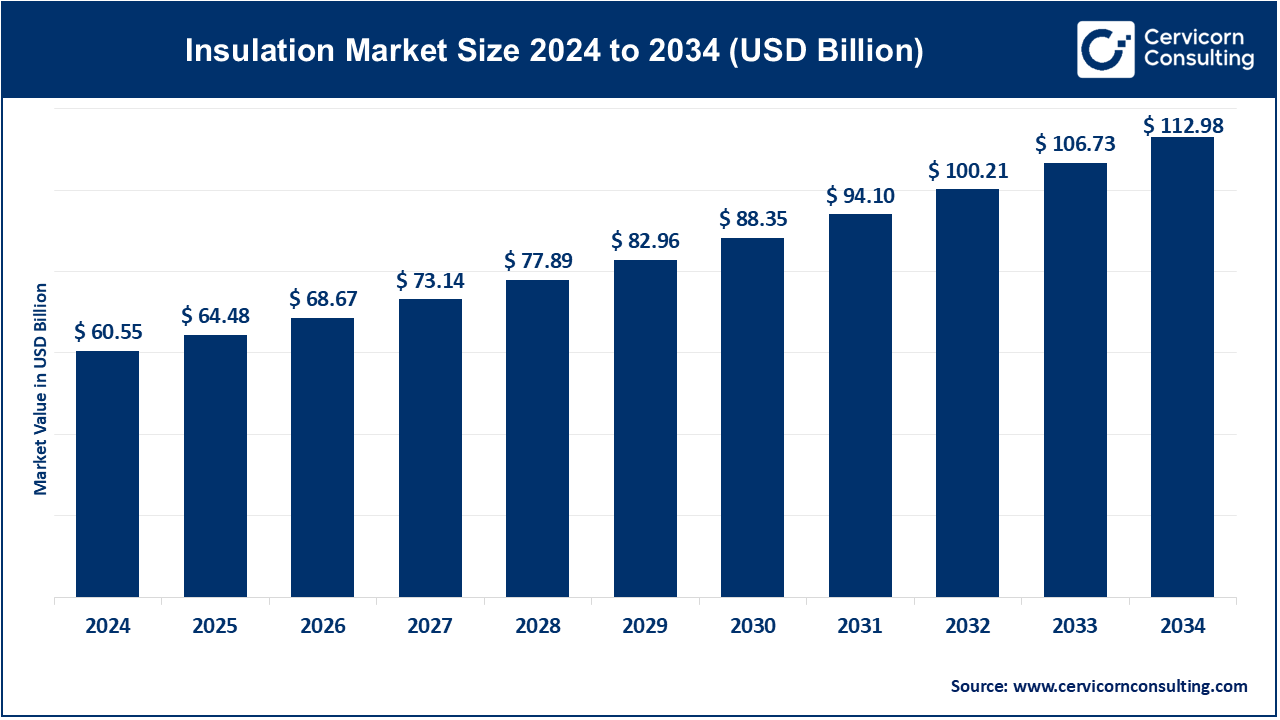

The global insulation market size was accounted for USD 60.55 billion in 2024 and is expected to be worth around USD 112.98 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 6.44% from 2025 to 2034.

The global insulation market has seen significant growth in recent years, driven by factors like the increasing demand for energy-efficient solutions in buildings and infrastructure. With a rising focus on sustainability and the need to reduce carbon footprints, insulation has become a vital part of energy conservation efforts. The construction industry, especially in residential, commercial, and industrial buildings, has been one of the key drivers of the market. The growing awareness of the environmental impact of energy consumption is pushing governments and consumers to invest in better insulation materials. As a result, the market for insulation materials such as foam boards, fiberglass, and cellulose is expected to grow steadily. Another factor contributing to the market's growth is the adoption of green building codes and regulations worldwide. Between March 2023 and February 2024, the world exported approximately 298,019 shipments of insulation materials, marking a 32% growth compared to the previous year. The top importers during this period were Vietnam (68%), Ukraine (6%), and Singapore (5%). Governments are enforcing stricter standards for energy efficiency, leading to increased demand for high-performance insulation materials.

Insulation refers to materials or systems used to reduce the transfer of heat, sound, or electricity from one place to another. It is most commonly used in buildings, homes, and industries to maintain temperature control, improve energy efficiency, and enhance comfort. Insulation works by creating a barrier that slows down the movement of heat, preventing cold air from entering and warm air from escaping, especially in walls, attics, and floors. Common insulation materials include fiberglass, foam, cellulose, and mineral wool. Insulation can also be used for soundproofing, making spaces quieter, and for electrical purposes, where materials prevent the flow of unwanted electricity.

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 60.55 Billion |

| Projected Market Size (2034) | USD 112.98 Billion |

| Growth Rate (2025 to 2034) | 6.44% |

| Largest Revenue Holder Region | Asia Pacific |

| Fastest Growing Region | North America |

| Report Segments | Type, Function, Application, End Users, Region |

| Key Companies | Saint-Gobain, Owens Corning, Johns Manville (a Berkshire Hathaway company), Rockwool International, Knauf Insulation, Kingspan Group, Dow Inc., Basf SE, Mineral Wool (Wool), Nitto Denko Corporation, Celotex (a Saint-Gobain brand), Sika AG, GAF Materials Corporation, Jushi Group, Haley & Aldrich Inc. and others |

Increased Government Support and Incentives

Government incentives and subsidies aimed at promoting energy-efficient construction are a major driver of the insulation market. Programs that offer financial support for the installation of insulation materials, as well as tax credits for energy-efficient buildings, are encouraging widespread adoption.

Growing Demand for Residential Insulation

The residential sector is witnessing significant growth in demand for insulation, driven by rising energy costs and the need for enhanced comfort. Homeowners are increasingly investing in insulation to reduce energy consumption, lower utility bills, and improve indoor comfort.

High Initial Costs

Despite the long-term benefits, the high initial costs associated with advanced insulation materials and installation can be a barrier to market growth. The upfront investment required for high-performance insulation solutions may deter some consumers, particularly in cost-sensitive markets.

Fluctuating Raw Material Prices

The insulation market is sensitive to fluctuations in the prices of raw materials, such as polyurethane, fiberglass, and mineral wool. Volatile prices can affect the profitability of manufacturers and lead to higher costs for end-users, potentially slowing market growth.

Expansion into Emerging Markets

Emerging markets present significant opportunities for growth in the insulation market. As these regions continue to develop, the demand for energy-efficient buildings and infrastructure is expected to rise, creating new opportunities for insulation manufacturers and suppliers.

Advancements in Manufacturing Processes

Innovations in manufacturing processes, such as the use of automation and digital technologies, are creating opportunities for cost reductions and efficiency improvements in the production of insulation materials. These advancements can help manufacturers meet the growing demand for insulation while maintaining competitive pricing.

Environmental Concerns

While insulation materials contribute to energy efficiency, the environmental impact of some materials, such as those that are non-biodegradable or contain harmful chemicals, is a growing concern. Addressing these environmental issues through the development of greener, more sustainable insulation products is a key challenge for the industry.

Skilled Labor Shortages

The shortage of skilled labor in the construction industry is a significant challenge for the insulation market. The installation of insulation materials requires specialized skills, and the lack of qualified workers can lead to project delays, increased costs, and compromised quality.

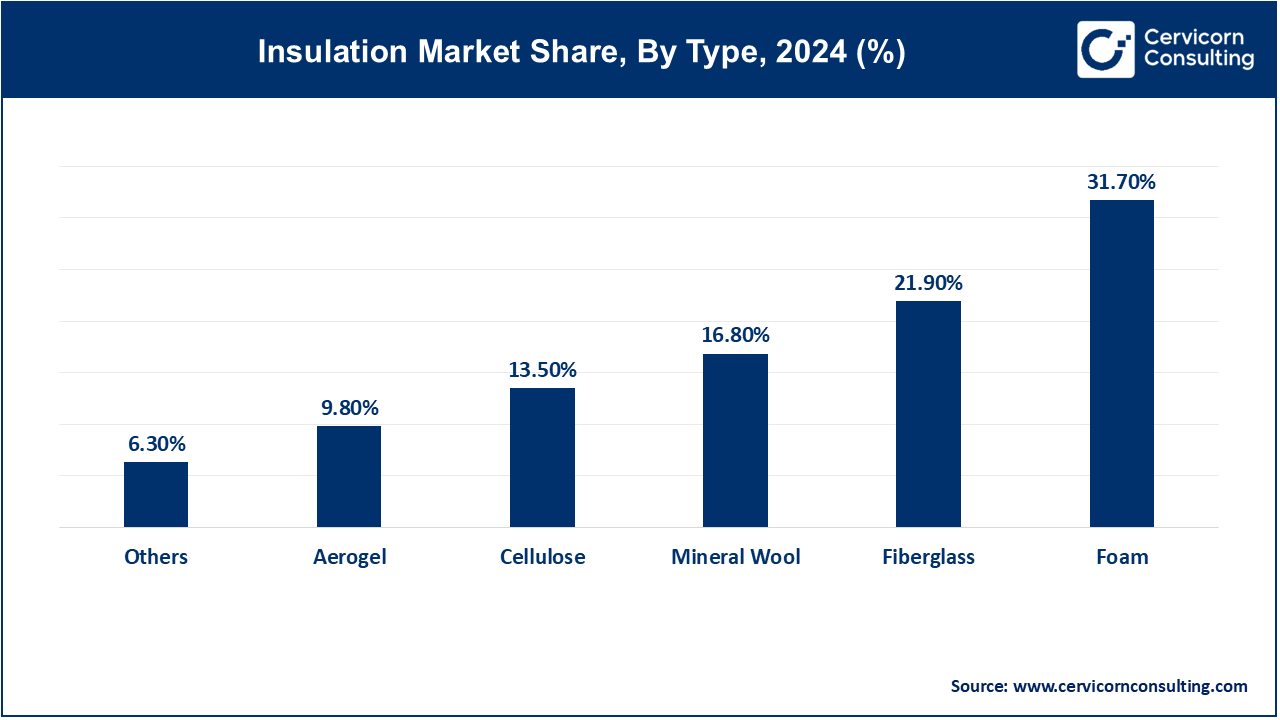

The insulation market is segmented into type, function, application, end-users and region. Based on type, the market is classified into fiberglass, mineral wool, foam (polyurethane, polystyrene), cellulose, and aerogel. Based on function, the market is classified into thermal, acoustic, electric, and others. Based on application, the market is classified into wall insulation, roof and ceiling insulation, floor insulation, pipe and duct insulation, acoustic insulation. Based on end-users, the market is classified into residential, commercial, industrial, HVAC & OEM, transportation ( automotive, marine, aerospace), institutional, and infrastructure.

Fiberglass Insulation: The fiberglass segment has captured 21.90% revenue share in 2024. Fiberglass is widely used in both residential and commercial construction due to its affordability and efficient thermal performance. It is made from fine glass fibers and is typically installed in batts, rolls, or loose-fill form. This type of insulation is particularly effective in reducing heat transfer in walls, attics, and floors, helping to lower energy costs and enhance indoor comfort. It’s also non-combustible, adding a layer of fire safety to buildings.

Mineral Wool Insulation: The mineral wool segment has captured 16.80% revenue share in 2024. Known for its excellent fire resistance and soundproofing properties, mineral wool insulation is commonly used in industrial applications and commercial buildings. It’s made from natural rock or slag and can withstand higher temperatures than other insulation materials. This makes it ideal for use in areas that require high fire safety standards, such as around boilers, furnaces, and in fire-rated wall assemblies. Additionally, its dense structure also helps in reducing noise transmission between rooms.

Foam Insulation (Polyurethane, Polystyrene): Foam insulation, which includes materials like polyurethane and polystyrene, offers superior thermal resistance (R-value) and is frequently used in residential and commercial applications. These materials are applied as spray foam or rigid foam boards, making them versatile for insulating walls, roofs, and floors. Foam insulation provides an airtight seal that prevents air leaks and moisture intrusion, enhancing the building’s energy efficiency and longevity.

Cellulose Insulation: The cellulose segment has garnered revenue share of 13.50% in 2024. Made from recycled paper products, cellulose insulation is an eco-friendly option that is gaining popularity for its sustainability and effective thermal performance. It is typically used in loose-fill form, blown into wall cavities, attics, and other hard-to-reach areas. Besides being environmentally friendly, cellulose has a high R-value and excellent soundproofing capabilities. It’s treated with non-toxic fire retardants, making it a safe choice for residential and commercial buildings.

Aerogel Insulation: The aerogel segment has garnered revenue share of 9.80% in 2024. Aerogel is a high-performance insulation material known for its extremely low thermal conductivity. Despite its lightweight and thin profile, it provides superior insulation, making it suitable for specialized applications where space and weight are critical factors, such as in aerospace, industrial piping, and high-tech building projects. Aerogel’s unique properties allow it to provide exceptional thermal insulation without adding significant bulk, making it ideal for modern, energy-efficient designs.

Wall Insulation: Wall insulation is crucial for minimizing heat transfer through walls, ensuring that buildings maintain consistent indoor temperatures. It is commonly used in both new constructions and renovations to improve energy efficiency. Insulating walls helps reduce heating and cooling costs, enhances indoor comfort, and contributes to a building’s overall energy performance. Various materials, such as fiberglass, foam, and cellulose, are used based on the specific needs of the project.

Roof and Ceiling Insulation: Roof and ceiling insulation plays a vital role in reducing heat loss in winter and heat gain in summer, particularly in climates with extreme temperatures. This type of insulation is critical for maintaining a building’s energy efficiency and preventing condensation issues. Materials like fiberglass batts, spray foam, and reflective insulation are often used in roofs and ceilings to create a thermal barrier that keeps indoor environments comfortable while reducing energy consumption.

Floor Insulation: Installed under floors, insulation helps to reduce energy loss and improve comfort, particularly in buildings located in colder climates. Floor insulation is essential in preventing heat from escaping through the floor, which can lead to higher energy costs and reduced indoor comfort. It’s commonly used in basements, crawl spaces, and over unheated areas. Materials like rigid foam boards, fiberglass, and mineral wool are typically used for insulating floors.

Pipe and Duct Insulation: Insulating pipes and ducts is critical for preventing energy loss in HVAC systems and plumbing. Proper insulation helps maintain the temperature of air or water traveling through the ducts and pipes, reducing the load on heating and cooling systems. This not only improves system efficiency but also prevents condensation and freezing in pipes, which can lead to costly damage. Foam pipe insulation and fiberglass duct wraps are commonly used materials for this purpose.

Acoustic Insulation: Acoustic insulation is designed to reduce sound transmission between rooms or spaces, making it essential for improving privacy and comfort in both commercial and residential buildings. It is commonly installed in walls, floors, and ceilings to absorb sound and reduce noise levels. Materials like mineral wool, fiberglass, and specialized acoustic panels are used to achieve effective soundproofing, making this type of insulation especially important in multi-family housing, offices, and entertainment venues.

Residential: The residential segment has generated highest revenue share of 39% in 2024. Homeowners and residential developers rely on insulation to improve energy efficiency, enhance indoor comfort, and reduce utility costs. Insulation is used throughout the home, from attics and walls to floors and basements, helping to maintain a consistent indoor temperature and reduce energy consumption. The residential market is driven by the growing demand for energy-efficient homes, influenced by rising energy costs and increasing awareness of the environmental impact of residential energy use.

Commercial: Commercial buildings, including office spaces, retail stores, and hotels, require effective insulation for thermal regulation and energy savings. Insulation in commercial buildings helps reduce operational costs, improve occupant comfort, and meet regulatory standards for energy efficiency. The demand in this sector is driven by the need for sustainable building practices and compliance with energy codes, as well as the desire to create comfortable environments for employees and customers.

Industrial: Factories, warehouses, and industrial plants use insulation for temperature control, energy efficiency, and safety. Industrial insulation is critical for maintaining process temperatures, protecting equipment, and reducing energy consumption. It is also used to prevent condensation and provide fire protection in high-temperature environments. The industrial sector demands specialized insulation solutions that can withstand harsh conditions and improve the overall efficiency and safety of operations.

Institutional: Schools, hospitals, and government buildings require insulation to maintain indoor environmental quality, ensure energy efficiency, and meet strict health and safety standards. Insulation in institutional buildings helps create comfortable and healthy environments for occupants while reducing energy costs. This segment is driven by government regulations, the need for sustainable building practices, and the emphasis on creating safe, comfortable spaces for education, healthcare, and public services.

Infrastructure: Insulation is also essential in infrastructure projects like tunnels, bridges, and public transportation systems. It helps ensure safety, energy efficiency, and durability in these large-scale projects. Infrastructure insulation is designed to withstand extreme environmental conditions, provide fire protection, and enhance the longevity of structures. The demand in this segment is driven by ongoing urbanization, the expansion of public transport networks, and the need for resilient infrastructure.

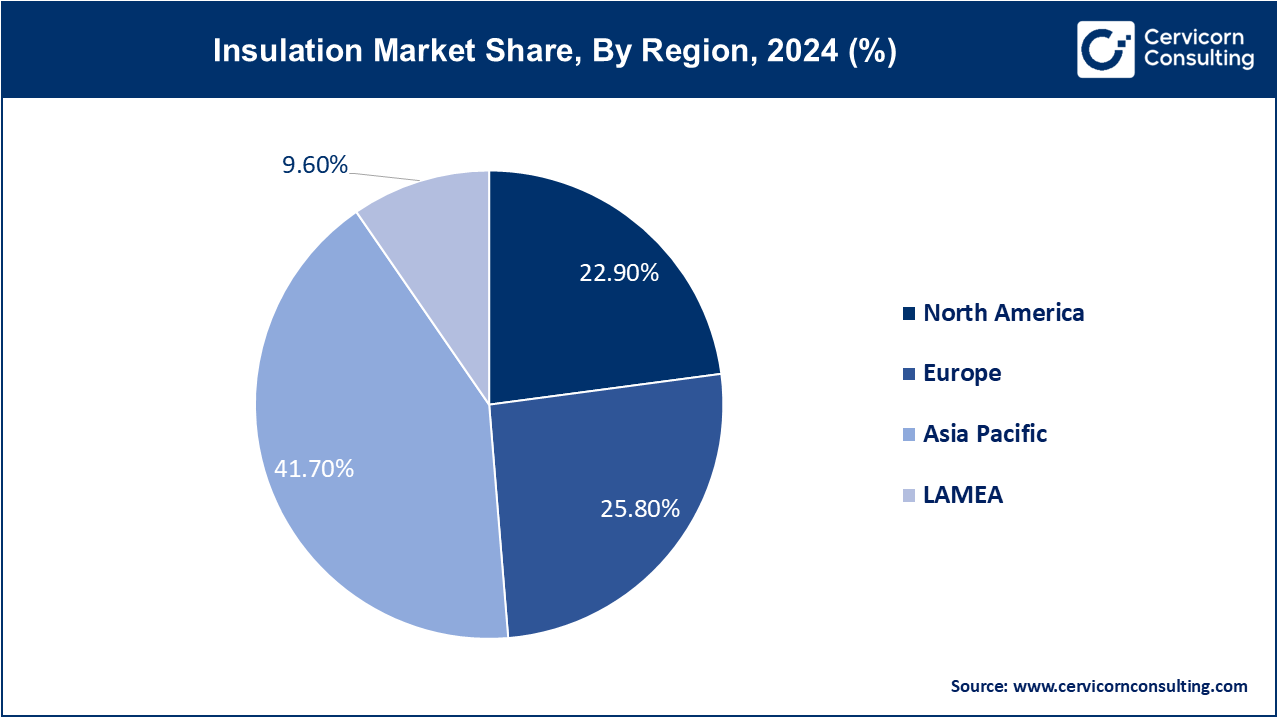

The insulation market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

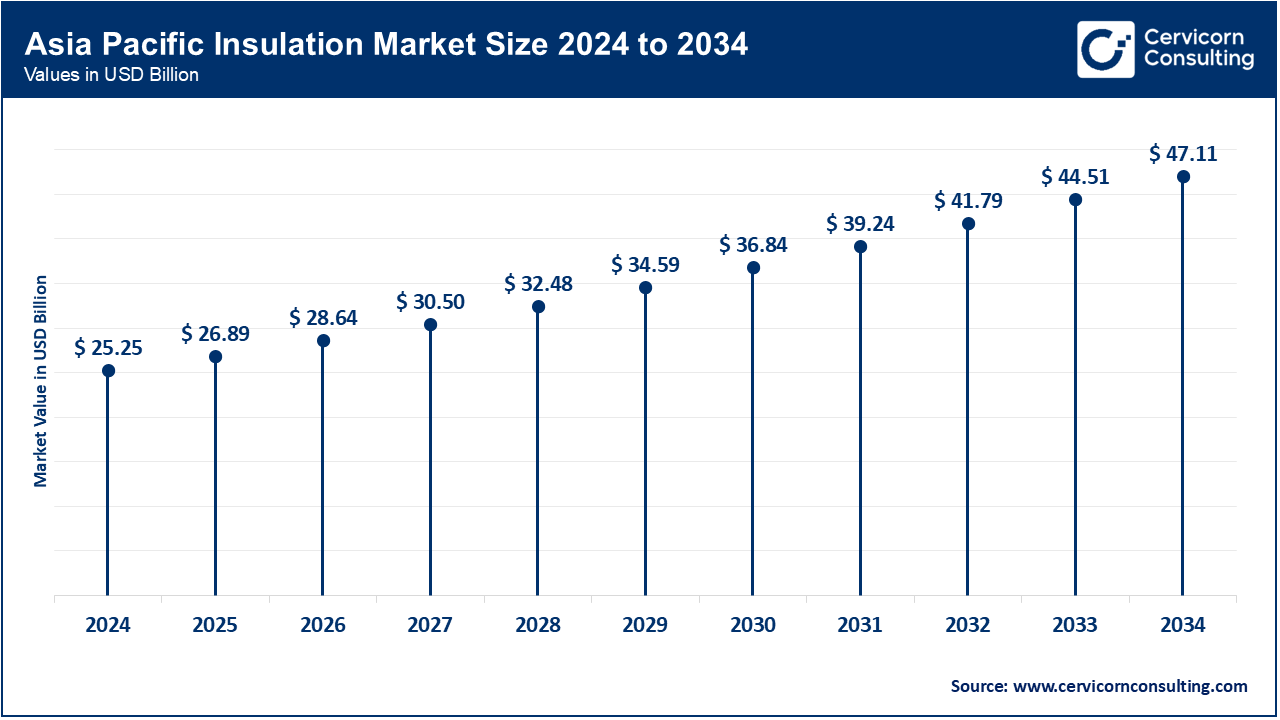

The Asia Pacific insulation market size was valued at USD 25.25 billion in 2024 and is expected to reach around USD 47.11 billion by 2034. Rapid urbanization and infrastructure development are key drivers of the insulation market in the Asia-Pacific region. Emerging economies like China, India, and Southeast Asian countries are experiencing a construction boom, leading to increased demand for insulation materials. The region’s diverse climate conditions, ranging from tropical to cold, require a variety of insulation solutions to ensure energy efficiency in buildings. Government initiatives to promote green buildings also support market growth.

The North America insulation market size was estimated at USD 13.87 billion in 2024 and is projected hit around USD 25.87 billion by 2034. The North American insulation market is driven by stringent energy efficiency regulations, the push for sustainable construction practices, and the need for energy-efficient buildings. The U.S. and Canada are key markets where retrofitting existing buildings to improve energy efficiency is a significant growth driver. The region's cold climate also fuels the demand for high-performance insulation, particularly in residential and commercial buildings.

The Europe insulation market size was valued at USD 15.62 billion in 2024 and is anticipated surpass around USD 29.15 billion by 2034. Europe is focused on meeting the EU’s energy efficiency goals, leading to significant growth in insulation demand, especially for renovation and retrofitting projects. Countries like Germany, France, and the UK are at the forefront of adopting advanced insulation materials to meet stringent building codes and reduce carbon emissions. The region’s commitment to sustainability and energy conservation drives the market, particularly in the residential and commercial sectors.

The LAMEA insulation market size was accounted for USD 5.81 billion in 2024 and is projected to hit around USD 10.85 billion by 2034. The LAMEA insulation market is expanding due to increased awareness of energy efficiency and advancements in construction infrastructure. In Latin America, modern construction and sustainability drive demand, while the Middle East benefits from significant investments in large-scale projects and advanced technologies. Despite resource limitations in Africa, progress is being made through international partnerships and funding, improving access to innovative insulation materials across the region.

Among the emerging players, James Hardie Industries plc utilizes advanced fiber cement technology to deliver innovative non-load bearing wall solutions, enhancing both durability and environmental sustainability. Siniat Ltd. is at the forefront of developing eco-friendly building materials, blending sustainability with high performance for diverse construction needs.

Dominant players such as Armstrong World Industries, Inc. drive market growth through their broad product portfolio and recent advancements, including carbon-reducing solutions for commercial buildings. Saint-Gobain S.A. integrates cutting-edge technologies across its extensive range of building materials, offering comprehensive construction solutions. These key players, with their innovative approaches and strategic initiatives, underscore their leadership and influence in the evolving insulation market.

CEO Statements

Here are some recent CEO statements from key players in the market:

Gene M. Murtagh, CEO of Kingspan:

"With energy from buildings accounting for roughly 40% of all emissions, a more thermally efficient building envelope will be vital in curtailing global temperature rises. Insulation will be central to this effort."

Robert Buck, President and CEO of TopBuild:

"The addition of Insulation Works will enhance our residential and commercial business and provide expertise across the agricultural insulation market. It is another example of our disciplined M&A strategy of targeting businesses in our core area of insulation with strong leadership and potential for future growth. We are excited to welcome the team, including owner Brett Counts, as he continues his focus on growing the business."

Key players in the insulation market are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the market include:

These advancements mark a notable expansion in the insulation industry, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Function

By Application

By End-Users

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Insulation

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Function Overview

2.2.3 By Application Overview

2.2.4 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Insulation Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Government Support and Incentives

4.1.1.2 Growing Demand for Residential Insulation

4.1.2 Market Restraints

4.1.2.1 High Initial Costs

4.1.2.2 Fluctuating Raw Material Prices

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Advancements in Manufacturing Processes

4.1.4 Market Challenges

4.1.4.1 Environmental Concerns

4.1.4.2 Skilled Labor Shortages

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Insulation Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Insulation Market, By Type

6.1 Global Insulation Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Fiberglass

6.1.1.2 Mineral Wool

6.1.1.3 Foam (Polyurethane, Polystyrene)

6.1.1.4 Cellulose

6.1.1.5 Aerogel

Chapter 7 Insulation Market, By Function

7.1 Global Insulation Market Snapshot, By Function

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Thermal

7.1.1.2 Acoustic

7.1.1.3 Electric

7.1.1.4 Others

Chapter 8 Insulation Market, By Application

8.1 Global Insulation Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Wall Insulation

8.1.1.2 Roof and Ceiling Insulation

8.1.1.3 Floor Insulation

8.1.1.4 Pipe and Duct Insulation

8.1.1.5 Acoustic Insulation

Chapter 9 Insulation Market, By End-Users

9.1 Global Insulation Market Snapshot, By End-Users

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Residential

9.1.1.2 Commercial

9.1.1.3 Industrial

9.1.1.4 HVAC & OEM

9.1.1.5 Transportation (Automotive, Marine, Aerospace)

9.1.1.6 Institutional

9.1.1.7 Infrastructure

Chapter 10 Insulation Market, By Region

10.1 Overview

10.2 Insulation Market Revenue Share, By Region 2024 (%)

10.3 Global Insulation Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Insulation Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Insulation Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Insulation Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Insulation Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Insulation Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Insulation Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Insulation Market, By Country

10.5.4 UK

10.5.4.1 UK Insulation Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Insulation Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Insulation Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Insulation Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Insulation Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Insulation Market, By Country

10.6.4 China

10.6.4.1 China Insulation Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Insulation Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Insulation Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Insulation Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Insulation Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Insulation Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Insulation Market, By Country

10.7.4 GCC

10.7.4.1 GCC Insulation Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Insulation Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Insulation Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Insulation Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 Saint-Gobain

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Owens Corning

12.3 Johns Manville (a Berkshire Hathaway company)

12.4 Rockwool International

12.5 Knauf Insulation

12.6 Kingspan Group

12.7 Dow Inc.

12.8 Basf SE

12.9 Mineral Wool (Wool)

12.10 Nitto Denko Corporation