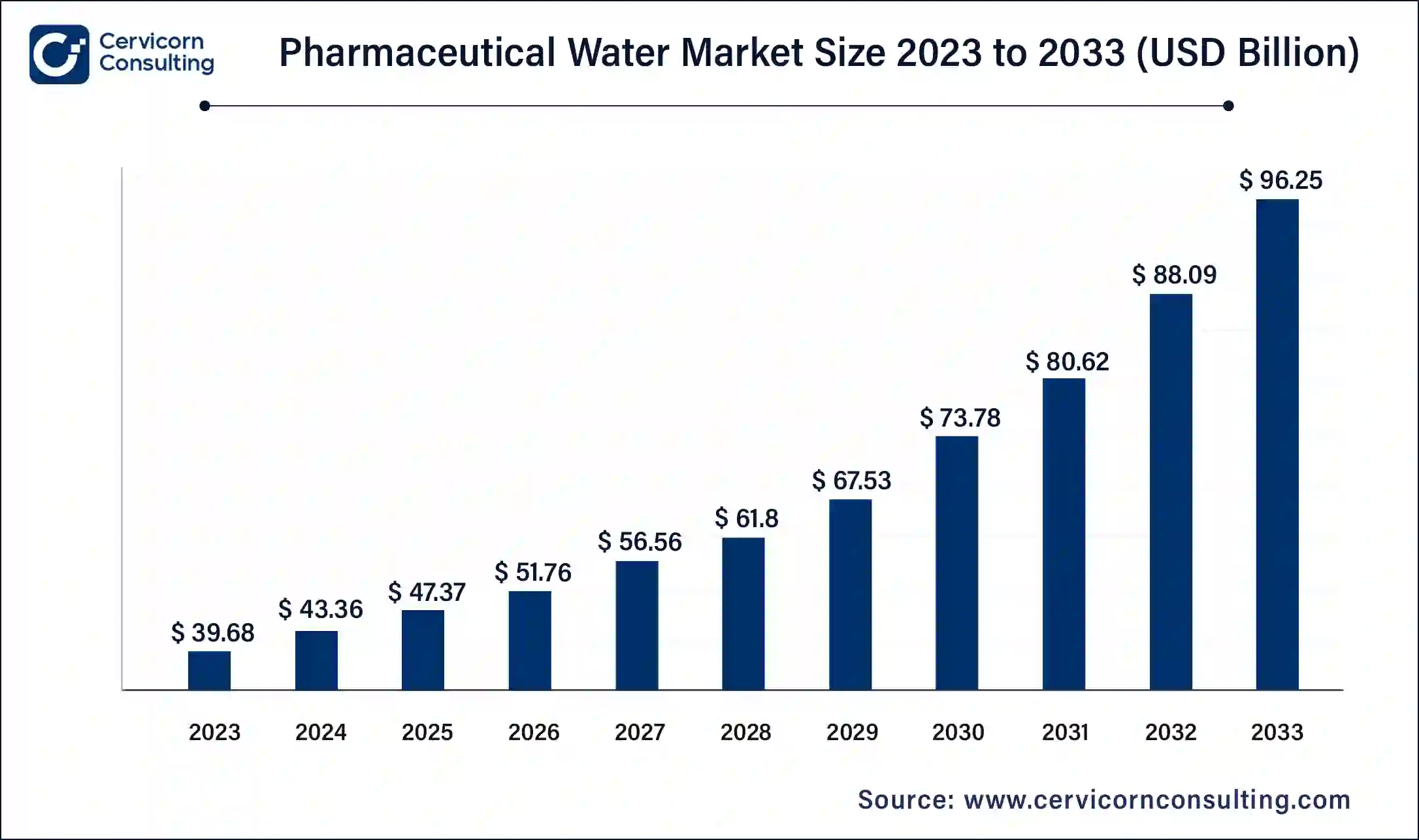

The global pharmaceutical water market size was measured at USD 43.36 billion in 2024 and is anticipated to reach around USD 96.25 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.26% from 2024 to 2033.

The pharmaceutical water market has seen substantial demand due to its essential role in drug manufacturing, formulation, and laboratory applications. With increasing global concerns regarding product safety and the rising production of biopharmaceuticals, water quality has become a crucial focus for pharmaceutical manufacturers. The adoption of advanced filtration and purification technologies has also driven innovation, with companies offering customized solutions tailored to meet stringent regulatory standards for water used in drug production. Moreover, the growing emphasis on regulatory compliance is pushing companies to invest in reliable water treatment systems, fostering market growth. The market is influenced by factors such as technological advancements in water purification systems, government regulations on water quality, and the rising production of injectables, biologics, and vaccines.

Pharmaceutical water is a critical component in the pharmaceutical industry, serving as a raw material, ingredient, and solvent in the processing, formulation, and manufacture of pharmaceutical products, active pharmaceutical ingredients (APIs), and intermediates. It is utilized in various stages, including synthesis, production of finished products, and as a cleaning agent for rinsing vessels, equipment, and primary packaging materials. The quality of pharmaceutical water is paramount, as it must meet stringent standards to ensure the safety and efficacy of pharmaceutical products. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), have established guidelines for water used in pharmaceutical applications, emphasizing the removal of minerals, organics, and microbes to prevent contamination.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 43.36 Billion |

| Market Growth Rate | CAGR of 9.26% from 2024 to 2033. |

| Market Size by 2033 | USD 96.25 Billion |

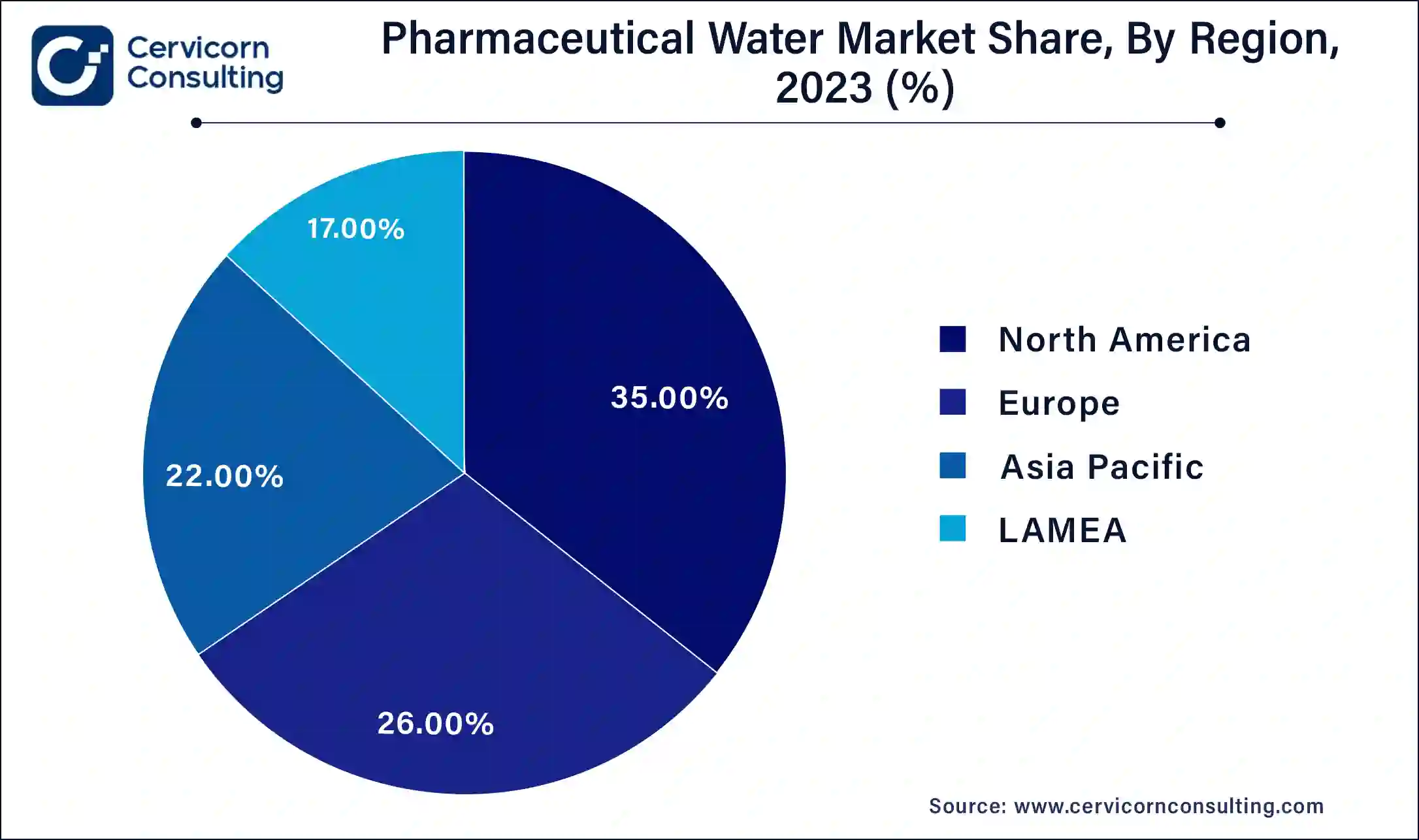

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Type, Technology, Application and Regions |

Global Pandemic Preparedness:

Increasing Outsourcing Trends:

High Capital Investment:

The significant upfront costs of acquiring and installing advanced water purification systems, along with ongoing operational expenses for maintenance and upgrades, can strain the financial resources of pharmaceutical companies. This financial barrier may delay or limit investments in modernizing water treatment infrastructure.

Complex Regulatory Landscape:

Advanced Water Purification Technologies:

Expansion in Emerging Markets:

Water Quality Variability:

Water Scarcity and Resource Management:

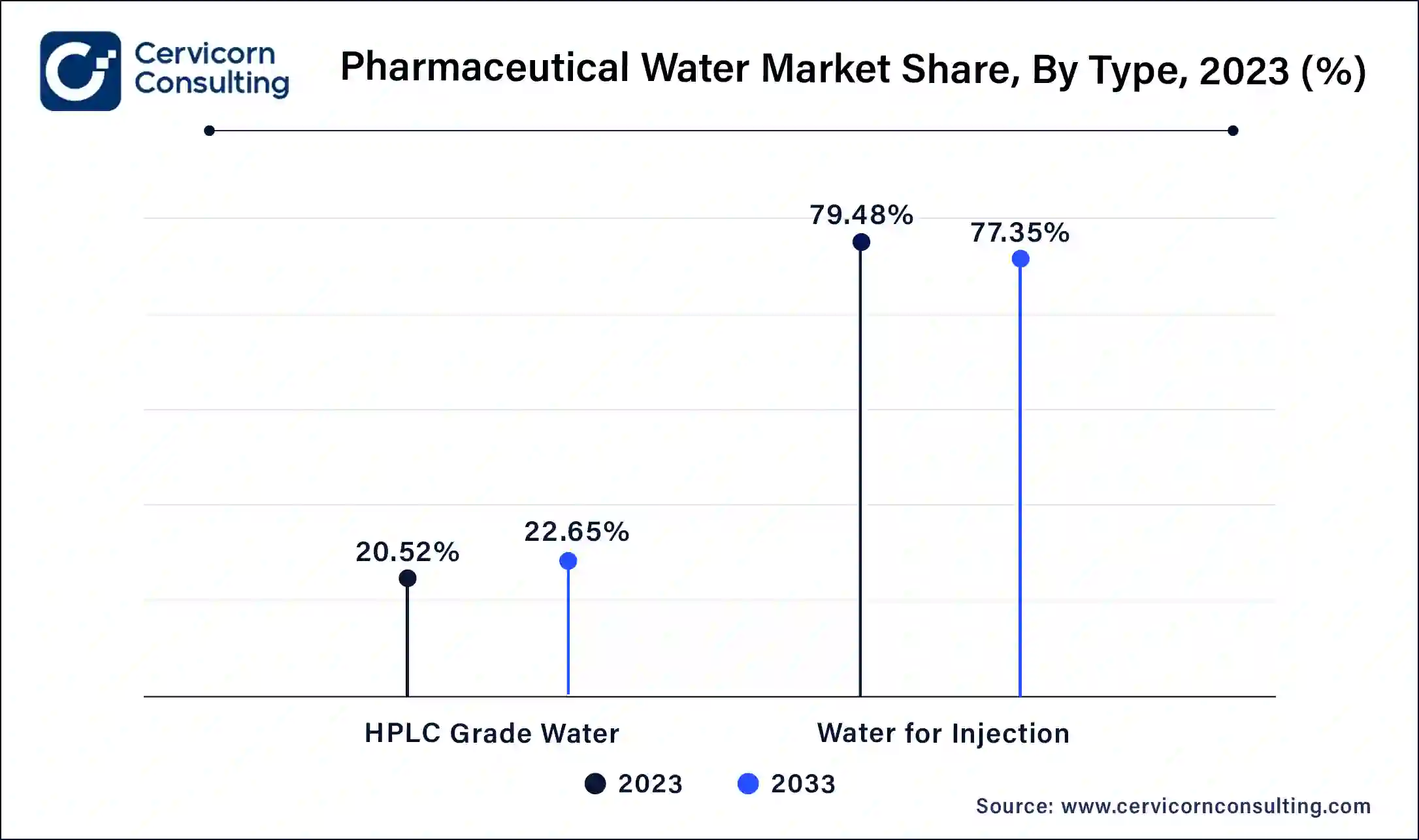

HPLC Grade Water: High Performance Liquid Chromatography (HPLC) Grade Water is purified to meet stringent quality standards suitable for analytical and chromatographic applications in pharmaceutical laboratories. This segment has captured market share of 20.52% in 2023. Trends include increasing demand for ultra-pure water quality to ensure accurate and reproducible analytical results, driven by advancements in analytical techniques and the need for precise pharmaceutical testing.

Water for Injection (WFI): Water for Injection is produced using techniques such as distillation or membrane filtration to meet rigorous standards for injectable pharmaceuticals. In 2023 the water for injection segment has covered highest market share of 79.48%. Trends focus on enhancing production efficiency, ensuring compliance with global pharmacopeial standards, and adopting advanced purification technologies to meet growing demand for sterile and pyrogen-free water in parenteral drug formulations.

Membrane Filtration: Utilizes semi-permeable membranes to remove particles, microorganisms, and dissolved solids from water, ensuring purity for pharmaceutical applications. Trend: Increasing adoption due to efficiency, scalability, and compatibility with sustainable practices.

Distillation: Involves boiling water to produce steam, which is condensed and collected as purified water. Trend: Essential for producing Water for Injection (WFI) due to reliability and compliance with regulatory standards.

Electrodeionization (EDI): Removes ions from water using ion-exchange membranes and electrical current, producing high-purity water without chemical regeneration. Trend: Growing preference for continuous operation and reduced chemical usage.

UV Oxidation: Utilizes ultraviolet light to disinfect water by disrupting microbial DNA. Trend: Rising use for microbial control in pharmaceutical water systems due to effectiveness and environmental benefits.

Others: Includes technologies like reverse osmosis (RO) for selective filtration and ozonation for disinfection, adapting to specific purity and production needs in pharmaceutical water treatment.

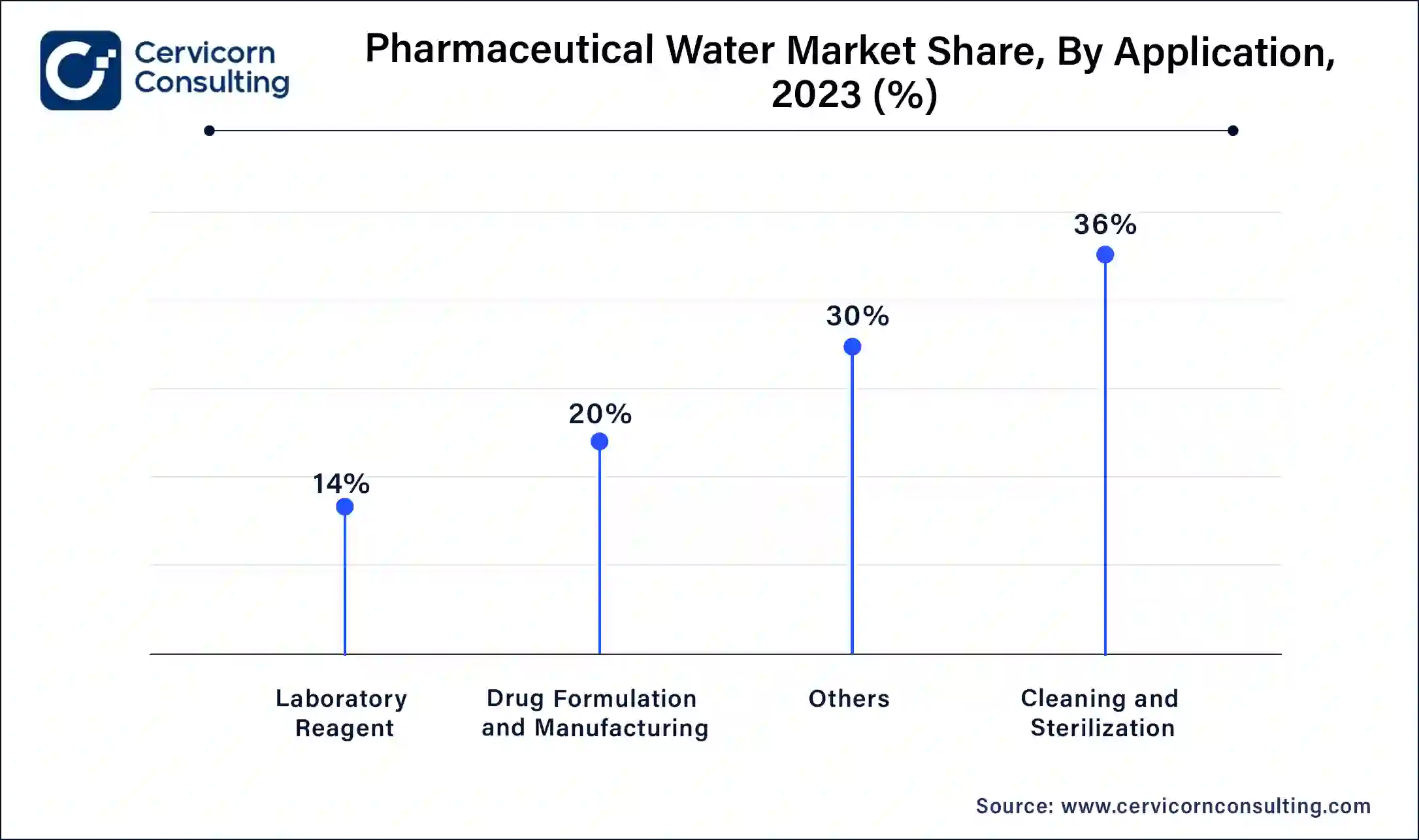

Drug Formulation and Manufacturing: Pharmaceutical water is essential in drug formulation and manufacturing processes, ensuring purity and safety of medications. Trends include increasing demand for high-quality water for biopharmaceutical production and stringent regulatory compliance. This segment has registered market share of 20% in 2023.

Laboratory Reagent: Laboratory reagent segment has recorded market share of 14% in 2023. High-purity water is critical for accurate laboratory testing and research. Trends focus on advanced water purification technologies to meet precise laboratory requirements and enhance research reliability.

Cleaning and Sterilization: Water is vital for equipment cleaning and sterilization in pharmaceutical facilities. Trends emphasize efficient water treatment systems to maintain hygienic standards and reduce environmental impact. The cleaning and sterilization segment has garnered 36% of share in 2023.

Others: The other segment has accounted market share of 30% in 2023. This segment may include uses like HVAC system maintenance and environmental monitoring, where water quality plays a crucial role in supporting overall pharmaceutical operations and compliance.

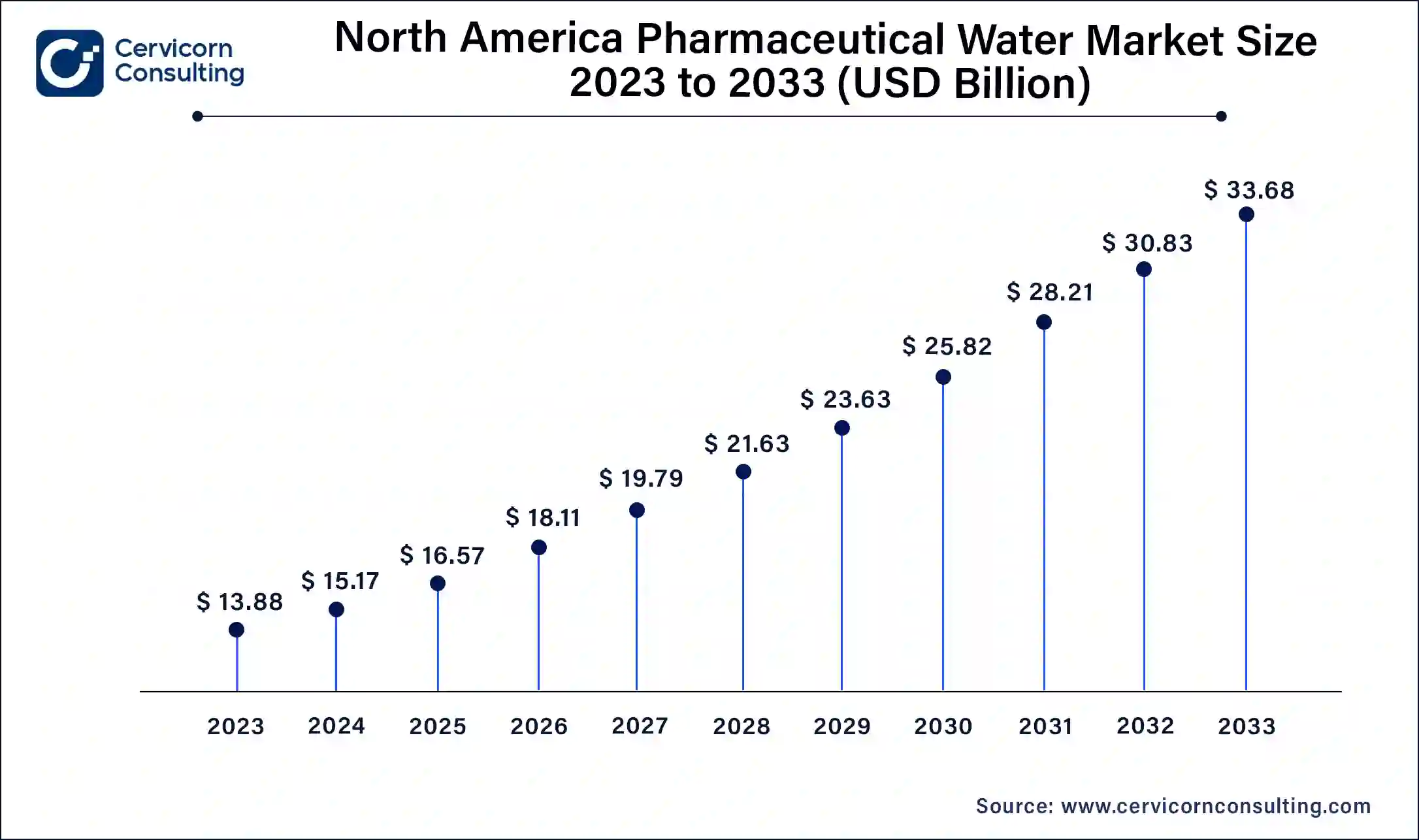

In North America, there is a strong focus on implementing advanced water purification technologies to meet stringent regulatory requirements. North America market size is expected to reach around USD 33.69 billion by 2033 increasing from USD 15.18 billion in 2024. Trends include increased investment in sustainable water management practices and adoption of innovative filtration and disinfection technologies to ensure pharmaceutical-grade water quality. U.S market size is estimated to reach around USD 26.95 billion by 2033 increasing from USD 12.14 billion in 2024.

The Asia-Pacific region experiences rapid pharmaceutical industry growth and increasing demand for high-quality water in drug manufacturing. Asia Pacific market size is calculated at USD 9.54 billion in 2024 and is projected to grow around USD 21.18 billion by 2033. Trends include expanding pharmaceutical production capacities, adoption of cost-effective water treatment solutions, and regulatory harmonization efforts to align with international standards, fostering market expansion and technological innovation.

Europe emphasizes sustainable water use and compliance with strict environmental regulations. Europe market size is measured at USD 11.27 billion in 2024 and is expected to grow around USD 25.03 billion by 2033. Trends include the integration of smart water management systems, such as IoT-enabled monitoring and predictive maintenance, to optimize water usage efficiency and reduce operational costs in pharmaceutical manufacturing.

LAMEA(Latin America, Middle East, and Africa) countries focus on improving healthcare infrastructure and regulatory frameworks to support pharmaceutical manufacturing. LAMEA market size is forecasted to reach around USD 16.36 billion by 2033 from USD 7.37 billion in 2024. Trends include investment in water infrastructure development, partnerships with international manufacturers for technology transfer, and local capacity building in water treatment technologies to enhance market competitiveness and sustainability.

Innovative newcomers in the pharmaceutical water market, such as BioPure Technology and PureAire Monitoring Systems, are leveraging advanced technologies like nanofiltration and real-time monitoring for water quality assurance. These companies focus on offering scalable, cost-effective solutions tailored to pharmaceutical manufacturing needs, driving market disruption. Key players dominating the market include Veolia Water Technologies, SUEZ Water Technologies & Solutions, and Merck KGaA. They lead through extensive global reach, comprehensive service offerings, and continuous innovation in water purification technologies. Their established reputations and robust regulatory compliance frameworks solidify their market leadership positions.

Market Segmentation

By Type

By Technology

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Pharmaceutical Water

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Technology Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Pharmaceutical Water Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Global Pandemic Preparedness

4.1.1.2 Increasing Outsourcing Trends

4.1.2 Market Restraints

4.1.2.1 High Capital Investment

4.1.2.2 Complex Regulatory Landscape

4.1.3 Market Opportunity

4.1.3.1 Advanced Water Purification Technologies

4.1.3.2 Expansion in Emerging Markets

4.1.4 Market Challenges

4.1.4.1 Water Quality Variability

4.1.4.2 Water Scarcity and Resource Management

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Pharmaceutical Water Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Pharmaceutical Water Market, By Type

6.1 Global Pharmaceutical Water Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 HPLC Grade Water

6.1.1.2 Water for Injection

Chapter 7 Pharmaceutical Water Market, By Technology

7.1 Global Pharmaceutical Water Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Membrane Filtration

7.1.1.2 Distillation

7.1.1.3 Electrodeionization (EDI)

7.1.1.4 UV Oxidation

7.1.1.5 Others

Chapter 8 Pharmaceutical Water Market, By Application

8.1 Global Pharmaceutical Water Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Drug Formulation and Manufacturing

8.1.1.2 Laboratory Reagent

8.1.1.3 Cleaning and Sterilization

8.1.1.4 Others

Chapter 9 Pharmaceutical Water Market, By Region

9.1 Overview

9.2 Pharmaceutical Water Market Revenue Share, By Region 2023 (%)

9.3 Global Pharmaceutical Water Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Pharmaceutical Water Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Pharmaceutical Water Market, By Country

9.5.4 UK

9.5.4.1 UK Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Pharmaceutical Water Market, By Country

9.6.4 China

9.6.4.1 China Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Pharmaceutical Water Market, By Country

9.7.4 GCC

9.7.4.1 GCC Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Pharmaceutical Water Market Revenue, 2021-2033 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Veolia Water Technologies

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 SUEZ Water Technologies & Solutions

11.3 Pall Corporation (now part of Danaher Corporation)

11.4 Merck KGaA

11.5 Thermo Fisher Scientific Inc.

11.6 ELGA LabWater (part of Veolia)

11.7 Pall Medical (now part of SUEZ)

11.8 Barnstead International (part of Thermo Fisher Scientific)

11.9 Aquafine Corporation (part of Trojan Technologies)

11.10 Evoqua Water Technologies