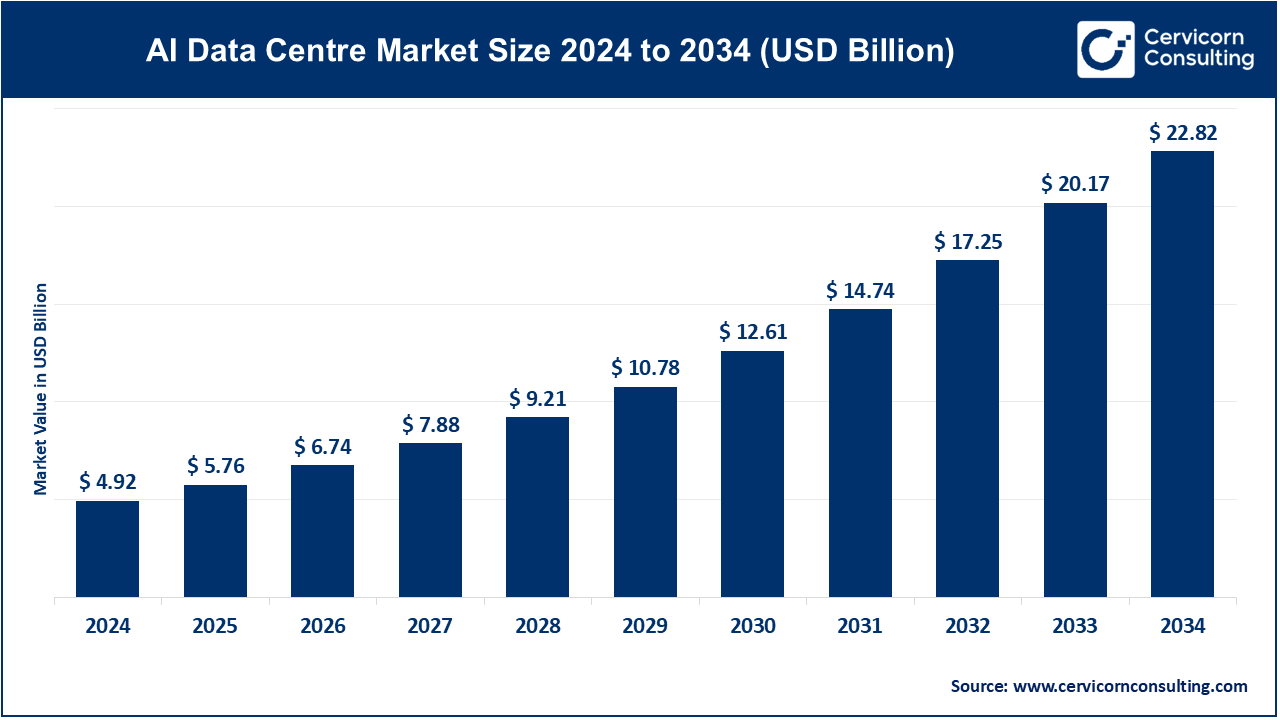

The global AI data centre market size was valued at USD 4.92 billion in 2024 and is expected to hit around USD 22.82 billion by 2034, growing at a compound annual growth rate (CAGR) of 40.1% from 2025 to 2034.

The AI data center market is expanding rapidly due to the increasing adoption of AI-driven technologies across various sectors such as healthcare, retail, finance, and manufacturing. Businesses are leveraging AI to enhance efficiency, automate processes, and gain deeper insights from data, driving the demand for powerful computing infrastructure. Cloud service providers like AWS, Google Cloud, and Microsoft Azure are leading the way, building AI-focused data centers with cutting-edge technologies to accommodate this surge in demand. The rise of generative AI applications, like ChatGPT, and AI-based tools for image recognition, natural language processing, and predictive analytics have significantly influenced the growth. Additionally, the push for energy-efficient and sustainable data centers has created opportunities for innovation in cooling systems, renewable energy integration, and green computing. In recent, Microsoft plans to invest USD 80 billion in AI data center infrastructure during its fiscal year 2025, reflecting the growing demand for cloud and AI services. Government funding for AI research and policies supporting digital transformation also play a key role in boosting the market.

An AI data center is a specialized facility designed to support artificial intelligence (AI) applications and workloads. Unlike traditional data centers, AI data centers use high-performance computing (HPC) hardware, such as GPUs and TPUs, to handle the complex calculations required for machine learning and AI algorithms. They provide the infrastructure to train AI models, process large volumes of data, and deploy AI applications efficiently. These centers also incorporate advanced cooling systems, energy-efficient designs, and optimized network configurations to handle the significant computational demands of AI. AI data centers are used in industries such as healthcare, finance, autonomous vehicles, and e-commerce to power AI innovations like chatbots, fraud detection systems, and recommendation engines.

The Connected healthcare market is seeing a rapid growth due to several significant factors associated with the digital transformation involved:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 4.92 Billion |

| Projected Market Size (2034) | USD 22.82 Billion |

| Growth Rate (2025 to 2034) | 40.10% |

| Report Segmentation | Component, Data Centre Type, Technology, Deployment Model, Region |

| Key Companies | NVIDIA Corporation, Intel Corporation, IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services (AWS), Alibaba Cloud Baidu, Inc., Oracle Corporation, Advanced Micro Devices (AMD), Inc., Hewlett Packard Enterprise (HPE), Cisco Systems, Inc., Dell Technologies, Tencent Cloud, Fujitsu Limited. |

The AI data centre market is segmented into component, data centre type, technology, deployment model and region. Based on component, the market is classified into hardware, software, and services. Based on data centre type, the market is classified into enterprise data center, colocation data center, hyperscale data centers, and edge data centers. Based on technology, the market is classified into Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), and Computer Vision. Based on deployment model, the market is classified into on-premises, cloud-based, hybrid.

North America is the most significant hub for developing AI data centre innovation. Currently, it is at the head of the market. As such, it has spent a lot in smart data centre and AI-driven infrastructure. The region is picked up by AI and cloud technology that is driving the region, especially the US and Canada. Government incentives have been driving growth in the market coupled with strong demand by big tech houses and enterprises of energy-efficient data centres.

Artificial intelligence adoption is very robust in Europe. Digital transformation has become the top focus for the EU as well as sustainability, and primarily based on these factors, the adoption of artificial intelligence throughout Europe is happening. Primarily, Germany, the UK, and France comprise the top market leaders in Europe with a highly significant number of investments made in artificial intelligence to meet the rigorous carbon reduction targets. Evidently, for the region, the commitment towards sustainability and green energy is driving AI-driven solutions within data centres for the optimization of energy use and reduction of carbon emissions.

There is a rapid growth of artificial intelligence data centres in the region, with China, Japan, and South Korea being front runners. The countries are establishing AI-driven data centres to develop the digital economy in the region. High investment in AI research along with government plans for smart infrastructure is further driving the market.

AI data centre market in the LAMEA region is emerging amid the growing interest in digitalization and energy management. The countries are now beginning to invest in AI to achieve the effective efficiency of the data centres and reduce the cost of operations. Not as rapid in the growth of others, still much to develop and achieve this area because it already has developed infrastructure and continues to implement AI-driven solutions.

Both emerging enterprises and established ones are making strides in innovation that is changing the AI data centre market. There are several marked emerging companies such as graph core and Cerebra’s Systems which are doing everything possible to advance AI and ML in terms of bettering the speed and efficiency of data centres. To illustrate, Graph core Company has introduced the Intelligence Processing Unit, which takes care of heavy AI workloads, offering up more space and energy utilization improvements. Cerebra’s Systems on the other hand sells the largest integrated circuit known as the Wafer Scale Engine meant for high-performance computing AI.

Such traditional market leaders such as NVIDIA and IBM continue to be the major players in the AI data centre market, using their strong R&D, to stay on top. Advanced CPU technology refers mainly to the NVIDIA GPUs, which are still the number one source of AI data processing. As far as CCD for business is concerned, the IBM solution is more about the infusion of AI in the massive very big data trends to get actions that define path to efficiency and processes optimization. All these though different and operating in different markets, are key players in the quest for the digitalization of data center operations and possess innovations that enhance performance and lower power consumption and make it possible to use AI in many areas of the economy.

CEO Statements

NVIDIA (Jensen Huang, CEO):

"AI is the most important technological revolution of our time, and our data center products are designed to enable organizations to harness the full potential of artificial intelligence. We're committed to providing the infrastructure that accelerates AI innovation and drives transformative change across industries."

IBM (Arvind Krishna, CEO):

"At IBM, we believe that AI should be infused into every aspect of business operations. Our AI-powered data centers are not just about processing power; they are about delivering actionable insights that empower organizations to make smarter, data-driven decisions."

Google Cloud (Thomas Kurian, CEO):

"Google Cloud is focused on helping businesses leverage AI to transform their operations. Our AI data centers are designed to deliver unparalleled scalability and efficiency, enabling our customers to innovate faster and achieve their business goals."

Microsoft Azure (Satya Nadella, CEO):

"We are committed to empowering every organization to harness the power of AI. Our Azure AI data centers provide the resources necessary for businesses to develop intelligent applications that drive growth and enhance customer experiences."

Strategic Launches and Expansions highlight the rapid advancements and collaborative efforts in the AI Data Centre market. Industry players are involved in various aspects of AI Data Centre, including technology, component, and AI, play a significant role in advancing the market. Some notable examples of key developments in the AI Data Centre Market include:

Market Segmentation

By Component

By Data Centre Type

By Technology

By Deployment Model

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of AI Data Centre

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Data Centre Type Overview

2.2.3 By Technology Overview

2.2.4 By Deployment Model Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on AI Data Centre Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Accelerated Digital Transformation

4.1.1.2 Cost-Efficiency and Operational Savings

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Cyber Security Concerns

4.1.2.2 Diverse Regulatory Landscapes

4.1.3 Market Opportunity

4.1.3.1 Emerging Markets Boost Growth with AI-Driven Infrastructure

4.1.3.2 5G Growth Fuels Demand for AI-Powered Edge Computing

4.1.4 Market Challenges

4.1.4.1 Integration with Legacy Systems

4.1.4.2 User Adoption and Engagement

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global AI Data Centre Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 AI Data Centre Market, By Component

6.1 Global AI Data Centre Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Services

Chapter 7 AI Data Centre Market, By Data Centre Type

7.1 Global AI Data Centre Market Snapshot, By Data Centre Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Enterprise data center

7.1.1.2 Colocation data center

7.1.1.3 Hyperscale Data Centers

7.1.1.4 Edge Data centers

Chapter 8 AI Data Centre Market, By Technology

8.1 Global AI Data Centre Market Snapshot, By Technology

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Machine Learning (ML)

8.1.1.2 Deep Learning (DL)

8.1.1.3 Natural Language Processing (NLP)

8.1.1.4 Computer Vision

Chapter 9 AI Data Centre Market, By Deployment Model

9.1 Global AI Data Centre Market Snapshot, By Deployment Model

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 On-Premises

9.1.1.2 Cloud-Based

9.1.1.3 Hybrid

Chapter 10 AI Data Centre Market, By Region

10.1 Overview

10.2 AI Data Centre Market Revenue Share, By Region 2024 (%)

10.3 Global AI Data Centre Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America AI Data Centre Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe AI Data Centre Market, By Country

10.5.4 UK

10.5.4.1 UK AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific AI Data Centre Market, By Country

10.6.4 China

10.6.4.1 China AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA AI Data Centre Market, By Country

10.7.4 GCC

10.7.4.1 GCC AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA AI Data Centre Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12 Company Profiles

12.1 NVIDIA Corporation

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Intel Corporation

12.3 IBM Corporation

12.4 Google LLC

12.5 Microsoft Corporation

12.6 Amazon Web Services (AWS)

12.7 Alibaba Cloud

12.8 Baidu, Inc.

12.9 Oracle Corporation

12.10 Advanced Micro Devices (AMD), Inc.