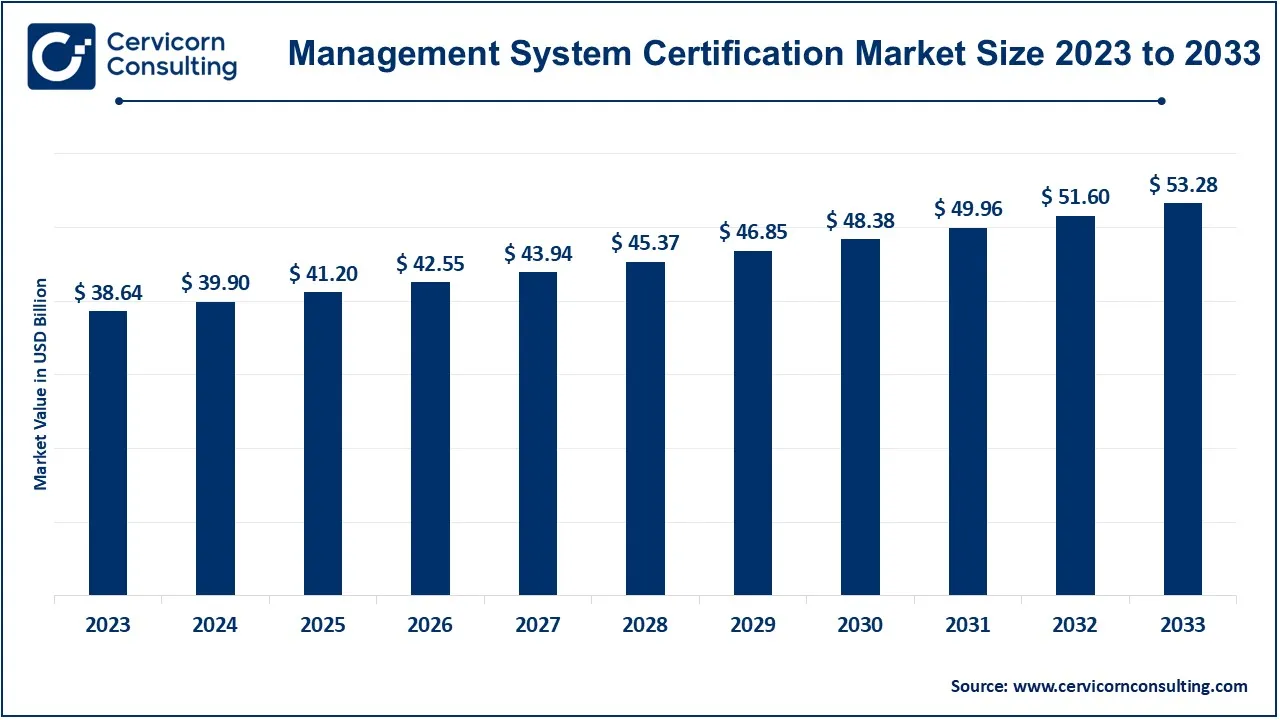

The global management system certification market size was valued at USD 39.9 billion in 2024 and is expected to be worth around USD 53.28 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2033.

The management system certifications market has been growing steadily due to increasing awareness of the importance of standardized management practices. As businesses around the world recognize the benefits of implementing structured systems to meet industry-specific requirements and improve overall performance, the demand for these certifications has surged. For example, in sectors like manufacturing, healthcare, and technology, companies seek these certifications to gain a competitive edge, improve customer satisfaction, and enhance operational effectiveness. In the future, the market for management system certifications is expected to expand further, driven by the growing need for regulatory compliance, risk management, and sustainability. Organizations are increasingly adopting certifications related to environmental and social governance (ESG), which are becoming crucial in a market that values corporate responsibility. In countries like Japan, China, and South Korea, the adoption of ISO certifications is growing, with China being one of the largest adopters of ISO 9001 and 14001 in the past decade.

A management system certification is an official recognition that an organization’s processes and practices comply with international standards. These certifications are often awarded to companies that implement effective management systems, which focus on improving quality, safety, environmental sustainability, or other operational aspects. Popular certifications include ISO 9001 (Quality Management), ISO 14001 (Environmental Management), ISO 45001 (Occupational Health and Safety), and ISO 27001 (Information Security Management). Organizations that earn these certifications demonstrate their commitment to meeting customer expectations, improving operational efficiency, and reducing risks. These certifications are recognized globally and are often required to work with certain clients or in specific industries.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 41.2 Billion |

| Projected Market Size in 2033 | USD 53.28 Billion |

| Growth Rate 2024 to 2033 | 5.50% |

| Leading Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Segments | Certification, Service, Application, End User, Region |

| Key Companies | ASTM, DNV Group AS, DQS Holding GmbH, Drata Inc., Holding Socotec, IMQ S.p.A., Lloyd's Register Group Services Limited, RINA S.p.A., The British Standards Institution, TUV NORD GROUP |

The management system certification market is segmented into certification, service, application, end user and region. Based on certification, the market is classified into product, and management system. Based on service, the market is classified into certification & verification, training & business assurance. Based on application, the market is classified into quality management systems, information security and IT, occupational health and safety, food safety, cyber security, environmental management, and others. Based on end user, the market is classified into aerospace & defense, automotive & transportation, construction, consumer goods & retail, energy & utilities, healthcare & life sciences, information technology & telecommunication, manufacturing, and others.

Based on certification, the global market is segmented into product certification and system certification. The product certification segment has dominated the highest revenue share in 2023.

Product Certification: The product certification segment has accounted 67% of the total revenue share in 2023. Product certification refers to the procedures through which specific products are determined to be in conformity with safety and quality standards. This certification reassures consumers and stakeholders that the product is reliable and legal. It is useful for companies that want to improve their marketability and gain consumer trust, as well as be legally compliant.

Management System Certification Market Revenue Share, By Certification, 2023 (%)

| Certification | 2023 (%) |

| Product | 67% |

| Management System | 33% |

System Certification: The system certification segment has accounted 33% of the total revenue share in 2023. System certification involves evaluating the entire management system of an organization, which may include systems developed specifically for such purposes; for example, quality management ISO 9001 or environmental management ISO 14001 certification. This certification provides confirmation that the organization is committed to product quality, meeting legal requirements, and an ongoing improvement through the recognition of its conformity to several processes; hence, this is an importance for overall operational efficiency.

Based on end user, the global market is segmented into quality management systems, information security and IT, occupational health and safety, food safety, cyber security, environmental management, others. The cyber security segment has dominated the market in 2023.

Aerospace & Defense: There are so many sectors that follow standard regulations to ensure safety and reliability in their operations, and the aerospace and defense industries are no different. The AS9100 certification is a guarantee that organizations fulfill certain quality criteria necessary for establishing credibility in aerospace industry and defense contracting environments.

Transport & Automobile: To the automobile industry, ISO/TS 16949 stipulates a key influence on fostering quality management during manufacture. Certification is seen as an assurance of international standards compliance and hence, from the product perspective, brings safety standards to increase customer confidence-all in all, a competitive edge in supply chain management.

Construction: Certifying agencies in the construction sector pay attention to verifying safety and quality management; an example would be ISO 45001 for occupational health and safety. This kind of certification provides a high degree of assurance to stakeholders that the risks will be appropriately handled, regulatory compliance maintained, and ultimately enhances the quality of construction services.

Consumer Goods & Retail: In the case of consumer goods and retail, the certification gives approval not only about the quality but also safety for products, hence giving some kind of assurance to the customers about the standards adhered to in the products purchased. Certifications such as ISO 22000 pertaining to food safety would instill confidence in consumers that would eventually lead to enhanced sales and improved competitiveness in the market.

Energy & Utilities: The Energy and Utilities sector utilizes certification to demonstrate compliance with environmental and safety regulations, as is the case with ISO 50001 for energy management. ISO 50001 encourages continuous improvement in energy efficiency, which reduces operational costs and provides corporate responsibility-proof-these are critical components of any sustainable energy landscape.

Healthcare & Life Sciences: Certification of the healthcare and life sciences industry lies at the heart of ensuring patient safety and product efficacy. Such standards do govern and assure from ISO 13485 for medical devices and other engagements that aim at ensuring lawful compliance, the improved processes, and enhanced quality of healthcare goods and services.

Information Technology & Telecommunication: ISO/IEC 27001 for information security management provides goodwill for the IT and telecommunication industry. These certifications help organizations in the protection of sensitive data and improve customer trust.

Manufacturing: By its very nature, quality and process efficiency in the manufacturing arena are highly related to certification such as ISO 9001. Operational improvements with these certifications result in reduced waste and compliance with international standards which make them indispensable for manufacturers aspiring for their competitive advantage.

Others: The "Others" category encircles diverse spheres and sectors that also seek certified in their management systems as areas such as hospitality, education, and agriculture, through the certification enabling the enhancement of operational processes, ensuring quality while adhering to valid pertinent regulatory needs for organizations flourishing in their own unique environments.

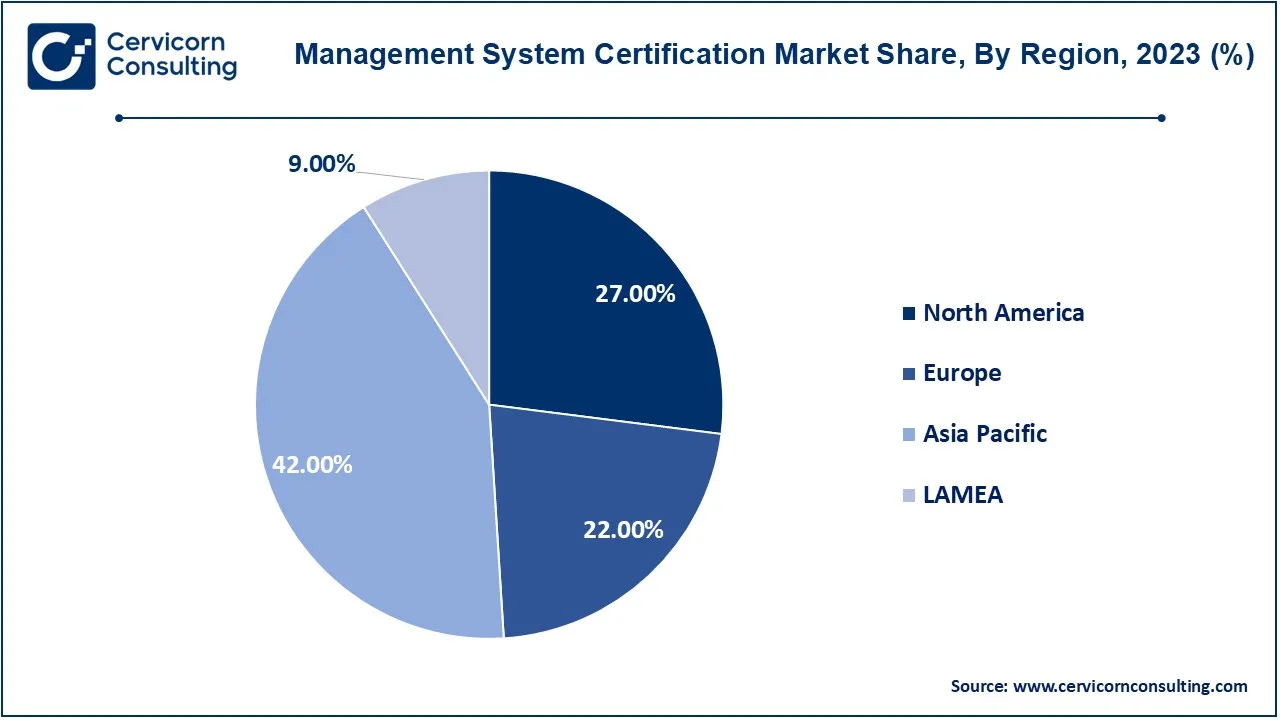

The management system certification market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region:

The Asia-Pacific management system certification market size was valued at USD 16.23 billion in 2023 and is expected to be worth around USD 22.38 billion by 2033. The quick growth of the management system certification market there is following direct industrialization and globalization of countries like China, Japan, and India. China, which has established itself as a major manufacturing hub in the world, wishes to have the certified quality-and-safety requirements in order for it to be at par with the international standards, especially in electronics or automotive. Japan concerns itself with innovation and quality management, whereby performing ISO 9001 certification in a special manner. With the augmenting economy of India, management system certifications are being adopted across a wide range of sectors; the enhance competitiveness driving validity with international standards in this market is awash.

The North America management system certification market size was estimated at USD 10.43 billion in 2023 and is projected to hit around USD 14.39 billion by 2033. This region, which covers the United States and Canada, is a leader in management system certification due to stringent legal requirements and high emphasis on quality assurance. There are numerous organizations in the USA seeking certification to meet certain industry standards in industries such as aerospace, automotive, and health-care, while there is a major emphasis on environmental and safety certification in Canada, a drive for sustainable practices. Factors such as the existence of leading certification bodies in the region and established infrastructures support the growth of the management system certification market in North America, thus steering innovation in management systems.

The Europe management system certification market size was accounted at USD 8.50 billion in 2023 and is predicted to surpass around USD 11.72 billion by 2033. The European region, from Germany to the UK to France, holds significant market share in management system certification. Sensitive standards and regulations impose many obligations in this sector, from the automotive to the manufacturing and healthcare market. Germany backs those parties toward engineering and automotive; it is ISO that is driving the quality and environmental management. The UK and France both foster the spirit of compliance and continuous improvement in sustainability and safety, whereas the European Union’s strict governance on regulatory harmonization, for instance, has pieced more strings into the implementation of management system certifications in various member states.

The LAMEA management system certification market was valued at USD 3.48 billion in 2023 and is anticipated to reach around USD 4.80 billion by 2033. With this blend of Latin America, Middle East, and Africa, LAMEA represents a highly diversified market for management system certification. Countries like Brazil and Mexico in Latin America have initiated certifications to raise quality standards in manufacturing and services. The Middle East focuses on the UAE and Saudi Arabia. There has been a move to certification there with a view toward economic diversification-local national development and operational improvements in the construction and energy sectors. South Africa and Nigeria are the face of Africa, where there is now heightened recognition of the huge role certification plays in building business credibility and attracting foreign investment.

The market for management system certification is significantly influenced by key players like ASTM, DNV Group AS, DQS Holding GmbH, and Drata Inc. These companies leverage their extensive expertise, robust methodologies, and industry standards to offer comprehensive certification solutions across various sectors, including quality, environmental, and information security management systems. By employing advanced technologies and maintaining high service quality, they enhance their competitive edge and foster trust among clients. Additionally, these players actively engage in continuous improvement initiatives, ensuring that their certification processes align with evolving regulations and market demands, thereby driving growth in the management system certification market.

CEO Statements

Remi Eriksen, CEO of DNV Groups:

Frankie Ng, CEO of SGS Group:

Hervé Amani, CEO of Bureau Veritas:

Recent partnerships and product launches reflect the ongoing growth and collaboration in the management system certification industry. Leading companies such as ASTM, DNV Group AS, DQS Holding GmbH, and Drata Inc. are focusing on enhancing technologies to meet the increasing demand for compliance, risk management, and sustainability. These advancements cater to industries such as manufacturing, healthcare, and IT, where organizations seek more comprehensive digital and sustainable certification solutions. Through improved automation, cybersecurity features, and eco-friendly certifications, these companies are responding to market needs for seamless integration and enhanced assurance in operational and environmental standards. Some notable examples of key developments in the management system certification industry include:

These developments highlight notable advancements in the management system certification industry, with companies like ASTM, DNV Group, DQS Holding GmbH, and Drata Inc. adopting innovative technologies to address growing needs. Enhanced digital platforms, automated processes, and sustainable certification solutions are driving demand, particularly in industries like manufacturing, IT, and healthcare. These enhancements improve compliance, risk management, and sustainability efforts, offering comprehensive support to companies aiming for operational excellence. Partnerships and new product offerings reflect the industry's response to evolving regulatory standards and the increasing focus on digital transformation and environmental responsibility.

Market Segmentation

By Certification

By Service

By Application

By End User

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Management System Certification

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Certification Overview

2.2.2 By Service Overview

2.2.3 By Application Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 COVID 19 Impact on Management System Certification Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulatory Compliance Mandates

4.1.1.2 A Growing Demand for Quality Assurance

4.1.1.3 The Growing Realization of Environmental Sustainability

4.1.1.4 Globalization Spurs the Need for Internationally Recognized Standards

4.1.2 Market Restraints

4.1.2.1 High cost

4.1.2.2 Standard Complexity

4.1.2.3 Lack of Awareness

4.1.3 Market Challenges

4.1.3.1 Keeping Up With Changing Standards

4.1.3.2 Maintaining Certification

4.1.3.3 Striking a Cost-Benefit Balance

4.1.3.4 Data Protection Concerns

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Management System Certification Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Certifications

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Certification Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Management System Certification Market, By Certification

6.1 Global Management System Certification Market Snapshot, By Certification

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

6.1.1.1 Product

6.1.1.2 Management System

Chapter 7 Management System Certification Market, By Service

7.1 Global Management System Certification Market Snapshot, By Service

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

7.1.1.1 Certification & Verification

7.1.1.2 Training & Business Assurance

Chapter 8 Management System Certification Market, By Application

8.1 Global Management System Certification Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

8.1.1.1 Quality Management Systems

8.1.1.2 Information Security and IT

8.1.1.3 Occupational Health and Safety

8.1.1.4 Food Safety

8.1.1.5 Cyber Security

8.1.1.6 Environmental Management

8.1.1.7 Others

Chapter 9 Management System Certification Market, By End User

9.1 Global Management System Certification Market Snapshot, By End User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2021-2033

9.1.1.1 Aerospace & Defense

9.1.1.2 Automotive & Transportation

9.1.1.3 Construction

9.1.1.4 Consumer Goods & Retail

9.1.1.5 Energy & Utilities

9.1.1.6 Healthcare & Life Sciences

9.1.1.7 Information Technology & Telecommunication

9.1.1.8 Manufacturing

9.1.1.9 Others

Chapter 10 Management System Certification Market, By Region

10.1 Overview

10.2 Management System Certification Market Revenue Share, By Region 2023 (%)

10.3 Global Management System Certification Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Management System Certification Market Revenue, 2021-2033 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Management System Certification Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Management System Certification Market Revenue, 2021-2033 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Management System Certification Market Revenue, 2021-2033 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Management System Certification Market Revenue, 2021-2033 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Management System Certification Market Revenue, 2021-2033 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Management System Certification Market, By Country

10.5.4 UK

10.5.4.1 UK Management System Certification Market Revenue, 2021-2033 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UK Market Segmental Analysis

10.5.5 France

10.5.5.1 France Management System Certification Market Revenue, 2021-2033 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 France Market Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Management System Certification Market Revenue, 2021-2033 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 Germany Market Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Management System Certification Market Revenue, 2021-2033 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of Europe Market Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Management System Certification Market Revenue, 2021-2033 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Management System Certification Market, By Country

10.6.4 China

10.6.4.1 China Management System Certification Market Revenue, 2021-2033 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 China Market Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Management System Certification Market Revenue, 2021-2033 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 Japan Market Segmental Analysis

10.6.6 India

10.6.6.1 India Management System Certification Market Revenue, 2021-2033 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 India Market Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Management System Certification Market Revenue, 2021-2033 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 Australia Market Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Management System Certification Market Revenue, 2021-2033 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia Pacific Market Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Management System Certification Market Revenue, 2021-2033 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Management System Certification Market, By Country

10.7.4 GCC

10.7.4.1 GCC Management System Certification Market Revenue, 2021-2033 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCC Market Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Management System Certification Market Revenue, 2021-2033 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 Africa Market Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Management System Certification Market Revenue, 2021-2033 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 Brazil Market Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Management System Certification Market Revenue, 2021-2033 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 11 Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2021-2023

11.1.3 Competitive Analysis By Revenue, 2021-2023

11.2 Recent Developments by the Market Contributors (2023)

Chapter 12 Company Profiles

12.1 ASTM

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Certification/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 DNV Group AS

12.3 DQS Holding GmbH

12.4 Drata Inc.

12.5 Holding Socotec

12.6 IMQ S.p.A.

12.7 Lloyd's Register Group Services Limited

12.8 RINA S.p.A.

12.9 The British Standards Institution

12.10 TUV NORD GROUP