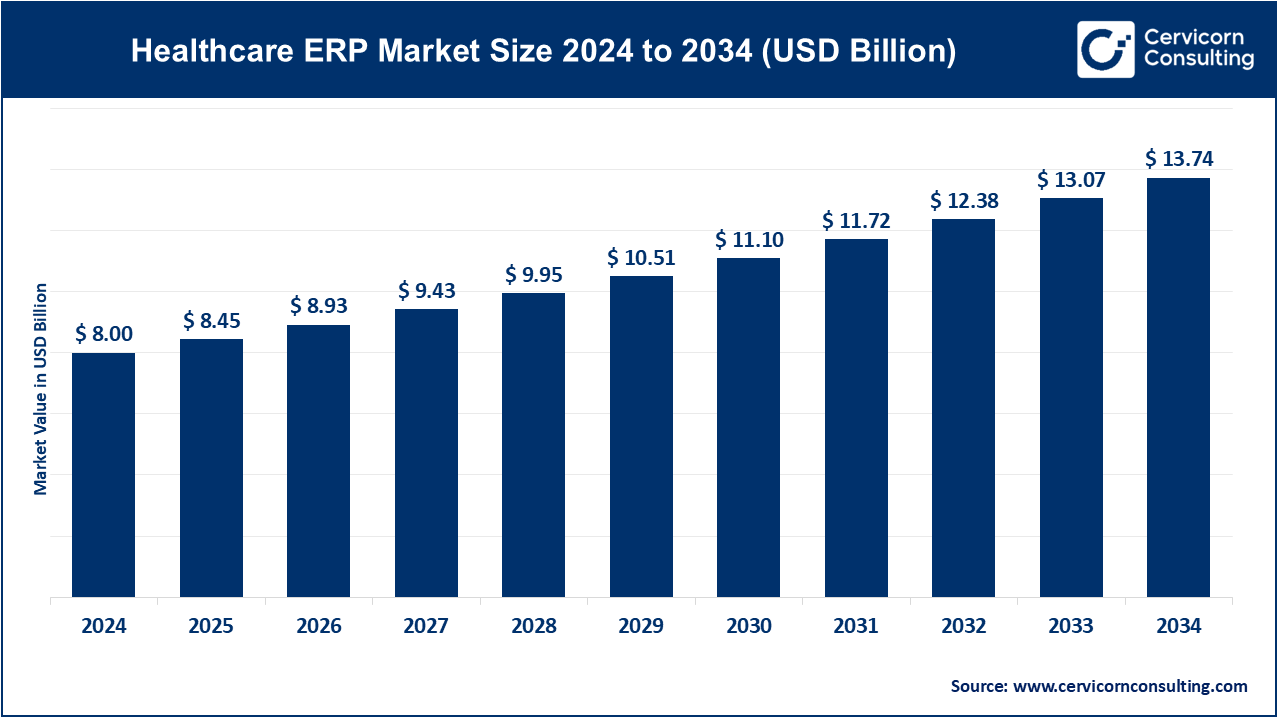

The global healthcare ERP market size was valued at USD 8 billion in 2024 and is projected to hit around USD 13.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.56% from 2025 to 2034.

The healthcare ERP market is witnessing steady growth as healthcare providers increasingly prioritize operational efficiency and data-driven decision-making. The rising adoption of electronic health records (EHRs) and the growing need to manage complex administrative tasks have made ERP systems a critical investment for hospitals, clinics, and diagnostic centers. Furthermore, governments worldwide are encouraging healthcare institutions to embrace digital transformation, which is driving demand for ERP solutions. Regionally, North America leads the market due to its advanced healthcare infrastructure and early adoption of technology, while Europe follows closely with strong government support for healthcare IT. Moreover, the shift toward cloud-based ERP systems is enhancing accessibility and scalability, making ERP solutions more attractive to small and medium-sized healthcare organizations globally. In June 2024, healthcare software firm Waystar, which aids hospitals and doctors in financial management, raised USD 968 million in its initial public offering (IPO), valuing the company at USD 3.69 billion. This move underscores the growing investor interest in healthcare ERP and related software solutions.

Healthcare ERP (Enterprise Resource Planning) is a software system designed to streamline and integrate various administrative, financial, and operational processes within healthcare organizations. It combines functions like patient records, inventory management, staff scheduling, billing, compliance tracking, and procurement into a unified platform. This ensures better communication between departments, reduces manual errors, and enhances overall efficiency. For example, a healthcare ERP can automate patient admissions, track medical supplies, and manage staff payroll simultaneously, allowing administrators to focus on improving patient care. By centralizing data and providing real-time analytics, healthcare ERP helps hospitals and clinics make data-driven decisions, optimize resource allocation, and maintain compliance with healthcare regulations.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.45 Billion |

| Estimated Market Size (2034) | USD 13.74 Billion |

| Growth Rate (2025 to 2034) | 5.56% |

| Dominating Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Function, Deployment, End User, Region |

| Key Companies | Microsoft Corporation, Oracle Corporation, SAP SE, Allscripts Healthcare Solutions, Inc., Sage Group Plc., Cerner Corporation, Infor, Inc., GE Healthcare, Odoo, QAD, Inc., Aptean, Epicor Software Corporation, ZEUS Systems Pvt. Ltd., DXC Technology, Epic Systems Corporation, Meditech, NextGen Healthcare, Inc., Carestream Health, Athenahealth, Inc., eClinicalWorks, Netsmart Technologies, Inc., NTT DATA Corporation |

Improved Scalability and Data Protection

Integrating Technologies with ERP

High Cost Associated with Implementation and Maintenance

Regulatory Compliance

Increasing Personalization

Increasing Usage of Predictive Analytics

Data Integration and Interoperability

Resistance to Change

The healthcare ERP market is segmented into function, deployment, end-user and region. Based on function, the market is classified into supply chain & logistics, finance & billing, inventory management, patient relationship management, and others. Based on deployment, the market is classified into on-premise, and cloud. Based on end-user, the market is classified into hospitals, clinics, and others.

Supply Chain & Logistics

The Supply Chain & Logistics segment has accounted revenue share of around 24.81% in 2024. The healthcare industry supply chain system operates behind the scenes in most healthcare systems. The responsibilities of a supply chain team in a healthcare system or hospital encompass a wide range of activities from strategic to tactical and require coordination with internal and external stakeholders. ERP plays a vital role in tying together the sources of supply and demand and controlling the movement of goods to guarantee the effective management of a business's supply chain. ERP systems help businesses reduce supply chain risks, improve supply chain monitoring with real-time data, and forecast and plan demand more effectively.

Finance & Billing

The finance & billion segment has dominated the market and accounted revenue share of 38.64% in 2024. Any healthcare organization is required to maintain a proper financial and billing section for taxes and transactions. Some of the financial processes that are prioritized by the ERP system include financial reporting, invoicing, revenue cycle management, and billing. Healthcare organizations are therefore implementing financial ERP solutions for ensuring accurate financial management, compliance, and cost control, owing to the increasing complexities associated with healthcare reimbursement and financial regulations.

Healthcare ERP Market Revenue Share, By Function, 2024 (%)

| By Function | 2024 (%) |

| Supply Chain & Logistics Management | 24.81% |

| Finance & Billing | 38.64% |

| Inventory and Material Management | 17.70% |

| Patient Relationship Management | 12.50% |

| Others | 6.35% |

Inventory Management

The inventory management segment has captured revenue share of 17.70% in 2024. Medical facilities such as clinics and hospitals can benefit from inventory management solutions that make the tracking and administration of medical supplies, equipment, and prescription drugs easier and more productive. These provide real-time visibility, automation, and data-driven insights for enhancing resource allocation and decision-making beyond the power of making simple spreadsheets. Furthermore, having a suitable process in place can positively impact the healthcare facility, by ensuring the availability of life-saving drugs and preventing stockouts of expensive drugs. This is where ERP systems come into play, providing a robust feature set that goes well beyond just monitoring medications and patches.

Patient Relationship Management

The patient relationship management segment has garnered revenue share of 12.50% in 2024. Merging of patient data from multiple departments into a single database is done with the help of healthcare ERP software, which in turn simplifies patient administration. The ERP system assists healthcare practitioners in reducing duplication and making more informed decisions owing to the access to real-time information. In addition to providing a forum for case discussions, information sharing, and treatment plan coordination, healthcare ERP systems also help physicians, nurses, and administrative staff manage patients more effectively. Hence, this kind of data integration provides a comprehensive approach to ensure the well-being of the patient.

Others

The others segment has captured revenue share of 6.35% in 2024. Clinical operations that include tasks like patient care, electronic medical records, scheduling, and clinical workflows, are addressed by the clinical ERP system. Clinical ERP systems assist healthcare providers to optimize resources and improve operational efficiency and patient outcomes. In the highly competitive healthcare sector implementation of successful sales and marketing strategies is crucial for making money. For this purpose, ERP systems are being used in healthcare organizations that help them stay competitive and thereby attract new clients. The ERP system offers an interface to track ongoing industry trends, sales leads, and marketing campaigns for this reason. Furthermore, human resource management is equally necessary for healthcare organizations to effectively oversee a diverse workforce, which can be achieved by the integration of HR modules into healthcare ERP systems that help in payroll, performance reviews, and employee orientation.

On-Premise

The on-premise segment has leading the market and accounted revenue share of 72% in 2024. An on-premises ERP system is hosted and managed directly using any organization's infrastructure. The on-premise mode of deployment is found to greatly benefit organizations that prioritize compliance, customization, and data security. Aside from these, this method also provides better control over modules and data and runs without requiring an internet connection. Some of the significant upfront expenditures associated with on-premises systems include the cost of hardware and software, installation and maintenance fees, and support. As the systems are managed locally, highly qualified IT staff with specific knowledge are also essential for guaranteeing seamless functioning of the system.

Herbal Extract Market Revenue Share, By Deployment, 2024 (%)

| Deployment | 2024 (%) |

| On-Premise | 72% |

| Cloud | 28% |

Cloud

The flexibility offered by cloud-based ERPs is the among most popular choices made by numerous organizations. Users are authorized to use the software at any time and from any location just by hosting it on their servers and gaining access to it via the Internet. The cloud-based approach cuts down the need for manual intervention by providing automatic updates and dedicated support through the cloud. Furthermore, it was reported that around 70% of healthcare IT professionals had implemented cloud solutions in their organization by 2023, and an additional 20% intend to do so in the future.

Hybrid

The hybrid systems combine the features of both on-premise and cloud solutions. So, if a healthcare facility utilizes the hybrid system it can host and manage some processes on the cloud while handling some processes internally. By doing this, facilities can easily retain any form of sensitive data on-site while taking advantage of cloud computing's flexibility and hosting other documents on the cloud. The cost of maintaining a hybrid ERP solution can fluctuate based on the configuration in the end. Although this method necessitates meticulous preparation, the majority of organizations will encounter no difficulties in realizing its advantages with the assistance of an experienced technology consultant.

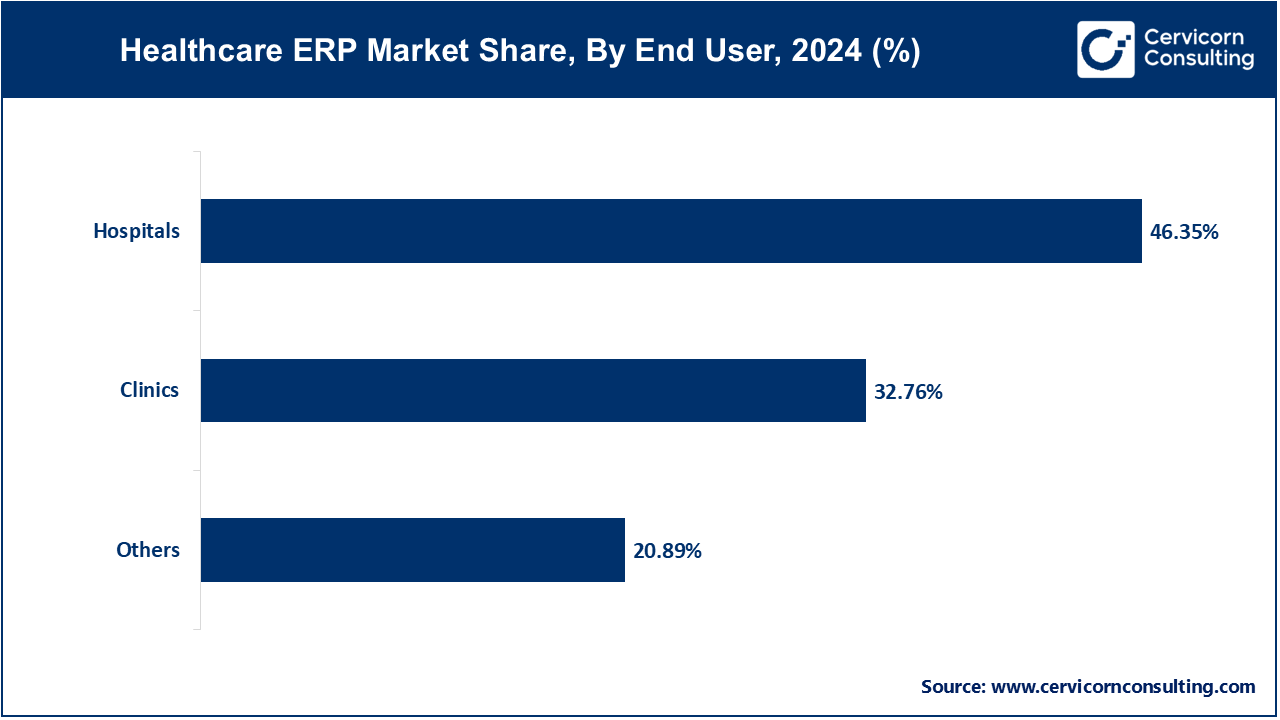

Hospitals

The hospitals segment has dominating the market, accounted revenue share of 46.35% in 2024. Hospitals have found success with the implementation of ERP because they boost output and efficiency, cut expenses, and enhance departmental communication while providing improved financial and operational visibility. ERP systems are modernizing hospitals and are therefore essential in the digital transformation. By facilitating the modernization process, streamlining development, and optimizing the ERP environment, hospitals can achieve improved efficiency and effectiveness overall.

Clinics

The clinics segment has accounted revenue share of 32.76% in 2024. Rapidly increasing commercial activity and increasing use of commercial facilities make commercial waste the fastest-growing market segment. Rising consumer awareness about proper waste disposal and adoption of corporate social responsibility initiatives are also expected to help drive market growth in this segment in the long term.

Others

The others segment has recorded 20.89% of the total revenue share in 2024. Others include life sciences, nursing homes, and pharmaceutical industries. Life sciences organizations operate in a highly regulated environment with changing business models, disruptive technologies, and significant amounts of data. The pace of change is only increasing. In a rapidly changing world, forward-thinking professionals focus on the horizon and the here and now. They anchor their experiences in today's reality while helping healthcare and life sciences organizations innovate and position themselves.

ERP for nursing homes is carefully designed to handle the multifaceted nature of outpatient care, from consultations to diagnostic tests to laboratory and pharmacy services. It deftly manages complicated appointment schedules, accommodates walk-ins, and streamlines billing between different departments. Elderly care service providers can streamline customer care, facility operations, and staff coordination to ensure quality care and effective communication with clients and their families.

ERP pharma software is a robust pharmacy solution that streamlines medical store operations. ERP in pharma facilitates digitization, reduces manual paperwork, and also promotes operational efficiency. The best ERP solutions for pharma companies have insightful analytics that enable informed decisions for saving costs and reducing overheads. Precision in billing, inventory management, patient data, and order processing optimizes the overall performance of the company.

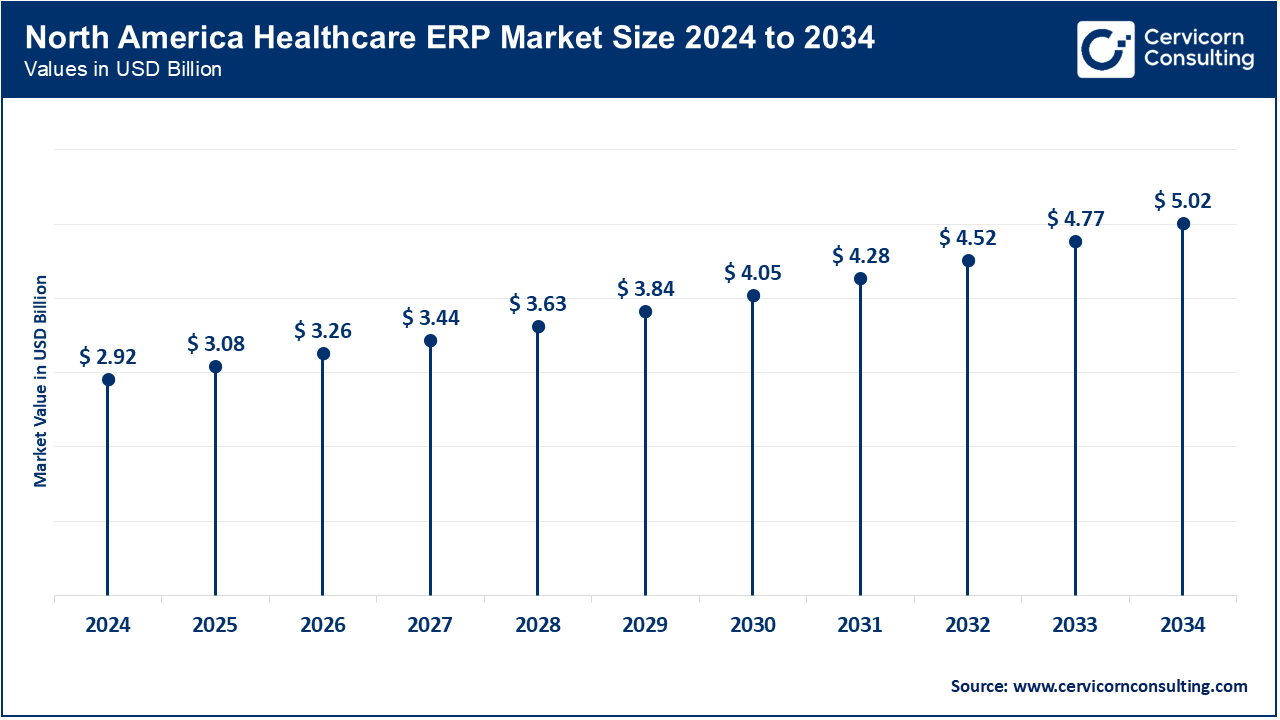

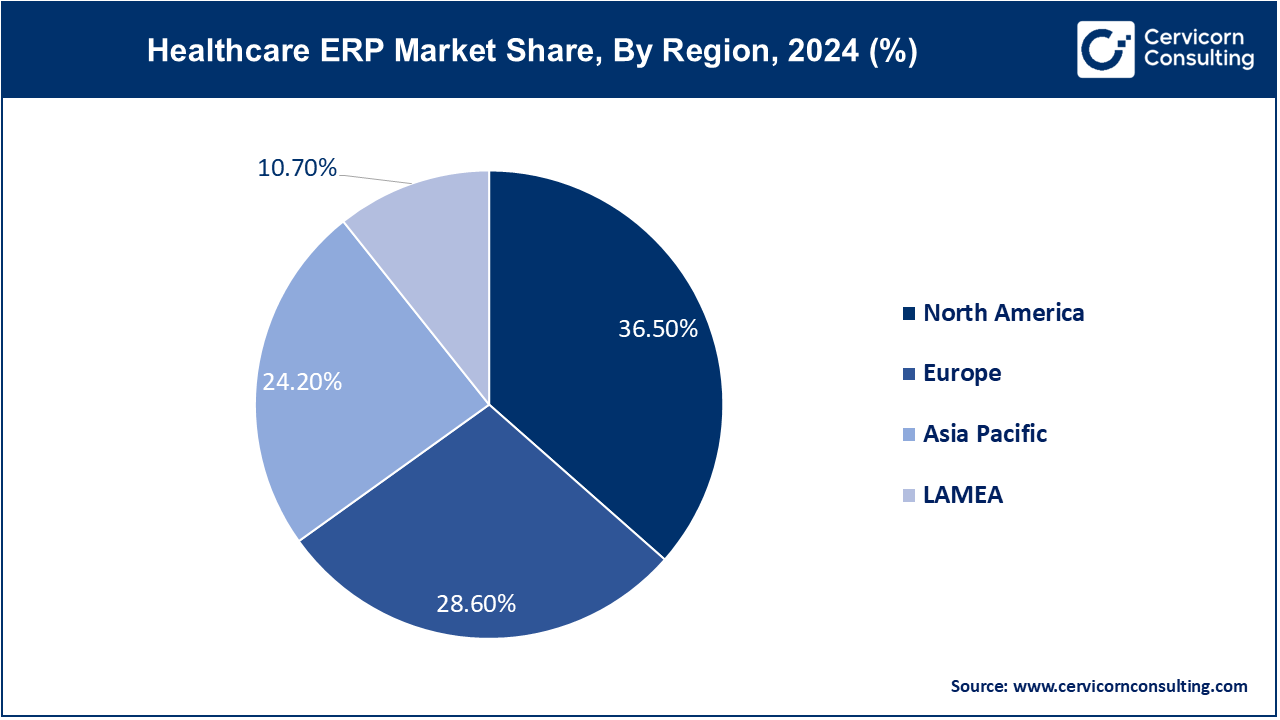

The North America healthcare ERP market size was estimated at USD 2.92 billion in 2024 and is expected to reach around USD 5.02 billion by 2034. Increasing adoption of digital and automated technologies in the North American healthcare sector. Furthermore, the increasing adoption of healthcare services due to the increasing prevalence of diseases and healthcare expenditure has compelled healthcare providers to adopt ERP systems to offer enhanced and personalized services to patients in North America.

Moreover, the government initiatives to promote the adoption of digital technologies to reduce paperwork, maintain a patient database, and improve the speedy delivery of healthcare services have played a crucial role in the growth of the North American healthcare ERP market.

The Europe healthcare ERP market size was valued at USD 2.29 billion in 2024 and is projected to hit around USD 3.93 billion by 2034. The European healthcare tech industry is expanding at an unprecedented rate due to several factors, including regulatory support, technological advancements, and a growing need for creative solutions. As a result, the growing market penetration and accessibility of cloud services for general consumers are anticipated to present significant growth opportunities for the healthcare ERP market in the region.

Additionally, it is also anticipated that the low operational costs of cloud-based healthcare ERP software would motivate healthcare facilities to adopt the solution. Oracle inaugurated a new Health Support Hub in Barcelona in October 2023. With the opening of the new facility in Europe, it would be easy for Oracle to address the requirements of the customers of modernizing their healthcare systems to enhance patient outcomes and care more effectively.

Europe is home to a diverse ecosystem where there are established companies, research institutions, and entrepreneurs who specialize in healthcare technology. Furthermore, countries such as the United Kingdom, Germany, and France are at the forefront of adopting the technology; however, on the other hand, the smaller nations are also making substantial accomplishments in this field.

The Asia-Pacific healthcare ERP market size was accounted for USD 1.94 billion in 2024 and is predicted to surpass around USD 3.33 billion by 2034. The market growth in the Asia Pacific region is due to the increasing government investment in developing digitized and technologically advanced healthcare infrastructure. Moreover, the increasing prevalence of various chronic diseases and the rapidly growing geriatric population is causing the number of patients to increase rapidly. Therefore, to provide prompt and improved care services to patients, the demand for healthcare ERP systems is expected to grow rapidly in Asia Pacific during the forecast period.

The LAMEA healthcare ERP market was valued at USD 0.86 billion in 2024 and is expected to reach around USD 1.47 billion by 2034. Enterprise resource planning (ERP) software is a comprehensive business management software that consolidates the diverse functions of an organization into a single system. Eton Solutions, a cloud-based enterprise resource planning (ERP) platform provider, expanded its global presence in September 2023 by establishing a new office in the United Arab Emirates (UAE). Through this expansion, the goal of Eaton Solutions was to offer cutting-edge solutions to customers across the Middle East.

In addition, governments in the area are also deducing policies that encourage high adoption of technology and at the same time recognize the role of digital infrastructure in economic development. For example, the Dubai Paperless Strategy initiative of the Dubai Government aimed at digitizing all the government processes, which in turn encouraged various businesses and organizations to go digital and implement ERP solutions. In addition, Kenya also found salvation from this technology for numerous of their patients. ERPs have been used in the medical field to improve patient data storage and to connect all the life-saving equipment in hospitals for easy access. Eventually, the incorporation of ERP in healthcare has led to better treatment outcomes and patient care in the region.

Many competitors in the healthcare ERP system industry have made partnerships, agreements, acquisitions, and business expansions their main development strategies to increase the scope of services they offer. In September 2023, Marengo Asia Hospital partnered with Oracle to deploy Oracle ERP, taking advantage of Oracle's all-inclusive support to keep up with technological developments in the healthcare industry.

In June 2023, MedTech Systems integrated an advanced analytics module into its healthcare enterprise resource planning software. This module analyzes large amounts of healthcare data and provides healthcare organizations with actionable insights by using artificial intelligence and machine learning algorithms. The analytics module provides predictive analytics capabilities that enable hospitals and clinics to make data-driven decisions to optimize patient care, allocate resources, and manage costs.

CEO Statements

Satya Nadella, CEO of Microsoft:

"Despite all this rapid change in the computing industry, we are still at the beginning of the digital revolution."

John Case, CEO of Acumatica:

"Coming through the whole COVID wave, people had so much pressure on them with supply chains, inventory management, pricing, and labor shortages. So, a lot of very smart manufacturers realized they can't do things the same way anymore. So that started a whole wave of innovation that was needed."

Key players in the healthcare ERP industry are pivotal in delivering a variety of innovative construction solutions, such as prefabrication techniques, sustainable materials, and advanced digital technologies. Some notable developments in the healthcare ERP sector include:

These advancements mark a notable expansion in the healthcare ERP industry, driven by strategic acquisitions and innovative projects. The focus is on boosting sustainability, enhancing construction efficiency, and broadening product offerings to meet diverse building needs.

Market Segmentation

By Function

By Deployment

By End-User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Healthcare ERP

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Function Overview

2.2.2 By Deployment Overview

2.2.3 By End-User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Healthcare ERP Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Driver 1

4.1.1.2 Driver 2

4.1.2 Market Restraints

4.1.2.1 Restraint 1

4.1.2.2 Restraint 2

4.1.3 Market Opportunity

4.1.3.1 Opportunity 1

4.1.3.2 Opportunity 2

4.1.4 Market Challenges

4.1.4.1 Challenge 1

4.1.4.2 Challenge 2

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Healthcare ERP Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Healthcare ERP Market, By Function

6.1 Global Healthcare ERP Market Snapshot, By Function

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Supply Chain & Logistics

6.1.1.2 Finance & Billing

6.1.1.3 Inventory Management

6.1.1.4 Patient Relationship Management

6.1.1.5 Others

Chapter 7 Healthcare ERP Market, By Deployment

7.1 Global Healthcare ERP Market Snapshot, By Deployment

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 On-Premise

7.1.1.2 Cloud

Chapter 8 Healthcare ERP Market, By End-User

8.1 Global Healthcare ERP Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospitals

8.1.1.2 Clinics

8.1.1.3 Others

Chapter 9 Healthcare ERP Market, By Region

9.1 Overview

9.2 Healthcare ERP Market Revenue Share, By Region 2024 (%)

9.3 Global Healthcare ERP Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Healthcare ERP Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Healthcare ERP Market, By Country

9.5.4 UK

9.5.4.1 UK Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UK Market Segmental Analysis

9.5.5 France

9.5.5.1 France Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 France Market Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 Germany Market Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of Europe Market Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Healthcare ERP Market, By Country

9.6.4 China

9.6.4.1 China Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 China Market Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 Japan Market Segmental Analysis

9.6.6 India

9.6.6.1 India Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 India Market Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 Australia Market Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia Pacific Market Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Healthcare ERP Market, By Country

9.7.4 GCC

9.7.4.1 GCC Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCC Market Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 Africa Market Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 Brazil Market Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Healthcare ERP Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 10 Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11 Company Profiles

11.1 Microsoft Corporation

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Oracle Corporation

11.3 SAP SE

11.4 Allscripts Healthcare Solutions, Inc.

11.5 Sage Group Plc.

11.6 Cerner Corporation

11.7 Infor, Inc.

11.8 GE Healthcare

11.9 Odoo

11.10 QAD, Inc.