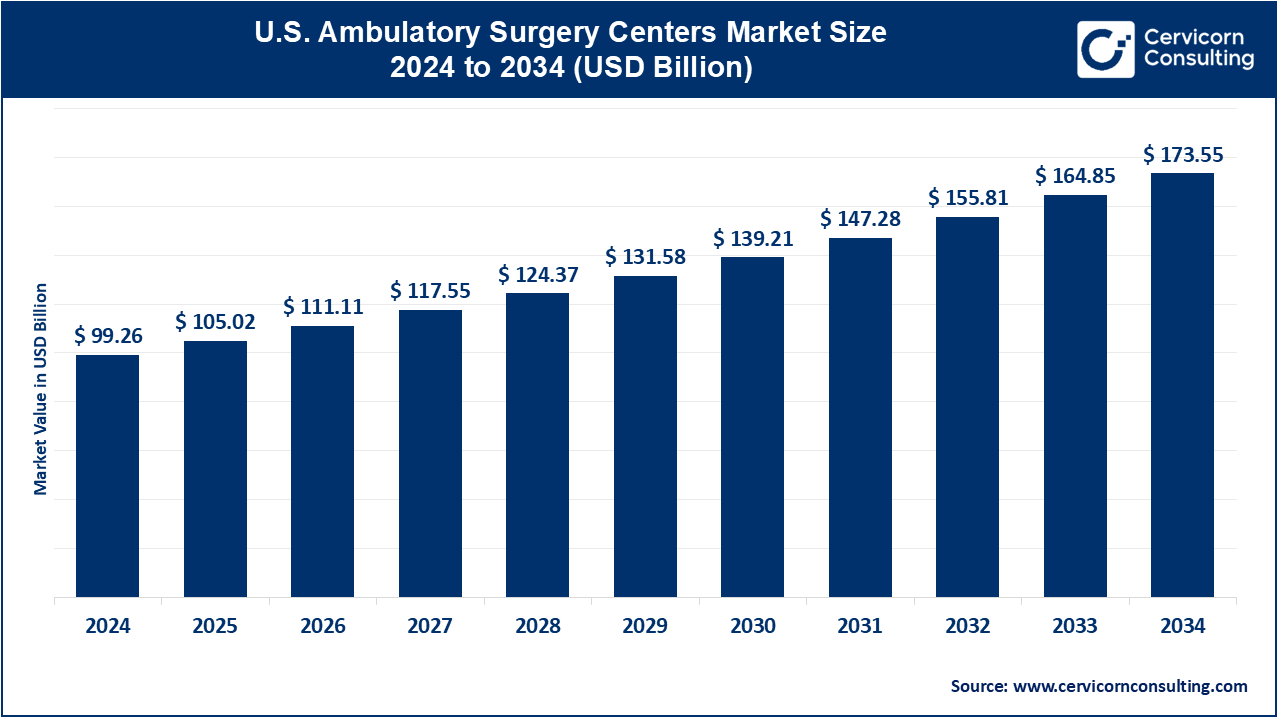

The U.S. ambulatory surgery centers market size was valued at USD 99.26 billion in 2024 and is expected to be worth around USD 173.55 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.75% from 2025 to 2034. The U.S. ambulatory surgery center (ASC) market has experienced rapid expansion, driven by increasing demand for ambulatory surgery, technological advancements in healthcare and healthcare cost containment.

The ambulatory surgery centers market in U.S. is growing owing to the increasing popularity of inpatient surgery services performed in an outpatient setting, along with the availability of reasonably priced healthcare options. ASCs optimize operations and deliver outpatient surgical procedures which do not require the admission of beneficiaries into the hospital, thereby decreasing recovery duration for patients.

Other drivers of the market include continuous developments in surgery instruments, the increasing prevalence of various ailments, and the transitioning paradigm of care seeking from volume to value. Furthermore, ASCs in such a case are preferred by the patients and the insurance companies as they are much cheaper than staying in a conventional hospital. More and more, improvement of clinical and economic performance are placed by health care providers above all other aspects and therefore the anti-market degree is expected to grow.

Why ambulatory surgery centers?

Ambulatory surgery centers (ASCs) is a type of specialized healthcare facilities excluded from hospital care but willing to offer day surgery for outpatient convenience patterns. Day surgery centers are capable of undertaking diverse ranges of surgery which include acute trauma services to orthopaedic, ocular, GI, and even cosmetic procedures. The ASCs present several patients benefits such as lesser time to undergo the procedure, reduced probability of acquiring infections and cheaper costs for the patients and also the system. Emphasizing and narrowing the scope of services blurs the boundaries of health services and enhances patient satisfaction. The ASC enrolment trend has increased following the positive evolution of multiple disciplines of medicine that allow executing major interventions in less elaborate ways as well shifting general fundamentals of the industry towards value.

ASCs are specialty outpatient surgical facilities that provide patients with the convenience of having surgeries and procedures performed safely outside the hospital setting with better quality outcomes and more cost savings. The continued expansion of minimally invasive surgeries procedures which require less down time, are less risky compared to traditional open operations, and older population trend, continuing rise in healthcare costs as well as growth in high deductible insurance plans have all combined to contribute to industry growth.

ASCs deliver care at a lower cost than hospitals do so both insurance companies as well as consumers benefiting from out-of-pocket exposure find this option extremely appealing especially given the combination of higher deductibles becoming the norm across all forms of health insurance coverage for nearly everyone over the next year or two/plus tele-health trending and rapid advances of robotic aided technology using imagery have spurred incremental growth.

Rising Demand for Outpatient Procedures

More and more patients are opting for outpatient surgery because it is more convenient, they recover faster, and it is more cost effective in comparison to being admitted to a hospital. The development of medical technologies, for example, minimally invasive strategies, allows the performance of complex operations in outpatient settings, requiring no hospitalization for long periods.

Shifting Healthcare Policies

The emergence of new healthcare policies emphasized on cost control and improving patient care is stimulating the expansion of the U.S. Ambulatory Surgery Centers (ASC) market. So, both policymakers and health practitioners are paying more attention to the value-based dimension of care which focuses on improving medical service delivery at the least possible price. Today, a large number of surgical procedures are performed at ASCs because it is less expensive than a hospital and provides the same standard of surgical care.

There are also changes in reimbursement policies for the use of ASCs, such as the expansion of Medicare coverage for outpatient procedures. This regulatory change has led to the transfer of more operations out of the hospital and into ASCs, adding to the growth of the market and meeting the overall efficiency objectives in healthcare delivery.

Rising Healthcare Costs

The increasing operational costs is expected to boost the growth of the Ambulatory center surgery market in the United States as both the patients and their insurers search for alternatives to the hospital surgeries that are less expensive. AKIN – Conventional ASCs reduce the costs incurred in the surgical care provision without compromising the quality; hence patients are able to receive affordable treatments.

ASCs have gained increasing attraction from insurance companies, employers, and patients that wish to minimize out of pocket or health plan expenditures without compromising access to care as health care costs keep escalating especially for procedures performed in inpatient settings. The clear-view prices and practicability of ASCs also add to their attractiveness, ensuring that ASCs are the most preferred facilities for conducting outpatient surgeries, thus propelling penetration into the market-heightened price sensitivity in making health care decisions.

Access to Care

Improved access to care is expected to drive the growth of the U.S. Ambulatory Surgery Centers (ASC) market during the forecast period. With more people covered by insurance like Medicaid and other reform measures, there is high desire for inexpensive surgical options that can be accessed easily.

The growing urgent need for affordable surgical options at the community level is met by ASCs that offer surgery as an alternative to that of hospitals and more often in areas outside cities where specialty healthcare is absentee. Also, the availability of lower pricing and the possibility of convenient time scheduling in ASCs are considered attractive to the both insured and uninsured people. Focusing on providing outpatient procedures and increasing access to medical care, ASCs are providing a solution to the increasing demand for medical services while alleviating the load on hospitals which fuels the growth of the market.

Aging Population

Since the geriatric population generally have a higher rate of diseases which makes them seek surgical interventions more frequently which is expected to propel the growth of the ambulatory surgery centers market in U.S. The baby boomer generation is getting older and therefore will be in a high prevalence of diseases that are age-related like cataracts, joint problems and cardio vascular ones a lot of which will be treated by day care surgery in ASCs.

The centers offer a quick and satisfactory alternative to those elderly patients who usually do not want prolonged recovery and more extended type of treatment. In addition, due to the technological progress in surgery, more complicated and invasive procedures can be done in an outpatient department safely, considering the rising amount of the elderly population that requires more care. This decision further suggests that the demand for ASCs will be fueled by the changes in demographic structure that later becomes a fundamental aspect of the entire system of health care delivery in dealing with the increase in aging-related issue.

Increased Adoption of Minimally Invasive Procedures

The development of new surgical technologies such as laparoscopy, robotic surgery and imaging, has facilitated the execution of clinical procedures that require deeper access using smaller incisions, thereby enhancing the recovery period, minimizing pain and reducing complications. It is specifically these procedures that are best performed in an ASC because these patients require outpatient care, thus presenting an alternative to the patients that is more effective and less expensive than traditional hospitals.

In ASCs, where such operative strategies are employed, the time spent in surgery is considerably less, thus, more patients can be managed in a given period. With both the patients and the healthcare providers being incline towards less invasive procedures, the need for such most procedures centers performing these operations is likely to increase erecting growth in the market.

Growth in Specialization

The rise in specialization is expected to boost the growth of the U.S. Ambulatory Surgery Centers (ASC) market since more centers become oriented towards certain surgical specialties such as orthopaedics, ophthalmology, gastroenterology, and urology Specialization is primarily driven by the competitive markets. Focusing on specific areas enables the ASCs to provide very advanced treatment to the patients who are in search for advanced treatment recommendations and expert surgeons.

The quality as well as the precision of the surgical care is not only improved but also operational efficiency is enhanced because workforce and supplies are aimed at relatively fewer procedures. This focus enables the ASCs to optimize clinical outcomes, minimize the complications, and enhance patient’s satisfaction. With rising demand for outpatient procedures, particularly cataract as well as joint replacement, which require specialized services, the formation of focused ASCs is likely to increase further fuelling the growth of the market and the innovation aspects.

Expanding Medicare Coverage

Medicare has broadened its coverage to many of the surgeries that can be safely done in ASCs, including joint replacements, cardiovascular procedures, and cataract surgeries. This has opened ASCs up to a larger portion of the healthcare market as it makes these facilities more available and closer to the elderly populations which largely constitute this market.

Medicare again is planning to spend less on reimbursement for patients receiving care and treatment in a hospital setting after surgery, by encouraging more surgeries to be done in ASCs. This not only increases patient volume but also allows for market growth overall since this direction of Medicare’s action aligns insurers and providers with what is considered affordable care for an outpatient setting.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 105.02 Billion |

| Market Size by 2034 | USD 173.55 Billion |

| Growth Rate (2025 to 2034) | 5.75% |

| Key Segments | Type, Ownership, Application, Popilation, Type, Specialty, Device Type |

| Key Companies | Medical Facilities Corporation, Constitution Surgery Alliance, Covenant Physician Partners, Inc., Physicians Endoscopy, LLC, HCA Healthcare, Surgical Care Affiliates, SurgCenter, TH Medical, AMSURG (Kohlberg Kravis Roberts & Co. L.P.), Surgery Partners |

Increasing Demand for Outpatient Surgeries

Technological Advancements

Staffing Shortages

Regulatory Challenges

Telehealth Integration

Advancements in Feedstock Utilization

Regulatory Compliance and Standards

Limited Procedure Scope

Single-Specialty

The single-specialty segment has dominated the market in 2024, accounted for 61.43%. Single-specialty ASCs are health facilities that provide specialty surgical care in a specific medical field such as ophthalmology, orthopaedics, gastroenterology, or urology. By virtue of their efficiency in specialization, they can streamline operations, enhance productivity, and offer excellent services specifically in them of treatment.

Concentrating on a particular type of surgery enables the single-specialty ASCs to perfectly allocate their resources, staff expertise, and surgical techniques, so such benefit the patient and the patient get more quickly improve. This diverse strategy also enables more patients to come, lowers costs, and increases their satisfaction. This is because they are likely to come to specialized centers for their particular medical needs.

Multi-Specialty

The multi-specialty segment has accounted revenue share of 38.57%. Multi-specialty ASCs provide services related to surgery in the medical field of orthopaedics, ophthalmology, gastroenterology, general surgery, and multi-specialty centers within one facility. The steadiest flow of preference from both healthcare providers and patients is directed toward these centers because of the ease of obtaining various types of surgeries at one site.

Multi-specialty ASCs, wherein a more diversified range of specialties is added, stand a better chance at attractive markets with wider patient bases and referral networks, and from better maximization of their staff and resources. Because of this high flexibility, these multi-specialty ASCs can easily ride out fluctuations in any market environment because they are not dependent on the rise of any one particular procedure type. Multi-specialty centers work with a greater number of insurance plans and payers; hence, they have more potential for revenue.

Physician-Owned

The physician-owned segment has held dominant position and accounted for 62.30% in 2024. Physician-owned ASCs are rather those ambulatory surgery centers that are run and administered by those usually having their share of ownership intertwined with other medical partners of the centre. This model hands over the control of various operations, including scheduling, staffing, and even the choice of surgical procedures, into the hands of the physicians; hence, the care is very patient-centric. The ownership by physicians usually results in better surgeon cooperation to develop more specialized protocols and streamline processes to meet the specific needs of their practices. Apart from this advantage, these centers operate at relatively lower costs concerning overhead; thus, such a situation is quite attractive to patients as well as many payers.

Hospital-Owned

The hospital-owned segment has accounted revenue share of 13.20% in 2024. These surgical facilities are, in essence, a part of a larger hospital system and, thus, derive the benefits and infrastructural support of their parent institutions while delivering ambulatory surgical services. They perform a large clientele of diversified surgical procedures, mostly with the support of sophisticated technology available at the hospital, specialized staff, and complete support in taking care of the patients. As a result, a shift in patient piloting from different levels of care may be worthwhile with the continuity of care by integrating inpatient capabilities with ambulatory services within hospital-owned ASCs.

At times, most of these centers have, in fact, a greater availability of specialist referrals over an otherwise open market and very often rely on the centers to constantly feed them with a number of referrals from their physician community.

Corporate-Owned

The corporate-owned segment has generated revenue share of 24.50% in 2024. Corporate-owned ASCs with selective suppliers and only certain procedures! While a smaller patient base per location may seem inherently negative, these centers benefit from economies of scale enabling streamlined processes and standardized protocols as well as pooling resources across multiple sites. This includes the availability of capital for investment in new technology, marketing and training of staff which are important in order to improve the financial status of ASCs.

Moreover, corporate-owned ASCs stands to enjoy the operational management, regulatory compliance, insurance negotiation acumen of an experienced parent company having potential for higher reimbursement rates and less administrative overhead. By contrast, these models are not always able to deliver the personalized care that patients value and deserve as the corporatization of medicine can hinder this type of patient experience in favour of profitability.

Surgical Supplies

The surgical services segment has held dominant position and accounted revenue share of 75.70% in 2024. Surgical Services In the country, Surgical Services is provided in one of the most modern outpatient ambulatory surgery centers or ASCs. These are special types of centers providing a variety of day-care surgical procedures where the patient comes in for surgery but does not stay in overnight. These centers concentrate on delivering effective services in different branches of practice such as orthopaedics, ophthalmology, gastroenterology, plastic surgery, and many others among other operations performed within the centers these days. With modern and improved ways of performing surgery e.g. minimal invasive ways, ambulatory surgery centers aims at faster recovery times, less pain so much fewer chances of complications or infections, and the advantages of healthcare services are even additional to the patients.

ASC model emphasizes efficiency and patient care which lowers spends when compared to a hospital-based model but also increases patient volumes. But for ASCs to be able to avoid stagnating growth and operational performance, there is a need to address certain growth inhibitors including a regulatory environment, shortages in workforce and competition from hospital-based ASC’s.

Diagnostic Service

The diagnostic services segment has captured 24.30% of the total revenue share in 2024. The diagnostic services in ASCs include an extensive laundry list of diagnostic procedures apart from the surgical procedures performed within an outpatient setting. This allows completion of treatment in one visit. They allow the patient to undergo various diagnostic procedures like imaging, laboratory tests, and endoscopic investigations before the pertinent surgery takes place. In this way, the new model decreases the number of necessary follow-up appointments of the patients, thus increasing their comfort and iOS improving. The decisions on treatment strategies can also be taken in a shorter time.

ASCs enhance patient verticality and waiting times for the patients within the establishment by providing the diagnosis services at the same venue such and this translates to better outcomes and experience for the patients.

New entrants are disrupting the U.S. Ambulatory Surgery Centers (ASC) landscape with business models based on collaborations, capital intensive technologies and portfolio expansion activities. Many of the ASC joint ventures that new players have entered into reported affiliations with hospitals, health systems or insurers indicating a strategic decision to increase patient pool by collaborating with entity within larger healthcare system and leveraging their resources and optimizing network. Start-ups and corporate giants in healthcare space also ventured into ASC market to capitalize on growing interest in outpatient department by introducing applications based on latest medical technologies including AI-enhanced diagnoses systems, robotic surgery applications or virtual telemedicine consultations to drive efficiency pre- post-surgery care.

CEO Statements

Here are some recent CEO statements from key players in the U.S. Ambulatory Surgery Centers Market

Joan Dentler, president and CEO of Avanza Healthcare Strategies

“Payer pressures and other market forces have softened hospitals’ historically defensive posture toward ASCs, paving the way for overall growth, lower operating costs, and heightened patient satisfaction,”

Key players in the U.S. Ambulatory Surgery Centers Market have implemented diverse strategic initiatives to ensure continued growth, including mergers, collaborations, product development, and regional expansions. The recent surge in environmental regulations and the push for sustainable energy sources have driven significant changes in the market. Companies are now focusing on innovative technologies and expanding their production capacities to meet the growing demand for Ambulatory Surgery Centers. Some notable examples of key developments in the U.S. Ambulatory Surgery Centers Market include:

These strategic developments highlight a trend toward consolidation and technological innovation within the U.S. Ambulatory Surgery Centers Market. Companies are broadening their service offerings and leveraging advanced technologies to enhance production efficiency and expand their market presence.

Market Segmentation

By Type

By Ownership

By Application

By Population Type

By Specialty

By Device Type

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of U.S. Ambulatory Surgery Centers

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Ownership Overview

2.2.3 By Application Overview

2.2.4 By Population Type Overview

2.2.5 By Specialty Overview

2.2.6 By Device Type Overview

2.3 Competitive Overview

Chapter 3 Impact Analysis

3.1 COVID 19 Impact on U.S. Ambulatory Surgery Centers Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Market Implications

3.3 Regulatory and Policy Changes Impacting Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Demand for Outpatient Surgeries

4.1.1.2 Technological Advancements

4.1.2 Market Restraints

4.1.2.1 Staffing Shortages

4.1.2.2 Regulatory Challenges

4.1.3 Market Opportunity

4.1.3.1 Telehealth Integration

4.1.3.2 Advancements in Feedstock Utilization

4.1.4 Market Challenges

4.1.4.1 Regulatory Compliance and Standards

4.1.4.2 Limited Procedure Scope

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 U.S. Ambulatory Surgery Centers Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 U.S. Ambulatory Surgery Centers Market, By Type

6.1 U.S. Ambulatory Surgery Centers Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Multi-Specialty

6.1.1.2 Single-Specialty

Chapter 7 U.S. Ambulatory Surgery Centers Market, By Ownership

7.1 U.S. Ambulatory Surgery Centers Market Snapshot, By Ownership

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Corporate-Owned

7.1.1.2 Hospital-Owned

7.1.1.3 Physician-Owned

Chapter 8 U.S. Ambulatory Surgery Centers Market, By Application

8.1 U.S. Ambulatory Surgery Centers Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Surgical Services

8.1.1.2 Diagnostics Services

Chapter 9 U.S. Ambulatory Surgery Centers Market, By Population Type

9.1 U.S. Ambulatory Surgery Centers Market Snapshot, By Population Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Children

9.1.1.2 Adults

Chapter 10 U.S. Ambulatory Surgery Centers Market, By Specialty

10.1 U.S. Ambulatory Surgery Centers Market Snapshot, By Specialty

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Orthopedics

10.1.1.2 Pain Management/Spinal Injections

10.1.1.3 Gastroenterology

10.1.1.4 Ophthalmology

10.1.1.5 Plastic Surgery

10.1.1.6 Otolaryngology

10.1.1.7 Obstetrics/Gynecology

10.1.1.8 Dental

10.1.1.9 Podiatry

10.1.1.10 Cardiology

10.1.1.11 Respiratory

10.1.1.12 Others

Chapter 11 U.S. Ambulatory Surgery Centers Market, By Device Type

11.1 U.S. Ambulatory Surgery Centers Market Snapshot, By Device Type

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Orthopedic

11.1.1.2 Gastroenterology

11.1.1.3 Ophthalmology

11.1.1.4 Dermatology

11.1.1.5 Pain Management

11.1.1.6 Cardiology

11.1.1.7 Respiratory

11.1.1.8 Others

Chapter 12 U.S. Ambulatory Surgery Centers Market, By Region

12.1 Overview

12.2 U.S. Ambulatory Surgery Centers Market Revenue Share, By Region 2024 (%)

12.3 U.S. Ambulatory Surgery Centers Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America U.S. Ambulatory Surgery Centers Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe U.S. Ambulatory Surgery Centers Market, By Country

12.5.4 UK

12.5.4.1 UK U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UK Market Segmental Analysis

12.5.5 France

12.5.5.1 France U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 France Market Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 Germany Market Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of Europe Market Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific U.S. Ambulatory Surgery Centers Market, By Country

12.6.4 China

12.6.4.1 China U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 China Market Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 Japan Market Segmental Analysis

12.6.6 India

12.6.6.1 India U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 India Market Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 Australia Market Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia Pacific Market Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA U.S. Ambulatory Surgery Centers Market, By Country

12.7.4 GCC

12.7.4.1 GCC U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCC Market Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 Africa Market Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 Brazil Market Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA U.S. Ambulatory Surgery Centers Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 13 Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14 Company Profiles

14.1 Medical Facilities Corporation

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Constitution Surgery Alliance

14.3 Covenant Physician Partners, Inc.

14.4 Physicians Endoscopy, LLC

14.5 HCA Healthcare

14.6 Surgical Care Affiliates

14.7 SurgCenter

14.8 TH Medical

14.9 AMSURG (Kohlberg Kravis Roberts & Co. L.P.)

14.10 Surgery Partners