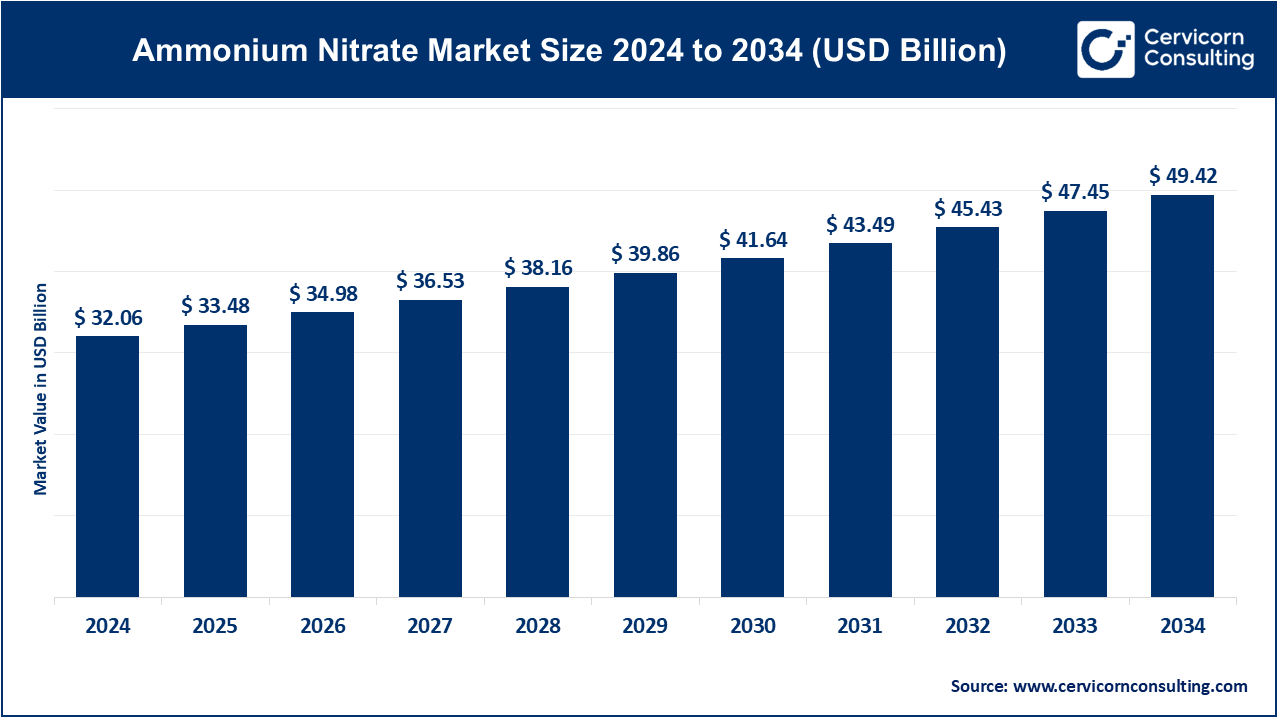

The global ammonium nitrate market size was valued at USD 32.06 billion in 2024 and is projected to hit around USD 49.42 billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.42% from 2025 to 2034.

The global ammonium nitrate market has shown consistent growth, driven primarily by the increasing demand for fertilizers in agricultural production. As the world’s population grows and food demand rises, the need for effective fertilizers like ammonium nitrate has become more prominent. Countries with large agricultural sectors, such as China, India, and the United States, are major consumers. In 2023, India imported ammonium nitrate valued at approximately USD 260.79 million, totaling around 511.6 million kilograms. Furthermore, the growth of advanced farming techniques and the adoption of high-yield crops also contribute to market expansion. The increasing push towards sustainable farming practices is expected to further drive demand for ammonium nitrate, particularly in countries focused on increasing food security. The market for ammonium nitrate is also influenced by industrial applications, especially in mining and construction. With infrastructure development expanding globally, ammonium nitrate plays a critical role in the production of explosives for blasting and demolition.

Ammonium Nitrate as for its use is mostly as a fertilizer. This feeds as pellets that are coated with clay; Customers and consumers can therefore purchase the product in their preferred form. This is the case especially in agriculture since nitrogen is highly present in this compound which makes it very important. Nitrogen is amongst the macronutrients that the plants require and which enables the metabolic activities within the plant to take place.

Farmers use ammonium nitrate as it is cheaper as compared to many other expensive fertilizers. It can also bring about quick results and which can enhance the fruit setting possibility of a plant. It may also impact on the quality of the green leafy vegetables since the nitrogen which accounts for use by the plants is in actual sense beneficial in the process of photosynthesis.

Other well-known application of ammonium nitrate is in production of explosives where it serves as an additive. One external factor affecting ammonium nitrate is heat and any case of application of this factor may lead to an explosion. This substance is an oxidating agent of quite a high class. This means that it possess the ability to transfer some electrons from other reacting particles under redox chemical reaction. This is the reason why ammonium nitrates are always combines and incorporated together with combustibles such as TNT and others.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 33.48 Billion |

| Projected Market Size (2034) | USD 49.42 Billion |

| Growth Rate (2025 to 2034) | 4.42% |

| Largest Revenue Holder | Europe |

| Fastets Growing Region | Asia Pacific |

| Segments Covered | Form, Application, End User, Region |

| Top Companies | Yara International ASA, CF Industries Holdings, Inc., Nutrien Ltd., Orica Limited, EuroChem Group, Nouryon, TogliattiAzot, OCI Nitrogen, SABIC, K+S Group, Incitec Pivot Limited, LUXI Chemical Group, Fertiberia, JSC Acron |

Fertilizers: Ammonium nitrate is a critical component in the agricultural sector, where it serves as a potent nitrogen-rich fertilizer. It plays a vital role in enhancing soil fertility, supporting plant growth, and significantly improving crop yields. Due to its high nitrogen content, ammonium nitrate is particularly effective in providing the essential nutrients that plants need during their growth cycles. Its ability to dissolve easily in water ensures that nutrients are readily available to plants, making it a preferred choice for farmers globally. The use of ammonium nitrate in fertilizers is especially prominent in regions with high agricultural activity, contributing to food security and sustainable farming practices.

Explosives: In the mining, quarrying, and construction industries, ammonium nitrate is extensively used in the production of explosives. Its highly reactive nature makes it an ideal component in the formulation of blasting agents, such as ANFO (Ammonium Nitrate Fuel Oil), which is widely used for blasting operations. The explosive power of ammonium nitrate is harnessed to break through rock and earth, facilitating the extraction of minerals and the preparation of construction sites. Its relatively low cost and effectiveness in large-scale blasting operations have made it a staple in the explosives industry, particularly in regions with significant mining and construction activities.

Industrial Applications: Beyond its use in agriculture and explosives, ammonium nitrate finds applications in various industrial processes. It is utilized in the production of specialty chemicals, where it acts as a key reagent. In laboratories, ammonium nitrate is used for specific analytical purposes, such as in the synthesis of other chemical compounds or as a component in industrial refrigeration systems. Its versatility in industrial applications stems from its chemical properties, which allow it to be used in a range of chemical reactions and manufacturing processes.

Medical Applications: Although used in smaller quantities compared to other applications, ammonium nitrate also has medical uses. It is incorporated into certain pharmaceutical formulations and medical treatments, where its chemical properties are harnessed for therapeutic purposes. For example, ammonium nitrate may be used in the preparation of certain medications or in the production of diagnostic reagents. Its role in the medical field is more specialized, reflecting its utility in niche applications within pharmaceutical manufacturing and healthcare.

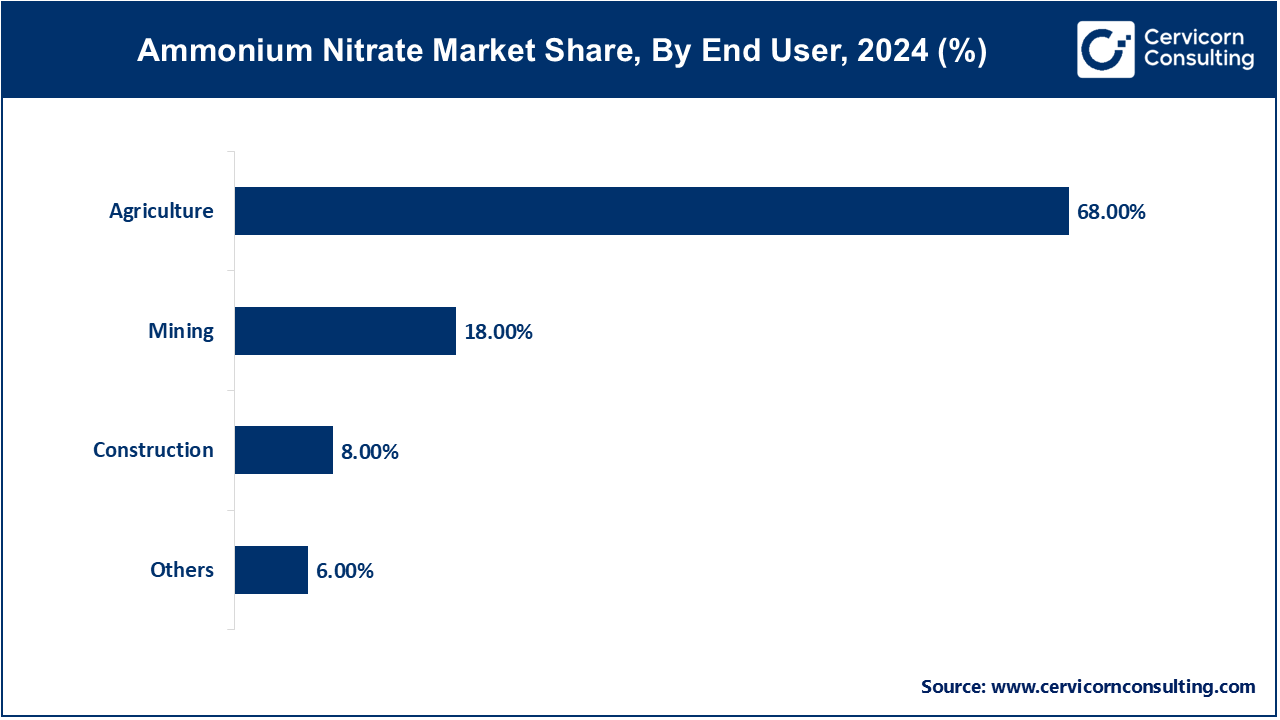

Agriculture: The agriculture industry is the largest end-user of ammonium nitrate, consuming it primarily as a fertilizer. Farmers and agricultural enterprises rely on ammonium nitrate to enhance soil fertility, boost crop yields, and support sustainable farming practices. The high nitrogen content of ammonium nitrate makes it particularly effective in promoting the healthy growth of a wide range of crops, from grains to vegetables. Its widespread use in agriculture underscores its importance in food production and the global agricultural supply chain, especially in regions where intensive farming is practiced.

Mining and Quarrying: In the mining and quarrying industries, ammonium nitrate is a crucial component in the production of explosives used for blasting operations. It is widely used to create explosive mixtures that are employed in the extraction of minerals and ores from the earth. The efficiency of ammonium nitrate in breaking through hard rock formations makes it indispensable in these industries. Its use in mining and quarrying is particularly significant in resource-rich regions, where large-scale extraction activities require reliable and powerful blasting agents.

Construction: The construction industry utilizes ammonium nitrate for demolition and excavation purposes, leveraging its explosive properties. It is commonly used in controlled blasting operations to clear land, excavate foundations, and break down structures. The ability of ammonium nitrate-based explosives to deliver precise and controlled blasts makes them ideal for use in urban construction projects where minimizing collateral damage is critical. Its role in the construction industry highlights its importance in infrastructure development and large-scale building projects.

Chemicals: Ammonium nitrate serves as a key raw material in the chemical industry, where it is used in the production of various chemicals and in research and development activities. Its chemical properties make it suitable for use in the synthesis of other compounds, as well as in laboratory experiments. The versatility of ammonium nitrate in the chemical industry is reflected in its wide range of applications, from the production of basic chemicals to its use in more advanced research settings.

Granular: Granular ammonium nitrate is the most common form used across various industries, particularly in agriculture and explosives. Its granular structure allows for easy handling, storage, and application. In agriculture, granular ammonium nitrate is spread on fields to fertilize crops, while in the explosives industry, it is used to create consistent and effective blasting agents. The granules' uniform size and shape make them ideal for controlled release of nitrogen in fertilizers and for predictable reactivity in explosive mixtures.

Liquid: Liquid ammonium nitrate is less common but is used in specific industrial applications where a dissolved form is required. In industries such as chemical manufacturing or industrial refrigeration, liquid ammonium nitrate is used for its reactive properties in controlled processes. The liquid form allows for precise dosing and mixing in industrial applications, where the solid form may not be as effective. Its use is more specialized, catering to industries that require ammonium nitrate in a more versatile and easily integrated form.

Prilled: Prilled ammonium nitrate consists of small, bead-like granules that are particularly favored in the explosives industry. The prilling process results in a product with a consistent size and shape, which enhances its performance in explosive formulations. Prilled ammonium nitrate is often used in the production of ANFO, a common explosive used in mining and construction. The prills' uniformity ensures that the explosive mixture is homogeneous, leading to more predictable and efficient blasting results. Its use in explosives manufacturing highlights the importance of precision in the formulation of industrial explosives.

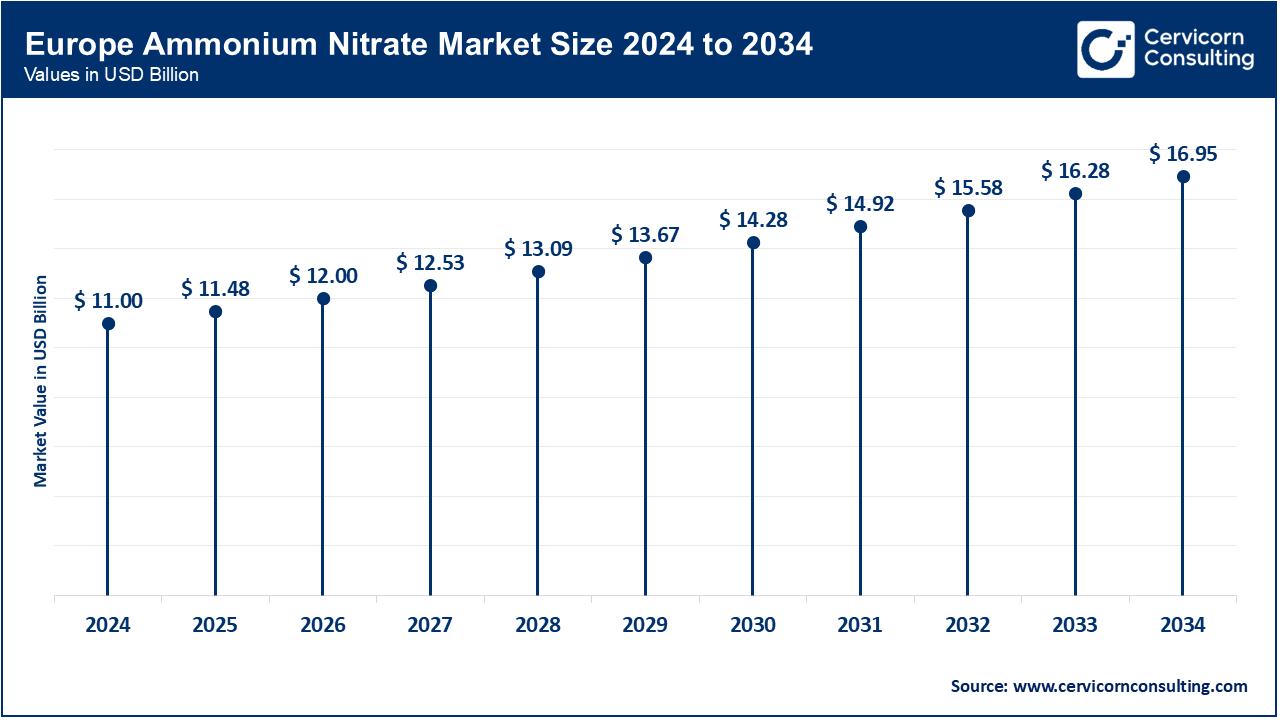

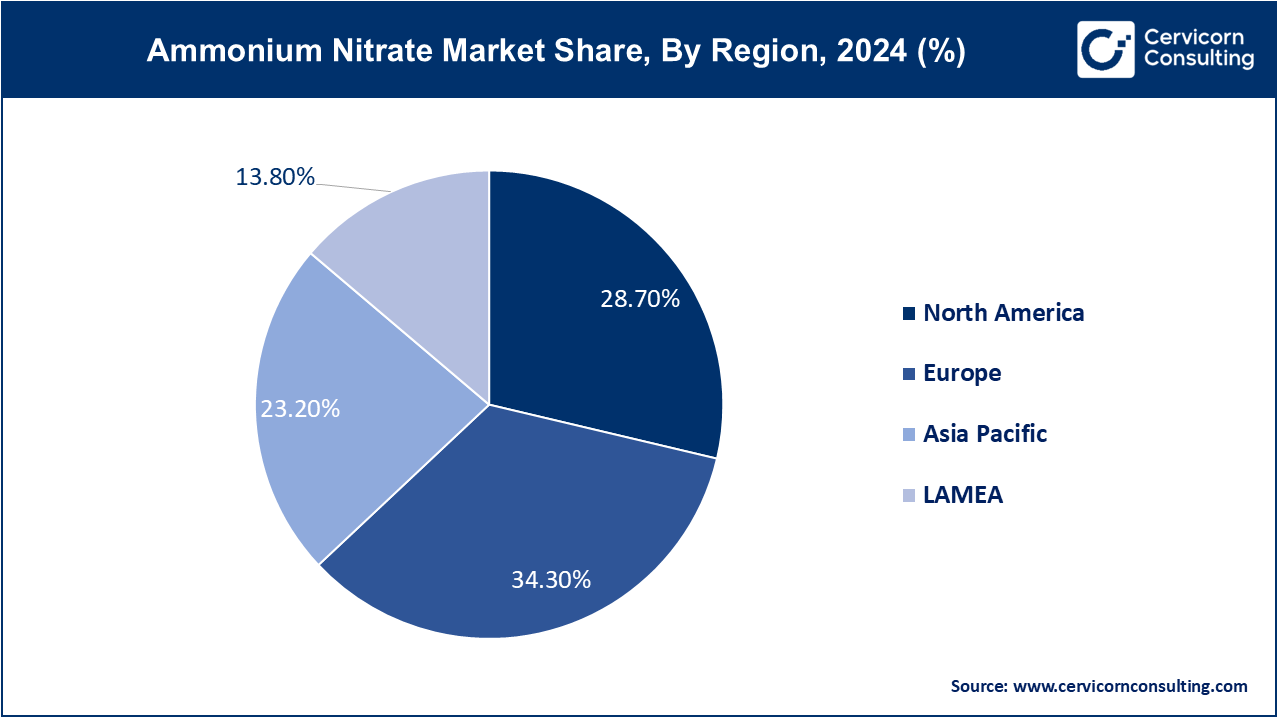

The Europe ammonium nitrate market size was valued at USD 11 billion in 2024 and is expected to reach around USD 16.95 billion by 2034 with a CAGR of 4.60%. Europe is leading the market with demand spurred by its applications in agriculture, explosives, and industrial processes. Countries like Germany and France lead the market due to their strong agricultural sectors and industrial base. The European market is characterized by a strong regulatory framework that ensures the safe use of ammonium nitrate, as well as a focus on sustainable practices. This includes innovations in product formulation and efficient use in both agricultural and industrial contexts, aligning with Europe’s broader goals of environmental sustainability and resource management.

The North America is robust, largely driven by its extensive use in agriculture and industrial applications. The North America ammonium nitrate market size was valued at USD 9.2 billion in 2024 and is anticipated to hit around USD 14.18 billion by 2034 with a CAGR of 4.50%. The United States, a major producer and consumer, benefits from advanced manufacturing technologies and significant agricultural demand. Canada also contributes notably, with ammonium nitrate playing a crucial role in agricultural productivity and mining activities. The market dynamics in this region are influenced by consistent demand from the agricultural sector, stringent regulations, and ongoing technological advancements that enhance production efficiency and product safety.

The Asia-Pacific region is experiencing rapid growth due to escalating industrialization and agricultural demands. The global ammonium nitrate market size was estimated at USD 7.44 billion in 2024 and is projected to surpass around USD 11.46 billion by 2034 with a CAGR of 4.80%. China and India are significant contributors, with high demand for fertilizers driven by large-scale agricultural activities and infrastructure projects. Japan and South Korea also have substantial markets, particularly for specialized applications like explosives in mining and construction. The region's growth is supported by substantial investments in manufacturing infrastructure, advancements in agricultural technology, and increasing industrial activities, which bolster the demand for ammonium nitrate.

The global ammonium nitrate market size was valued at USD 4.42 billion in 2024 and is projected to reach around USD 6.82 billion by 2034. The Middle East, with its growing construction and mining industries, also contributes to the demand for ammonium nitrate. However, market growth in this region faces challenges such as economic fluctuations and infrastructural constraints. Despite these challenges, the region’s rich natural resources and increasing industrial activities offer significant opportunities for future market expansion. Brazil and South Africa are notable markets, benefiting from their burgeoning agricultural sectors and infrastructure development.

New players such as Hydrogen Pro and PowerCell Sweden AB are leveraging advancements in high-efficiency electrolyzer technology for green hydrogen production, focuses on innovative fuel cell systems. While dominating players like Air Liquide and Linde plc stand out due to their extensive global hydrogen infrastructure and industry expertise. Air Liquide excels with its expansive hydrogen networks and advanced storage solutions, while Linde plc drives innovation through its strategic partnerships and R&D efforts. Both established and emerging players are crucial in advancing hydrogen storage technologies and integrating them into broader energy systems.

CEO Statements

Yara International ASA: “Our focus is on sustainable agriculture and providing high-quality nitrogen fertilizers, including ammonium nitrate, to meet the increasing global food demand while minimizing environmental impact.”

CF Industries Holdings, Inc: “We are committed to being a leading provider of essential fertilizers, including ammonium nitrate, that help farmers increase crop yields and improve global food security.”

Nutrien Ltd: "Nutrien’s goal is to support global agriculture by delivering reliable and innovative products like ammonium nitrate, which are crucial for feeding a growing population

These developments underscore significant strides in advancing infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global Ammonium Nitrate Market.

Strategic partnerships and Launches highlight the rapid advancements and collaborative efforts in the ammonium nitrate market. Industry players are involved in various aspects of ammonium nitrate, including production, storage technologies, and fuel cells, and play a significant role in advancing the market.

These developments underscore significant strides in advancing hydrogen infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global market.

Market Segmentation

By Form

By Application

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Ammonium Nitrate

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Form Overview

2.2.2 By Application Overview

2.2.3 By End User Overview

2.2.4 By Application Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Ammonium Nitrate Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Demand in Agriculture

4.1.1.2 Expansion of Mining Activities

4.1.2 Market Restraints

4.1.2.1 Safety Concerns

4.1.2.2 Environmental Impact

4.1.3 Market Opportunity

4.1.3.1 Growth in Emerging Markets

4.1.3.2 Innovation in Fertilizer Technology

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance and Safety Standards

4.1.4.2 Technological Adaptation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Ammonium Nitrate Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Ammonium Nitrate Market, By Form

6.1 Global Ammonium Nitrate Market Snapshot, By Form

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Granular

6.1.1.2 Liquid

6.1.1.3 Prilled

Chapter 7 Ammonium Nitrate Market, By Application

7.1 Global Ammonium Nitrate Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Fertilizers

7.1.1.2 Explosives

7.1.1.3 Industrial

7.1.1.4 Medical

7.1.1.5 Others

Chapter 8 Ammonium Nitrate Market, By End User

8.1 Global Ammonium Nitrate Market Snapshot, By End User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Mining

8.1.1.2 Construction

8.1.1.3 Agriculture

8.1.1.4 Military Explosives

8.1.1.5 Others

Chapter 9 Ammonium Nitrate Market, By Region

9.1 Overview

9.2 Ammonium Nitrate Market Revenue Share, By Region 2024 (%)

9.3 Global Ammonium Nitrate Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Ammonium Nitrate Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Ammonium Nitrate Market, By Country

9.5.4 UK

9.5.4.1 UK Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Ammonium Nitrate Market, By Country

9.6.4 China

9.6.4.1 China Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Ammonium Nitrate Market, By Country

9.7.4 GCC

9.7.4.1 GCC Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Ammonium Nitrate Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Yara International ASA

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 CF Industries Holdings, Inc.

11.3 Nutrien Ltd.

11.4 Orica Limited

11.5 EuroChem Group

11.6 Nouryon

11.7 TogliattiAzot

11.8 OCI Nitrogen

11.9 SABIC

11.10 K+S Group