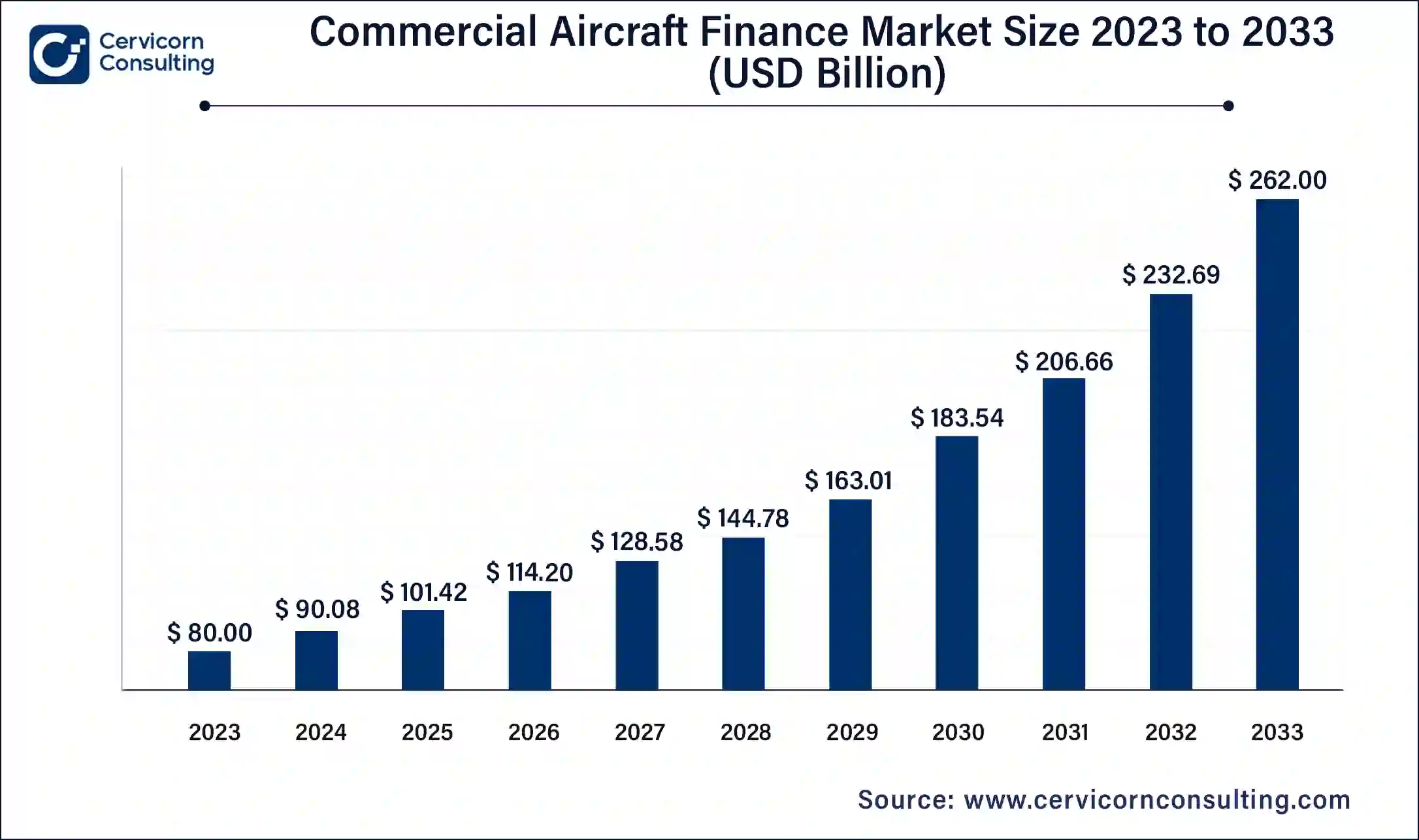

The global commercial aircraft finance market size was valued at USD 90.08 billion in 2024 and is anticipated to reach around USD 262 billion by 2033, growing at a compound annual growth rate (CAGR) of 12.59% from 2024 to 2033.

The commercial aircraft finance market is witnessing robust growth, driven by increasing global passenger demand and a surge in aircraft orders. Airlines are focusing on fleet expansion and modernization, with a strong preference for fuel-efficient and technologically advanced aircraft. Leasing companies are playing a pivotal role in financing, with their share of the global fleet growing steadily, as airlines prefer asset-light business models to reduce financial risk. The rise of low-cost carriers (LCCs), especially in regions like Asia-Pacific and Latin America, has further boosted the demand for financing solutions tailored to their operational needs. Moreover, the market is influenced by the shift towards sustainability, as airlines invest in low-emission aircraft to align with environmental goals and regulations. Financial institutions are increasingly offering green financing options, while lessors and manufacturers explore innovative funding structures.

Commercial aircraft finance involves the funding and leasing of aircraft for airlines and other aviation operators. This specialized field provides financial solutions for the acquisition, leasing, and operation of commercial aircraft, ensuring airlines can access fleets without bearing the full upfront costs. Financing options include loans, leases (operating or finance), export credit, and asset-backed securitization. Operating leases, in particular, are popular as they allow airlines to use aircraft without purchasing them outright, thus conserving capital. Major players in this field include banks, leasing companies, and aircraft manufacturers, with financial institutions often collaborating with lessors to fund aircraft acquisition.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 90.08 Billion |

| Market Growth Rate | CAGR of 12.59% from 2024 to 2033 |

| Market Size by 2033 | USD 262 Billion |

| Segments Covered | Aircraft Type, Leasing Type, Security Type, Application and Regions |

Regulatory Changes:

Technological Advancements:

High Capital Intensity:

Residual Value Risk:

Sustainable Financing Initiatives:

Emerging Market Expansion:

Geopolitical Instability:

Currency Fluctuations:

Narrow-Body Aircrafts: Market trends for narrow-body aircraft include a strong preference for fuel-efficient models driven by airlines' focus on reducing operational costs. Drivers such as increasing short-haul travel and regional connectivity fuel demand, making these aircraft popular for low-cost carriers and short-distance routes, leading to higher leasing and financing activity in this segment.

Wide-Body Aircrafts: Wide-body aircraft trends are influenced by the resurgence of long-haul travel and international routes post-pandemic. Drivers include airlines’ strategies to enhance long-distance service and capacity. The need for larger aircraft to accommodate growing passenger volumes on intercontinental flights creates opportunities for financing large-scale aircraft purchases and leases, despite higher capital requirements.

Others: This segment includes various aircraft types such as regional jets and cargo planes. Trends of this segment includes growth in specialized aviation needs and increased e-commerce driving demand for cargo aircraft. Drivers for this segment are market diversification and technological advancements, leading to unique financing solutions tailored to the specific requirements of these niche aircraft types.

Dry Leasing: Trends in Dry leasing segment show a rise in long-term leases for airlines looking to maintain fleet flexibility and minimize capital expenditure. Drivers of this segment include cost-efficiency and the ability to quickly adjust fleet size based on market demand. This leasing type supports financial stability and operational adaptability, especially appealing to airlines facing uncertain economic conditions or fleet expansion needs.

Wet Leasing: Trends in Wet leasing segment are driven by short-term demand spikes and seasonal travel fluctuations. The need for immediate capacity expansion and operational support during peak periods or for new routes fuels this segment. Wet leasing allows airlines to access fully equipped aircraft with crew, insurance, and maintenance, providing flexibility and operational efficiency without long-term financial commitments.

Asset-Backed Security (ABS): ABS trends reflect growing interest in aircraft-backed securities due to their ability to offer stable returns tied to tangible assets. Drivers include investors’ search for secure, income-generating investments and airlines’ need for liquidity. The backing of physical aircraft provides collateral, enhancing credit quality and attracting institutional investors seeking predictable cash flows and lower risk.

Non-Asset Backed Security (Non-ABS): Non-ABS trends are shaped by the demand for unsecured financing solutions that offer greater flexibility. Drivers include the need for financing options that don’t rely on specific assets for collateral, allowing for broader investment opportunities and potentially higher yields. This segment caters to investors seeking higher returns and airlines requiring capital without tying up aircraft assets.

Long Haul Aircraft: Trends in long-haul aircraft finance reflect a growing recovery in international travel and demand for high-capacity planes. Drivers include airlines' strategies to expand global routes and the need for fuel-efficient, long-range aircraft. This segment benefits from increased financing opportunities as airlines invest in advanced models to cater to rising global passenger traffic and competitive international markets.

Medium Distance Aircraft: Medium-distance aircraft finance trends are driven by a resurgence in regional travel and the demand for versatile, cost-effective solutions. Drivers include airlines’ need for efficient aircraft that bridge short and long-haul routes and lower operational costs. As regional travel increases, airlines are investing in these versatile aircraft to optimize route networks and enhance connectivity

North America: The North American commercial aircraft finance market is characterized by a well-established aviation sector with major airlines and aircraft leasing companies. Trends include a focus on fleet modernization and integration of advanced technologies. Drivers such as strong economic performance and high air travel demand sustain investment in both narrow-body and wide-body aircraft. The region benefits from a mature market infrastructure and significant access to capital, making it a leading hub for aircraft financing activities and innovation.

Europe: In Europe, the commercial aircraft finance market is influenced by the diverse regulatory landscape and a high concentration of major airlines and leasing companies. Trends include a strong push towards sustainability and the adoption of green technologies. Drivers such as the need for fleet renewal to meet environmental standards and the resurgence in travel post-pandemic drive investment. Europe’s market is shaped by its regulatory environment and the presence of numerous international finance institutions.

Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in commercial aircraft finance due to increasing air travel demand and economic expansion. Trends include a surge in fleet acquisitions by emerging market airlines and a focus on modernizing fleets. Drivers such as urbanization, rising incomes, and expanding aviation networks fuel demand for both narrow-body and wide-body aircraft. The region's dynamic economic environment and burgeoning middle class create significant opportunities for aircraft financing.

LAMEA: The LAMEA market is characterized by emerging opportunities and diverse aviation needs. Trends include an emphasis on expanding regional connectivity and investing in fleet modernization. Drivers such as economic diversification, infrastructure development, and increasing air travel in these regions create demand for tailored financing solutions. Challenges like economic volatility and varying regulatory frameworks are balanced by the potential for growth in a developing market landscape.

New players such as Nassau Capital and Jackson Square Aviation are leveraging tailored financing solutions and innovative fleet management strategies to establish their presence. Nassau Capital focuses on bespoke financing for diverse aircraft needs, while Jackson Square Aviation offers customized leasing solutions with a global approach. Dominating the market, AerCap Holdings N.V. and GECAS drive growth through their extensive fleets and strong global networks. AerCap emphasizes sustainable aviation investments and strategic acquisitions, whereas GECAS collaborates with manufacturers like Boeing to provide specialized financing solutions and advance industry innovations, ensuring fleet efficiency and market leadership.

Aengus Kelly, CEO of AerCap Holdings N.V.

Avolon CEO, Domhnal Slattery

Aengus Kelly, CEO of AerCap Holdings N.V.

GECAS CEO, Andrew Horncastle

SMBC Aviation Capital CEO, Peter Barrett

CIT Aerospace CEO, Jeff Knittel

Market Segmentation

By Aircraft Type

By Leasing Type

By Security Type

By Application

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Commercial Aircraft Finance

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Aircraft Type Overview

2.2.2 By Leasing Type Overview

2.2.3 By Security Type Overview

2.2.4 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Commercial Aircraft Finance Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Changes

4.1.1.2 Technological Advancements

4.1.2 Market Restraints

4.1.2.1 High Capital Intensity

4.1.2.2 Residual Value Risk

4.1.3 Market Opportunity

4.1.3.1 Sustainable Financing Initiatives

4.1.3.2 Emerging Market Expansion

4.1.4 Market Challenges

4.1.4.1 Geopolitical Instability

4.1.4.2 Currency Fluctuations

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Commercial Aircraft Finance Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Commercial Aircraft Finance Market, By Aircraft Type

6.1 Global Commercial Aircraft Finance Market Snapshot, By Aircraft Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Narrow-Body Aircrafts

6.1.1.2 Wide-Body Aircrafts

6.1.1.3 Others

Chapter 7 Commercial Aircraft Finance Market, By Leasing Type

7.1 Global Commercial Aircraft Finance Market Snapshot, By Leasing Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Dry Leasing

7.1.1.2 Wet Leasing

Chapter 8 Commercial Aircraft Finance Market, By Security Type

8.1 Global Commercial Aircraft Finance Market Snapshot, By Security Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Asset-Backed Security (ABS)

8.1.1.2 Non-Asset Backed Security (Non-ABS)

Chapter 9 Commercial Aircraft Finance Market, By Application

9.1 Global Commercial Aircraft Finance Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Long Haul Aircraft

9.1.1.2 Medium Distance Aircraft

Chapter 10 Commercial Aircraft Finance Market, By Region

10.1 Overview

10.2 Commercial Aircraft Finance Market Revenue Share, By Region 2023 (%)

10.3 Global Commercial Aircraft Finance Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Commercial Aircraft Finance Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Commercial Aircraft Finance Market, By Country

10.5.4 UK

10.5.4.1 UK Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Commercial Aircraft Finance Market, By Country

10.6.4 China

10.6.4.1 China Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Commercial Aircraft Finance Market, By Country

10.7.4 GCC

10.7.4.1 GCC Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Commercial Aircraft Finance Market Revenue, 2021-2033 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 AerCap Holdings N.V.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 GECAS (GE Capital Aviation Services)

12.3 Avolon

12.4 Air Lease Corporation (ALC)

12.5 SMBC Aviation Capital

12.6 BBAM

12.7 Boeing Capital Corporation

12.8 Deutsche Bank

12.9 CIT Aerospace

12.10 Nassau Capital