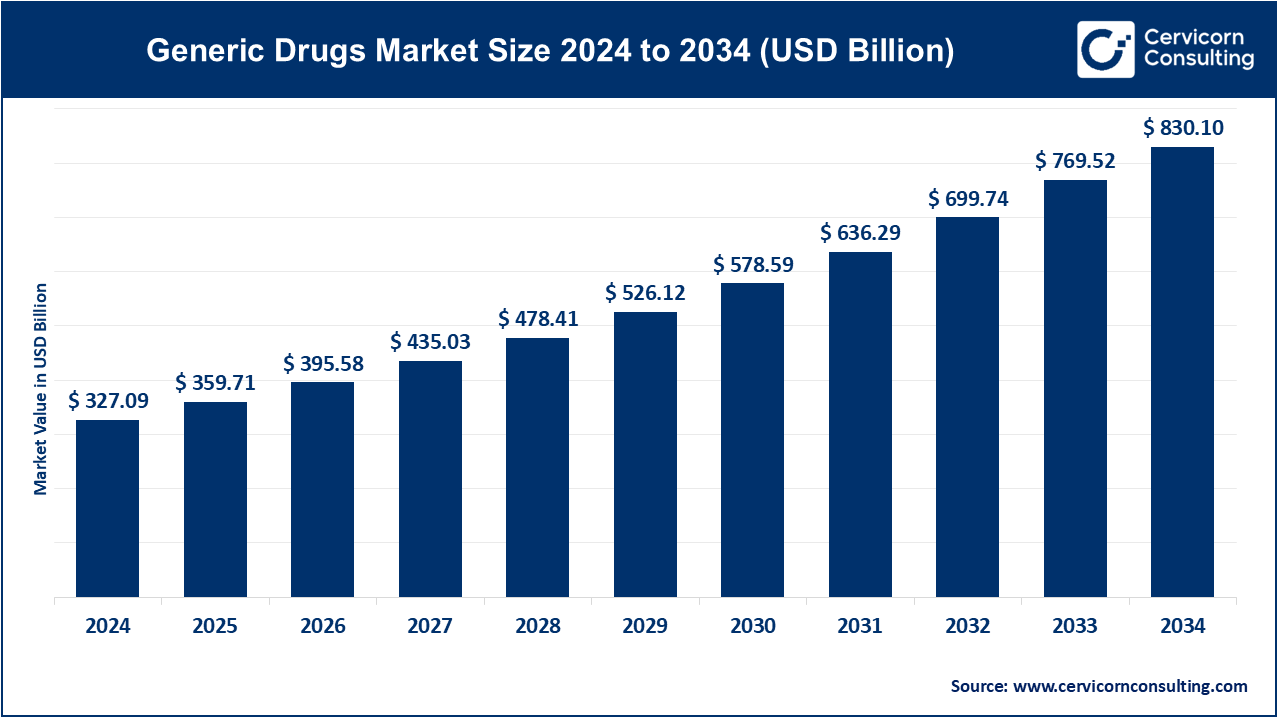

The global generic drugs market size was valued at USD 327.09 billion in 2024 and is expected to be worth around USD 830.10 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.76% from 2025 to 2034.

Owing to the bolstering demand of generic drugs they are becoming an essential part of the healthcare system. Although using generics has saved healthcare systems a great deal of money, their ability to save costs is frequently highlighted. The demand for pharmaceuticals that are accessible and affordable is increasingly significant in the dynamic healthcare landscape.

Generic drugs are medications that may be manufactured and distributed by entities other than the original innovator company after the original patents have expired. These drugs provide the same therapeutic effects as their branded equivalents but at a much lower cost thanks to their bioequivalence. As countries work to improve healthcare affordability and increase access to necessary medications, the generics market has emerged as a critical global enabler of these objectives.

Increasing popularity of injectable generics: Injectables are faster-acting, and the medical community and pharmaceutical researchers are quickly developing novel formulations in oncology and other specialty therapeutic areas. Governments are supporting their manufacture due to the advantages offered by generic injectables in terms of quality, dosage, strength, and cheaper R&D cycle. A growing number of drug shortages, especially in the US, along with patent expirations for many blockbuster drugs, an aging population, and a rise in chronic and lifestyle diseases, are other factors contributing to the market’s growth.

Regulatory Compliance and Quality Standards: The generic drug manufacturers are shaped by the constantly changing regulatory requirements and the advancement of technology. The compliance standards are becoming more and more stringent owing to the regulatory authorities, the priority of patient safety, and medication efficacy. Therefore, to maintain competitiveness, uniformity, and transparency, generic drug companies must constantly strive to improve.

Growing Market Expansion: The pharmaceutical industry is constantly changing as a result of the increased demand for readily available healthcare services globally. Leading the way in this revolutionary shift are Indian companies that manufacture generic drugs. Further, as generic drug manufacturing companies enter foreign markets, they are faced with new prospects for development and cooperation. Owing to the ease of accessibility and affordability of high-quality generic medicines have played a significant role in improving healthcare outcomes in both developed and developing countries, thereby leading to the growth of the market.

Expanding the Portfolio to Include Wider Range of Drugs: There has been a consecutive rise in healthcare costs and demand for prescription drugs in Asia Pacific and North America because of the aging populations in these regions. By devising new compounds and enhancing existing technologies pharmaceutical companies are trying to address a wider range of healthcare issues. Cipla Biotec invested about US$ 90 million in a biosimilar plant located in Durban, South Africa. Cipla is a leading international supplier of antiretrovirals, with nearly a thousand drugs available. Biosimilars are produced in the US, the EU, and Asia to be exported to other nations for use in public and private sectors.

Innovation in R&D: Some of the leading companies in the market are making novel formulations, that are in dispersible forms and ease the administration, taste-masked alternatives that enhance palatability, and tablets with extended-release that require less dosage. Nanocarriers, transdermal patches, and inhalers are some of the examples of novel drug delivery technologies that further improve patient adherence, bioavailability, and efficacy. By allocating funds for R&D pharma companies can further enhance healthcare by providing more patient-centered, cost-effective, and accessible treatment options. This leads to better patient care and a more promising future for the sector.

Increasing Technological Advancements: Cutting-edge technologies are critical for pharmaceutical companies' flourishing in the highly competitive market. Pharmaceutical companies can thereby boost the efficacy of their manufacturing processes and reduce bottlenecks by speeding up production cycles through implementing cutting-edge technologies. ZIM Labs a pharmaceutical manufacturing company is pioneering its way in innovating by utilizing cutting-edge technologies to optimize production processes and guarantee precise and punctual operations. In addition, by using state-of-the-art technologies the companies can investigate innovative drug formulations and delivery systems, thereby promoting product differentiation and innovation.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 359.71 Billion |

| Projected Market Size (2034) | USD 830.10 Billion |

| Growth Rate from 2025 to 2034 | 9.76% |

| Most Prominent Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Type, Brand, Route of Administration, Distribution Channel, Application, Region |

| Key Companies | Mylan N.V., Abbott Laboratories, ALLERGAN, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Viatris Inc., Sun Pharmaceutical Industries Ltd., STADA Arzneimittel AG, GlaxoSmithKline Plc., Baxter International Inc., Pfizer Inc., Sandoz International GmbH (Novartis), Dr. Reddy's Laboratories Ltd. |

Increasing Government Initiatives and Policies

Growing Physician Demand

Product Recalls

Manufacturing Complex Generics

New Market Expansion in Africa

Growing continuous investments

Quality and Safety Concerns

Increases In Drug Shortages

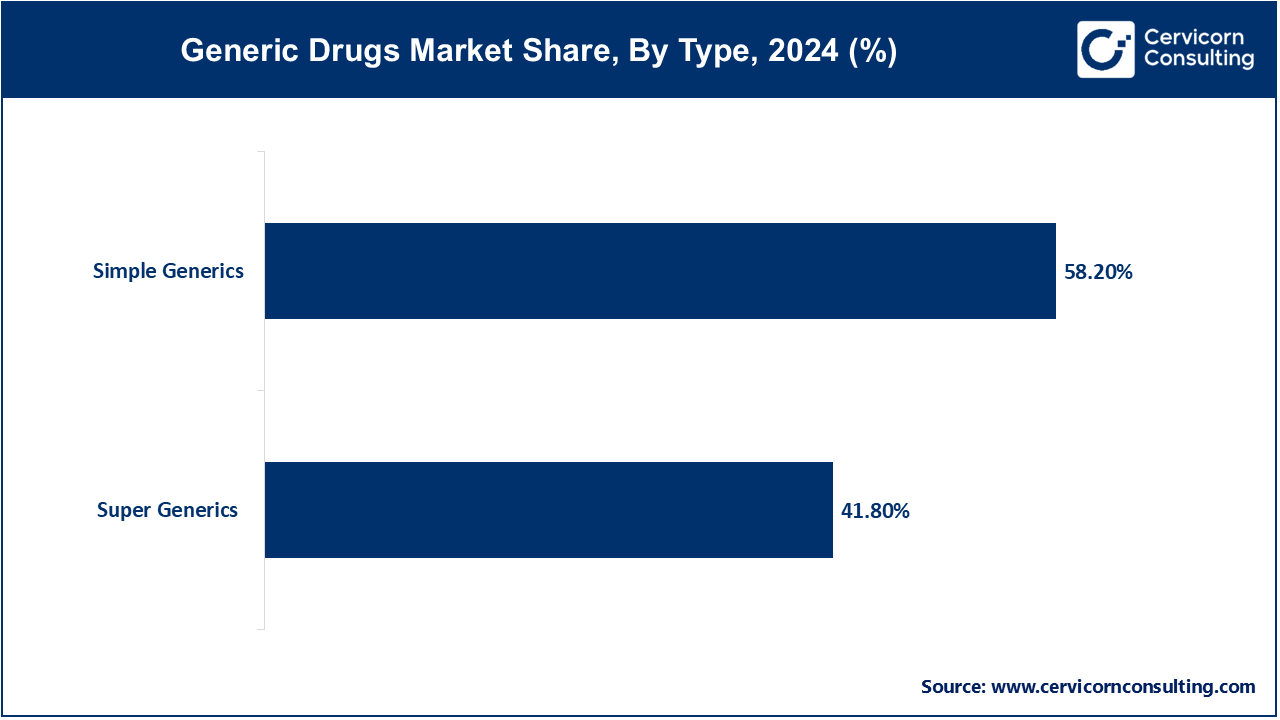

Simple Generics: The simple generics segment has held leading position in 2023 and accounted for 58.20% in 2024. The drugs that have the same active ingredients, dosage forms, strengths, and modes of administration as their brand-name equivalents are known as simple or traditional generics. These generics undergo extensive testing thereby ensuring their therapeutic equivalent and compatibility with other reference products, as well as demonstrating their bioequivalence to the original brand-name medication. When the patents of the brand-name manufacturer expire at that time simple generics are usually released into the market. This enables generic manufacturers to produce the cost-effective alternatives of brand-name and dispense them in the market for use.

Super Generics: The super generics segment has captured revenue share of 41.80% in 2024. A more sophisticated category of generics, is known as super generics that provide supplementary advantages over traditional generics. Super generics are created by using cutting-edge technologies or formulation changes to improve the medication's safety, effectiveness, administration, and adherence to therapy. These amplifications in the drugs could be in the form of improved pharmacokinetics, altered release profiles, improved bioavailability, or novel delivery methods like nanotechnology or lipid-based formulations. Super generics are developed by using modern technologies, which try and solve the drawbacks of traditional generic formulations or the original branded medicine. The goal is to provide patients with better therapeutic results and experiences.

Oral: The oral segment has accounted revenue shareof 65.12% in 2024. Oral medication is taken through the mouth and has the potential to produce therapeutic effects by entering the circulation through the gastrointestinal tract. This method of administration is frequently employed due to its efficacy, ease of application, and patient preference. Generic drugs can be given to patients in a convenient and non-invasive manner which can be in the form of either tablets, capsules, or liquids. Since oral medications are used so extensively in treating acute and chronic illnesses and in preventive healthcare, they are considered the key to drug therapy.

Injectable: The injectables segment has captured 21.72% of the total revenue share in 2024. Injectables make sure of rapid absorption and distribution of the drug all through the body. Administration of the drug is done with the support of a needle or syringe that bypasses the gastrointestinal tract and enters the body directly. Some specific medications and therapeutic indications determine which of the many routes are appropriate for drug administration. The different routes of injecting medicine include intramuscular, subcutaneous, intravenous, and intradermal (into the skin). There are a few advantages of this administration method in comparison to the others which include a higher degree of dosing accuracy, a faster start of action, and enhanced solubility. However, there are chances of feeling some kind of uneasiness and discomfort while getting medicine injected.

Others: The others segment includes transdermal, nasal, and sublingual routes of administration.The transdermal route of administration implies a drug penetrating the body through the skin through creams, gels, ointments, or patches. Using a needle to inject medication beneath the skin's exterior layers is known as subcutaneous administration. Administering it transdermally is effortless, harmless, and noninvasive. Some of the examples include hormone replacement therapy, hormonal contraceptives, and other pharmaceuticals. When administered through the nasal passage, the drug is rapidly absorbed into the bloodstream through the process of spraying or sniffing for eg. decongestant sprays. Nasal and various other respiratory conditions are directly addressed by this method of administration. The drug can enter the circulation and be absorbed rapidly by placing it under the tongue, a process known as sublingual administration. A comparable mechanism of action is observed with buccal administration, in which the substance is inserted between the gums and the inside of the cheek.

Cardiovascular: The World Health Organization estimates that approximately 17.5 million deaths annually worldwide are attributable to cardiovascular diseases, or 32% of all deaths. Heart attacks and strokes account for 85% of these fatalities. In addition, men are more vulnerable than women. Approximately 850,000 Americans experience a heart attack annually, according to the same source. Of these, 605,000 had their first heart attack and over 200,000 people have had a previous heart attack. This represents a significant market opportunity for the generics market as the demand for low-cost drugs for treatment contributes significantly to the growth of the generics market.

Oncology: A wide range of medications are included in therapies such as hormone therapies, targeted therapies, and chemotherapy, and are orally consumed for treating cancers, including leukemia, breast, lung, colon, and prostate cancers. Whether these drugs are taken individually or in conjunction with other therapies or modalities like radiation or surgery, they are crucial in the treatment to fight cancer. Also, the use of generic drugs in treating cancer offers significant cost savings thereby making the treatment more affordable and accessible.

Infectious Diseases: Some of the widely known infectious diseases, include human papillomavirus (HPV), malaria, hepatitis, HIV, influenza, and tuberculosis. In the coming days, market growth may be triggered by the increasing burden of disease and the growing population demand. The World Health Organization (WHO) states that the antiretroviral drug supplies of around 73 countries are on the brink of exhaustion as a result of the COVID-19 pandemic. In addition, 24 countries have reported supply disruptions and critically depleted ARV stocks. These countries are home to approximately 8.3 million individuals, which accounts for approximately one-third (33%) of the global HIV treatment population.

Central Nervous System (CNS): Generic medications are essential in the management of a variety of neurological and psychiatric conditions, such as schizophrenia, epilepsy, Parkinson's disease, anxiety, and melancholy, within the central nervous system(CNS) category. Many of these disorders necessitate long-term pharmacotherapy to alleviate symptoms and enhance treatment outcomes. Generic pharmaceuticals that influence the central nervous system (CNS) are designed to alleviate symptoms associated with CNS disorders, restore chemical equilibrium in the brain, and modulate neurotransmitter activity. Therefore, generics are likely to be cost-effective alternatives to branded central nervous system (CNS) medications.

Others: The others segment includes diabetes, respiratory diseases, and arthritis. There has been an increase in diabetes cases worldwide, and it is projected to keep on rising, which will drive the global market for generic medications. According to a June 2023 report published by the Institute for Health Metrics and Evaluation, there will be ~1.3 billion cases of diabetes worldwide by 2050, from 529 million cases in 2022. According to data from the American Lung Association, 12.5 million people were detected with emphysema, chronic bronchitis, or chronic obstructive pulmonary disease (COPD) in 2020. Further, one of the most common causes of disability among adults in the US is arthritis, which affects over 54 million people. This growth in cases of arthritis may lead to demand for generic medications that have the capability of reducing inflammation which is often followed by many types of other illnesses.

Hospital Pharmacy: Hospitals, clinics, and outpatient centers are among the healthcare facilities that accommodate hospital pharmacies. These pharmacies function under the direction of medical professionals who provide medication to both inpatients and outpatients. Hospital pharmacies also play a crucial role in managing the entire process of medicine distribution and at the same time ensuring the safe and effective administration of medications to patients in a hospital setting. Hospital pharmacies also handle formulary and drug preparation, store medications, and offer services to enhance patient care and safety.

Retail Pharmacy: Retail pharmacies are likely to be the first point of contact for patients looking for prescription and over-the-counter medications. These pharmacies are generally found in community facilities like supermarkets and standalone stores. Patients have the option of conveniently obtaining their prescriptions near their residences or through online platforms for purchasing medicines from these pharmacies. Furthermore, these pharmacies stock a wide range of generic and branded drugs.

Online Pharmacy: There are endless opportunities to use the internet's unmatched medium, which is unrestricted by geography, for sending and receiving goods. With an over-the-counter or free online consultation model, online pharmacies sell a variety of lifestyle items, prescription drugs, and pharmaceuticals, including those for non-medical purposes. Mark Cuban Cost Plus Drugs Company (MCCPDC) opened an online pharmacy in January 2022, that provides patients with more than 100 kinds of affordable generic drugs. Furthermore, the segment's growth is propelled by the ease, flexibility, and convenience that come with buying medications online.

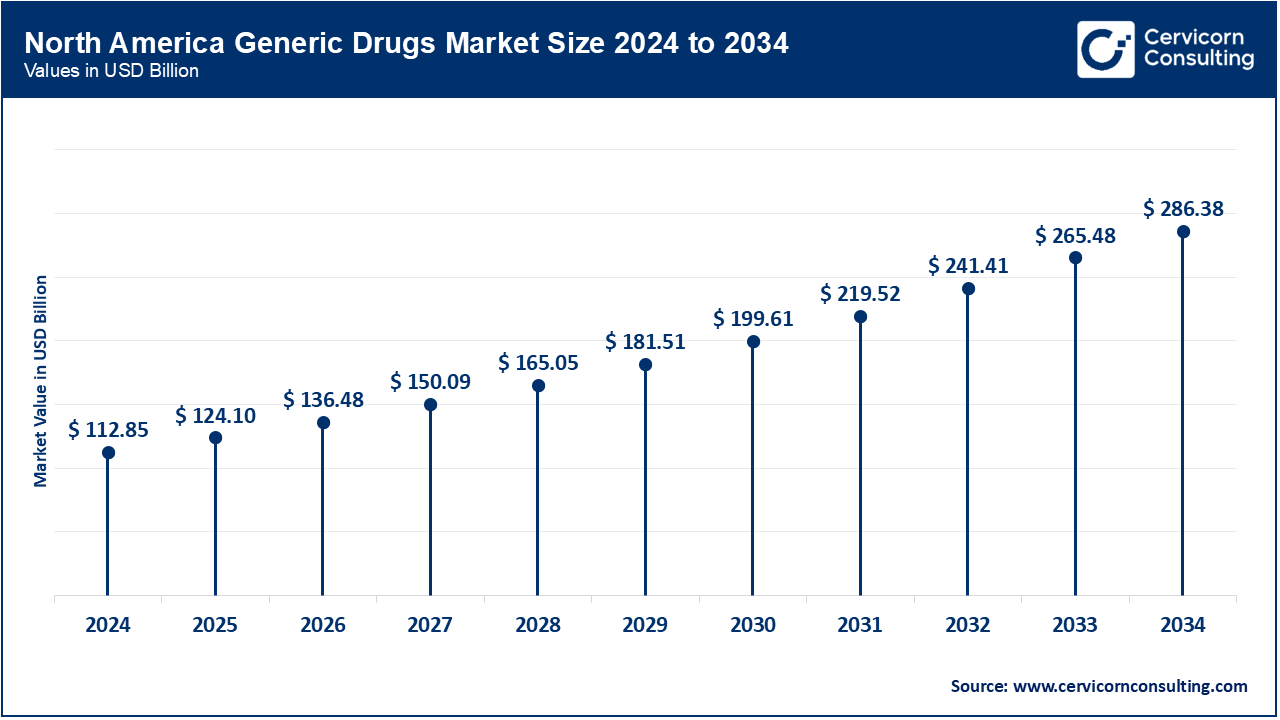

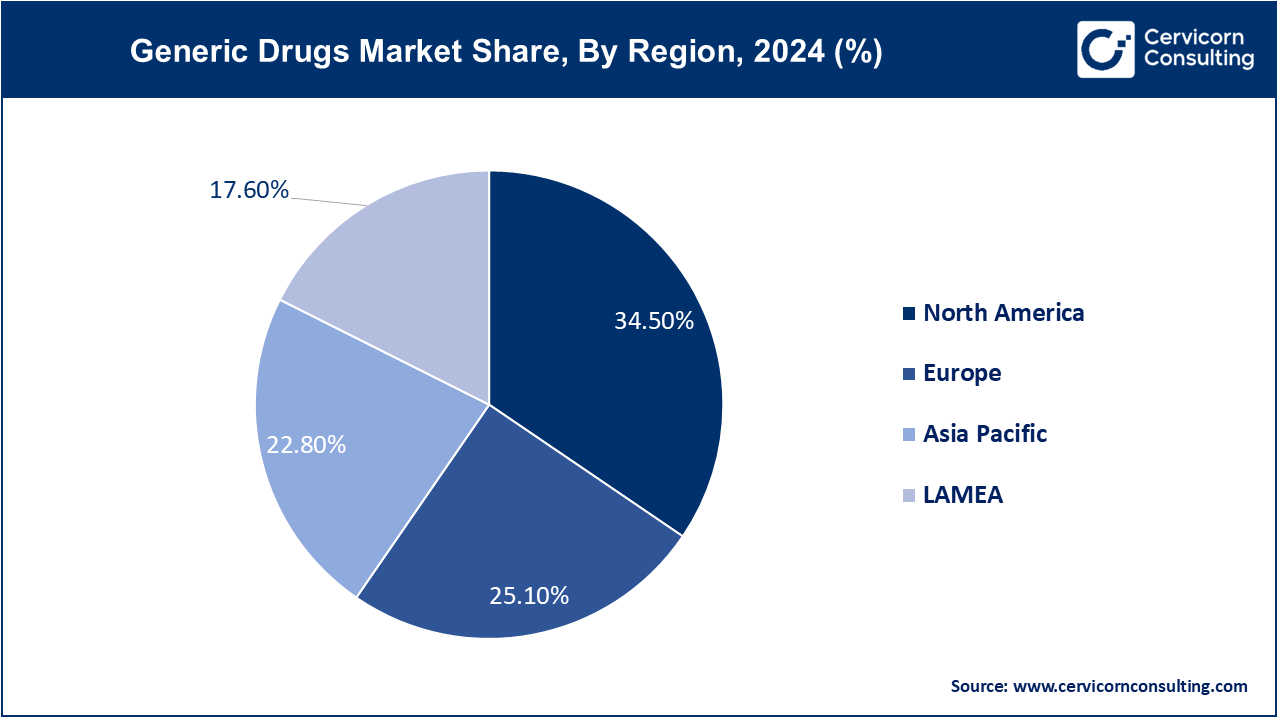

The North America generic drugs market size was valued at USD 112.85 billion in 2024 and is expected to reach around USD 286.38 billion by 2034. The North America market is driven by increasing utilization of healthcare services, and related expenses including patient out-of-pocket expenses, and use of prescription drugs. An increasing number of favorable government initiatives coupled with the rising number of product launches and demand for generic drugs are key revenue drivers.

The FDA's Office of Generic Drugs (OGD) orchestrates thorough reviews to be sure of the fact that generic medications are of the highest quality and reasonably priced. Furthermore, there are a growing number of ANDA approvals as well as first-to-file advantages like Paragraph IV (PIV) certification. Prominent entities like Mylan N.V. and Teva Pharmaceutical Industries Ltd. submitted 81 PIVs and 160 PIVs respectively.

The Europe generic drugs market size is expected to reach from USD 82.1 billion in 2024 to USD 208.35 billion by 2034. The market in Europe is expected to grow due to the well-established healthcare infrastructure along with collaboration and partnerships between industry players, research organizations, and healthcare providers. The European Medicines Agency (EMA) is encouraging the approval of generics thereby allowing companies to market their versions. This propels more businesses to introduce generic versions of branded medications in Europe.

Owing to the rising healthcare demands and tight budgets, generics have dramatically improved patient access to medications, thereby revolutionizing healthcare in Europe. Generic medications have increased access to medications by more than 100% in the last ten years across all therapeutic areas without raising the overall cost of care. This transformation has resulted in increased access to gold-standard therapies for millions of patients across Europe.

The Asia-Pacific generic drugs market size was accounted at USD 74.58 billion in 2024 and is projected to hit around USD 189.26 billion by 2034. The Asia Pacific market is being driven by investments in research and development as well as rising healthcare spending due to the emergence of chronic diseases like diabetes, cancer, and cardiovascular disease. To save healthcare costs and increase access to necessary medications, governments throughout the Asia-Pacific region are pushing for the use of generics.

By leveraging cost advantages and manufacturing skills, countries such as China and India are leading the way in the production of generic drugs. Further, Lupin acquired Southern Cross Pharma Pty Ltd (SCP), which has its headquarters located in Melbourne, Australia, in July 2021. Generic medication production is SCP's area of expertise for treating a range of ailments.

The LAMEA generic drugs market was valued at USD 57.57 billion in 2024 and is predicted to surpass around USD 146.10 billion by 2034. Latin America's market development will be positively influenced by the necessity for sustainable healthcare and healthcare spending. For example, in March 2021, Biocon collaborated with Libbs Farmaceutica to introduce its generic pharmaceuticals in Brazil. Through this collaboration, the market is expected to expand and these generic medicines will become more affordable and accessible.

Pharmaceutical prices and industry are heavily regulated by governments in the Middle East. Saudi Arabia, for instance, is aiming to diversify its economy and reduce healthcare expenditures by encouraging the production of generic pharmaceuticals locally. Thus, it is anticipated that the generics market in LAMEA will continue to expand, as a result of the rising prevalence of diseases such as diabetes, cardiovascular disease, and cancer, as well as lifestyle changes.

The major players follow a strategy where they seek regulatory approvals for their products and sign contracts and agreements to expand their reach. In May 2023, Ginkgo Bioworks and Centrient Pharmaceuticals announced an expansion of their partnership after the success of their first project to introduce sustainable innovations in the generic API space. In February 2023, the US FDA approved Sun Pharma's generic Lenidomide capsules, 2.5 mg, 20 mg, and provisional approval for 10 mg, 15 mg, and 25 mg. Revlimid capsules, 5 mg, 10 mg, 15 mg, 25 mg, and 2.5 mg, 20 mg will be used as the reference product for each product approval.

CEO Statements

Chip Davis, President and CEO of GPhA:

"Generic drugs have saved the healthcare system."

Steve Collis, Chairman & CEO of Cencora:

"In recognizing the tremendous care benefits of pharmaceuticals, it becomes evident that choosing a drug over hospitalization or physician visits makes practical sense, let’s not overlook the invaluable advantages pharmaceuticals offer and preserve these benefits.."

Key players in the generic drugs market are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the generic drugs market include:

These advancements mark a notable expansion in the generic drugs market, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Type

By Brand

By Route of Administration

By Application

By Distribution Channel

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Generic Drugs

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Brand Overview

2.2.3 By Route of Administration Overview

2.2.4 By Application Overview

2.2.5 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Generic Drugs Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Government Initiatives and Policies

4.1.1.2 Growing Physician Demand

4.1.2 Market Restraints

4.1.2.1 Product Recalls

4.1.2.2 Manufacturing Complex Generics

4.1.3 Market Opportunity

4.1.3.1 New Market Expansion in Africa

4.1.3.2 Growing continuous investments

4.1.4 Market Challenges

4.1.4.1 Quality and Safety Concerns

4.1.4.2 Increases In Drug Shortages

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Generic Drugs Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Generic Drugs Market, By Type

6.1 Global Generic Drugs Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Simple Generics

6.1.1.2 Super Generics

Chapter 7 Generic Drugs Market, By Brand

7.1 Global Generic Drugs Market Snapshot, By Brand

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Pure Generic Drugs

7.1.1.2 Branded Generic Drugs

Chapter 8 Generic Drugs Market, By Route of Administration

8.1 Global Generic Drugs Market Snapshot, By Route of Administration

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Oral

8.1.1.2 Injectable

8.1.1.3 Subcutaneous

8.1.1.4 Others

Chapter 9 Generic Drugs Market, By Application

9.1 Global Generic Drugs Market Snapshot, By Application

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Cardiovascular

9.1.1.2 Oncology

9.1.1.3 Infectious Disease

9.1.1.4 Central Nervous System (CNS)

9.1.1.5 Respiratory

9.1.1.6 Others

Chapter 10 Generic Drugs Market, By Distribution Channel

10.1 Global Generic Drugs Market Snapshot, By Distribution Channel

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

10.1.1.1 Hospital Pharmacy

10.1.1.2 Retail Pharmacy

10.1.1.3 Online Pharmacy

Chapter 11 Generic Drugs Market, By Region

11.1 Overview

11.2 Generic Drugs Market Revenue Share, By Region 2023 (%)

11.3 Global Generic Drugs Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Generic Drugs Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Generic Drugs Market, By Country

11.5.4 UK

11.5.4.1 UK Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Generic Drugs Market, By Country

11.6.4 China

11.6.4.1 China Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Generic Drugs Market, By Country

11.7.4 GCC

11.7.4.1 GCC Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Generic Drugs Market Revenue, 2021-2033 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2021-2023

12.1.3 Competitive Analysis By Revenue, 2021-2023

12.2 Recent Developments by the Market Contributors (2023)

Chapter 13 Company Profiles

13.1 Mylan N.V.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Abbott Laboratories

13.3 ALLERGAN

13.4 Teva Pharmaceutical Industries Ltd.

13.5 Eli Lilly and Company

13.6 Viatris Inc.

13.7 Sun Pharmaceutical Industries Ltd.

13.8 STADA Arzneimittel AG

13.9 GlaxoSmithKline Plc.

13.10 Baxter International Inc.