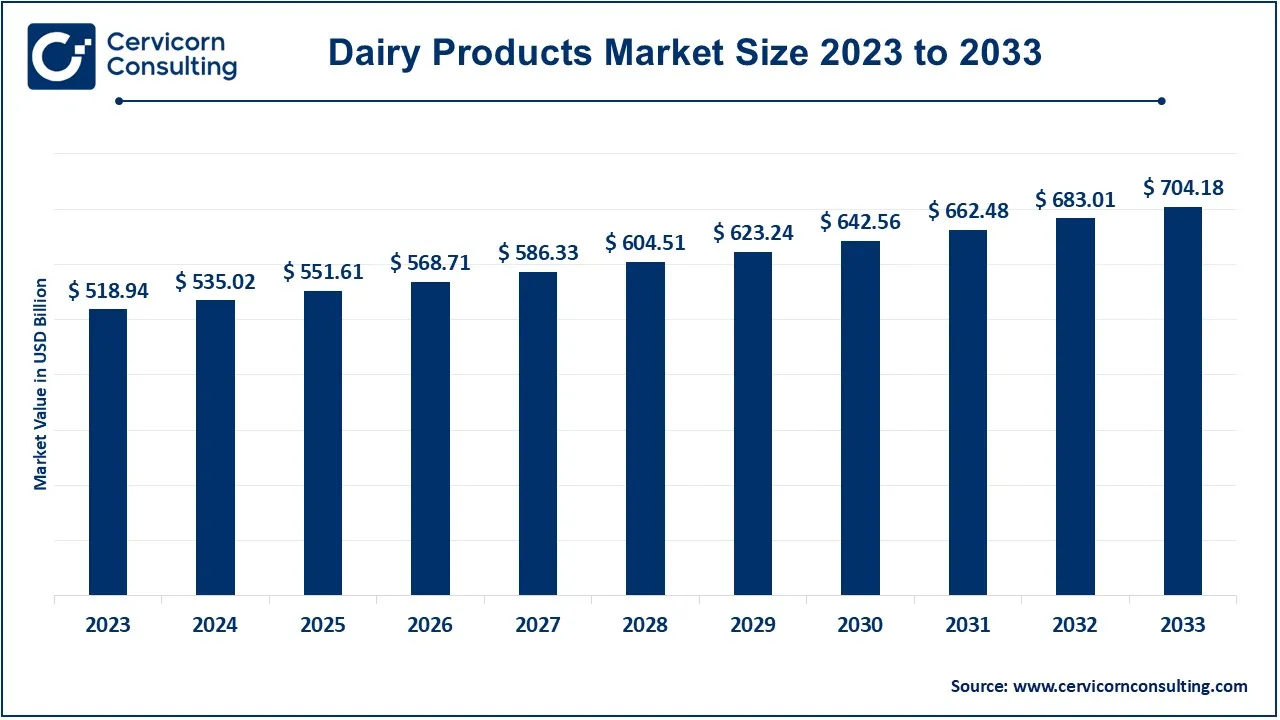

The global dairy products market size was captured at USD 535.02 billion in 2024 and is expected to reach around USD 704.18 billion by 2033, growing at a compound annual growth rate (CAGR) of 3.09% from 2024 to 2033.

The global dairy product market has experienced significant growth over the past few years and is expected to continue expanding. This growth can be attributed to the rising demand for dairy products in emerging economies, particularly in Asia-Pacific regions. As people’s disposable income increases, there is a greater demand for processed dairy items such as cheese, yogurt, and milk-based beverages. Additionally, the awareness about the health benefits of dairy, such as improved bone health and weight management, has contributed to the market's growth. Companies are innovating by introducing low-fat, lactose-free, and plant-based dairy alternatives to cater to the diverse needs of consumers. In the coming years, the dairy products market is projected to witness continued growth due to the increasing popularity of healthy and functional foods. The rise of the vegan and plant-based diet trend has also led to the development of dairy alternatives like almond, soy, and oat milk. The export value of dairy products from India was over 22 billion Indian rupees in 2023, a decrease from the previous year's export value of over 29 billion rupees.

Dairy products are food items made from milk. The most common dairy products include milk, cheese, yogurt, butter, and cream. These products are rich in essential nutrients like calcium, protein, vitamins A and D, and potassium, making them an important part of a balanced diet. Dairy products are produced from the milk of cows, goats, sheep, and other animals. Milk undergoes processing to produce various products, including pasteurization to kill harmful bacteria and fermentation to create yogurt and cheese. Many people consume dairy for its nutritional benefits, such as supporting strong bones, muscle growth, and overall health. However, some individuals may be lactose intolerant and avoid dairy due to digestive issues.

Report Highlights

Increasing Demand for Convenience Foods: The growing preference for ready-to-eat and convenient meal solutions boosts the demand for dairy products such as cheese slices, yogurt cups, and flavored milk, which offer quick and easy consumption options.

Expansion of Dairy Alternatives: The rising popularity of dairy alternatives, such as plant-based milk and cheese, is driven by lactose intolerance and veganism. This trend encourages innovation and product diversification in the dairy sector.

Emerging Markets: Expanding dairy consumption in emerging markets like India and Southeast Asia presents opportunities for growth, as rising incomes and urbanization increase demand for diverse dairy products.

Sustainability and Organic Products: Growing consumer interest in sustainable and organic dairy products creates opportunities for brands to develop and market environmentally friendly and organic dairy options, catering to eco-conscious consumers.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 535.02 Billion |

| Market Size by 2033 | USD 704.18 Billion |

| Market Growth Rate | CAGR of 3.09% from 2024 to 2033 |

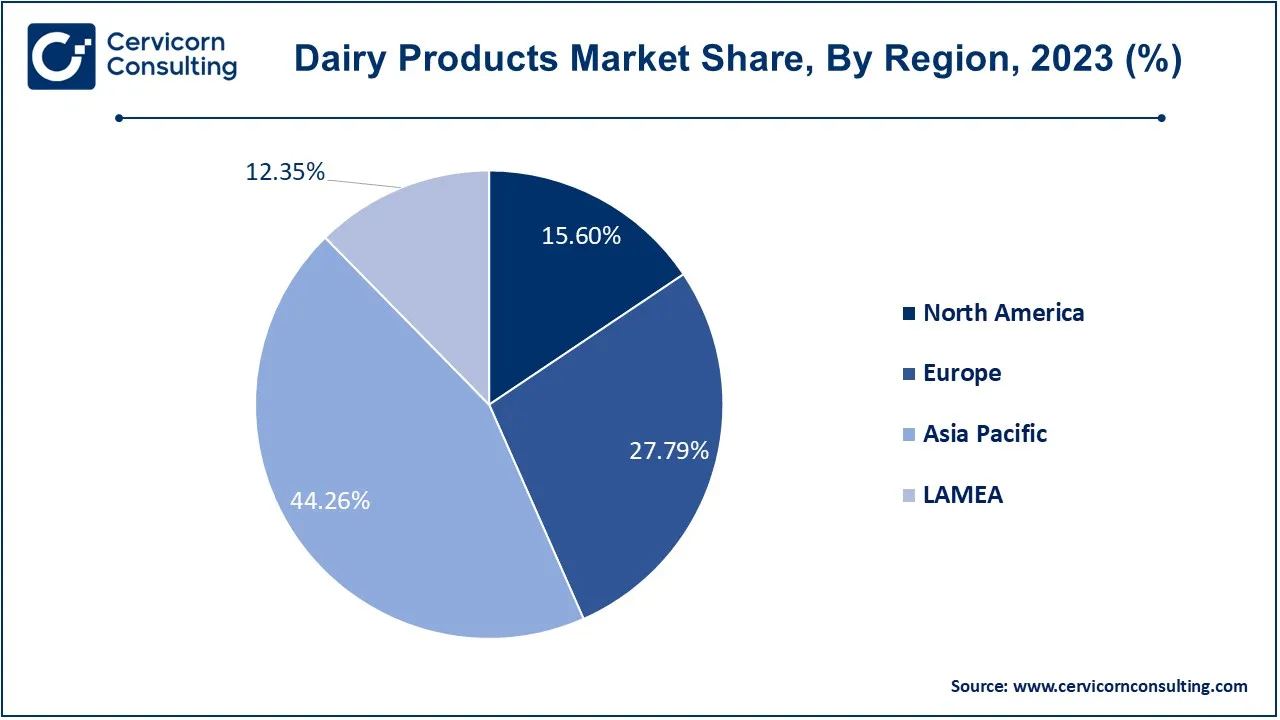

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Product Type, Distribution Channel and Regions |

Increasing Urbanization:

Enhanced Dairy Processing Technologies:

Fluctuating Raw Material Prices:

Regulatory and Health Concerns:

Growth in Functional Dairy Products:

Expansion of Premium and Artisanal Dairy Products:

Environmental Impact:

Supply Chain Disruptions:

Milk: The milk product type has confirmed highest market share of 58.71% in the year of 2023. Milk is a liquid dairy product consumed fresh or processed into various forms, including whole, skim, and flavored varieties. The market is shifting towards organic and plant-based alternatives, such as almond and oat milk, driven by health-conscious consumers and those with lactose intolerance. Additionally, fortified and functional milks with added nutrients are gaining popularity.

Cheese: Cheese segment has recorded second highest market share of 19.16% in 2023. Cheese is a dairy product produced by coagulating milk proteins, available in various types such as cheddar, mozzarella, and gouda. The cheese market is expanding with the growing popularity of gourmet and artisanal cheeses. There is increasing demand for low-fat and reduced-sodium options, and innovative cheese flavors and textures are being introduced to cater to diverse consumer preferences.

Yogurt: The yogurt segment has captured market share of 9.15% in 2023. Yogurt is a fermented dairy product made from milk and beneficial bacteria cultures, available in various forms such as Greek, regular, and probiotic yogurt. The yogurt market is experiencing growth in Greek and high-protein varieties, along with plant-based and dairy-free options. Consumers are increasingly seeking probiotic-rich yogurts for digestive health and functional benefits.

Dessert: Dessert segment has registered market share of 6.3% in 2023. Dairy-based desserts include products like puddings, custards, and ice creams made from milk and cream. There is rising consumer interest in premium and low-sugar dairy desserts, including those with natural and organic ingredients. Innovation in flavors and health-conscious formulations, such as reduced-fat and lactose-free options, is driving market growth.

Butter: In 2023, the butter segment has reported 4.26% of market share. Butter is a dairy product made from churning cream, available in salted, unsalted, and flavored varieties. The butter market is seeing increased demand for artisanal and organic butters. There is also growing interest in plant-based butter substitutes and spreads, driven by dietary preferences and health considerations.

Milk Powder: Milk powder is a dried form of milk used for various applications, including reconstitution into liquid milk and as an ingredient in processed foods. The milk powder market is expanding due to its convenience and long shelf life. Increased demand for infant formula and dairy ingredients in food manufacturing is driving growth, along with innovations in fortification and specialized formulations.

Cream: Cream is a dairy product derived from the high-fat layer of milk, used in cooking and as a topping or ingredient in desserts. The cream market is experiencing growth with the rise of premium and organic creams. There is also increasing interest in reduced-fat and plant-based cream alternatives, catering to health-conscious consumers and dietary preferences.

Others: In 2023, the others segment has measured market share of 2.42%. The "Others" category includes various dairy products not specifically mentioned, such as kefir, buttermilk, and dairy-based sauces. This segment is growing as consumers explore diverse dairy products and traditional items. Innovations in flavors, packaging, and functional benefits are driving interest in these niche products, reflecting broader trends in personalization and health-focused consumption.

Hypermarket / Supermarket: The hypermarkets and supermarkets segment has dominated the market with market share of 54.2% in 2023. Hypermarkets and supermarkets are large retail outlets offering a wide range of dairy products, including milk, cheese, yogurt, and butter. This segment is seeing increased demand for private-label products and organic options. Stores are expanding their dairy sections and integrating advanced inventory management to ensure product freshness and variety. The rise of in-store promotions and loyalty programs is also driving growth.

Convenience Store: Convenience stores segment has achieved market share of 32.71% in 2023. Convenience stores are smaller retail outlets offering essential dairy products like milk, cheese, and yogurt for quick purchases. Convenience stores are focusing on offering ready-to-eat and single-serve dairy products to cater to on-the-go consumers. There is a growing trend toward stocking premium and organic options to meet evolving consumer preferences, along with enhanced refrigeration technologies to maintain product quality.

Speciality Store: The speciality store segment has calculated market share of 9.84% in 2023. Specialty stores focus on niche or premium dairy products, such as artisanal cheeses and gourmet yogurts. This segment is growing due to increasing consumer interest in high-quality, unique dairy items. Specialty stores emphasize product authenticity and sourcing, often highlighting local or organic ingredients. Trends include the rise of curated selections and personalized customer experiences.

Online Stores: Online stores sell dairy products through e-commerce platforms, offering home delivery options for convenience. The online segment is expanding rapidly due to the growing preference for online shopping and home delivery. Innovations such as subscription services, personalized recommendations, and improved logistics are enhancing consumer convenience. There is also a rise in direct-to-consumer sales from dairy brands.

Others: In 2023, the others segment has generated 3.25% of market share in 2023. This category includes alternative distribution channels such as direct-to-salon sales, foodservice, and institutional buyers. Opportunities in this segment include partnerships with foodservice providers and institutions that use dairy products in bulk. There is an increasing focus on customized dairy solutions and supply chain innovations to meet the specific needs of these non-traditional distribution channels.

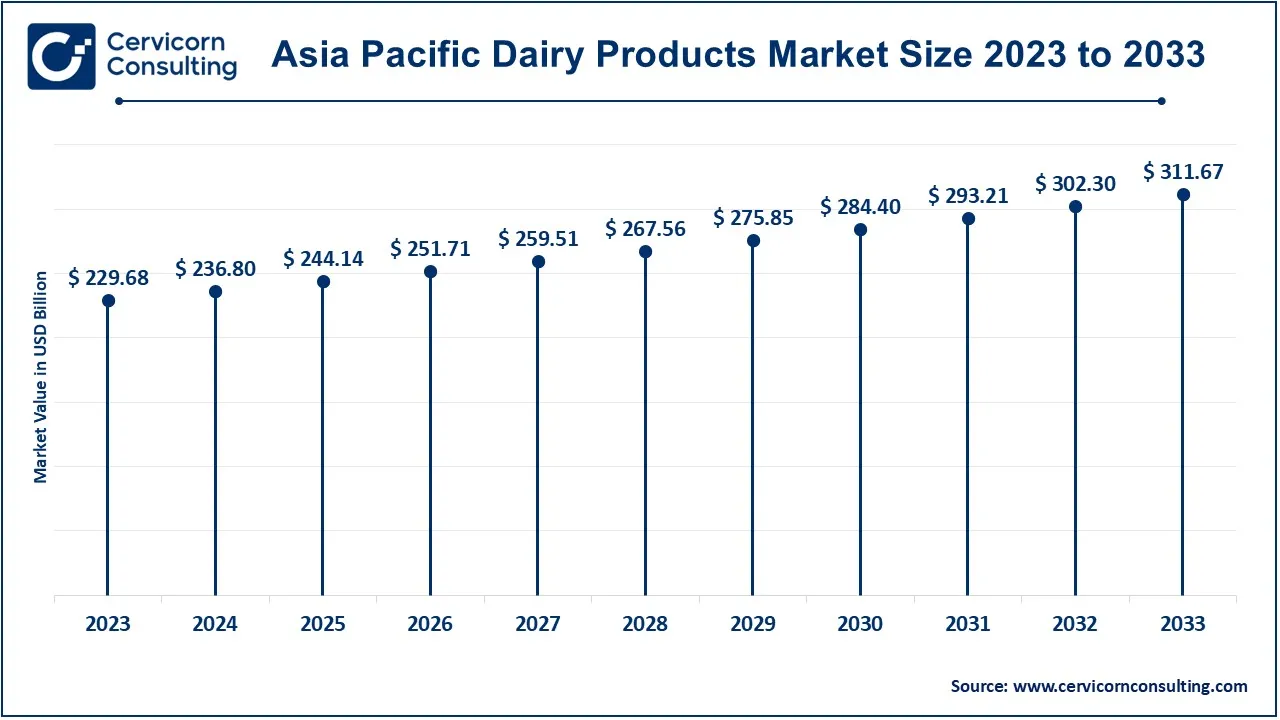

The Asia-Pacific region is experiencing rapid growth in dairy consumption due to increasing urbanization, rising incomes, and changing dietary habits. Asia Pacific market size is calculated at USD 236.80 billion in 2024 and is projected to grow around USD 311.67 billion by 2033 with a CAGR of 3.06%. There is a growing interest in dairy products like yogurt and cheese, coupled with a rising trend for functional dairy products. Market expansion is also driven by innovations in product flavors and formats.

In North America, there is a growing demand for organic and specialty dairy products driven by health-conscious consumers. North America market size is expected to reach around USD 109.85 billion by 2033 increasing from USD 83.46 billion in 2024 with a CAGR of 3.87%. The market is also experiencing increased adoption of dairy alternatives, such as plant-based milks. Technological advancements in dairy processing and supply chain efficiency are enhancing product availability and quality. U.S market size is estimated to reach around USD 82.39 billion by 2033 increasing from USD 62.60 billion in 2024.

Europe is seeing a trend toward sustainable and ethical dairy production, with consumers prioritizing eco-friendly packaging and organic options. Europe market size is measured at USD 148.68 billion in 2024 and is expected to grow around USD 195.69 billion by 2033 with a CAGR of 3.21%. The region is also witnessing growth in premium and artisanal dairy products, driven by a strong emphasis on quality and traditional methods. Regulatory standards and health trends influence product offerings.

In LAMEA(Latin America, Middle East, and Africa), there is growing demand for affordable and accessible dairy products due to rising disposable incomes and urbanization. LAMEA market size is forecasted to reach around USD 86.97 billion by 2033 from USD 66.07 billion in 2024. The market is expanding with increased investment in dairy infrastructure and distribution networks. Additionally, there is a rising interest in dairy alternatives and premium products in select markets.

Companies like Oatly and Elmhurst are entering the market with innovative dairy alternatives, focusing on plant-based products and sustainable practices. They leverage advancements in formulation and production to cater to the growing demand for lactose-free and environmentally friendly options. Nestlé S.A. and Danone S.A. dominate the market through extensive product portfolios, global distribution networks, and substantial R&D investments. They drive innovation with new product launches and strategic acquisitions, maintaining market leadership by adapting to evolving consumer preferences and investing in sustainable practices.

Market Segmentation

By Product Type

By Distribution Channel

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Dairy Products

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Dairy Products Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Urbanization

4.1.1.2 Enhanced Dairy Processing Technologies

4.1.2 Market Restraints

4.1.2.1 Fluctuating Raw Material Prices

4.1.2.2 Regulatory and Health Concerns

4.1.3 Market Opportunity

4.1.3.1 Growth in Functional Dairy Products

4.1.3.2 Expansion of Premium and Artisanal Dairy Products

4.1.4 Market Challenges

4.1.4.1 Environmental Impact

4.1.4.2 Supply Chain Disruptions

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Dairy Products Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Dairy Products Market, By Product Type

6.1 Global Dairy Products Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Milk

6.1.1.2 Cheese

6.1.1.3 Yogurt

6.1.1.4 Dessert

6.1.1.5 Butter

6.1.1.6 Milk Powder

6.1.1.7 Cream

6.1.1.8 Others

Chapter 7 Dairy Products Market, By Distribution Channel

7.1 Global Dairy Products Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Hypermarket / Supermarket

7.1.1.2 Convenience Store

7.1.1.3 Speciality Store

7.1.1.4 Online Stores

7.1.1.5 Others

Chapter 8 Dairy Products Market, By Region

8.1 Overview

8.2 Dairy Products Market Revenue Share, By Region 2023 (%)

8.3 Global Dairy Products Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Dairy Products Market Revenue, 2021-2033 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Dairy Products Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Dairy Products Market Revenue, 2021-2033 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Dairy Products Market Revenue, 2021-2033 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Dairy Products Market Revenue, 2021-2033 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Dairy Products Market Revenue, 2021-2033 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Dairy Products Market, By Country

8.5.4 UK

8.5.4.1 UK Dairy Products Market Revenue, 2021-2033 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UK Market Segmental Analysis

8.5.5 France

8.5.5.1 France Dairy Products Market Revenue, 2021-2033 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 France Market Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Dairy Products Market Revenue, 2021-2033 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 Germany Market Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Dairy Products Market Revenue, 2021-2033 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of Europe Market Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Dairy Products Market Revenue, 2021-2033 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Dairy Products Market, By Country

8.6.4 China

8.6.4.1 China Dairy Products Market Revenue, 2021-2033 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 China Market Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Dairy Products Market Revenue, 2021-2033 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 Japan Market Segmental Analysis

8.6.6 India

8.6.6.1 India Dairy Products Market Revenue, 2021-2033 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 India Market Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Dairy Products Market Revenue, 2021-2033 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 Australia Market Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Dairy Products Market Revenue, 2021-2033 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia Pacific Market Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Dairy Products Market Revenue, 2021-2033 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Dairy Products Market, By Country

8.7.4 GCC

8.7.4.1 GCC Dairy Products Market Revenue, 2021-2033 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCC Market Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Dairy Products Market Revenue, 2021-2033 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 Africa Market Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Dairy Products Market Revenue, 2021-2033 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 Brazil Market Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Dairy Products Market Revenue, 2021-2033 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 9 Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2021-2023

9.1.3 Competitive Analysis By Revenue, 2021-2023

9.2 Recent Developments by the Market Contributors (2023)

Chapter 10 Company Profiles

10.1 Nestlé S.A.

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Danone S.A.

10.3 Lactalis Group

10.4 Arla Foods amba

10.5 FrieslandCampina N.V.

10.6 Saputo Inc.

10.7 Kraft Heinz Company

10.8 General Mills, Inc.

10.9 Dean Foods Company

10.10 Fonterra Co-operative Group Limited