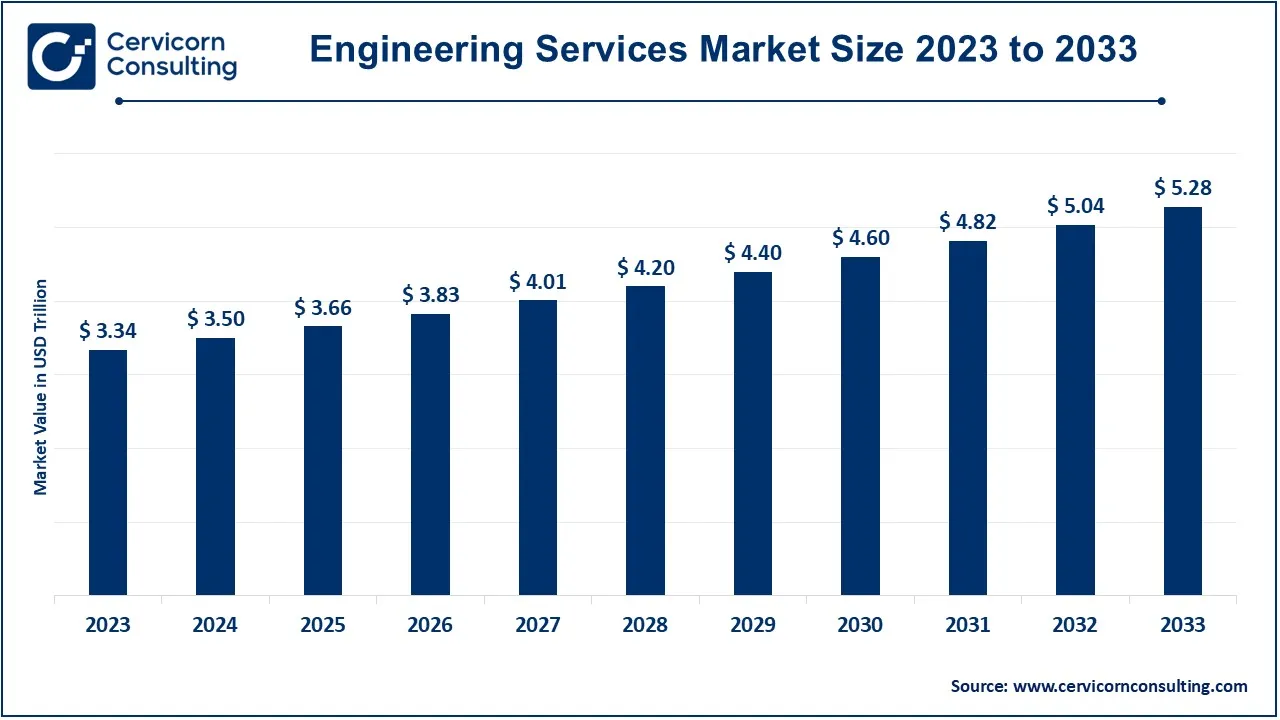

The global engineering services market size was valued at USD 3.50 trillion in 2024 and is expected to hit around USD 5.28 trillion by 2033, growing at a compound annual growth rate (CAGR) of 4.68% from 2024 to 2033.

The engineering services market is experiencing rapid expansion due to the increasing demand for innovative solutions across various industries. Companies are relying on engineering expertise to develop efficient, sustainable, and technologically advanced products and infrastructure. Key industries driving this demand include aerospace, automotive, IT, telecommunications, and construction. The rise of smart cities, renewable energy projects, and advanced manufacturing techniques has further amplified the need for specialized engineering services. Additionally, the growing trend of outsourcing engineering tasks to reduce costs and access global talent has significantly impacted the market. With digitalization reshaping industries, services such as software development, system integration, and automation have become critical. Between April 2022 and March 2023, India's engineering goods & Services exports were significant, with Maharashtra exporting USD 72.5 billion, primarily in engineering goods, accounting for 16.60% of the country's total exports.

Engineering services involve the application of technical knowledge, skills, and creativity to design, develop, and maintain various systems, products, or infrastructure. These services span a wide range of industries, including construction, manufacturing, aerospace, automotive, and technology. Examples include designing buildings, developing new machines, creating software systems, and improving production processes. Engineering services can also include consulting, project management, and testing to ensure that solutions are efficient, safe, and sustainable. Professionals in this field often specialize in areas such as civil, mechanical, electrical, or software engineering, using advanced tools and methods like CAD (Computer-Aided Design) and simulations. Their work plays a crucial role in solving real-world problems and driving innovation.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 3.50 Trillion |

| Projected Market Size by 2033 | USD 5.28 Trillion |

| Growth Rate | CAGR of 4.68% from 2024 to 2033 |

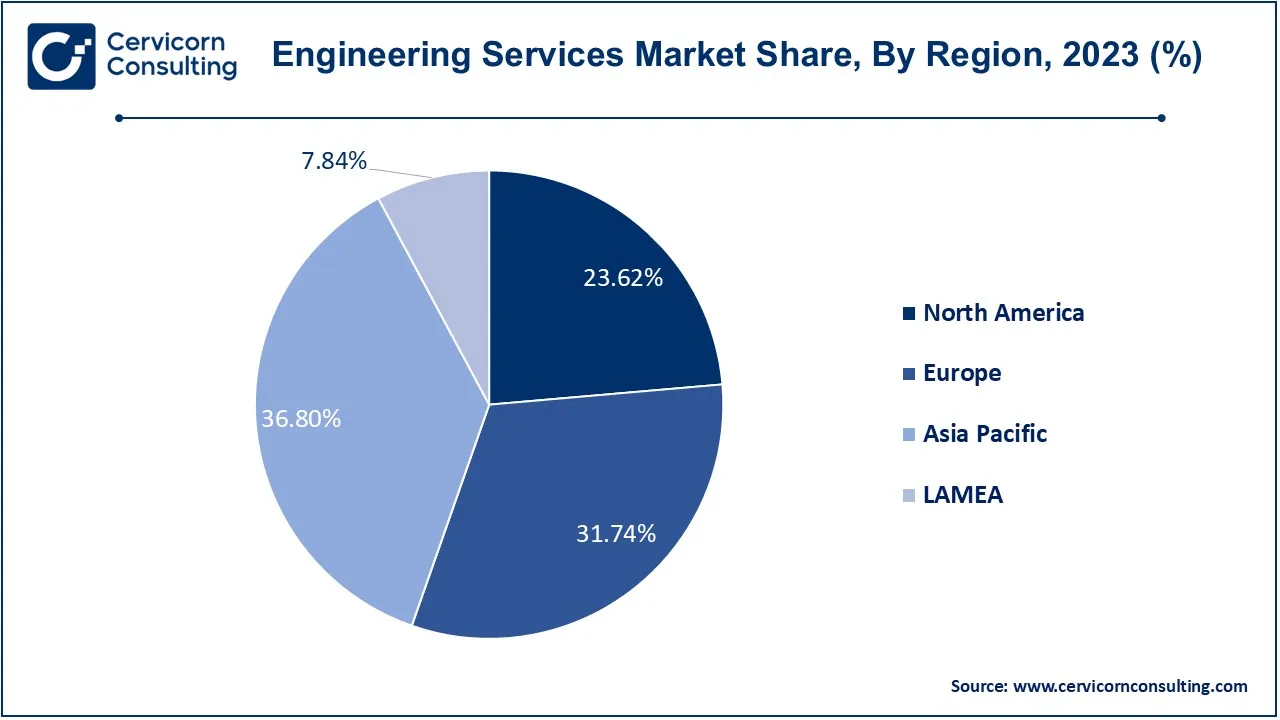

| Largest Revenue Holder Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Coverage | By Engineering Disciplines, Delivery Model, Service, Industries and Regions |

Increased Investment in Research and Development (R&D)

The rapid pace of technological advancement requires substantial investment in new tools, software, and infrastructure. Innovation and keeping a competitive advantage have compelled firms to invest a lot in research and development. This leads to an increased need for engineering services that facilitate the creation of new technologies, products, and processes. Engineering firms are important in appreciating research and coming up with applications and solutions.

Growth in Renewable Energy Sector

Moving away from the traditional sources of energy to the likes of solar, wind, and even hydropower is the other main driver for the growth of the engineering service market. There is a need for engineering companies to design, construct, and refine systems and facilities for power generation from renewables in response to this global trend which reduces dependence on environmentally unfriendly sources of energy.

Shortage of Skilled Workforce

High Cost of Technology Implementation

Adoption of Modular and Prefabricated Construction:

Integration of Advanced Simulation and Modelling Tools

Managing Data Security and Privacy

Adapting to Rapid Technological Changes

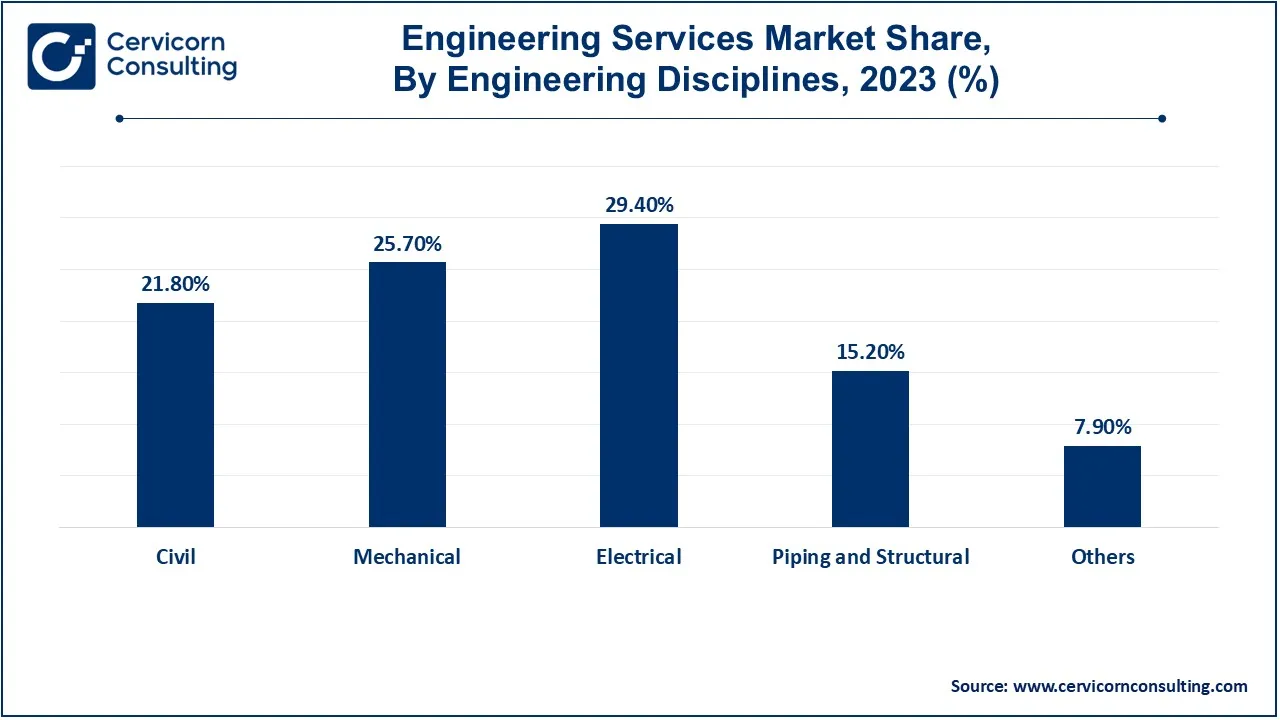

Civil Engineering: As a branch of engineering, civil focuses on the infrastructure design, construction and preservation including roads, bridges and buildings. It includes emerging railways and smart infrastructure technology, green building construction, and advanced materials and techniques. The depletion of available space in cities where a certain level of civil infrastructure is focused increases the supply of civil engineering problem solving.

Mechanical Engineering: In mechanical engineering, mechanical systems and devices including engines, machines, and mechanical systems such as HVAC are designed and manufactured. These trends involve the use of robotics, the Internet of Things, and high-performance materials. The factors advocating for a well-efficient energy system towards industrialization and provision of mechanical engineering services are on the upward surge.

Electrical Engineering: This branch of engineering concerns itself with designing and constructing electrical systems such as power generation systems, transmission systems and distribution systems. Innovations in renewable energy sources, smart grid technology and infrastructure for electric vehicles are amongst the recent improvements in this sector. The upsurge in electrical engineering services is due to the increasing demand for energy efficiency improvements and the adoption of more digital systems in different processes.

Piping and Structural: Piping and structural engineering comprises of piping system and any structures supporting the piping systems within industries such as oil and gas and construction industrial spaces. Incorporation of modern materials and technology has brought efficiency and safety through, for example, use of computerized designs and technology. The increasing number of construction projects and expansion of infrastructures creates an opportunity in this sector.

Others: The “Others” category encompasses niche engineering fields including, but not limited to, the aerospace and the environmental and chemical engineering. These trends show a strong orientation towards the issues of sustainability, design methods more advanced than the traditional ones, and application of new materials. The growth of such sectors as aviation and environmental management creates the demand for new engineering services due to the complex nature of the work and new technologies that are emerging.

Offshore: It includes executing engineering services from a different country than the client’s, commonly to cut down costs and also source for specialized skills. Trends include the growing dependency on remote teams and technology to oversee the management of the teams. This model is on the rise because it is cost effective and allows sourcing of skills from different parts of the world without any geographical limitation.

Onsite: Onsite delivery models refer to the situation where engineering services are carried out at the client’s site especially for the purpose of teamwork and resolving issues at hand without delay. Trends include more client interaction and modifying projects according to the client’s wishes. This model often has advantages especially where a project is vast complex and requires full-time attention, because it helps make strong ties with the clients and offers solutions that suit their requirements.

Product Engineering: It constitutes the ideation, design, development, and launch of new products at the market. The trends in this discipline includes development of smarter products through use of advanced technologies such as AI and IoT, application of digital twins for conjoining ideas and concepts to produce prototypes and increased focus towards green design due to regulatory and consumer demands.

Process Engineering: Process engineering specializes in the design and management of ways to improve process efficiency and product quality. Current trends focus on integrating automation and digital means of operation to lessen the workloads, lean manufacturing maximization, as well as employing data analytics to watch and control processes in real time.

Automation Related Services: The automation related services include the implementation and maintenance of the automated systems for enhancing the operational efficiency. Nowadays, these include deployment of robots, artificial intelligent automation, and the fourth industrial revolution concepts where there are cyber-physical systems. There is also a rise in demand for a user-defined automation concept especially for developed industries and the improvement of self-operating systems.

Asset Management Related Services: The services relating to asset management consist of proper implementation and utilization of physical and virtual assets within their life span. The trends are the use of digital twins for asset tracking, AI based predictive maintenance and use of the internet of things for better management of assets. These services apply to limit the asset costs while maximizing the efficiency of the operations.

Others: The “Others” category involves other specialized engineering services such as agricultural engineering, structural engineering, and project management consulting. Trends in these areas include changes in strategies due to emphasis on environmental sustainability, occupational safety, and regulatory compliance, and integration of modern science and information technology in the specialized areas. This part of the market highlights the versatility of engineering services offered to different sectors and the increasing need for customized solutions.

Aerospace and Defense: The provision of engineering services within the aerospace as well as defense industry encompasses aircraft, spacecraft and their respective weapons systems design, development and maintenance activities. The trends associated with it include the use of better composite materials, the robotics in aerospace and system autonomics. There is emphasis on safety and performance capabilities and operational effectiveness while adhering to the regulations and fostering defensive technologies.

Automotive: The engineering services offered within the automotive industry include the design of vehicles and product testing as well as support during the manufacturing process. Important trends are associated with the introduction of electric vehicles (EVs), advancements in vehicle self-driving technology, and smart manufacturing technologies. The sector is also enhancing fuel efficiency and reducing emissions while integrating advanced driver assistance systems (ADAS).

Chemical and Petrochemical: The chemical and petrochemical engineering field involves engineering services that include the design of a plant, facilitating the process and maintaining machinery. Key trends are the shift to more cost effective and environment friendly processes, improvement in plastics and other recyclables, and application of digital twins technology to facilitate monitoring. The sector has objectives of minimizing its negative effects on the environment while operational efficiency is increasing.

Electric Power Generation: The scope of engineering services associated with electric power generation encompasses the design, development, and upkeep of power generation plants and their supporting systems. Increasingly, the use of non-conventional energy sources like solar and wind, modernization of grids and the use of smart grid technologies are on the increase. The aim is on making energy generation more effective, dependable, and eco-friendly.

Municipal Utility Projects: These Municipal utility projects include engineering design services devoted to the provision of water, waste disposal, and other services to urban centers. Trends comprise the use of smart technologies in cities, the practice of water recycling and conservation and building infrastructures that are climate change resilient. The primary focus of the sector is to ensure sustainable urban development that is characterized by enhanced service delivery.

Mining: Mining engineering is comprised of services offered in relation to exploration, design and planning of mines and their operations. Trends emphasize on more automation, safety improvement by introducing better observation techniques for deeper ground mining and safe environmental practices/methods. The impact on the environment of the processes of production is being investigated, and methods of raw material obtaining are working more effectively.

Oil and Gas: Concerning the oil and gas domain, engineering services include, but are not limited to, exploration activities, drilling operations, and production processes of the located oil reserves. These include digital oilfields technologies, new drilling practices, as well as measures to enhance environment protection. The industry is concentrating on enhancement of the production systems whilst decreasing the cost of production in global markets and high volatility of the prices in certain periods.

Transportation: Activities under engineering services in transportation include designing and managing infrastructural works such as roads, rail and bridge systems. Smart transportation systems, electric and autonomous vehicles, and advanced strategies for traffic control belong to the latest technological developments today. Moreover, there is a growing concern towards safety, efficiency and ecology of the wheeled transportation networks.

Others: The "Others" section represents a variety of sectors spanning from the chemical medicine industry to the creation of buildings and structures within which engineering services are offered additionally. The trends depend on the expected growth rate of each sector but most usually cover digital transformation, orientation to sustainability and tackling the issues with creative ideas. This section indicates engineering services are not only restricted within a discipline but also serve the ever-changing needs in distinct areas.

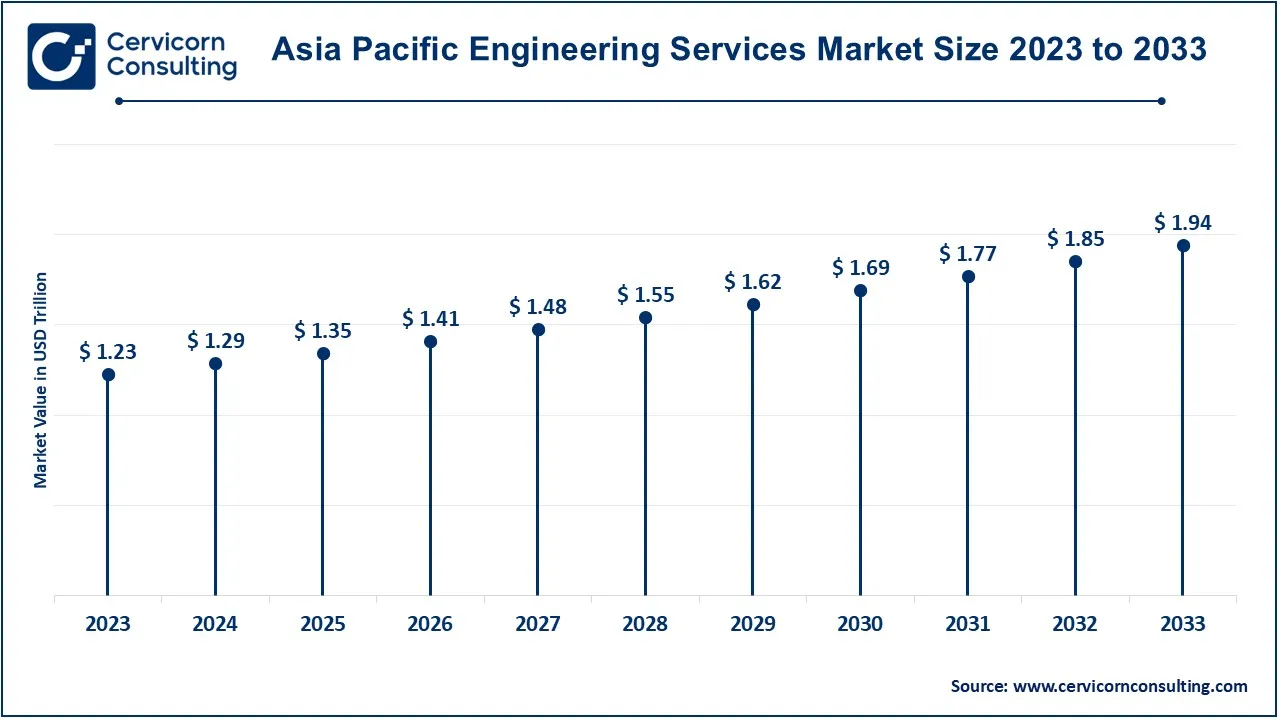

The Asia Pacific engineering services market size is calculated at USD 1.29 trillion in 2024 and is projected to grow around USD 1.94 trillion by 2033 with a CAGR of 4.7%. The growing engineering services sector in Asia-Pacific is driven today primarily by industrialization and urbanization of the region. These include megaprojects like building high-speed rail for smart cities, and investments in clean energy and factories. The region is also making progress in its digital arm even with the likes of AI and IoT whose aim is to boost GDP and cities development.

North America market size is expected to reach around USD 1.25 trillion by 2033 increasing from USD 0.83 trillion in 2024 with a CAGR of 5.23%. In North America, the diagnosis of the engineering services market shows that it is driven by technological advancement and growth in infrastructure. Among the trends include heavy funding of smart cities and environmentally friendly building activities, development of self-driving as well as electric cars, and the digital change across sectors. Region, further, aims at improving the resilience and efficacy of the energy and utilities.

The Europe engineering market size is measured at USD 1.11 trillion in 2024 and is expected to grow around USD 1.68 trillion by 2033 with a CAGR of 4.81%. European market focuses more on the regulatory aspects and green development. They include the use of clean energy technologies as well thanks to the circular economy, and the use of more advanced energy saving in building design. The region is also quite ambitious in terms of strict environmental protection and application of innovations into the public and transport infrastructure, systems.

The LAMEA market size is forecasted to reach around USD 0.41 trillion by 2033 from USD 0.27 trillion in 2024. The engineering services market in LAMEA, on the other hand, presents a mixed bag of unique challenges and opportunities. Trends include the focus on market restructuring and more investments in infrastructure and urbanization especially among the developing countries. Attention is also given to the energy and water management systems through the application of new technologies to solve utility service problems and the enhancement of economic growth through better information communication infrastructure.

New players like Tetra Tech, Inc. and Ramboll Group A/S are driving innovation by integrating advanced technologies such as AI and digital twins into their engineering solutions. They focus on sustainable practices and smart infrastructure development. Dominating the market, AECOM Technology Corporation and Jacobs Engineering Group Inc. lead with their extensive global reach and expertise in large-scale infrastructure projects. They leverage advanced technologies, extensive experience, and a broad service portfolio to maintain their competitive edge and address complex client needs across diverse sectors.

CEO Statements

Market Segmentation

By Engineering Disciplines

By Delivery Model

By Service

By Industries

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Energy Storage System

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Application Overview

2.2.3 By End Use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Energy Storage System Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Decreasing Costs of Energy Storage Technologies

4.1.1.2 Regulatory Mandates and Energy Security Concerns

4.1.2 Market Restraints

4.1.2.1 Limited Lifespan and Degradation Issues

4.1.2.2 Complexity and High Initial Investment

4.1.3 Market Opportunity

4.1.3.1 Advancements in Alternative Storage Technologies

4.1.3.2 Integration with Renewable Energy Projects

4.1.4 Market Opportunity

4.1.4.1 Regulatory and Standardization Issues

4.1.4.2 Grid Integration and Infrastructure Limitations

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Energy Storage System Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Energy Storage System Market, By Technology

6.1 Global Energy Storage System Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Pumped Storage

6.1.1.2 Electrochemical Storage

6.1.1.3 Electromechanical Storage

6.1.1.4 Thermal Storage

Chapter 7 Energy Storage System Market, By Application

7.1 Global Energy Storage System Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Stationary

7.1.1.2 Transport

Chapter 8 Energy Storage System Market, By End Use

8.1 Global Energy Storage System Market Snapshot, By End Use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Residential

8.1.1.2 Non-Residential

8.1.1.3 Utilities

Chapter 9 Energy Storage System Market, By Region

9.1 Overview

9.2 Energy Storage System Market Revenue Share, By Region 2023 (%)

9.3 Global Energy Storage System Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Energy Storage System Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Energy Storage System Market, By Country

9.5.4 UK

9.5.4.1 UK Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Energy Storage System Market, By Country

9.6.4 China

9.6.4.1 China Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Energy Storage System Market, By Country

9.7.4 GCC

9.7.4.1 GCC Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Energy Storage System Market Revenue, 2021-2033 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2021-2023

10.1.3 Competitive Analysis By Revenue, 2021-2023

10.2 Recent Developments by the Market Contributors (2023)

Chapter 11 Company Profiles

11.1 Tesla, Inc.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 LG Energy Solution Ltd.

11.3 Samsung SDI Co., Ltd.

11.4 Panasonic Corporation

11.5 Contemporary Amperex Technology Co. Limited (CATL)

11.6 BYD Company Ltd.

11.7 General Electric Company

11.8 Siemens AG

11.9 ABB Ltd.

11.10 Schneider Electric SE