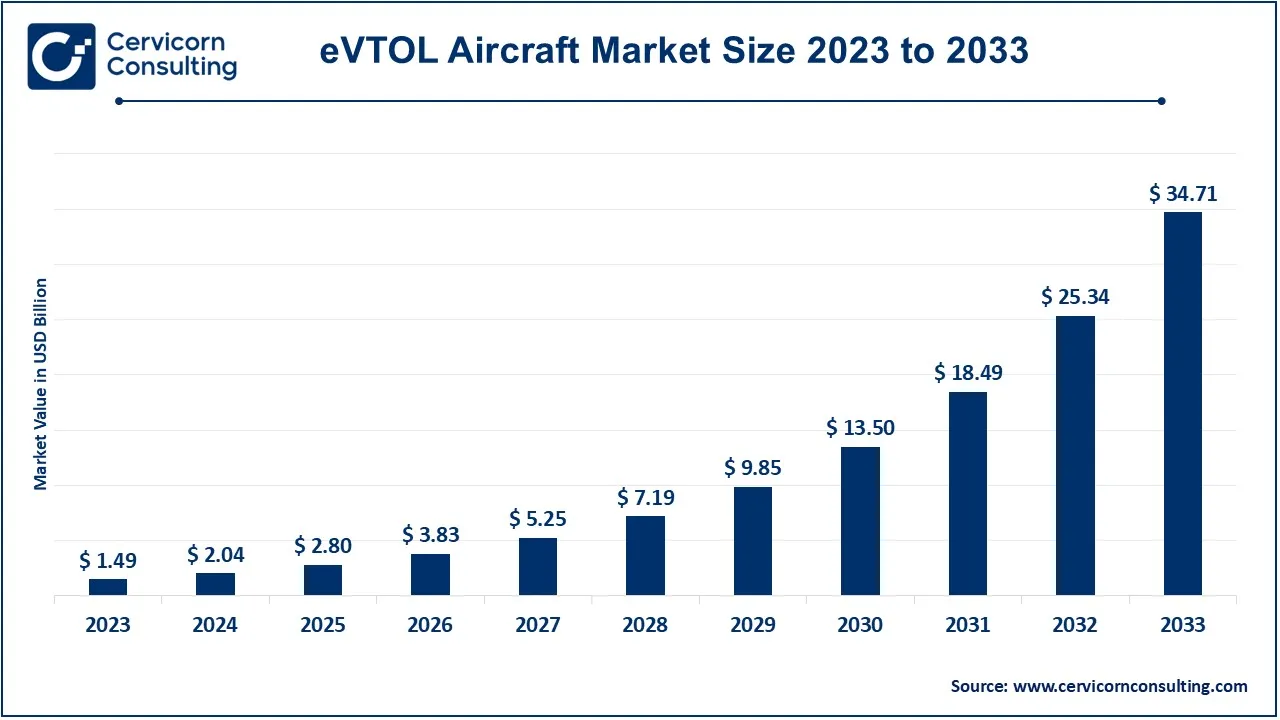

The global eVTOL aircraft market size was accounted at USD 2.04 billion in 2024 and is expected to reach around USD 34.71 billion by 2033, growing at a compound annual growth rate (CAGR) of 37% from 2024 to 2033.

The eVTOL market is experiencing rapid growth due to advancements in battery technology, electric propulsion systems, and regulatory developments. As urban congestion continues to rise, the demand for efficient, on-demand air transport is expected to increase. Leading aerospace companies and startups are heavily investing in eVTOL development, with a goal to commercialize these aircraft for air taxi services in major metropolitan areas. The market is expected to expand significantly over the next decade, driven by growing interest from investors, governments, and urban planners seeking innovative solutions to improve mobility. In addition, as eVTOLs promise to reduce carbon emissions and alleviate traffic congestion, they are gaining traction among policymakers and environmental advocates. Government incentives, regulatory frameworks, and public acceptance are also key factors influencing the growth of the eVTOL market. The UAE is actively pursuing eVTOL operations, with plans for air taxi services in Dubai by early 2026. Archer Aviation has signed agreements to launch commercial air taxi operations in the UAE, including in-country manufacturing and training.

An eVTOL (Electric Vertical Take-Off and Landing) aircraft is a type of electric-powered aircraft designed to take off, land, and hover vertically. Unlike traditional airplanes or helicopters, eVTOLs do not require long runways for takeoff and landing, making them ideal for urban environments. They use electric motors to power rotors or fans, enabling them to fly quietly and with minimal environmental impact compared to conventional aircraft. These aircraft are designed for short-range, urban air mobility (UAM) purposes, including air taxis, cargo delivery, and other forms of transport. eVTOLs promise to revolutionize the transportation industry by reducing congestion and offering fast, efficient, and sustainable options for travel in cities.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 2.04 Billion |

| Market Growth Rate | CAGR of 37% from 2024 to 2033 |

| Market Size by 2033 | USD 34.71 Billion |

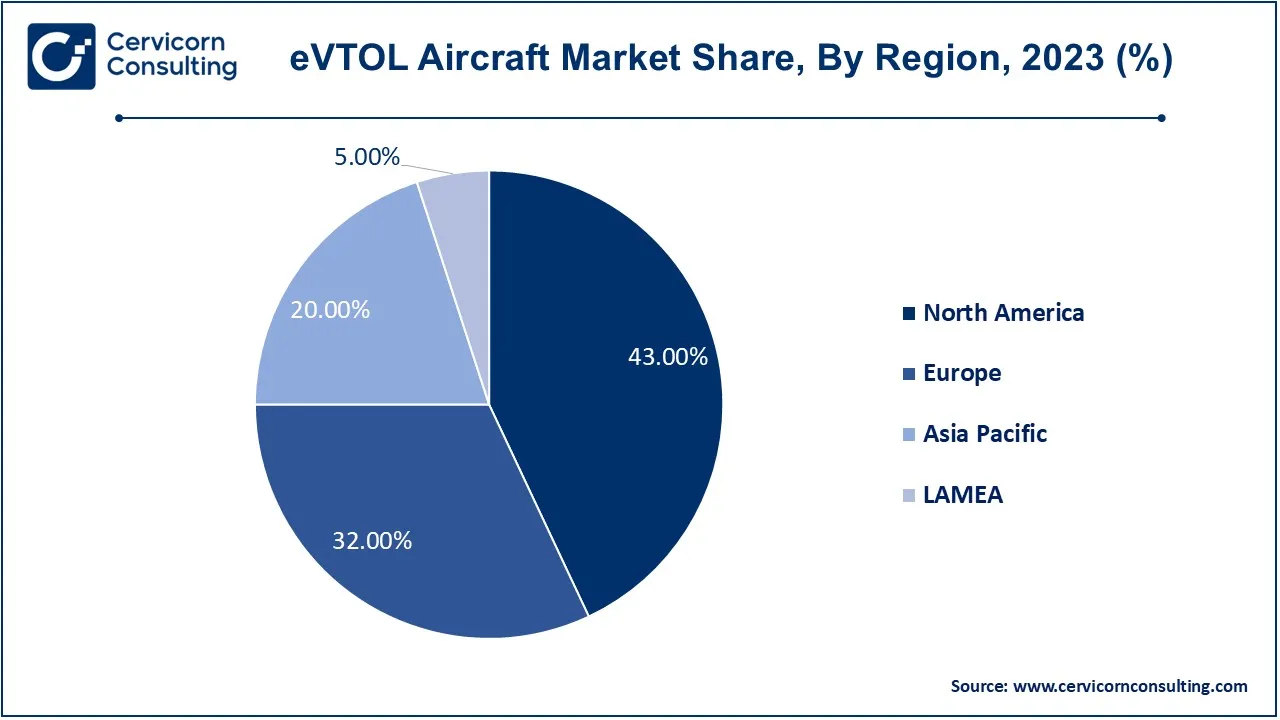

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segment Coverage | By Lift Technology, Propulsion Type, System, Mode of Operations, Range, Maximum Take-off Weight (MTOW), Application and Regions |

Advancements in Autonomy and AI:

Consumer Demand for On-Demand Mobility:

Regulatory and Certification Challenges:

High Development and Operational Costs:

Tourism and Leisure:

Disaster Relief and Emergency Services:

Air Traffic Management and Integration:

Public Acceptance and Safety Concerns:

Vectored Thrust: Vectored thrust eVTOLs use rotating engines or rotors to transition between vertical lift and forward flight. This technology allows for efficient aerodynamic performance and faster speeds during horizontal flight. Vectored thrust is gaining traction for its versatility in urban air mobility and longer-range missions. Companies like Joby Aviation and Lilium are leading in this segment, focusing on high-speed, longer-range eVTOLs that can efficiently serve both urban and regional markets.

Multirotor: Multirotor eVTOLs are equipped with multiple rotors that provide vertical lift, similar to drones. They are often simpler in design and are ideal for short-range, low-altitude flights. Multirotor designs are popular for urban air mobility due to their simplicity, safety, and ease of control. These eVTOLs are well-suited for short-distance air taxi services within cities. Companies like EHang are pioneering this segment, emphasizing autonomous flight capabilities for cost-effective operations.

Lift Plus Cruise: Lift plus cruise eVTOLs utilize separate sets of rotors for vertical lift and forward propulsion, offering a balance between the efficiency of vectored thrust and the simplicity of multirotor designs. This technology is emerging as a viable option for mid-range urban and suburban transportation. It provides increased safety and reliability by separating lift and cruise functions. Companies such as Airbus with its CityAirbus NextGen are exploring this design to achieve optimized performance for passenger transport over medium distances.

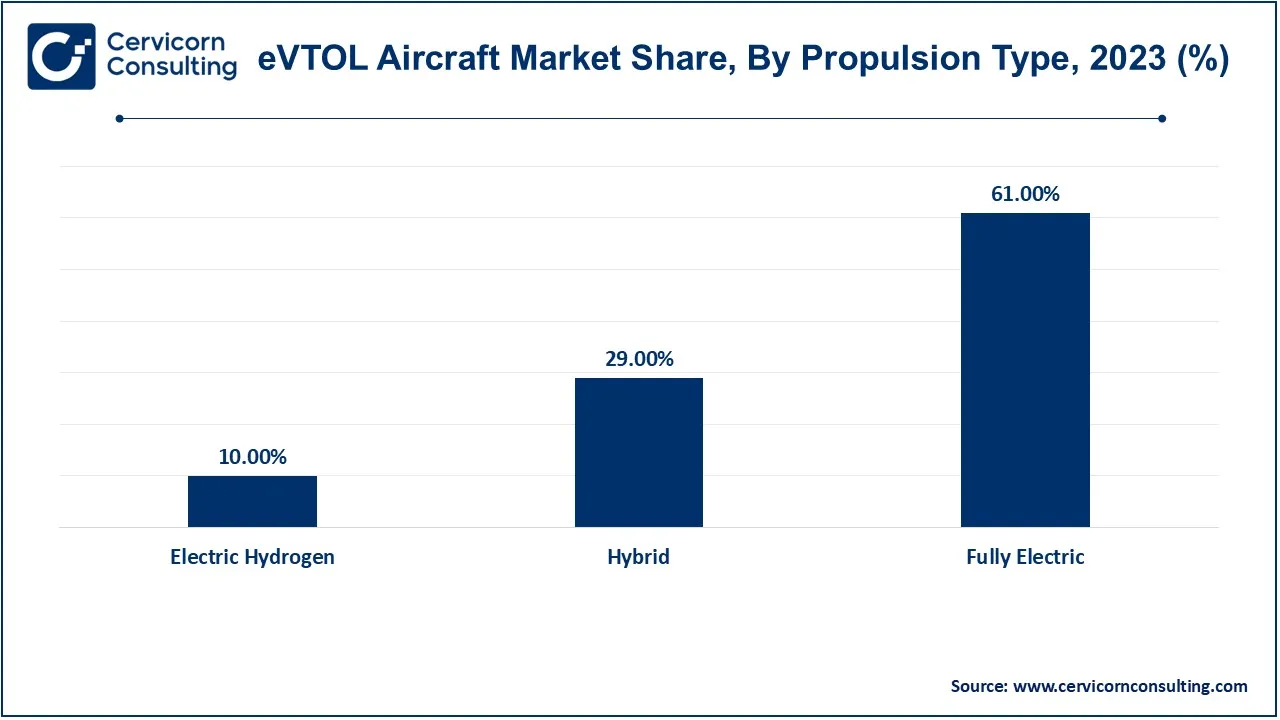

Fully Electric: The fully electric segment has reported highest market share of 61% in 2023. Fully electric eVTOL aircraft are powered entirely by battery systems, offering zero-emission flights. These aircraft are designed for short to medium-range urban air mobility. The push for sustainability is driving significant investment in fully electric eVTOLs. Advancements in battery technology, such as increased energy density and faster charging, are enhancing range and efficiency.

Hybrid: The hybrid segment has recorded market share of 29% in 2023. Hybrid eVTOL aircraft utilize a combination of electric power and traditional fuel (e.g., combustion engines) to extend range and operational flexibility. Hybrid propulsion systems are gaining traction as a transitional technology, offering extended range compared to fully electric models. This approach reduces the reliance on battery technology while maintaining lower emissions.

Electric Hydrogen: The electric hydrogen segment has registered market share of 10% in 2023. Electric hydrogen eVTOL aircraft use hydrogen fuel cells to generate electricity, providing a clean energy alternative with the potential for longer flight durations. Hydrogen fuel cell technology is emerging as a promising solution for eVTOLs, offering higher energy density and faster refueling compared to batteries. This technology is gaining interest for its potential to enable long-range, zero-emission flights.

Batteries & Cells: Batteries and cells are the core power sources for eVTOL aircraft, providing the necessary energy to operate electric motors and other systems. Advancements in battery technology, such as increased energy density and faster charging times, are crucial for extending the range and flight time of eVTOLs.

Electric Motors/Engines: Electric motors or engines convert electrical energy from batteries into mechanical energy to power the propulsion systems of eVTOL aircraft. The trend towards lightweight, high-efficiency electric motors is driving the development of more powerful and reliable propulsion systems.

Aerostructure: Aerostructure refers to the physical components of the eVTOL aircraft, including the airframe, wings, fuselage, and landing gear. Lightweight composite materials and advanced manufacturing techniques are being increasingly used to reduce the weight and improve the aerodynamic efficiency of eVTOL aerostructures.

Avionics: Avionics encompasses the electronic systems used for communication, navigation, and control of eVTOL aircraft. The integration of advanced avionics, including autonomous flight control systems, GPS navigation, and collision avoidance technologies, is critical for the safe operation of eVTOLs in urban environments.

Software: Software systems in eVTOLs manage flight operations, including navigation, propulsion control, and onboard diagnostics, as well as passenger interfaces and fleet management. Software development is focused on improving the reliability and functionality of eVTOL systems. Innovations include AI-driven flight control, predictive maintenance algorithms, and real-time data analytics, which enhance safety, efficiency, and the overall passenger experience. The software segment has generated market share of 43% in 2023.

Others: This category includes additional systems and components, such as sensors, actuators, lighting, and environmental control systems, that contribute to the overall operation of eVTOL aircraft. The integration of advanced sensors and environmental control systems is improving the safety and comfort of eVTOL flights.

Autonomous: Autonomous eVTOL aircraft operate without human pilots on board, utilizing advanced AI and automation systems to manage flight operations and navigation. These vehicles are designed for fully automated, on-demand air transportation services. The trend toward autonomous eVTOLs is driven by advancements in AI and sensor technology, which enhance safety and efficiency. Autonomous segment has accounted market share of 33% in 2023.

Piloted: Piloted eVTOL aircraft are operated by human pilots who manage flight operations. These vehicles are typically used in early market phases to ensure safety and operational reliability before fully autonomous systems are deployed. Piloted eVTOLs are seeing growing adoption as they offer a transitional solution for urban air mobility. This segment has calculated market share of 27% in 2023.

Passenger Transportation: eVTOL aircraft for passenger transportation focus on providing urban air mobility solutions, including air taxis and airport shuttles. They aim to offer a faster, more efficient alternative to ground transportation. The trend is towards integrating eVTOLs into urban transportation networks to alleviate traffic congestion. Advances in battery technology and regulatory support are accelerating the development of commercial air taxi services and improving the feasibility of urban air mobility.

Cargo Transportation: eVTOL aircraft designed for cargo transportation are used for parcel delivery, heavy cargo, and logistics. They offer solutions for moving goods quickly in urban and remote areas. Growing e-commerce and logistics demands are driving innovation in cargo eVTOLs. Companies are developing larger and more efficient cargo drones for last-mile delivery, focusing on reducing delivery times and costs while expanding service areas.

Emergency Services: eVTOL aircraft used for emergency services include medical evacuation, disaster relief, and search and rescue operations. They provide rapid response capabilities in urgent situations. The emphasis is on improving response times and access to remote or inaccessible areas. Advances in technology are enhancing the reliability and efficiency of eVTOLs in emergency situations, with a focus on integrating them into existing emergency response frameworks.

Military and Defense: eVTOL aircraft for military and defense applications are designed for tactical operations, reconnaissance, and logistics support. They provide vertical takeoff and landing capabilities in various operational environments. The military is exploring eVTOLs for versatile missions, including rapid troop deployment and logistical support. The focus is on developing robust, durable designs that can operate in challenging conditions and integrate with existing defense systems.

Recreational and Tourism: eVTOL aircraft for recreational and tourism purposes include scenic flights, luxury travel, and exclusive experiences. They offer novel ways to explore destinations and enjoy aerial views. The market is expanding with the development of high-end, luxury eVTOL services. Innovations are focused on enhancing passenger comfort and providing unique experiences, with potential growth in high-tourism regions and scenic destinations.

Others: This category includes various specialized applications of eVTOL aircraft not covered by the primary segments. It may include roles such as agricultural monitoring, infrastructure inspection, and more. Emerging uses are expanding the eVTOL market. Innovations in technology are enabling new applications, with companies exploring niche markets and specialized functions that leverage the unique capabilities of eVTOL aircraft.

North America is leading in eVTOL development due to substantial investments, advanced technological infrastructure, and supportive regulatory environments. North America market size is expected to reach around USD 14.93 billion by 2033 increasing from USD 0.88 billion in 2024 with a CAGR of 38.2%. The U.S. and Canada are seeing increasing interest from major aerospace companies and startups. Key trends include the rapid advancement of air taxi prototypes, urban air mobility initiatives, and integration of eVTOLs into existing transportation systems. Regulatory frameworks are being actively developed to accommodate eVTOL operations.

Asia-Pacific is seeing rapid growth in eVTOL adoption due to high urbanization rates, increasing infrastructure investments, and government support for innovative transportation solutions. Asia Pacific market size is calculated at USD 0.41 billion in 2024 and is projected to grow around USD 6.94 billion by 2033 with a CAGR of 42.7%. Countries like China, Japan, and India are exploring eVTOLs for both passenger and cargo applications. Trends include the development of eVTOL prototypes tailored to high-density urban environments, and collaborations with technology companies to address specific regional needs such as air traffic congestion and logistics challenges.

Europe is experiencing significant growth in the eVTOL market driven by ambitious urban air mobility projects and strong environmental regulations. Countries like the UK, Germany, and France are at the forefront, with numerous pilot projects and collaborations between startups and established aerospace firms. Europe market size is measured at USD 0.65 billion in 2024 and is expected to grow around USD 1.11 billion by 2033 with a CAGR of 39.1%. Trends include a focus on sustainability and green technologies, and significant investments in infrastructure development such as vertiports and advanced air traffic management systems.

The LAMEA(Latin America, Middle East, and Africa) region is beginning to explore eVTOL technology, with a focus on addressing transportation challenges in urban and remote areas. Initial trends include pilot programs in the Middle East and South America aimed at demonstrating the viability of eVTOLs in diverse environments. LAMEA market size is forecasted to reach around USD 1.74 billion by 2033 from USD 0.10 billion in 2024 with a CAGR of 31.7%. Challenges include the need for infrastructure development and regulatory frameworks, but there is growing interest in leveraging eVTOLs for regional connectivity and logistics in developing markets.

Archer Aviation, Inc. and Lilium GmbH are making significant strides in the eVTOL market with innovative designs like Archer's "Maker" and Lilium's 7-rotor "Lilium Jet," targeting urban and regional air mobility. Joby Aviation, Inc. and Volocopter GmbH are key market leaders, with Joby advancing its electric air taxi through successful test flights and regulatory progress, while Volocopter is pioneering urban air taxis with its VoloCity, focusing on safety and infrastructure development. These companies are shaping the future of eVTOL aircraft with groundbreaking technologies and strategic advancements.

Market Segmentation

By Lift Technology

By Propulsion Type

By System

By Mode of Operations

By Range

By Maximum Take-off Weight (MTOW)

By Application

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of EVTOL aircraft

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Lift Technology Overview

2.2.2 By Propulsion Type Overview

2.2.3 By System Overview

2.2.4 By Mode of Operations Overview

2.2.5 By Range Overview

2.2.6 By Maximum Take-off Weight (MTOW) Overview

2.2.7 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on EVTOL aircraft Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Advancements in Autonomy and AI

4.1.1.2 Consumer Demand for On-Demand Mobility

4.1.2 Market Restraints

4.1.2.1 Regulatory and Certification Challenges

4.1.2.2 High Development and Operational Costs

4.1.3 Market Opportunity

4.1.3.1 Tourism and Leisure

4.1.3.2 Disaster Relief and Emergency Services

4.1.4 Market Challenges

4.1.4.1 Air Traffic Management and Integration

4.1.4.2 Public Acceptance and Safety Concerns

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global EVTOL aircraft Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 EVTOL aircraft Market, By Lift Technology

6.1 Global EVTOL aircraft Market Snapshot, By Lift Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Vectored Thrust

6.1.1.2 Multirotor

6.1.1.3 Lift Plus Cruise

Chapter 7 EVTOL aircraft Market, By Propulsion Type

7.1 Global EVTOL aircraft Market Snapshot, By Propulsion Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Fully Electric

7.1.1.2 Hybrid

7.1.1.3 Electric Hydrogen

Chapter 8 EVTOL aircraft Market, By System

8.1 Global EVTOL aircraft Market Snapshot, By System

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Hardware

8.1.1.2 Software

Chapter 9 EVTOL aircraft Market, By Mode of Operations

9.1 Global EVTOL aircraft Market Snapshot, By Mode of Operations

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Autonomous

9.1.1.2 Semi-autonomous

9.1.1.3 Piloted

Chapter 10 EVTOL aircraft Market, By Range

10.1 Global EVTOL aircraft Market Snapshot, By Range

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

10.1.1.1 Intracity (20km-100km)

10.1.1.2 Intercity (Above 100Km)

Chapter 11 EVTOL aircraft Market, By Maximum Take-off Weight (MTOW)

11.1 Global EVTOL aircraft Market Snapshot, By Maximum Take-off Weight (MTOW)

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

11.1.1.1 <250 Kg

11.1.1.2 250-500 Kg

11.1.1.3 500-1500 Kg

11.1.1.4 >1500 Kg

Chapter 12 EVTOL aircraft Market, By Application

12.1 Global EVTOL aircraft Market Snapshot, By Application

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

12.1.1.1 Passenger Transportation

12.1.1.2 Cargo Transportation

12.1.1.3 Emergency Services

12.1.1.4 Military and Defense

12.1.1.5 Recreational and Tourism

12.1.1.6 Others

Chapter 13 EVTOL aircraft Market, By Region

13.1 Overview

13.2 EVTOL aircraft Market Revenue Share, By Region 2023 (%)

13.3 Global EVTOL aircraft Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America EVTOL aircraft Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe EVTOL aircraft Market, By Country

13.5.4 UK

13.5.4.1 UK EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UK Market Segmental Analysis

13.5.5 France

13.5.5.1 France EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 France Market Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 Germany Market Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of Europe Market Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific EVTOL aircraft Market, By Country

13.6.4 China

13.6.4.1 China EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 China Market Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 Japan Market Segmental Analysis

13.6.6 India

13.6.6.1 India EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 India Market Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 Australia Market Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia Pacific Market Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA EVTOL aircraft Market, By Country

13.7.4 GCC

13.7.4.1 GCC EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCC Market Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 Africa Market Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 Brazil Market Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA EVTOL aircraft Market Revenue, 2021-2033 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 14 Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2021-2023

14.1.3 Competitive Analysis By Revenue, 2021-2023

14.2 Recent Developments by the Market Contributors (2023)

Chapter 15 Company Profiles

15.1 Joby Aviation, Inc.

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 Volocopter GmbH

15.3 Lilium GmbH

15.4 Vertical Aerospace Ltd.

15.5 Archer Aviation, Inc.

15.6 EHang Holdings Limited

15.7 Bell Textron Inc.

15.8 Hyundai Motor Group

15.9 Airbus SE

15.10 Boeing Company