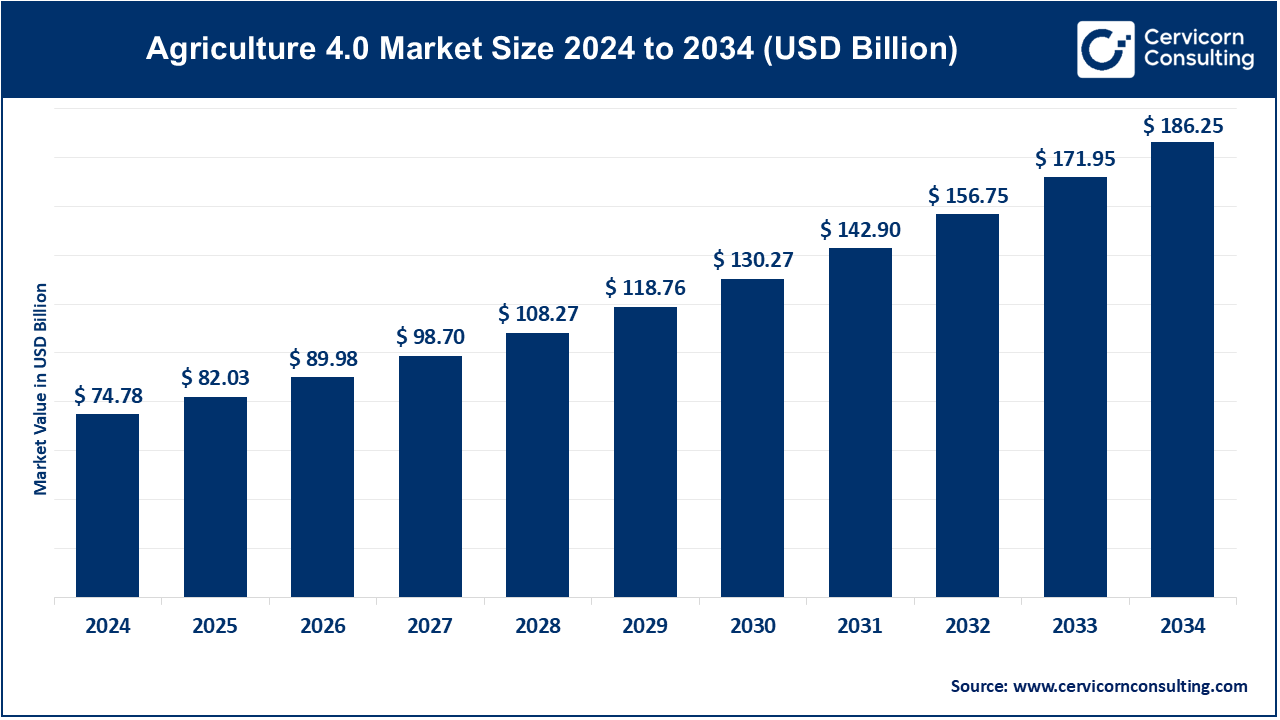

The global agriculture 4.0 market size was valued at USD 74.78 billion in 2024 and is anticipated to hit around USD 186.25 billion by 2034, growing at a CAGR of 9.55% from 2025 to 2034.

The agriculture 4.0 market is witnessing rapid growth due to increasing adoption of smart farming technologies. Governments worldwide are investing in digital agriculture to improve food security and sustainability. Rising awareness about climate change and resource optimization is pushing farmers to adopt AI-driven solutions, IoT-based sensors, and precision farming techniques. The demand for high-yield crops and sustainable farming practices is further driving market expansion. Additionally, agri-tech startups and venture capital funding are fueling innovation in the sector. With advancements in automation, AI, and data analytics, the agriculture industry is becoming more resilient to climate change and unpredictable weather conditions. The adoption of farm management software and cloud-based analytics is also accelerating, helping farmers make real-time, data-driven decisions. As digital farming continues to evolve, Agriculture 4.0 is expected to revolutionize food production, improve efficiency, and enhance profitability for farmers worldwide.

Key Insights Beneficial to the Agriculture 4.0 Market:

The agriculture 4.0 market is expected to flourish, owing to this reason of increase in crop yield and efficiency in mitigation of climate change. The artificial intelligence is going to take the operators of precision agriculture to evaluate tremendous data information gathered from the soil conditions, weather patterns, and crops that together inform timely decision-making and use towards maximizing planting schedules, resource allocation for growing and pest control so as to reduce operational expenses and increase crop yield.

The growing applications of drones and robots in growing and harvesting crops

Rising global food demand

Rapid advancement in sustainable intensification, precision agriculture, and smart farming

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 82.03 Billion |

| Projected Market Size by 2034 | USD 186.25 Billion |

| Growth Rate (2025 to 2034) | 9.55% |

| Dominating Region | Asia Pacific |

| Growing Region | North America |

| Segments Covered | Component, End User, Application, Region |

| Key Companies | AGCO Corporation, Bayer AG, CNH Industrial, Corteva Agriscience, CropX inc., Deere & Company, IBM, Kubota Corporation, Saga Robotics AS, Syngenta Crop Protection AG, Trimble Inc., Yara International |

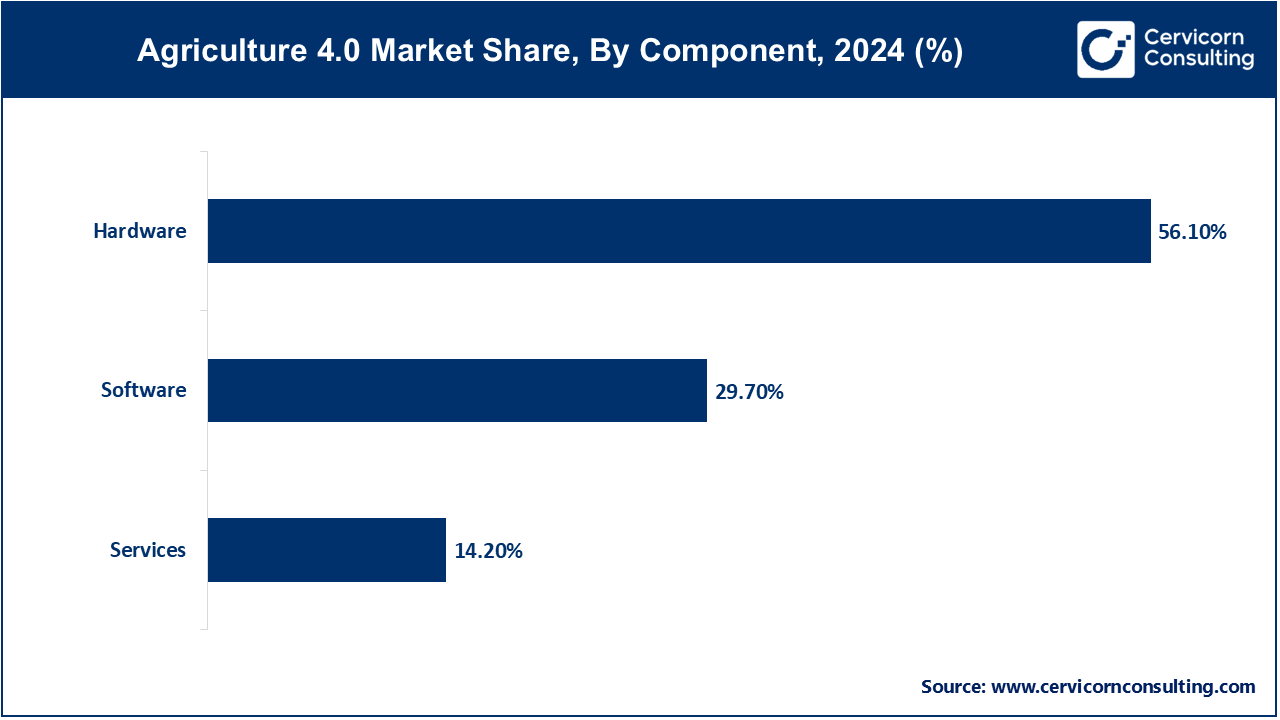

Hardware: The hardware segment has generated highest revenue share of 56.10% in 2024. The hardware segment encompasses various devices and equipment used in agriculture 4.0, including sensors, drones, automated machinery, and IoT devices. These technologies collect data, monitor conditions, and perform tasks to enhance farming efficiency. The increasing need for precision agriculture is driving demand for advanced hardware solutions that enable real-time monitoring and automation of farming operations. Additionally, advancements in sensor technology and reduced costs of drones and IoT devices make these tools more accessible to farmers, facilitating widespread adoption.

Software: The software segment has garnered revenue share of 29.70% in 2024. The software segment includes applications and platforms for data analysis, farm management, and decision support systems. These software solutions process the data collected from various hardware devices, providing insights that help farmers optimize their operations and improve productivity. The growing emphasis on data-driven decision-making in agriculture fuels the demand for sophisticated software solutions that can analyze complex datasets. Moreover, the increasing adoption of cloud computing and big data analytics enables farmers to leverage powerful tools for enhanced farm management.

Services: The services segment has accounted revenue share of 14.20% in 2024. The services segment comprises consulting, training, and support services that assist farmers in implementing and optimizing agriculture 4.0 technologies. These services ensure that farmers can effectively utilize the tools and technologies available to them. The rising complexity of advanced agricultural technologies drives demand for expert consulting and training services, helping farmers understand and implement these solutions effectively. Additionally, the need for ongoing support in managing and maintaining these technologies contributes to the growth of service offerings in the agriculture 4.0 market.

Farming: Farming is a primary application segment where agriculture 4.0 technologies are utilized for precision agriculture, crop monitoring, and yield optimization. The integration of IoT devices, sensors, and AI-driven analytics enables farmers to gather real-time data on soil health, weather conditions, and crop performance, leading to improved decision-making. The increasing global food demand drives farmers to adopt precision agriculture techniques to maximize yields while minimizing resource usage. Additionally, advancements in technology facilitate greater accessibility to farming solutions.

Forestry: In forestry, Agriculture 4.0 technologies enhance forest management, monitoring, and resource allocation. Technologies such as drones and remote sensing are employed to assess tree health, monitor deforestation, and manage resources sustainably. Growing concerns over deforestation and climate change prompt the adoption of advanced monitoring solutions in forestry, allowing for better management of forest resources and promoting sustainable practices.

Livestock Monitoring: Livestock monitoring involves using sensors and wearable technology to track the health, behaviour, and location of animals. This application helps farmers optimize feeding, breeding, and healthcare management, leading to improved livestock productivity and welfare. The rise in consumer demand for high-quality, ethically sourced animal products fuels the need for effective livestock management solutions. Additionally, the focus on animal health and welfare drives the adoption of monitoring technologies.

Fish Farm Monitoring: Fish farm monitoring leverages IoT devices and data analytics to optimize fish farming operations. Technologies are used to monitor water quality, fish health, and feeding schedules, enhancing productivity and sustainability in aquaculture. The increasing global demand for seafood and sustainable aquaculture practices drive the need for advanced monitoring systems, ensuring efficient resource use and higher yields in fish farming.

Others: The others segment includes applications in areas such as agrochemical management, soil health monitoring, and supply chain optimization. These solutions aim to enhance various aspects of agricultural operations and contribute to overall efficiency. The growing need for sustainable agricultural practices and regulatory pressures regarding chemical usage drive the adoption of advanced monitoring and management solutions in these areas. Furthermore, innovations in supply chain technology facilitate better tracking and efficiency, responding to market demands for transparency.

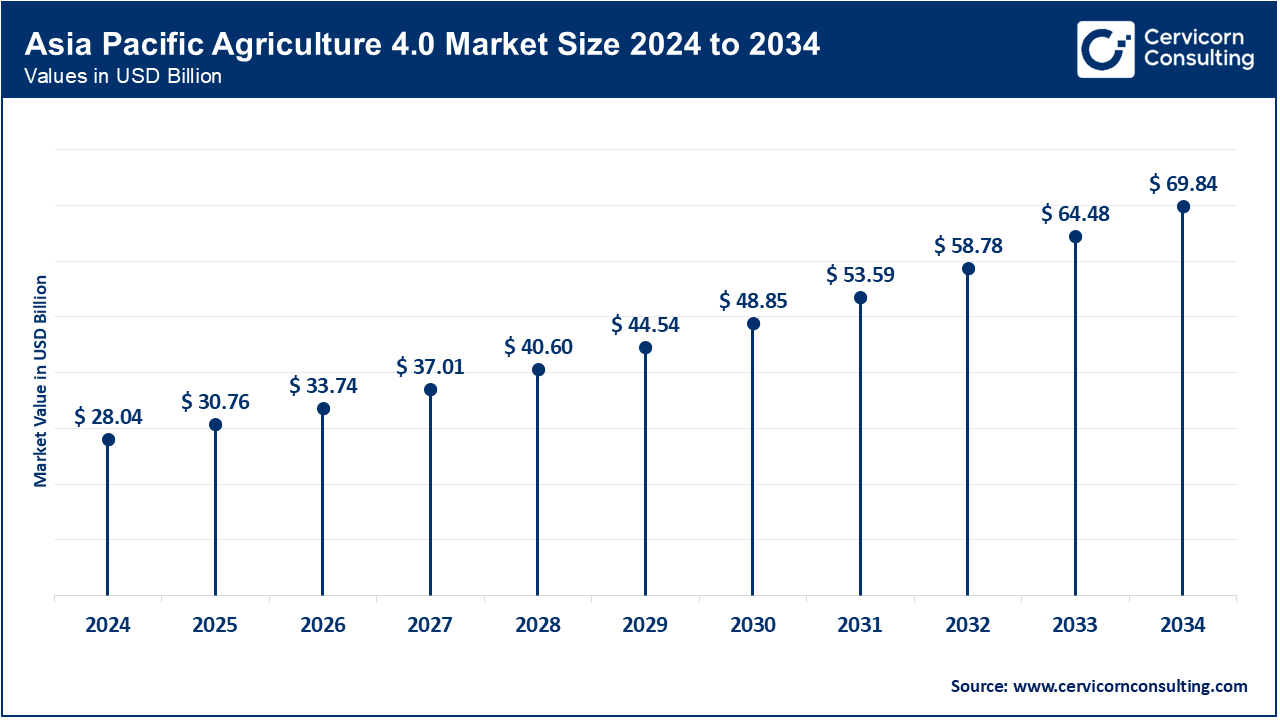

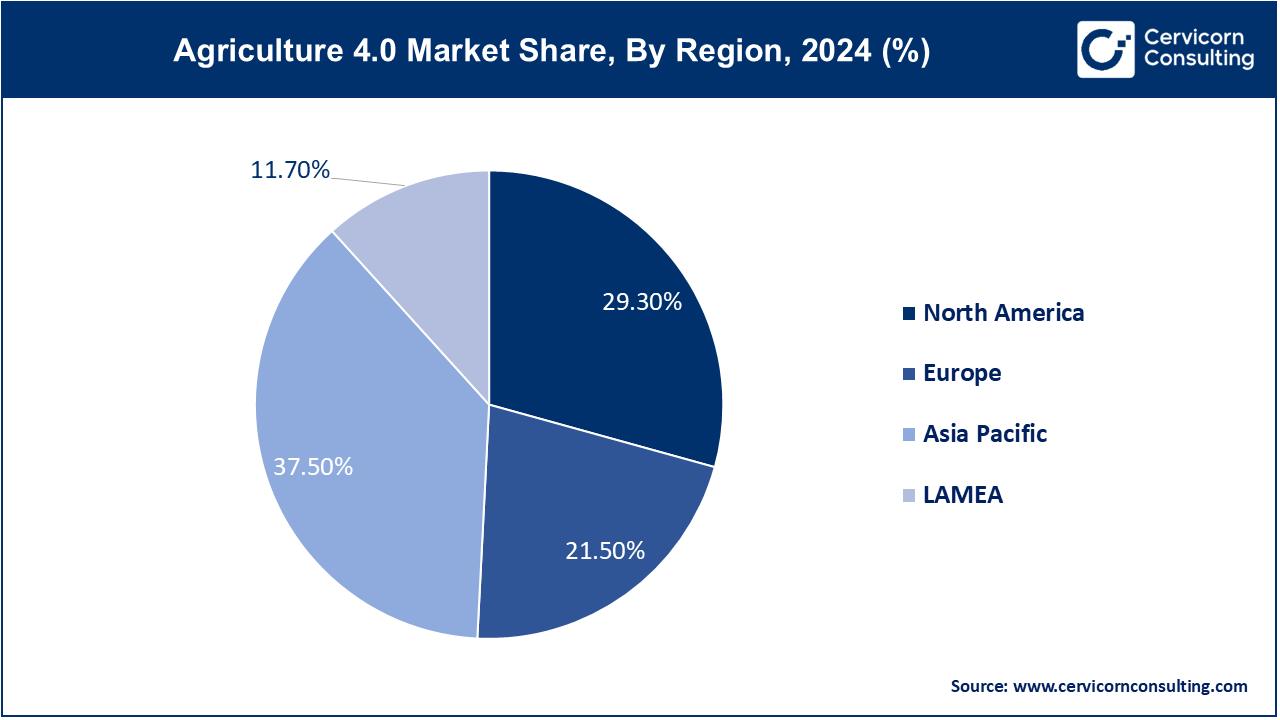

The Asia-Pacific agriculture 4.0 market size was valued at USD 28.04 billion in 2024 and is expected to reach around USD 69.84 billion by 2034. The Asia-Pacific region is experiencing rapid growth, fuelled by rising population demands, urbanization, and the urgent need for improved food security. Governments across the region are heavily investing in technology to enhance agricultural productivity and sustainability, reflecting the region’s commitment to addressing food challenges. China plays a significant role in the agriculture 4.0 market by focusing on modernizing its agricultural practices through technology adoption. Government policies aimed at enhancing food security support this transformation. Meanwhile, India’s agriculture sector is evolving with the introduction of digital tools, driven by initiatives aimed at improving productivity and resource efficiency in response to its growing population.

The North America agriculture 4.0 market was worth at USD 21.91 billion in 2024 and is anticipated to reach around USD 54.57 billion by 2034. North America dominates the agriculture 4.0 market, driven by its advanced agricultural practices and high adoption of technology among farmers. The region benefits from a robust infrastructure and extensive research and development in agricultural technologies. Additionally, there is a growing emphasis on sustainable farming practices, which encourages the integration of innovative solutions to enhance productivity and efficiency. In the United States, precision agriculture technologies are widely adopted, propelled by a focus on maximizing efficiency and productivity. The presence of major agri-tech companies and significant investments in research and development further strengthen the market position. Canada is also witnessing increased adoption of digital agriculture technologies, supported by government initiatives and a strong commitment to sustainable practices within the agriculture sector.

The Europe agriculture 4.0 market size was accounted for USD 16.08 billion in 2024 and is projected to surpass around USD 40.04 billion by 2034. Europe is significantly influenced by stringent regulations promoting sustainability and eco-friendly practices. There is a rising awareness among consumers regarding food quality, which drives the need for innovative agricultural technologies. The region’s focus on reducing environmental impacts while improving agricultural efficiency encourages farmers to adopt cutting-edge farming solutions. Germany stands out as a leader in agricultural technology, promoting advanced farming techniques with an emphasis on automation and digital solutions. The country benefits from strong governmental support for sustainable farming initiatives, further bolstering its market position. Similarly, France has a robust agricultural sector that is increasingly investing in smart farming technologies to enhance productivity and sustainability in agricultural practices.

The LAMEA agriculture 4.0 market size was estimated at USD 8.75 billion in 2024 and is predicted to hit around USD 21.79 billion by 2034. LAMEA is a growing market, primarily driven by the need for improved agricultural productivity and sustainability. As agricultural challenges like climate change and resource scarcity become increasingly pressing, there is a rising interest in adopting innovative technologies to address these issues. In Brazil, significant strides are being made in Agriculture 4.0 as advanced technologies are leveraged to boost agricultural output, particularly in key sectors such as soy and coffee production. South Africa is also adopting smart farming technologies to tackle water scarcity and improve crop yields, making notable progress in the agriculture 4.0 market. Additionally, Mexico is gradually integrating digital solutions into its agricultural sector, propelled by the necessity for increased efficiency and competitiveness in the global market.

The agriculture 4.0 market is dominated by a few central players, including AGCO Corporation, CropX Inc., Deere & Company, and IBM, among others. These organizations are recognized for their innovative solutions and commitment to advancing agricultural practices through technology. They leverage cutting-edge advancements in automation, data analytics, and precision farming techniques to enhance productivity and sustainability. Their strong research and development capabilities, coupled with strategic partnerships, enable them to address the evolving needs of the agricultural sector. By offering comprehensive platforms and solutions, these companies play a pivotal role in driving the adoption of Agriculture 4.0, ultimately transforming the way farming is conducted globally.

CEO Statements

John May – CEO of Deere & Company (John Deere):

Marc Olin – CEO of Trimble Inc.:

Eric Hansotia – CEO of AGCO Corporation:

Market Segmentation

By Component

By Application

By End-use

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Agriculture 4.0

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Application Overview

2.2.3 By End-use Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Agriculture 4.0 Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increased Climatic Resilience

4.1.1.2 Technological Push

4.1.2 Market Restraints

4.1.2.1 Low Technical Knowledge

4.1.2.2 Data Privacy

4.1.3 Market Challenges

4.1.3.1 Integration of Disparate Technologies

4.1.3.2 Uncertain Return on Investment

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Agriculture 4.0 Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Agriculture 4.0 Market, By Component

6.1 Global Agriculture 4.0 Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Service

Chapter 7 Agriculture 4.0 Market, By Application

7.1 Global Agriculture 4.0 Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Farming

7.1.1.2 Forestry

7.1.1.3 Livestock Monitoring

7.1.1.4 Fish Farm Monitoring

7.1.1.5 Smart Green House

Chapter 8 Agriculture 4.0 Market, By End-use

8.1 Global Agriculture 4.0 Market Snapshot, By End-use

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Livestock

8.1.1.2 Agro-forestry

8.1.1.3 Fishing

8.1.1.4 Aquaculture

Chapter 9 Agriculture 4.0 Market, By Region

9.1 Overview

9.2 Agriculture 4.0 Market Revenue Share, By Region 2024 (%)

9.3 Global Agriculture 4.0 Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Agriculture 4.0 Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Agriculture 4.0 Market, By Country

9.5.4 UK

9.5.4.1 UK Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Agriculture 4.0 Market, By Country

9.6.4 China

9.6.4.1 China Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Agriculture 4.0 Market, By Country

9.7.4 GCC

9.7.4.1 GCC Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Agriculture 4.0 Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 AGCO Corporation

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Bayer AG

11.3 CNH Industrial

11.4 Corteva Agriscience

11.5 CropX inc.

11.6 Deere & Company

11.7 IBM

11.8 Kubota Corporation

11.9 Saga Robotics AS

11.10 Syngenta Crop Protection AG