to mental health challenges and poor behavior patterns. Treatment often includes therapy, counseling, medication management, and lifestyle interventions, aimed at improving individuals' mental health and their ability to function in daily life. Major types of behavioral health disorders include anxiety, depression, addiction, eating disorders, and bipolar disorder.

Report Scope

| Area of Focus | Details |

| Market size in 2025 | USD 163.56 Billion |

| Market size in 2034 | USD 228.30 Billion |

| Market Growth Rate | CAGR of 3.8% from 2025 to 2034 |

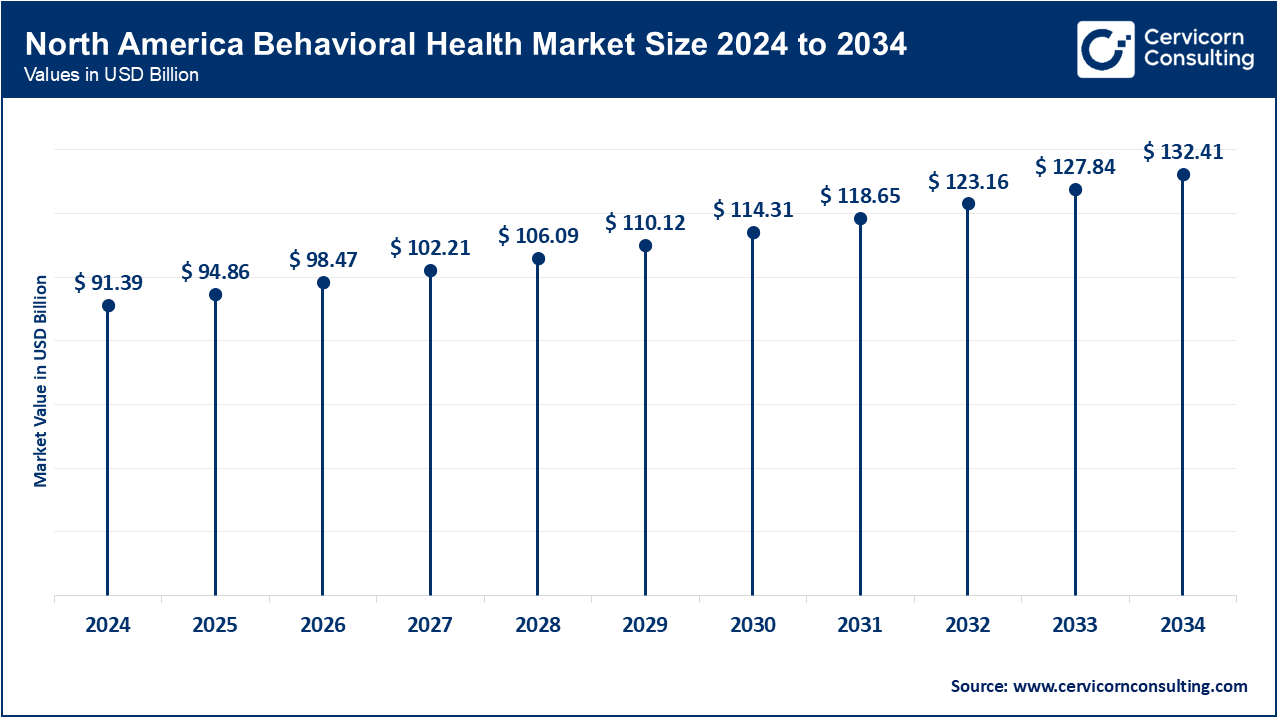

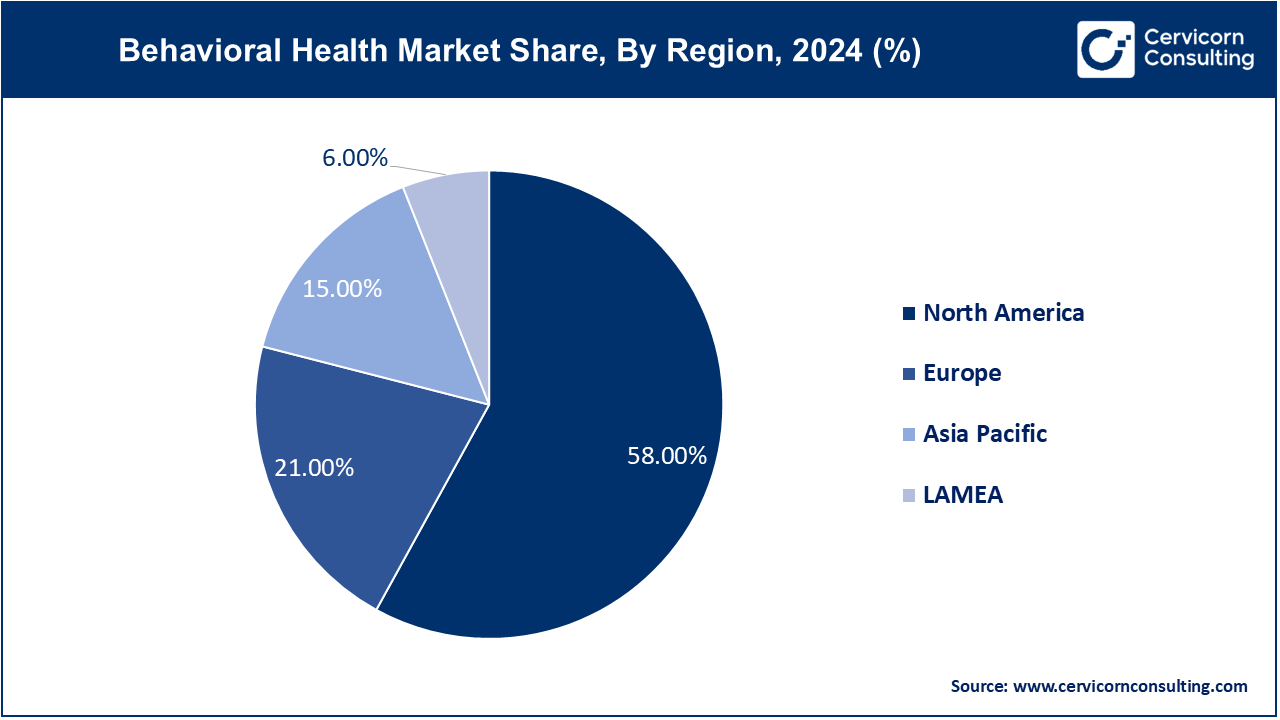

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Service Type, Disorder Type, End-Users, Regions |

Increased Funding and Investment:

Workplace Mental Health Initiatives:

Stigma and Cultural Barriers:

Limited Access to Services:

Emerging Technologies:

The integration of emerging technologies such as virtual reality (VR) and augmented reality (AR) presents significant opportunities in the behavioral health market. These technologies can enhance therapeutic interventions, providing immersive and interactive experiences for treating conditions like PTSD, anxiety, and phobias. Additionally, advancements in AI and machine learning can lead to more personalized and efficient mental health care solutions, improving patient outcomes and expanding service reach.

Growing Awareness and Education:

Increasing global awareness and education about mental health create opportunities for expanding services and support. Public health campaigns, school programs, and corporate wellness initiatives are reducing stigma and encouraging individuals to seek help. As awareness grows, the demand for mental health services is likely to rise, opening new avenues for service providers to address unmet needs in various communities.

Data Privacy and Security Concerns:

Workforce Shortages:

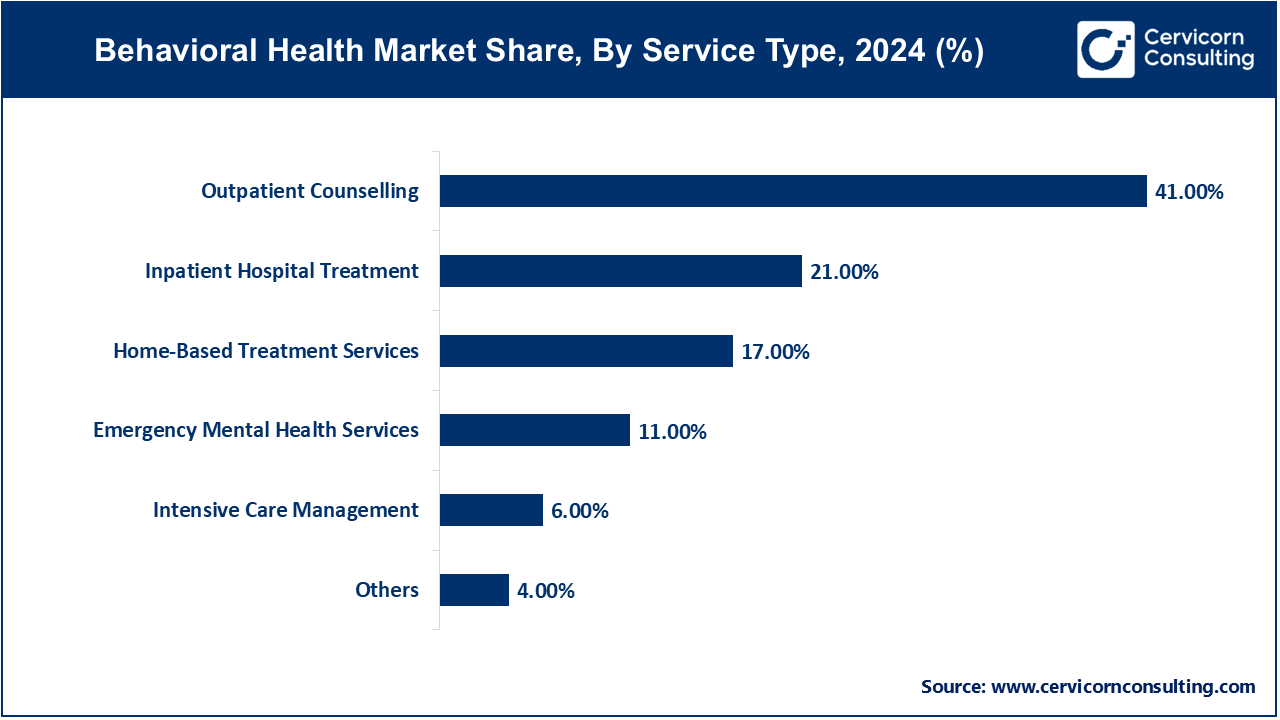

Home-Based Treatment Services: The home-based treatment services segment has recorded market share of 17% in 2024. Home-based treatment services are growing due to their convenience and personalized care delivery. Advancements in telehealth and mobile health technologies enable remote monitoring and therapy, reducing barriers to access and allowing for continuous care in a familiar environment, which enhances patient comfort and adherence.

Outpatient Counseling: The outpatient counselling segment has dominated the market with share of 41% in 2024. Outpatient counseling is expanding as more individuals seek flexible, accessible mental health support. This service type allows patients to receive therapy during non-working hours and return to their daily lives, promoting ongoing management of mental health conditions without the need for hospital admission, thus increasing service utilization.

Emergency Mental Health Services: The emergency mental health services segment has covered market share of 11% in 2024. Emergency mental health services are crucial as they address acute mental health crises promptly. The rising prevalence of mental health disorders and increased awareness have heightened the need for rapid intervention. Enhanced emergency response systems and crisis intervention strategies are key trends driving this service segment.

Inpatient Hospital Treatment: The inpatient hospital treatment segment has captured market share of 21% in 2024. Inpatient hospital treatment is driven by the need for intensive, structured care for severe mental health conditions. It offers a controlled environment with comprehensive care and monitoring. The trend towards integrating multidisciplinary teams and advanced therapeutic approaches is enhancing the effectiveness of inpatient treatment for complex cases.

Intensive Care Management: The intensive care management segment has accounted market share of 6% in 2024. Intensive care management is growing due to the need for coordinated care for individuals with severe or chronic mental health issues. This approach involves comprehensive, multidisciplinary care plans, often including case management and frequent follow-ups. It ensures tailored, high-quality care, improving long-term outcomes for patients with complex needs.

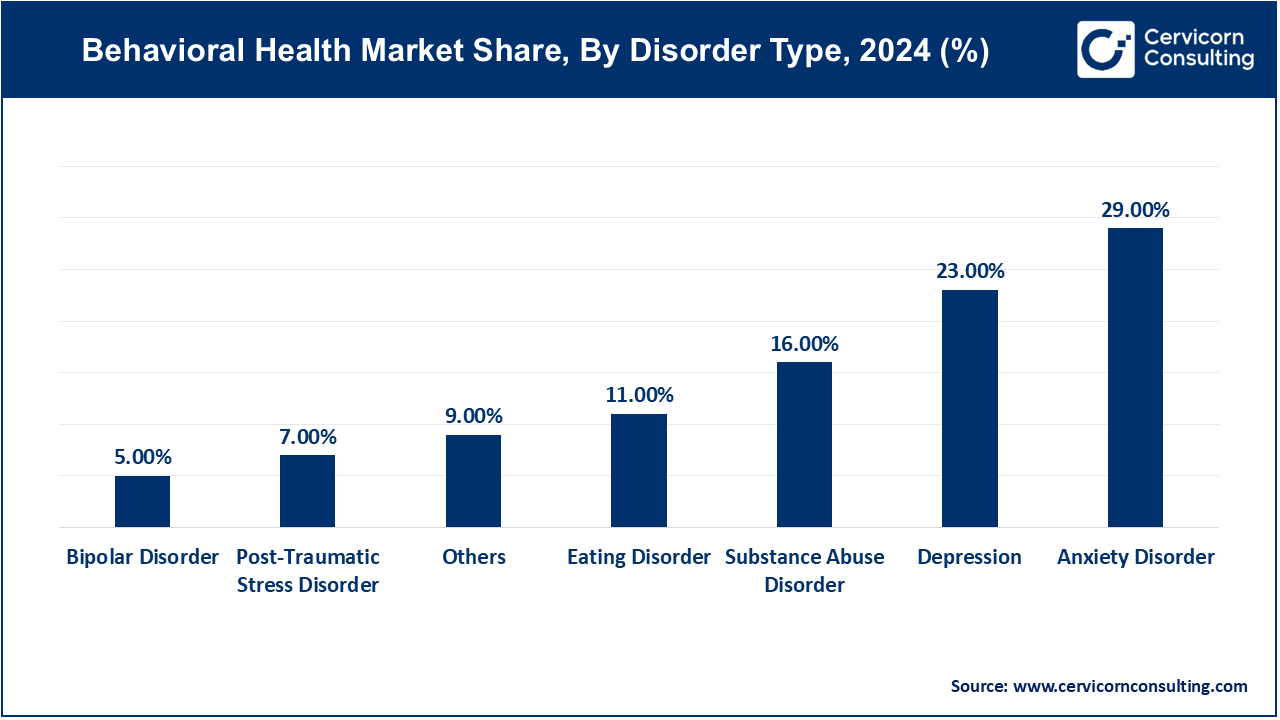

Bipolar Disorder: The bipolar bisorder segment has registered market share of 5% in 2024. Market for bipolar disorder services is growing due to increased awareness and improved diagnostic tools. Advances in pharmacotherapy and psychotherapy offer better management options, and integrated care models are enhancing patient outcomes. Greater public awareness and de-stigmatization efforts also drive demand for specialized treatment services

Anxiety Disorder: The anxiety disorder segment has measured highest market share of 29% in 2024. The rise in anxiety disorder cases drives demand for specialized treatment options, including therapy and medication. Increased awareness of mental health and the impact of stressors such as the COVID-19 pandemic contribute to market growth. Innovations in digital therapy platforms and self-help tools are expanding treatment accessibility.

Depression: The depression segment has captured market share of 23% in 2024. Depression treatment services are expanding due to rising prevalence and growing recognition of mental health's importance. Advances in antidepressant medications, psychotherapy approaches, and digital health tools are improving treatment efficacy. Increased public awareness and initiatives to reduce stigma further drive the demand for comprehensive depression care.

Post-Traumatic Stress Disorder (PTSD): This segment has account market share of 7% in 2024. PTSD services are growing as awareness of trauma’s long-term effects increases. Enhanced therapeutic approaches, including cognitive-behavioral therapy and trauma-focused interventions, improve treatment outcomes. The rise in PTSD cases among veterans and survivors of violence, coupled with improved support systems, drives the demand for specialized services.

Eating Disorder: The eating disorder segment has garnered market share of 11% in 2024. The market for eating disorder treatment is expanding due to rising awareness and the growing incidence of disorders like anorexia, bulimia, and binge eating. Advances in psychological therapies and nutritional interventions are improving treatment outcomes. Increased media focus on body image and mental health awareness also drives service demand.

Substance Abuse Disorder: The substance abuse disorder segment has held market share of 16% in 2024. Substance abuse disorder services are in high demand due to increasing addiction rates and growing recognition of the need for comprehensive treatment. Enhanced treatment approaches, including medication-assisted therapies and integrated care models, address both addiction and co-occurring mental health issues, improving patient outcomes and support systems.

Others: The others segment has achieved market share of 9% in 2024. This segment includes various less common disorders, each with unique treatment needs. Market growth is driven by advances in diagnostic techniques and tailored therapeutic approaches. Increased research into rare and emerging conditions, combined with improved healthcare access, supports the development of specialized services for diverse mental health issues.

Outpatient Clinics: Outpatient clinics are increasingly popular due to their accessibility and flexibility, offering ongoing therapy and counseling without hospital admission. The rise in preventive mental health care and telehealth services enhances their reach. They provide convenient, cost-effective care and support for various behavioral health conditions, driving market growth.

Hospitals: Hospitals remain crucial for intensive and acute mental health care, offering comprehensive services including emergency interventions and inpatient treatment. Advances in psychiatric care, integrated treatment models, and expanding mental health facilities contribute to their growing role in managing severe and complex cases effectively.

Rehabilitation Centers: Rehabilitation centers are seeing increased demand for substance abuse and behavioral disorder treatments. These centers offer specialized, structured programs for recovery and long-term management, including therapy, counseling, and support services. The rising prevalence of substance use disorders and a focus on comprehensive recovery solutions drive market growth.

Homecare Setting: Homecare settings are growing due to the convenience and personalized nature of care. Advancements in telehealth and mobile health technologies enable effective remote monitoring and support for behavioral health conditions. This trend is driven by patient preferences for in-home care and the need for continuous, individualized treatment.

The North America market size is calculated at USD 91.39 billion in 2024 and is projected to grow around USD 132.41 billion by 2034. The North America market due to a well-established healthcare infrastructure and high awareness of mental health issues. The U.S. and Canada are prominent in adopting innovative treatment solutions, including telehealth and digital therapies. The region benefits from significant government funding, insurance coverage for mental health services, and robust support networks. Increased focus on mental health in public policies and workplace initiatives further fuels market growth, addressing a broad spectrum of behavioral health needs.

The Europe market size is predicted to hit around USD 47.94 billion by 2034 from USD 33.09 billion in 2024. Europe market is driven by advanced healthcare systems and increasing awareness of mental health issues. The region is seeing growth in mental health services due to supportive government policies, expanded insurance coverage, and rising public awareness. Countries like Germany, the UK, and France lead in adopting new therapies and digital health tools. The emphasis on integrating mental health into primary care and expanding access to services in underserved areas supports overall market growth.

The Asia Pacific market size is expected to reach around USD 34.24 billion by 2034 increasing from USD 23.64 billion in 2024. The Asia-Pacific region is experiencing rapid growth, driven by increasing urbanization, rising disposable incomes, and greater awareness of mental health. Countries such as China, Japan, and India are expanding mental health services and adopting new technologies. There is a notable rise in demand for both traditional and digital mental health solutions. Government initiatives and investments in healthcare infrastructure aim to address the growing need for comprehensive mental health services, improving accessibility and quality of care.

The LAMEA market size is estimated to reach around USD 13.71 billion by 2034 increasing from USD 9.45 billion in 2024. LAMEA market is expanding due to growing awareness and improving healthcare infrastructure. In Latin America, there is increasing focus on mental health services as stigma decreases and access improves. The Middle East benefits from high investments in healthcare facilities and digital health solutions. Africa, while facing challenges such as limited resources, is seeing progress through international partnerships and funding initiatives aimed at expanding mental health services and increasing accessibility across diverse regions.

Among the new players, Mindstrong Health leverages advanced digital biomarkers and AI to provide real-time insights into mental health, enhancing personalized care. Pear Therapeutics focuses on developing FDA-approved digital therapeutics, combining technology with evidence-based treatment for conditions like substance abuse and depression. Dominating players like Teladoc Health drive growth through its extensive telehealth network and recent acquisitions, including the merger with Livongo to enhance chronic condition management. Cerner Corporation integrates electronic health records with behavioral health data, facilitating comprehensive care. Innovations and collaborations, such as Teladoc’s partnerships with health systems and Cerner’s technological advancements, underscore their leadership in the evolving behavioral health market.

Market Segmentation

By Service Type

By Disorder Type

By End-Users

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Behavioral Health

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Type Overview

2.2.2 By Disorder Type Overview

2.2.3 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Behavioral Health Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Funding and Investment

4.1.1.2 Workplace Mental Health Initiatives

4.1.2 Market Restraints

4.1.2.1 Stigma and Cultural Barriers

4.1.2.2 Limited Access to Services

4.1.3 Market Opportunity

4.1.3.1 Emerging Technologies

4.1.3.2 Growing Awareness and Education

4.1.4 Market Challenges

4.1.4.1 Data Privacy and Security Concerns

4.1.4.2 Workforce Shortages

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Behavioral Health Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Behavioral Health Market, By Service Type

6.1 Global Behavioral Health Market Snapshot, By Service Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Home-Based Treatment Services

6.1.1.2 Outpatient Counselling

6.1.1.3 Emergency Mental Health Services

6.1.1.4 Inpatient Hospital Treatment

6.1.1.5 Intensive Care Management

6.1.1.6 Other

Chapter 7 Behavioral Health Market, By Disorder Type

7.1 Global Behavioral Health Market Snapshot, By Disorder Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Bipolar Disorder

7.1.1.2 Anxiety Disorder

7.1.1.3 Depression

7.1.1.4 Post-Traumatic Stress Disorder

7.1.1.5 Eating Disorder

7.1.1.6 Substance Abuse Disorder

7.1.1.7 Others

Chapter 8 Behavioral Health Market, By End-Users

8.1 Global Behavioral Health Market Snapshot, By End-Users

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Outpatient Clinics

8.1.1.2 Hospitals

8.1.1.3 Rehabilitation Centers

8.1.1.4 Homecare Setting

Chapter 9 Behavioral Health Market, By Region

9.1 Overview

9.2 Behavioral Health Market Revenue Share, By Region 2024 (%)

9.3 Global Behavioral Health Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Behavioral Health Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Behavioral Health Market, By Country

9.5.4 UK

9.5.4.1 UK Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Behavioral Health Market, By Country

9.6.4 China

9.6.4.1 China Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Behavioral Health Market, By Country

9.7.4 GCC

9.7.4.1 GCC Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Behavioral Health Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 MedeAnalytics

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Cerner Corporation

11.3 Teladoc Health

11.4 McKinsey & Company

11.5 American Well (Amwell)

11.6 MHS (Mental Health Systems)

11.7 MedeAnalytics

11.8 Mindstrong Health

11.9 Acadia Healthcare

11.10 Evidation Health