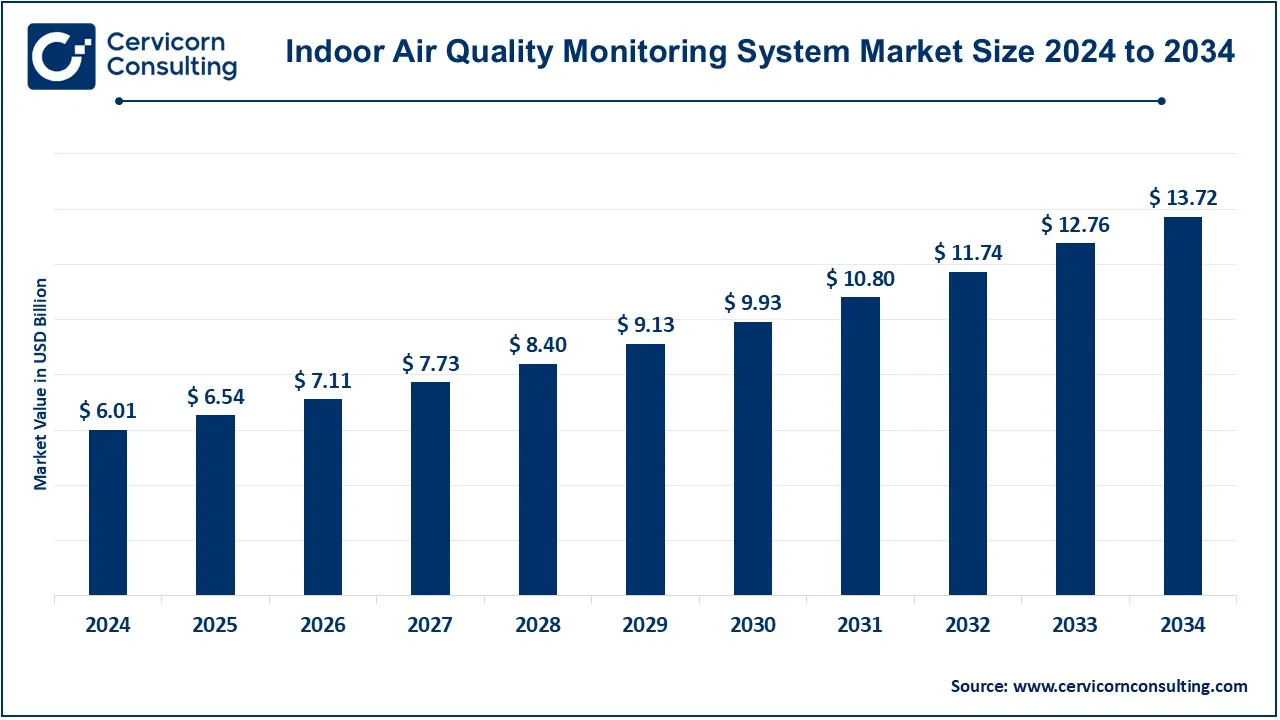

The global indoor air quality monitoring system market size was valued at USD 6.01 billion in 2024 and is expected to be worth around USD 13.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.72% over the forecast period 2025 to 2034.

The indoor air quality (IAQ) monitoring system market is growing rapidly due to rising pollution levels, urbanization, and increasing health concerns. Governments worldwide are implementing regulations for air quality standards, driving demand for monitoring systems. The adoption of smart homes, industrial safety protocols, and IoT-based solutions further boosts the IAQ monitoring system market expansion. Corporate sectors and healthcare facilities are increasingly integrating IAQ systems for a healthier work environment. With climate change and growing environmental concerns, businesses are investing in IAQ solutions to comply with sustainability goals. Technological advancements, such as AI-powered analytics and wireless sensors, enhance system efficiency. The demand for cost-effective and user-friendly IAQ monitors is increasing, further fueling market growth. The shift towards energy-efficient buildings and green certifications like WELL and LEED also supports IAQ market expansion.

An Indoor Air Quality (IAQ) Monitoring System is a device or network of sensors that continuously track air quality inside buildings. It measures pollutants like carbon dioxide, carbon monoxide (CO), volatile organic compounds (VOCs), particulate matter (PM2.5 & PM10), humidity, and temperature. These sensors provide real-time data, helping detect harmful pollutants and maintain a healthy indoor environment. IAQ monitoring systems are widely used in homes, offices, hospitals, and schools to ensure safe air quality. They help in identifying poor ventilation, mold growth risks, and exposure to hazardous chemicals. Smart systems use IoT and AI to analyze trends and send alerts when air quality drops, allowing timely action. These systems improve health, boost productivity, and reduce respiratory issues like asthma and allergies.

Key Insights related to the IAQ monitoring system:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 6.01 Billion |

| Expected Market Size in 2034 | USD 13.72 Billion |

| CAGR (2025 to 2034) | 8.72% |

| Superior Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Component, End User, Region |

| Key Companies | 3M, General Electric, HORIBA Scientific, Aeroqual, Emerson Electric Co., Seimens, Merck KGaA, Teledyne Technologies Incorporated., Testo SE & Co. KGaA, Thermo Fisher Scientific Inc. |

The indoor air quality monitoring system market is segmented into component, end user and region. Based on component, the market is classified into hardware, software, and services. Based on end user, the market is classified into residential, commercial, and industrial.

Hardware: The hardware segment accounted for highest revenue share in 2024. Hardware encases the primary materials which are being used for air quality monitoring and detection like detectors and sensors. These measure pollutants like carbon dioxide, VOCs, particulate matters and others. The hardware maintained its credibility based on its accuracy and durability for long-term monitoring. There is also demand for these systems from the bearing runetsdast and high-tech fitted elements which make the system work and collect data central.

Software: The software segment is expected to hit highest CAGR during the forecast period. Software is instrumental in the analysis, visualization, and reporting of air quality data collected through the hardware devices. In addition to this, it supports continuous examination, storage of information and analysis of the patterns. In most air quality management focused software solutions, development projects include applications on cloud systems, tablets and advanced decision support systems based on artificial intelligence (AI).

Services: Services include installation, maintenance, calibration, and support after sales offered by air quality monitoring companies. These ensure that the systems remain functional and accurate for long periods. Similarly, the consulting services allow the companies to follow the requirements set in the legislation and maximally use the system as well as carry out actions aimed at improving IAQ.

Commercial: The commercial segment has leading the the with highest revenue share in 2024. The commercial air quality monitoring segment includes air quality monitoring solutions for offices, retail, educational and hospital sectors where a healthy environment is imperative for productivity, occupant health as well as for legal standards. Many of these buildings have air pollution monitoring systems installed in the ceiling as part or integrated to the HVAC system.

Industrial: The industrial segment is projected to witness a significant growth during the forecast period. There is a definite need for suitable air quality monitoring systems in every industrial space to protect the workers and comply with the laws. Airborne pollutants in factory and manufacturing facilities, storage areas, and even warehouses often come from dangerous chemicals, dusts as well as gas emissions which make real time air quality monitoring necessary for minimizing chances of exposure as well as meeting the requirements of any industrial sector.

Indoor Air Quality Monitoring System Market Revenue Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Commercial | 44% |

| Industrial | 36% |

| Residential | 20% |

Residential: The residential segment is rising over upcoming years. This particular segment can be defined as incorporating all possible air quality monitoring solutions that can be used in a house, a flat, or any other self-contained living unit. Concern for the health effects of indoor pollution has brought the issue to the attention of most homeowners who now settle for air quality monitors to assess pollutants such as dust, smoke, and mold in an effort to make their homes safer.

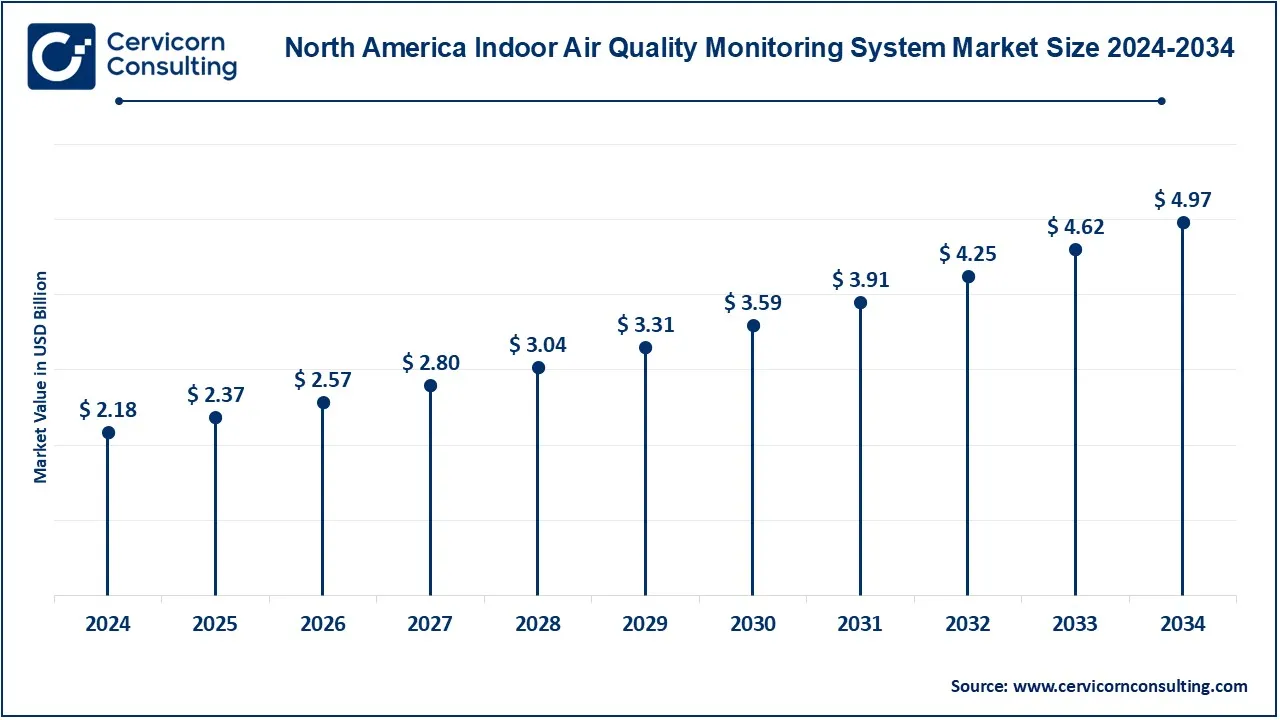

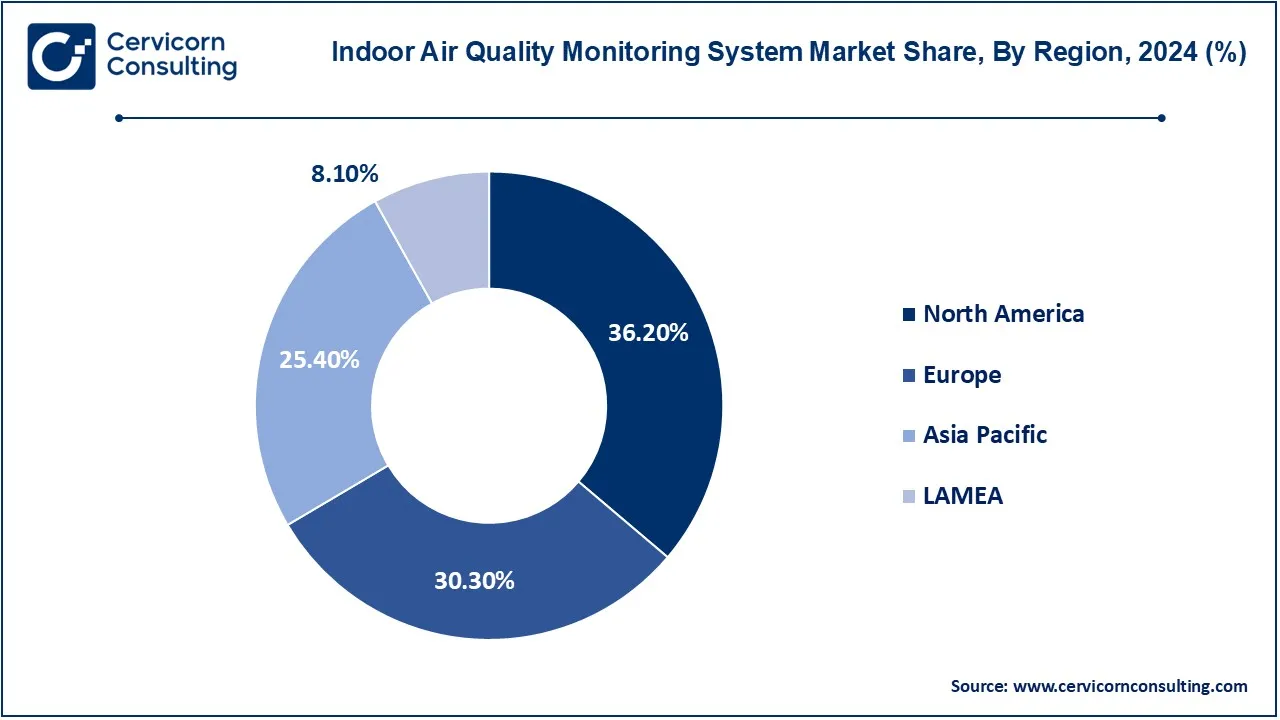

The indoor air quality monitoring system market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America has dominated the market in 2024.

The North America indoor air quality monitoring system market size was valued at USD 2.18 billion in 2024 and is expected to reach around USD 4.97 billion by 2034. The North America can be attributed to the stringent regulations as well as the concern about the air quality in the served regions. This region is majorly dominated by the United States and Canada, where there is considerable demand from the residential, commercial as well as the industrial sectors. Such growth is attributed to the adoption of the indoor air regulations by the us environmental protective agency (EPA) in mainly schools, acute care hospitals, and businesses. Furthermore, the development of smart homes and IoT-enabled air monitoring systems is growth enhancing in these two nations with growing health and safety concerns of the consumers.

The Europe indoor air quality monitoring system market size was estimated at USD 1.82 billion in 2024 and is projected to hit around USD 4.16 billion by 2034. The Europe is chiefly dominated by Germany, the UK and France as a result of environmental related policies and investitures towards the provision of a safe working environment. The European Union has member states policies aimed at controlling air pollution which include the Clean Air Programme. In the region, Germany positions itself as the forerunner in advanced industrial and smart building applications, while the air quality concerns in the UK are centered around schools, hospitals and other public areas. Rising government policies along with increasing public health concerns are notable factors driving the market in these countries.

The Asia-Pacific indoor air quality monitoring system market size was accounted for USD 1.53 billion in 2024 and is preojected to surpass around USD 3.48 billion by 2034. In the Asia-Pacific region, China, Japan, and India are the major contributors to the market. Rapid urbanization, industrialization, and high pollution levels in these countries drive the demand for air quality monitoring, especially in industrial and commercial sectors. China’s growing focus on tackling air pollution and the development of smart cities are boosting demand for these systems. Japan and India are also seeing increased adoption in residential spaces, driven by rising awareness of the health impacts of poor indoor air quality.

The LAMEA indoor air quality monitoring system market was valued at USD 0.49 billion in 2024 and is anticipated to reach around USD 1.11 billion by 2034. The LAMEA region is growing, with countries like Brazil, Saudi Arabia, and South Africa emerging as key players. Brazil's industrial expansion and growing urban areas are increasing the need for air quality monitoring in workplaces and residential areas. In the Middle East, countries like Saudi Arabia are adopting monitoring systems in response to construction projects and air pollution concerns. Africa, particularly South Africa, is experiencing demand due to rising awareness of the health risks associated with poor air quality and increasing regulations.

The market for indoor air quality monitoring systems is dominated by major players such as 3M, Emerson Electric Co., HORIBA, Ltd., General Electric Company, Merck, Siemens AG, Teledyne Technologies Incorporated, and Thermo Fisher Scientific, Inc. These companies leverage their advanced technologies to develop precise, efficient, and scalable monitoring solutions. Their expertise spans across hardware, software, and service solutions, enabling real-time monitoring of pollutants like carbon dioxide, volatile organic compounds (VOCs), and particulate matter. These firms focus on innovation, regulatory compliance, and strategic partnerships to meet growing demand across residential, commercial, and industrial sectors.

CEO Statements

Ronald J. Rittenmeyer, CEO of Teledyne Technologies

Michael T. Ducker, CEO of 3M

Kevin M. Klesch, CEO of Aeroqual

Market Segmentation

By Component

By End use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Indoor Air Quality Monitoring System

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By End Use Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Indoor Air Quality Monitoring System Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Prevalence of respiratory diseases and allergies on the rise

4.1.1.2 Increased urbanization and industrialization

4.1.1.3 Growth in number of smart cities

4.1.1.4 Need for control of pollution even in enclosed spaces

4.1.2 Market Restraints

4.1.2.1 The initial and recurring costs for the installation and usage can be considered exorbitant

4.1.2.2 Insufficient appreciation in developing countries

4.1.2.3 Use of low cost sensors brings challenges of data credibility

4.1.2.4 Making it to work with other systems in the structure is a challenge

4.1.3 Market Challenges

4.1.3.1 Major Problem in Global Air Quality Monitoring Systems Standardization

4.1.3.2 Overreliance on factors such as the external environment, policies

4.1.3.3 Compromise Between Cost and Efficiency of Systems

4.1.3.4 Incorporating Advanced Monitoring Technologies in the Rehabilitation of Old Buildings

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Indoor Air Quality Monitoring System Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Indoor Air Quality Monitoring System Market, By Component

6.1 Global Indoor Air Quality Monitoring System Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Hardware

6.1.1.2 Software

6.1.1.3 Services

Chapter 7. Indoor Air Quality Monitoring System Market, By End use

7.1 Global Indoor Air Quality Monitoring System Market Snapshot, By End use

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Residential

7.1.1.2 Commercial

7.1.1.3 Industrial

Chapter 8. Indoor Air Quality Monitoring System Market, By Region

8.1 Overview

8.2 Indoor Air Quality Monitoring System Market Revenue Share, By Region 2024 (%)

8.3 Global Indoor Air Quality Monitoring System Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Indoor Air Quality Monitoring System Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Indoor Air Quality Monitoring System Market, By Country

8.5.4 UK

8.5.4.1 UK Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Indoor Air Quality Monitoring System Market, By Country

8.6.4 China

8.6.4.1 China Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Indoor Air Quality Monitoring System Market, By Country

8.7.4 GCC

8.7.4.1 GCC Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Indoor Air Quality Monitoring System Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 3M

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 General Electric

10.3 HORIBA Scientific

10.4 Aeroqual

10.5 Emerson Electric Co.

10.6 Seimens

10.7 Merck KGaA

10.8 Teledyne Technologies Incorporated.

10.9 Testo SE & Co. KGaA

10.10 Thermo Fisher Scientific Inc.