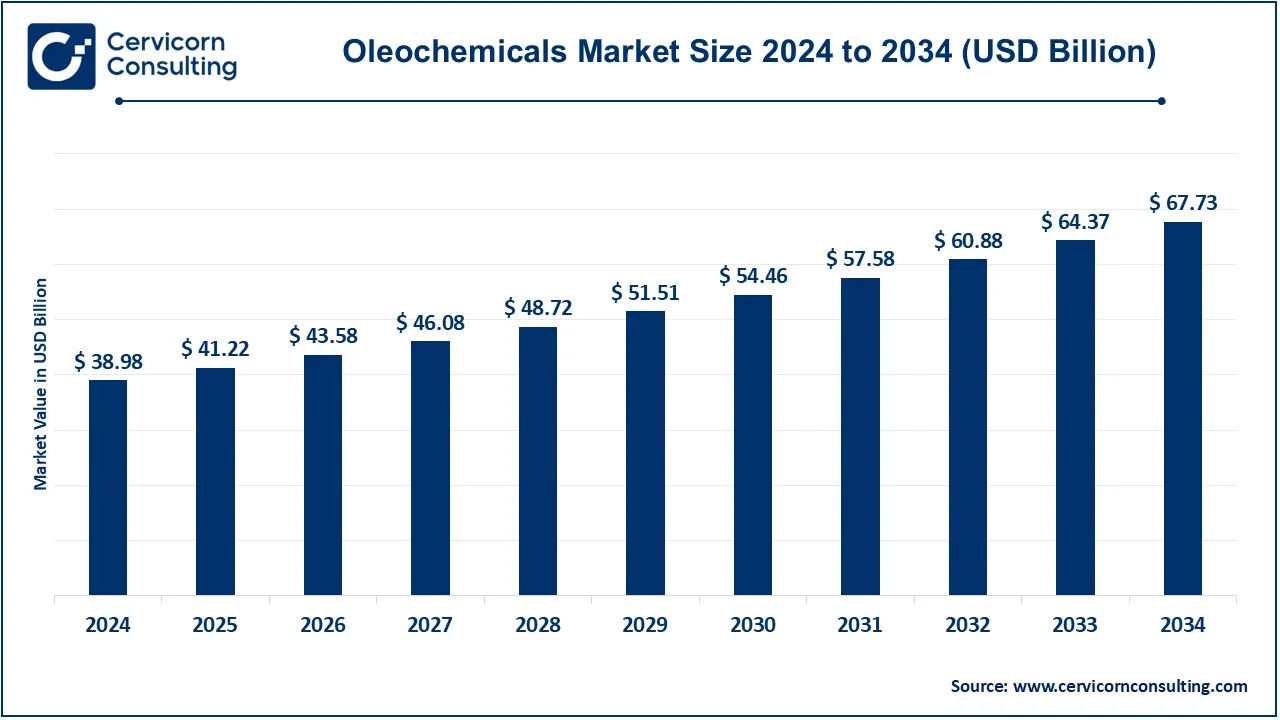

The global oleochemicals market size was valued at USD 38.98 billion in 2024 and is expected to be worth around USD 67.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.73% from 2025 to 2034.

The oleochemicals market has been witnessing substantial growth due to rising demand for bio-based and sustainable products. Increased environmental awareness, government regulations on reducing carbon footprints, and a growing preference for biodegradable alternatives are driving this expansion. Additionally, industries such as cosmetics, pharmaceuticals, and food processing are incorporating oleochemicals into their products to meet sustainability goals. Technological advancements and innovations in production techniques are also fueling market growth. The shift towards biofuels and green chemicals in developed economies further accelerates the demand for oleochemicals. With Asia-Pacific leading in production and consumption, and increasing investments in research and development, the global oleochemicals market is expected to expand steadily in the coming years.

Oleochemicals are chemicals derived from natural oils and fats, typically sourced from plant-based oils like palm, coconut, and soybean, or animal fats. These chemicals serve as sustainable alternatives to petroleum-based products and are widely used in industries like personal care, food, pharmaceuticals, and biofuels. The key oleochemicals include fatty acids, fatty alcohols, glycerin, and methyl esters, which are essential in producing soaps, detergents, cosmetics, lubricants, and biodegradable plastics. Oleochemicals are valued for their eco-friendliness, renewability, and biodegradability. Their production process involves hydrolysis, transesterification, or hydrogenation of natural oils and fats. With increasing environmental concerns and stringent regulations on synthetic chemicals, industries are shifting towards oleochemicals as sustainable solutions.

The recent import-export data reflects the demand and supply trends in the oleochemicals market, influencing its growth trajectory.

Rising Demand for Organic Chemicals:

High Chemical Imports Driving Domestic Production:

Report Scope

| Area of Focus | Details |

| Market Size in 2024 | USD 38.98 Billion |

| Projected Market Size in 2034 | USD 67.73 Billion |

| Expected CAGR (2025 to 2034) | 5.73% |

| High-impact Region | North America |

| Accelerating Region | Asia-Pacific |

| Key Segments | Type, Application, Region |

| Key Companies | Vantage Specialty Chemicals, Inc., Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd., Kao Chemicals Global, Ecogreen Oleochemicals, Corbion N.V, Cargill, Incorporated, Oleon NV, Godrej Industries, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, BASF SE |

The oleochemicals market is segmented into type, application and region. Based on type, the market is classified into fatty acids, fatty alcohols, methyl esters, glycerin, specialty esters and others. Based on application, the market is classified into food & beverages, chemicals, animal feed, personal care & cosmetics, consumer goods, food processing, textiles, paints & inks, industrial, healthcare & pharmaceuticals, polymer & plastic additives and others.

Fatty Acids: Fatty acids are carboxylic acids with long chain lengths derived from vegetable oils and animal fats. The major raw materials for various kinds of products are involved in soap, detergents, and cosmetics. This is because they have multiple applications acting as a primary raw material to prepare surfactants, lubricants, and emulsifiers. Their potential factor further propelling their marketability contributes to the application of these substances in the food industry as preservatives and flavoring agents.

Fatty Alcohols: Fatty alcohols are prepared either through the hydrogenation of fatty acids or through the reduction of fatty esters. Fatty alcohols are used in the formulation of surfactants and emulsifiers in cosmetic products such as shampoos and lotions. Fatty alcohols, being hydrophobic as well as hydrophilic, have numerous applications in the form of detergents and industrial cleaners. This is because natural and biodegradable cosmetics are in increased demand. Fatty alcohols therefore constitute one of the significant components of the market for oleochemicals.

Methyl Esters: Methyl esters, prepared through the transesterification of fatty acids or triglycerides, are mainly used for biodiesel. However, they also form an integral part of several personal care products and housekeeping items, where they are used mainly because of their environmental benignity and excellent solubility. As the utilization of renewable sources of energy grows, it is expected to fuel further expansion in the field of biodiesel, which uses significantly large quantities of methyl esters, to strengthen its hold on the world of oleochemicals.

Glycerin: Glycerin is essentially a glycerol by-product of soap manufacturing or even biodiesel manufacturing processes. It is one very diverse compound used for all sectors related to food, pharma, and cosmetic product application areas. Glycerin provides moisturizing, it provides the basis of multiple moisturizing products that cater to skin care. As for being a sweetener it, along with the purpose to preserve food. The demand for glycerin is growing in the market because it has non-toxic and eco-friendly characteristics that have gained consumer appeal and increased their demand for natural and safe ingredients.

Food & Beverages: Under food and beverages, oleochemicals are used as emulsifiers, stabilizers, preservatives, and more. Fatty acids along with glycerin provide a lot of importance to impart texture, enhance the flavor, and extend the shelf life. The rise in customer demand for clean-label natural food products has enhanced the demand for using oleochemicals as functional ingredients. This trend enhances food quality and meets the improved interest in wellness.

Chemicals: This is a wide field, which comprises surfactants, lubricants, and solvents. Oleochemicals form an important raw material in the production of these chemicals, therefore offering a source that is renewable as compared to those derived from petroleum. As they are biodegradable, they work efficiently in many chemical applications, and hence manufacturers, who are compelled to abide by the regulations set aside by the environment, have the best choice for their chemical production. Green chemical production is in demand since firms seek more environmentally friendly options.

Animal Feed: Oleochemicals are increasingly being added to animal feed formulations in the form of energy content and essential fatty acids, which improve their nutritional qualities for better growth and performance of animals. Increasing requirement of animal proteins across the globe and more efficient formulation is also considered to add further to oleochemical use in this area. Further, the trend of sustainable livestock farming is that oleochemicals offer benefits in the sense that they give a natural and healthy input in animal nutrition.

Others: Other fields of application that use them include personal care products, pharmaceuticals, and industrial applications. In the field of personal care, oleochemicals are emulsifiers besides providing moisturizing effects, thus enhancing the overall effectiveness of the product. The usage of oleochemicals varies from application in excipients and stabilizers of the preparation of drugs to that in industrial applications ranging from those in lubricating oils for industries to protective coatings over a variety of substrates. The description of different applications is described as being flexible for oleochemicals from all industries and businesses.

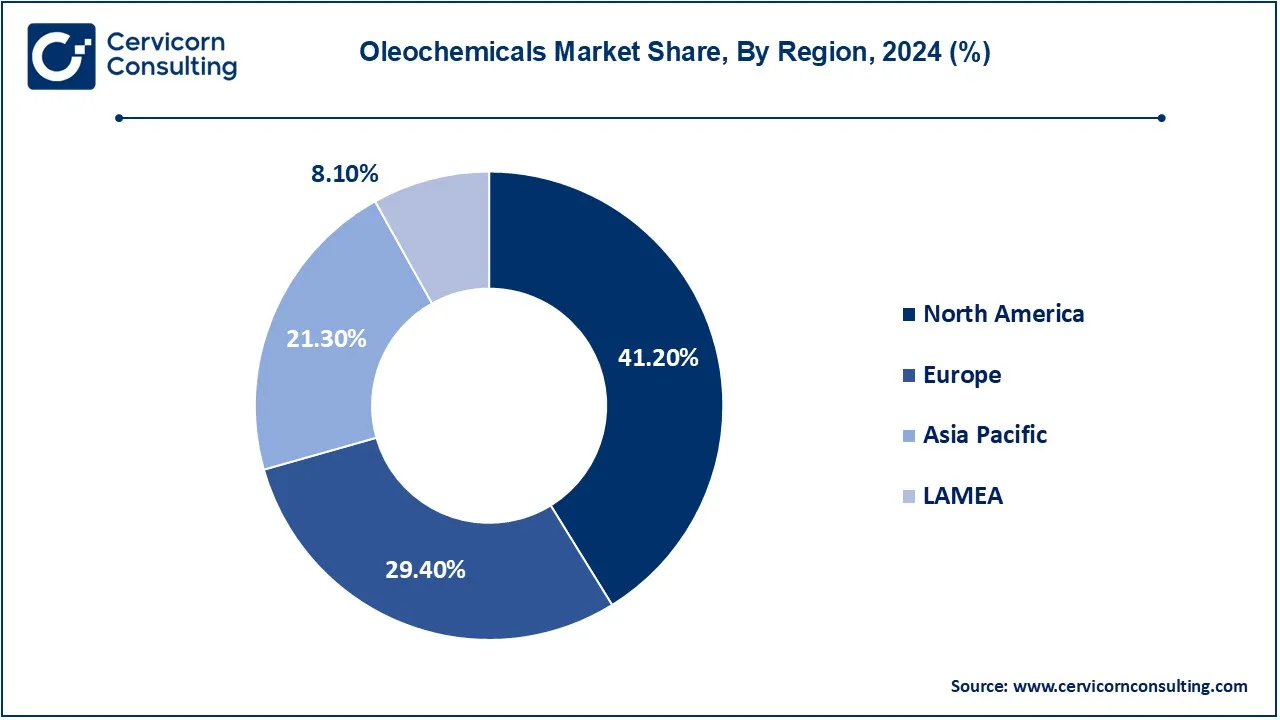

The oleochemicals marketis segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). The North America market has dominated the market in 2024.

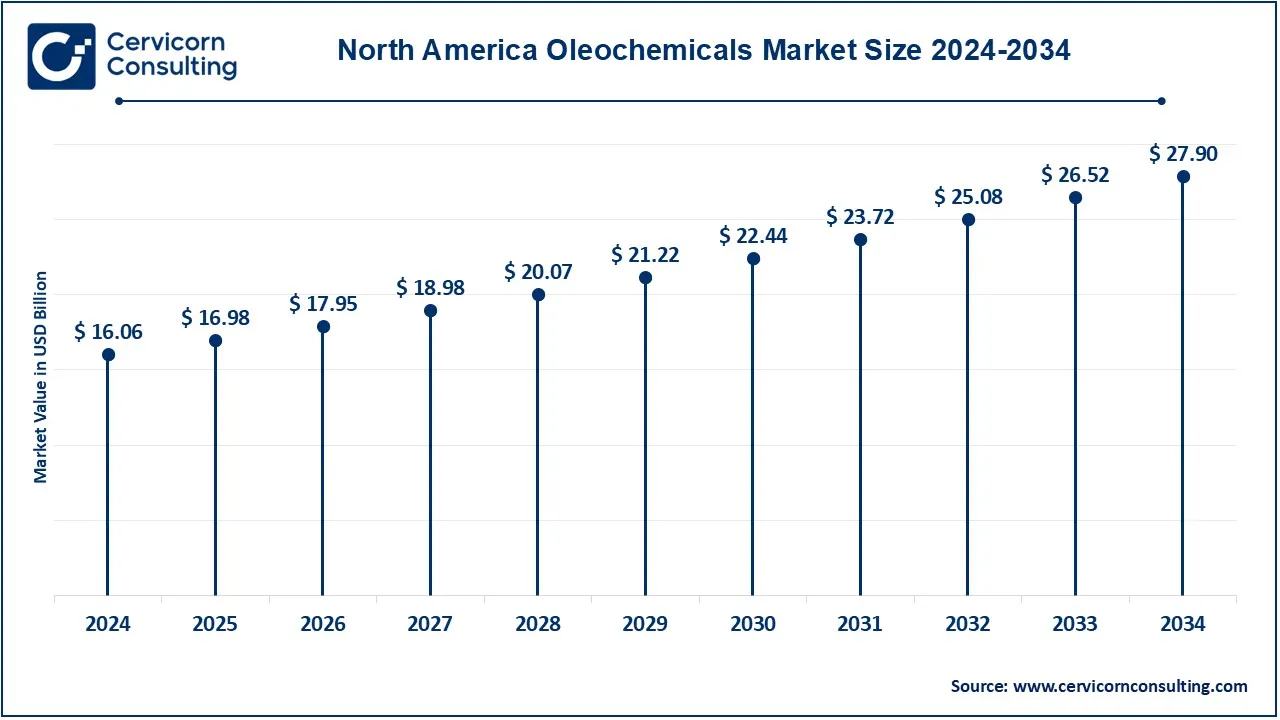

The North America oleochemicals market size was valued at USD 16.06 billion in 2024 and is expected to reach USD 27.90 billion by 2034. The oleochemical production in the United States as well as its consumption are quite significant and focused more towards sustainable and bio-based products. Environment-friendly alternatives in personal care, food, and industrial applications are witnessing demand and thereby contributing to the growth of the market. Canada is an agricultural-rich country, and therefore, provides a huge source of raw materials for vegetable oils by the country. The facilitative regulation climate for the encouragement of green initiatives has also made investments in oleochemical production as well as innovation in the region.

The Europe oleochemicals market size was estimated at USD 11.46 billion in 2024 and is projected to hit around USD 19.91 billion by 2034. The European market stresses much more on sustainability, and its regulations and rules concerning chemical production and usage are far stiffer as compared to other markets. Innovator Germany is rated thus giving it a greater production capacity, especially in terms of biodiesel and fatty alcohols. Raw material processing is one thing through which the Netherlands itself benefits heavily from its strategic location and advanced logistics. Gaining consumer awareness coupled with rising demand for natural ingredients in personal care and food products drive this market at a rather vigorous clip in Europe's oleochemical sector.

The Asia-Pacific oleochemicals market size was accounted for USD 8.30 billion in 2024 and is predicted to surpass around USD 14.43 billion by 2034. The Asia-Pacific region is expected to witness strong growth due to rapid industrialization and urbanization in China, India, Malaysia, and Indonesia. China is one of the largest oleochemicals consuming as well as producing nations on account of growing sectors such as personal care and food. India is also growing fast, where consumers' disposable income is increasing and the need for natural and organic products also rises. Malaysia and Indonesia are other suppliers of palm oil, an essential feedstock for oleochemicals, which bodes well for the growth prospects of the region.

The LAMEA oleochemicals market size was valued at USD 3.16 billion in 2024 and is expected to be worth USD 5.49 billion by 2034. Among the Latin American nations, Brazil and Argentina stand atop the list due to their agricultural output, primarily obtained through vegetable oils from such countries. The Middle Eastern region is investing in more diversified economies that are not entirely based on oil alone, and oleochemicals are considered to be an attractive sector by major nations like Saudi Arabia and the UAE. South Africa and Nigeria are also targeting the production of oleochemicals in Africa to effectively use their agricultural resources. Growing interests in sustainable development and diversification of economies in the regions are also expected to promote the growth of the LAMEA oleochemicals market.

CEO Statements

Brian Sikes, CEO of Cargill Inc.

Tan Sri Dato' Seri Lee Oi Hian, CEO ofKuala Lumpur Kepong Berhad

Dato’ Lee Yeow Chor, CEO of IOI Group

Recent product launches and agreements in the oleochemicals industry indicate a rising pace of innovation and strategic collaboration among key industry players. Some of the developers that are driving innovative functions and features toward producing a more sophisticated indoor cycling experience for consumers are Cargill Inc., Kuala Lumpur Kepong Berhad, BASF SE, Oleon N.V., IOI Group Berhad, Wilmar International, and Kao Chemicals. Among these include training solutions through AI, better connectivity, and even the ability to create realistic riding simulations to meet this rising demand for versatile and exciting fitness products. As technology evolves and collaboration increases, the evolutions in the markets are only expected to intensify and further improve the conditions for all fitness surroundings.

Market Segmentation

By Type

By Application

By Regions

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Oleochemicals

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 COVID 19 Impact on Oleochemicals Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Global Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Global Market Implications

3.3 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Cost Efficiency

4.1.1.2 Continuous innovations in oleochemical products

4.1.1.3 Consumer Awareness

4.1.2 Market Restraints

4.1.2.1 High Production Costs

4.1.2.2 Raw material price volatility

4.1.2.3 Technical limitation

4.1.3 Market Challenges

4.1.3.1 Huge Competition

4.1.3.2 Consumer Preferences

4.1.3.3 Quality Control

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Oleochemicals Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Oleochemicals Market, By Type

6.1 Global Oleochemicals Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Fatty Acids

6.1.1.2 Fatty Alcohols

6.1.1.3 Methyl Esters

Chapter 7. Oleochemicals Market, By Application

7.1 Global Oleochemicals Market Snapshot, By Application

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Food & Beverages

7.1.1.2 Chemicals

7.1.1.3 Animal Feed

7.1.1.4 Industrial

7.1.1.5 Healthcare & Pharmaceuticals

7.1.1.6 Polymer & Plastic Additives

7.1.1.7 Others

Chapter 8. Oleochemicals Market, By Region

8.1 Overview

8.2 Oleochemicals Market Revenue Share, By Region 2024 (%)

8.3 Global Oleochemicals Market, By Region

8.3.1 Market Size and Forecast

8.4 North America

8.4.1 North America Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.4.2 Market Size and Forecast

8.4.3 North America Oleochemicals Market, By Country

8.4.4 U.S.

8.4.4.1 U.S. Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.4.4.2 Market Size and Forecast

8.4.4.3 U.S. Market Segmental Analysis

8.4.5 Canada

8.4.5.1 Canada Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.4.5.2 Market Size and Forecast

8.4.5.3 Canada Market Segmental Analysis

8.4.6 Mexico

8.4.6.1 Mexico Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.4.6.2 Market Size and Forecast

8.4.6.3 Mexico Market Segmental Analysis

8.5 Europe

8.5.1 Europe Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.5.2 Market Size and Forecast

8.5.3 Europe Oleochemicals Market, By Country

8.5.4 UK

8.5.4.1 UK Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.5.4.2 Market Size and Forecast

8.5.4.3 UKMarket Segmental Analysis

8.5.5 France

8.5.5.1 France Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.5.5.2 Market Size and Forecast

8.5.5.3 FranceMarket Segmental Analysis

8.5.6 Germany

8.5.6.1 Germany Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.5.6.2 Market Size and Forecast

8.5.6.3 GermanyMarket Segmental Analysis

8.5.7 Rest of Europe

8.5.7.1 Rest of Europe Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.5.7.2 Market Size and Forecast

8.5.7.3 Rest of EuropeMarket Segmental Analysis

8.6 Asia Pacific

8.6.1 Asia Pacific Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.6.2 Market Size and Forecast

8.6.3 Asia Pacific Oleochemicals Market, By Country

8.6.4 China

8.6.4.1 China Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.6.4.2 Market Size and Forecast

8.6.4.3 ChinaMarket Segmental Analysis

8.6.5 Japan

8.6.5.1 Japan Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.6.5.2 Market Size and Forecast

8.6.5.3 JapanMarket Segmental Analysis

8.6.6 India

8.6.6.1 India Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.6.6.2 Market Size and Forecast

8.6.6.3 IndiaMarket Segmental Analysis

8.6.7 Australia

8.6.7.1 Australia Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.6.7.2 Market Size and Forecast

8.6.7.3 AustraliaMarket Segmental Analysis

8.6.8 Rest of Asia Pacific

8.6.8.1 Rest of Asia Pacific Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.6.8.2 Market Size and Forecast

8.6.8.3 Rest of Asia PacificMarket Segmental Analysis

8.7 LAMEA

8.7.1 LAMEA Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.7.2 Market Size and Forecast

8.7.3 LAMEA Oleochemicals Market, By Country

8.7.4 GCC

8.7.4.1 GCC Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.7.4.2 Market Size and Forecast

8.7.4.3 GCCMarket Segmental Analysis

8.7.5 Africa

8.7.5.1 Africa Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.7.5.2 Market Size and Forecast

8.7.5.3 AfricaMarket Segmental Analysis

8.7.6 Brazil

8.7.6.1 Brazil Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.7.6.2 Market Size and Forecast

8.7.6.3 BrazilMarket Segmental Analysis

8.7.7 Rest of LAMEA

8.7.7.1 Rest of LAMEA Oleochemicals Market Revenue, 2022-2034 ($Billion)

8.7.7.2 Market Size and Forecast

8.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 9. Competitive Landscape

9.1 Competitor Strategic Analysis

9.1.1 Top Player Positioning/Market Share Analysis

9.1.2 Top Winning Strategies, By Company, 2022-2024

9.1.3 Competitive Analysis By Revenue, 2022-2024

9.2 Recent Developments by the Market Contributors (2024)

Chapter 10. Company Profiles

10.1 Vantage Specialty Chemicals, Inc.

10.1.1 Company Snapshot

10.1.2 Company and Business Overview

10.1.3 Financial KPIs

10.1.4 Product/Service Portfolio

10.1.5 Strategic Growth

10.1.6 Global Footprints

10.1.7 Recent Development

10.1.8 SWOT Analysis

10.2 Emery Oleochemicals

10.3 Evonik Industries AG

10.4 Wilmar International Ltd.

10.5 Kao Chemicals Global

10.6 Ecogreen Oleochemicals

10.7 Corbion N.V

10.8 Cargill, Incorporated

10.9 Oleon NV

10.10 Godrej Industries

10.11 IOI Corporation Berhad

10.12 Kuala Lumpur Kepong Berhad

10.13 BASF SE