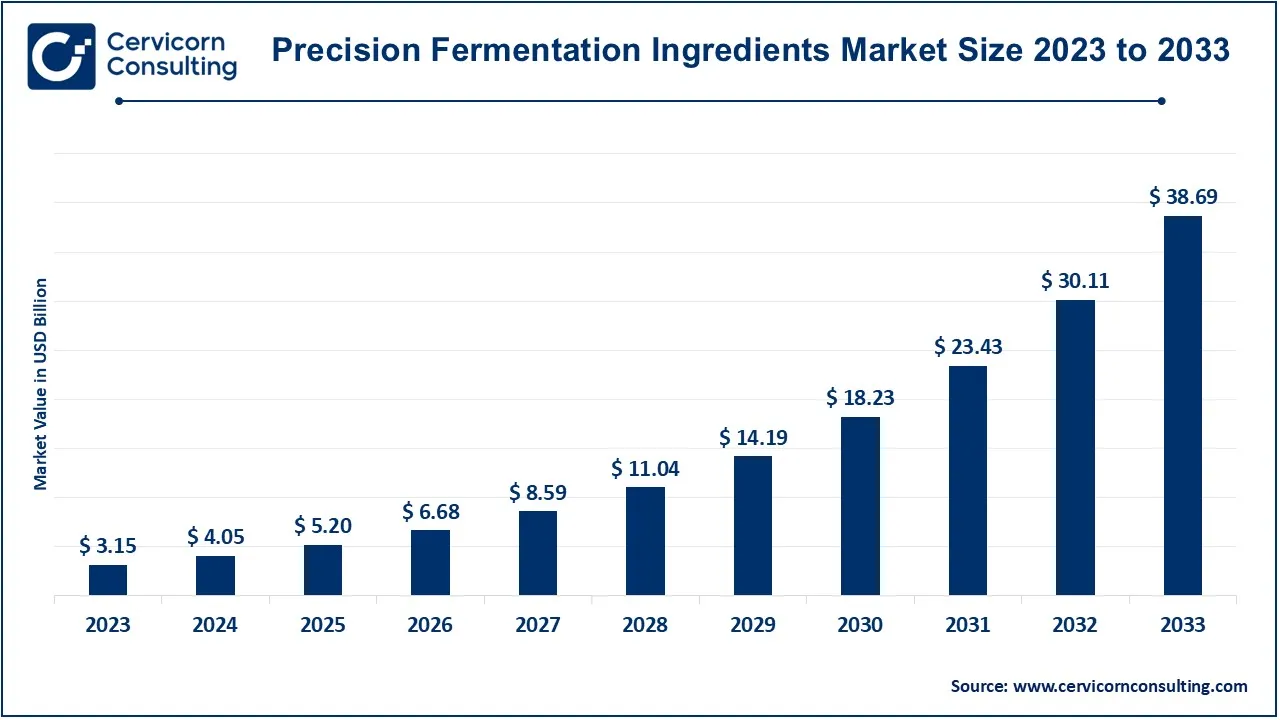

The global precision fermentation ingredients market size was valued at USD 4.05 billion in 2024 and is anticipated to reach around USD 38.69 billion by 2033, growing at a compound annual growth rate (CAGR) of 28.50% over the forecast period 2024 to 2033.

The market for precision fermentation ingredients is expanding rapidly due to the rising demand for sustainable, ethical, and high-quality alternatives to traditional ingredients. This growth is driven by the increasing awareness of environmental and animal welfare concerns, along with the growing trend of plant-based and lab-grown products. Food companies are using precision fermentation to develop animal-free dairy proteins, egg substitutes, and flavor enhancers, which appeal to health-conscious and environmentally aware consumers. The shift toward clean-label and functional ingredients further boosts its adoption. Beyond food, the cosmetics and pharmaceutical sectors are contributing to market growth. Precision fermentation enables the production of bio-identical compounds like collagen, vitamins, and enzymes, which are free from animal-derived sources. Startups and established players alike are entering the market, encouraged by supportive government policies and investor interest. For instance, MycoTechnology partnered with the Oman Investment Authority to establish Vital Foods Technologies LLC, aiming to produce mushroom-based protein using locally cultivated dates.

Precision fermentation is a cutting-edge technology used to produce ingredients like proteins, fats, enzymes, and vitamins in a highly controlled and sustainable manner. It involves using microorganisms such as yeast, bacteria, or fungi, which are programmed through genetic engineering to produce specific compounds. These microorganisms are grown in fermentation tanks, where they produce the desired ingredients. Once the fermentation process is complete, the product is purified and extracted for use in various industries. This method is revolutionizing sectors like food, cosmetics, and pharmaceuticals. For example, precision fermentation is being used to create alternative proteins, such as casein or whey, traditionally found in dairy, without the need for animals. It also helps in producing enzymes for food processing and bioactive compounds for health supplements.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 4.05 Billion |

| Projected Market Size (2033) | USD 38.69 Billion |

| Growth Rate (2024 to 2033) | 28.50% |

| Highest Revenue Share (Region) | North America |

| Fastest Growing Region | Europe |

| Report Segments | Ingredient Type, Application, Source, Region |

| Top Companies | Ginkgo Bioworks, Inc., Eden Brew Perfect Day, Inc., Modern Meadow, Inc., MycoTechnology, Inc., Calysta, Inc., Quorn Foods, Nutritional Growth Solutions, Conagen, Inc., Synlogic, Inc., Arzeda Corporation, Trellis Biomed, Kite Hill (a part of Danone S.A.), Mosaic Foods, Lycée Agricole de La Baie |

Consumer Demand for Clean Label Products:

Global Population Growth and Food Security Concerns:

High Production Costs:

Regulatory Challenges and Approval Processes:

Development of Specialty Ingredients for Niche Markets:

Expansion into Emerging Markets:

Consumer Acceptance and Perception:

Competition with Established Industries:

The precision fermentation ingredients market is segmented into ingredient, application, source, and region. Based on ingredient, the market is classified into proteins, carbohydrates, fats, vitamins and minerals, yeast based, enzymes, and other. Based on application, food and beverages, pharmaceuticals, animal feed, cosmetics and personal care products, and other. Based on source, the market is classified into plant based, animal feed, and others.

Proteins: Proteins produced via precision fermentation involve the use of microorganisms to synthesize high-quality proteins, such as casein, whey, and collagen, without relying on animal sources. There is increasing demand for alternative proteins driven by the rise of vegan and vegetarian diets. Precision fermentation offers scalable production of proteins that mimic animal-derived products in taste and texture, appealing to health-conscious and environmentally-aware consumers.

Carbohydrates: Carbohydrates created through precision fermentation include functional sugars and starches that can be produced more sustainably compared to traditional agriculture. The market is witnessing a surge in demand for low-calorie sweeteners and prebiotic fibers. Precision fermentation allows for the creation of customized carbohydrate structures, meeting the needs for healthier and functional food products, and catering to dietary restrictions like low-sugar or keto diets.

Fats: Fats derived from precision fermentation include omega-3 fatty acids and medium-chain triglycerides (MCTs), produced by microorganisms to replicate the health benefits and sensory properties of traditional fats. As consumers seek plant-based and sustainable alternatives to animal fats, precision fermentation enables the production of fats with specific nutritional profiles and flavor properties, such as vegan butter and oils, supporting the growth of plant-based food markets.

Vitamins and Minerals: Precision fermentation is used to produce vitamins and minerals in a controlled environment, ensuring high purity and bioavailability compared to synthetic or naturally extracted sources. The demand for fortified foods and personalized nutrition is driving innovation in vitamin and mineral production. Precision fermentation offers a sustainable and efficient method to produce essential micronutrients, addressing global malnutrition and health concerns.

Yeast Based: Yeast-based ingredients produced via precision fermentation include flavors, fragrances, and nutritional components such as yeast extracts and beta-glucans. The use of yeast as a platform for producing complex flavors and nutritional ingredients is growing. This trend is supported by the need for natural and clean-label products, with applications in plant-based foods, beverages, and functional products like probiotics.

Enzymes: Enzymes generated through precision fermentation are bio-catalysts used to enhance food processing, improve product quality, and create novel food textures. There is increasing utilization of enzymes in food processing for efficiency and sustainability. Precision fermentation enables the production of enzymes tailored to specific functions, such as lactose-free dairy products, optimizing production processes and reducing environmental impact.

Others: This category includes peptides, flavors, fragrances, and other bioactive compounds produced using precision fermentation for various industrial applications. Precision fermentation is facilitating innovation in producing novel compounds, such as unique flavor profiles and bioactive peptides for functional foods. The technology offers opportunities to create sustainable alternatives to traditionally extracted ingredients, appealing to the growing demand for innovative and eco-friendly products.

Food and Beverages: In 2023, the food and beverages segment has accounted revenue share of 50%. Precision fermentation is used to produce alternative proteins, enzymes, and flavors for the food and beverage industry, providing sustainable and scalable solutions for dairy and meat alternatives. Trends include a growing demand for plant-based foods, clean-label products, and functional ingredients that enhance health benefits. This segment is driven by consumer interest in ethical and environmentally friendly food choices, boosting innovation in this space.

Pharmaceuticals: In 2023, the pharmaceuticals segment has accounted revenue share of 23%. In pharmaceuticals, precision fermentation is employed to create complex molecules, enzymes, and vitamins essential for drug formulation and therapeutic applications. The trend focuses on producing high-purity, cost-effective pharmaceutical ingredients with consistent quality. This technology enables the production of biologics and personalized medicine, offering opportunities to develop innovative treatments while reducing reliance on traditional extraction methods from natural sources.

Animal Feed: Precision fermentation in animal feed involves the production of proteins, amino acids, and enzymes to enhance nutrition and growth performance in livestock. Trends include a shift toward sustainable and antibiotic-free feed solutions that improve animal health and reduce environmental impact. The use of precision fermentation allows for the creation of tailored feed ingredients, addressing specific dietary requirements and promoting efficient resource use.

Cosmetics and Personal Care Products: In 2023, the cosmetics and personal care products segment has accounted revenue share of 9%. In cosmetics and personal care, precision fermentation is utilized to produce high-quality, bio-based ingredients like hyaluronic acid and peptides. Trends emphasize sustainability, transparency, and efficacy, with consumers seeking products derived from natural processes. This approach enables the creation of innovative formulations with enhanced performance and reduced environmental footprint, aligning with the growing demand for ethical and clean beauty products.

Others: Other applications include textiles, bioplastics, and biofuels, where precision fermentation provides sustainable alternatives to conventional materials. Trends focus on reducing reliance on fossil fuels and minimizing environmental impact through innovative bioprocessing technologies.

These applications benefit from the ability to produce custom-designed molecules, facilitating the development of advanced materials and renewable energy solutions that meet industry-specific requirements and sustainability goals.

Plant-Based: In 2023, the plant based segment has accounted revenue share of 34%. Derived from plant sources, these ingredients are produced using fermentation technology to enhance their nutritional profile, flavor, or texture. Increasing consumer demand for plant-based diets and sustainability drives growth. Innovations focus on creating high-quality, nutritious alternatives to meat and dairy, catering to the expanding vegan and vegetarian markets.

Animal-Based: In 2023, the animal feed segment has accounted revenue share of 26%. Ingredients derived from animal sources, but produced through fermentation to replicate animal proteins, fats, or other components. Growing interest in ethical and sustainable meat alternatives is fueling development. These ingredients aim to provide similar nutritional benefits as traditional animal products while reducing environmental impact and animal welfare concerns.

Others: Includes ingredients derived from unconventional sources like microorganisms or algae, produced via fermentation. Advances in biotechnology are exploring new sources such as fungi and algae for specialized ingredients. This segment is expanding due to its potential for innovation and sustainability, offering novel solutions across various industries including food, pharmaceuticals, and cosmetics.

The precision fermentation ingredients market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

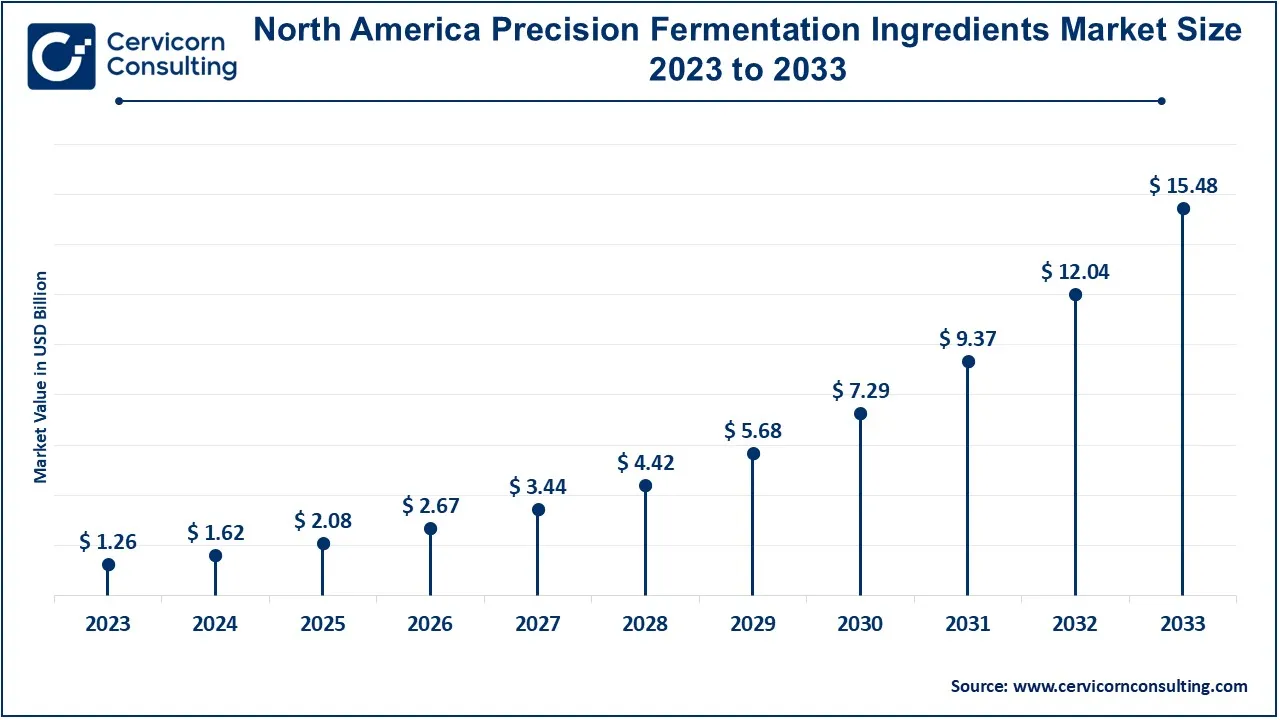

The North America precision fermentation ingredients market size was estimated at USD 1.26 billion in 2023 and is expected to hit around USD 15.48 billion by 2033. The North America market is driven by strong consumer demand for plant-based and alternative protein products. The region is a leader in innovation and investment in precision fermentation technologies, with significant advancements in developing new ingredients and improving production efficiencies. Regulatory support and substantial venture capital investment are fostering rapid growth in this area.

The Asia-Pacific precision fermentation ingredients market size was worth USD 0.66 billion in 2023 and is projected to reach around USD 8.12 billion by 2033. The Asia-Pacific region is experiencing rapid urbanization and a rising middle class, which is increasing demand for diverse and high-quality food products. There is growing interest in precision fermentation as a means to address food security and nutritional challenges. The region is also seeing significant investments in research and development to leverage local agricultural resources.

The Europe precision fermentation ingredients market size was accounted for USD 0.95 billion in 2023 and is predicted to surpass around USD 11.61 billion by 2033. Europe is focusing on sustainability and regulatory compliance, with stringent environmental and food safety standards. There is a growing emphasis on integrating precision fermentation into traditional food systems to meet the EU's sustainability goals. European consumers are increasingly interested in clean label and ethically produced ingredients, driving innovation in plant-based and sustainable alternatives.

The LAMEA precision fermentation ingredients market size was reached at USD 0.28 billion in 2023 and is projected to be worth around USD 3.48 billion by 2033. In LAMEA, there is a rising focus on improving food security and enhancing local food production capabilities. Precision fermentation is gaining traction as a solution to address these issues. Additionally, growing awareness of sustainable practices and interest in new food technologies are driving the adoption of fermentation-derived ingredients, especially in emerging markets.

Companies like Eden Brew and Mosaic Foods are leveraging cutting-edge technology and unique fermentation processes to enter the market with novel ingredients and products. Ginkgo Bioworks and Perfect Day lead the market due to their advanced biotech capabilities and strong R&D investments. Ginkgo Bioworks excels in custom organism design, while Perfect Day focuses on dairy alternatives, establishing themselves through strategic partnerships and extensive product lines. These leaders drive market trends with their technological advancements and broad product offerings.

The Precision Fermentation Ingredients Market has seen several key developments in recent years, with companies seeking to expand their market presence and leverage synergies to improve their offerings and profitability. Some notable examples of key development in the Precision Fermentation Ingredients Market include:

This key development helped companies expand their offerings, improve their market presence, and capitalize on growth opportunities in the Precision Fermentation Ingredients Market. The trend is expected to continue as companies seek to gain a competitive edge in the market.

Market Segmentation

By Ingredient Type

By Application

By Source

Regional

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Precision Fermentation Ingredients

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Ingredient Type Overview

2.2.2 By Application Overview

2.2.3 By Source Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Precision Fermentation Ingredients Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Consumer Demand for Clean Label Products

4.1.1.2 Global Population Growth and Food Security Concerns

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Regulatory Challenges and Approval Processes

4.1.3 Market Opportunity

4.1.3.1 Development of Specialty Ingredients for Niche Markets

4.1.3.2 Expansion into Emerging Markets

4.1.4 Market Challenges

4.1.4.1 Consumer Acceptance and Perception

4.1.4.2 Competition with Established Industries

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Precision Fermentation Ingredients Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Precision Fermentation Ingredients Market, By Ingredient Type

6.1 Global Precision Fermentation Ingredients Market Snapshot, By Ingredient Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Proteins

6.1.1.2 Carbohydrates

6.1.1.3 Fats

6.1.1.4 Vitamins and Minerals

6.1.1.5 Yeast Based

6.1.1.6 Enzymes

6.1.1.7 Others

Chapter 7 Precision Fermentation Ingredients Market, By Application

7.1 Global Precision Fermentation Ingredients Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Food and Beverages

7.1.1.2 Pharmaceuticals

7.1.1.3 Animal Feed

7.1.1.4 Cosmetics and Personal Care Products

7.1.1.5 Others

Chapter 8 Precision Fermentation Ingredients Market, By Source

8.1 Global Precision Fermentation Ingredients Market Snapshot, By Source

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Supermarkets/Hypermarkets

8.1.1.2 Convenience Stores

8.1.1.3 Online Retail

8.1.1.4 Others

Chapter 9 Precision Fermentation Ingredients Market, By Application

9.1 Global Precision Fermentation Ingredients Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Plant Based

9.1.1.2 Animal Based

9.1.1.3 Others

Chapter 10 Precision Fermentation Ingredients Market, By Region

10.1 Overview

10.2 Precision Fermentation Ingredients Market Revenue Share, By Region 2023 (%)

10.3 Global Precision Fermentation Ingredients Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Precision Fermentation Ingredients Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Precision Fermentation Ingredients Market, By Country

10.5.4 UK

10.5.4.1 UK Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Precision Fermentation Ingredients Market, By Country

10.6.4 China

10.6.4.1 China Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Precision Fermentation Ingredients Market, By Country

10.7.4 GCC

10.7.4.1 GCC Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Precision Fermentation Ingredients Market Revenue, 2021-2033 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 Precision Fermentation Ingredients Market Top Companies

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Ginkgo Bioworks, Inc.

12.3 Eden Brew

12.4 Perfect Day, Inc.

12.5 Modern Meadow, Inc.

12.6 MycoTechnology, Inc.

12.7 Calysta, Inc.

12.8 Quorn Foods

12.9 Nutritional Growth Solutions

12.10 Conagen, Inc.