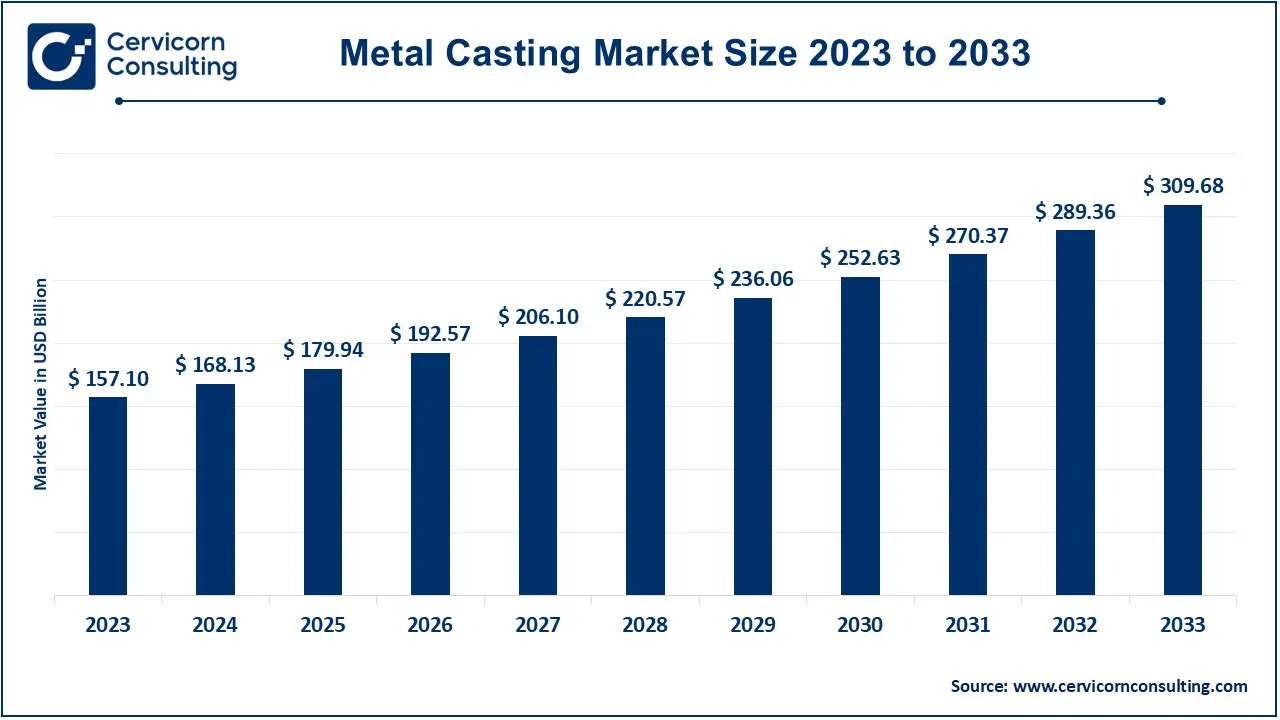

The global metal casting market size was estimated at USD 168.13 billion in 2024 and is expected to surpass around USD 309.68 billion by 2033. It is growing at a compound annual growth rate (CAGR) of 7.02% from 2024 to 2033.

The global metal casting market has witnessed significant growth over the last decade, driven by the increased demand from industries such as automotive, aerospace, and heavy machinery. As industries modernize and the need for lightweight, durable components rises, metal casting has become essential for producing complex parts that cannot be easily manufactured through other processes. The adoption of new technologies, such as 3D printing for mold making and automation in casting processes, is further boosting the industry's growth. Additionally, the rising focus on sustainability and energy efficiency in manufacturing is pushing the development of eco-friendly casting techniques, which is expected to create new market opportunities. The metal casting industry has seen substantial investments aimed at modernization and capacity expansion. For instance, Howell Foundry announced a USD 7.4 million investment to upgrade its processing facility in West Feliciana Parish.

Metal casting is a manufacturing process in which metal is heated until it becomes molten and then poured into a mold to cool and solidify into a specific shape. This process is used to create a wide range of parts, from small intricate components to large industrial items. The metal used in casting can be iron, aluminum, steel, or other alloys. Once the metal solidifies in the mold, the part is removed, and any excess material is trimmed. Metal casting is essential in industries like automotive, aerospace, and construction, where complex shapes and durable components are required. There are various types of casting processes, including sand casting, die casting, investment casting, and centrifugal casting, each suited to different needs. Sand casting is the most common and affordable, often used for larger parts.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 168.13 Billion |

| Projected Market Size (2033) | USD 309.68 Billion |

| Growth Rate (2024 to 2033) | 7.02% |

| Largest Revenue Holder Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segments Covered | Material Type, Application, Process Type, Components, Vehicle Type, Electric & Hybrid Vehicle Type, End User, Regions |

| Companies Mentioned | Alcoa Corporation, Buhler Group, Castrol Limited, Dynacast, Eagle Alloy Inc., Federal-Mogul Corporation, Grede Holdings LLC, Hitachi Metals Ltd., IHI Corporation, Kurtz Ersa Corp., Littelfuse Inc., Mino Group, Nemak, Precision Castparts Corp., Tata Metaliks Limited and others |

Ferrous Metals: Ferrous metals, which include cast iron and steel, are widely utilized in the metal casting industry due to their strength, durability, and relatively low cost. Cast iron, known for its excellent castability and wear resistance, is commonly used in automotive components such as engine blocks and cylinder heads. Steel, being more versatile, can be alloyed with other elements to enhance specific properties, making it suitable for machinery parts, construction materials, and tools. The demand for ferrous metal casting sector is driven by their essential role in various industries, particularly automotive and industrial machinery, where performance and reliability are crucial.

Non-Ferrous Metals: Non-ferrous metals encompass a range of materials such as aluminium, copper, zinc, and magnesium, known for their lightweight, corrosion resistance, and good thermal and electrical conductivity. Aluminium is one of the most popular non-ferrous metals used in casting, especially in the automotive and aerospace industries, where reducing weight is essential for improving fuel efficiency. Copper is valued for its excellent electrical conductivity and is commonly used in electrical components. Zinc and magnesium are often employed in die casting due to their favourable properties for creating intricate shapes and lightweight structures. The growing trend toward lightweight materials in various applications continues to drive the demand for non-ferrous Metal Casting Markets.

Sand Casting: The sand casting segment has generated revenue share of 41.20% in 2023. The sand casting is the most widely used casting method, involving the creation of molds from sand mixed with a bonding agent. This process allows for the production of complex shapes and large components, making it ideal for various applications across industries. Sand casting is particularly advantageous due to its low cost, flexibility, and ability to produce high-quality castings. It is commonly used for manufacturing ferrous and non-ferrous metal parts, including engine blocks, housings, and machinery components. The ability to easily modify molds for different designs further enhances its appeal in the market.

Die Casting: The die casting segment has generated revenue share of 27.40% in 2023. The die casting is a precision casting method that involves forcing molten metal into a mold cavity under high pressure. This process is typically used for non-ferrous metals like aluminium, zinc, and magnesium, enabling the production of intricate and high-precision parts with excellent surface finishes. Die casting is favoured for high-volume production due to its efficiency and ability to produce consistent, dimensionally accurate components. Common applications include automotive parts, electronic housings, and consumer goods. The growth of the automotive and electronics industries significantly drives the demand for die-cast components.

Investment Casting: The investment casting segment has captured revenue share of 16.60% in 2023. The investment casting, also known as lost-wax casting, is a precision process that uses a wax pattern to create intricate shapes with high tolerances. The wax pattern is coated with a ceramic shell, which is then heated to remove the wax and harden the shell. This method allows for the production of complex geometries and is suitable for both ferrous and non-ferrous metals. Investment casting is widely used in industries such as aerospace, medical devices, and jewellery, where precision and surface finish are critical. The ability to produce lightweight yet strong components further enhance its application scope, especially in high-performance sectors.

Permanent Mold Casting: The permanent mold casting utilizes reusable metal molds to produce castings, making it a suitable process for high-volume production of non-ferrous metals. The use of durable Molds allows for improved dimensional accuracy and surface finish compared to sand casting. This method is particularly effective for manufacturing components that require consistent quality and repeatability, such as automotive parts and industrial machinery components. The efficiency and longevity of permanent mold casting contribute to its growing adoption in the market, especially as industries seek to streamline production processes and reduce costs.

Centrifugal Casting: The centrifugal casting is a unique method where molten metal is poured into a rotating mold, utilizing centrifugal force to create cylindrical parts with uniform density. This process is ideal for producing pipes, tubes, and other round components with minimal porosity and excellent mechanical properties. Centrifugal casting is commonly used in industries such as oil and gas, where strong and reliable components are essential. The ability to produce large, high-quality castings with consistent thickness makes this method a preferred choice for specific applications in the market.

Automotive: The automotive segment has generated 57.40% revenue share in 2023. The automotive industry is a significant application area for metal casting market, where various components such as engine blocks, transmission cases, wheels, and suspension parts are produced. The demand for lightweight and durable materials in vehicles drives the use of both ferrous and non-ferrous metal casting. Innovations in automotive design, such as electric vehicles and advanced engine technologies, require high-performance castings that meet stringent safety and efficiency standards. As the automotive industry evolves, the need for reliable and cost-effective markets continues to grow.

Aerospace: Aerospace applications require precision-engineered components that can withstand extreme conditions, making metal casting market essential for producing critical parts such as turbine blades, landing gear, and structural components. Investment casting is commonly used in this sector due to its ability to produce complex shapes with tight tolerances. The aerospace industry demands high-quality materials that meet rigorous safety and performance standards, driving the need for advanced casting techniques and materials. As the aerospace sector expands, the demand for high-performance castings is expected to increase significantly.

Industrial Machinery: Metal casting is widely utilized in the production of equipment and machinery used across various industrial applications. Components such as housings, frames, and gears are often cast from ferrous and non-ferrous metals, providing the necessary strength and durability for heavy-duty operations. The growth of industries such as manufacturing, construction, and energy generation fuels the demand for robust and reliable castings. As automation and advanced manufacturing technologies continue to evolve, the need for specialized castings that enhance performance and efficiency will likely rise.

Construction: The building and construction segment has generated 9.10% revenue share in 2023. In the construction industry, metal casting are used for various components, including structural elements, fittings, and decorative items. Cast iron is often employed for its strength and durability in construction applications, while aluminum is used for lightweight fixtures and architectural elements. The demand for sustainable and energy-efficient building materials drives the need for high-quality castings that meet performance and aesthetic requirements. As urbanization and infrastructure development continue to grow globally, the construction industry's reliance on market is expected to increase.

Consumer Goods: The consumer goods sector utilizes metal casting for a wide range of products, including cookware, decorative items, and household appliances. Aluminum and stainless-steel castings are commonly used for their lightweight and corrosion-resistant properties. The trend towards high-quality, durable consumer products drives the demand for castings in this market segment. As consumer preferences shift toward sustainable and innovative designs, market will continue to play a vital role in producing a variety of everyday items.

The metal casting market is segmented into several key regions such as Asia-Pacific, North America, Europe, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region:

The North America metal casting market size was valued at USD 29.69 billion in 2023 and is expected to reach around USD 58.53 billion by 2033. The North America is robust and well-established, driven by strong demand from automotive, aerospace, and industrial machinery sectors. The United States stands out with its advanced casting technologies and significant manufacturing capabilities, catering to diverse industrial needs. Canada also plays a crucial role, particularly in producing high-quality components for the automotive and energy sectors. The region’s market dynamics are influenced by ongoing technological advancements, stringent quality standards, and a comprehensive regulatory framework that enhances the efficiency and safety of casting processes. The focus on innovation and high-performance materials continues to shape the North American metal casting industry landscape.

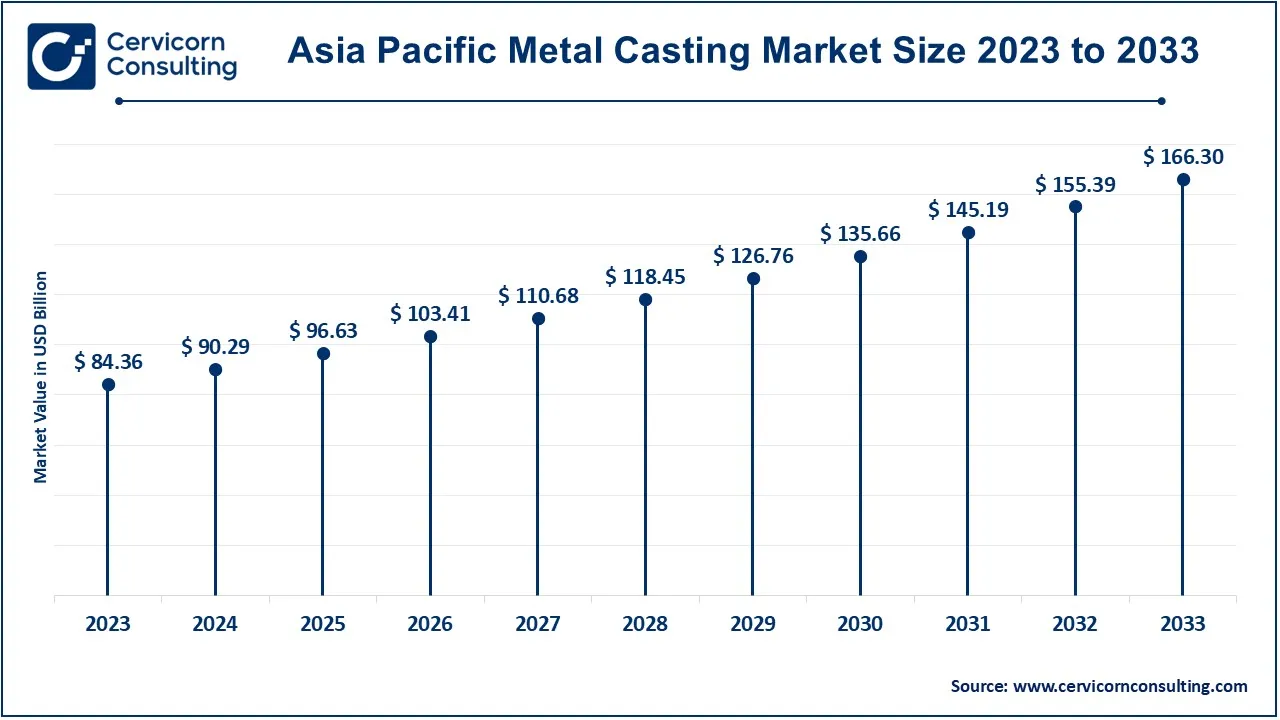

The Asia-Pacific metal casting market size was estimated at USD 84.36 billion in 2023 and is expected to hit around USD 166.30 billion by 2033, growing at a CAGR of 7.40% from 2024 to 2033. The Asia-Pacific region is dominating market, fueled by accelerated industrialization and expanding consumer bases. China and India are key contributors, with high demand arising from automotive, electronics, and construction sectors. Japan and South Korea also play significant roles, particularly in producing high-precision and high-performance components. The region’s growth is supported by substantial investments in manufacturing infrastructure and technological advancements, driving innovation and increasing the adoption of advanced casting solutions. The expanding industrial and consumer markets are further propelling the development of new casting technologies and processes.

The Europe metal casting market size was accounted for USD 34.25 billion in 2023 and is projected to garner around USD 67.51 billion by 2033 with a CAGR of 5.70% from 2024 to 2033. Europe is driving growth with demand driven by sectors such as automotive, aerospace, and construction. Countries like Germany, France, and Italy lead due to their strong industrial bases and emphasis on precision engineering. The European market is characterized by rigorous regulatory standards that ensure high product quality and environmental sustainability. The region’s commitment to reducing environmental impact and advancing manufacturing practices aligns with its broader goals of sustainable development. Innovations in casting technologies and materials are prevalent, reflecting Europe’s focus on enhancing production efficiency and meeting the needs of various high-tech industries.

The LAMEA metal casting market was worth at USD 8.80 billion in 2023 and it is expanding around USD 17.34 billion by 2033 with a CAGR of 7.02% from 2024 to 2033. The LAMEA region is evolving, driven by industrial expansion and growing demand across various sectors. Brazil and South Africa are prominent markets, benefiting from their developing manufacturing sectors and increasing consumer demand. The Middle East’s burgeoning construction and automotive industries also contribute to market growth. Despite challenges such as economic instability and infrastructure limitations, the region’s rich natural resources and rising industrial activities present significant opportunities for market development. The potential for technological advancements and further expansion in metal casting industry is substantial, reflecting the region’s evolving industrial landscape.

The metal casting industry is dominated by several key players, including General Electric, Alcoa Corporation, and Foundry Group, among others. These companies are recognized for their advanced manufacturing capabilities, innovative casting technologies, and extensive product portfolios. General Electric is a leading player in the aerospace and industrial sectors, leveraging its expertise in precision casting to produce high-performance components.

Alcoa Corporation focuses on aluminium casting and has made significant investments in sustainability and advanced manufacturing processes. Foundry Group comprises a network of foundries specializing in various casting techniques, providing customized solutions across industries.

The competitive landscape is further enriched by numerous regional players and emerging companies that are increasingly adopting advanced technologies to enhance production efficiency and meet the growing demand from diverse end-user industries.

CEO Statements

Alcoa Corporation: “Our focus is on enhancing our leadership in sustainable metal production while driving innovation across our aluminum casting processes to meet the evolving needs of our global customers."

Buhler Group: “We are committed to advancing casting technologies through continuous innovation and sustainability, ensuring that our solutions provide the highest value to our customers.”

Dynacast: "At Dynacast, we are driven by our passion for precision and excellence in die casting, continuously investing in technology to meet the demanding needs of our clients across various industries.”

Market Segmentation

By Material Type

By Application

By Process Type

By Components

By Vehicle Type

By Electric & Hybrid Vehicle Type

By End User

By Regions

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Metal Casting

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Type Overview

2.2.2 By Application Overview

2.2.3 By Process Type Overview

2.2.4 By Components Overview

2.2.5 By Vehicle Type Overview

2.2.6 By Electric & Hybrid Vehicle Type Overview

2.2.7 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Metal Casting Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand from Key Industries

4.1.1.2 Technological Innovation

4.1.2 Market Restraints

4.1.2.1 High Initial Investment

4.1.2.2 Material Limitations

4.1.3 Market Opportunity

4.1.3.1 Expansion into Emerging Markets

4.1.3.2 Advancements in Material Science

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance

4.1.4.2 Technological Adaptation

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Metal Casting Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Metal Casting Market, By Material Type

6.1 Global Metal Casting Market Snapshot, By Material Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Ferrous Metals

6.1.1.2 Non-Ferrous Metals

Chapter 7 Metal Casting Market, By Application

7.1 Global Metal Casting Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Body Assemblies

7.1.1.2 Engine Parts

7.1.1.3 Transmission Parts

Chapter 8 Metal Casting Market, By Process Type

8.1 Global Metal Casting Market Snapshot, By Process Type

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Sand Casting

8.1.1.2 Die Casting

8.1.1.3 Investment Casting

8.1.1.4 Permanent Mold Casting

8.1.1.5 Centrifugal Casting

8.1.1.6 Others

Chapter 9 Metal Casting Market, By Components

9.1 Global Metal Casting Market Snapshot, By Components

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Alloy Wheels

9.1.1.2 Battery Housing

9.1.1.3 Cross Car Beam

9.1.1.4 Cylinder Heads

9.1.1.5 Clutch Casing

9.1.1.6 Crank Cases

9.1.1.7 Engine Block

9.1.1.8 Differential Cover Housing

9.1.1.9 Engine Mount

9.1.1.10 Flywheel Housing

9.1.1.11 Front Door Frame

9.1.1.12 Exhaust Manifold

9.1.1.13 Intake Manifold

9.1.1.14 Gearbox Housing

9.1.1.15 Ignition & Lock Housing

9.1.1.16 Oil Pan

9.1.1.17 Rear Door Frame

9.1.1.18 Seat Frame

9.1.1.19 Turbocharger Housing

9.1.1.20 Transmission Housing

Chapter 10 Metal Casting Market, By Vehicle Type

10.1 Global Metal Casting Market Snapshot, By Vehicle Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

10.1.1.1 Passenger Car

10.1.1.2 HCV

Chapter 11 Metal Casting Market, By Electric & Hybrid Vehicle Type

11.1 Global Metal Casting Market Snapshot, By Electric & Hybrid Vehicle Type

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

11.1.1.1 BEV

11.1.1.2 HEV

11.1.1.3 PHEV

Chapter 12 Metal Casting Market, By End User

12.1 Global Metal Casting Market Snapshot, By End User

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

12.1.1.1 Automotive

12.1.1.2 Aerospace

12.1.1.3 Industrial Machinery

12.1.1.4 Construction

12.1.1.5 Consumer Goods

Chapter 13 Metal Casting Market, By Region

13.1 Overview

13.2 Metal Casting Market Revenue Share, By Region 2023 (%)

13.3 Global Metal Casting Market, By Region

13.3.1 Market Size and Forecast

13.4 North America

13.4.1 North America Metal Casting Market Revenue, 2021-2033 ($Billion)

13.4.2 Market Size and Forecast

13.4.3 North America Metal Casting Market, By Country

13.4.4 U.S.

13.4.4.1 U.S. Metal Casting Market Revenue, 2021-2033 ($Billion)

13.4.4.2 Market Size and Forecast

13.4.4.3 U.S. Market Segmental Analysis

13.4.5 Canada

13.4.5.1 Canada Metal Casting Market Revenue, 2021-2033 ($Billion)

13.4.5.2 Market Size and Forecast

13.4.5.3 Canada Market Segmental Analysis

13.4.6 Mexico

13.4.6.1 Mexico Metal Casting Market Revenue, 2021-2033 ($Billion)

13.4.6.2 Market Size and Forecast

13.4.6.3 Mexico Market Segmental Analysis

13.5 Europe

13.5.1 Europe Metal Casting Market Revenue, 2021-2033 ($Billion)

13.5.2 Market Size and Forecast

13.5.3 Europe Metal Casting Market, By Country

13.5.4 UK

13.5.4.1 UK Metal Casting Market Revenue, 2021-2033 ($Billion)

13.5.4.2 Market Size and Forecast

13.5.4.3 UK Market Segmental Analysis

13.5.5 France

13.5.5.1 France Metal Casting Market Revenue, 2021-2033 ($Billion)

13.5.5.2 Market Size and Forecast

13.5.5.3 France Market Segmental Analysis

13.5.6 Germany

13.5.6.1 Germany Metal Casting Market Revenue, 2021-2033 ($Billion)

13.5.6.2 Market Size and Forecast

13.5.6.3 Germany Market Segmental Analysis

13.5.7 Rest of Europe

13.5.7.1 Rest of Europe Metal Casting Market Revenue, 2021-2033 ($Billion)

13.5.7.2 Market Size and Forecast

13.5.7.3 Rest of Europe Market Segmental Analysis

13.6 Asia Pacific

13.6.1 Asia Pacific Metal Casting Market Revenue, 2021-2033 ($Billion)

13.6.2 Market Size and Forecast

13.6.3 Asia Pacific Metal Casting Market, By Country

13.6.4 China

13.6.4.1 China Metal Casting Market Revenue, 2021-2033 ($Billion)

13.6.4.2 Market Size and Forecast

13.6.4.3 China Market Segmental Analysis

13.6.5 Japan

13.6.5.1 Japan Metal Casting Market Revenue, 2021-2033 ($Billion)

13.6.5.2 Market Size and Forecast

13.6.5.3 Japan Market Segmental Analysis

13.6.6 India

13.6.6.1 India Metal Casting Market Revenue, 2021-2033 ($Billion)

13.6.6.2 Market Size and Forecast

13.6.6.3 India Market Segmental Analysis

13.6.7 Australia

13.6.7.1 Australia Metal Casting Market Revenue, 2021-2033 ($Billion)

13.6.7.2 Market Size and Forecast

13.6.7.3 Australia Market Segmental Analysis

13.6.8 Rest of Asia Pacific

13.6.8.1 Rest of Asia Pacific Metal Casting Market Revenue, 2021-2033 ($Billion)

13.6.8.2 Market Size and Forecast

13.6.8.3 Rest of Asia Pacific Market Segmental Analysis

13.7 LAMEA

13.7.1 LAMEA Metal Casting Market Revenue, 2021-2033 ($Billion)

13.7.2 Market Size and Forecast

13.7.3 LAMEA Metal Casting Market, By Country

13.7.4 GCC

13.7.4.1 GCC Metal Casting Market Revenue, 2021-2033 ($Billion)

13.7.4.2 Market Size and Forecast

13.7.4.3 GCC Market Segmental Analysis

13.7.5 Africa

13.7.5.1 Africa Metal Casting Market Revenue, 2021-2033 ($Billion)

13.7.5.2 Market Size and Forecast

13.7.5.3 Africa Market Segmental Analysis

13.7.6 Brazil

13.7.6.1 Brazil Metal Casting Market Revenue, 2021-2033 ($Billion)

13.7.6.2 Market Size and Forecast

13.7.6.3 Brazil Market Segmental Analysis

13.7.7 Rest of LAMEA

13.7.7.1 Rest of LAMEA Metal Casting Market Revenue, 2021-2033 ($Billion)

13.7.7.2 Market Size and Forecast

13.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 14 Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2021-2023

14.1.3 Competitive Analysis By Revenue, 2021-2023

14.2 Recent Developments by the Market Contributors (2023)

Chapter 15 Company Profiles

15.1 Alcoa Corporation

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Global Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 Buhler Group

15.3 Castrol Limited

15.4 Dynacast

15.5 Eagle Alloy Inc.

15.6 Federal-Mogul Corporation

15.7 Grede Holdings LLC

15.8 Hitachi Metals Ltd.

15.9 IHI Corporation

15.10 Kurtz Ersa Corp.