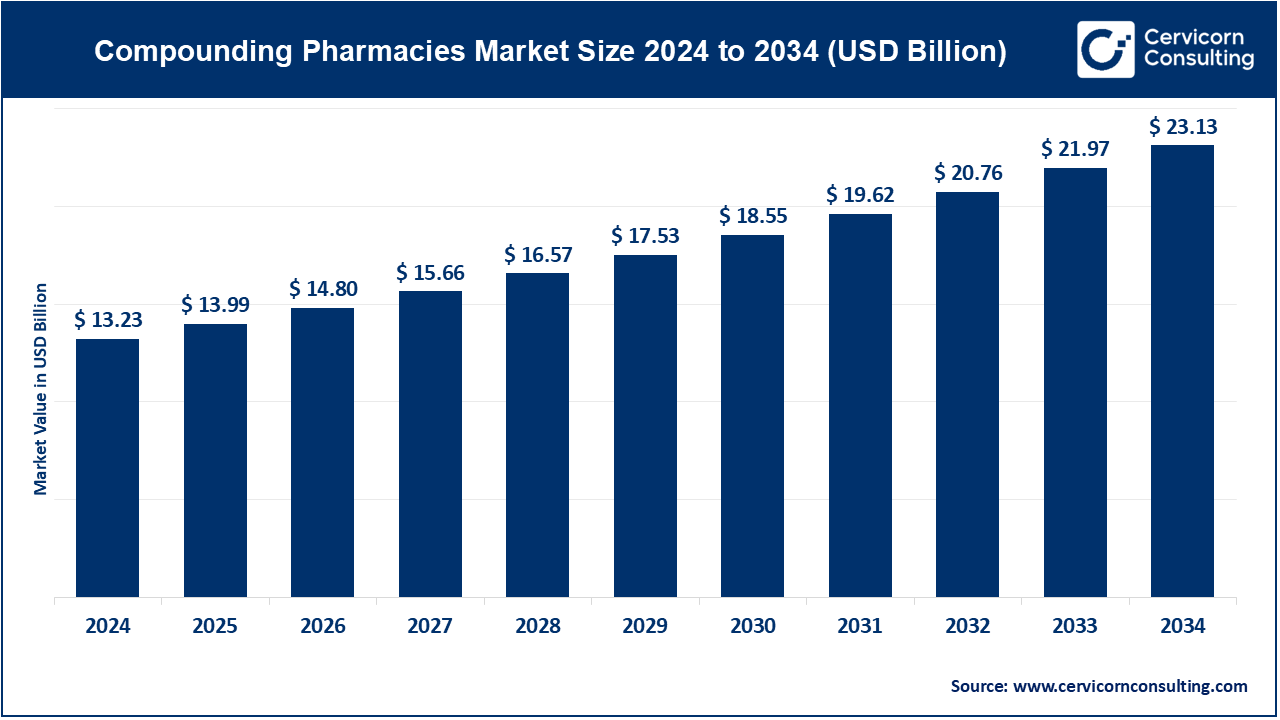

The global compounding pharmacies market size was accounted at USD 13.23 billion in 2024 and is projected to grow around USD 23.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.8% from 2025 To 2034.

The compounding pharmacy market is driven by an increasing demand for personalized healthcare solutions and the growing prevalence of chronic diseases requiring specialized treatments. These pharmacies serve niche needs by customizing medications for patients who cannot use commercially available drugs due to allergies, dosage restrictions, or specific medical conditions. The expanding use of compounded medications in areas like hormone replacement therapy, dermatology, and pain management has further fueled their adoption. Additionally, the veterinary segment has seen significant growth, with pet owners seeking tailored medications for their animals. Market growth is also supported by advancements in compounding technologies and a rising preference for individualized treatment plans among patients and healthcare providers. The scarcity of certain commercially produced drugs has pushed the demand for compounding pharmacies as they provide critical alternatives.

Compounding pharmacies specialize in preparing customized medications tailored to meet the specific needs of individual patients. Unlike mass-produced drugs, compounded medications are created by pharmacists who mix, alter, or combine ingredients to provide personalized solutions. These pharmacies are particularly beneficial for patients who require medications in specific dosages, forms, or formulations that are not commercially available. Common uses include creating allergen-free medications, altering flavors for pediatric patients, or preparing topical treatments. Compounding pharmacies cater to various medical fields, including dermatology, pain management, veterinary medicine, and hormone replacement therapy, making them a vital part of personalized healthcare.

Report Scope

| Coverage | Details |

| Market Size in 2025 | USD 13.99 Billion |

| Market Growth Rate | CAGR of 5.8% from 2025 to 2034 |

| Market Size by 2034 | USD 23.13 Billion |

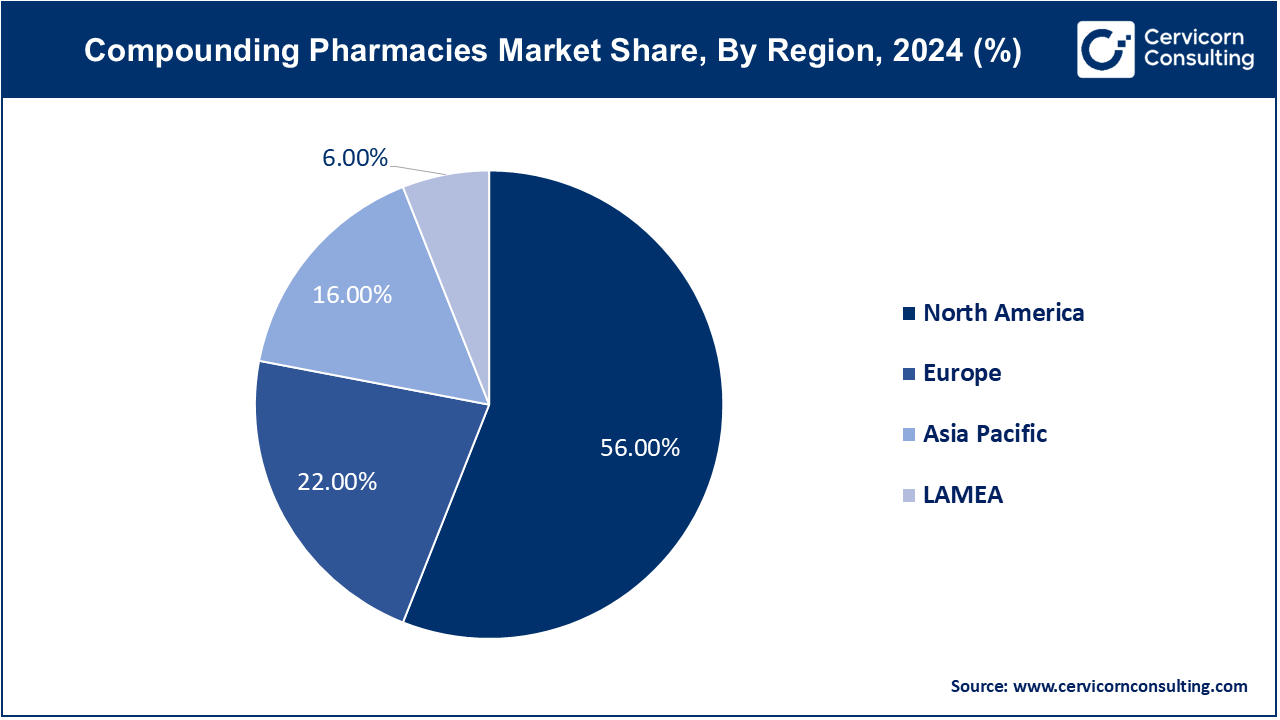

| Largest Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segment Covered | By Therapeutic Area, Age Cohort, Compounding Type, Sterility, Product, Regions |

Patient-Specific Needs

Discontinuation of Commercial Drugs

Regulatory Challenges

Quality and Safety Concerns

Personalized Medicine Advancements

With the increasing focus on personalized medicine, compounding pharmacies have a unique opportunity to provide highly customized treatment solutions tailored to individual patient needs. Advances in pharmacogenomics and personalized healthcare approaches enable compounding pharmacists to create more precise formulations, enhancing treatment efficacy and patient outcomes.

Expansion into Telepharmacy

Supply Chain Disruptions

Skilled Workforce Shortage

Hormone Replacement Therapy: Market trends in hormone replacement therapy (HRT) within compounding pharmacies include increasing demand for bioidentical hormones as patients seek natural alternatives. Drivers include an aging population and rising awareness of personalized treatment benefits, leading to more customized HRT formulations to address specific hormonal imbalances and improve patient outcomes.

Pain Management: The pain management segment has generated market share of 33% in 2024. Trends in pain management highlight a growing preference for customized medication regimens to effectively address chronic pain conditions. Drivers such as the need for alternative therapies to opioids and individualized pain relief solutions boost demand for compounded pain management drugs, offering tailored dosages and formulations for optimal pain control.

Specialty Drugs: Specialty drugs in the compounding pharmacy market are trending towards highly personalized treatments for complex conditions. Drivers include advancements in biotechnology and personalized medicine, which require custom formulations to meet specific patient needs, particularly for rare diseases and conditions where standard medications are ineffective or unavailable.

Dermatology: In dermatology, market trends show increasing demand for personalized skincare solutions and compounded treatments for conditions like eczema, psoriasis, and acne. Drivers include rising consumer awareness of personalized dermatological care and the need for tailored topical formulations that address unique skin conditions and sensitivities.

Nutritional Supplements: Trends in nutritional supplements within compounding pharmacies reflect a growing interest in personalized health and wellness. Drivers include the rising popularity of preventive healthcare and individualized nutrition plans, leading to demand for custom-formulated supplements that cater to specific dietary needs and health goals, enhancing overall wellness.

Others: The others segment includes a wide range of therapeutic areas, including veterinary medicine and pediatric care. Trends include the increasing need for customized dosage forms and flavors. Drivers such as the unique requirements of animals and children for precise, palatable medications contribute to the growth of compounding services in these niches.

Pediatric: In the pediatric segment, market trends emphasize the demand for child-friendly formulations and dosages that are often unavailable in commercial medications. The pediatric segment has recorded market share of 21.97% in 2024. Drivers include the need for medications that address specific pediatric health issues and the importance of flavoring and dosage customization to improve compliance among young patients.

Adult: The adult segment has covered market share of 45.26% in 2024. For this segment, trends focus on personalized treatment options for chronic conditions and lifestyle-related health issues. Drivers include the increasing prevalence of chronic diseases such as diabetes and hypertension, leading to a need for tailored medications that offer specific dosages and formulations to optimize therapeutic outcomes and manage long-term health conditions.

Geriatric: The geriatric segment trends highlight a growing demand for customized medications to address multiple and complex health conditions common in older adults. This segment has registered market share of 32.77% in 2024. Drivers include an aging population and the prevalence of chronic illnesses, necessitating compounded medications that cater to unique dosage requirements, ease of administration, and improved tolerability for elderly patients.

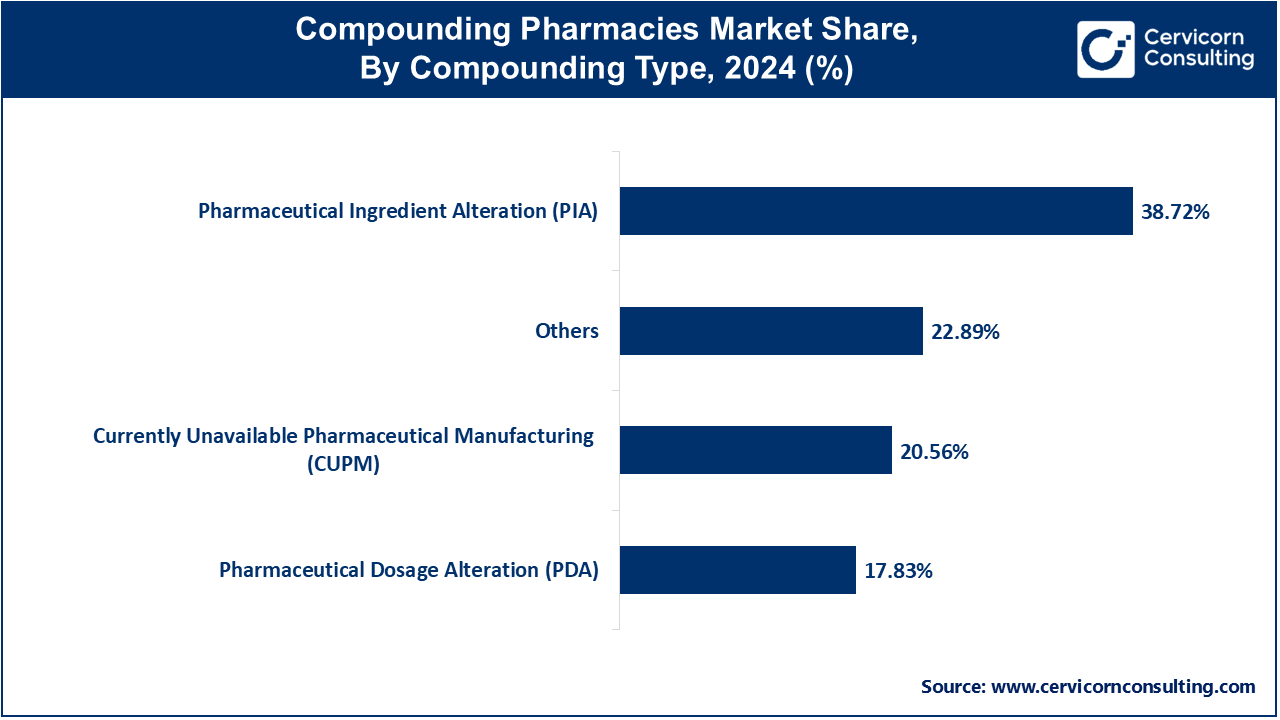

Pharmaceutical Ingredient Alteration (PIA): This segment has measured market share of 38.72% in 2024. In the Pharmaceutical Ingredient Alteration (PIA) segment, market trends focus on creating medications by modifying existing ingredients to meet specific patient needs. Drivers include the demand for allergen-free or customized formulations that are not available in standard products. PIA allows compounding pharmacies to provide solutions for patients with unique sensitivities or requirements by adjusting ingredient profiles.

Currently Unavailable Pharmaceutical Manufacturing (CUPM): This segment has captured market share of 20.56% in 2024. The Currently Unavailable Pharmaceutical Manufacturing (CUPM) segment trends towards addressing gaps in the market where certain drugs are discontinued or hard to find. Drivers include drug shortages and discontinuations by large manufacturers, prompting compounding pharmacies to produce needed medications. This segment helps ensure continuity of care by offering alternatives for medications that are no longer commercially available.

Pharmaceutical Dosage Alteration (PDA): Pharmaceutical Dosage Alteration (PDA) trends highlight the customization of medication dosages to fit individual patient needs. This segment has garnered market shae of 17.83% in 2024. Drivers include the necessity for precise dosage adjustments due to varying patient tolerances and requirements, such as for children or those with specific health conditions. PDA allows pharmacies to provide tailored dosages that improve treatment efficacy and patient adherence.

Others: The others segment has accounted market share of 22.89% in 2024. This segment in compounding types includes a variety of less common compounding practices. Trends include the development of unique dosage forms and specialized preparations. Drivers include niche patient needs and innovative compounding techniques that address specific health conditions or preferences, expanding the range of personalized treatment options available in the compounding pharmacy market.

Sterile: In the sterile compounding segment, trends emphasize the need for high-precision, contamination-free formulations, particularly for injections and ophthalmic preparations. Drivers include increased demand for sterile medications in hospitals and clinics due to their critical role in preventing infections and ensuring patient safety. Enhanced regulatory standards and advanced sterilization technologies further boost this segment’s growth.

Non-Sterile: The non-sterile compounding segment focuses on creating customized oral medications, topical treatments, and non-injection formulations. Trends include a rising demand for personalized creams, ointments, and capsules tailored to specific patient needs. Drivers include the need for customized dosage forms and the ability to address unique health issues with non-sterile preparations, enhancing treatment options outside of sterile environments.

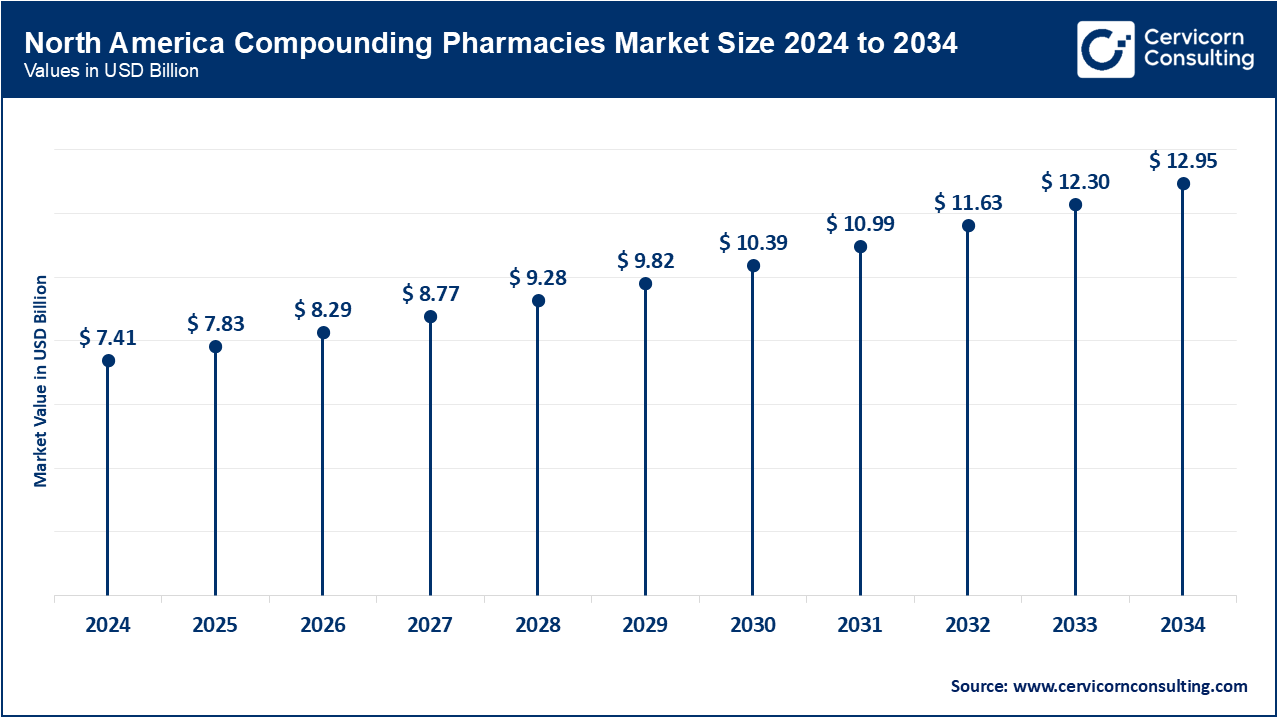

In North America, the compounding pharmacies market is highly developed, driven by advanced healthcare infrastructure and a strong focus on personalized medicine. North America market size is calculated at USD 7.41 billion in 2024 and is projected to grow around USD 12.95 billion by 2034. The U.S. and Canada have stringent regulatory frameworks ensuring high standards in compounding practices. Trends include increased demand for customized medications due to rising chronic disease prevalence and an aging population. Additionally, there is significant growth in telepharmacy services, enhancing accessibility and convenience for patients across the region.

Europe market size is projected to grow around USD 5.08 billion by 2034 from USD 2.91 billion in 2024. The European compounding pharmacies market is characterized by a diverse regulatory landscape and a growing emphasis on personalized healthcare solutions. Countries across Europe are witnessing increased demand for compounded medications due to varying national healthcare needs and an aging demographic. Trends include a focus on integrating advanced compounding technologies and strict adherence to EU regulations. Market growth is driven by a rising prevalence of chronic conditions and the need for tailored therapeutic solutions.

Asia Pacific market size is estimated to achieve around USD 3.71 billion by 2034 increasing from USD 2.12 billion in 2024. The Asia-Pacific compounding pharmacies market is expanding rapidly due to increasing healthcare access and rising awareness of personalized medicine. Countries like China, India, and Japan are experiencing significant growth in demand for compounded medications, driven by a large population base and a growing middle class. Trends include advancements in compounding technology and increasing investment in healthcare infrastructure. The market is also supported by the rise in chronic diseases and a focus on improving patient-specific treatment options.

In the LAMEA region, the compounding pharmacies market is developing with a focus on addressing diverse healthcare needs. The LAMEA market size is calculated USD 0.79 billion in 2024 and is anticipated to grow around USD 1.39 billion by 2034. Growth is driven by increasing drug shortages and a rising demand for personalized treatments in these regions. Trends include efforts to improve healthcare access and quality amid economic and infrastructural challenges. The market is supported by expanding healthcare systems and a growing awareness of customized medication benefits, though regulatory and logistical hurdles remain.

New players such as Capsule Pharmacy and Revive Pharmacy are leveraging advanced digital tools and personalized care to enhance their offerings. Capsule Pharmacy integrates innovative technology for efficient prescription management, while Revive Pharmacy focuses on customized compounding solutions tailored to individual patient needs. On the other hand, Fagron and Patterson Companies, Inc. are dominating the market through their extensive global networks and diverse product portfolios. Fagron drives growth with continuous technological advancements and strategic acquisitions, while Patterson Companies excels with its broad distribution channels and partnerships with healthcare providers, optimizing medication accessibility and patient care.

Fagron CEO, Rafael Padilla

"At Fagron, our commitment is to advance the field of personalized medicine through innovative compounding solutions. We are focused on integrating cutting-edge technologies and expanding our global presence to meet the evolving needs of healthcare providers and patients."

Patterson Companies, Inc.

CEO, Jeremy J. A.

"Patterson Companies remains dedicated to enhancing healthcare delivery by providing high-quality compounding services. Our focus on technological advancements and strategic partnerships helps us deliver customized medication solutions that improve patient outcomes and support healthcare professionals."

Wedgewood Pharmacy CEO, Steve Schwartz

"Wedgewood Pharmacy is committed to leading the compounding industry through exceptional quality and personalized service. We strive to exceed industry standards by investing in advanced compounding technologies and maintaining rigorous quality controls to ensure patient safety and satisfaction."

Medisca CEO, Tom McLean

"Medisca is at the forefront of innovation in compounding, continuously evolving our product offerings and services to meet the demands of a dynamic healthcare landscape. Our dedication to research and development ensures that we provide the highest quality compounded medications for our clients."

Custom Rx Pharmacy CEO, Dr. Marc Davidson

"At Custom Rx Pharmacy, our mission is to deliver tailored medication solutions that address the unique needs of each patient. We leverage our expertise and state-of-the-art compounding techniques to provide effective and personalized treatments, improving patient care and outcomes."

PharMEDium Services CEO, Dan O’Connell

"PharMEDium Services is focused on advancing the safety and efficacy of compounded medications through rigorous quality assurance and innovative practices. Our dedication to excellence and collaboration with healthcare providers ensures that we meet the highest standards in patient care."

These statements reflect the commitment of these key players to innovation, quality, and patient-centered care in the compounding pharmacies market.

Market Segmentation

By Therapeutic Area

By Age Cohort

By Compounding Type

By Sterility

By Product

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Compounding Pharmacies

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Therapeutic Area Overview

2.2.2 By Age Cohort Overview

2.2.3 By Compounding Type Overview

2.2.4 By Sterility Overview

2.2.5 By Product Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Compounding Pharmacies Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Patient-Specific Needs

4.1.1.2 Discontinuation of Commercial Drugs

4.1.2 Market Restraints

4.1.2.1 Regulatory Challenges

4.1.2.2 Quality and Safety Concerns

4.1.3 Market Opportunity

4.1.3.1 Personalized Medicine Advancements

4.1.3.2 Expansion into Telepharmacy

4.1.4 Market Challenges

4.1.4.1 Supply Chain Disruptions

4.1.4.2 Skilled Workforce Shortage

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Compounding Pharmacies Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Compounding Pharmacies Market, By Therapeutic Area

6.1 Global Compounding Pharmacies Market Snapshot, By Therapeutic Area

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hormone Replacement Therapy

6.1.1.2 Pain Management

6.1.1.3 Specialty Drugs

6.1.1.4 Dermatology

6.1.1.5 Nutritional Supplements

6.1.1.6 Others

Chapter 7 Compounding Pharmacies Market, By Age Cohort

7.1 Global Compounding Pharmacies Market Snapshot, By Age Cohort

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Pediatric

7.1.1.2 Adult

7.1.1.3 Geriatric

Chapter 8 Compounding Pharmacies Market, By Compounding Type

8.1 Global Compounding Pharmacies Market Snapshot, By Compounding Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Pharmaceutical Ingredient Alteration (PIA)

8.1.1.2 Currently Unavailable Pharmaceutical Manufacturing (CUPM)

8.1.1.3 Pharmaceutical Dosage Alteration (PDA)

8.1.1.4 Others

Chapter 9 Compounding Pharmacies Market, By Sterility

9.1 Global Compounding Pharmacies Market Snapshot, By Sterility

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Sterile

9.1.1.2 Non-sterile

Chapter 10 Compounding Pharmacies Market, By Product

10.1 Global Compounding Pharmacies Market Snapshot, By Product

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Oral

10.1.1.2 Parenteral

10.1.1.3 Topical

10.1.1.4 Ophthalmic

10.1.1.5 Nasal

10.1.1.6 Rectal

10.1.1.7 Otic

Chapter 11 Compounding Pharmacies Market, By Region

11.1 Overview

11.2 Compounding Pharmacies Market Revenue Share, By Region 2024 (%)

11.3 Global Compounding Pharmacies Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Compounding Pharmacies Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Compounding Pharmacies Market, By Country

11.5.4 UK

11.5.4.1 UK Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Compounding Pharmacies Market, By Country

11.6.4 China

11.6.4.1 China Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Compounding Pharmacies Market, By Country

11.7.4 GCC

11.7.4.1 GCC Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Compounding Pharmacies Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Fagron

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Patterson Companies, Inc.

13.3 Wedgewood Pharmacy

13.4 Capsule Pharmacy

13.5 Medisca

13.6 The Compounding Center

13.7 PharMEDium Services

13.8 Custom Rx Pharmacy

13.9 Pharmacy Solutions

13.10 NorthStar Rx