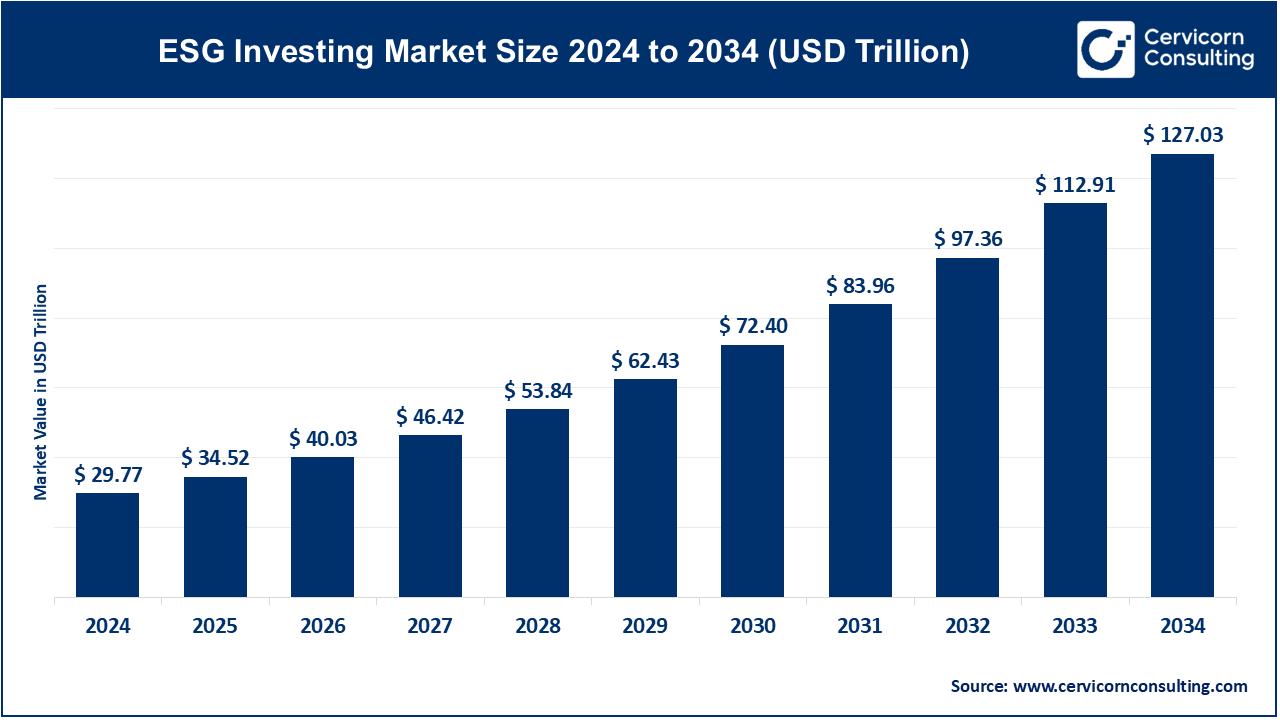

The global ESG investing market size was valued at USD 29.77 trillion in 2024 and is expected to reach around USD 127.03 trillion by 2034, growing at a compound annual growth rate (CAGR) of 15.96% from 2025 to 2034.

The ESG investing market has seen significant momentum, driven by the increasing recognition of the importance of sustainable and ethical business practices. As more individuals, businesses, and governments focus on environmental protection, social equality, and good governance, the demand for ESG-focused investments has risen sharply. This is particularly evident in the rise of ESG-themed mutual funds, exchange-traded funds (ETFs), and sustainable bonds, which provide investors with opportunities to support companies that align with their values. Additionally, ESG investing is gaining traction due to a shift in investor attitudes, especially among younger generations who prioritize sustainability. As these investors become a larger segment of the market, financial institutions are adapting by offering more ESG investment products. The growing pressure from governments and international organizations for businesses to disclose their environmental and social impacts further boosts the ESG market, pushing more companies to implement transparent ESG strategies.

ESG Investing (Environmental, Social, and Governance) refers to a type of investing that considers a company's impact on the environment, how it treats its employees and communities, and the governance practices it follows, in addition to traditional financial factors. ESG investing evaluates these three areas to identify companies that are socially responsible and sustainable. Environmental factors could include a company’s carbon footprint or waste management; social factors focus on things like labor practices, community involvement, and customer satisfaction; governance includes corporate transparency, leadership ethics, and shareholder rights. This type of investing aims to promote ethical practices while potentially earning a profit for investors.

Report Scope

| Are of Focus | Details |

| Market Size in 2024 | USD 29.77 Trillion |

| Projected Market Size (2034) | USD 127.03 Trillion |

| Growth Rate (2025 to 2034) | 15.96% |

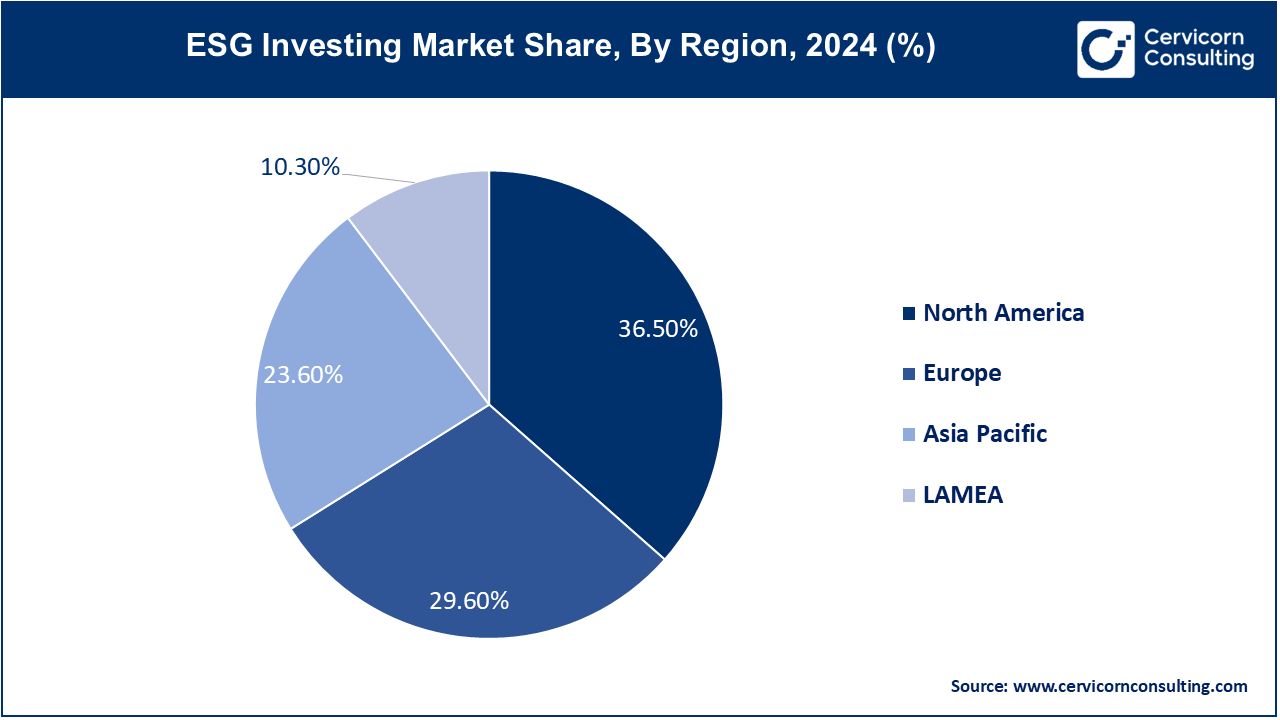

| Largest Revenue Holder by Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Segments Covered | Investment, services, Application, End User, Region |

| Top Companies | BlackRock, Inc., Vanguard Group, Inc., State Street Global Advisors, JPMorgan Chase & Co., Goldman Sachs Asset Management, Morgan Stanley Investment Management, UBS Asset Management, Amundi Asset Management, AXA Investment Managers, BNP Paribas Asset Management, Legal & General Investment Management, Allianz Global Investors, PIMCO (Pacific Investment Management Company), Schroders plc, Fidelity International |

Increased Funding and Investment

Corporate Accountability and Risk Management

Economic Volatility

Challenges in ESG Reporting and Standardization

Emerging Technologies

Education and Awareness Campaigns

Supply Chain Disruptions

Skill Gaps in ESG Expertise

The ESG investing market is segmented into type, investment, services, application, end user and region. Based on type, the market is classified into ESG integration, impact investing, sustainable funds, green bonds, and others. Based on investment, the market is classified into equity investments, fixed income investments, private equity and venture capital, thematic and impact investments. Based on services, the market is classified into asset management services, advisory services, research and data analytics, ESG reporting and certification. Based on application, the market is classified into corporate governance, environmental sustainability, social responsibility, and climate change mitigation. Based on end user, the market is classified into institutional investors, individual investors, corporations, and non-profit organizations.

Equity Investments: ESG equity investments focus on purchasing shares in companies that demonstrate strong environmental, social, and governance practices. These investments typically target companies with sustainable business models and ethical governance structures, offering potential long-term growth by aligning with ESG criteria. Investors are increasingly drawn to these investments as they seek to balance financial returns with positive social and environmental impact.

Fixed Income Investments: ESG-focused fixed-income investments involve purchasing bonds from issuers that meet specific ESG standards. This includes green bonds, social bonds, and sustainability-linked bonds, which finance projects with positive environmental or social outcomes. These bonds provide investors with a more secure investment option while supporting initiatives that promote sustainability and responsible governance.

Private Equity and Venture Capital: In the ESG space, private equity and venture capital investments support companies at various stages of growth that prioritize ESG factors. These investments often focus on innovative solutions to social, environmental, and governance challenges, offering the potential for significant impact alongside financial returns. Investors in this segment are increasingly seeking opportunities to back companies that drive positive change.

Thematic and Impact Investments: Thematic and impact investments focus on specific ESG themes, such as renewable energy, social equity, or corporate governance. Impact investing, in particular, aims to generate measurable social and environmental benefits alongside financial returns. These types of investments are gaining traction as investors look for ways to align their portfolios with their values and contribute to global sustainability efforts

Asset Management Services: These services involve the management of portfolios that are aligned with ESG criteria, offering investors strategies that integrate environmental, social, and governance factors into the investment process. Asset managers provide clients with opportunities to invest in companies that meet specific ESG standards, helping to manage risks and identify opportunities linked to sustainability.

Advisory Services: ESG advisory services guide investors in understanding and implementing ESG strategies, including risk assessment, sustainability reporting, and portfolio alignment with ESG goals. These services are crucial for institutional investors, corporations, and individuals looking to develop tailored ESG investment strategies that align with their objectives and regulatory requirements

Research and Data Analytics: Providers of ESG research and data analytics offer crucial services that help investors evaluate companies based on their ESG performance. These services rely on data-driven insights to inform investment decisions, making it easier for investors to compare ESG metrics across industries and ensure transparency in their portfolios.

ESG Reporting and Certification: This segment includes services that assist companies in reporting their ESG performance and obtaining certifications like B Corp, LEED, or other sustainability ratings. These services are essential for improving ESG transparency, attracting ESG-focused investors, and ensuring that companies meet industry standards for sustainable practices

Corporate Governance: ESG investing in corporate governance focuses on companies with strong leadership, board diversity, transparency, and accountability. Investors seek out companies that demonstrate ethical governance practices, which are crucial in reducing risks associated with poor management and fostering long-term stability.

Environmental Sustainability: Investments targeting environmental sustainability focus on companies that prioritize reducing their environmental impact, such as those in renewable energy, waste management, and conservation. These investments support the global shift towards sustainable business practices and help mitigate environmental risks.

Social Responsibility: ESG investments in social responsibility focus on companies that contribute positively to society, through practices like fair labor, diversity, and community engagement. These investments aim to support businesses that uphold high ethical standards and contribute to social well-being, enhancing corporate reputation and long-term value.

Climate Change Mitigation: This application involves investing in companies that are actively working to combat climate change. Investors in this segment focus on businesses that reduce carbon emissions, develop clean energy solutions, or enhance climate resilience, aligning their portfolios with global efforts to address climate-related challenges.

Institutional Investors: Large entities such as pension funds, insurance companies, and sovereign wealth funds are major players in the ESG investing market. These investors incorporate ESG factors into their strategies to manage risks and enhance long-term returns, often using their significant capital to influence corporate behavior.

Individual Investors: Retail investors are increasingly drawn to ESG investing as awareness of sustainability issues grows. These investors seek to align their financial goals with their values by choosing ESG-focused mutual funds, ETFs, or robo-advisors that offer exposure to socially responsible companies.

Corporations: Companies participate in the ESG investing market by adopting corporate sustainability programs, issuing green bonds, and linking executive compensation to ESG performance. These initiatives help companies attract ESG-conscious investors and improve their reputation in the market.

Non-Profit Organizations: Non-profits, including foundations and endowments, are adopting ESG investing strategies to align their investments with their missions. These organizations prioritize investments that generate positive social or environmental outcomes, balancing financial returns with their broader goals for societal impact.

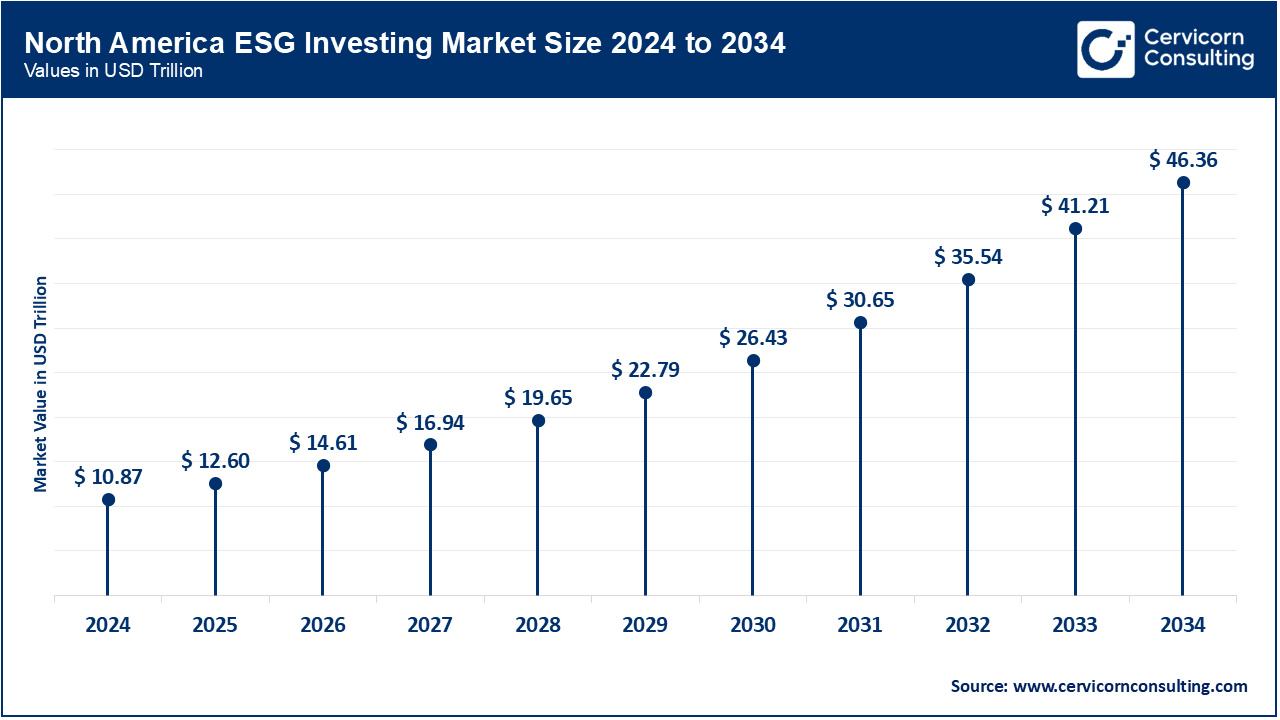

The North America ESG investing market size was estimated at USD 10.87 trillion in 2024 and is expected to hit around USD 46.36 trillion by 20343. The North America leading the market, due to its strong financial sector and growing awareness of environmental, social, and governance issues among investors. The U.S. and Canada are at the forefront of integrating ESG factors into mainstream investment strategies, driven by increasing regulatory pressures and the rising demand for sustainable investment options. Significant capital inflows into ESG funds, coupled with the growth of shareholder activism and the expansion of green bond markets, contribute to the region's dominance in the ESG investing landscape.

The Europe ESG investing market size was estimated at USD 8.81 trillion in 2024 and is projected to surpass around USD 37.6 trillion by 2034. Europe region is characterized by its stringent regulatory framework and strong investor commitment to sustainability. The region has seen substantial growth due to the implementation of the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR), which encourage transparency and accountability in ESG investments. Countries like Germany, the UK, and France are leading the way in adopting ESG principles across various asset classes. The region's focus on reducing carbon emissions, promoting social equity, and enhancing corporate governance drives continued market expansion.

The Asia-Pacific ESG investing market size was valued at USD 7.03 trillion in 2024 and is expected to reach around USD 29.98 trillion by 2034. The Asia-Pacific region is expanding rapid growth in the market, fueled by increasing investor interest in sustainability and government initiatives promoting green finance. Countries such as Japan, China, and India are witnessing significant expansion in ESG-related investments, supported by rising awareness of climate risks and social issues. The region's growth is further bolstered by the development of sustainable finance frameworks and the launch of ESG-focused funds, which cater to the growing demand for responsible investment options.

The global ESG investing market size was valued at USD 3.07 trillion in 2024 and is expected to reach around USD 13.08 trillion by 2034. The LAMEA region is seeing an expansion in the market, driven by improving economic conditions and growing awareness of sustainability issues. In Latin America, there is an increasing focus on responsible investing as a means to address social inequalities and environmental challenges. The Middle East is benefiting from substantial investments in renewable energy projects and sustainable infrastructure, while Africa is gradually gaining attention from global investors interested in impact investing and social development initiatives. Despite challenges such as limited resources and regulatory complexities, the region is making progress through international partnerships and funding aimed at enhancing ESG integration.

Among the emerging players, Ethic Inc. leverages cutting-edge technology to provide personalized, data-driven ESG investing solutions, helping investors align their portfolios with their values. Aspiration focuses on sustainable banking and investment products, emphasizing environmental and social impact while offering competitive financial returns. Leading players like BlackRock, Inc. continue to dominate the market through their extensive ESG product lines and strategic initiatives, such as incorporating climate risk into their investment processes.

MSCI Inc. plays a crucial role in the market by providing ESG ratings and analytics that help investors make informed decisions. Innovations and collaborations, such as Ethic’s partnership with large financial institutions and MSCI’s continuous enhancement of its ESG data offerings, underscore their leadership in the evolving ESG Investing Market.

CEO Statements

Here are some recent CEO statements from key players in the ESG investing market:

Larry Fink, CEO of BlackRock, Inc.

David Solomon, CEO of Goldman Sachs

Key players in the ESG investing market plays a crucial role in promoting sustainable practices across industries. Companies in this market integrate environmental, social, and governance (ESG) factors into their investment strategies and drive innovation to support global sustainability goals. Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Investment

By Services

By Application

By End User

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of ESG Investing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Investment Overview

2.2.3 By Services Overview

2.2.4 By Application Overview

2.2.5 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on ESG Investing Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Funding and Investment

4.1.1.2 Corporate Accountability and Risk Management

4.1.2 Market Restraints

4.1.2.1 Economic Volatility

4.1.2.2 Challenges in ESG Reporting and Standardization

4.1.3 Market Opportunity

4.1.3.1 Emerging Technologies

4.1.3.2 Education and Awareness Campaigns

4.1.4 Market Challenges

4.1.4.1 Supply Chain Disruptions

4.1.4.2 Skill Gaps in ESG Expertise

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global ESG Investing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 ESG Investing Market, By Type

6.1 Global ESG Investing Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 ESG Integration

6.1.1.2 Impact Investing

6.1.1.3 Sustainable Funds

6.1.1.4 Green Bonds

6.1.1.5 Others

Chapter 7 ESG Investing Market, By Investment

7.1 Global ESG Investing Market Snapshot, By Investment

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Equity Investments

7.1.1.2 Fixed Income Investments

7.1.1.3 Private Equity and Venture Capital

7.1.1.4 Thematic and Impact Investments

Chapter 8 ESG Investing Market, By Services

8.1 Global ESG Investing Market Snapshot, By Services

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Asset Management Services

8.1.1.2 Advisory Services

8.1.1.3 Research and Data Analytics

8.1.1.4 ESG Reporting and Certification

Chapter 9 ESG Investing Market, By Application

9.1 Global ESG Investing Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Corporate Governance

9.1.1.2 Environmental Sustainability

9.1.1.3 Social Responsibility

9.1.1.4 Climate Change Mitigation

Chapter 10 ESG Investing Market, By End User

10.1 Global ESG Investing Market Snapshot, By End User

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Institutional Investors

10.1.1.2 Individual Investors

10.1.1.3 Corporations

10.1.1.4 Non-Profit Organizations

Chapter 11 ESG Investing Market, By Region

11.1 Overview

11.2 ESG Investing Market Revenue Share, By Region 2024 (%)

11.3 Global ESG Investing Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America ESG Investing Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America ESG Investing Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. ESG Investing Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada ESG Investing Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico ESG Investing Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe ESG Investing Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe ESG Investing Market, By Country

11.5.4 UK

11.5.4.1 UK ESG Investing Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France ESG Investing Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany ESG Investing Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe ESG Investing Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific ESG Investing Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific ESG Investing Market, By Country

11.6.4 China

11.6.4.1 China ESG Investing Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan ESG Investing Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India ESG Investing Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia ESG Investing Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific ESG Investing Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA ESG Investing Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA ESG Investing Market, By Country

11.7.4 GCC

11.7.4.1 GCC ESG Investing Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa ESG Investing Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil ESG Investing Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA ESG Investing Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 BlackRock, Inc.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Vanguard Group, Inc.

13.3 State Street Global Advisors

13.4 JPMorgan Chase & Co.

13.5 Goldman Sachs Asset Management

13.6 Morgan Stanley Investment Management

13.7 UBS Asset Management

13.8 Amundi Asset Management

13.9 AXA Investment Managers

13.10 BNP Paribas Asset Management