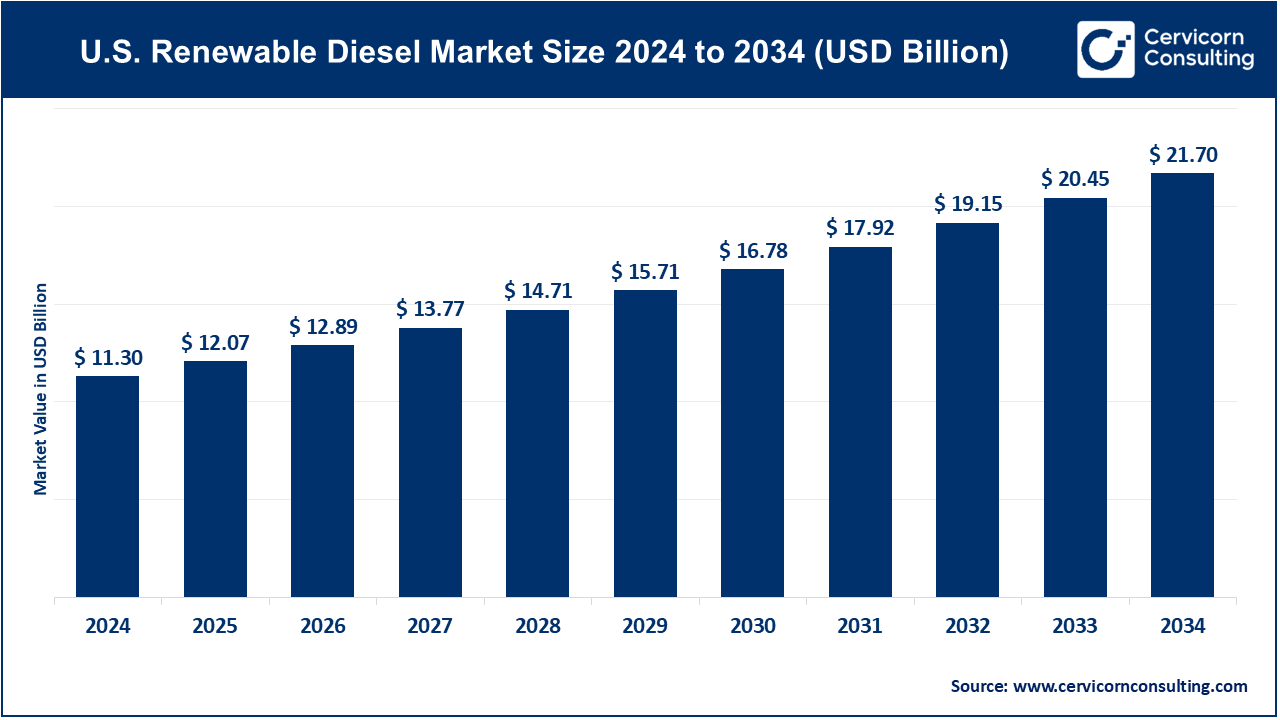

The U.S. renewable diesel market size was valued at USD 11.30 billion in 2024 and is expected to hit around USD 21.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.74% from 2025 to 2034.

The U.S. renewable diesel market is experiencing rapid growth due to rising demand for low-carbon fuels and government mandates. Production capacity has expanded significantly, with major investments in new plants and upgrades of existing refineries. By 2025, the U.S. renewable diesel production capacity is expected to exceed 5 billion gallons annually, up from less than 1 billion gallons in 2020. Companies like Chevron and Marathon Petroleum are converting traditional refineries to produce renewable diesel. This growth is driven by environmental goals, corporate sustainability initiatives, and consumer demand for cleaner fuels, positioning renewable diesel as a critical solution in reducing emissions in transportation and industrial sectors.

Renewable diesel is a type of biofuel made from various renewable feedstocks: vegetable oils, animal fats, and waste oils. Unlike traditional biodiesel, renewable diesel is chemically identical to petroleum diesel and can be used directly in existing diesel engines without modification. It is produced through a hydrogenation process whereby the biomass feedstock has its oxygen removed, creating a fuel that is far more stable, having much higher energy density, while it burns cleaner, too, compared to conventional diesel.

The renewable diesel market is developing rapidly due to increasing demand for low-carbon fuels, government requirements, and other financial incentives targeted at reducing GHG emissions. Furthermore, its ability to be smoothly integrated into existing fuel infrastructures makes this renewable fuel an attractive option for both transportation and industrial sectors. North America and Europe lead the main production and consumption of renewable diesel. It is dominated by such flagship companies as Neste, Valero, and Renewable Energy Group. The renewable diesel market can be expected to attain reasonable growth in view of the fact that sustainability recently has turned to a major focus globally. This expectation is corroborated by continuous development in production technologies and a favorable regulatory environment.

The U.S. renewable diesel market is a dynamic sector dedicated to providing a variety of sustainable fuel solutions, including production, distribution, and application across diverse industries. Fueled by technological advancements in refining processes and feedstock innovations, along with growing consumer demand for eco-friendly and efficient fuel options, the market is rapidly expanding. Key drivers include government incentives, regulatory mandates for reduced emissions, and increased awareness of the environmental impact of fossil fuels.

Moreover, the seamless integration of renewable diesel into existing infrastructure and the exploration of new applications are enhancing adoption and operational efficiencies. Despite challenges such as high production costs and feedstock supply issues, the market remains strong and continues to progress, supported by technological innovations and heightened environmental awareness.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 12.07 Billion |

| Projected Market Size by 2034 | USD 21.70 Billion |

| Growth Rate (2025 to 2034) | 6.74% |

| Segments Covered | Type, Feedstock, Service, Application, End User, Region |

| Key Players | Neste, Renewable Energy Group (REG), Valero Energy Corporation, Darling Ingredients, Diamond Green Diesel, Marathon Petroleum Corporation, Phillips 66, Chevron Corporation, Andeavor, World Energy, Red Rock Biofuels, Ryze Renewables, Gevo, Inc., Global Clean Energy Holdings, Flint Hills Resources |

Rising Incidence of Climate Change Concerns:

Supportive Regulatory Environment

High Production Costs

Feedstock Availability and Supply Chain Issues

Expansion of Production Capacity

Advancements in Feedstock Utilization

Regulatory Compliance and Standards

Integration of Emerging Technologies

The U.S. renewable diesel market is segmented into type, feedstock, service, application and region. Based on type, the market is classified into bodiesel, renewable hydrocarbon diesel (RHD), hydrogenation-derived renewable diesel (HDRD). Based on feedstock, the market is classified into soybean oil, animal fats, used cooking oil. Based on service, the market is classified into production services, distribution services, consulting services, maintenance and support services. Based on application, the market is classified into transportation, industrial, and power generation. Based on end-use, the market is classified into industrial manufacturing, government and municipalities, retail and distribution centers, energy sector, hospitality and leisure.

Biodiesel: Biodiesel is one of the most common forms of renewable diesel in the U.S. market, produced from vegetable oils, animal fats, and recycled cooking grease. It is used primarily as a blend with petroleum diesel to reduce emissions. The growth of the biodiesel segment is driven by its compatibility with existing diesel engines and infrastructure, along with federal mandates for renewable fuel usage.

Renewable Hydrocarbon Diesel (RHD): Renewable Hydrocarbon Diesel, also known as green diesel, is chemically identical to petroleum diesel and can be used in any proportion with conventional diesel. It is produced through advanced refining processes, such as hydroprocessing. The segment is gaining traction due to its higher energy content and lower emissions compared to traditional biodiesel.

Hydrogenation-Derived Renewable Diesel (HDRD): HDRD is produced through the hydrogenation of vegetable oils and animal fats, resulting in a product that is very similar to petroleum diesel. This type is favored for its performance and environmental benefits, including lower particulate emissions. The market for HDRD is expanding due to its suitability for use in existing diesel engines without modifications.

Soybean Oil: Soybean oil is a major feedstock for renewable diesel production in the U.S. due to its abundant availability and high oil content. It is primarily used in the production of biodiesel. The segment benefits from the well-established soybean agriculture industry in the U.S., providing a reliable supply chain for producers.

Animal Fats: Animal fats, including tallow and lard, are used in the production of renewable diesel, particularly HDRD. This feedstock is a byproduct of the meat industry, offering a cost-effective and sustainable source for diesel production. The use of animal fats is driven by their lower cost compared to vegetable oils and their high efficiency in fuel production.

Used Cooking Oil: Used cooking oil, or waste vegetable oil, is an increasingly popular feedstock due to its sustainability and lower cost. It is collected from restaurants and food processing industries and processed into renewable diesel. This segment is growing as more businesses and municipalities implement recycling programs for used cooking oil.

Transportation: The transportation sector is the largest consumer of renewable diesel in the U.S., with significant usage in commercial fleets, public transportation, and personal vehicles. Renewable diesel's compatibility with existing diesel engines and infrastructure makes it an attractive option for reducing emissions in the transportation industry.

Industrial: Industrial applications of renewable diesel include its use in heavy machinery, agricultural equipment, and generators. The industrial segment benefits from renewable diesel's high energy content and cleaner-burning properties, which reduce maintenance costs and improve engine performance.

Power Generation: Renewable diesel is also used in power generation, particularly in backup and remote power systems. Its stable performance and lower emissions compared to petroleum diesel make it a preferred choice for power generation applications, contributing to market growth in this segment.

Production Services: Production services encompass the various stages of renewable diesel manufacturing, including feedstock procurement, refining, and quality control. Companies offering production services play a critical role in ensuring the availability of high-quality renewable diesel in the market.

Distribution Services: Distribution services involve the transportation and delivery of renewable diesel from production facilities to end-users. Efficient distribution networks are essential for maintaining a steady supply and meeting the growing demand for renewable diesel across different regions.

Consulting Services: Consulting services provide expertise in areas such as regulatory compliance, feedstock selection, and process optimization. These services help businesses navigate the complexities of the renewable diesel market and implement best practices for production and usage.

Maintenance and Support Services: Maintenance and support services ensure the ongoing performance and reliability of renewable diesel production facilities and equipment. This includes routine maintenance, troubleshooting, and upgrades to production systems, ensuring continuous and efficient operations.

Industrial Manufacturing: Industrial manufacturing facilities use renewable diesel for various applications, including generators, boilers, and machinery. The sector benefits from the reliability and efficiency of renewable diesel, which supports continuous operations and reduces emissions. Increased awareness of corporate social responsibility and sustainability initiatives further drive the adoption of renewable diesel in manufacturing.

Government and Municipalities: Government agencies and municipalities are key end-users of renewable diesel, especially for public transportation fleets, emergency response vehicles, and municipal services. The use of renewable diesel aligns with government policies aimed at reducing greenhouse gas emissions and promoting the use of renewable energy sources. Incentives and mandates at the federal, state, and local levels encourage the adoption of renewable diesel in this segment.

Retail and Distribution Centers: Retail companies and distribution centers use renewable diesel for transportation and logistics operations, including delivery trucks and forklifts. This segment values renewable diesel for its environmental benefits and ability to help meet sustainability goals. The push towards green logistics and eco-friendly supply chain practices drives demand for renewable diesel in retail and distribution.

Energy Sector: The energy sector uses renewable diesel in power generation and backup power systems. Renewable diesel’s stability and lower emissions make it suitable for use in power plants, remote power systems, and emergency generators. The transition towards renewable energy sources and the need for reliable, cleaner fuel alternatives boost the demand for renewable diesel in this sector.

Hospitality and Leisure: The hospitality and leisure industry, including hotels, resorts, and recreational facilities, utilizes renewable diesel for operational needs such as backup generators and maintenance equipment. This sector prioritizes sustainable practices to appeal to environmentally conscious consumers and reduce operational emissions, driving the adoption of renewable diesel.

Among the new players, Ryze Renewables leverages advanced refining technologies to produce high-quality renewable diesel, aiming to increase production capacity and reduce carbon emissions. Red Rock Biofuels focuses on converting forestry and agricultural waste into renewable diesel, expanding its production capabilities through innovative feedstock utilization.

Dominating players like Neste and Renewable Energy Group (REG) drive market leadership through extensive production networks and high-quality fuel standards. Neste is known for its aggressive expansion strategy and integration of cutting-edge technology, while REG excels in operational efficiency and support services, enhancing the overall fuel performance and maintaining a competitive edge in the market.

CEO Statements

Benjamin Cowart, CEO of Vertex:

"Due to the significant macroeconomic headwinds over the past 12 months, many of which we believe will continue to occur over the next 18 months and potentially beyond, we have decided to strategically pause our renewable diesel business and pivot to producing conventional fuels."

Key players in the U.S. renewable diesel industry have implemented diverse strategic initiatives to ensure continued growth, including mergers, collaborations, product development, and regional expansions. The recent surge in environmental regulations and the push for sustainable energy sources have driven significant changes in the market. Companies are now focusing on innovative technologies and expanding their production capacities to meet the growing demand for renewable diesel. Some notable examples of key developments in the U.S. renewable diesel industry include:

These strategic developments highlight a trend toward consolidation and technological innovation within the U.S. renewable diesel sector. Companies are broadening their service offerings and leveraging advanced technologies to enhance production efficiency and expand their market presence.

Market Segmentation

By Type

By Feedstock

By Service

By Application

By End-use

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of U.S. Renewable Diesel

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Feedstock Overview

2.2.3 By Service Overview

2.2.4 By Application Overview

2.2.5 By End-use Overview

2.3 Competitive Overview

Chapter 3 Impact Analysis

3.1 COVID 19 Impact on U.S. Renewable Diesel Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Market Implications

3.3 Regulatory and Policy Changes Impacting Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Incidence of Climate Change Concerns

4.1.1.2 Supportive Regulatory Environment

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Feedstock Availability and Supply Chain Issues

4.1.3 Market Opportunity

4.1.3.1 Expansion of Production Capacity

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance and Standards

4.1.4.2 Integration of Emerging Technologies

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 U.S. Renewable Diesel Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 U.S. Renewable Diesel Market, By Type

6.1 U.S. Renewable Diesel Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Biodiesel

6.1.1.2 Renewable Hydrocarbon Diesel (RHD)

6.1.1.3 Hydrogenation-Derived Renewable Diesel (HDRD)

Chapter 7 U.S. Renewable Diesel Market, By Feedstock

7.1 U.S. Renewable Diesel Market Snapshot, By Feedstock

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Soybean Oil

7.1.1.2 Animal Fats

7.1.1.3 Used Cooking Oil

Chapter 8 U.S. Renewable Diesel Market, By Service

8.1 U.S. Renewable Diesel Market Snapshot, By Service

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Production Services

8.1.1.2 Distribution Services

8.1.1.3 Consulting Services

8.1.1.4 Maintenance and Support Services

Chapter 9 U.S. Renewable Diesel Market, By Application

9.1 U.S. Renewable Diesel Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Transportation

9.1.1.2 Industrial

9.1.1.3 Power Generation

Chapter 10 U.S. Renewable Diesel Market, By End-use

10.1 U.S. Renewable Diesel Market Snapshot, By End-use

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Industrial Manufacturing

10.1.1.2 Government and Municipalities

10.1.1.3 Retail and Distribution Centers

10.1.1.4 Energy Sector

10.1.1.5 Hospitality and Leisure

Chapter 11 U.S. Renewable Diesel Market, By Region

11.1 Overview

11.2 U.S. Renewable Diesel Market Revenue Share 2024 (%)

11.3 U.S. Market Segmental Analysis

11.3.1.1

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Neste

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Renewable Energy Group (REG)

13.3 Valero Energy Corporation

13.4 Darling Ingredients

13.5 Diamond Green Diesel

13.6 Marathon Petroleum Corporation

13.7 Phillips 66

13.8 Chevron Corporation

13.9 Andeavor

13.10 World Energy