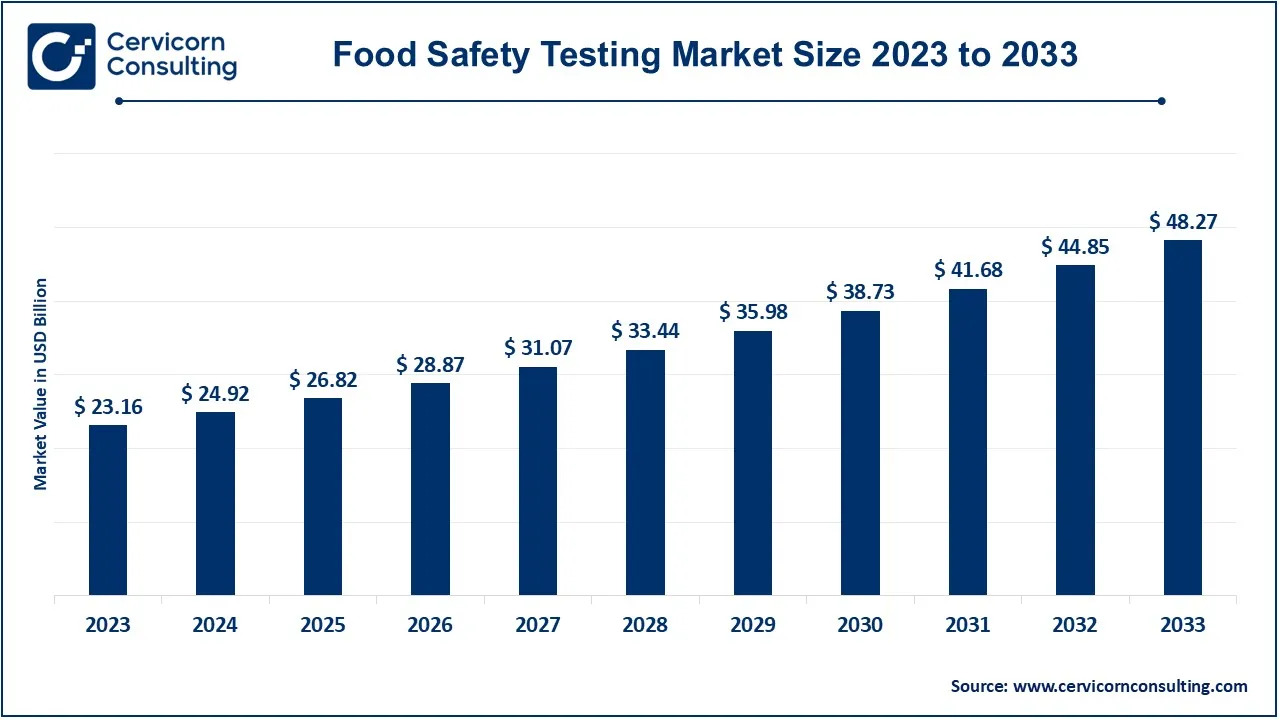

The global food safety testing market size was valued at USD 24.92 billion in 2024 and is expected to be worth around USD 48.27 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.62% from 2024 to 2033.

The global food safety testing market is experiencing rapid growth due to the increasing demand for safe, high-quality food products and stricter regulations from governments worldwide. As foodborne illnesses and contamination outbreaks continue to impact public health, the demand for testing services is rising. Advances in testing technologies, such as PCR (Polymerase Chain Reaction) and rapid testing kits, are making food safety testing more efficient and accessible. Additionally, increased consumer awareness about food safety and transparency has prompted food manufacturers to adopt better testing practices to gain consumer trust and comply with regulatory standards. In recent years, the food safety testing market has also seen significant growth due to the rise of international trade and supply chain complexities. Global food trade exposes consumers to a variety of risks, prompting the need for more rigorous safety measures. The August 2024 incident, where 12% of India's spice samples failed safety tests due to pesticide contamination, has intensified global scrutiny on food safety. With countries like the US, UK, and Australia investigating brands like MDH and Everest, the demand for comprehensive food safety testing has surged.

Food safety testing refers to the process of testing food products for contaminants, pathogens, and harmful chemicals that could pose health risks to consumers. This testing ensures that food products are safe to eat and comply with safety regulations. It involves detecting substances like bacteria (e.g., Salmonella, E. coli), viruses (e.g., norovirus), pesticides, heavy metals, allergens, and other harmful components. Methods used for food safety testing include microbiological analysis, chemical testing, and sensory evaluations. The goal is to prevent foodborne illnesses, protect public health, and ensure food quality throughout the production, processing, and distribution stages.

Report Highlights

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 26.82 Billion |

| Estimated Market Size (2033) | USD 48.27 Billion |

| Growth Rate (2024 to 2033) | 7.62% |

| Prominent Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Test, Product, Application, End User, Region |

| Key Companies | Eurofins Scientific, Intertek Group plc, Bureau Veritas, Thermo Fisher Scientific, Neogen Corporation, Bio-Rad Laboratories, Merieux NutriSciences, ALS Limited, AsureQuality, Romer Labs, 3M Company, Microbac Laboratories, TÜV SÜD, R-Biopharm AG, Covance Inc., NSF International, Symbio Laboratories, Silliker Inc., Campden BRI |

Rising Global Focus on Food Safety

Increased Investments in Testing Technologies

High Costs of Advanced Testing Methods

Complex Regulatory Landscape

Expansion in Emerging Markets

Growing Demand for Organic and Clean-Label Products

Infrastructure Development in Developing Regions

Public Awareness and Trust in Testing Methods

The food safety testing market is segmented into type, product, application, end-users and region. Based on type, the market is classified into pathogen testing, pesticide residue testing, genetically modified organism (GMO) testing, allergen testing, and others. Based on product, the market is classified into microbiological testing, chemical testing, immunoassays, and PCR-based testing. Based on application, the market is classified into meat, poultry, & seafood products, dairy & dairy products, processed food, beverages, cereals & grains, others. Based on end-users, the market is classified into food manufacturers, food processing companies, retailers, and laboratories.

Pathogen Testing: The pathogen testing segment has accounted revenue share of 46.10% in 2023. Detection of Pathogens such as Salmonella, E. coli and Listeria is an essential test regularly performed in the analysis of foods. It serves as a safety net because it points where contamination could be originating in order to prevent any food from being consumed. This type of testing is used extensively in sectors like meats, poultry as well as dairy products because of the high risk of BSE orFood borne diseases for consumption.

Pesticide Residue Testing: The pesticide residue testing segment has held revenue share of 10.20% in 2023. Residues analysis includes checking pesticide deposits that could be left on the fruits, vegetables, and other producer that we get from farms. It is crucial that residues of pesticides applied are kept to minimum to address legal requirements within export markets, most especially within the organic and clean label foods categories.

GMO Testing: The GMO testing segment has accounted revenue share of 16.70% in 2023. GMO testing detects genetically modified organisms in food products so that manufacturers are able to satisfy labeling conditions and legal constraints. This type of testing is especially significant in those countries where labeling of GMO is required and, in the markets, where people want clear information about the product they are consuming.

Allergen Testing: The allergen testing segment has accounted revenue share of 5.90% in 2023. Food allergen testing guarantees that products containing allergic compounds such as gluten or nuts or dairy have no traces of allergens that could trigger allergic reactions in allergic customers. Because more consumers and regulatory agencies pay attention to the labeling of products containing these ingredients, such testing plays an important role in the protection of consumer rights and avoiding product recalls.

Microbiological Testing: Microbial analysis deals with identification and counting of pathogenic bacteria that may interfere with food during processing, handling or storage. It is mandatory for food safety and is used broadly in risky food categories such as meat and dairy products to control the occurrence of foodborne diseases.

Chemical Testing: Hazardous chemical analysis is employed in the identification of the chemical substances including toxins, heavy metals and pesticide residues on foods. Such type of testing is crucial in meeting both national and international safety standards and meeting the requirements of safety regulations.

Immunoassays: Allergen and pathogen detection are the most usual immunoassays, which use antibodies to detect certain proteins or pathogens in food samples. They are a fast and effective testing method that has become common with the food producers to identify the contaminants at different processing levels.

PCR-Based Testing: PCR is a molecular biomolecular method for amplifying target sequences of nucleic acids which also excellently suits pathogen and GMO identification. Due to its specificity and ability to provide positive results within a short duration, the method can be widely used in food safety testing.

Food Manufacturers: Food manufacturers apply safety tests to investigate the safety of foods before they are released to the market. This pathogen, allergen, and chemical residues testing allows maintaining compliance with regulatory laws and regulations, preventing product recalls, and retaining customer confidence.

Food Processing Companies: The analysis of contamination hazards is critical to food processing companies, and that is why they conduct food safety testing throughout the production process. Evaluations can also be done at every possible level right from the raw materials and intermediaries to the final products; this is done to prevent the entries of the nasty from the finished products.

Retailers: The interests of the public have made the retailers who sell food products to invest in food safety testing service to confirm that their food products are safe for the consumer. Due to heightened customer awareness, retailers employ food allergen, pathogen and contaminants investigation for quality and safe foods available in their stores.

Laboratories: Third party testing/assay labs are agencies that offer testing services to individuals or companies that produce, process or sell food merchandise. These state of art Labs offer microbial analysis test, chemical test, genetic test, etc., which involved safety features to meet food safety standard at international level.

The North America food safety testing market size was estimated at USD 7.46 billion in 2023 and is expected to reach around USD 15.54 billion by 2033, growing at a CAGR of 7.54% from 2024 to 2033. North America is expected to be the largest market because of such regulations, developed technology usage, and consumer protection quality. The United States especially takes the lead having strict laws on food safety which are implemented through the FDA and USDA that compel regular testing within value chains. It is also a fact that Canada plays its role in market growth by stepping up investment in food safety and having an ever-increasing number of people understanding the dangers of foodborne diseases.

The Europe food safety testing market size is projected to grow from USD 6.67 billion in 2023 to USD 13.90 billion by 2033. Europe presents the second largest market growth due to increased regulation and standardization by the European Food Safety Authority (EFSA) coupled with high requirement of food safety in different food segments. The advanced testing methods particularly for allergens, pathogen and chemical contaminants have being developed most by countries Germany France and the UK. SWOT analysis – The regions demand for sustainable and clean label products also is fast increasing the need for food safety testing.

The Asia-Pacific food safety testing market size was accounted for USD 5.88 billion in 2023 and is projected to surpass around USD 12.26 billion by 2033, with a CAGR of 8.81% from 2024 to 2033. The Asia-Pacific region is expected to boom in the near future because of the factors such as increasing urbanization, increasing disposable income of consumers and growing issues and concerns related to food safety. China, Japan and India for instance are putting their resources in sophisticated food testing methods to meet the standards of safety because the region is becoming a leading exporter of food production. The government’s efforts to enhance strict measures regarding food safety is also driving the market growth.

The LAMEA food safety testing market was valued at USD 3.15 billion in 2023 and is projected to hit around USD 6.65 billion by 2033. LAMEA market is relatively in its growing phase for as the awareness regarding foodborn illness is increasing and the globalization of food industry is increasing at a significant rate. For instance, Brazil is paying much attention to the enhancement of food safety regulations to enhance its agricultural exports, and the Middle East region especially the UAE is investing in the infrastructure to address the standards required in food safety. Africa, like most other regions, has challenges with infrastructure and is slowly moving in the right direction with regards to the food testing capabilities.

Among the new entrants into the food safety testing industry, Neogen Corporation is making a concerted effort to carve a niche by coming up with equipment and kits that provide real time effects of pathogens and allergens on food, in order to help firms guarantee their products’ safety. On the other hand, Eurofins Scientific is growing its international network of highly skilled chemical and microbiological testing services and positively revolutionising food safety benchmarks in various parts of the world. On the other hand, large experienced leaders such as SGS and Bureau Veritas with years of experience in food testing and certification services maintain dominance by covering most testing services and providing solutions that comply with the required international standards.

Thermo Fisher Scientific always employs biotechnology in offering state of the art testing solutions and services while MNSC combines the ability in testing, advisory and consulting services all related to food safety. These industry advancements are prompted by innovation and partnership mechanism where new entrants to the food safety testing industry have equal important roles to play as those that have subscribed to the historic traditions of the business.

CEO Statements

Ganji Kamala Vardhana Rao, CEO of Food Safety and Standards Authority of India (FSSAI)

"Encouraged states/UTs to increase the regular surveillance, monitoring, inspections and random sampling of food products and their compliance with the laid down standards."

Dr. Gilles Martin, CEO ofEurofins

"We are extremely pleased to welcome LabCorp’s Covance Food Solutions and its talented teams to the Eurofins Group. Its competencies, reputation for scientific excellence and complementary geographic footprint, client focus and service offerings further strengthen Eurofins’ global offering in the very competitive food testing market. We look forward to working together as an integrated network of independent state-of-the-art laboratories providing our customers access to the full range of services and technological capabilities of the combined Group."

The food safety testing market is moving towards great innovative strides in the sense of quality and safety of food products through technologies such as pathogenic detection, allergenic detection, and chemical residual analysis. These companies are trying the introduction of new technologies such as the quick diagnostic tools, automation, and even data driven-testing in line with global food safety requirements. In the case of Food Safety Testing Market, the following can be pointed out as market developments include:

These events have clearly pointed towards a sharper rise in the food safety testing sector through growth in strategic collaborations, rising investments and changes in regulatory policies. Currently, key players are more interested in enhancing the testing programme, employing better diagnostic methods for food products, and enhancing the laboratory framework in order to fulfil the growing need in the field of food safety. These endeavours can be made to guarantee food quality, lower and safeguard the consumer as well as meet the emergent standards and safety measures within different parts of the world.

Advancements in RT-LAMP, l later generation molecular diagnostic systems, and automation are also helping to spread food safety testing across the supply chain of food products making them safer and more standard for consumers across the globe.

Market Segmentation

By Test

By Product

By Application

By End-Users

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Food Safety Testing

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Test Overview

2.2.2 By Product Overview

2.2.3 By Application Overview

2.2.4 By End-Users Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Food Safety Testing Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Global Focus on Food Safety

4.1.1.2 Increased Investments in Testing Technologies

4.1.2 Market Restraints

4.1.2.1 High Costs of Advanced Testing Methods

4.1.2.2 Complex Regulatory Landscape

4.1.3 Market Opportunity

4.1.3.1 Expansion in Emerging Markets

4.1.3.2 Growing Demand for Organic and Clean-Label Products

4.1.4 Market Challenges

4.1.4.1 Infrastructure Development in Developing Regions

4.1.4.2 Public Awareness and Trust in Testing Methods

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Food Safety Testing Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Food Safety Testing Market, By Test

6.1 Global Food Safety Testing Market Snapshot, By Test

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Pathogen Testing

6.1.1.2 Pesticide Residue Testing

6.1.1.3 Genetically Modified Organism (GMO) Testing

6.1.1.4 Allergen Testing

6.1.1.5 Others

Chapter 7 Food Safety Testing Market, By Product

7.1 Global Food Safety Testing Market Snapshot, By Product

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Microbiological Testing

7.1.1.2 Chemical Testing

7.1.1.3 Immunoassays

7.1.1.4 PCR-Based Testing

Chapter 8 Food Safety Testing Market, By Application

8.1 Global Food Safety Testing Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Meat, Poultry, & Seafood Products

8.1.1.2 Dairy & Dairy Products

8.1.1.3 Processed Food

8.1.1.4 Beverages

8.1.1.5 Cereals & Grains

8.1.1.6 Others

Chapter 9 Food Safety Testing Market, By End-Users

9.1 Global Food Safety Testing Market Snapshot, By End-Users

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Food Manufacturers

9.1.1.2 Food Processing Companies

9.1.1.3 Retailers

9.1.1.4 Laboratories

Chapter 10 Food Safety Testing Market, By Region

10.1 Overview

10.2 Food Safety Testing Market Revenue Share, By Region 2023 (%)

10.3 Global Food Safety Testing Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Food Safety Testing Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Food Safety Testing Market, By Country

10.5.4 UK

10.5.4.1 UK Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Food Safety Testing Market, By Country

10.6.4 China

10.6.4.1 China Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Food Safety Testing Market, By Country

10.7.4 GCC

10.7.4.1 GCC Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Food Safety Testing Market Revenue, 2021-2033 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 Eurofins Scientific

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Intertek Group plc

12.3 Bureau Veritas

12.4 Thermo Fisher Scientific

12.5 Neogen Corporation

12.6 Bio-Rad Laboratories

12.7 Merieux NutriSciences

12.8 ALS Limited

12.9 AsureQuality

12.10 Romer Labs